Professional Documents

Culture Documents

2019 Non-Filer Statement

2019 Non-Filer Statement

Uploaded by

cameOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 Non-Filer Statement

2019 Non-Filer Statement

Uploaded by

cameCopyright:

Available Formats

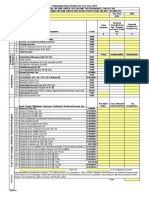

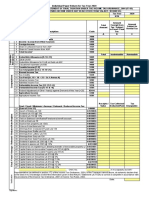

2019 IRS Non-Filer Statement

As part of the 2021-2022 Oberlin financial aid application process, we require that all applicants submit signed

copies of all federal tax forms for both parents and students. In some situations, the student and/or parent may

not be required by the IRS to file federal taxes. You may submit this form if you were not required to, nor did you,

file a 2019 federal tax return.

If selected for verification by the Dept. of Education you may need to request a verification of non-filing

letter from the IRS. You will be notified by our office if you need to request this letter.

Please be sure to:

List all income earned or received during 2019

Attach copies of all W-2’s and/or 1099 forms received in 2019

If you did not have any income in 2019, enter ‘None’

Oberlin Student Name: Gonzalo Ochoa Camarena

Oberlin Student ID: T 01369337

Name of Non-Filer: Gonzalo Ochoa Camarena

Non-Filer is a: Student Parent Spouse

Employer/Source of Income Amount Earned Attachment

[ ] W2

[ ] 1099

None [ ] Not Applicable

[ ] W2

[ ] 1099

[ ] Not Applicable

[ ] W2

[ ] 1099

[ ] Not Applicable

[ ] W2

[ ] 1099

[ ] Not Applicable

$0

TOTAL ________________

I certify that I was not required to, and did not, file a 2019 federal tax return.

January, 4th 2021

Signature Date

Printed Name

{Non-Filer 10/2020}

You might also like

- TWG Bid Evaluation Report - Template For SharingDocument4 pagesTWG Bid Evaluation Report - Template For SharingLegal Officer III100% (13)

- Calculate Completing A 1040Document2 pagesCalculate Completing A 1040api-4921774500% (1)

- Accounting at Interactive Questions1Document32 pagesAccounting at Interactive Questions1IQBALNo ratings yet

- Fitzgerald ComplaintDocument16 pagesFitzgerald ComplaintKenan FarrellNo ratings yet

- What's New in WorkdayDocument5,294 pagesWhat's New in Workdayict hmisNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxTendai ZamangweNo ratings yet

- 2010 ChecklistDocument1 page2010 ChecklistkrenerbookkeepingNo ratings yet

- LC032ALP000EVDocument32 pagesLC032ALP000EVAttia FatimaNo ratings yet

- Tributaria e Aduaneira Declaracao de Rendimentos IRS Modelo 3 Contrato Saphal LamaDocument6 pagesTributaria e Aduaneira Declaracao de Rendimentos IRS Modelo 3 Contrato Saphal LamasitalghimireNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxDSM DRIVING SCHOOLNo ratings yet

- ITR-4 Sugam: Indian Income Tax ReturnDocument5 pagesITR-4 Sugam: Indian Income Tax ReturnJay Prakash shuklaNo ratings yet

- Manual ReturnDocument26 pagesManual ReturnMuhammad Arsalan TariqNo ratings yet

- Tremblay 2006TCC486 EDocument7 pagesTremblay 2006TCC486 Ephil.humeniukNo ratings yet

- 4176-3408 Hua Yang: Recipient's Name and AddressDocument44 pages4176-3408 Hua Yang: Recipient's Name and AddresslindaNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- Indian Income Tax ReturnDocument12 pagesIndian Income Tax ReturnSharanu DodamaniNo ratings yet

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Income List DocumentDocument1 pageIncome List DocumentJesse NicholsNo ratings yet

- TAXATIONDocument12 pagesTAXATIONGraceNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- US Internal Revenue Service: f9452 - 2001Document2 pagesUS Internal Revenue Service: f9452 - 2001IRSNo ratings yet

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990Document38 pagesReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990Fr. ENo ratings yet

- UBS 1099 ConsolidatedDocument37 pagesUBS 1099 Consolidatedahnis2016No ratings yet

- Ny STFDocument8 pagesNy STFERPWebTutorNo ratings yet

- Itr4 EnglishDocument7 pagesItr4 Englishvagiw16705No ratings yet

- Sasumbatomlin19 IL 1040XsgsgfgDocument4 pagesSasumbatomlin19 IL 1040Xsgsgfgdanherman341No ratings yet

- US Internal Revenue Service: f1096 - 1999Document2 pagesUS Internal Revenue Service: f1096 - 1999IRSNo ratings yet

- MSAW U.S Tax GuideDocument17 pagesMSAW U.S Tax GuideHenri FontanaNo ratings yet

- US Internal Revenue Service: F940ez - 1991Document4 pagesUS Internal Revenue Service: F940ez - 1991IRSNo ratings yet

- Form PDF 241510250260524Document11 pagesForm PDF 241510250260524kunalarora24831No ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- Indian Income Tax Return Assessment Year 2021 - 22: SugamDocument12 pagesIndian Income Tax Return Assessment Year 2021 - 22: SugamArihant SatpathyNo ratings yet

- Sugam: Indian Income Tax Return Assessment Year 2021 - 22Document7 pagesSugam: Indian Income Tax Return Assessment Year 2021 - 22Chetanya VigNo ratings yet

- Individual Paper Returnfor Tax Year 2022Document25 pagesIndividual Paper Returnfor Tax Year 2022abdul karimNo ratings yet

- US Internal Revenue Service: I1099 - 1994Document34 pagesUS Internal Revenue Service: I1099 - 1994IRS100% (1)

- Real Estate Services – ITC Reversal - Taxguru - inDocument4 pagesReal Estate Services – ITC Reversal - Taxguru - inPradeepkumarNo ratings yet

- Form 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-VDocument2 pagesForm 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-Vapi-26236657No ratings yet

- Manual Return 2023Document28 pagesManual Return 2023arsalanghuralgtNo ratings yet

- 8892-0234 Vibhor Jain Designated Bene Plan/Tod: Recipient's Name and AddressDocument6 pages8892-0234 Vibhor Jain Designated Bene Plan/Tod: Recipient's Name and AddressVibhor JainNo ratings yet

- MCQ On Individual Income TaxDocument14 pagesMCQ On Individual Income TaxRandy ManzanoNo ratings yet

- Draft Manual Income Tax Return FormDocument26 pagesDraft Manual Income Tax Return FormSaleem MominNo ratings yet

- Result Step 1. ResultDocument1 pageResult Step 1. ResultKalyan YadavNo ratings yet

- Itr4 PreviewDocument10 pagesItr4 PreviewSK TOYFIK ALINo ratings yet

- Form PDF 717976660131022Document9 pagesForm PDF 717976660131022paridarashmi12No ratings yet

- US Internal Revenue Service: f1096 - 1998Document2 pagesUS Internal Revenue Service: f1096 - 1998IRSNo ratings yet

- 2019-Nov-Book of EntriesDocument2 pages2019-Nov-Book of EntriesAbid faisal AhmedNo ratings yet

- Financial Statement-AdjustmentDocument40 pagesFinancial Statement-AdjustmentSyafiqah NajwaNo ratings yet

- Individual Paper Return For Tax Year 2019: SignatureDocument10 pagesIndividual Paper Return For Tax Year 2019: SignatureEngr Saad Bin SarfrazNo ratings yet

- 605is NewDocument2 pages605is NewMiralem MisiniNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 Previewzaid97220No ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- Ir 1241Document1 pageIr 1241Kit ChuNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- US Internal Revenue Service: f8859 - 1997Document2 pagesUS Internal Revenue Service: f8859 - 1997IRSNo ratings yet

- Should Landlords Be Filing 1099s For Service Providers - ForbesDocument3 pagesShould Landlords Be Filing 1099s For Service Providers - ForbeswuliaNo ratings yet

- US Internal Revenue Service: fw5 - 2001Document3 pagesUS Internal Revenue Service: fw5 - 2001IRSNo ratings yet

- Form PDFDocument12 pagesForm PDFShreedhar MurthyNo ratings yet

- NTN MoitDocument1 pageNTN MoitAdeel AhmedNo ratings yet

- NTN MoitDocument1 pageNTN MoitAdeel AhmedNo ratings yet

- Festival Coralifornia, Traducción Al InglésDocument6 pagesFestival Coralifornia, Traducción Al IngléscameNo ratings yet

- $12,000 in Scholarships: 2020 Shirley Rabb Winston Scholarship in Classical VoiceDocument10 pages$12,000 in Scholarships: 2020 Shirley Rabb Winston Scholarship in Classical VoicecameNo ratings yet

- Food For Thought: Did The First Cooked Meals Help Fuel The Dramatic Evolutionary Expansion of The Human Brain?Document4 pagesFood For Thought: Did The First Cooked Meals Help Fuel The Dramatic Evolutionary Expansion of The Human Brain?came100% (2)

- BrundibárGuia de EstudioDocument10 pagesBrundibárGuia de EstudiocameNo ratings yet

- French Diction F14Document77 pagesFrench Diction F14cameNo ratings yet

- 330 Langalibalele Street, Pietermaritzburg, 3201 Directorate: Human Resource Management Services Recruitment and SelectionDocument5 pages330 Langalibalele Street, Pietermaritzburg, 3201 Directorate: Human Resource Management Services Recruitment and Selectionbryston bryNo ratings yet

- RPD Daily Incident Report 8/21/23Document5 pagesRPD Daily Incident Report 8/21/23inforumdocsNo ratings yet

- Quality Assurance, Testing and Inspection PlanDocument11 pagesQuality Assurance, Testing and Inspection PlanSanjay SharmaNo ratings yet

- Eft, Ecs, Core Banking SolutionsDocument28 pagesEft, Ecs, Core Banking SolutionsRamya KarthiNo ratings yet

- SLORD CaseDocument1 pageSLORD CaseJosh NapizaNo ratings yet

- Kirsteen M. MacKenzie - The Solemn League and Covenant of The Three Kingdoms and The Cromwellian Union, 1643-1663 (Routledge Research in Early Modern History) (Retail)Document223 pagesKirsteen M. MacKenzie - The Solemn League and Covenant of The Three Kingdoms and The Cromwellian Union, 1643-1663 (Routledge Research in Early Modern History) (Retail)Rodrigo Couto Gondim RochaNo ratings yet

- Apartheid Politics and Architecture in South AfricaDocument13 pagesApartheid Politics and Architecture in South AfricaWeber BragaNo ratings yet

- A-2 ResinDocument6 pagesA-2 Resinthehighlife1080No ratings yet

- DNVGL Ru Ship Pt1ch3Document8 pagesDNVGL Ru Ship Pt1ch3DeonNo ratings yet

- Preamble: Read Republic Act 8491Document3 pagesPreamble: Read Republic Act 8491Junjie FuentesNo ratings yet

- HSBC Red Catalog For RewardsDocument19 pagesHSBC Red Catalog For RewardsLeofred LozanoNo ratings yet

- Company Liquidation Process and ProcedureDocument2 pagesCompany Liquidation Process and ProcedureandrewNo ratings yet

- Loi Steam CoalDocument3 pagesLoi Steam CoalAchmad DjunaidiNo ratings yet

- Chima Nkemdirim, Q.C.: Chief of Staff - Office of Mayor Naheed NenshiDocument15 pagesChima Nkemdirim, Q.C.: Chief of Staff - Office of Mayor Naheed NenshiInstitute for Research on Public Policy (IRPP)No ratings yet

- Syria The Fall of The House of Assad PDFDocument315 pagesSyria The Fall of The House of Assad PDFPolar NightsNo ratings yet

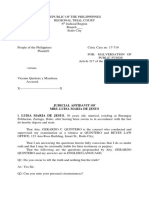

- Judicial Affidavit of Mrs. Luisa Maria de JesusDocument4 pagesJudicial Affidavit of Mrs. Luisa Maria de JesusJeremy MorenoNo ratings yet

- Loksewa Construction ManagementDocument129 pagesLoksewa Construction Managementmadan kunwarNo ratings yet

- Informatica 9.5.1 Hot Fix 2 Message ReferenceDocument479 pagesInformatica 9.5.1 Hot Fix 2 Message ReferenceRobert MartinNo ratings yet

- Cala FilesDocument62 pagesCala FilesshameprojectNo ratings yet

- M.B. Sanghi Vs HCP SynopsisDocument3 pagesM.B. Sanghi Vs HCP SynopsisArshaNo ratings yet

- PDF All PPT Videos MPPDocument129 pagesPDF All PPT Videos MPPDuha ShahNo ratings yet

- PLEA BARGAINING - A CRITICAL ANALYSIS by Krishan Kr. KajalDocument7 pagesPLEA BARGAINING - A CRITICAL ANALYSIS by Krishan Kr. KajalDr. P.K. Pandey100% (1)

- The Code On Wages 2019: India's First Step Towards Consolidation of Labour LawsDocument50 pagesThe Code On Wages 2019: India's First Step Towards Consolidation of Labour LawsTanu Priya100% (1)

- UntitledDocument10 pagesUntitledapi-145618953No ratings yet

- PH IMS SP12 FR09 Complaint Report To SupplierDocument1 pagePH IMS SP12 FR09 Complaint Report To SupplierMohamed HamedNo ratings yet

- 5th TNNLU-CCI BrochureDocument26 pages5th TNNLU-CCI BrochureAshu SaxenaNo ratings yet

- Natalia Mooting QDocument1 pageNatalia Mooting QPok Nik LiNo ratings yet

- Diploma in Custom Clearance and Freight Forwarding: Duration: Eligibility: Admission Procedure: ObjectiveDocument1 pageDiploma in Custom Clearance and Freight Forwarding: Duration: Eligibility: Admission Procedure: Objectiveavijit kundu senco onlineNo ratings yet

- Installing Oracle Unified DirectoryDocument118 pagesInstalling Oracle Unified DirectoryVishwajeet SinghNo ratings yet