Professional Documents

Culture Documents

Solution For Neha's Assignment: DR CR

Solution For Neha's Assignment: DR CR

Uploaded by

Ramesh Kulkarni0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

Assignment Solution

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageSolution For Neha's Assignment: DR CR

Solution For Neha's Assignment: DR CR

Uploaded by

Ramesh KulkarniCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

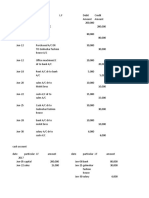

Solution For Neha’s Assignment

On 1st April 2015 Suman Traders purchased Machinery for ` 30,000. On 1st Oct, 2015, they purchased

further Machinery costing `20,000. On 1st Oct 2016 they sold the Machine purchased on 1st April 2015

for `18,000 and brought another Machine for `15,000 on the same date. Depreciation is provided on

Machinery @20% p.a. on the Diminishing Balance Method and financial year closes on 31st March every

year. Prepare the Machinery Account and Depreciation Account for the year 2015-16, 2016-17 and

2017-18

In the Books of Suman Traders

Machinery Account

DR CR

Date Particulars Jf Amount Date Particulars Jf Amount

1-Apr-15 To Bank/Cash M-1 30000 31-Mar-16 By Depreciation M-1 6000

1-102015 To Bank/Cash M-2 20000 31-Mar-16 By Depreciation M-2 2000

31-Mar-16 By Balance c/d M-1 24000

31-Mar-16 By Balance c/d M-2 18000

50000 50000

2016-17

1-Apr-16 To Balance b/d M-1 24000 1-Oct-16 By Bank M-22 Sold 18000

1-Apr-16 To Balance b/d M-2 18000 1-Oct-16 By Depreciation M-2 1800

1-Oct-16 To Profit on Sale M-2 1800 31-Mar-17 By Depreciation M-1 4800

1-Oct-16 To Bank of M-3 15000 31-Mar-17 By Depreciation M-3 1500

By Balance c/d M-1 19200

By Balance c/d M3 13500

58800 58800

2017-18

31-Mar-18

1-Apr-17 To Balance bd M-1 19000 By Depreciation M-1 3800

31-Mar-18

1-Apr-17 To Balancebd M-3 13500 By Depreciation M-3 2700

31-Mar-18

By Balance c/d M-1 15200

31-Mar-18

By Balance c/d M3 10800

32500 32500

2018-19 To Balance bd M-1 15200

To Balancebd M-3 10800

You might also like

- HSBC Bank StatementDocument1 pageHSBC Bank Statementwilliams edwards80% (10)

- JPM Crypto Market 210701Document20 pagesJPM Crypto Market 210701Brentjaciow100% (5)

- Swift PaymentsDocument23 pagesSwift PaymentsDharanya VNo ratings yet

- Church Company Completes These Transactions and Events During MarchDocument56 pagesChurch Company Completes These Transactions and Events During Marchlaale dijaanNo ratings yet

- DHFL Sanction LetterDocument6 pagesDHFL Sanction LetterRamesh Kulkarni75% (4)

- PDF 3Document3 pagesPDF 3RushabhNo ratings yet

- Accrued and Prepayment QPDocument8 pagesAccrued and Prepayment QPTahmina Sobhan100% (1)

- 26AS Financial Year 2017-18Document5 pages26AS Financial Year 2017-18Amol LandgeNo ratings yet

- DPM11.004 Fra S16Document1 pageDPM11.004 Fra S16AnkitNo ratings yet

- Basti Malook CC Ledger 18-19Document1 pageBasti Malook CC Ledger 18-19Zaki NiaziNo ratings yet

- PAIR Investment Company Limited: LedgerDocument15 pagesPAIR Investment Company Limited: LedgerMuhammad SamiNo ratings yet

- Depreciation NotesDocument3 pagesDepreciation NotesDixit PhuyalNo ratings yet

- Equipment Creation Format-PSF (MEC)Document361 pagesEquipment Creation Format-PSF (MEC)Rajesh YadavNo ratings yet

- Account TransactionDocument3 pagesAccount TransactionruaidaNo ratings yet

- GPFLedgerDocument1 pageGPFLedgerGautamNo ratings yet

- Working Note Calcualation of Depreciation (SLM) & Profit or Loss On Sale of FurnitureDocument2 pagesWorking Note Calcualation of Depreciation (SLM) & Profit or Loss On Sale of FurnitureHarendra PrajapatiNo ratings yet

- Amulya Kumar Verma 26asDocument4 pagesAmulya Kumar Verma 26asSatyendra SinghNo ratings yet

- Dep & Sale of MachineDocument9 pagesDep & Sale of MachineIsha ParwaniNo ratings yet

- AccountDocument13 pagesAccountpuiyan0314No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961safiNo ratings yet

- Hire Purchase Solutions AmendentDocument4 pagesHire Purchase Solutions Amendentbuddybest22No ratings yet

- BK公式 PDFDocument23 pagesBK公式 PDFJia Yao TaiNo ratings yet

- Accounting PROJECT YASHDocument19 pagesAccounting PROJECT YASHZaka ullahNo ratings yet

- Interest CalculationDocument1 pageInterest Calculationcasamba306No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961YashodhaNo ratings yet

- SNDT 6 F 231Document10 pagesSNDT 6 F 231Dheer PopatNo ratings yet

- BCTPC0226N 2019 PDFDocument4 pagesBCTPC0226N 2019 PDFAnonymous wCIT17No ratings yet

- 2021 California Housing Market ForecastDocument100 pages2021 California Housing Market ForecastC.A.R. Research & EconomicsNo ratings yet

- Double Column Cash Book 6 MarksDocument5 pagesDouble Column Cash Book 6 MarksGagan VNo ratings yet

- Neen 10CDocument3 pagesNeen 10CGeneen GelvoleoNo ratings yet

- Ledger Statement Payment WiseDocument39 pagesLedger Statement Payment WisekrishnaplastNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Akaub KU !Document6 pagesAkaub KU !Nick WilliamNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Santosh IyerNo ratings yet

- Account 16Document41 pagesAccount 16divineauramasterNo ratings yet

- TallyDocument1 pageTallycivtect indiaNo ratings yet

- Sales Register 2019Document30 pagesSales Register 2019dhaval galaNo ratings yet

- 3531 24773 Textbooksolution PDFDocument42 pages3531 24773 Textbooksolution PDFADITYA BANSALNo ratings yet

- Activity and Tutorial 1,2,3Document4 pagesActivity and Tutorial 1,2,3NUR AFFIDAH LEENo ratings yet

- Pakan TanjungDocument646 pagesPakan Tanjungrehobot tanjungNo ratings yet

- Rajdeep Show Room: ParticularsDocument12 pagesRajdeep Show Room: ParticularsTAKOLNo ratings yet

- Aut Hori Sati On LetterDocument15 pagesAut Hori Sati On LetterRaj Kothari MNo ratings yet

- AnswerDocument83 pagesAnswerTavnish SinghNo ratings yet

- Revision Test Paper Cap-Ii: Advanced Accounting Questions Accounting For DepartmentsDocument279 pagesRevision Test Paper Cap-Ii: Advanced Accounting Questions Accounting For Departmentsshankar k.c.No ratings yet

- CCP102Document22 pagesCCP102api-3849444No ratings yet

- Pisalbo KrishaDocument9 pagesPisalbo KrishaJandy CabalceNo ratings yet

- Tutorial 2 - QuestionsDocument6 pagesTutorial 2 - Questionsjunming laiNo ratings yet

- Rent 2017 - 2018Document9 pagesRent 2017 - 2018Muhammad SamiNo ratings yet

- Project ReportDocument5 pagesProject Reportsonali deotaleNo ratings yet

- A.Y. 2021-22Document4 pagesA.Y. 2021-22LAXMI FINANCENo ratings yet

- Laziz Bakery - Assignment Acc 106Document9 pagesLaziz Bakery - Assignment Acc 106نور الفاتحةNo ratings yet

- حل اسئلة الكراسة أ.فاطمة حمادDocument147 pagesحل اسئلة الكراسة أ.فاطمة حمادnnoorain96No ratings yet

- TF-Formats-BRV Business Review CommitteeDocument19 pagesTF-Formats-BRV Business Review CommitteeUsman TirmiziNo ratings yet

- Redemption of Debentures 1Document12 pagesRedemption of Debentures 1shaikhshamaaparveen105No ratings yet

- Lecture Discussion For Depreciation Expense October 14 2020Document2 pagesLecture Discussion For Depreciation Expense October 14 2020Garp BarrocaNo ratings yet

- ,667 Monthly Depreciation X 11 Months From Feb 1 To December 31, 2015)Document2 pages,667 Monthly Depreciation X 11 Months From Feb 1 To December 31, 2015)Garp BarrocaNo ratings yet

- Journal and LedgerDocument3 pagesJournal and LedgerEvery thingNo ratings yet

- Atepb6797n 2018Document4 pagesAtepb6797n 2018hvacpps3No ratings yet

- Depreciation - DPP 03 - (Aarambh 2.0 2024)Document4 pagesDepreciation - DPP 03 - (Aarambh 2.0 2024)Kanishk SawaliyaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ahamed UmarNo ratings yet

- Lac Statac PDF 53765Document1 pageLac Statac PDF 53765Sneha muraliNo ratings yet

- Purchases Journal Date Account Credited Post Reff Account Payable (CR) Cleaning Supplies (DR)Document8 pagesPurchases Journal Date Account Credited Post Reff Account Payable (CR) Cleaning Supplies (DR)BqnezaNo ratings yet

- GST DemandDocument4 pagesGST DemandconsultcountryNo ratings yet

- CH 2 MCQDocument24 pagesCH 2 MCQRamesh KulkarniNo ratings yet

- Best CA Foundation Books To Crack The ExamDocument3 pagesBest CA Foundation Books To Crack The ExamRamesh KulkarniNo ratings yet

- Bagal Annexure II in Principle Format PDFDocument4 pagesBagal Annexure II in Principle Format PDFRamesh KulkarniNo ratings yet

- Bagal Annexure II in Principle FormatDocument4 pagesBagal Annexure II in Principle FormatRamesh KulkarniNo ratings yet

- How To Get Loans Even With A Low Credit ScoreDocument3 pagesHow To Get Loans Even With A Low Credit ScoreRamesh KulkarniNo ratings yet

- KrushirajDocument7 pagesKrushirajRamesh KulkarniNo ratings yet

- AAC Project Report 1Document8 pagesAAC Project Report 1Ramesh KulkarniNo ratings yet

- Gaurav Foundation: Scholarship Programme - Registration FormDocument14 pagesGaurav Foundation: Scholarship Programme - Registration FormRamesh KulkarniNo ratings yet

- School MGMT ActDocument6 pagesSchool MGMT ActRamesh KulkarniNo ratings yet

- Shri Sewa Hospital 1Document6 pagesShri Sewa Hospital 1Ramesh KulkarniNo ratings yet

- Unit 1 - Motion: Calculating SpeedDocument37 pagesUnit 1 - Motion: Calculating SpeedRamesh Kulkarni100% (1)

- Force N MotionDocument20 pagesForce N MotionRamesh KulkarniNo ratings yet

- Algebra - 100% - SET - 5 - AP PDFDocument12 pagesAlgebra - 100% - SET - 5 - AP PDFRamesh KulkarniNo ratings yet

- Multifactor ModelDocument2 pagesMultifactor ModelBasra AjmalNo ratings yet

- R 5Document1 pageR 5Elwyn P. Biason100% (1)

- FAR 1 Pre Batch Over All Lecture NotesDocument60 pagesFAR 1 Pre Batch Over All Lecture NotesHadeed HafeezNo ratings yet

- A Review On Sapiens by HarariDocument16 pagesA Review On Sapiens by Hararimunna tarikNo ratings yet

- Towne & City Devt v. Voluntad - People's Industrial v. CADocument5 pagesTowne & City Devt v. Voluntad - People's Industrial v. CAIyahNo ratings yet

- (GROUP 3) Mundell-Fleming Model in International FinanceDocument40 pages(GROUP 3) Mundell-Fleming Model in International Financehoangminh01122019No ratings yet

- Cost of Capital Exercise ProblemDocument4 pagesCost of Capital Exercise ProblemDhruv MahajanNo ratings yet

- Market Manipulation: Economic and Financial Consulting and Expert TestimonyDocument20 pagesMarket Manipulation: Economic and Financial Consulting and Expert TestimonyBokang Junior KgariNo ratings yet

- New Keynesian Model - Week 6 LectureDocument3 pagesNew Keynesian Model - Week 6 LectureAlex LancashireNo ratings yet

- Binancelistingagreement 2Document4 pagesBinancelistingagreement 2smithstacy4422No ratings yet

- Indian Bank Global Credit Card Usage GuideDocument14 pagesIndian Bank Global Credit Card Usage GuideJijithpillaiNo ratings yet

- Developpments in OTC MarketsDocument80 pagesDeveloppments in OTC MarketsRexTradeNo ratings yet

- FMMA Vol 01 PDFDocument117 pagesFMMA Vol 01 PDFMuhammad Ahmad50% (2)

- Nirmal Todi 2021Document24 pagesNirmal Todi 2021Sujan TripathiNo ratings yet

- Richquack: White Paper ofDocument12 pagesRichquack: White Paper ofjay ancajasNo ratings yet

- Bankit Prepaid CardDocument7 pagesBankit Prepaid CardSachin Varshney0% (1)

- S1 2020 Reading Guide BTF3931Document13 pagesS1 2020 Reading Guide BTF3931Yu WeiNo ratings yet

- Full Download Test Bank For Management 10th Edition Ricky W Griffin PDF Full ChapterDocument34 pagesFull Download Test Bank For Management 10th Edition Ricky W Griffin PDF Full Chaptercrincumose.at2d100% (22)

- Corpfin8 PDFDocument3 pagesCorpfin8 PDFLê Chấn PhongNo ratings yet

- CFAB Accounting Chap02 Accounting EquationDocument38 pagesCFAB Accounting Chap02 Accounting EquationHoa NguyễnNo ratings yet

- Direction: Write The Letter of The Correct Answer On Your Answer SheetDocument3 pagesDirection: Write The Letter of The Correct Answer On Your Answer SheetNeah Neoh NeohnNo ratings yet

- INTERNSHIP REPORT UpDocument50 pagesINTERNSHIP REPORT UpFact BeamNo ratings yet

- Behavioral FinanceDocument5 pagesBehavioral FinancemanojeethNo ratings yet

- Wa0000.Document3 pagesWa0000.Gajendra1990No ratings yet

- Investers Preference Towards Mutual FundsDocument24 pagesInvesters Preference Towards Mutual FundsritishsikkaNo ratings yet

- Module 1 Investment in AssociateDocument7 pagesModule 1 Investment in AssociateCharice Anne VillamarinNo ratings yet

- Smart Junior Product Brochure NewDocument11 pagesSmart Junior Product Brochure Newmanuk193No ratings yet