Professional Documents

Culture Documents

Business Profile Viz-a-Viz Target and Achievements As On

Business Profile Viz-a-Viz Target and Achievements As On

Uploaded by

Junaid BakshiCopyright:

Available Formats

You might also like

- Tata Motors Dupont and Altman Z-Score AnalysisDocument4 pagesTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDINo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Section 1: Representative company-MCBDocument13 pagesSection 1: Representative company-MCBHussainNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- Tata motorDocument19 pagesTata motorkiruthikatamilchelvanNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- Cash FlowDocument6 pagesCash Flowahmedmostafaibrahim22No ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Y2020 Budget PL-NMDocument1 pageY2020 Budget PL-NMBảo AnNo ratings yet

- 12008-Dave Tejaskumar Rakeshkumar (Fa&b)Document31 pages12008-Dave Tejaskumar Rakeshkumar (Fa&b)Achal SharmaNo ratings yet

- Training and DevelopmentDocument12 pagesTraining and Developmentprashanth AtleeNo ratings yet

- AnalysisDocument3 pagesAnalysisMohamed MamdouhNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Nestle India Dupont AnalysisDocument2 pagesNestle India Dupont AnalysisINDIAN REALITY SHOWSNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Statistik Perbankan Syariah - Maret 2023Document1 pageStatistik Perbankan Syariah - Maret 2023Muhammad GausAbu BalqisNo ratings yet

- Segment Wise GDP Report November 2022 FinalDocument16 pagesSegment Wise GDP Report November 2022 Finalshikha guptaNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Group - 3 Jayanand, Kanchan, Priyanka, Shukla, Diwakar, VipulDocument32 pagesGroup - 3 Jayanand, Kanchan, Priyanka, Shukla, Diwakar, VipulSiddharth yadiyapurNo ratings yet

- CBRMDocument14 pagesCBRMSurajSinghalNo ratings yet

- Berger 1Document8 pagesBerger 1Nikesh PandeyNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- Asian Paints Financial ModelDocument15 pagesAsian Paints Financial ModelDeepak NechlaniNo ratings yet

- Budgetary For Renewable Energy PlantDocument1 pageBudgetary For Renewable Energy PlanthuskyjackNo ratings yet

- Store Factsheet: Nama Store: Number of Store: Opening DateDocument8 pagesStore Factsheet: Nama Store: Number of Store: Opening DateNikita Dara AmeliaNo ratings yet

- Sample Excel FileDocument60 pagesSample Excel FileFunny ManNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Summary of Financial Performance For The Period Ended November 2018 (With Budget Estimates)Document4 pagesSummary of Financial Performance For The Period Ended November 2018 (With Budget Estimates)salini jhaNo ratings yet

- Book 1Document1 pageBook 1api-324903184No ratings yet

- NAV ComputationDocument130 pagesNAV ComputationamiNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- Performance ReportDocument24 pagesPerformance ReportJuan VegaNo ratings yet

- Financial Performance Trend: Sno. ParticularsDocument2 pagesFinancial Performance Trend: Sno. ParticularsASHOK JAINNo ratings yet

- Combined Valuing Yahoo in 2013Document12 pagesCombined Valuing Yahoo in 2013Þorgeir DavíðssonNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- P&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValueDocument66 pagesP&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValuePrabhdeep DadyalNo ratings yet

- Revenues & Earnings: All Figures in US$ MillionDocument4 pagesRevenues & Earnings: All Figures in US$ MillionenzoNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulNo ratings yet

- Presentation Fy 2020Document9 pagesPresentation Fy 2020hammalbaloch5656No ratings yet

- Inputs Bank PG 2020 2019 2018 2017 2016 2020Document15 pagesInputs Bank PG 2020 2019 2018 2017 2016 2020CKNo ratings yet

- Glaxosmithkline Consumer Healthcare: Group MembersDocument19 pagesGlaxosmithkline Consumer Healthcare: Group MembersBilal AfzalNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Lbo Model G M Breveries 1695729504Document5 pagesLbo Model G M Breveries 1695729504Nacho SniechowskiNo ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Sir Farukh ReportDocument15 pagesSir Farukh ReportMuhammad Nouman Khan MashwaniNo ratings yet

- Death Claim - 2018-19Document4 pagesDeath Claim - 2018-19myevolapNo ratings yet

- Final BSP PresentationDocument21 pagesFinal BSP Presentationnavneetgautam1191No ratings yet

- Reporte Copeme Imf Mar2023Document52 pagesReporte Copeme Imf Mar2023Jesús Del Prado MattosNo ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Report On Rosemary Chiavetta in Harrisburg PA From NuwberDocument82 pagesReport On Rosemary Chiavetta in Harrisburg PA From Nuwbermaria-bellaNo ratings yet

- Law of Torts and Consumer Protection Act: NegligenceDocument30 pagesLaw of Torts and Consumer Protection Act: NegligenceSoumyadeep Mitra100% (6)

- Media Release 3665 (English) 14 08 14Document2 pagesMedia Release 3665 (English) 14 08 14ElPaisUyNo ratings yet

- Conversation B2Document5 pagesConversation B2julian gomez sosaNo ratings yet

- TMA Bye LawsDocument30 pagesTMA Bye LawsAsif Malik67% (3)

- Psychiatric Nursing NotesDocument13 pagesPsychiatric Nursing NotesCarlo VigoNo ratings yet

- University of Caloocan City - : An Analysis Paper OnDocument7 pagesUniversity of Caloocan City - : An Analysis Paper OnKylieNo ratings yet

- CIR Vs Filinvest (Case Digest)Document3 pagesCIR Vs Filinvest (Case Digest)Togz Mape100% (1)

- 14-128 MTR Veh Appraisal FormDocument2 pages14-128 MTR Veh Appraisal FormJASONNo ratings yet

- 31-07-2020 - The Hindu Handwritten NotesDocument16 pages31-07-2020 - The Hindu Handwritten NotesnishuNo ratings yet

- The FATF Recommendations On Combating Money Laundering and The Financing of Terrorism & ProliferationDocument27 pagesThe FATF Recommendations On Combating Money Laundering and The Financing of Terrorism & ProliferationAli SaeedNo ratings yet

- Rajasthan High Court OrderDocument7 pagesRajasthan High Court OrderNDTVNo ratings yet

- 2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyDocument10 pages2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyNick PopeNo ratings yet

- Comparative Relationship Between Traditional Architecture and Modern ArchitectureDocument24 pagesComparative Relationship Between Traditional Architecture and Modern ArchitectureGem nuladaNo ratings yet

- GFFS General-Form Rev-20061Document14 pagesGFFS General-Form Rev-20061Judy Ann GacetaNo ratings yet

- Born Again of The People: Luis Taruc and Peasant Ideology in Philippine Revolutionary PoliticsDocument43 pagesBorn Again of The People: Luis Taruc and Peasant Ideology in Philippine Revolutionary PoliticsThania O. CoronicaNo ratings yet

- International Journal of Bank Marketing: Article InformationDocument32 pagesInternational Journal of Bank Marketing: Article Informationrohil qureshiNo ratings yet

- Fouts Def 2nd Production of DocumentsDocument88 pagesFouts Def 2nd Production of Documentswolf woodNo ratings yet

- Assignment/ Tugasan - Principles of ManagementDocument11 pagesAssignment/ Tugasan - Principles of ManagementSuriya KumaraNo ratings yet

- Garcia v. Drilon, G.R. No. 179267, 25 June 2013Document1 pageGarcia v. Drilon, G.R. No. 179267, 25 June 2013Albert RoseteNo ratings yet

- Vinayyak - CV - Sap - ExpDocument3 pagesVinayyak - CV - Sap - ExpmanikandanNo ratings yet

- MLCFDocument27 pagesMLCFMuhammad HafeezNo ratings yet

- Gulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsDocument20 pagesGulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsmurphygtNo ratings yet

- The CPP/NPA/NDF Constitute The Local Communist Movement in The Philippines Beforehand, ItDocument19 pagesThe CPP/NPA/NDF Constitute The Local Communist Movement in The Philippines Beforehand, Itzy_tanNo ratings yet

- John Lee - China's Rise and The Road To War - WSJDocument4 pagesJohn Lee - China's Rise and The Road To War - WSJ33ds100No ratings yet

- Acc21 March18Document12 pagesAcc21 March18Romero Mary Jane C.No ratings yet

- Expert Days 2018: SUSE Enterprise StorageDocument15 pagesExpert Days 2018: SUSE Enterprise StorageArturoNo ratings yet

- Traffic Monitoring GuideDocument18 pagesTraffic Monitoring GuideaskarahNo ratings yet

Business Profile Viz-a-Viz Target and Achievements As On

Business Profile Viz-a-Viz Target and Achievements As On

Uploaded by

Junaid BakshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Profile Viz-a-Viz Target and Achievements As On

Business Profile Viz-a-Viz Target and Achievements As On

Uploaded by

Junaid BakshiCopyright:

Available Formats

1

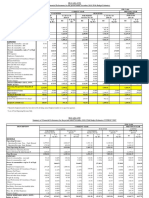

Business Profile Viz-a-Viz Target and Achievements as on 31-MAR-2019

(Rs. In Lakhs)

%age

% of

Particulars Q4 Q1 Q2 Q3 Q4 Growth(%) Target of

Total

Achmnt.

2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 YoY QoQ

Deposits 6770.54 6162.31 6219.47 6103.34 7126.40 5.26% 16.76% 100% .

Corporate 0.00 0.00 0.00 0.00 0.00 0.00% 0.00% 0.00% .

Inter-bank 0.00 0.00 0.00 0.00 0.00 0.00% 0.00% 0.00% .

Retail 6770.54 6162.31 6219.47 6103.34 7126.40 5.26% 16.76% 100% .

Demand Deposit 1706.77 1240.28 1351.59 1120.89 1588.78 -6.91% 41.74% 22.29% .

Savings Bank 3093.23 3036.36 3026.51 2972.40 3427.64 10.81% 15.32% 48.1% .

CASA (Total) 4800.00 4276.65 4378.10 4093.30 5016.42 4.51% 22.55% 70.39% .

Term Deposits 1970.54 1885.66 1841.37 2010.05 2109.97 7.08% 4.97% 29.61% .

Term - Banks 0.00 0.00 0.00 0.00 0.00 0.00% 0.00% 0.00% .

Term - Retail 1970.54 1885.66 1841.37 2010.05 2109.97 7.08% 4.97% 100% .

Term - Corporate 0.00 0.00 0.00 0.00 0.00 0.00% 0.00% 0.00% .

No. of Deposit Accounts 29103.00 29249.00 30385.00 30897.00 31725.00 9.01% 2.68% .

Cost of Deposits (%) 3.72 3.87 3.90 3.91 4.05 8.34 3.6 .

(Rs. In Lakhs)

Particulars Q4 Q1 Q2 Q3 Q4 Growth(%) % of Target Achmnt.

2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 YoY QoQ Total % age

2. Advances 5194.24 5633.19 6076.30 6214.38 6333.53 21.93% 1.92% 100% .

Agri & Allied 751.02 673.14 671.25 663.90 809.48 7.78% 21.93% 12.78% .

MSMEs 1788.51 2107.72 2132.75 2095.97 2125.11 18.82% 1.39% 33.55% .

DRI 7.68 7.53 7.79 7.48 7.35 -4.3% -1.74% .12% .

Other Priority Sector 419.10 465.84 650.57 727.80 762.33 81.9% 4.74% 12.04% .

Total Priority Sector 2966.31 3254.23 3462.36 3495.14 3704.27 24.88% 5.98% 58.49% .

Loan & Advances against Deposit 47.08 88.90 93.82 91.65 90.79 92.84% -.94% 1.43% .

Personal Segment 2130.33 2232.14 2472.81 2578.17 2509.78 17.81% -2.65% 39.63% .

Other Non Priority Sector 50.51 57.93 47.30 49.43 28.69 -43.2% -41.96% .45% .

Total Non Priority Sector 2227.93 2378.96 2613.94 2719.24 2629.26 18.01% -3.31% 41.51% .

Out of Total Advances 0.00 0.00 0.00 0.00 0.00 -100% -100% .

Retail 5194.24 5633.19 6076.30 6214.38 6333.53 21.93% 1.92% 100% .

Corporate 0.00 0.00 0.00 0.00 0.00 -100% -100% 0% .

Out of Total Advances 0.00 0.00 0.00 0.00 0.00 -100% -100% .

Accounts in SMA O 387.00 391.00 445.00 348.00 408.00 5.43% 17.24% .

Accounts in SMA 1 242.00 238.00 256.00 268.00 256.00 5.79% -4.48% .

Accounts in SMA 2 384.00 341.00 458.00 441.00 384.00 0% -12.93% .

Yield on Advances(%) 3.30 11.28 6.20 4.20 3.09 -.21 -1.11 .

No. of Adv. Accounts 2844.00 2788.00 2882.00 2917.00 2857.00 .46% -2.06% .

(Rs. In Lakhs)

Non Performing assets Q4 Q1 Q2 Q3 Q4 Growth(%) % of Target Achmnt.

2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 YoY QoQ Total % age

NPAs at the beginning of the Year 24.34 22.92 22.25 20.02 18.05 -25.84% -9.84% .

Fresh Slippages 2.68 0.00 0.00 0.16 0.00 -100% -100% .

Upgradation/ Recovery 4.10 0.67 2.23 2.13 3.17 -22.68% 48.83% .

NPA at the end 22.92 22.25 20.02 18.05 14.88 -35.08% -17.56% .

RLAs 3.24 3.24 3.24 3.24 3.24 0% 0% .

Recovery in RLAs 0.00 0.00 0.00 0.00 0.00 -100% -100% .

Other/Third Party Business of as on 31-MAR-2019

2

Other Business (Cum. Position) Q4 Q1 Q2 Q3 Q4 YoY Inc/Dec Target Achmnt.

2017-2018 2018-2019 2018-2019 2018-2019 2018-2019

No. of Cr. Cards issued 14.00 7.00 2.00 11.00 3.00 -78.57% -57.14% . 0.00%

ATM / Dr. Cards issued . . . . . 0.00% % . 0.00%

POS Installations 22.00 34.00 37.00 43.00 43.00 95.45% 26.47% . 0.00%

E Banking Users . . . . . 0.00% % .

No of ATMs Associated 2.00 2.00 2.00 2.00 2.00 0% 0% .

Insurance Business

(Rs.In Lakhs)

Insurance (Pr. Collected) Q3 Q4 QoQ Target Achmnt.

2018-2019 2018-2019

Life . . 0.00% . 0.00%

Non-Life . . 0.00% . 0.00%

Operative Results as on 31-MAR-2019

(Rs. In Lakhs)

Operating Results Q4 FY Q1 Q2 Q3 Q4 FY YoY YoY

2017-2018 2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 2018-2019 Q4 FY

Profit / (Loss) 76.65 219.23 82.13 89.03 89.52 87.37 348.05 15.49% 59.49%

Intt. Earned 154.79 430.87 150.57 172.81 181.19 180.92 685.49 17.64% 59.46%

TP Cr. Received 105.06 327.33 111.94 110.00 109.93 113.25 445.12 8.83% 36.4%

Interest Income (Total) 259.85 758.20 262.51 282.81 291.12 294.17 1130.61 13.64% 49.31%

Non-Interest Income 9.32 23.95 8.78 11.60 12.43 11.84 44.65 42.31% 94.55%

Total Income 269.17 782.15 271.29 294.41 303.55 306.01 1175.26 14.11% 50.45%

Intt. Paid 59.73 192.81 61.71 61.04 62.47 65.15 250.37 10.93% 30.53%

TP Chg. Paid 109.47 305.25 106.30 122.58 128.51 128.58 485.97 18.54% 59.73%

Interest Expense (Total) 169.20 498.06 168.01 183.62 190.98 193.73 736.34 15.18% 48.14%

Operating Expenses 4.02 11.95 3.47 3.66 3.85 5.49 16.47 81.79% 50.41%

Establishment Exp. 19.30 52.91 17.68 18.10 19.20 19.42 74.40 6.12% 43.32%

Total Expenses 192.52 562.92 189.16 205.38 214.03 218.64 827.21 14.16% 47.21%

Net Intt. Income (NII) 90.65 260.14 94.50 99.19 100.14 100.44 394.27 12.04% 52.15%

Total Business 11964.78 11964.78 11795.50 12295.77 12317.72 13459.93 13459.93 12.51% 12.51%

Analytic Ratios

Analytical Ratios (B.S.) Q4 Q1 Q2 Q3 Q4

2017-2018 2018-2019 2018-2019 2018-2019 2018-2019

CASA 70.9% 69.4% 70.39% 67.07% 70.39%

CD Ratio 76.72% 91.41% 97.7% 101.82% 88.87%

GNPA .44% .39% .33% .29% .23%

Analytical Ratios (PL) Q4 FY Q1 Q2 Q3 Q4 FY

2017-2018 2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 2018-2019

Intt. Incm to Total Incm. 96.54% 96.94% 96.76% 96.06% 95.91% 96.13% 96.2%

Non-Intt Incm to Ttl. Incm 3.46% 3.06% 3.24% 3.94% 4.09% 3.87% 3.8%

Intt. Exp. to Total Expense 87.89% 88.48% 88.82% 89.41% 89.23% 88.61% 89.01%

3

Analytical Ratios (PL) Q4 FY Q1 Q2 Q3 Q4 FY

2017-2018 2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 2018-2019

HR Cost / Incm Ratio 19.31% 37.25% 17.12% 16.34% 17.06% 17.3% 33.9%

Net Pft to Ttl Business .64% 1.83% .7% .72% .73% .65% 2.59%

Net Intt. Incm Margin (NIIM) 1.75% 1.73% 1.68% 1.63% 1.61% 1.59% 1.63%

Productivity as on 31-MAR-2019

Analytical Ratios (B.S.) Q4 Q1 Q2 Q3 Q4

2017-2018 2018-2019 2018-2019 2018-2019 2018-2019

CASA 70.9% 69.4% 70.39% 67.07% 70.39%

CD Ratio 76.72% 91.41% 97.7% 101.82% 88.87%

GNPA .44% .39% .33% .29% .23%

Analytical Ratios (PL) Q4 FY Q1 Q2 Q3 Q4 FY

2017-2018 2017-2018 2018-2019 2018-2019 2018-2019 2018-2019 2018-2019

Intt. Incm to Total Incm. 96.54% 96.94% 96.76% 96.06% 95.91% 96.13% 96.2%

Non-Intt Incm to Ttl. Incm 3.46% 3.06% 3.24% 3.94% 4.09% 3.87% 3.8%

Intt. Exp. to Total Expense 87.89% 88.48% 88.82% 89.41% 89.23% 88.61% 89.01%

HR Cost / Incm Ratio 19.31% 37.25% 17.12% 16.34% 17.06% 17.3% 33.9%

Net Pft to Ttl Business .64% 1.83% .7% .72% .73% .65% 2.59%

Net Intt. Incm Margin (NIIM) 1.75% 1.73% 1.68% 1.63% 1.61% 1.59% 1.63%

You might also like

- Tata Motors Dupont and Altman Z-Score AnalysisDocument4 pagesTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDINo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Section 1: Representative company-MCBDocument13 pagesSection 1: Representative company-MCBHussainNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- Tata motorDocument19 pagesTata motorkiruthikatamilchelvanNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- Cash FlowDocument6 pagesCash Flowahmedmostafaibrahim22No ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Y2020 Budget PL-NMDocument1 pageY2020 Budget PL-NMBảo AnNo ratings yet

- 12008-Dave Tejaskumar Rakeshkumar (Fa&b)Document31 pages12008-Dave Tejaskumar Rakeshkumar (Fa&b)Achal SharmaNo ratings yet

- Training and DevelopmentDocument12 pagesTraining and Developmentprashanth AtleeNo ratings yet

- AnalysisDocument3 pagesAnalysisMohamed MamdouhNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Nestle India Dupont AnalysisDocument2 pagesNestle India Dupont AnalysisINDIAN REALITY SHOWSNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Statistik Perbankan Syariah - Maret 2023Document1 pageStatistik Perbankan Syariah - Maret 2023Muhammad GausAbu BalqisNo ratings yet

- Segment Wise GDP Report November 2022 FinalDocument16 pagesSegment Wise GDP Report November 2022 Finalshikha guptaNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Group - 3 Jayanand, Kanchan, Priyanka, Shukla, Diwakar, VipulDocument32 pagesGroup - 3 Jayanand, Kanchan, Priyanka, Shukla, Diwakar, VipulSiddharth yadiyapurNo ratings yet

- CBRMDocument14 pagesCBRMSurajSinghalNo ratings yet

- Berger 1Document8 pagesBerger 1Nikesh PandeyNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- Asian Paints Financial ModelDocument15 pagesAsian Paints Financial ModelDeepak NechlaniNo ratings yet

- Budgetary For Renewable Energy PlantDocument1 pageBudgetary For Renewable Energy PlanthuskyjackNo ratings yet

- Store Factsheet: Nama Store: Number of Store: Opening DateDocument8 pagesStore Factsheet: Nama Store: Number of Store: Opening DateNikita Dara AmeliaNo ratings yet

- Sample Excel FileDocument60 pagesSample Excel FileFunny ManNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Summary of Financial Performance For The Period Ended November 2018 (With Budget Estimates)Document4 pagesSummary of Financial Performance For The Period Ended November 2018 (With Budget Estimates)salini jhaNo ratings yet

- Book 1Document1 pageBook 1api-324903184No ratings yet

- NAV ComputationDocument130 pagesNAV ComputationamiNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- Performance ReportDocument24 pagesPerformance ReportJuan VegaNo ratings yet

- Financial Performance Trend: Sno. ParticularsDocument2 pagesFinancial Performance Trend: Sno. ParticularsASHOK JAINNo ratings yet

- Combined Valuing Yahoo in 2013Document12 pagesCombined Valuing Yahoo in 2013Þorgeir DavíðssonNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- P&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValueDocument66 pagesP&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValuePrabhdeep DadyalNo ratings yet

- Revenues & Earnings: All Figures in US$ MillionDocument4 pagesRevenues & Earnings: All Figures in US$ MillionenzoNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulNo ratings yet

- Presentation Fy 2020Document9 pagesPresentation Fy 2020hammalbaloch5656No ratings yet

- Inputs Bank PG 2020 2019 2018 2017 2016 2020Document15 pagesInputs Bank PG 2020 2019 2018 2017 2016 2020CKNo ratings yet

- Glaxosmithkline Consumer Healthcare: Group MembersDocument19 pagesGlaxosmithkline Consumer Healthcare: Group MembersBilal AfzalNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Lbo Model G M Breveries 1695729504Document5 pagesLbo Model G M Breveries 1695729504Nacho SniechowskiNo ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Sir Farukh ReportDocument15 pagesSir Farukh ReportMuhammad Nouman Khan MashwaniNo ratings yet

- Death Claim - 2018-19Document4 pagesDeath Claim - 2018-19myevolapNo ratings yet

- Final BSP PresentationDocument21 pagesFinal BSP Presentationnavneetgautam1191No ratings yet

- Reporte Copeme Imf Mar2023Document52 pagesReporte Copeme Imf Mar2023Jesús Del Prado MattosNo ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Report On Rosemary Chiavetta in Harrisburg PA From NuwberDocument82 pagesReport On Rosemary Chiavetta in Harrisburg PA From Nuwbermaria-bellaNo ratings yet

- Law of Torts and Consumer Protection Act: NegligenceDocument30 pagesLaw of Torts and Consumer Protection Act: NegligenceSoumyadeep Mitra100% (6)

- Media Release 3665 (English) 14 08 14Document2 pagesMedia Release 3665 (English) 14 08 14ElPaisUyNo ratings yet

- Conversation B2Document5 pagesConversation B2julian gomez sosaNo ratings yet

- TMA Bye LawsDocument30 pagesTMA Bye LawsAsif Malik67% (3)

- Psychiatric Nursing NotesDocument13 pagesPsychiatric Nursing NotesCarlo VigoNo ratings yet

- University of Caloocan City - : An Analysis Paper OnDocument7 pagesUniversity of Caloocan City - : An Analysis Paper OnKylieNo ratings yet

- CIR Vs Filinvest (Case Digest)Document3 pagesCIR Vs Filinvest (Case Digest)Togz Mape100% (1)

- 14-128 MTR Veh Appraisal FormDocument2 pages14-128 MTR Veh Appraisal FormJASONNo ratings yet

- 31-07-2020 - The Hindu Handwritten NotesDocument16 pages31-07-2020 - The Hindu Handwritten NotesnishuNo ratings yet

- The FATF Recommendations On Combating Money Laundering and The Financing of Terrorism & ProliferationDocument27 pagesThe FATF Recommendations On Combating Money Laundering and The Financing of Terrorism & ProliferationAli SaeedNo ratings yet

- Rajasthan High Court OrderDocument7 pagesRajasthan High Court OrderNDTVNo ratings yet

- 2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyDocument10 pages2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyNick PopeNo ratings yet

- Comparative Relationship Between Traditional Architecture and Modern ArchitectureDocument24 pagesComparative Relationship Between Traditional Architecture and Modern ArchitectureGem nuladaNo ratings yet

- GFFS General-Form Rev-20061Document14 pagesGFFS General-Form Rev-20061Judy Ann GacetaNo ratings yet

- Born Again of The People: Luis Taruc and Peasant Ideology in Philippine Revolutionary PoliticsDocument43 pagesBorn Again of The People: Luis Taruc and Peasant Ideology in Philippine Revolutionary PoliticsThania O. CoronicaNo ratings yet

- International Journal of Bank Marketing: Article InformationDocument32 pagesInternational Journal of Bank Marketing: Article Informationrohil qureshiNo ratings yet

- Fouts Def 2nd Production of DocumentsDocument88 pagesFouts Def 2nd Production of Documentswolf woodNo ratings yet

- Assignment/ Tugasan - Principles of ManagementDocument11 pagesAssignment/ Tugasan - Principles of ManagementSuriya KumaraNo ratings yet

- Garcia v. Drilon, G.R. No. 179267, 25 June 2013Document1 pageGarcia v. Drilon, G.R. No. 179267, 25 June 2013Albert RoseteNo ratings yet

- Vinayyak - CV - Sap - ExpDocument3 pagesVinayyak - CV - Sap - ExpmanikandanNo ratings yet

- MLCFDocument27 pagesMLCFMuhammad HafeezNo ratings yet

- Gulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsDocument20 pagesGulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsmurphygtNo ratings yet

- The CPP/NPA/NDF Constitute The Local Communist Movement in The Philippines Beforehand, ItDocument19 pagesThe CPP/NPA/NDF Constitute The Local Communist Movement in The Philippines Beforehand, Itzy_tanNo ratings yet

- John Lee - China's Rise and The Road To War - WSJDocument4 pagesJohn Lee - China's Rise and The Road To War - WSJ33ds100No ratings yet

- Acc21 March18Document12 pagesAcc21 March18Romero Mary Jane C.No ratings yet

- Expert Days 2018: SUSE Enterprise StorageDocument15 pagesExpert Days 2018: SUSE Enterprise StorageArturoNo ratings yet

- Traffic Monitoring GuideDocument18 pagesTraffic Monitoring GuideaskarahNo ratings yet