Professional Documents

Culture Documents

Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate Finance

Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate Finance

Uploaded by

Kanya RetnoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate Finance

Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate Finance

Uploaded by

Kanya RetnoCopyright:

Available Formats

lOMoARcPSD|8764734

Formulas - All chapters - Corporate Finance

Corporate Finance (Aarhus Universitet)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by EZRA VALENTINO (ezra.valentino@ui.ac.id)

lOMoARcPSD|8764734

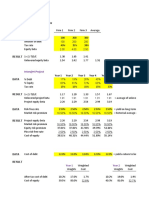

Chapter 2

Accounts Receivable Days = Accounts Receivable / Average Daily Sales

Accounts Payable Days = Accounts Payable / Average Daily Sales

Cash Ratio = Cash / Current Liabilities

Change in Stockholders Equity = Retained Earnings + Net sales of stock

Change in Stockholders Equity = Net Income - Dividends + Sales of stock - Repurchases of stock

Current Ratio = Current Assets / Current Liabilities

Debt to Capital Ratio = Total Debt /( Total Equity + Total Debt)

Debt-Equity Ratio = Total Debt / Total Equity

Debt-to-Enterprise Value Ratio = Net Debt / (Market Value of Equity + Net Debt)

Debt-to-Enterprise Value Ratio = Net Debt / Enterprise Value

EBITDA = EBIT + Depreciation and Amortization

Enterprise Value = Market Value of Equity + Debt - Debt

EPS = Net Income / Shares Outstanding

Gross Margin = Gross Profit / Sales

Inventory Turnover = Annual Cost of Sales / Inventory

Market Value of Equity = Shares outstanding*Market price per share

Market-to-Book ratio = Market value of equity / Book Value of Equity

Net Debt = Total Debt - Excess Cash & Short-term Investments

Net Profit Margin = Net Income / Sales

Operating Margin = Operating Income / Sales

P/E ratio = Market Capitalization / Net Income

P/E ratio = Share price / Earnings per Share

Quich Ration = (Cash & Short-term Investments + Accounts Receivable) / Current Liabilities

Retained Earnings = Net Income - Dividends

ROA = (Net Income + Interest Expense) / Book Value of Assets

ROE = Net Income / Book Value of Equity

ROIC = EBIT (1 - tax rate) / (Book Value of Equity + Net Debt)

ROE = (Net Income / Sales) * (Sales / Total Assets) * (Total Assets / Book Value of Equity)

The Balance Sheet Equation = Assets = Liabilities + Shareholders’ Equity

Equity Multiplier (book) = Total Assets / Book Value of Equity

Equity Multiplier (market) = Total Assets / Market Value of Equity

Chapter 3

Expected return of a risky investment = Expected gain at end of year / Initial cost

NPV = PV(Benefits) - PV (Costs)

NPV = PV(All projects cash flow)

NPV (Buy security) = PV (All cash flows paid by the security) - Price (Security)

NPV (Sell security) = Price (Security) - PV (All cash flows paid by the security)

Price(Security) = PV (All cash flows paid by the security)

r_s = rf + (risk premium for investment s)

Return = Gain at End of Year / Initial Costs

Chapter 4

C (load or annuity payment) = P / ((1/r)*(1-(1/(1+r)^n)))

FV = C * (1+r)^n

FV_n (cash flow stream) = PV * (1+r)^n

FV_n (cash flow) = C*(1+r)*(1+r)*...*(1+r)=C*(1+r)^n

FV(annuity) = C/r * (1-(1/(1+r)^n)) * (1+r)^n

Downloaded by EZRA VALENTINO (ezra.valentino@ui.ac.id)

lOMoARcPSD|8764734

IRR (growing perpetuity) = (C/P) + g

IRR (with two cash flows) = ((FV/P)^(1/n))-1

PV (C in perpetuity) = C/r

PV (cash flow stream) = C_0 + C_1/(1+r) + C_2/(1+r)^2 + ... + C_n/(1+r)^n

PV (growing perpetuity) = C / (r-g)

PV (growing perpetuity) = C / (r-g) * (1-((1+g)/(1+r)^2))

PV (perpetuity) = C/(1+r) + C/(1+r)^2 +C/(1+r)^3 + ...

PV (with g) = C / (1+r) + (C*(1+g))/((1+r)^2) + (C*(1+g)^2)/((1+r)^3) + ...

PV_n (cash flow) = C / (1 + r)^n

PV(annuity of C with interest rate r) = C * 1/r * (1-(1/(1+r)^n))

PV(annuity of C) = P - (P/(1+r)^n)

Chapter 5

(1+EAR) = (1+(ARP/k))^k

(1+EAR) = e^ARP

ARP = ln(1+EAR)

Equivalent n-Period Discount Rate = ((1+r)^n) -1

Growth in Purchasing Power = (1+r) / (1+i)

Interest Rate (compounding period) = ARP / (k_periods/year)

PV = C_n / ( 1+r_n)^n

r (real) = (r-i) / (1+i)

Chapter 6

CPN = (Coupon Rate * Face Value) / Number of Coupon Payments per Year

P = FV / ((1+YTM)^n)

P = CPN * (1/y) * (1-(1/(1+y)^n)) + (FV/(1+y)^n)

P (coupon bond) = (CPN / 1 + YTM_1) + (CPN /( 1 + YTM_2)^2) + … + ((CPN+FV)/(1+YTM_n)^n)

r_n = YTM

YTM = ((FV/P)^(1/n))-1

YTM = (FV/P) - 1

Chapter 8

After-Tax Cash Flow from Asset Sale = Sale Price - (t * Gain on Sale)

Book Value = Purchase Price - Accumulated Depreciation

Free cash flow = (Revenues - Costs - Depreciation) * (1-t) + Depreciation - CapEx - ∆NWC

Free cash flow = (Revenues - Costs * (1-t) - CapEx - ∆NWC + t * Depreciation

Gain on sales = Sale Price - Book Value

Income Tax = EBIT * t

Net working capital = Current assets - Current liabilities

Net working capital = Cash + Inventory + Receivables - Payables

PV(FCF) = FCF / (1+r)^t

PV(FCF) = FCF * (1/(1+r)^t)

Unlevered Net Income = EBIT * (1-t)

Unlevered Net Income = (Revenues - Costs - Depreciation) * (1-t)

Chapter 9

Change in earnings = New investment * Return on new investment

Div_t (dividend payout rate) = (Earnings / Shares Outstanding) * Dividend Payput Rate

Downloaded by EZRA VALENTINO (ezra.valentino@ui.ac.id)

lOMoARcPSD|8764734

Earnings growth rate = Change in earnings / earnings

Forward P/E = P_0/EPS_1

Forward P/E = (Div_1/EPS_1)/(r_e-g)

Forward P/E = Dividend Payout Rate / (r_e - g)

g = Retention rate * return on new investment

New investment = Earnings * Retention Rate

P_0 (constant growth) = Div / ( r_e - g )

P_0 (constant long-term growth) = (Div_1/(1+r_e)) + (Div_2/(1+r_e)^2) + … + (Div_n/(1+r_e)^n) + (1/(1+r_e)^n) * Div_(n+1)/(r_e-g

P_0 (discounted free cash flow) = (V_0 + Cash_0 - Debt_0) / Shares outstanding_0

P_0 (dividend discount) = (Div_1/(1+r_e)) + (Div_2/(1+r_e)^2) + … + (Div_n/(1+r_e)^n) + (P_n/(1+r_e)^n)

P_0 (multiple year) = (Div_1/(1+r_e)) + ((Div_2+P_2)/(1+r_e)^2)

P_0 (one year) = (Div_1 + P_1) / (1+r_e)

P_0 (total payment model) = PV (future total dividend and repurchases) / Shares outstanding

P_n = Div_(n+1)/(r_e-g)

r_e = (Div + P_1) / P_0

r_e (constant growth) = (Div_1 / P_0) + g

V_0 (continuation) = (FCF_1/(1+r_wacc)) + (FCF_2/(1+r_wacc)^2) + … + ((FCF_n+V_n)/(1+r_wacc)^n)

V_0 (discounted free cash flow) = PV (future free casg flow of firm)

V_0(enterprise) = FCF/(r_wacc-g_fcf)

V_n (continuation) = (FCF_(n+1)/(r_wacc-g_fcf))

V_n (continuation) = ((1+g_fcf)/(r_wacc-g_fcf))*FCF_n

Chapter 10

E(R) = sum(Pr.*R)

1 + R_annual = (1+R_q1) * (1+R_q2) * (1+R_q3) * (1+R_q4)

Cov(Ri,Rj) = E((Ri-E(Ri)*(Rj-E(Rj))

Cov(Ri,Rj) = (1/(t-1)) * sum(Ri-Ri_average) * (Rj-Rj_average)

E (Rp) = E (sum(xi*Ri))

Market Risk Premium = E(R_market) - rf

r_i (cost of capital) = rf + β * (E(R_market) - rf)

R_p (weighted average) = (x_1*R_1) + (x_2*R_2) + … + (x_n*R_n)

R_t+1 = ((Div_t+1 + P_t+1) / P_t) - 1

R(average) = (1/t) * (R_1+R_2+ … +R_t)

SD(average) = SD (Individual Risk) / (number_of_observation^0,5)

SD(R) = Var(R)^0,5

SD(Rp) arbitrary weights = sum( x * (SD/Ri) * corr(Ri, Rp) )

Sharpe ratio = (E(Rp)-rf)/SD(Rp)

Var(R) = E((R-E(R))^2)

Var(R) realized returns = (1/(t-1)) * sum( R_t - R_average)^2

Var(Rp) large portfolio = (1/n) * average_variance

Var(Rp) two stock = x1^2*Var(R1) + x2^2*Var(R2) + 2*x1*x2*Cov(R1,R2)

x_i (portfolio weights) = Value of investment i / total value of portfolio

βi^p = (SD(Ri)*corr(Ri,Rp))/SD(Rp)

Chapter 12

Effective after tax interest = r*(1-t)

Net debt = Debt - Excess cash and short term investments

r_u (unlevered) = ((E/(E+B)*r_e)+((D/(E+B)*r_d)

r_wacc = ((E/(E+B)*r_e)+((D/(E+B)*r_d*(1-t))

r_wacc = r_u-(D/(E+D))*t*r_d

Downloaded by EZRA VALENTINO (ezra.valentino@ui.ac.id)

lOMoARcPSD|8764734

β_u (unlevered) = ((E/(E+B)*β_e)+((D/(E+B)*β_d)

Chapter 14

EPS = Earnings / Number of shares

MarkV_E = MarkV_A - MarkV_Liabilities

r_e = r_u + ((D/E)*(r_u-r_d))

β_e = β_u + ((D/E)*(β_u-β_d))

Chapter 15

Cash flow to investors with leverage = Cash flow to invester with leverage + interest tax shield

Interest tax shield = Corporate tax rate * interest payments

Market value of debt = PV (future interest payments)

PV (Interest Tax Shield) = (t*interest)/rf

PV (Interest tax shield) = t * Future Interest payments

PV (Interest Tax Shield)_perpetual = D * t

r* (effective tax advantage of debt) = ((1-t_i)-(1-t_c)*(1-t_e))/(1-t_i)

T_ex* = 1-((1-t_e)/(1-t_i))

V_L = V_U + PV(Interest Tax Shield)

V_L = V_U + (r * D)

Chapter 16

V_L (agency) = V_U + PV(Interest Tax Shield) - PV(Financial Distress Costs) - PV(Agency Costs of Debt) + PV(Agency Benefit

V_L (optimal) = V_U + PV(Interest tax shield) - PV(Financial Distress Costs)

Chapter 17

Div = 100*rf*(1-t)

Div*(1-t) = (P_cum - P_ex)*(1-t_g)

P_cum = P_ex + div_0 * ((1-t_d)/(1-t_g))

P_retain = (Div*(1-t_d))/(rf*(1-t_i))

t_d* (effective dividend t) = (t_d-t_g)/(1-t_g)

t_retain = 1-(((1-t_c)*(1-t_g))/(1-t_i))

Chapter 18

V0_L = (FCF_1/(1+r_wacc)) + (FCF_2/(1+r_wacc)^2) + …

APV (adjusted present value) = V_U + PV(Interest Tax Shield)

Dt (debt capacity) = d * Vt_L

FCFE (Free Cash Flow to Equity) = FCF - (1-t_c) * Interest payments + net borrowing

Net borrowing at date t = D_t - D_(t-1)

PV (Interest tax shield) = t_c * k * PV (FCF )

PV(t*int_t) = ((t*int_t)/((1+r_U)^t-1*(1+r_d))

r_wacc (project) = (r_u) - (d) * (t_c) * (r_d)

V_L = (1+t*k*((1+r_u)/(1+r_d)))*V_U

V_L (interest coverage ratio) = V_U + t_c * k * V_U

Vt_L = ((FCF_(t+1) + V_(L_t+1) / (1+r_wacc))

Chapter 19

Downloaded by EZRA VALENTINO (ezra.valentino@ui.ac.id)

lOMoARcPSD|8764734

Sales = Market Size * Market Share * Average Sales Price

Raw materials = Market Size * Market Share * Raw Materials per Unit

Sales and marketing = Sales * (Sales and Marketing % of Sales)

Income tax = Pretax Income * Tax rate

After-tax interest expense = (1 - Tax Rate) * (Interest on Debt - Interest on Excess Cash)

Net borrowing in year t = Net Debt in Year t - Net Debt in Year_(t-1)

New Stockholders’ Equity = Equity Contributions - Expensed Transaction Fees

β_U (unlevering beta) = (Equity value / Enterprise value) * β_E + (Net debt value / Enterprise value) * β_D

Continuation Enterprise Value at Forecast Horizon = EBITDA at Horizon * EBITDA Multiple at Horizon

Enterprise Value in Year T = FCF_t+1 / (r_wacc - g)

FCF_t+1 = UNI_T+1 + Depr._T+1 - ∂NWC_T+1 - CapEx_T+1

CapEx_t+1 = Depr._t+1 + g * fixed assets_t

FCF_t+1 = (1 + g ) * UNI_t - g * NWC_t - g * Fixed_assets_t

V_U_t-1 = (FCF_t + V_U_t) / (1 + r_u)

Ts_t-1 = (Interest Tax Shield_t + T_s_t) / (1 + r_d)

Cash Multiple = Total Cash Received / Total Cash Invested

Downloaded by EZRA VALENTINO (ezra.valentino@ui.ac.id)

You might also like

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Practice Midterm SolutionsDocument18 pagesPractice Midterm SolutionsGNo ratings yet

- Chapter 4 SolvedDocument21 pagesChapter 4 SolvedQuế Hoàng Hoài ThươngNo ratings yet

- Mini Case CH 3 SolutionsDocument14 pagesMini Case CH 3 SolutionsTimeka CarterNo ratings yet

- List of 63 Useful Exam Formulas For Paper F9Document4 pagesList of 63 Useful Exam Formulas For Paper F9Muhammad Imran UmerNo ratings yet

- Chap 002Document26 pagesChap 002dbjnNo ratings yet

- ECN 134: Solution Key To Problem Set 2 Part A: CF Statement. You Are Given The Following Information of XYZ Corporation For 2011Document11 pagesECN 134: Solution Key To Problem Set 2 Part A: CF Statement. You Are Given The Following Information of XYZ Corporation For 2011Ashekin MahadiNo ratings yet

- 3 - Cost Volume Profit AnalysisDocument1 page3 - Cost Volume Profit AnalysisPattraniteNo ratings yet

- CFi Capital Structure Leverage ProblemsDocument6 pagesCFi Capital Structure Leverage ProblemsJustin Russo HarryNo ratings yet

- Financial Management Formula SheetDocument2 pagesFinancial Management Formula SheetSantosh Kumar100% (3)

- AE 13 Partnership Corp. Acctg 2019 2020 PDFDocument6 pagesAE 13 Partnership Corp. Acctg 2019 2020 PDFMaebell P. ValdezNo ratings yet

- Bread and Butter Report - FinalDocument30 pagesBread and Butter Report - FinalJason PhillipsNo ratings yet

- 01 Financial Reporting and Analysis - An IntroductionDocument29 pages01 Financial Reporting and Analysis - An IntroductionFariza MakhayNo ratings yet

- EM302 Formula Sheet 2013Document4 pagesEM302 Formula Sheet 2013Jeff JabeNo ratings yet

- Hand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadDocument55 pagesHand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadHamad Bakar HamadNo ratings yet

- Assignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BDocument4 pagesAssignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BAnshum SethiNo ratings yet

- Balance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Document27 pagesBalance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Anonymous H0SJWZE8100% (1)

- Valuation of Bonds and Shares: Problem 1Document29 pagesValuation of Bonds and Shares: Problem 1Sourav Kumar DasNo ratings yet

- Risk and ReturnDocument117 pagesRisk and ReturnLee ChiaNo ratings yet

- Bond ValuationDocument10 pagesBond ValuationVivek SuranaNo ratings yet

- Bond ValuationDocument12 pagesBond ValuationvarunjajooNo ratings yet

- Corporate Finance ProjectDocument13 pagesCorporate Finance ProjectAbhay Narayan SinghNo ratings yet

- Bond Valuation Question Bank PDFDocument27 pagesBond Valuation Question Bank PDFMOHIT KAUSHIKNo ratings yet

- Bond ValuationDocument17 pagesBond ValuationMatthew RyanNo ratings yet

- Answers To Problem Sets: How Much Should A Corporation Borrow?Document8 pagesAnswers To Problem Sets: How Much Should A Corporation Borrow?priyanka GayathriNo ratings yet

- Midsem Cheat Sheet (Finance)Document2 pagesMidsem Cheat Sheet (Finance)lalaran123No ratings yet

- Solutions. Chapter. 9Document6 pagesSolutions. Chapter. 9asih359No ratings yet

- Elasticity EconomicsDocument14 pagesElasticity EconomicsYiwen LiuNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Capital Structure and LeverageDocument47 pagesCapital Structure and LeverageLokamNo ratings yet

- Module - 3 - Risk and ReturnDocument46 pagesModule - 3 - Risk and ReturnGourav ParidaNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Chapter 12: An Alternative View of Risk and Return:: The Arbitrage Pricing TheoryDocument12 pagesChapter 12: An Alternative View of Risk and Return:: The Arbitrage Pricing TheoryAsad NaeemNo ratings yet

- Bond Valuation Formulas in ExcelDocument22 pagesBond Valuation Formulas in Excelrameessalam852569No ratings yet

- Valuation of BondsDocument27 pagesValuation of BondsAbhinav Rajverma100% (1)

- Dividend Discount ModelDocument19 pagesDividend Discount Modelrajat vermaNo ratings yet

- Finance ProblemSets11Document323 pagesFinance ProblemSets11Stefan CN100% (2)

- S2 CMA c02 Cost-Volume-Profit AnalysisDocument25 pagesS2 CMA c02 Cost-Volume-Profit Analysisdiasjoy67No ratings yet

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- DCF ValuationDocument3 pagesDCF ValuationDurga ShankarNo ratings yet

- Value Based Management BCG ApproachDocument14 pagesValue Based Management BCG ApproachAvi AhujaNo ratings yet

- The Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000Document24 pagesThe Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000chandel08No ratings yet

- Session 10-11, CVP Analysis - PPTX (Repaired)Document35 pagesSession 10-11, CVP Analysis - PPTX (Repaired)Nikhil ChitaliaNo ratings yet

- Corporate FinanceDocument19 pagesCorporate FinanceBilal Shahid100% (4)

- FE 445 M1 CheatsheetDocument5 pagesFE 445 M1 Cheatsheetsaya1990No ratings yet

- Cost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast UniversityDocument23 pagesCost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast Universityasif rahanNo ratings yet

- 5 - Capital Budgeting - Risk & UncertaintyDocument22 pages5 - Capital Budgeting - Risk & UncertaintySymron KheraNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- Independent University, Bangladesh: Assignment ACN 202 SEC-05Document7 pagesIndependent University, Bangladesh: Assignment ACN 202 SEC-05Murad HasanNo ratings yet

- FM PPT Ratio AnalysisDocument12 pagesFM PPT Ratio AnalysisHarsh ManotNo ratings yet

- Comparable Companies: Inter@rt ProjectDocument9 pagesComparable Companies: Inter@rt ProjectVincenzo AlterioNo ratings yet

- Leverage and Capital StructureDocument8 pagesLeverage and Capital StructureC H ♥ N T ZNo ratings yet

- Capital Structure IDocument117 pagesCapital Structure Ikill_my_kloneNo ratings yet

- Problem Sets 15 - 401 08Document72 pagesProblem Sets 15 - 401 08Muhammad GhazzianNo ratings yet

- Cost of Capital Solved Problems - Cost of Capital - Capital StructureDocument1 pageCost of Capital Solved Problems - Cost of Capital - Capital StructureAnonymous qOdzTznKE100% (1)

- Time Value of Money ScriptDocument15 pagesTime Value of Money ScriptSudheesh Murali NambiarNo ratings yet

- Formula SheetDocument9 pagesFormula Sheetrocky2219No ratings yet

- Dividend DecisionsDocument55 pagesDividend Decisionsparth kNo ratings yet

- A) Project ADocument9 pagesA) Project AАнастасия ОсипкинаNo ratings yet

- Solutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelFrom EverandSolutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelNo ratings yet

- CheatSheet (Finance)Document1 pageCheatSheet (Finance)Guan Yu Lim100% (3)

- FIN 401 - Cheat SheetDocument2 pagesFIN 401 - Cheat SheetStephanie NaamaniNo ratings yet

- Financial Management FormulasDocument9 pagesFinancial Management FormulasTannao100% (2)

- Problem Set 2 Chapter 3: Questions 1-2, Quantitative Problems 1-3, 11, 13, 14Document3 pagesProblem Set 2 Chapter 3: Questions 1-2, Quantitative Problems 1-3, 11, 13, 14NaeemNo ratings yet

- Projecting Cash Flow and EarningsDocument46 pagesProjecting Cash Flow and EarningsNaeemNo ratings yet

- Topic 3 Solutions: I S E I I SDocument8 pagesTopic 3 Solutions: I S E I I SNaeemNo ratings yet

- Auditing The Human Resource Management Process: © Mcgraw-Hill Education 2014 © Mcgraw-Hill Education 2014Document27 pagesAuditing The Human Resource Management Process: © Mcgraw-Hill Education 2014 © Mcgraw-Hill Education 2014NaeemNo ratings yet

- Lussier Test Bank 12 Chapter 12 Test BanksDocument23 pagesLussier Test Bank 12 Chapter 12 Test BanksNaeemNo ratings yet

- Return, Risk, and The Security Market LineDocument49 pagesReturn, Risk, and The Security Market LineNaeemNo ratings yet

- IPPTChap 015Document44 pagesIPPTChap 015NaeemNo ratings yet

- Global Economic Activity and Industry AnalysisDocument51 pagesGlobal Economic Activity and Industry AnalysisNaeemNo ratings yet

- Diversification and Risky Asset AllocationDocument45 pagesDiversification and Risky Asset AllocationNaeemNo ratings yet

- Common Stock ValuationDocument57 pagesCommon Stock ValuationNaeemNo ratings yet

- Bond Prices and YieldsDocument52 pagesBond Prices and YieldsNaeemNo ratings yet

- Evidence and Documentation: © Mcgraw-Hill Education 2014Document45 pagesEvidence and Documentation: © Mcgraw-Hill Education 2014NaeemNo ratings yet

- Behavioral Finance and The Psychology of InvestingDocument58 pagesBehavioral Finance and The Psychology of InvestingNaeemNo ratings yet

- Mutual Funds and Other Investment CompaniesDocument51 pagesMutual Funds and Other Investment CompaniesNaeemNo ratings yet

- Risk Assessment: © Mcgraw-Hill Education 2014Document35 pagesRisk Assessment: © Mcgraw-Hill Education 2014NaeemNo ratings yet

- Overview of Security TypesDocument31 pagesOverview of Security TypesNaeemNo ratings yet

- The Investment ProcessDocument46 pagesThe Investment ProcessNaeemNo ratings yet

- IPPTChap 001Document45 pagesIPPTChap 001NaeemNo ratings yet

- Accounting For Corporate Combinations and Associations Australian 8th Edition Arthur Solutions Manual Full Chapter PDFDocument33 pagesAccounting For Corporate Combinations and Associations Australian 8th Edition Arthur Solutions Manual Full Chapter PDFKristenGilbertpoir100% (17)

- FM Ii Handout-2Document85 pagesFM Ii Handout-2Fãhâd Õró ÂhmédNo ratings yet

- Auditing Problems: RequiredDocument2 pagesAuditing Problems: RequiredvhhhNo ratings yet

- Week 5 Chapter 11Document6 pagesWeek 5 Chapter 11CIA190116 STUDENTNo ratings yet

- I. Capital Budgeting (30 Questions)Document26 pagesI. Capital Budgeting (30 Questions)Joseph Prado Fernandez0% (1)

- Dwnload Full Corporate Finance A Focused Approach 6th Edition Ehrhardt Test Bank PDFDocument36 pagesDwnload Full Corporate Finance A Focused Approach 6th Edition Ehrhardt Test Bank PDFmiltongoodwin2490i100% (17)

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Financial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsDocument9 pagesFinancial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsArpit BhawsarNo ratings yet

- Translation ActivityDocument1 pageTranslation ActivityJon Dumagil Inocentes, CPANo ratings yet

- Chapter 2Document83 pagesChapter 2Korubel Asegdew YimenuNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesPhạm Hồng Trang Alice -No ratings yet

- Testbank - Error Correction Answer KeyDocument1 pageTestbank - Error Correction Answer KeyDawn Rei DangkiwNo ratings yet

- Financial Planning and Pro Forma Statements Simplistic Approach Part 2Document17 pagesFinancial Planning and Pro Forma Statements Simplistic Approach Part 2ishaNo ratings yet

- Test Bank Bank For Advanced Accounting 3 e by JeterDocument15 pagesTest Bank Bank For Advanced Accounting 3 e by Jeterjr centenoNo ratings yet

- AkuntansiDocument87 pagesAkuntansipuput indah sariNo ratings yet

- Financial Accounting & Reporting III ExercisesDocument34 pagesFinancial Accounting & Reporting III ExercisesMei Chien Yap67% (3)

- Stock KKDocument7 pagesStock KKamir rabieNo ratings yet

- Lesson 19 - Preparation of Capital Statement and Balance SheetDocument6 pagesLesson 19 - Preparation of Capital Statement and Balance SheetMayeng MonayNo ratings yet

- Introducing Accounting in Business: ACG 2021: Chapter 1Document59 pagesIntroducing Accounting in Business: ACG 2021: Chapter 1Kelvin Jay Sebastian SaplaNo ratings yet

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document66 pagesKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINo ratings yet

- Financial Reporting Novmock2019 PDFDocument21 pagesFinancial Reporting Novmock2019 PDFAndy AsanteNo ratings yet

- Ac6 ProblemsDocument21 pagesAc6 ProblemsLysss EpssssNo ratings yet

- Title Viii Corporate Books and Records: I. LimitationsDocument12 pagesTitle Viii Corporate Books and Records: I. LimitationsRengeline LucasNo ratings yet

- 5th Year Buscom For DiscussionDocument5 pages5th Year Buscom For DiscussionAirille CarlosNo ratings yet

- Akl Bab 9Document23 pagesAkl Bab 9nisaa12No ratings yet