Professional Documents

Culture Documents

Cotx302 Exam 1 Sem 2 2017

Cotx302 Exam 1 Sem 2 2017

Uploaded by

Valeria PetrovCopyright:

Available Formats

You might also like

- M6 Activity 1 Case ApplicationDocument2 pagesM6 Activity 1 Case ApplicationJay Mariz C. Ramirez100% (1)

- Share-Based Payments With Answer PDFDocument9 pagesShare-Based Payments With Answer PDFAyaka FujiharaNo ratings yet

- Dell Working Capital SolutionDocument10 pagesDell Working Capital SolutionIIMnotes100% (1)

- Case Study On Agency TheoryDocument2 pagesCase Study On Agency TheoryGammoudi27% (11)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Practice Problems 1Document1 pagePractice Problems 1Ma Angelica Balatucan0% (1)

- AFA IIPl III Question Dec 2016Document4 pagesAFA IIPl III Question Dec 2016HossainNo ratings yet

- Financial Accounting III Question November 2017Document9 pagesFinancial Accounting III Question November 2017katelynnewson07No ratings yet

- RT 301 - September 2020 EMA1 - QuestionDocument8 pagesRT 301 - September 2020 EMA1 - QuestionsibambonotheteleloNo ratings yet

- Accounting IpcnDocument17 pagesAccounting IpcnShasank TiwaryNo ratings yet

- CPA Ireland-Financial-Accounting-April-2018Document19 pagesCPA Ireland-Financial-Accounting-April-2018Mwenda MongweNo ratings yet

- Accounts g1 MTPDocument191 pagesAccounts g1 MTPJattu TatiNo ratings yet

- Taxation 3 - June 2019Document6 pagesTaxation 3 - June 201950902849No ratings yet

- Acc100 Supp PDFDocument11 pagesAcc100 Supp PDFLebohang NgubaneNo ratings yet

- 2018 - Test 2 - QuestionsDocument8 pages2018 - Test 2 - QuestionsmolemothekaNo ratings yet

- Final May 2019 C4Document22 pagesFinal May 2019 C4sweya juliusNo ratings yet

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- CTAA021 Tutorial 22 February 2024Document4 pagesCTAA021 Tutorial 22 February 2024202200224No ratings yet

- 2021 FAC1A TUT Question Unit 3 Acc Equation, GJ, GL and Trial BalanceDocument2 pages2021 FAC1A TUT Question Unit 3 Acc Equation, GJ, GL and Trial BalanceDaniel OwensNo ratings yet

- Far160 (CT October 2018) QuestionDocument4 pagesFar160 (CT October 2018) QuestionFarah HusnaNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZaid NaveedNo ratings yet

- BCTA UJ Question PaperDocument14 pagesBCTA UJ Question PaperFresh LoverzzNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Question Paper - InD As 103 & 12Document7 pagesQuestion Paper - InD As 103 & 12pratikdubey9586No ratings yet

- ACCT6034 MID RCQuestionDocument5 pagesACCT6034 MID RCQuestionOshin MenNo ratings yet

- Past Paper 2022Document3 pagesPast Paper 2022linfordnyathiNo ratings yet

- F6 Mock Exam - 2018Document13 pagesF6 Mock Exam - 2018chanellvdb1No ratings yet

- 2017 FIA324-test 2Document10 pages2017 FIA324-test 2popla poplaNo ratings yet

- FR Question Paper 81655199552Document3 pagesFR Question Paper 81655199552Nakul GoyalNo ratings yet

- ACCOUNTING 102 (ACCT102 P2 W2) : School of Accounting, Economics and Finance TEST 1: 29 AUGUST 2017Document5 pagesACCOUNTING 102 (ACCT102 P2 W2) : School of Accounting, Economics and Finance TEST 1: 29 AUGUST 2017Anathi QueenNo ratings yet

- RT 301 - End of Module Assessment - Pathway 1 - July 2020 - EMA3Document3 pagesRT 301 - End of Module Assessment - Pathway 1 - July 2020 - EMA3sibambonotheteleloNo ratings yet

- 147308Document4 pages147308Ahmed Raza TanveerNo ratings yet

- Introduction To Financial AccountingDocument2 pagesIntroduction To Financial AccountingNdivho MavhethaNo ratings yet

- Lease QuestionsDocument12 pagesLease Questionszakhonalubanzi95No ratings yet

- BCOM Y3 - ACC 3 - June 2020 Take Home AssessmentDocument4 pagesBCOM Y3 - ACC 3 - June 2020 Take Home AssessmentNtokozo Siphiwo Collin DlaminiNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument13 pagesCambridge International Advanced Subsidiary and Advanced LevelAR RafiNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2019/FAR160Document4 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2019/FAR160Nurul Syaza MusaNo ratings yet

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Chapter 8Document7 pagesChapter 8jeanNo ratings yet

- Aud Quiz 2Document6 pagesAud Quiz 2MC allivNo ratings yet

- Class Example Companies 2023Document2 pagesClass Example Companies 2023NjabuloNo ratings yet

- Specific Financial Reporting Ac413 May19bDocument5 pagesSpecific Financial Reporting Ac413 May19bAnishahNo ratings yet

- Auditing Problems-Ppep1Document4 pagesAuditing Problems-Ppep1Par CorNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelMalik AliNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelKKNo ratings yet

- Ifrs 15 QuestionsDocument2 pagesIfrs 15 QuestionsTata MgpNo ratings yet

- Jagger PLC Prepares Its Financial Statements For The Year Ended 31 March. The Company Has Extracted TheDocument1 pageJagger PLC Prepares Its Financial Statements For The Year Ended 31 March. The Company Has Extracted TheAndrea SalazarNo ratings yet

- FA Dec 2018Document8 pagesFA Dec 2018Shawn LiewNo ratings yet

- 1 QUESTION PAPER Continuous EvaluationDocument11 pages1 QUESTION PAPER Continuous EvaluationBono magadaniNo ratings yet

- Tutorial 2 Capital Allowances - Q&ADocument8 pagesTutorial 2 Capital Allowances - Q&AKamal JabriNo ratings yet

- Far160 - Dec 2019 - QDocument8 pagesFar160 - Dec 2019 - QNur ain Natasha ShaharudinNo ratings yet

- Moderator: Mr. L.J. Muthivhi (CA), SADocument11 pagesModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNo ratings yet

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyNo ratings yet

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- Topic5 Capital Allowance Student 2016Document3 pagesTopic5 Capital Allowance Student 2016Veenesha MuralidharanNo ratings yet

- Acca Tx-Mys 2019 SeptemberDocument13 pagesAcca Tx-Mys 2019 SeptemberChoo LeeNo ratings yet

- 1st Quiz Afar2 Q PDFDocument2 pages1st Quiz Afar2 Q PDFAnonymous 7HGskNNo ratings yet

- CHP 6 Exercise With AnswerDocument5 pagesCHP 6 Exercise With AnswerRanbirSinghNo ratings yet

- Problems - Adjusting EntriesDocument3 pagesProblems - Adjusting EntriesaNo ratings yet

- PL Financial Accounting and Reporting IFRS Exam June 2019Document10 pagesPL Financial Accounting and Reporting IFRS Exam June 2019scottNo ratings yet

- EdexelDocument12 pagesEdexelManuthi HewawasamNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- IFRS16 LeasesDocument179 pagesIFRS16 LeasesValeria PetrovNo ratings yet

- IAS1 Presentation of Financial StatementsDocument78 pagesIAS1 Presentation of Financial StatementsValeria PetrovNo ratings yet

- IAS 37 Provisions, Contingent Assets and Contingent LiabilitiesDocument73 pagesIAS 37 Provisions, Contingent Assets and Contingent LiabilitiesValeria PetrovNo ratings yet

- Ias 16 PpeDocument168 pagesIas 16 PpeValeria PetrovNo ratings yet

- A Present Economic Resource Controlled by The Entity As A Result of Past EventsDocument11 pagesA Present Economic Resource Controlled by The Entity As A Result of Past EventsValeria PetrovNo ratings yet

- Deposit Insurance and Credit Guarantee CorporationDocument5 pagesDeposit Insurance and Credit Guarantee CorporationleoharshadNo ratings yet

- Module 6 - Current LiabilitiesDocument14 pagesModule 6 - Current LiabilitiesDaniellaNo ratings yet

- H What Is ProrationDocument2 pagesH What Is ProrationDanica BalinasNo ratings yet

- Mohammed Abdullah Oman Project Quotation From IDM ShawnDocument2 pagesMohammed Abdullah Oman Project Quotation From IDM Shawnaleen8511No ratings yet

- Conduit Foreign IncomeDocument36 pagesConduit Foreign IncomeRizki Adhi PratamaNo ratings yet

- Case Study - GCC Economic Outlook PDFDocument18 pagesCase Study - GCC Economic Outlook PDFMhmd KaramNo ratings yet

- TEAM06 Lufthansa Ver.08.25Document33 pagesTEAM06 Lufthansa Ver.08.25Adonis SardiñasNo ratings yet

- 4 Money Laundering MainDocument21 pages4 Money Laundering MainZerin HossainNo ratings yet

- Financial Management Assignment: Prepared By, Rahul Pareek IMI, New DelhiDocument72 pagesFinancial Management Assignment: Prepared By, Rahul Pareek IMI, New Delhipareek2020100% (1)

- Can I Link My Direct Express Card To Cash App - Google SearchDocument1 pageCan I Link My Direct Express Card To Cash App - Google Searchcodybrown22No ratings yet

- Kirsal KalkinmaDocument115 pagesKirsal KalkinmaAydın GöğüşNo ratings yet

- Types of Financial InstitutionDocument8 pagesTypes of Financial InstitutionDevNo ratings yet

- The Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestDocument36 pagesThe Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestCodinasound CaNo ratings yet

- Slides Topic 12 BhoDocument51 pagesSlides Topic 12 BhoFranchesca CalmaNo ratings yet

- Rocket Personal Loan MethodDocument37 pagesRocket Personal Loan MethodGerald Stewart100% (1)

- Module-8 Break Even AnalysisDocument17 pagesModule-8 Break Even AnalysisDrKanchan GhodkeNo ratings yet

- Review of LiteratureDocument5 pagesReview of LiteratureUma MaheswariNo ratings yet

- MBA 3rd Semester Curriculum in Session 2020-21Document18 pagesMBA 3rd Semester Curriculum in Session 2020-21Uma KhamhariNo ratings yet

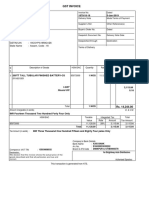

- GST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Document1 pageGST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Yogesh GuptaNo ratings yet

- Challan Format (Specialist)Document1 pageChallan Format (Specialist)hgfvhgNo ratings yet

- Colégio Cristão Beira Unida: Chart of AccountsDocument2 pagesColégio Cristão Beira Unida: Chart of AccountsMissionário Manuel MárioNo ratings yet

- Letter of OfferDocument40 pagesLetter of OfferANAPARTI NaveenNo ratings yet

- Tax Invoice: Iit Madras Research ParkDocument2 pagesTax Invoice: Iit Madras Research ParksherlockNo ratings yet

- Handbook How To Do Business in GC enDocument8 pagesHandbook How To Do Business in GC enСергей МартынецNo ratings yet

- Investing in CryptocurrencyDocument25 pagesInvesting in CryptocurrencyNikola AndricNo ratings yet

- NCERT Questions - Financial Statements (Final Accounts) - Evero PDFDocument53 pagesNCERT Questions - Financial Statements (Final Accounts) - Evero PDFYogendra PatelNo ratings yet

- Ifrs at A Glance Ifrs 1 First Time Adoption of Ifrss: WWW - Bdo.GlobalDocument4 pagesIfrs at A Glance Ifrs 1 First Time Adoption of Ifrss: WWW - Bdo.GlobalAhmed AshrafNo ratings yet

Cotx302 Exam 1 Sem 2 2017

Cotx302 Exam 1 Sem 2 2017

Uploaded by

Valeria PetrovOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cotx302 Exam 1 Sem 2 2017

Cotx302 Exam 1 Sem 2 2017

Uploaded by

Valeria PetrovCopyright:

Available Formats

Faculty of Commerce

Taxation 3

COTX302

Examination A – November 2017

Internal Examiner: Stanford Kasai

External Examiner: Carien Cass

Total Marks: 100

Duration: 3 Hours

Sub-Minimum: 40%

Section A: VAT 20 Marks

Section B: Business Entities 30 Marks

Section C: General Deduction Formula 20 Marks

Section D: Capital Gains Tax 30 Marks

Instructions to Candidates:

Read each question carefully

1. Answer all questions in the answer book provided. Start every question on a new page.

2. All rough work should be done in the back of the answer book and indicated as such.

3. This examination paper should not be removed from the examination venue.

4. Please scratch out all blank spaces

5. DO NOT USE CORRECTION FLUID (Tip-Ex). If you make a mistake, neatly cross out the

mistake.

6. Use a non-programmable calculator ONLY.

NB This examination paper consists of 7 pages

EXAM COTX302 November 2017 V17.1 Page 1 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

Section A

VAT 20 Marks

Answer the following questions in your answer book.

Question One

Chelsea (Pty) Ltd (Chelsea) is a retail shop dealing in fertilizer supplies for the local market. The

company’s first VAT period ended 31 December 2016 and the second period 28 February 2017.

The financial year-end of the company is 28 February 2017. All amounts include VAT, where

applicable.

1. Chelsea (Pty) Ltd issued an invoice to Eden hazard (Pty) Ltd on 1 February 2017 for

R6 840 000 in respect of supplies to be made for the period 1 March 2017 to 28 February

2018.

2. In an attempt to increase sales, Chelsea bought a brand new Toyota Hilux 2.8

GD-6 4x4 Raider Diesel Single Cab (a motor vehicle as defined) as a competition prize for

the local farmers who purchased fertilizer during the months of January and February

2017. The car was purchased from a local car dealership at a special price of R436 506.

The market value of the car was R536 826. The motor car was won and delivered to the

winning customer at the end of the competition on 28 February 2017.

3. The manager at Chelsea is provided with the free use of a delivery truck for domestic

purposes (not a motor car) since 1 December 2016. The determined value (for VAT

purposes) of the truck is R85 500. Chelsea pays for all fuel and maintenance to the vehicle,

except when the manager is on holiday. During February 2017, the manager went on a

three-week holiday with the truck (to tow his caravan). The manager used the company’s

petrol card during the holiday. On his return he paid the company an amount of R800

consisting of R450 for the use of the truck and R350 for fuel.

4. On 2 January 2017 Chelsea purchased a second-hand delivery vehicle from Mr.Gibbs

Smalling (a non-vendor) for R36 480 and paid the amount immediately. The company’s

original intention was to use the vehicle for deliveries, but on 3 January 2017 the company

received an offer from a client in Portugal (Josefa Mario) to purchase the vehicle from

Chelsea for an amount in Portuguese currency equivalent to R68 400 (correctly

converted) that Chelsea could not refuse. They accepted the offer and the vehicle was

EXAM COTX302 November 2017 V17.1 Page 2 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

immediately delivered to Portugal on 5 January 2017, before they brought the vehicle into

use. The transaction was correctly recorded as a debtor for R68 400, payable on 31

January 2017. By 15 February 2017 no payment was received from the debtor. Chelsea

tried in vain to trace the debtor and had to eventually write off the outstanding debt as bad

debt on 28 February 2017.

YOU ARE REQUIRED TO:

Determine the VAT implications for Chelsea (Pty) Ltd for the year of assessment ended on

28 February 2017 and show the necessary calculations of the input and output tax on the above

transactions.

Provide brief reasons where no VAT is calculated.

You may assume that the supply of the motor car is a deemed disposal in terms of section 8(13).

NB: Round off your final answers to the nearest rand. (20)

[20]

SUBTOTAL: [20]

EXAM COTX302 November 2017 V17.1 Page 3 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

Section B

Business Entities 30 Marks

Answer the following questions in your answer book.

Question One

Forester (Pty) Ltd (VAT vendor) is a manufacturing company and it is not a small business

corporation as defined in the Income Tax Act. The following transactions relate to the company’s

trading activities for the year of assessment ended 31 March 2017. All amounts exclude VAT,

unless stated otherwise):

1. Taxable income amounted to R1 820 545, before taking into account the following

information

2. The stock figures for the year were as follows:

01/04/2016 31/03/2017

Cost Price Market Value Cost Price Market Value

Raw material R292 874 R292 936 R576 719 R436 137

Manufactured R150 771 R157 734 R310 541 R234 843

3. Purchases of raw materials made during the year of assessment amounted to R780 567.

4. The company developed a design to be used in the manufacturing process. The registration

of the design was renewed under the Designs Act 195 of 1993 on 1 January 2017, at a cost

of R18 200.

5. The company acquired a patent on 1 April 2016 at a cost of R550 000 and immediately

brought it into use in its income-producing operations. .

6. The following information relates to the transactions regarding fixed assets:

o Factory A was erected for R3 000 000 and brought into use on 1 June 2014.

o A new computer, which is used for running the business, was purchased for R34 200

on 1 June 2016 and brought into use on the same date.

o A motorcycle was purchased on 1 November 2016 for R43 200, for making ad hoc

deliveries. On 31 January 2017, the motorcycle was scrapped after having been

damaged in an accident.

7. Forester (Pty) Ltd acquired a special XFG machinery for R80 000 under an agreement

(formally and finally signed by every party to it ) on 1 October 2016, and brought into use

on that date for the purpose of research and development as defined in the Act s 11D.

EXAM COTX302 November 2017 V17.1 Page 4 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

8. A manufacturing machine was destroyed in a fire on 31 May 2016. It cost R352 500 on 1

November 2014. Its tax value at 31 March 2016 was R141 000. Proceeds from its insurer

were R270 000. This machine was replaced by a used machine, which was purchased for

R190 000 cash on 1 July 2016, and brought into use on the same day.

9. An amount of R60 000 (including VAT), relating to trading debtors, was written off as

irrecoverable.

10. Other expenditure incurred on 1 January 2017:

o Repairs to the factory building amounted to R180 000

o A donation of R16 000 to Simunye Children Hospital (A section 18A certificate was

obtained.)

11. Other information:

o Forester (Pty) Ltd has elected the section 11(o) allowance.

o Binding general ruling (BGR) No. 7 lists the following write-off periods (apply them

where applicable):

Computers 3 years

Motorcycles 4 years

YOU ARE REQUIRED TO:

Calculate the tax liability of Forester (Pty) Ltd for the year of assessment ended 31 March 2017.

Round off your answers to the nearest Rand.

(30)

[30]

SUBTOTAL: [30]

EXAM COTX302 November 2017 V17.1 Page 5 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

Section C

General Deduction Formula 20 Marks

Answer the following questions in your answer book.

Question One

Lizzanie (Pty) Ltd is a management consulting company operating in Randburg. The company is

a registered VAT vendor. Lizzanie (Pty) Ltd has concluded the following transactions for the year

of assessment ended 28 February 2017 and requires your advice on the correct tax treatment of

each of the transactions below:

1.1. R8 600 paid to Homebuilders on 15 December 2016 to repair the roof of the office

building hat had collapsed due to a violent storm. The full amount was recovered from

the company’s insurance. (2)

1.2. R875 was paid to SARS on 31 October 2016 for administrative penalties relating to the

late submission of the annual income tax return for the 2014 year of assessment (2).

1.3. Monthly rental of R1 540 (including VAT) was paid during the year of assessment on

office equipment used exclusively in the business, payable on the first of each

month (10).

1.4. R450 000 paid to Homebuilders on 30 November 2016 for the construction of residential

flats. The flats will be rented out to Lizzanie (Pty) Ltd.’s employees as from

1 January 2017 (6)

YOU ARE REQUIRED TO:

Briefly discuss whether or not the expenses relating to the above transactions (1.1-1.4.) would be

deductible by Lizzanie (Pty) Ltd for the 2017 year of assessment in terms of the general deduction

formula (section 11(a)) and section 23 (prohibited deductions) of the Income Tax Act. Refer to

relevant case law if applicable and list the requirements where necessary. (20).

[20]

SUBTOTAL: [20]

EXAM COTX302 November 2017 V17.1 Page 6 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

Section D

Capital Gains Tax 30 Marks

Answer of the following questions in your answer book.

Question One

Abbibus (Pty) Ltd is a company that manufactures soccer balls. The company’s year of assessment

ends on 30 June 2017.

The Factory Building

Abbibus (Pty) Ltd’s factory building was destroyed in a fire on 15 January 2017. The factory

building was insured against losses from fire, and the insurer paid Abbibus (Pty) Ltd an indemnity

payment of R2 400 000 (excluding VAT) on 15 February 2017. The building was originally

erected by Abbibus (Pty) Ltd during March 2001 at a cost of R1 500 000, and it was brought into

use immediately. The total amount of tax allowances claimed in respect of this building for the

2002 to 2016 years of assessment was R1 050 000.

The market value of the building was R1 000 000 on 1 October 2001, and the TAB cost was

R1 187 500.

The Portable Generator

Abbibus (Pty) Ltd purchased a portable generator from a South African company for R85 000 on

1 December 2016 and brought it into use on the same day. Binding general ruling: No 7 (BGR7)

accepts a five-year write-off period for portable generators. Abbibus (Pty) Ltd sold the generator

on 31 May 2017 for R180 000, as the company decided to purchase a more powerful generator in

the next year.

Abbibus (Pty) Ltd has an assessed capital loss from the prior year of assessment of R65 000.

YOU ARE REQUIRED TO:

Calculate Abbibus (Pty) Ltd’s taxable capital gain/loss for the 2017 year of assessment. (30).

[30]

SUBTOTAL: [30]

TOTAL: [100]

EXAM COTX302 November 2017 V17.1 Page 7 of 7

Pearson Institute of Higher Education

Formerly Midrand Graduate Institute

You might also like

- M6 Activity 1 Case ApplicationDocument2 pagesM6 Activity 1 Case ApplicationJay Mariz C. Ramirez100% (1)

- Share-Based Payments With Answer PDFDocument9 pagesShare-Based Payments With Answer PDFAyaka FujiharaNo ratings yet

- Dell Working Capital SolutionDocument10 pagesDell Working Capital SolutionIIMnotes100% (1)

- Case Study On Agency TheoryDocument2 pagesCase Study On Agency TheoryGammoudi27% (11)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Practice Problems 1Document1 pagePractice Problems 1Ma Angelica Balatucan0% (1)

- AFA IIPl III Question Dec 2016Document4 pagesAFA IIPl III Question Dec 2016HossainNo ratings yet

- Financial Accounting III Question November 2017Document9 pagesFinancial Accounting III Question November 2017katelynnewson07No ratings yet

- RT 301 - September 2020 EMA1 - QuestionDocument8 pagesRT 301 - September 2020 EMA1 - QuestionsibambonotheteleloNo ratings yet

- Accounting IpcnDocument17 pagesAccounting IpcnShasank TiwaryNo ratings yet

- CPA Ireland-Financial-Accounting-April-2018Document19 pagesCPA Ireland-Financial-Accounting-April-2018Mwenda MongweNo ratings yet

- Accounts g1 MTPDocument191 pagesAccounts g1 MTPJattu TatiNo ratings yet

- Taxation 3 - June 2019Document6 pagesTaxation 3 - June 201950902849No ratings yet

- Acc100 Supp PDFDocument11 pagesAcc100 Supp PDFLebohang NgubaneNo ratings yet

- 2018 - Test 2 - QuestionsDocument8 pages2018 - Test 2 - QuestionsmolemothekaNo ratings yet

- Final May 2019 C4Document22 pagesFinal May 2019 C4sweya juliusNo ratings yet

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- CTAA021 Tutorial 22 February 2024Document4 pagesCTAA021 Tutorial 22 February 2024202200224No ratings yet

- 2021 FAC1A TUT Question Unit 3 Acc Equation, GJ, GL and Trial BalanceDocument2 pages2021 FAC1A TUT Question Unit 3 Acc Equation, GJ, GL and Trial BalanceDaniel OwensNo ratings yet

- Far160 (CT October 2018) QuestionDocument4 pagesFar160 (CT October 2018) QuestionFarah HusnaNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZaid NaveedNo ratings yet

- BCTA UJ Question PaperDocument14 pagesBCTA UJ Question PaperFresh LoverzzNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Question Paper - InD As 103 & 12Document7 pagesQuestion Paper - InD As 103 & 12pratikdubey9586No ratings yet

- ACCT6034 MID RCQuestionDocument5 pagesACCT6034 MID RCQuestionOshin MenNo ratings yet

- Past Paper 2022Document3 pagesPast Paper 2022linfordnyathiNo ratings yet

- F6 Mock Exam - 2018Document13 pagesF6 Mock Exam - 2018chanellvdb1No ratings yet

- 2017 FIA324-test 2Document10 pages2017 FIA324-test 2popla poplaNo ratings yet

- FR Question Paper 81655199552Document3 pagesFR Question Paper 81655199552Nakul GoyalNo ratings yet

- ACCOUNTING 102 (ACCT102 P2 W2) : School of Accounting, Economics and Finance TEST 1: 29 AUGUST 2017Document5 pagesACCOUNTING 102 (ACCT102 P2 W2) : School of Accounting, Economics and Finance TEST 1: 29 AUGUST 2017Anathi QueenNo ratings yet

- RT 301 - End of Module Assessment - Pathway 1 - July 2020 - EMA3Document3 pagesRT 301 - End of Module Assessment - Pathway 1 - July 2020 - EMA3sibambonotheteleloNo ratings yet

- 147308Document4 pages147308Ahmed Raza TanveerNo ratings yet

- Introduction To Financial AccountingDocument2 pagesIntroduction To Financial AccountingNdivho MavhethaNo ratings yet

- Lease QuestionsDocument12 pagesLease Questionszakhonalubanzi95No ratings yet

- BCOM Y3 - ACC 3 - June 2020 Take Home AssessmentDocument4 pagesBCOM Y3 - ACC 3 - June 2020 Take Home AssessmentNtokozo Siphiwo Collin DlaminiNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument13 pagesCambridge International Advanced Subsidiary and Advanced LevelAR RafiNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2019/FAR160Document4 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2019/FAR160Nurul Syaza MusaNo ratings yet

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Chapter 8Document7 pagesChapter 8jeanNo ratings yet

- Aud Quiz 2Document6 pagesAud Quiz 2MC allivNo ratings yet

- Class Example Companies 2023Document2 pagesClass Example Companies 2023NjabuloNo ratings yet

- Specific Financial Reporting Ac413 May19bDocument5 pagesSpecific Financial Reporting Ac413 May19bAnishahNo ratings yet

- Auditing Problems-Ppep1Document4 pagesAuditing Problems-Ppep1Par CorNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelMalik AliNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelKKNo ratings yet

- Ifrs 15 QuestionsDocument2 pagesIfrs 15 QuestionsTata MgpNo ratings yet

- Jagger PLC Prepares Its Financial Statements For The Year Ended 31 March. The Company Has Extracted TheDocument1 pageJagger PLC Prepares Its Financial Statements For The Year Ended 31 March. The Company Has Extracted TheAndrea SalazarNo ratings yet

- FA Dec 2018Document8 pagesFA Dec 2018Shawn LiewNo ratings yet

- 1 QUESTION PAPER Continuous EvaluationDocument11 pages1 QUESTION PAPER Continuous EvaluationBono magadaniNo ratings yet

- Tutorial 2 Capital Allowances - Q&ADocument8 pagesTutorial 2 Capital Allowances - Q&AKamal JabriNo ratings yet

- Far160 - Dec 2019 - QDocument8 pagesFar160 - Dec 2019 - QNur ain Natasha ShaharudinNo ratings yet

- Moderator: Mr. L.J. Muthivhi (CA), SADocument11 pagesModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNo ratings yet

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyNo ratings yet

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- Topic5 Capital Allowance Student 2016Document3 pagesTopic5 Capital Allowance Student 2016Veenesha MuralidharanNo ratings yet

- Acca Tx-Mys 2019 SeptemberDocument13 pagesAcca Tx-Mys 2019 SeptemberChoo LeeNo ratings yet

- 1st Quiz Afar2 Q PDFDocument2 pages1st Quiz Afar2 Q PDFAnonymous 7HGskNNo ratings yet

- CHP 6 Exercise With AnswerDocument5 pagesCHP 6 Exercise With AnswerRanbirSinghNo ratings yet

- Problems - Adjusting EntriesDocument3 pagesProblems - Adjusting EntriesaNo ratings yet

- PL Financial Accounting and Reporting IFRS Exam June 2019Document10 pagesPL Financial Accounting and Reporting IFRS Exam June 2019scottNo ratings yet

- EdexelDocument12 pagesEdexelManuthi HewawasamNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- IFRS16 LeasesDocument179 pagesIFRS16 LeasesValeria PetrovNo ratings yet

- IAS1 Presentation of Financial StatementsDocument78 pagesIAS1 Presentation of Financial StatementsValeria PetrovNo ratings yet

- IAS 37 Provisions, Contingent Assets and Contingent LiabilitiesDocument73 pagesIAS 37 Provisions, Contingent Assets and Contingent LiabilitiesValeria PetrovNo ratings yet

- Ias 16 PpeDocument168 pagesIas 16 PpeValeria PetrovNo ratings yet

- A Present Economic Resource Controlled by The Entity As A Result of Past EventsDocument11 pagesA Present Economic Resource Controlled by The Entity As A Result of Past EventsValeria PetrovNo ratings yet

- Deposit Insurance and Credit Guarantee CorporationDocument5 pagesDeposit Insurance and Credit Guarantee CorporationleoharshadNo ratings yet

- Module 6 - Current LiabilitiesDocument14 pagesModule 6 - Current LiabilitiesDaniellaNo ratings yet

- H What Is ProrationDocument2 pagesH What Is ProrationDanica BalinasNo ratings yet

- Mohammed Abdullah Oman Project Quotation From IDM ShawnDocument2 pagesMohammed Abdullah Oman Project Quotation From IDM Shawnaleen8511No ratings yet

- Conduit Foreign IncomeDocument36 pagesConduit Foreign IncomeRizki Adhi PratamaNo ratings yet

- Case Study - GCC Economic Outlook PDFDocument18 pagesCase Study - GCC Economic Outlook PDFMhmd KaramNo ratings yet

- TEAM06 Lufthansa Ver.08.25Document33 pagesTEAM06 Lufthansa Ver.08.25Adonis SardiñasNo ratings yet

- 4 Money Laundering MainDocument21 pages4 Money Laundering MainZerin HossainNo ratings yet

- Financial Management Assignment: Prepared By, Rahul Pareek IMI, New DelhiDocument72 pagesFinancial Management Assignment: Prepared By, Rahul Pareek IMI, New Delhipareek2020100% (1)

- Can I Link My Direct Express Card To Cash App - Google SearchDocument1 pageCan I Link My Direct Express Card To Cash App - Google Searchcodybrown22No ratings yet

- Kirsal KalkinmaDocument115 pagesKirsal KalkinmaAydın GöğüşNo ratings yet

- Types of Financial InstitutionDocument8 pagesTypes of Financial InstitutionDevNo ratings yet

- The Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestDocument36 pagesThe Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestCodinasound CaNo ratings yet

- Slides Topic 12 BhoDocument51 pagesSlides Topic 12 BhoFranchesca CalmaNo ratings yet

- Rocket Personal Loan MethodDocument37 pagesRocket Personal Loan MethodGerald Stewart100% (1)

- Module-8 Break Even AnalysisDocument17 pagesModule-8 Break Even AnalysisDrKanchan GhodkeNo ratings yet

- Review of LiteratureDocument5 pagesReview of LiteratureUma MaheswariNo ratings yet

- MBA 3rd Semester Curriculum in Session 2020-21Document18 pagesMBA 3rd Semester Curriculum in Session 2020-21Uma KhamhariNo ratings yet

- GST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Document1 pageGST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Yogesh GuptaNo ratings yet

- Challan Format (Specialist)Document1 pageChallan Format (Specialist)hgfvhgNo ratings yet

- Colégio Cristão Beira Unida: Chart of AccountsDocument2 pagesColégio Cristão Beira Unida: Chart of AccountsMissionário Manuel MárioNo ratings yet

- Letter of OfferDocument40 pagesLetter of OfferANAPARTI NaveenNo ratings yet

- Tax Invoice: Iit Madras Research ParkDocument2 pagesTax Invoice: Iit Madras Research ParksherlockNo ratings yet

- Handbook How To Do Business in GC enDocument8 pagesHandbook How To Do Business in GC enСергей МартынецNo ratings yet

- Investing in CryptocurrencyDocument25 pagesInvesting in CryptocurrencyNikola AndricNo ratings yet

- NCERT Questions - Financial Statements (Final Accounts) - Evero PDFDocument53 pagesNCERT Questions - Financial Statements (Final Accounts) - Evero PDFYogendra PatelNo ratings yet

- Ifrs at A Glance Ifrs 1 First Time Adoption of Ifrss: WWW - Bdo.GlobalDocument4 pagesIfrs at A Glance Ifrs 1 First Time Adoption of Ifrss: WWW - Bdo.GlobalAhmed AshrafNo ratings yet