Professional Documents

Culture Documents

Swing Trading Four-Day Breakouts: Step 1: Visually Scan For Stocks in The

Swing Trading Four-Day Breakouts: Step 1: Visually Scan For Stocks in The

Uploaded by

Shujun YipOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swing Trading Four-Day Breakouts: Step 1: Visually Scan For Stocks in The

Swing Trading Four-Day Breakouts: Step 1: Visually Scan For Stocks in The

Uploaded by

Shujun YipCopyright:

Available Formats

For Traders’ Tips use only — Not for redistribution

Copyright © Technical Analysis, Inc.

TRADING ON MOMENTUM

Swing Trading

Four-Day Breakouts

When trading breakouts, one challenge Step 1: Visually scan for stocks in the What is the price that proves the trade

is to find charts that will continue to $20–$70/share price range that are in right, versus uncertain or wrong? This

move in your favor. Here’s one pat- uptrends and have a recent sequence technique is effective because it buys

tern that could help you identify those of four or more green candles in a into continuous strong momentum. I

strong moves. row on a 90-day daily candlestick have found in testing with numerous

chart. You can see this type of pat- trades that lower values, such as just two

by Ken Calhoun tern illustrated in the chart of Weight or three green candles in a row, is much

Y

Watchers International Inc. (WTW) less consistent and does not work out

our biggest challenge in swing in Figure 1. nearly as often. When using four or more

trading breakouts will be to find candles to identify trend strength, you are

charts that continue up strongly Step 2: Set a buy stop order at $0.50 buying into sustainable buying pressure

after you enter your trade. A above the high of the highest of the that is more likely to continue.

favorite strategy used by experienced four candles seen in the series. From a practical standpoint, the

traders is to look at the ratio of green to challenge is that you do need to visu-

red candles in recent days’ trading for Step 3: Use an initial $2 stop (and ally scan through 90-day candlestick

clues of the underlying technical trad- trailing stop) for all swing trades. charts to manually locate these types

ing strength. of patterns. The good news is that once

This month, I’ll demonstrate how to Step 4: (for experienced traders): you practice visual scanning for strong

use a simplified breakout pattern where Add to winning trades after each new breakouts using this technique as well as

you enter after four daily green candle four green-day series is seen. This is strategies covered in my earlier articles,

days in a row have been observed. This to build your position over time (also you will find yourself starting to be more

can be an effective strategy because when known as position sizing). focused and demanding when it comes

buyers are consistently in charge of price to finding exceptionally strong charts

action for four or more days in a row, Insights: Why this worth trading.

price will often continue upward. technique works

Whenever you evaluate a chart for tech- Trade management tips

Swing trading four-day nical strength, it helps to have clearly As with all trading, it is a smart idea to

breakout strategy defined reasons for your entry and exit. “trade wide, not deep,” meaning you

This strategy is easy enough to under-

stand: You visually scan for charts that

are in a clearly defined uptrend in which

you see a sequence of four or more green

candle days in a row. This tells you buy-

ing pressure is especially strong and is

likely to continue.

As a former corporate statistician and

quality engineer, one thing I learned

early on was to look for exceptional

“outlier” data signals. Similarly, when

it comes to swing trading, you should

always be on the lookout for extremely

strong breakout patterns that work out

most of the time, using price action for

momentum trade entries.

Step-by-step action plan

esignal

Here’s how you can start using this

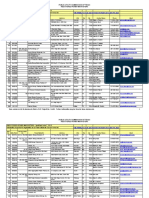

price-action breakout strategy with your Figure 1: Swing Trading Four-Day Breakouts. On this 90-day daily chart of Weight Watchers Inter-

swing trades: national Inc. (WTW), you would enter a trade just after each sequence of four green candle days in a row.

October 2017 • Technical Analysis of Stocks & Commodities • 7

For Traders’ Tips use only — Not for redistribution Copyright © Technical Analysis, Inc.

TRADING ON MOMENTUM

should look to trade a minimum of Ken Calhoun is a producer of trading

three to five positions simultaneously courses, a live trading room, and video- when buyers are

on smaller share size to test breakout based training systems for active traders. consistently in charge of

strength before trading larger share He is the founder of TradeMastery.com,

size. Adding to winning trades while an educational resource site for active

price action for four or

taking very small stops on those that traders, and is a UCLA alumnus. more days in a row, price

don’t work out is a key to professional will often continue upward.

trading success.

October 2017 • Technical Analysis of StockS & commoditieS • 37

You might also like

- Business Plan For Juan A Drink PDFDocument17 pagesBusiness Plan For Juan A Drink PDFMaria Jane MoyanoNo ratings yet

- 4 Sem Bcom - Advanced Corporate AccountingDocument56 pages4 Sem Bcom - Advanced Corporate AccountingDipak Mahalik57% (7)

- Williams %R RulesDocument12 pagesWilliams %R Rulesbigtrends100% (1)

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Intra-Day Trading Tactics: Pristine.com's Stategies for Seizing Short-Term OpportunitiesFrom EverandIntra-Day Trading Tactics: Pristine.com's Stategies for Seizing Short-Term OpportunitiesNo ratings yet

- 1 How Much Would Zoe A Receive in Initial LoanDocument2 pages1 How Much Would Zoe A Receive in Initial Loantrilocksp SinghNo ratings yet

- PersonalManager ListDocument10 pagesPersonalManager ListSneha LiveitNo ratings yet

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- The Use of Marketing Metrics by British Fundraising CharitiesDocument10 pagesThe Use of Marketing Metrics by British Fundraising CharitiesshivmittalNo ratings yet

- Opening Bell: L B R O S T T SDocument8 pagesOpening Bell: L B R O S T T SErezwaNo ratings yet

- Trading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsFrom EverandTrading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsRating: 1 out of 5 stars1/5 (1)

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Doji Sandwich Ebook PDFDocument11 pagesDoji Sandwich Ebook PDFSergio Adrián NesiNo ratings yet

- 01-A Color-Based System For Short-Term TradingDocument4 pages01-A Color-Based System For Short-Term TradingLao ZhuNo ratings yet

- Swing Trading - Rules and PhilosophyDocument5 pagesSwing Trading - Rules and PhilosophyJoe D100% (1)

- Tsunami Setups - Volatility Contraction in TradingDocument5 pagesTsunami Setups - Volatility Contraction in TradingHenningNo ratings yet

- Exit Strategies For Stocks and Futures: Charles LebeauDocument41 pagesExit Strategies For Stocks and Futures: Charles LebeauDrew Morrisson100% (1)

- Maximizing Gains With Trade ManagementDocument11 pagesMaximizing Gains With Trade Managementhafis82No ratings yet

- Bollinger Bands - Using Volatility by Matthew ClaassenDocument5 pagesBollinger Bands - Using Volatility by Matthew ClaassenTradingTheEdgesNo ratings yet

- Building A Better Breakout System Using Simple Filters PDFDocument4 pagesBuilding A Better Breakout System Using Simple Filters PDFKiran KrishnaNo ratings yet

- Report RSI80 20TradingStrategyDocument19 pagesReport RSI80 20TradingStrategyCapitanu Iulian100% (1)

- Anchored Momentum Indicator Study by Rudy StefenelDocument10 pagesAnchored Momentum Indicator Study by Rudy StefenelSimon RobinsonNo ratings yet

- John Murphy's Ten Laws of Technical Trading - All Star Charts - All Star ChartsDocument6 pagesJohn Murphy's Ten Laws of Technical Trading - All Star Charts - All Star ChartsjohnrollNo ratings yet

- Bullish J Hook PatternDocument17 pagesBullish J Hook Patternoguz GUCLUNo ratings yet

- G5-T6 How To Use RSIDocument4 pagesG5-T6 How To Use RSIThe ShitNo ratings yet

- Traders Expo Las Vegas Intensive Workshop November 2011 Pocket PivotsDocument38 pagesTraders Expo Las Vegas Intensive Workshop November 2011 Pocket PivotsteppeiNo ratings yet

- SellingRulesArticleMay16 PDFDocument8 pagesSellingRulesArticleMay16 PDFGourav SinghalNo ratings yet

- Adx PDFDocument6 pagesAdx PDFpaolo100% (1)

- ADXBreakoutScanning 04 2010Document6 pagesADXBreakoutScanning 04 2010mcarv63No ratings yet

- Williams %R ScansDocument18 pagesWilliams %R Scansbigtrends100% (1)

- Day Trading and Learning 110217Document34 pagesDay Trading and Learning 110217abiel_guerraNo ratings yet

- Summary of Market PracticesDocument39 pagesSummary of Market Practicesdatsno100% (2)

- Edited - Swing Trading Strategy 3Document35 pagesEdited - Swing Trading Strategy 3Vijay0% (1)

- Nimblr TA: Technical Analysis Breakouts On Intraday Breakouts On IntradayDocument8 pagesNimblr TA: Technical Analysis Breakouts On Intraday Breakouts On Intradayaman.4uNo ratings yet

- OHLC Trading Strategy For Profitable Day Trading in 2023Document9 pagesOHLC Trading Strategy For Profitable Day Trading in 2023jazzydefiantNo ratings yet

- MACD Cheat SheetDocument1 pageMACD Cheat Sheetsasa332138No ratings yet

- Peter Aan - RSIDocument4 pagesPeter Aan - RSIanalyst_anil14100% (1)

- 200 Ema Reversal StrategyDocument20 pages200 Ema Reversal StrategyarjeetNo ratings yet

- Bollinger Bands & ADX: This Lesson Is Provided byDocument4 pagesBollinger Bands & ADX: This Lesson Is Provided bymjmariaantonyrajNo ratings yet

- Expo14 ADX PowerTrendsDocument67 pagesExpo14 ADX PowerTrendsZoltán Nagy0% (1)

- What Are Episodic Pivots and How To Find Them: Home Members Only MM Stockbee 50 VideosDocument6 pagesWhat Are Episodic Pivots and How To Find Them: Home Members Only MM Stockbee 50 VideosXoodmaNo ratings yet

- 50 200 MA Simply The Best RoadDocument16 pages50 200 MA Simply The Best RoadkhanNo ratings yet

- Simple Ideas For A Mean Reversion Strategy With Good ResultsDocument37 pagesSimple Ideas For A Mean Reversion Strategy With Good ResultsVAIBHAV BUNTYNo ratings yet

- Bobble Pattern Ebook PDFDocument12 pagesBobble Pattern Ebook PDFContra_hourNo ratings yet

- Lessons On Buying StocksDocument5 pagesLessons On Buying StocksAravinda KumarNo ratings yet

- Defining The Bull & BearDocument8 pagesDefining The Bull & BearNo NameNo ratings yet

- Chart Pattern AdxDocument8 pagesChart Pattern Adx10578387No ratings yet

- The Average Directional Movement IndexDocument6 pagesThe Average Directional Movement IndexMarcelino Gomes SilvaNo ratings yet

- TASC Magazine January 2009Document51 pagesTASC Magazine January 2009Trend Imperator100% (1)

- 2 Predicting Price ActionDocument25 pages2 Predicting Price ActionRaju MondalNo ratings yet

- 031 TickDocument4 pages031 Tickankja2007100% (2)

- (Star B.) The MACD Profit AlertDocument6 pages(Star B.) The MACD Profit AlertHaoNo ratings yet

- Short Term StrategiesDocument59 pagesShort Term StrategiesStas KhanutinNo ratings yet

- Toby Crabel NR2Document5 pagesToby Crabel NR2Aditya SoniNo ratings yet

- The 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeDocument3 pagesThe 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeSweety DasNo ratings yet

- ADX Breakout Scanning: StrategiesDocument6 pagesADX Breakout Scanning: StrategiesbankuowNo ratings yet

- Weekly Breakout Box SystemDocument3 pagesWeekly Breakout Box SystemMisterSimpleNo ratings yet

- Retracements With TMV: Trade Breakouts andDocument7 pagesRetracements With TMV: Trade Breakouts andDevang Varma100% (1)

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- The Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsFrom EverandThe Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsNo ratings yet

- Your Next Great Stock: How to Screen the Market for Tomorrow's Top PerformersFrom EverandYour Next Great Stock: How to Screen the Market for Tomorrow's Top PerformersRating: 3 out of 5 stars3/5 (1)

- CF Bake House: Project ReportDocument22 pagesCF Bake House: Project ReportRajinikkanthNo ratings yet

- Chapter 8 Student SlidesDocument33 pagesChapter 8 Student SlidesDavid OkonkwoNo ratings yet

- Babylon SummaryDocument5 pagesBabylon SummaryAditya Pandey100% (1)

- Statistics For Economics Accounting and Business Studies 7th Edition Barrow Solutions ManualDocument25 pagesStatistics For Economics Accounting and Business Studies 7th Edition Barrow Solutions Manualterrisinghwpkagycxmi100% (12)

- CH 10Document43 pagesCH 10Abdulrahman AlotaibiNo ratings yet

- Cash Managment (Q)Document7 pagesCash Managment (Q)amna zamanNo ratings yet

- Tree of WealthDocument121 pagesTree of WealthJoseAliceaNo ratings yet

- Troika Moot Court PetitionerDocument16 pagesTroika Moot Court PetitionerVishal MandalNo ratings yet

- UNIT 5 - Company AuditDocument12 pagesUNIT 5 - Company AuditHrishikesh R BhatNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Exam Schedule Winter 2018Document1 pageExam Schedule Winter 2018Muneeb ShahidNo ratings yet

- Simple Interest Worksheet 2Document2 pagesSimple Interest Worksheet 2A.BensonNo ratings yet

- Asset Rotation Fund: Tactical and FlexibleDocument2 pagesAsset Rotation Fund: Tactical and FlexibleEttore TruccoNo ratings yet

- BNM Takaful Operational Framework 2019Document29 pagesBNM Takaful Operational Framework 2019YEW OI THIMNo ratings yet

- Choudhry FTP Principles Jan 2018Document133 pagesChoudhry FTP Principles Jan 2018James BestNo ratings yet

- IBRD Information Statement FY23Document159 pagesIBRD Information Statement FY23pupusmyus3No ratings yet

- Financial System in MalaysiaDocument8 pagesFinancial System in MalaysiaqairunnisaNo ratings yet

- Updated Final Report 12Document54 pagesUpdated Final Report 12Shyam TomerNo ratings yet

- Account StatementDocument8 pagesAccount StatementMuhammad SadiqueNo ratings yet

- BSE Debt SegmentDocument5 pagesBSE Debt SegmentDeepika AnejaNo ratings yet

- Negative ExternalitiesDocument11 pagesNegative ExternalitiesGeronimo StiltonNo ratings yet

- Internship ReportDocument36 pagesInternship ReportAnnan AkbarNo ratings yet

- A Survey Report On Consumer Buying Behaviour: Submitted To, MR - Bhavik Shah (Vnsgu)Document28 pagesA Survey Report On Consumer Buying Behaviour: Submitted To, MR - Bhavik Shah (Vnsgu)Dipak BagsariyaNo ratings yet

- Banking Case StudiesDocument8 pagesBanking Case StudiesAnonymous t9KdMruhUNo ratings yet