Professional Documents

Culture Documents

Revised Corporation Code of The Philippines

Revised Corporation Code of The Philippines

Uploaded by

Jon MickOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revised Corporation Code of The Philippines

Revised Corporation Code of The Philippines

Uploaded by

Jon MickCopyright:

Available Formats

Affords greater protection to minority stockholders

REVISED CORPORATION CODE OF THE PHILIPPINES - It expanded the list of books and records required to be kept by the corporation

(Republic Act No. 11232) available for examination and expanded the remedies available in case of

violation of stockholders’ right of inspection

Title I: GENERAL PRINCIPLES Codifies internationally- accepted practices and norms on conducting business.

- Allowing the right to vote through electronic communication and sending notices

of meeting electronically

A. GENERAL PRINCIPLES - Provisions for arbitration mechanism to resolve disputes within the corporation

Strengthens the powers of the Securities and Exchange Commission (hereafter “SEC”)

1. THE CORPORATION CODE OF THE PHILIPPINES (Sec.1) to be able to fully exercise its regulatory authority over corporations

- Enumerates enforcement provisions and authorized the SEC to administer,

Section 1. Section 1. Title of the Code. - This Code shall be known as the "Revised Corporation investigate and prosecute violation of the RCC provisions.

Code of the Philipines".

a. History 2. PRIVATE CORPORATIONS, defined (Sec.2)

- Act. No. 1459, Corporation Law (enacted on March 1, 1906, took effect on April 1, Section 2. Corporation defined. – A corporation is an artificial being created by operation of law,

1906) having the right of succession and the powers, attributes and properties expressly authorized by

law or incident to its existence.

- Batas Pambansa Blg. 68 (Corporation Code of the Philippines) – May 1, 1980

- Republic Act No. 11232, otherwise known as the Revised Corporation Code (hereafter 3. ATTRIBUTES OF A CORPORATION

referred to as “RCC”)

repealed the 38-year-old Batas Pambansa 68 a. Created by operation of law

approved by Congress on February 20, 2019

signed into law by President Rodrigo R.Duterte on February 21, 2019 A.XII, Sec.16, Phil. Constitution

took effect on February 23, 2019, upon completion of its publication in Manila The Congress shall not, except by general law, provide for the formation, organization,

Bulletin and Business Mirror, or regulation of private corporations. Government-owned or controlled corporations

effective upon its publication on February 21, 2019 may be created or established by special charters in the interest of the common good

otherwise known as the Corporation and subject to the test of economic viability.

GR: Created by operation of law

b. Salient points of the RCC Mere consent of the parties is not sufficient. The State must give its consent either

through a special law (in case of government corporations) or a general law (i.e.,

Promotes ease of doing business, hence, the provisions, among others, on one-person Corporation Code in case of private corporations).

corporation, the option of the corporation to have perpetual existence and the EXC: Sec. 4

elimination of the minimum subscription requirement upon incorporation. Section 4. Corporations created by special laws or charters. – Corporations created by

special laws or charters shall be governed primarily by the provisions of the special law

Adopts best practices on good corporate governance. or charter creating them or applicable to them, supplemented by the provisions of this

- For instance, the RCC requires certain items to be contained in the bylaws, Code, insofar as they are applicable. (n)

minutes and agenda of regular stockholders’ meetings all aimed at fostering 2-fold test: Common good & economic viability (A.XII, Sec.16, Phil. Constitution)

transparency.

Atty. Maan Grace B. Elago BLR 221 Page 1 of 5

b. Artificial being Corporate Fiction: a personality separate from the stockholders/members.

Public Convenience: Instead of dealing with all the individual stockholders, it

GR: Doctrine of Corporate Entity (Sec.18) is for public convenience to deal with the corporation alone.

- Where corporate fiction is used to justify a wrong, to protect fraud, or to

Section 18. Registration, Incorporation and Commencement of Corporation Existence. - defend a crime

xxx

A private corporation organized under this Code commences its corporate existence Instances of piercing the veil of corporate fiction

and juridical personality from the date the Commission issues the certificate of - Where a corporation functions for the benefit of a single person (mere alter

incorporation under its official seal thereupon the incorporators, ego/business conduit of the owner)

stockholders/members and their successors shall constitute a body corporate under - Corporation is a mere instrumentality of the individual stockholders

the name stated in the articles of incorporation for the period of time mentioned - Subsidiary company is created merely as an agency of a parent corp

therein, unless said period is extended or the corporation is sooner dissolved in

accordance with law.

Alter ego/Instrumentality doctrine

Definition There must be control, not merely majority or complete stock control,

A corporation has a juridical personality separate and distinct from that of its but complete domination, not only of finances but of policy and

stockholders or members. business practice in respect to the transaction attacked so that the

Used for purposes of convenience and to subserve the ends of justice corporate entity as to this transaction had at the time no separate mind,

will or existence of its own

Consequences: - Domestic corporation is controlled by aliens

- Ownership of property, capacity to sue and be sued in its own right (Art. 46, Dummy doctrine

NCC); Where the corporation is controlled by aliens, in violation of the law as

- Entitlement to constitutional rights; eg. Due process, equal protection; where it was organized under Philippine laws

(Cannot always claim equal rights with natural persons; i.e. entitlement to - Organized by an insolvent debtor to defraud his creditors

moral damages.

- Liability for crimes or torts; Effect

- Not liable for the debts of its stockholders and vice versa In piercing the veil, the stockholders become liable instead of the corporation.

- Remains unchanged and unaffected in its identity by changes in its individual

membership c. With powers, attributes and properties expressly authorized by law or incident to its

existence (Title IV)

EXC: Doctrine of Piercing the Veil of Corporate Fiction/Doctrine of Corporate Alter Ego

As a mere creature of law, it can exercise only such powers as the law may choose to grant

Definition it, either expressly or impliedly.

Piercing the veil of corporate entity requires the court to see through the

protective shroud which exempts its stockholders from liabilities that ordinarily d. With right to Succession

they could be subject to, or distinguishes one corporation from a seemingly

separate one, were it not for the existing corporate fiction. Succession (artificial succession), defined – continuation of a corporation’s legal status

This doctrine allows the State to disregard the fiction of juridical personality of the despite changes in ownership/management

corporation where the entity is formed or used for non-legitimate purposes

Right of succession

Elements: Control, breach of duty, injury A corporation has the capacity for continuous existence despite changes in

rd

stockholders/members or by any transfer of shares by a stockholder to a 3 person.

Grounds

- Where corporate fiction is used to defeat public convenience

Atty. Maan Grace B. Elago BLR 221 Page 2 of 5

4. ADVANTAGES AND DISADVANTAGES OF A CORPORATION Effect of mismanagement Partner vs. partner Corp vs. Board

Right of succession None Yes

ADVANTAGES DISADVANTAGES Only up to extent of

Extent of liability Liable to 3rd persons

Complicated in formation and investment

Legal capacity to act as a legal unit

management Transferability of interest No Yes

Relatively high cost of formation & Dissolution Any time With consent of the state

Continuity of existence

operation Governing law New Civil Code RA 11232

Credit strengthened by continuity of Credit weakened by limited liability of

existence SHs

Centralized management Lack of personal element B. COMPONENTS OF A CORPORATION (Subjective components)

Standardized creation, organization, Greater degree of governmental

management, dissolution control 1. Promoter

Makes feasible gigantic financial enterprises SHs voting rights theoretical in large A person who, acting alone or with others, takes initiative in founding and organizing the

Limited liability of SHs corps where proxies are used business or enterprise of the issuer and receives consideration therefor

SHs have little voice in conduct of

SHs are not considered general agents

business 2. Incorporators (Sec. 5,10)

Separation of control/mgmt &

Transferrability of interests Section 5. Corporators and Incorporators, Stockholders and Members. – xxx

ownership

Incorporators are those stockholders or members mentioned in the articles of incorporation as

originally forming and composing the corporation and who are signatories thereof.

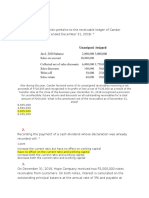

5. CORPORATION VS. PARTNERSHIP

Section 10. Number and Qualifications of Incorporators. - Any person, partnership, association or

Similarities corporation, singly or jointly with others but not more than fifteen (15) in number, may organize

a corporation for any lawful purpose or purposes: Provided, That natural persons who are

Juridical personality licensed to practice a profession, and partnerships or associations organized for the purpose of

Can only act through its agents practicing a profession, shall not be allowed to organize as a corporation unless otherwise

Aggregate of individuals provided under special laws. Incorporators who are natural persons must be of legal age.

Distribution of profits to those who contribute capital Each incorporator of a stock corporation must own or be a subscriber to at least one (1) share of

Organized only if the law allows it the capital stock.

Taxable A corporation with a single stockholder is considered a One Person Corporation as described in

“Perpetual” existence Title XIII, Chapter III of this Code.

Differences 3. Corporators (Sec. 5)

Section 5. Corporators and Incorporators, Stockholders and Members. - Corporators are those

PARTNERSHIP CORPORATION who compose a corporation, whether as stockholders or shareholders in a stock corporation or

Manner of creation Mere agreement of parties Operation of Law/ Law as a members in a nonstock corporations. xxx

Number of incorporators At least 2 Even 1 a. Stockholders; subscribers

b. Members

Commencement of juridical Issuance of Certificate of

Execution of contract

personality Incorporation

4. Governing Body (Title III)

Expressly granted by law

a. Board of Directors

Powers As authorized by partners or incident to its

b. Board of Trustees

existence

Management GR: all partners Board

Atty. Maan Grace B. Elago BLR 221 Page 3 of 5

5. Managing and Administrative Body dividends to its members, trustees, or officers: Provided, That any profit which a nonstock

a. Executive committee corporation may obtain incidental to its operations shall, whenever necessary or proper, be

b. Contracted Managers used for the furtherance of the purpose of purposes for which the corporation was

organized, subject to the provisions of this Title.

6. Corporate Officers (Sec. 24) The provisions governing the stock corporations, when pertinent, shall be applicable to

Section 24. Corporate Officers. - Immediately after their election, the directors of a corporation nonstock corporations except as may be covered by specific provisions of this Title.

must formally organize an elect: (a) a president, who must be a director; (b) a treasurer, who

must be a resident of the Philippines; and (d) such other officers as may be provided in the 2. As to number of persons composing the corporation

bylaws. If the corporation is vested with public interest, the board shall also elect compliance

officer. The same person may hold two (2) or more positions concurrently, except that no one a. Corporation Aggregate : a corporation consisting of more than one member or corporator

shall act as president and secretary or as president and treasurer at the same time, unless

otherwise allowed in this Code. b. Corporation Sole : a religious corporation which consists of one member or corporator only

The officers shall manage the corporation and perform such duties as may be provided in the and his successors, such as a bishop. (Sec. 108)

bylaws and/or as resolved by the board of directors.

c. One Person Corporation : one with a single stockholder (Sec. 116)

7. Underwriter

A person, usually an investment banker, who: Section 116. One Person Corporation. - A One Person Corporation is a corporation with a

(1) Has agreed, alone or with others, to buy at stated terms an entire issue of securities or a single stockholder: Provided, That only a natural person, trust, or an estate may form a One

substantial part thereof; or Person Corporation.

(2) Has guaranteed the sale of an issue by agreement to buy from the issuing party any unsold Banks and quasi-banks, preneed, trust, insurance, public and publicly-listed companies, and

portion at a stated price; or non-chartered government-owned and -controlled corporations may not incorporate as

(3) Has agreed to use his “best efforts” to market all or part of an issue; or ONe Person Corporations: Provided, further, That a natural person who is licensed to

(4) Has offered for sale stock he has purchased from a controlling stockholder exercise a profession may not organize as a One Person Corporation for the purpose of

exercising such profession except as otherwise provided under special laws.

3. As to legal status

C. CLASSIFICATION OF CORPORATIONS a. De Jure Corporation

Organized in accordance with the requirements of law; existing both in fact and in law

1. As to existence of shares of stock

b. De Facto Corporation (Sec.19)

a. Stock Corporation (Sec.3) Organized with a colorable compliance with the requirements of a valid law; existing in fact

but not in law

Section 3. Classes of Corporations. - Corporations formed or organized under this Code may

be stock or nonstock corporations. Stock corporations are those which have capital stock Section 19. De facto Corporations. - The due incorporation of any corporation claiming in

divided into shares and are authorized to distribute to the holders of such shares, dividends, good faith to be a corporation under this Code, and its right to exercise corporate powers,

or allotments of the surplus profits on the basis of the shares held. All other corporations shall not be required into collaterally in any private suit to which such corporation may be a

are nonstock corporations. party. Such inquiry may be made by the Solicitor General in a quo warranto proceeding.

b. Non-Stock Corporation (Sec.3 & 86) c. Corporation by Estoppel (Sec.20)

A group of persons that assumes to act as a corporation knowing it to be without authority

Section 86. Definition. - For purposes of this Code and subject to its provisions on to do so, and enters into a transaction with a third person on the strength of such

dissolution, a nonstock corporation is one where no part of its income is distributable as appearance. It is precluded to deny its existence in an action under said transaction. It is

neither a de jure nor de facto corporation

Atty. Maan Grace B. Elago BLR 221 Page 4 of 5

1) Government –owned or controlled corporation (GOCC)

Section 20. Corporation by Estoppel. - All persons who assume to act as a corporation One created or organized by the government or of which the government is

knowing it to be without the authority to do so shall be liable as general partners for all the majority stockholder; it is not for the government of a portion of the

debts, liabilities and damages incurred or arising as a result thereof: Provided, however, State

That when any such ostensible corporation is sued on any transaction entered by its as a e.g. GSIS, SSS, PNRC,

corporation or on any tort committed by it as such, it shall not be allowed to use on any its May be organized as stock (ex. Land Bank of the Phil., Dev’t. Bank of the Phil.)

lack of corporate personality as a defense. Anyone who assumes an obligation to an or non-stock

ostensible corporation as such cannot resist performance thereof on the ground that there 2) Quasi-Public Corporation (a.k.a. “public utility” or “public service corporation”)

was in fact no corporation. A.k.a. “public utility” or “public service corporation”; a private corporation

which have accepted from the State the grant of franchise or contract

d. Corporation by Prescription involving the performance of public duties but which are organized for profit.

One which has exercised corporate powers for an indefinite period without interference on e.g. electric, water, telephone and transportation companies

the part of the sovereign power and which by fiction of law is given the status of a

corporation, e.g. Roman Catholic Church 6. As to publicity

4. As to relationship of management and control a. Open corporation

Open to any person who may wish to become a stockholder/member thereto

a. Parent/Holding Corporation

One which controls another as a subsidiary by the power, either directly or indirectly, to b. Close corporation (Title XII)

elect management. It is one that holds stocks in other companies for purposes of control Limited to selected prsons or members of a family

rather than for mere investment.

7. Special corporations

b. Subsidiary Corporation

i. Majority-owned Subsidiary a. Educational corporations (Sec. 105-106)

Its capital stock (51% to 94%) is owned by another corporation

ii. Wholly-Owned Subsidiary b. Religious corporations (Sec. 107-114)

Its capital stock (95% to 100%) is owned by another corporation Lay corporation – organized for a purpose other than for religion; may be:

Eleemosynary (for charitable purposes), or

c. Affiliates Civil (for business/profit)

Companies subject to the common control of the Holding Corporation

8. As to place of incorporation

d. Parent and Subsidiary Corporation

Separate entities with power to contract with each other a. Domestic Corporation

Formed, organized, or existing under Philippine laws

5. As to Functions

b. Foreign Corporation

a. Public Corporation Formed, organized or existing under any laws other than those of the Philippines. (Sec. 123)

One formed or organized for the government of a portion of the State for the general good

and welfare

b. Private Corporation

Those formed for private purpose, usually for profit-making

- includes:

Atty. Maan Grace B. Elago BLR 221 Page 5 of 5

You might also like

- Revised Corporation CodeDocument172 pagesRevised Corporation CodeRic John Naquila Cabilan70% (10)

- Exercise 1:: (A. Decline B. Decrease C. Drop D. Improvement E. Reduction)Document2 pagesExercise 1:: (A. Decline B. Decrease C. Drop D. Improvement E. Reduction)Jon MickNo ratings yet

- Kelson Sporting Equipment IncDocument3 pagesKelson Sporting Equipment IncJon MickNo ratings yet

- Minutes of Regular Board of Directors' Meeting - August 25 2016Document18 pagesMinutes of Regular Board of Directors' Meeting - August 25 2016John ArchibaldNo ratings yet

- LAW NO. 489 ORGANIC LAW OF THE CENTRAL BANK OF PARAGUAY, AMENDED AS OF 1997 - Translated by IMFDocument32 pagesLAW NO. 489 ORGANIC LAW OF THE CENTRAL BANK OF PARAGUAY, AMENDED AS OF 1997 - Translated by IMFvictor_chaparro_1No ratings yet

- RFBT 07 CorporationsDocument16 pagesRFBT 07 CorporationsMary Grace Galenzoga ButronNo ratings yet

- BP 22 VS ESTAFA Copy 1Document8 pagesBP 22 VS ESTAFA Copy 1suchezia lopezNo ratings yet

- NFJPIA - Mockboard 2011 - P2 PDFDocument6 pagesNFJPIA - Mockboard 2011 - P2 PDFSteven Mark MananguNo ratings yet

- PartnershipDocument43 pagesPartnershipitik meowmeowNo ratings yet

- RFBT.3405 CorporationDocument22 pagesRFBT.3405 CorporationMonica GarciaNo ratings yet

- Civil LawReview Refresher by Atty RabuyaDocument4 pagesCivil LawReview Refresher by Atty RabuyaJ Velasco PeraltaNo ratings yet

- 1 Corporation Accounting IntroductionDocument6 pages1 Corporation Accounting IntroductionShane Ivory ClaudioNo ratings yet

- Lecture Note Revised Corporation Code Oct 2020-1Document27 pagesLecture Note Revised Corporation Code Oct 2020-1De MarcusNo ratings yet

- Handout in Corporation LawDocument62 pagesHandout in Corporation LawGabx Tapas100% (1)

- Module 3.2 - Preferential Taxation Keyworded Lecture NotesDocument8 pagesModule 3.2 - Preferential Taxation Keyworded Lecture NotesGabs SolivenNo ratings yet

- Notes On Hector de LeonDocument2 pagesNotes On Hector de LeongoerginamarquezNo ratings yet

- Chapter 4 Reviewer Law 2 7Document6 pagesChapter 4 Reviewer Law 2 7Hannamae Baygan100% (1)

- Lupisan-Baysa PDFDocument206 pagesLupisan-Baysa PDFRicart Von LauretaNo ratings yet

- IV. Classification of CorporationsDocument5 pagesIV. Classification of Corporationschristine jimenezNo ratings yet

- Title IvDocument6 pagesTitle IvCheriferDahangCoNo ratings yet

- Chapter 3Document2 pagesChapter 3Kristine TiuNo ratings yet

- Obligations and Contracts: ReviewerDocument50 pagesObligations and Contracts: ReviewerJune Karl CepidaNo ratings yet

- Corporation General Principles What Is A Corporation?Document5 pagesCorporation General Principles What Is A Corporation?Mirela VerzosaNo ratings yet

- A. Partnerships: 1. General ProvisionsDocument33 pagesA. Partnerships: 1. General ProvisionsRubierosseNo ratings yet

- Law On Partnership and Corporation by Hector de Leon Pages 39 50Document12 pagesLaw On Partnership and Corporation by Hector de Leon Pages 39 50erickson hernanNo ratings yet

- Corporation Law Reviewer 2Document5 pagesCorporation Law Reviewer 2Richard Allan LimNo ratings yet

- Module 2Document6 pagesModule 2trixie mae0% (1)

- Reviewer RCCPDocument27 pagesReviewer RCCPGodwin De GuzmanNo ratings yet

- Copy of RFBT 04 01 Law On ObligationDocument127 pagesCopy of RFBT 04 01 Law On ObligationStephanieNo ratings yet

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- Acc224-Ais Final Exam ReviewerDocument3 pagesAcc224-Ais Final Exam ReviewerDonabelle MarimonNo ratings yet

- Chapter 2 Obligations of The Partners Section 3Document6 pagesChapter 2 Obligations of The Partners Section 3Kaye Alyssa EnriquezNo ratings yet

- The Intermediate Accounting Series Volume 2 2016 Empleo Robles SolmanDocument239 pagesThe Intermediate Accounting Series Volume 2 2016 Empleo Robles SolmanAngelika AureNo ratings yet

- PRTC PARTNERSHIP HandoutDocument11 pagesPRTC PARTNERSHIP HandoutKristian ArdoñaNo ratings yet

- CorporationDocument10 pagesCorporationace zeroNo ratings yet

- Landicho - COMPARE-Partnership vs. CorporationDocument3 pagesLandicho - COMPARE-Partnership vs. CorporationKaren LandichoNo ratings yet

- H15 - Local TaxationDocument7 pagesH15 - Local Taxationnona galidoNo ratings yet

- Module 7 Chapter 9 Input VATDocument7 pagesModule 7 Chapter 9 Input VATChris SumandeNo ratings yet

- Corporation: Republic Act No. 11232 Revised Corporation Code (2019)Document12 pagesCorporation: Republic Act No. 11232 Revised Corporation Code (2019)Steffanie Olivar100% (1)

- RCCP Title II Incorporation and Organization of Private CorporationsDocument31 pagesRCCP Title II Incorporation and Organization of Private CorporationsChet Buenfeliz TacliadNo ratings yet

- Law On Partnership and Corporation by Hector de Leon PDF FreeDocument41 pagesLaw On Partnership and Corporation by Hector de Leon PDF FreeKimberly AcolNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- Ra 11232 (Revised Corporation Code of The Philippines)Document26 pagesRa 11232 (Revised Corporation Code of The Philippines)Darryl Sarte BoocNo ratings yet

- Corporation Code PDFDocument54 pagesCorporation Code PDFVince FernandezNo ratings yet

- Notes in Business Laws and RegulationsDocument10 pagesNotes in Business Laws and RegulationsZie TanNo ratings yet

- Business Law IncorporatorsDocument9 pagesBusiness Law IncorporatorsAsdfghjkl qwertyuiopNo ratings yet

- Revised Corporation CodeDocument13 pagesRevised Corporation CodeDencel CundanganNo ratings yet

- QUICKNOTES On Cooperative CodeDocument2 pagesQUICKNOTES On Cooperative CodeAlexis SosingNo ratings yet

- Revised Corporation Code 11.16.19Document118 pagesRevised Corporation Code 11.16.19Ed Apalla100% (1)

- NOTES I Dissolution of Corp.Document4 pagesNOTES I Dissolution of Corp.Melissa Kayla ManiulitNo ratings yet

- Quiz No. 1 Risks Returns and Capital StructureDocument5 pagesQuiz No. 1 Risks Returns and Capital StructureFaith CastroNo ratings yet

- Revised Corporation Code of The PhilippinesDocument5 pagesRevised Corporation Code of The PhilippinesNino Michael PagcaliwaganNo ratings yet

- Notes - FAR - InvestmentDocument7 pagesNotes - FAR - InvestmentElaineJrV-IgotNo ratings yet

- Law2 CH 1 Law2 Business Laws and RegulationsDocument8 pagesLaw2 CH 1 Law2 Business Laws and Regulationsnelma mae ruzNo ratings yet

- Revised Corporation Code of The PhilippinesDocument65 pagesRevised Corporation Code of The PhilippinesJeffrey DyNo ratings yet

- Laws On PartnershipDocument17 pagesLaws On PartnershipCGNo ratings yet

- Law On Obligations ComprehensiveDocument22 pagesLaw On Obligations ComprehensiveCruxzelle BajoNo ratings yet

- Revised CodeDocument3 pagesRevised CodeShanelle SilmaroNo ratings yet

- Corporation 1 34Document24 pagesCorporation 1 34Annamarisse parungaoNo ratings yet

- 04 Reo Ho Mas Fs AnalysisDocument6 pages04 Reo Ho Mas Fs AnalysisRefinej WickerNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- RCC Reviewer Part IIDocument17 pagesRCC Reviewer Part IIjoventiladorNo ratings yet

- 2017 The Corporation Code of The Philippines Reviewer (Final) - 2Document167 pages2017 The Corporation Code of The Philippines Reviewer (Final) - 2Vinson GabatoNo ratings yet

- KTRL+ Corpo Syllabus - 2018Document18 pagesKTRL+ Corpo Syllabus - 2018Kevin G. PerezNo ratings yet

- RSU Form No. 3 - Dorm ContractDocument1 pageRSU Form No. 3 - Dorm ContractJon MickNo ratings yet

- Production OrientationDocument1 pageProduction OrientationJon MickNo ratings yet

- GN Et Ic Co MP Ass: Name: Lizardo, Cyrus Vaughn D. Classcode: 7868Document1 pageGN Et Ic Co MP Ass: Name: Lizardo, Cyrus Vaughn D. Classcode: 7868Jon MickNo ratings yet

- Abra Bugle NewsDocument1 pageAbra Bugle NewsJon MickNo ratings yet

- Problem 10-33 Multiple Choice (IFRS 16)Document20 pagesProblem 10-33 Multiple Choice (IFRS 16)Jon MickNo ratings yet

- Ae 211 Final ExamDocument10 pagesAe 211 Final ExamJon MickNo ratings yet

- LOCATION: Sagada Activities Duration: 4 Days Before Checklist of Equipments and GadgetsDocument2 pagesLOCATION: Sagada Activities Duration: 4 Days Before Checklist of Equipments and GadgetsJon MickNo ratings yet

- Fitness EssayDocument1 pageFitness EssayJon MickNo ratings yet

- Out of School Youth WOSOCODocument2 pagesOut of School Youth WOSOCOJon MickNo ratings yet

- Fin Statement AnalysisDocument22 pagesFin Statement AnalysisJon MickNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Introduction of The WorkDocument2 pagesIntroduction of The WorkJon MickNo ratings yet

- Order in The Matter of M/s Bishal Horticulture and Animal Projects Limited (BHAPL)Document32 pagesOrder in The Matter of M/s Bishal Horticulture and Animal Projects Limited (BHAPL)Shyam SunderNo ratings yet

- Project On Investment BankingDocument82 pagesProject On Investment BankingMahesh Sawant50% (6)

- LML4806 2023 Semester 2 FI Concession Exam PaperDocument6 pagesLML4806 2023 Semester 2 FI Concession Exam Papercharmainemosima1No ratings yet

- Agency Theory and Corporate GovernanceDocument17 pagesAgency Theory and Corporate GovernancePutra IskandarNo ratings yet

- Corporate Governance.....Document10 pagesCorporate Governance.....jyotsana vermaNo ratings yet

- HR PoliciesDocument3 pagesHR PoliciesakashtrivedeNo ratings yet

- A. K. Capital Services Limited: Flat No. N, Sagar Apartment, 6, Tilak Marg, New Delhi - 110 001Document64 pagesA. K. Capital Services Limited: Flat No. N, Sagar Apartment, 6, Tilak Marg, New Delhi - 110 001Vignesh SrinivasanNo ratings yet

- Starwood Hot 2008 Annual ReportDocument178 pagesStarwood Hot 2008 Annual ReportEijaz AnwarNo ratings yet

- Employment Contract - TemplateDocument23 pagesEmployment Contract - TemplateM00SEKATEERNo ratings yet

- Internal Control ConceptsDocument14 pagesInternal Control Conceptsmaleenda100% (1)

- Audit Committee, Board of Director Characteristics, and Earnings ManagementDocument26 pagesAudit Committee, Board of Director Characteristics, and Earnings ManagementFebri RahadiNo ratings yet

- Job Description School Director 2Document4 pagesJob Description School Director 2api-353859154No ratings yet

- 2015 05 11 - Conservatory Board Meeting Minutes - FinalDocument7 pages2015 05 11 - Conservatory Board Meeting Minutes - Finalapi-283790301No ratings yet

- NEA v. Maguindanao Electric CooperativeDocument20 pagesNEA v. Maguindanao Electric Cooperativelili cruzNo ratings yet

- Mar 15 BoardminutesDocument2 pagesMar 15 Boardminutesapi-278552078No ratings yet

- Litonjua Jr. vs. Eternit CorpDocument2 pagesLitonjua Jr. vs. Eternit CorpRia Evita RevitaNo ratings yet

- Best PracticeDocument43 pagesBest Practicehamrez100% (1)

- Creative Accounting and Window DressingDocument7 pagesCreative Accounting and Window DressingOnaderu Oluwagbenga Enoch100% (1)

- Annual: Zarai Taraqiati Bank LimitedDocument60 pagesAnnual: Zarai Taraqiati Bank Limitednaseem ashrafNo ratings yet

- SEBI Takeover Code - UpdatedDocument24 pagesSEBI Takeover Code - UpdatedSagarNo ratings yet

- Project On North West General Hospital Peshawar - DOC XDocument63 pagesProject On North West General Hospital Peshawar - DOC XNiaz MuhammadNo ratings yet

- Cap 3 of 1998 The Postal Corporation of Kenya ActDocument8 pagesCap 3 of 1998 The Postal Corporation of Kenya ActEkai NabenyoNo ratings yet

- JBL-2012AR 10kDocument18 pagesJBL-2012AR 10kHellokitty1234567891No ratings yet

- Code-A1: Civil Appeal No. of 2019Document23 pagesCode-A1: Civil Appeal No. of 2019Suryanshi GuptaNo ratings yet

- Transfer of Shares (Sec. 63) Jan 282019Document25 pagesTransfer of Shares (Sec. 63) Jan 282019rapturereadyNo ratings yet

- Draft Appointment LetterDocument5 pagesDraft Appointment LetterHanuman PatelNo ratings yet

- AnnualReport 2011Document154 pagesAnnualReport 2011Anna FedoseevaNo ratings yet

- Condo:board Removal Requisition MCC 232Document14 pagesCondo:board Removal Requisition MCC 232condomadness13No ratings yet