Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

27 viewsCoke and Pepsi Serve Up New Strategies For A Post-COVID World

Coke and Pepsi Serve Up New Strategies For A Post-COVID World

Uploaded by

Sauriya SinhaCoca-Cola and PepsiCo reported significant declines in earnings for the second quarter due to the negative impacts of the COVID-19 pandemic on sales at restaurants and other businesses outside the home. Both companies have launched new e-commerce initiatives and products to offset losses from carbonated soft drinks. However, a full recovery could be difficult as about half of their sales typically come from businesses that have been closed by the pandemic.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Environmental AuditDocument4 pagesEnvironmental Auditbuson1100% (1)

- A Review of Prime Hydration - The UproarDocument3 pagesA Review of Prime Hydration - The UproarDANIEL STEPHANO TERAN VEGA0% (1)

- CoCa Cola Social Media MarketingDocument14 pagesCoCa Cola Social Media MarketingAbhiraj ChakrabartiNo ratings yet

- Coca Cola Strategic Management ReportDocument44 pagesCoca Cola Strategic Management ReportRakhi Patil33% (3)

- Karnataka TP Officer ListDocument20 pagesKarnataka TP Officer ListSauriya Sinha100% (1)

- IMB2022009 (Abhijeet) Coca ColaDocument3 pagesIMB2022009 (Abhijeet) Coca ColaChiragNo ratings yet

- Goals of CocaDocument7 pagesGoals of Coca2K19/UMBA/25 VIDHI SARAFFNo ratings yet

- The Coca-Cola CompanyDocument4 pagesThe Coca-Cola CompanypaldeptNo ratings yet

- Coca ColaDocument13 pagesCoca ColaShahzad PATEL100% (1)

- Coco Cola SWOT Analysis: StrengthsDocument17 pagesCoco Cola SWOT Analysis: StrengthsDeepNo ratings yet

- Marketing Report - Coca ColaDocument9 pagesMarketing Report - Coca ColaAvBNo ratings yet

- Coca Cola Marketing PlanDocument14 pagesCoca Cola Marketing PlanShubhrant ShuklaNo ratings yet

- Strategic Management: Rashi AnejaDocument17 pagesStrategic Management: Rashi AnejaRashi Aneja 2027455No ratings yet

- POM Final ExamDocument15 pagesPOM Final ExamNiaz AhmedNo ratings yet

- Coca-Cola Company: Information - Industry AnalysisDocument6 pagesCoca-Cola Company: Information - Industry AnalysisGeorge MosesNo ratings yet

- Coke's RFID-Based Dispensers Redefine Business IntelligenceDocument7 pagesCoke's RFID-Based Dispensers Redefine Business IntelligenceSnehashis SenNo ratings yet

- Coca Cola Situation AnalysisDocument14 pagesCoca Cola Situation AnalysisEhtiaz KarimNo ratings yet

- Coca Cola Vs PepsiDocument4 pagesCoca Cola Vs PepsiMy HuỳnhNo ratings yet

- What Is The CocaDocument5 pagesWhat Is The CocaGhumonto SafiurNo ratings yet

- Coca ColaDocument62 pagesCoca ColaRaman Chamber100% (2)

- Thesis On Coke and PepsiDocument7 pagesThesis On Coke and Pepsistephaniewilliamscolumbia100% (2)

- Industry Profile: A) GlobalDocument22 pagesIndustry Profile: A) GlobalParKhurNo ratings yet

- Presented By: Ayesha Sadaqat Tooba Shoqat Saleem Khan Hareem Rafay Abdullah SaeedDocument38 pagesPresented By: Ayesha Sadaqat Tooba Shoqat Saleem Khan Hareem Rafay Abdullah SaeedAyesha raoNo ratings yet

- A PPT On Coca ColaDocument20 pagesA PPT On Coca ColaVikas Tirmale0% (1)

- Introduction of The Brand:: Pepsico Inc. Is An American Multinational Brand Producing Food, Snack andDocument9 pagesIntroduction of The Brand:: Pepsico Inc. Is An American Multinational Brand Producing Food, Snack andmridulkatiyar06_5470No ratings yet

- STRENGHTDocument7 pagesSTRENGHTThanhthuy VõNo ratings yet

- Project of Coca Cola 110406035123 Phpapp01Document77 pagesProject of Coca Cola 110406035123 Phpapp01varunvarshney1988No ratings yet

- Research Paper # 1: Anthony ByrumDocument8 pagesResearch Paper # 1: Anthony ByrumSteven AnthonyByrumNo ratings yet

- Coca Cola CoDocument18 pagesCoca Cola Coapi-549696516No ratings yet

- Assignment On: Coca ColaDocument11 pagesAssignment On: Coca ColaAbdul Ahad JamilNo ratings yet

- Explore The Reasons For Coca-Cola's High-Profit Margins: Qianhao Gao, Shihui Geng, Yuke Shi, Shuya ZhaoDocument7 pagesExplore The Reasons For Coca-Cola's High-Profit Margins: Qianhao Gao, Shihui Geng, Yuke Shi, Shuya Zhaosukhjotkalher5No ratings yet

- Management Thought ReportDocument18 pagesManagement Thought Reportঅর্থী ইয়াসমিনNo ratings yet

- Entrepreneurship - AssignmentDocument11 pagesEntrepreneurship - AssignmentKelas MemasakNo ratings yet

- Coke VsDocument5 pagesCoke VsBaberNo ratings yet

- Corporate StrategyDocument7 pagesCorporate Strategyyerra tarun kumarNo ratings yet

- Market Share Coca-Cola: Portfolio DiversificationDocument4 pagesMarket Share Coca-Cola: Portfolio Diversificationrehan shaikhNo ratings yet

- Strategies Businesses Can Adopt To Respond To Issues of GlobalisationDocument4 pagesStrategies Businesses Can Adopt To Respond To Issues of Globalisationxj100% (5)

- Coca Cola Company Detail AnalysisDocument5 pagesCoca Cola Company Detail AnalysismagdalineNo ratings yet

- Sibusiso SCM Assignment 1Document15 pagesSibusiso SCM Assignment 1Sibusiso ZuluNo ratings yet

- Revenue ModelDocument15 pagesRevenue ModelSibusiso ZuluNo ratings yet

- Conference Call Transcript KOF 3Q22Document17 pagesConference Call Transcript KOF 3Q22Bandile ShobaNo ratings yet

- KandyDocument5 pagesKandyFeroze_Khan_4143No ratings yet

- The Coca-Cola CompanyDocument3 pagesThe Coca-Cola CompanyCarlo Emmanuel DyNo ratings yet

- Group Paper Coke Vs PepsiDocument14 pagesGroup Paper Coke Vs PepsiAtika BhatnagarNo ratings yet

- Warstler NewsletterDocument3 pagesWarstler Newsletterapi-312576338No ratings yet

- Coca-Cola - S Future Growth Strategy - DiversificationDocument13 pagesCoca-Cola - S Future Growth Strategy - DiversificationAwais RazaNo ratings yet

- PE Project - 4Document3 pagesPE Project - 4h8v9yx98ygNo ratings yet

- ABJ-4006-0 Int'l Marketing Strategy 202223.editedDocument31 pagesABJ-4006-0 Int'l Marketing Strategy 202223.editedngolodedan2No ratings yet

- Coca-Cola Company: Aizon, Mabel Claire H. Hetutua, Therese Janine D. Lamosa, Raniel G. Bsac 2BDocument5 pagesCoca-Cola Company: Aizon, Mabel Claire H. Hetutua, Therese Janine D. Lamosa, Raniel G. Bsac 2BTristan Arthur BernalesNo ratings yet

- Final Exam Logistics and Supply Chain 1 PDFDocument17 pagesFinal Exam Logistics and Supply Chain 1 PDFasmayoussefatiaNo ratings yet

- Brand ReportDocument5 pagesBrand ReportSharif Usman SanawanNo ratings yet

- Competitive Position of Coca-Cola: PepsicoDocument6 pagesCompetitive Position of Coca-Cola: PepsicoAlka AggarwalNo ratings yet

- Coca-Cola ProjectionsDocument4 pagesCoca-Cola ProjectionsFranchesca ZapantaNo ratings yet

- 2010 Change of StrategyDocument3 pages2010 Change of StrategyIndu MathyNo ratings yet

- Iemb2023 227 234Document8 pagesIemb2023 227 234Amna AzamNo ratings yet

- Evaluate How Coca-Cola Sought Growth and Profitability. Use Case Study ExamplesDocument10 pagesEvaluate How Coca-Cola Sought Growth and Profitability. Use Case Study ExamplesNyaradzai MaoreraNo ratings yet

- Bps Coca Cola PaperDocument21 pagesBps Coca Cola Paperapi-252651948No ratings yet

- Financial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Document17 pagesFinancial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Shloak AgrawalNo ratings yet

- Appetite for Convenience: How to Sell Perishable Food Direct to ConsumersFrom EverandAppetite for Convenience: How to Sell Perishable Food Direct to ConsumersNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Consumer Buying Behaviour On Cars, MRDocument23 pagesConsumer Buying Behaviour On Cars, MRSauriya SinhaNo ratings yet

- Smart Task Report - 072957Document5 pagesSmart Task Report - 072957Sauriya SinhaNo ratings yet

- How Coca-Cola Is Pivoting Its Innovation and Commercial Strategies in The COVID-19 EraDocument3 pagesHow Coca-Cola Is Pivoting Its Innovation and Commercial Strategies in The COVID-19 EraSauriya SinhaNo ratings yet

- 30127-Article Text-46842-1-10-20200807Document11 pages30127-Article Text-46842-1-10-20200807Sauriya SinhaNo ratings yet

- Formula of SummoningDocument3 pagesFormula of SummoningSauriya SinhaNo ratings yet

- Name of The Intern: Snehal Manager: Gayatri Territory: BangaloreDocument11 pagesName of The Intern: Snehal Manager: Gayatri Territory: BangaloreSauriya SinhaNo ratings yet

- How The Coca-Cola Company Is Responding To The Coronavirus OutbreakDocument3 pagesHow The Coca-Cola Company Is Responding To The Coronavirus OutbreakSauriya SinhaNo ratings yet

- BR Project Group 11 (1) 92Document25 pagesBR Project Group 11 (1) 92Sauriya SinhaNo ratings yet

- Business Forecasting: Deepak Kumar Mba 3 Sem. Rai Business SchoolDocument11 pagesBusiness Forecasting: Deepak Kumar Mba 3 Sem. Rai Business SchoolSauriya SinhaNo ratings yet

- 1) Max Weber Bureaucracy Theory: Regulations AuthorityDocument6 pages1) Max Weber Bureaucracy Theory: Regulations AuthoritySauriya SinhaNo ratings yet

- BR Project Group 11 (1) 92Document24 pagesBR Project Group 11 (1) 92Sauriya SinhaNo ratings yet

- Submitted To: Prof. Sarika TandonDocument18 pagesSubmitted To: Prof. Sarika TandonSauriya SinhaNo ratings yet

- In Business: Artificial Intelligence TechnologiesDocument11 pagesIn Business: Artificial Intelligence TechnologiesSauriya SinhaNo ratings yet

- Business Forecasting & Time Series AnalysisDocument28 pagesBusiness Forecasting & Time Series AnalysisSauriya SinhaNo ratings yet

- 7recession SheerwoodDocument12 pages7recession SheerwoodSauriya SinhaNo ratings yet

- 1) Bramble: GimletDocument13 pages1) Bramble: GimletJOSHUA JORDANNo ratings yet

- Fruit Based Spirit Final.2Document11 pagesFruit Based Spirit Final.2John Lloyd RimandoNo ratings yet

- Vocabulary: Drink and Containers: LESSON 1B: I Need A Bottle of WaterDocument4 pagesVocabulary: Drink and Containers: LESSON 1B: I Need A Bottle of WaterGabriel JPNo ratings yet

- Product ListDocument3 pagesProduct ListBagus PrasojoNo ratings yet

- Competitive Position of Coca-Cola: PepsicoDocument6 pagesCompetitive Position of Coca-Cola: PepsicoAlka AggarwalNo ratings yet

- BSHM 26 - Bar and Beverage Management-Midterm ExamDocument7 pagesBSHM 26 - Bar and Beverage Management-Midterm Examvandolf encarnacionNo ratings yet

- Chapter - 1 Industry Profile: Growth PotentialDocument33 pagesChapter - 1 Industry Profile: Growth PotentialPabitra BarikNo ratings yet

- Planning of The BarDocument7 pagesPlanning of The BarVipul BhandariNo ratings yet

- Water - BVHM - Semester IIDocument4 pagesWater - BVHM - Semester IIAshish DigheNo ratings yet

- Excise TaxDocument7 pagesExcise TaxKezNo ratings yet

- Whisper-Meniu-Bauturi-V2 0 9 6Document26 pagesWhisper-Meniu-Bauturi-V2 0 9 6morosanu_boyNo ratings yet

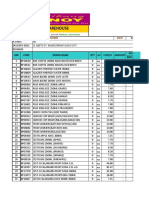

- Iloilo Warehouse: Zest-O Corporation DateDocument4 pagesIloilo Warehouse: Zest-O Corporation DateBP BENITONo ratings yet

- Kashif Khadim AssignmentDocument6 pagesKashif Khadim Assignmentarslan shahNo ratings yet

- M4L Liquor 1jan To 31mar 2022Document2 pagesM4L Liquor 1jan To 31mar 2022Tsitsi MutasaNo ratings yet

- Bar MenuDocument13 pagesBar MenuVlad Andrei DunaNo ratings yet

- Wine DissertationDocument4 pagesWine DissertationThesisPaperHelpSingapore100% (1)

- Cola Wars Case StudyDocument20 pagesCola Wars Case Studyfarhan HaidarNo ratings yet

- PHB Beverage Menu 6 DecDocument6 pagesPHB Beverage Menu 6 DecilyasNo ratings yet

- China Top Beverage PDFDocument8 pagesChina Top Beverage PDFEveline PatriciaNo ratings yet

- Indira - PepsicoDocument13 pagesIndira - PepsicoKiran Gupta100% (1)

- Thesis About BartenderDocument5 pagesThesis About Bartenderbk3q07k5100% (2)

- TheCoca ColaCompanyDocument13 pagesTheCoca ColaCompanyThivhonali Voice NetshimbupfeNo ratings yet

- History: New Bern, North Carolina Caleb BradhamDocument15 pagesHistory: New Bern, North Carolina Caleb BradhamNorul AFniza100% (1)

- Case Study - PepsiCoDocument9 pagesCase Study - PepsiCoOpera SingerNo ratings yet

- VKP StocklistDocument13 pagesVKP StocklistVinson AgirNo ratings yet

- Daily Inventory Cafe 70Document9 pagesDaily Inventory Cafe 70AndhikaNo ratings yet

- Tenpin Cocktail MenuDocument2 pagesTenpin Cocktail Menucam.newbike23No ratings yet

- Syllogism Question PDF 1Document5 pagesSyllogism Question PDF 1Angad JogdandNo ratings yet

- Coca ColaDocument39 pagesCoca ColaVishnuta AgrawalNo ratings yet

Coke and Pepsi Serve Up New Strategies For A Post-COVID World

Coke and Pepsi Serve Up New Strategies For A Post-COVID World

Uploaded by

Sauriya Sinha0 ratings0% found this document useful (0 votes)

27 views3 pagesCoca-Cola and PepsiCo reported significant declines in earnings for the second quarter due to the negative impacts of the COVID-19 pandemic on sales at restaurants and other businesses outside the home. Both companies have launched new e-commerce initiatives and products to offset losses from carbonated soft drinks. However, a full recovery could be difficult as about half of their sales typically come from businesses that have been closed by the pandemic.

Original Description:

Original Title

coce4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCoca-Cola and PepsiCo reported significant declines in earnings for the second quarter due to the negative impacts of the COVID-19 pandemic on sales at restaurants and other businesses outside the home. Both companies have launched new e-commerce initiatives and products to offset losses from carbonated soft drinks. However, a full recovery could be difficult as about half of their sales typically come from businesses that have been closed by the pandemic.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views3 pagesCoke and Pepsi Serve Up New Strategies For A Post-COVID World

Coke and Pepsi Serve Up New Strategies For A Post-COVID World

Uploaded by

Sauriya SinhaCoca-Cola and PepsiCo reported significant declines in earnings for the second quarter due to the negative impacts of the COVID-19 pandemic on sales at restaurants and other businesses outside the home. Both companies have launched new e-commerce initiatives and products to offset losses from carbonated soft drinks. However, a full recovery could be difficult as about half of their sales typically come from businesses that have been closed by the pandemic.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Coke And Pepsi Serve Up New

Strategies For A Post-COVID World

Carbonated soft drinks, as a category, is getting accustomed to change.

Consumers were already buying less sugary soda when COVID-19 hit, and

second-quarter earnings reports from Coca-Cola and PepsiCoshow the two

iconic brands must make big modifications to what was seen as an

impervious business.

Coca-Cola CEO James Quincey set the tone even before his company

reported big second-quarter problems on Tuesday (July 21). Coke saw

earnings drop 33 percent, as revenues saw their largest decline in 25 years.

“The economic impact of the lockdown is just starting to begin,” Quincey told

CNBC in May. “[Coming] after this virus crisis will be the economic impact and

hangover of the lockdown, and there will be a much greater focus from the

consumer on affordability or getting the prices lower.”

PepsiCo also reported weak second-quarter earnings earlier this month, with

soft beverage sales only partly offset by strong food sales. Unlike Coca-Cola,

PepsiCo is far more diversified, owning Quaker Oats Company and Frito-Lay

– which have performed well during the COVID-19 lockdowns and left the

company less exposed to soda’s big fizzle.

PepsiCo Chairman and CEO Ramon Laguarta said in announcing the

company’s second-quarter resultsthat “despite being faced with significant

challenges and complexities as a result of the COVID-19 pandemic, our

businesses performed relatively well during the quarter, with a notable level of

resiliency in our global snacks and foods business.”

But citing continued volatility and uncertainty, Laguarta added that company

officials “are not providing a financial outlook for fiscal year 2020 at this time.

However, we continue to believe we have ample liquidity and flexibility to

meet the needs of our business and return cash to shareholders. We remain

focused on winning in the marketplace with our strong portfolio of brands in

attractive categories, agile supply chain and flexible go-to-market systems,

while also building on our competitive advantages, to emerge an even

stronger company in the future.”

Putting Some Pop Into the Recovery

The two beverage titans had already been busy over the past several quarters

developing new concepts and partnerships to offset soft drinks’ long, slow

slide in favor of healthier options. But now, they must correct for COVID as

well.

Coke’s new Pour By Phone mobile app leverages the demand for touchless

options in quick-service restaurants (QSRs) and casual dining establishments

using resurgent QR codes. Coke also debuted its touchless Freestyle

system with Bluetooth connectivity in restaurants in 2019.

“The software will be available at more than 10,000 Coca-Cola Freestyle

dispensers this summer. All Freestyle dispensers will be contactless-

compatible by the end of the year,” PYMNTS reported at the time. “Research

shows that 60 percent of restaurant guests would choose to pour their own

fountain drinks versus having an employee do it for them.”

The carbonated colossus also introduced a new monthly

subscription service in February called The Insiders Club that promises

Coke swag and new flavors partly in a bid to have recurring revenues make

up for traditional soft drinks’ ongoing slide.

As for PepsiCo, the company leveraged its relative strength in the snacks

category to launch two direct-to-consumer (DTC) websites

– PantryShop.com and Snacks.com — at the height of the lockdown. The

sites offer bundles of Frito-Lay and other PepsiCo food products via home

delivery. PantryShop.com focuses on brands like Quaker and Tropicana,

while Snacks.com specializes in Frito-Lay snacks and related items.

"In these uncertain times, as more and more consumers are using

eCommerce channels to purchase food and beverage products,

PantryShop.com and Snacks.com offer shoppers another alternative for easy

and fast access to products they love,” Gibu Thomas, PepsiCo’s senior vice

president and head of eCommerce, said in a statement announcing the new

sites.

PepsiCo also announced a deal in February to buy the Rockstar Energy

drink brand for $3.85 billion, expanding its portfolio further away from

sweetened drinks into lifestyle niches. And last year, the company rolled out

its PepCoin cash-back loyalty rewards program.

Long Road To Recovery?

But despite such initiatives, Coca-Cola and PepsiCo could be in for a long

slog to make up for COVID-related losses. After all, they derive roughly half of

their sales from businesses outside of the home – bars, restaurants, stadiums

and other places that have been mostly shut down by the coronavirus.

You might also like

- Environmental AuditDocument4 pagesEnvironmental Auditbuson1100% (1)

- A Review of Prime Hydration - The UproarDocument3 pagesA Review of Prime Hydration - The UproarDANIEL STEPHANO TERAN VEGA0% (1)

- CoCa Cola Social Media MarketingDocument14 pagesCoCa Cola Social Media MarketingAbhiraj ChakrabartiNo ratings yet

- Coca Cola Strategic Management ReportDocument44 pagesCoca Cola Strategic Management ReportRakhi Patil33% (3)

- Karnataka TP Officer ListDocument20 pagesKarnataka TP Officer ListSauriya Sinha100% (1)

- IMB2022009 (Abhijeet) Coca ColaDocument3 pagesIMB2022009 (Abhijeet) Coca ColaChiragNo ratings yet

- Goals of CocaDocument7 pagesGoals of Coca2K19/UMBA/25 VIDHI SARAFFNo ratings yet

- The Coca-Cola CompanyDocument4 pagesThe Coca-Cola CompanypaldeptNo ratings yet

- Coca ColaDocument13 pagesCoca ColaShahzad PATEL100% (1)

- Coco Cola SWOT Analysis: StrengthsDocument17 pagesCoco Cola SWOT Analysis: StrengthsDeepNo ratings yet

- Marketing Report - Coca ColaDocument9 pagesMarketing Report - Coca ColaAvBNo ratings yet

- Coca Cola Marketing PlanDocument14 pagesCoca Cola Marketing PlanShubhrant ShuklaNo ratings yet

- Strategic Management: Rashi AnejaDocument17 pagesStrategic Management: Rashi AnejaRashi Aneja 2027455No ratings yet

- POM Final ExamDocument15 pagesPOM Final ExamNiaz AhmedNo ratings yet

- Coca-Cola Company: Information - Industry AnalysisDocument6 pagesCoca-Cola Company: Information - Industry AnalysisGeorge MosesNo ratings yet

- Coke's RFID-Based Dispensers Redefine Business IntelligenceDocument7 pagesCoke's RFID-Based Dispensers Redefine Business IntelligenceSnehashis SenNo ratings yet

- Coca Cola Situation AnalysisDocument14 pagesCoca Cola Situation AnalysisEhtiaz KarimNo ratings yet

- Coca Cola Vs PepsiDocument4 pagesCoca Cola Vs PepsiMy HuỳnhNo ratings yet

- What Is The CocaDocument5 pagesWhat Is The CocaGhumonto SafiurNo ratings yet

- Coca ColaDocument62 pagesCoca ColaRaman Chamber100% (2)

- Thesis On Coke and PepsiDocument7 pagesThesis On Coke and Pepsistephaniewilliamscolumbia100% (2)

- Industry Profile: A) GlobalDocument22 pagesIndustry Profile: A) GlobalParKhurNo ratings yet

- Presented By: Ayesha Sadaqat Tooba Shoqat Saleem Khan Hareem Rafay Abdullah SaeedDocument38 pagesPresented By: Ayesha Sadaqat Tooba Shoqat Saleem Khan Hareem Rafay Abdullah SaeedAyesha raoNo ratings yet

- A PPT On Coca ColaDocument20 pagesA PPT On Coca ColaVikas Tirmale0% (1)

- Introduction of The Brand:: Pepsico Inc. Is An American Multinational Brand Producing Food, Snack andDocument9 pagesIntroduction of The Brand:: Pepsico Inc. Is An American Multinational Brand Producing Food, Snack andmridulkatiyar06_5470No ratings yet

- STRENGHTDocument7 pagesSTRENGHTThanhthuy VõNo ratings yet

- Project of Coca Cola 110406035123 Phpapp01Document77 pagesProject of Coca Cola 110406035123 Phpapp01varunvarshney1988No ratings yet

- Research Paper # 1: Anthony ByrumDocument8 pagesResearch Paper # 1: Anthony ByrumSteven AnthonyByrumNo ratings yet

- Coca Cola CoDocument18 pagesCoca Cola Coapi-549696516No ratings yet

- Assignment On: Coca ColaDocument11 pagesAssignment On: Coca ColaAbdul Ahad JamilNo ratings yet

- Explore The Reasons For Coca-Cola's High-Profit Margins: Qianhao Gao, Shihui Geng, Yuke Shi, Shuya ZhaoDocument7 pagesExplore The Reasons For Coca-Cola's High-Profit Margins: Qianhao Gao, Shihui Geng, Yuke Shi, Shuya Zhaosukhjotkalher5No ratings yet

- Management Thought ReportDocument18 pagesManagement Thought Reportঅর্থী ইয়াসমিনNo ratings yet

- Entrepreneurship - AssignmentDocument11 pagesEntrepreneurship - AssignmentKelas MemasakNo ratings yet

- Coke VsDocument5 pagesCoke VsBaberNo ratings yet

- Corporate StrategyDocument7 pagesCorporate Strategyyerra tarun kumarNo ratings yet

- Market Share Coca-Cola: Portfolio DiversificationDocument4 pagesMarket Share Coca-Cola: Portfolio Diversificationrehan shaikhNo ratings yet

- Strategies Businesses Can Adopt To Respond To Issues of GlobalisationDocument4 pagesStrategies Businesses Can Adopt To Respond To Issues of Globalisationxj100% (5)

- Coca Cola Company Detail AnalysisDocument5 pagesCoca Cola Company Detail AnalysismagdalineNo ratings yet

- Sibusiso SCM Assignment 1Document15 pagesSibusiso SCM Assignment 1Sibusiso ZuluNo ratings yet

- Revenue ModelDocument15 pagesRevenue ModelSibusiso ZuluNo ratings yet

- Conference Call Transcript KOF 3Q22Document17 pagesConference Call Transcript KOF 3Q22Bandile ShobaNo ratings yet

- KandyDocument5 pagesKandyFeroze_Khan_4143No ratings yet

- The Coca-Cola CompanyDocument3 pagesThe Coca-Cola CompanyCarlo Emmanuel DyNo ratings yet

- Group Paper Coke Vs PepsiDocument14 pagesGroup Paper Coke Vs PepsiAtika BhatnagarNo ratings yet

- Warstler NewsletterDocument3 pagesWarstler Newsletterapi-312576338No ratings yet

- Coca-Cola - S Future Growth Strategy - DiversificationDocument13 pagesCoca-Cola - S Future Growth Strategy - DiversificationAwais RazaNo ratings yet

- PE Project - 4Document3 pagesPE Project - 4h8v9yx98ygNo ratings yet

- ABJ-4006-0 Int'l Marketing Strategy 202223.editedDocument31 pagesABJ-4006-0 Int'l Marketing Strategy 202223.editedngolodedan2No ratings yet

- Coca-Cola Company: Aizon, Mabel Claire H. Hetutua, Therese Janine D. Lamosa, Raniel G. Bsac 2BDocument5 pagesCoca-Cola Company: Aizon, Mabel Claire H. Hetutua, Therese Janine D. Lamosa, Raniel G. Bsac 2BTristan Arthur BernalesNo ratings yet

- Final Exam Logistics and Supply Chain 1 PDFDocument17 pagesFinal Exam Logistics and Supply Chain 1 PDFasmayoussefatiaNo ratings yet

- Brand ReportDocument5 pagesBrand ReportSharif Usman SanawanNo ratings yet

- Competitive Position of Coca-Cola: PepsicoDocument6 pagesCompetitive Position of Coca-Cola: PepsicoAlka AggarwalNo ratings yet

- Coca-Cola ProjectionsDocument4 pagesCoca-Cola ProjectionsFranchesca ZapantaNo ratings yet

- 2010 Change of StrategyDocument3 pages2010 Change of StrategyIndu MathyNo ratings yet

- Iemb2023 227 234Document8 pagesIemb2023 227 234Amna AzamNo ratings yet

- Evaluate How Coca-Cola Sought Growth and Profitability. Use Case Study ExamplesDocument10 pagesEvaluate How Coca-Cola Sought Growth and Profitability. Use Case Study ExamplesNyaradzai MaoreraNo ratings yet

- Bps Coca Cola PaperDocument21 pagesBps Coca Cola Paperapi-252651948No ratings yet

- Financial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Document17 pagesFinancial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Shloak AgrawalNo ratings yet

- Appetite for Convenience: How to Sell Perishable Food Direct to ConsumersFrom EverandAppetite for Convenience: How to Sell Perishable Food Direct to ConsumersNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Consumer Buying Behaviour On Cars, MRDocument23 pagesConsumer Buying Behaviour On Cars, MRSauriya SinhaNo ratings yet

- Smart Task Report - 072957Document5 pagesSmart Task Report - 072957Sauriya SinhaNo ratings yet

- How Coca-Cola Is Pivoting Its Innovation and Commercial Strategies in The COVID-19 EraDocument3 pagesHow Coca-Cola Is Pivoting Its Innovation and Commercial Strategies in The COVID-19 EraSauriya SinhaNo ratings yet

- 30127-Article Text-46842-1-10-20200807Document11 pages30127-Article Text-46842-1-10-20200807Sauriya SinhaNo ratings yet

- Formula of SummoningDocument3 pagesFormula of SummoningSauriya SinhaNo ratings yet

- Name of The Intern: Snehal Manager: Gayatri Territory: BangaloreDocument11 pagesName of The Intern: Snehal Manager: Gayatri Territory: BangaloreSauriya SinhaNo ratings yet

- How The Coca-Cola Company Is Responding To The Coronavirus OutbreakDocument3 pagesHow The Coca-Cola Company Is Responding To The Coronavirus OutbreakSauriya SinhaNo ratings yet

- BR Project Group 11 (1) 92Document25 pagesBR Project Group 11 (1) 92Sauriya SinhaNo ratings yet

- Business Forecasting: Deepak Kumar Mba 3 Sem. Rai Business SchoolDocument11 pagesBusiness Forecasting: Deepak Kumar Mba 3 Sem. Rai Business SchoolSauriya SinhaNo ratings yet

- 1) Max Weber Bureaucracy Theory: Regulations AuthorityDocument6 pages1) Max Weber Bureaucracy Theory: Regulations AuthoritySauriya SinhaNo ratings yet

- BR Project Group 11 (1) 92Document24 pagesBR Project Group 11 (1) 92Sauriya SinhaNo ratings yet

- Submitted To: Prof. Sarika TandonDocument18 pagesSubmitted To: Prof. Sarika TandonSauriya SinhaNo ratings yet

- In Business: Artificial Intelligence TechnologiesDocument11 pagesIn Business: Artificial Intelligence TechnologiesSauriya SinhaNo ratings yet

- Business Forecasting & Time Series AnalysisDocument28 pagesBusiness Forecasting & Time Series AnalysisSauriya SinhaNo ratings yet

- 7recession SheerwoodDocument12 pages7recession SheerwoodSauriya SinhaNo ratings yet

- 1) Bramble: GimletDocument13 pages1) Bramble: GimletJOSHUA JORDANNo ratings yet

- Fruit Based Spirit Final.2Document11 pagesFruit Based Spirit Final.2John Lloyd RimandoNo ratings yet

- Vocabulary: Drink and Containers: LESSON 1B: I Need A Bottle of WaterDocument4 pagesVocabulary: Drink and Containers: LESSON 1B: I Need A Bottle of WaterGabriel JPNo ratings yet

- Product ListDocument3 pagesProduct ListBagus PrasojoNo ratings yet

- Competitive Position of Coca-Cola: PepsicoDocument6 pagesCompetitive Position of Coca-Cola: PepsicoAlka AggarwalNo ratings yet

- BSHM 26 - Bar and Beverage Management-Midterm ExamDocument7 pagesBSHM 26 - Bar and Beverage Management-Midterm Examvandolf encarnacionNo ratings yet

- Chapter - 1 Industry Profile: Growth PotentialDocument33 pagesChapter - 1 Industry Profile: Growth PotentialPabitra BarikNo ratings yet

- Planning of The BarDocument7 pagesPlanning of The BarVipul BhandariNo ratings yet

- Water - BVHM - Semester IIDocument4 pagesWater - BVHM - Semester IIAshish DigheNo ratings yet

- Excise TaxDocument7 pagesExcise TaxKezNo ratings yet

- Whisper-Meniu-Bauturi-V2 0 9 6Document26 pagesWhisper-Meniu-Bauturi-V2 0 9 6morosanu_boyNo ratings yet

- Iloilo Warehouse: Zest-O Corporation DateDocument4 pagesIloilo Warehouse: Zest-O Corporation DateBP BENITONo ratings yet

- Kashif Khadim AssignmentDocument6 pagesKashif Khadim Assignmentarslan shahNo ratings yet

- M4L Liquor 1jan To 31mar 2022Document2 pagesM4L Liquor 1jan To 31mar 2022Tsitsi MutasaNo ratings yet

- Bar MenuDocument13 pagesBar MenuVlad Andrei DunaNo ratings yet

- Wine DissertationDocument4 pagesWine DissertationThesisPaperHelpSingapore100% (1)

- Cola Wars Case StudyDocument20 pagesCola Wars Case Studyfarhan HaidarNo ratings yet

- PHB Beverage Menu 6 DecDocument6 pagesPHB Beverage Menu 6 DecilyasNo ratings yet

- China Top Beverage PDFDocument8 pagesChina Top Beverage PDFEveline PatriciaNo ratings yet

- Indira - PepsicoDocument13 pagesIndira - PepsicoKiran Gupta100% (1)

- Thesis About BartenderDocument5 pagesThesis About Bartenderbk3q07k5100% (2)

- TheCoca ColaCompanyDocument13 pagesTheCoca ColaCompanyThivhonali Voice NetshimbupfeNo ratings yet

- History: New Bern, North Carolina Caleb BradhamDocument15 pagesHistory: New Bern, North Carolina Caleb BradhamNorul AFniza100% (1)

- Case Study - PepsiCoDocument9 pagesCase Study - PepsiCoOpera SingerNo ratings yet

- VKP StocklistDocument13 pagesVKP StocklistVinson AgirNo ratings yet

- Daily Inventory Cafe 70Document9 pagesDaily Inventory Cafe 70AndhikaNo ratings yet

- Tenpin Cocktail MenuDocument2 pagesTenpin Cocktail Menucam.newbike23No ratings yet

- Syllogism Question PDF 1Document5 pagesSyllogism Question PDF 1Angad JogdandNo ratings yet

- Coca ColaDocument39 pagesCoca ColaVishnuta AgrawalNo ratings yet