Professional Documents

Culture Documents

PPE Part 1 Module

PPE Part 1 Module

Uploaded by

Natalie SerranoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPE Part 1 Module

PPE Part 1 Module

Uploaded by

Natalie SerranoCopyright:

Available Formats

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Property, Plant and Equipment (Part 1)

Property, plant and equipment are:

a. Tangible assets (have physical substance);

b. Used in business (used in the production or supply of goods or services, for rental, or for

administrative purposes); and

c. Long-term in nature (expected to be used for more than one period).

Examples of PPE:

a. Land used in business

b. Land held for future plant site

c. Building used in business

d. Equipment used in the production of goods

e. Equipment held for environmental and safety reasons

f. Equipment held for rentals

g. Major spare parts and long-lived stand-by equipment

h. Furniture and fixture

i. Bearer plants

The following are not PPE:

a. Land held for speculation

b. Land held for an undetermined future use

c. Land and/or building classified as investment property under PAS 40 Investment Property

d. Property held for sale in the ordinary course of business

e. Assets classified as held for sale under PFRS 5

f. Biological assets related to agricultural activity, other than bearer plants

g. Intangible assets

h. Minor spare parts and short-lived stand-by equipment

RECOGNITION

An item of PPE is recognized if:

a. it is probable that future economic benefits associated with the item will flow to the entity; and

b. the cost of the item can be measured reliably.

INITIAL MEASUREMENT

An item of PPE is initially measured at cost. Cost comprises the following:

a. Purchase price, including import duties, nonrefundable purchase taxes, less trade discounts and

rebates.

b. Direct costs of bring the asset to the location and condition necessary for it to be used in the

manner intended by management.

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

c. Initial estimate of dismantlement, removal and site restoration cost for which the entity incurs

an obligation by acquiring or using the asset other than to produce inventories.

Examples of directly attributable costs:

a. Costs of employee benefits arising directly from the construction or acquisition of PPE;

b. Costs of site preparation;

c. Initial delivery and handling costs (e.g., freight costs);

d. Installation and assembly costs;

e. Testing costs, net of disposal proceeds of samples generated during testing and; and

f. Professional fees

Examples of costs that are expensed outright:

a. Costs of opening a new facility

b. Costs of introducing a new product or service

c. Costs of conducting business in a new location or with a new class of customers

d. Administration and other general overhead costs

CESSATION OF CAPITALIZATION OF COSTS

Capitalization of costs ceases when the PPE is in the location and condition necessary for it be

capable of operating in the manner intended by management. Therefore, costs incurred in using

or redeploying a PPE are not capitalized.

MEASUREMENT OF COST

Cost is measured at the cash price equivalent at the acquisition date. If payment is deferred

beyond normal credit terms, the difference between the cash price equivalent and the total

payment is recognized as interest over the credit period.

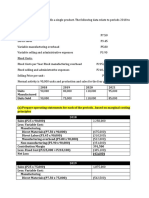

Illustration 1: Acquisition on cash basis

ABC Co. acquired a factory equipment overseas on a cash basis for ₱100,000. Additional costs

incurred include the following: commissions paid to brokers for the purchase of the equipment,

₱5,000; import duties of ₱25,000; non-refundable purchase taxes of ₱10,000; freight cost of

transferring the equipment to ABC Co.’s premises, ₱1,000; costs of assembling and installing the

equipment, ₱2,000; costs of testing the equipment, ₱1,500; and administration and other general

overhead costs, ₱4,200; and advertisement and promotion costs of the new product to be

produced by the equipment, ₱3,800. The samples generated from testing the equipment were

sold at ₱500.

Requirement: Compute for the initial cost of the equipment

Solution:

The initial cost of the equipment is computed as follows:

Purchase price (cash price equivalent) 100,000

Commissions to brokers 5,000

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Import duties 25,000

Non-refundable purchase taxes 10,000

Transportation cost 1,000

Assembling and installation costs 2,000

Testing costs 1,500

Net proceeds from samples generated (500)

Initial cost of equipment 144,000

INCIDENTAL OPERATIONS

Income and related expenses of incidental operations are recognized in profit or loss, and hence

do not affect the measurement cost of a PPE.

For example, a vacant lot may be temporarily used as a parking space before or during the

construction of a building. The income and related expenses from the parking space are

recognized in profit or loss.

SELF-CONSTRUCTED ASSETS

“The cost of a self-constructed asset is determined using the same principles as for an acquired

asset.” (PAS 16.22)

CLASSES OF PPE

A class of PPE is a grouping of assets of a similar nature and use in an entity’s operations. The

following are examples of separate classes:

a. land;

b. land and buildings;

c. machinery;

d. ships;

e. aircraft;

f. motor vehicles;

g. furniture and fixtures;

h. office equipment; and

i. bearer plants

LAND (PROPERTY)

Land is classified as PPE if it is used in the entity’s operations as “owner occupied” property,

e.g., land on which the entity’s office building was constructed and land used as plant site. Land

held for future plant site is also classified as PPE.

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

The following items of land are not classified as PPE.

1. Land being sold in the ordinary course of business – classified as “Inventory”

2. Land held for sale under PFRS 5 – classified as “Noncurrent asset held for sale”

3. Land held for long-term capital appreciation – classified as “Investment property”

4. Land held for a currently undetermined future use – classified as Investment property”

5. Land held as site for a building being constructed or developed for future use as investment

property - classified as “Investment property”

6. Land leased out under operating lease – classified as “Investment property”

COST OF LAND IMPROVEMENT

Land improvements are enhancements to the land which have definite useful life, such as

private driveways, walks, fences, drainages and water systems, cost of trees and shrubs and other

landscaping.

Land normally has an indefinite useful life, thus, it is not subject to depreciation. Therefore, land

improvements are segregated from the cost of land and depreciated over their estimated useful

lives.

BUILDING (PLANT)

Building is classified as PPE if it is used in the entity’s operations as “owner occupied property”,

e.g., building used to sell goods or services and building used for administrative purposes.

Building being constructed or developed for future use as “owner occupied” property is also

classified as PPE.

COSTS OF BUILDING IMPROVEMENT

Building improvements refer to costs incurred subsequent to occupancy of a purchased building

or subsequent to completion of a self-constructed building that either increase the useful life of

the building of improve its current state.

Building improvements include the following:

1. Cost of elevator, escalator, or similar items that was not originally included in the purchased

building or in the blueprint of a self-constructed building.

2. Ventilation systems, plumbing, and lighting systems installed after occupancy of a purchased

building of after completion of a self-constructed building. However, if they are installed prior to

occupancy or during construction, they are capitalized to the building account.

3. Immovable fixtures attached to the building which, if removed, would necessarily damage the

building, e.g., partitions, compartments and cranes. Movable fixtures are classified as furniture

and fixtures, e.g., signage.

EQUIPMENT

Includes delivery and transportation equipment, office equipment, machinery, furniture and

fixtures, furnishings, factory equipment and similar fixed assets.

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

COST OF EQUIPMENT

1. Purchase price including other necessary costs such as broker’s commissions and non-

refundable purchase taxes

2. Freight, handling charges, and insurance on the equipment while in transit

3. Cost of necessary special foundation or platform

4. Assembling and installation costs

5. Costs of testing and conducting trial runs

6. The initial estimate of decommissioning and restoration costs for which the entity has a

present obligation.

Cost of equipment includes the following:

A. Cost of relocating the equipment after it has been put to the location and condition originally

intended by management – this is recognized as expense

B. Cost of training personnel who will be responsible in operating the equipment – recognized as

expense

C. Cost of dismantling and removing an old equipment belonging to the entity prior to the

installation of a new equipment – recognized as expense except when the cost was previously

recognized as liability

BEARER PLANTS

A bearer plant is a living plant that:

a. Is used in the production or supply of agricultural produce;

b. Is expected to bear produce for more than one period; and

c. Has a remote likelihood of being sold as agricultural produce except for incidental scrap

sales.

Bearer plants are accounted for similar to self-constructed assets.

LUMP-SUM PURCHASE OF ITEMS OF PPE

The acquisition cost of a group of items of PPE acquired on a lump-sum price is allocated to the

individual assets based on their relative fair values at the date of purchase.

LAND AND BUILDING ACQUIRED ON A LUMP-SUM PRICE

The acquisition cost of land and building acquired on a lump-sum price is allocated to both the

land and building based on their relative fair values at purchase date.

However, if the building is unusable, from both the perspective of the entity and market

participants, such that it has an insignificant fair value, the total acquisition cost is allocated on

to the land. In this case, the building is not recognized as an asset because the asset recognition

criteria are not met.

The lump-sum acquisition cost is not allocated if both the land and building are classified

as inventory or investment property measured at fair value.

DEMOLITION COSTS

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

The accounting treatment for demolition costs depends on the reason for the demolition.

TO CONSTRUCT A NEW BUILDING

Cost of demolishing/razing the old building = cost of site preparation

- Directly attributable to the construction of a new building

- Capitalized as cost of the NEW BUILDING

- May need to be tested for impairment

- Carrying amount of the building demolished is recognized as LOSS

- Any proceeds from the sale of salvaged material are DEDUCTED FROM THE

DEMOLITION COST

TO CLEAR THE LAND FOR A POSSIBLE FUTURE SALE

- Demolition cost is capitalized only if it enhances the future economic benefits of the

LAND. (otherwise charged to EXPENSE)

- If the decision to demolish occurs PRIOR to the classification of the land as “held for

sale” (IFRS 5), the demolition cost is treated as “cost to sell”

- If the demolition cost is a PREREQUISITE to the sale of land classified as inventory—

treated as “COST TO SELL”

- Any proceeds from the sale of salvaged material are DEDUCTED FROM THE

DEMOLITION COST

Illustration 1: Lump-sum acquisition – building not demolished

On April 1, 20x1, ABC Co. purchased a land and building by paying ₱10,000,000 and assuming

a mortgage of ₱2,000,000. The land and building have fair values of ₱5,000,000 and

₱10,000,000, respectively. The building will be used by ABC Co. as its new office.

Additional costs relating to the purchase include the following:

Legal cost of conveying and registering title to land 8,000

Payment to tenants to vacate premises 9,000

Option pain on the land and building 6,000

Option pain on similar land and building not acquired 3,000

Broker’s fee on the land and building 15,000

Unpaid real estate taxes prior to April 1, 20x1 assumed by ABC Co. – assessed

on land 30,000

Real estate taxes after April 1, 20x1 20,000

Repairs and renovation costs before the building is occupied 40,000

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Repair costs after the building is occupied 50,000

Requirement: Compute for the allocated costs of the different classes of PPE.

Solution:

The total acquisition cost is determined as follows:

Cash payment 10,000,000

Mortgage assumed 2,000,000

Total acquisition cost 12,000,000

The fractions to be used in the cost allocation are derived from the relative fair values as follows:

Fair values Fractions

Land 5,000,000 5/15

Building 10,000,000 10/15

15,000,000

Land Building

Purchase price (12M x 5/15); (12M x 10/15) 4,000,000 8,000,000

Legal cost of conveying and registering title to land 8,000

Payment to tenants to vacate premises (9K x 5/15); (9K x 10/15) 3,000 6,000

Option pain on the land and building (6K x 5/15); (6K x 10/15) 2,000 4,000

Broker’s fee on the land and building (15K x 5/15); (15K x

10/15) 5,000 10,000

Unpaid real estate taxes prior to April 1, 20x1 assumed by ABC

Co. – assessed on land 30,000

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Repairs and renovation costs before the building is occupied 40,000

Totals 4,048,000 8,060,000

OTHER NOTES:

- Cash Discounts are DEDUCTED from the cost of PPE WHETHER TAKEN OR NOT.

SPECIAL ITEMS

Acquisition through exchange

A. Non-Monetary Asset or Assets

B. Combination of Monetary and Non-Monetary Assets

WITH COMMERCIAL SUSBTANCE

PPE received is measured using the ff ORDER OF PRIORITY:

i. FV of the asset GIVEN UP (PLUS Cash PAID or MINUS cash RECEIVED)

ii. FV of the asset RECEIVED (PLUS Cash PAID or MINUS cash RECEIVED)

LACKS COMMERCIAL SUBSTANCE

CA of the asset GIVEN UP (PLUS Cash PAID or MINUS cash RECEIVED)

- NO GAIN OR LOSS arises in this substance

Illustration 1: With fair value of asset given up

ABC Co. exchanged equipment with XYZ, Inc. pertinent data are shown below:

ABC Co. XYZ, Inc.

Equipment 1,000,000 2,000,000

Accumulated depreciation 200,000 800,000

Carrying amount 800,000 1,200,000

Fair value 950,000 1,100,000

Cash paid by ABC Co. to XYZ, Inc. 150,000 150,000

Requirements: Provide the journal entries in the books of ABC Co. and XYZ, Inc. to record the

exchange transaction.

Solutions:

ABC Co. (Payor)

The cost of the equipment received by ABC Co. in the exchange is computed as follows:

Fair value of asset given up 950,000

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Add: Cash paid 150,000

Cost of asset received by ABC Co. 1,100,000

Gain or loss on exchange computed as:

Fair value of asset given up 950,000

Carrying amount of asset given up (1M – 200,000) (800,000)

Gain on exchange 150,000

XYZ, Inc. (Payee)

The cost of the equipment received by XYZ, Inc. in the exchange is computed as follows:

Fair value of asset given 1,100,000

Less: Cash received (150,000)

Cost of asset received by XYZ 950,000

The entry in the books of XYZ, Inc. to record the exchange is as follows:

Equipment – new 950,000

Cash 150,000

Accumulated depreciation 800,000

Loss on exchange (squeeze) 100,000

Equipment - old 2,000,000

ACQUISITION THROUGH TRADE-IN

- Usually made by an entity with a SELLER—one who usually sells similar assets as the

one being exchanged.

- Accounted for in much the way as an exchange involving a combination of monetary and

non-monetary assets.

Order of Priority

PPE received is measured using the ff ORDER OF PRIORITY:

i. FV of the asset GIVEN UP PLUS Cash PAID

ii. FV of the asset RECEIVED (Cash price without trade-in)

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Illustration 1: Trade-in

ABC Co. traded in an old machine for a new model. Pertinent data are as follows:

Old equipment:

Cost 50,000

Accumulated depreciation 20,000

Average published retail value 6,000

New Equipment:

List price 95,000

Cash price without trade in 70,000

Cash price with trade in 55,000

Requirement: Provide the entry to record the acquisition of the new machine.

Solution:

The entry to record the trade-in is as follows:

Equipment – (cash price w/o trade in) 70,000

Accumulated depreciation 20,000

Loss on trade in (squeeze) 15,000

Equipment – old 50,000

Cash 55,000

ACQUISITION THROUGH ISSUANCE OF OWN EQUITY INSTRUMENTS

- Accounted for under IFRS 2—SHARE-BASED PAYMENTS

Order of Priority

PPE received is measured using the ff. ORDER OF PRIORITY:

i. FV of the asset RECEIVED (PLUS Cash PAID or MINUS cash RECEIVED)

ii. FV of the asset EQUITY INSTRUMENTS ISSUED

iii. PAR VALUE OF THE SHARES ISSUED

ACQUISITION THROUGH ISSUANCE OF BONDS PAYABLE

- PAS 16 and IFRS 9—FINANCIAL INSTRUMENTS

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Order of Priority

PPE received is measured using the ff ORDER OF PRIORITY:

i. FV of the BONDS PAYABLE ISSUED (or present value)

ii. FV of the asset RECEIVED (PLUS Cash PAID or MINUS cash RECEIVED)

iii. Face Value of the BONDS PAYABLE ISSUED

Illustration:

On January 1, 20x1 ABC Co. acquired land with fair value of ₱950,000 by issuing a 3-year,

10%, ₱1,000,000 bonds. Principal is due on January 1, 20x4 but interest is due at each year-end.

The prevailing market rate of interest for a similar instrument on January 1, 20x1 is 12%. The

present value of the future cash flows from the bonds discounted at 12% is ₱951,963.

The entry to record the acquisition is as follows:

Jan 1, 20x1 Land 951,963

Discount on bonds payable 48,037

Bonds payable 1,000,000

ACQUISITION BY DONATION

- Items of PPE received as donation are measured at FV and accounted for as:

Income - The donor is an UNRELATED PARTY.

- Any cost incurred attributable to the receipt of donation and transfer

of ownership is offset to the INCOME RECOGNIZED.

Donated Capital - The donor is an OWNER (SHAREHOLDER)

- “DONATED CAPITAL” is presented in EQUITY under SHARE

PREMIUM

- Any cost incurred attributable to the receipt of donation and transfer

of ownership is offset to the DONATED CAPITAL ACCOUNT.

Government - If the donor is the GOVERNMENT

Grant

Accountancy Academic Organization Tutorials 2020

PAGE \* Arabic \*

MERGEFORMAT 3

You might also like

- Co Product - Settings For SAP CostingDocument2 pagesCo Product - Settings For SAP CostingAparna Seksaria71% (14)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Grp3 Exercise 8Document12 pagesGrp3 Exercise 8Jessabell Delos SantosNo ratings yet

- Project Proposal FOR Car Assembly & Parts Manufacturing PlantDocument40 pagesProject Proposal FOR Car Assembly & Parts Manufacturing PlantTesfaye Degefa100% (1)

- Cost of Goods Manufactured Income Statement Norton IndustriesDocument2 pagesCost of Goods Manufactured Income Statement Norton IndustriesAmit PandeyNo ratings yet

- CHAPTER 5 COST ALLOCATION RevisedDocument12 pagesCHAPTER 5 COST ALLOCATION RevisedyebegashetNo ratings yet

- FAR.2908 - Investment Property.Document4 pagesFAR.2908 - Investment Property.Edmark LuspeNo ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- SEATWORK 04 - Leases: Multiple ChoiceDocument9 pagesSEATWORK 04 - Leases: Multiple ChoiceLilii DsNo ratings yet

- Blank 3330 Ch06Document17 pagesBlank 3330 Ch06Maria SyNo ratings yet

- Answer Key For Week 1 To 3 ULO 8 To 10Document7 pagesAnswer Key For Week 1 To 3 ULO 8 To 10Margaux Phoenix KimilatNo ratings yet

- Standard Costing & Variance AnalysisDocument10 pagesStandard Costing & Variance AnalysisMariella Antonio-NarsicoNo ratings yet

- AP 001 A.1 Bank Reconciliation Prob 1Document2 pagesAP 001 A.1 Bank Reconciliation Prob 1Loid Gumera LenchicoNo ratings yet

- Learning Resource 1 Lesson 2Document9 pagesLearning Resource 1 Lesson 2Novylyn AldaveNo ratings yet

- Ac101 ch3Document21 pagesAc101 ch3Alex ChewNo ratings yet

- Break-Even Analysis: Cost-Volume-Profit AnalysisDocument64 pagesBreak-Even Analysis: Cost-Volume-Profit AnalysisKelvin LeongNo ratings yet

- Project Management 2Document62 pagesProject Management 2Abdul HaseebNo ratings yet

- Inventories Quiz NotesDocument7 pagesInventories Quiz NotesMikaella Nicole PechardoNo ratings yet

- Reviewer+ +Midterm+ExaminationCOSTDocument7 pagesReviewer+ +Midterm+ExaminationCOSTMelka BelmonteNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- IAcctg1 Accounts Receivable ActivitiesDocument10 pagesIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNo ratings yet

- Question 1: (3 Points)Document9 pagesQuestion 1: (3 Points)Akmal ShahzadNo ratings yet

- QUIZ - PAS 16 and 40 - CleanDocument6 pagesQUIZ - PAS 16 and 40 - CleanMay Anne MenesesNo ratings yet

- EXAM About INTANGIBLE ASSETS 1Document3 pagesEXAM About INTANGIBLE ASSETS 1BLACKPINKLisaRoseJisooJennieNo ratings yet

- Abc StratDocument8 pagesAbc StratapremsNo ratings yet

- This Study Resource Was: Investments - Additional ConceptsDocument3 pagesThis Study Resource Was: Investments - Additional ConceptsMs VampireNo ratings yet

- CF Qualitative CharacteristicsDocument3 pagesCF Qualitative Characteristicspanda 1No ratings yet

- Included Investment Related Problems/questionsDocument22 pagesIncluded Investment Related Problems/questionsJanine LerumNo ratings yet

- CfasDocument32 pagesCfasLouiseNo ratings yet

- INTACC1 Chap 1 9Document14 pagesINTACC1 Chap 1 9Rommel estrellado100% (1)

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- Midterm Answer KeyDocument6 pagesMidterm Answer Keyazzenethfaye.delacruz.mnlNo ratings yet

- Finman Test BankDocument3 pagesFinman Test BankATHALIAH LUNA MERCADEJASNo ratings yet

- Adjusting ProbsDocument6 pagesAdjusting ProbsKrisha JohnsonNo ratings yet

- CASH FLOW STATEMENTS - Quiz 2Document2 pagesCASH FLOW STATEMENTS - Quiz 2JyNo ratings yet

- Accounting Concepts and PrinciplesDocument4 pagesAccounting Concepts and Principlesdane alvarezNo ratings yet

- Actual Costing Illustrative ProblemDocument5 pagesActual Costing Illustrative ProblemJuan Dela CruzNo ratings yet

- PAS 40 Test BankDocument6 pagesPAS 40 Test BankJake ScotNo ratings yet

- Lessor Accounting Quiz PSDocument4 pagesLessor Accounting Quiz PSBeatrice Ella DomingoNo ratings yet

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDocument5 pagesVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Governance Chapter 2Document4 pagesGovernance Chapter 2Tiffany CenizaNo ratings yet

- Provisions, Contingent Liabilities and Contingent AssetDocument37 pagesProvisions, Contingent Liabilities and Contingent AssetAbdulhafiz100% (1)

- FSA 2 SeatworksDocument5 pagesFSA 2 SeatworksElla Marie WicoNo ratings yet

- Compiled Sample Problems From The Book of de Leon Art 1305 1379Document6 pagesCompiled Sample Problems From The Book of de Leon Art 1305 1379Amielle CanilloNo ratings yet

- Shiena Joy Talamor - Unit IV Learning Activity Regulators of Financial System - 1Document7 pagesShiena Joy Talamor - Unit IV Learning Activity Regulators of Financial System - 1jonalyn sanggutanNo ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Ped-032 Sas Lesson-2Document6 pagesPed-032 Sas Lesson-2Maureen SanchezNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- Intermediate Accounting 1Document18 pagesIntermediate Accounting 1Shaina Jane LibiranNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- Far Qualifying ExaminationDocument30 pagesFar Qualifying ExaminationAlvin BaternaNo ratings yet

- Chapter 6 TBDocument26 pagesChapter 6 TBSophia UnaNo ratings yet

- Class Handout On Inventory Nov 4Document4 pagesClass Handout On Inventory Nov 4De MarcusNo ratings yet

- Cash and Cash Equivalents (IA)Document9 pagesCash and Cash Equivalents (IA)rufamaegarcia07No ratings yet

- Test Bank For Cornerstones of Cost Management 2nd Edition by Hansen PDFDocument23 pagesTest Bank For Cornerstones of Cost Management 2nd Edition by Hansen PDFJyasmine Aura V. AgustinNo ratings yet

- Standard Costing: Answer Key On Chapter 7Document5 pagesStandard Costing: Answer Key On Chapter 7Jaquelyn JacquesNo ratings yet

- PAS 16 - Property Plant and EquipmentDocument23 pagesPAS 16 - Property Plant and Equipmentロザリーロザレス ロザリー・マキルNo ratings yet

- Module 4 (Topic 3) - Land and BuildingDocument5 pagesModule 4 (Topic 3) - Land and BuildingAnn BergonioNo ratings yet

- BA-ReportFormat-apr 1-16 - SerranoDocument1 pageBA-ReportFormat-apr 1-16 - SerranoNatalie SerranoNo ratings yet

- ASYN Rodriguez PN. EssayDocument1 pageASYN Rodriguez PN. EssayNatalie SerranoNo ratings yet

- Opportunity RecognitionDocument22 pagesOpportunity RecognitionNatalie SerranoNo ratings yet

- BA-ReportFormat-1 - SERRANO, MA. NATALIE DOMINICDocument2 pagesBA-ReportFormat-1 - SERRANO, MA. NATALIE DOMINICNatalie SerranoNo ratings yet

- Updates in FSDocument3 pagesUpdates in FSNatalie SerranoNo ratings yet

- Donations ListDocument5 pagesDonations ListNatalie SerranoNo ratings yet

- BUS 227 MA Long Questions Answers Chapter 11Document13 pagesBUS 227 MA Long Questions Answers Chapter 11Natalie SerranoNo ratings yet

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- Ynbsc Hand GuideDocument259 pagesYnbsc Hand GuideNatalie SerranoNo ratings yet

- E. Other Percentage TaxesDocument49 pagesE. Other Percentage TaxesNatalie SerranoNo ratings yet

- YNBSC CL-10 Marcher's Report As of 20 Dec 21Document3 pagesYNBSC CL-10 Marcher's Report As of 20 Dec 21Natalie SerranoNo ratings yet

- AAO JPIA Days Consent Waiver FormDocument2 pagesAAO JPIA Days Consent Waiver FormNatalie SerranoNo ratings yet

- D. VAT Registration and Compliance Requirements FinalDocument34 pagesD. VAT Registration and Compliance Requirements FinalNatalie SerranoNo ratings yet

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- Last Na NiDocument5 pagesLast Na NiNatalie SerranoNo ratings yet

- Escribano Nadezhda A.1Document3 pagesEscribano Nadezhda A.1Natalie SerranoNo ratings yet

- ACCLAW-4 SyllabusDocument9 pagesACCLAW-4 SyllabusNatalie SerranoNo ratings yet

- G4 Research DraftDocument36 pagesG4 Research DraftNatalie SerranoNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Notes Serrano - Overview of The Auditing ProfessionDocument5 pagesNotes Serrano - Overview of The Auditing ProfessionNatalie SerranoNo ratings yet

- Theory of The FirmDocument15 pagesTheory of The FirmDaud SulaimanNo ratings yet

- Cost Accounting Self Assessment Materials Labor and OverheadDocument4 pagesCost Accounting Self Assessment Materials Labor and OverheadDarwyn HonaNo ratings yet

- 50 Procurement Formulas!Document9 pages50 Procurement Formulas!ebnugroho123No ratings yet

- STRATEGIC COST MANAGEMENT - Responsibility Accounting and Transfer Pricing - ConceptsDocument7 pagesSTRATEGIC COST MANAGEMENT - Responsibility Accounting and Transfer Pricing - ConceptsVanna AsensiNo ratings yet

- 5 Published Company AccountsDocument27 pages5 Published Company Accountsking brothersNo ratings yet

- Auditing and Assurance Services 7th Edition Louwers Solutions Manual 1Document36 pagesAuditing and Assurance Services 7th Edition Louwers Solutions Manual 1alyssaschwartzicrtpzjkaf100% (32)

- Module 2 QuizDocument6 pagesModule 2 QuizjmjsoriaNo ratings yet

- Accounting Standard 26Document16 pagesAccounting Standard 26Melissa ArnoldNo ratings yet

- Materials Management: - An OverviewDocument49 pagesMaterials Management: - An OverviewMohammed AadilNo ratings yet

- Activity Based Costing PractiseDocument23 pagesActivity Based Costing PractiseAR KuvadiyaNo ratings yet

- Call Planner JaspreetDocument4 pagesCall Planner JaspreetAlisha KhatterNo ratings yet

- LH - 02 - CAC - Cost Concepts and ClassficationDocument16 pagesLH - 02 - CAC - Cost Concepts and ClassficationDexter CanietaNo ratings yet

- Revision Test Papers MAY, 2023: Final Course Group - IIDocument109 pagesRevision Test Papers MAY, 2023: Final Course Group - IIEDGE VENTURESNo ratings yet

- Manual-Estimating The Cost of Environmental DegradationDocument265 pagesManual-Estimating The Cost of Environmental DegradationJay Dee100% (2)

- 42562-Oracle Project and Billing White PaperDocument2 pages42562-Oracle Project and Billing White PapermaheshatuNo ratings yet

- Costing For A Spinning MillDocument12 pagesCosting For A Spinning MillOUSMAN SEIDNo ratings yet

- Skans School of Accountancy Cost & Management AccountingDocument3 pagesSkans School of Accountancy Cost & Management AccountingmaryNo ratings yet

- SCM Lessius Chapter 4 Supply Contracts PDFDocument42 pagesSCM Lessius Chapter 4 Supply Contracts PDFSalah AlhyariNo ratings yet

- Test PracticeDocument26 pagesTest PracticeStephanie NaamaniNo ratings yet

- Cost Accounting Solman de Leon 2014 1Document181 pagesCost Accounting Solman de Leon 2014 1Mark Anthony Siva94% (16)

- Chapter 7 (Case) : Joan HoltzDocument2 pagesChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- Cost Sheet of ParleDocument3 pagesCost Sheet of Parlesucheta menon20% (5)

- Replacement AnalysisDocument22 pagesReplacement Analysismercedesferrer100% (1)

- 40 câuCustomer-Relationship-Management-MCQ PDFDocument8 pages40 câuCustomer-Relationship-Management-MCQ PDFDương Huy Chương ĐặngNo ratings yet

- Economic Analysis of Production of Essential Oil Using Steam Distillation TechnologyDocument5 pagesEconomic Analysis of Production of Essential Oil Using Steam Distillation TechnologygoutamsasmitaNo ratings yet

- 2 Insurance F PDFDocument42 pages2 Insurance F PDFjashveer rekhi17% (6)