Professional Documents

Culture Documents

Chapter 3 Liquidation Based Valuation

Chapter 3 Liquidation Based Valuation

Uploaded by

Mae Angiela Tanseco100%(1)100% found this document useful (1 vote)

2K views9 pagesliquidation based valuation

Original Title

Chapter-3-Liquidation-Based-Valuation

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentliquidation based valuation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

100%(1)100% found this document useful (1 vote)

2K views9 pagesChapter 3 Liquidation Based Valuation

Chapter 3 Liquidation Based Valuation

Uploaded by

Mae Angiela Tansecoliquidation based valuation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 9

VALUATION CONCEPTS AND METHODOLOGIES

LIQUIDATION BASED VALUATION

For most companies, the value generated by assets working together and by

human capital applied to managing those assets makes estimated going -

concern value greater than liquidation value. However, if there will be

circumstances that occur which doubts the going-concern ability of a

business, using going-concern value may not be appropriate anymore as the

future cash flows will not be realizable anymore. An alternative approach is

the use of liquidation value.

Liquidation value

According to the CFA Institute, liquidation value refers to the value of a

company if it were dissolved and its assets are sold individually. Liquidation

value represents the net amount that can be gathered if the business is shut

down and its assets are sold piecemeal. In some texts, liquidation value is

also known as net asset value.

For example, for the case of hotel closes, the assets it owns like beds, chairs,

furniture and kitchen equipment can be sold as part of a package or

separately. These assets are priced based on the value it can fetch if buyers

buy these assets separately. If these assets will be sold separately, there is

no guarantee that they can generate future cash flows anymore as it once did

when it was used in the hotel. Hence, their value is significantly reduced to its

liquidation value.

Once a business closes, synergies generated by assets working together or

by applying managerial skill to these assets are lost which reduces firm value.

In addition, liquidation value may continue to erode based on the time frame

available for liquidating assets. For example, perishable inventories should

be sold immediately or else it cannot be sold anymore if it gets spoiled.

Businesses cannot afford to wait for potential buyers that are willing to pay

higher price. The most appropriate choice is to sell it at a discount to recover

some money from it instead of throwing it away without recovering any

money. Businesses can wait longer period to sell other assets like building or

machineries unless they are other constraints that will require them to be

disposed in a shorter time.

Circumstances clearly dictates whether it will be appropriate to use liquidation

value or going concern value in a valuation exercise. If a business is profitable

or has sustainable growth prospects, these will normally show future cash

flows which will result in firm value that is higher than if the assets are just

separately like in a liquidation.

VALUATION CONCEPTS Al

However, if liquidation value becomes higher compared ee going

concem value, this may signal that a significant business even ranspired

which makes the liquidation value more appropriate in valuation exercise.

Liquidation value is the base price or the floor price for any firm valuation

exercise. Liquidation value should not be used to value profitable or growing

companies ae this approach does not consider growth shai of the

business. Liquidation prices can be difficult to obtain as these are no readily

available. Instead, liquidation value should be used for dying or losing

companies where liquidation is imminent to check whether profits can still be

realized upon sale of the assets owned.

A unique callout for liquidation value is if the firm is operating under a

proprietorship or a partnership model. In these two forms of organization,

profits and cash flows are highly dependent on the skills, knowledge, ability

or network of the owner or partners. As a result, liquidation value should

consider valuing separately the goodwill attributed to these partner-specific

qualities as this may not reflect the true value of the assets which will be sold

or transferred. In this scenario where liquidation is the motive, goodwill will

reduce liquidation value.

Situations to Consider Liquidation Value

The below list shows circumstances wherein liquidation value will be more

appropriate in valuation exercises:

° Business Failures

Business failure is the most common reason why businesses close or

liquidate. Early symptoms of business failure are low or negative

returns. Companies which consistently report operating losses will

eventually impact and reduce firm value. If the firm only earns return

at a rate lower than its cost of capital, this might signal business

failure. When left unresolved, this may lead to insolvency or even

bankruptcy.

Insolvency happens when a company cannot pay liabilities as they

come due. Insolvent firms have asset balance which is still greater

than liabilities but is having liquidity problems as a result of depleted

cash. Bankruptcy is the most serious type of business failure as this

happens when liabilities become greater than asset balance. As a

result, shareholders’ equity becomes negative balance. This signifies

that the firm cannot settle all its liabilities unless the assets can be sold

at a higher price than its book value (which is not often the case).

2 oS So "Ae ———

VALUATION CONCEPTS AND METHODOLOGIES

Business failures can be driven by different internal factors such as

mismanagement, poor financial evaluation and decisions, failure to

execute strategic plans, inadequate cash flow planning or failure to

manage working capital. These external factors that would attribute to

business failure may take the form of, but not limited to the following:

© severe economic down-turn

© dynamic consumer preferences

© material adverse governmental action or regulation

© occurrence of natural disasters or calamities

© occurrence of pandemic or general health hazards

Liquidation value can be used for businesses which are closing, are

closed, are in bankruptcy, are in industries that are in irreversible

trouble, or going concern firms that isn’t putting its assets to good use

and may be better off closing down and selling the assets. For

distressed companies, the liquidation value conveys relevant

information as it is typically the lower bound of the valuation range.

« Corporate or Project End of Life

Most corporations only have finite number of years to operate as

stated in their Articles of Incorporation. This is also similar in the case

of projects like joint ventures with finite life. Once the date arrives and

life is not extended, due process takes place to end the life of the

corporation and start the liquidation process. Non-extension of

corporate life may stem from collective decision of shareholders to

stop the operation and realize value from liquidating the company

instead. If corporate end of life is already certain, it is more appropriate

to compute terminal value using liquidation value.

¢ Depletion of scarce resources

In some industries like mining and oil, availability of scarce resources

significantly influences firm value. Oftentimes, these are also

industries that are highly regulated by the government. Government

regulation often requires that companies seek approval from the

government prior to commencement of operations. Once the contract

with the government expires or scarce resource become fully depleted

and no new site is prepared to support operation, this might signal

potential liquidation and valuation should be based on liquidation

value.

ION CONCEPTS AND METHODOLOGIES

ZANE

General Principles on Liquidation Value

Liquidation value is the most conservative valuation approach among all as it

considers the realizable value of the asset if it is sold now based on current

Conditions. This captures any markdowns (or markups) that potential buyers,

Negotiate to buy the assets.

General concepts considered in liquidation value are as follows:

* If the liquidation value is above income approach valuation (based on

going-concern principle) and liquidation comes into consideration,

liquidation value should be used.

If the nature of the business implies limited lifetime (e.g. a quarry, gravel,

fixed-term company etc.), the terminal value must be based on

liquidation. All costs necessary to close the operations (e.g. plant closure

costs, disposal costs, rehabilitation costs) should also be factored in and

deducted to arrive at the liquidation value.

* Non-operating assets should be valued by liquidation method as the

market value is reduced by costs of sale and taxes. Since they are not

part of the firm's operating activities, it might be inappropriate to use the

same going concern valuation technique used for business operations.

If such result is higher than net present value of cash-flows from

operating the asset, the liquidation value should be used.

e Liquidation valuation must be used if the business continuity is

dependent on current management that will not stay.

Liquidation value method can also be used as benchmark in making

investment decisions. When a company is profitable with good industry

outlook, the liquidation will typically be lower than the prevailing market price

of the share. Share price often reflects growth prospects of the company

which is a consideration that liquidation value does not have.

For firms that are experiencing decline or industry is consistently declining,

prevailing share prices might be lower than liquidation value. If this happens,

the rational decision for the business is to permanently close the business

and liquidate its assets. Some corporate investors tend to look for companies

whose shares exhibit this characteristic. Because liquidation value is higher

than market price of share, these corporate investors buy the shares at

prevailing market price and sell the company at the higher liquidation value.

This results in risk-free arbitrage profit for these corporate investors.

GE Le es |

VALUATION CONCEPTS AND METHODOLOGIES

However, if the company can be readily liquidated any time, market price per

share should never be below book value per share if all reported assets in the

balance sheet is accurate.

Types of Liquidation

Determining the type of liquidation that will occur is important because it will

affect the costs connected with liquidation of the property, including

commissions for those facilitating the liquidation (lawyers, accountants,

auditors) and taxes at the end of the transaction. These necessary expenses

affect the final value of the business.

Assets are sold strategically over an orderly period to attract and generate

the most money for the assets is known to be an orderly liquidation. This

liquidation process will expose assets for sale on the open market, with a

reasonable time allowed to find a purchaser, both buyer and seller having

knowledge of the uses and purposes to which the asset is adapted and for

which it is capable of being used, the seller being compelled to sell and the

buyer being willing, but not compelled, to buy.

Liquidation process, at which the asset or assets are sold as quickly as

possible, such as at an auction. This is known as forced liquidation.

Liquidation is done immediately especially if creditors have sued or a

bankruptcy is filed. Assets are sold in the market at the soonest time possible

which result in lower prices because of the rush sale. This ultimately drives

down liquidation value.

Calculating Liquidation Value

The liquidation value considers the present value of the sums that can be

obtained through the disposal (i.e. sale) of the assets of the firm in the most

appropriate way, net of the sums set aside for the closure costs, repayment

of the debts and settlement of all liabilities, and net of the tax charges

related to the transaction and the costs of the process of liquidation itself.

Liquidation value can be further computed on a per share basis by dividing

total liquidation value by outstanding ordinary shares. Liquidation value per

share should be considered together with other quantitative (e.g. current

share price, going concern DCF) and qualitative metrics to justify business

decisions to be made.

VALUATION CONCEPTS AND METHODOLOGIES —__

Present Value of Sale of Asset Php Xxx.xx

Less: Present Value of Cost for termination and

settlement for Liabilities (XXX.xx)

Less: Present Value of Tax Charges for the

Transactions and Other Liquidation Costs (__Xxx.xx)

Php XXX.Xx

Liquidation Value

Calculation for liquidation value at closure date is somewhat like the book

value calculation, except the value assumes a forced or orderly liquidation of

assets instead of book value. Book value should not be used as liquidation

value. Liquidation value can be obtained based on the potential sales price

of the assets being sold instead of relying on the costs recorded in the

books. Liquidation value is far more realistic as compared to the book value

method. Even if these assets generate lower than expected return in the

present business, liquidation value should be based on the potential earning

capacity of the individual asset when sold to the buying party instead of the

original capital invested in the assets.

In practice, the liabilities of the business are deducted from the liquidation

value of the assets at closure to determine the liquidation value of the

business. The overall value of a business that uses this method should be

lower than going-concern value.

In computing for the present value of a business or property on a liquidation

basis, the estimated net proceeds should be discounted at a rate that

reflects the risk involved back to the date of the original valuation. This is

important to ensure that all assumptions are aligned. Liquidation value can

be used as basis for terminal cash flow (instead of going concern terminal

cash flow) in a DCF calculation in order to compute firm value in case there

are years that the firm will still be operational prior to liquidation.

Special consideration should be emphasized for intangible assets like

patents and internally developed software programs which are often

unsaleable. When takeover occurs, it is usual that goodwill is recognized as

part of the transaction. Monetary equivalent specific for intangible assets

cannot be reliably and separately measured. Instead, intangible assets are

offset against shareholder's equity to come up with a conservative

liquidation value.

Estimation of liquidation values will be more complex if assets cannot be

easily identified or separated; hence, individual valuation may be

impractical.

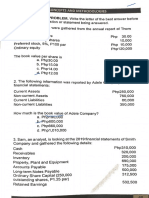

Illustrative Example 4

Pavement Company reported below balances based on its accounting books

records. Pavement Company has 250,000 outstanding shares.

Pavement Company

: December 31, 2019

(in ‘000 Philippine Pesos)

Assets

Cash 100,000

Accounts Receivable (A/R) — Net 800,000

Inventories 3,500,000

Prepaid Expenses 100,000

Property, Plant and Equipment (PPE) — Net ___ 4,500,000 _

Total Assets 9,000,000

Liabilities

Notes Payable 1,200,000

Other Liabilities 800,000

Total Liabilities 2,000,000

Pavement Company is undergoing financial problems and management

would like to assess liquidation value as part of their strategy formulation. If

assets will be sold/realized, they will only realize amount based on below

table.

To computed for the adjusted value of the assets, the current book values

should be multiplied by the assumed realizable value if they are liquidated.

Next, the liabilities should be deducted from the asset adjusted value to arrive

at the liquidation value (or net asset value).

Asset

Valued Asset Book Valued .

Asset Adjusted

At In Php Value At Value

Cash 100% Cash 100,000 100% Php

100,000

AJR - Net 85% AJR-Net 800,000 85% 680,000

Inventories 60% Inventories 3,500,000 60% 2,100,000

Prepaid 25% Prepaid 100,000 25% 25,000

Expenses Expenses

PPE-Net 60% PPE—Net 4,500,000 60% _2,700,000

VALUATION CONCEPTS AND METHODOLOG!

| Total ‘9,000,000 5,605,000

Assets

Php 5,605,000

Asset Adjusted Value

; 2,000,000

Less: Total liabilities to be settled

Liquidation Value - Pavement Company Php 3,605,000

Number of Outstanding Shares 250,000

Liquidation Value per Share Php 14.42

Illustrative Example 2

Golda Company, which is a company specifically created for a joint venture

agreement to extract gold, will end its corporate life in 3 years. Net Cash Flow

expected during the years it still operate is at Php3,000,000 per year. At the

end of its life, Golda estimates to incur Php10,000,000 for closure and

rehabilitation costs for its mining site and other costs related to the liquidation

process. Cost of capital is set at 10%. Remaining assets by end of the

corporate life will be bought by another company for Php 30,000,000 and

remaining debt of Php 4,000,000 will be fully paid off by then. If the valuation

happens now, compute for the value of Golda Company.

Since Golda Company will terminate its life after 3 years, it is more

appropriate to use liquidation value as terminal value input to the DCF model.

For the three years prior to the closure, Golda Company will continue to

generate positive Net Cash Flow and this will form part of its value.

Present Value (PV) of Cash Inflows during Years in Operation

PV of Annual Net Cash Flow = Net Cash Flow x PV Factor of 10%

PV of Net Cash Flow (Year 1) = Php 3,000,000 x 0.9091 = Php 2,727,273

PV of Net Cash Flow (Year 2) = Php 3,000,000 x 0.8264 = Php 2,479,339

PV of Net Cash Flow (Year 3) = Php 3,000,000 x 0.7513 = Php 2,253,944

PV of Cash Inflows during Years in Operation = PV of NCF (Year 1) + PV of

NCF (Year 2) + PV of NCF (Year 3)

PV of Cash Inflows during Years in Operation = Php 2,727,273 +

Php2,479,339 + Php 2,253,944

PV of Cash Inflows during Years in Operation = Php 7,460,556

VALUATION C NCEPTS AND METHODOLOGIES

Since Corporate life ends by Year 3, terminal value will be based on the

liquidation value by end of Year 3.

Present Value of Sale of Asset 22,539,000

(Php30,000,000 x 0.7513) eates

Less: Present Value of Cost for termination and

settlement for Liabilities

(Php 10,000,000 x 0.7513)

7,513,000

Less: Present Value of Tax Charges for the

Transactions and Other Liquidation Costs

(Php4,000,000 x 0.7513) 3,005,200

Liquidation Value Php 12,020,800_

__Php 12,020,800_

Cash flows during the remaining operating life and liquidation value by end of

Year 3 should be combined to arrive at the value of Golda Company now.

Value of Golda Company = PV of Cash Inflows during Years in Operation +

Liquidation Value

Value of Golda Company = Php 7,460,556 + Php 12,021,037

Value of Golda Company = Php 19,481,593

Illustrative Example 3

Droid Company's balance sheet revealed total assets of Php3 million, total

liabilities of Php1 million, and 100,000 shares of outstanding ordinary shares.

Upon checking with potential buyers, the assets of Droid can be sold for

Php1.8 million if sold today. Additional Php300,000 will also be incurred to

cover liquidation expenses. How much is the liquidation value of Droid

Company per share?

To compute for the liquidation value in this example, we need to consider how

much the company will receive from the assets if it will sell today. This money

will also be used to pay for the remaining liabilities and liquidation expenses.

Liquidation Value = Sale of Assets upon Liquidation - Payment for Liabilities

~ Liquidation Costs

Liquidation Value = Php 1,800,000 — Php 1,000,000 — Php 300,000

Liquidation Value = Php500,000

Liquidation Value per Share = Liquidation Value / Number of Outstanding

Ordinary Shares

Liquidation Value per Share = Php 500,000 / 100,000 shares

Liquidation Value per Share = Php 5.00 per share

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Questions For Chapter 2 and 3Document8 pagesQuestions For Chapter 2 and 3Mae Angiela Tanseco70% (10)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Excel Professional Services, Inc.: Donation Donor'S TaxDocument11 pagesExcel Professional Services, Inc.: Donation Donor'S TaxMae Angiela TansecoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document21 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- 3108 Deductions From Gross IncomeDocument17 pages3108 Deductions From Gross IncomeMae Angiela TansecoNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument8 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Discussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesDiscussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument11 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Going Concern Asset Based ValuationDocument21 pagesGoing Concern Asset Based ValuationMae Angiela TansecoNo ratings yet

- Chapter 4 Income Based ValuationDocument6 pagesChapter 4 Income Based ValuationMae Angiela TansecoNo ratings yet

- Chapter 2 Asset ValuationDocument8 pagesChapter 2 Asset ValuationMae Angiela TansecoNo ratings yet