Professional Documents

Culture Documents

Solutions To End-of-Section and Chapter Review Problems 137

Solutions To End-of-Section and Chapter Review Problems 137

Uploaded by

JasoncampbellCopyright:

Available Formats

You might also like

- Statistics For Managers Using Microsoft Excel 7th Edition Levine Solutions ManualDocument25 pagesStatistics For Managers Using Microsoft Excel 7th Edition Levine Solutions ManualEvelynSchneiderqwfi100% (32)

- Assignment IC104Document7 pagesAssignment IC104Zeon tvNo ratings yet

- Metropolitan Research Inc. ReportDocument8 pagesMetropolitan Research Inc. ReportYati GuptaNo ratings yet

- Report of Sales-SalaryDocument13 pagesReport of Sales-SalaryĐào ĐứcNo ratings yet

- SUSS BSBA: BUS105 Jul 2020 TOA AnswersDocument10 pagesSUSS BSBA: BUS105 Jul 2020 TOA AnswersAzido Azide100% (1)

- Assignment IV OC Download Shakher S070Document2 pagesAssignment IV OC Download Shakher S070Shakher SainiNo ratings yet

- Uoc Luong Tham SoDocument38 pagesUoc Luong Tham SoLinh MạnhNo ratings yet

- Dwnload Full Statistics For Managers Using Microsoft Excel 7th Edition Levine Solutions Manual PDFDocument21 pagesDwnload Full Statistics For Managers Using Microsoft Excel 7th Edition Levine Solutions Manual PDFbunkerlulleruc3s100% (16)

- Dwnload Full Statistics For Managers Using Microsoft Exce Global 8th Edition Levine Solutions Manual PDFDocument36 pagesDwnload Full Statistics For Managers Using Microsoft Exce Global 8th Edition Levine Solutions Manual PDFbunkerlulleruc3s100% (12)

- Assig 10 Problems Fundamentals of StatisticsDocument3 pagesAssig 10 Problems Fundamentals of Statisticsnelly818No ratings yet

- C/a/d Expressing Dollars and Employees in Thousands, The Weighted Mean Expenditure Per Employee IsDocument22 pagesC/a/d Expressing Dollars and Employees in Thousands, The Weighted Mean Expenditure Per Employee Iskdk4916No ratings yet

- Explore: Case Processing SummaryDocument2 pagesExplore: Case Processing SummaryFebry AndikaNo ratings yet

- HW 2Document12 pagesHW 2Munish RanaNo ratings yet

- (STATS) WordDocument7 pages(STATS) WordRIYA RIYANo ratings yet

- SIDM ChisquareDocument8 pagesSIDM ChisquareESHAN CHATTERJEENo ratings yet

- Representing and Describing Data: Descriptive StatisticsDocument30 pagesRepresenting and Describing Data: Descriptive StatisticsInês MariaNo ratings yet

- Reaserch Assignment Part IDocument21 pagesReaserch Assignment Part IYoseph BekeleNo ratings yet

- Intro To Statistics: Final ProjectDocument7 pagesIntro To Statistics: Final ProjectKumayl AzharNo ratings yet

- Homework - StatisticsDocument8 pagesHomework - StatisticsIsra'a Abed KhaderNo ratings yet

- Descriptive StatisticsDocument11 pagesDescriptive StatisticsRosemaribel TorresNo ratings yet

- PN 24524 SolutionsDocument7 pagesPN 24524 SolutionsSastry75No ratings yet

- Numerical Descriptive Measures: Tea-BagsDocument6 pagesNumerical Descriptive Measures: Tea-BagspinkyNo ratings yet

- MuklisDocument23 pagesMuklisVajri Mulya PratamaNo ratings yet

- Topic 1 Numerical MeasureDocument11 pagesTopic 1 Numerical MeasureNedal AbuzwidaNo ratings yet

- Stats Lecture 04. Central Tendency DataDocument21 pagesStats Lecture 04. Central Tendency DataShair Muhammad hazaraNo ratings yet

- Template For CH 6-9Document22 pagesTemplate For CH 6-9prabhjot kaurNo ratings yet

- Module 5 Sampling DistributionsDocument22 pagesModule 5 Sampling Distributionsyapemariel0No ratings yet

- MS8 IGNOU MBA Assignment 2009Document6 pagesMS8 IGNOU MBA Assignment 2009rakeshpipadaNo ratings yet

- (VCE Further) 2006 MAV Unit 34 Exam 1 SolutionsDocument12 pages(VCE Further) 2006 MAV Unit 34 Exam 1 SolutionsKawsarNo ratings yet

- Exact 3, X 3 at Least 3, X 3 at Most 3, X 3 Between 5 and 9, 5 X 9Document4 pagesExact 3, X 3 at Least 3, X 3 at Most 3, X 3 Between 5 and 9, 5 X 9Ehron RiveraNo ratings yet

- Number 3Document2 pagesNumber 3Jewel AlegreNo ratings yet

- Econ 299 Chapter 6.0Document19 pagesEcon 299 Chapter 6.0Elon MuskNo ratings yet

- Math Cat 3Document17 pagesMath Cat 3Nikhil SharmaNo ratings yet

- Case Processing SummaryDocument6 pagesCase Processing SummaryRenanda Rifki Ikhsandarujati RyanNo ratings yet

- CH 03Document33 pagesCH 03Nur Anugrah YusufNo ratings yet

- Stats Lecture 03. Summarizing of Data - NewDocument20 pagesStats Lecture 03. Summarizing of Data - NewShair Muhammad hazaraNo ratings yet

- Case Processing SummaryDocument2 pagesCase Processing Summarysari ruswatiNo ratings yet

- Worksheet 12: Averages and Measures of Spread: Answers To Core Revision Exercises: Data HandlingDocument2 pagesWorksheet 12: Averages and Measures of Spread: Answers To Core Revision Exercises: Data Handlingmk hatNo ratings yet

- Unit 3 Descriptive StatisticsPart2Document47 pagesUnit 3 Descriptive StatisticsPart2CZARINA JANE ACHUMBRE PACTURANNo ratings yet

- Stat... ICS Part-II 2022Document52 pagesStat... ICS Part-II 2022NasirNo ratings yet

- StatisticsDocument4 pagesStatisticsClaire ParoNo ratings yet

- RIVERA ECE11 Laboratory Exercise 3Document3 pagesRIVERA ECE11 Laboratory Exercise 3Ehron RiveraNo ratings yet

- Exercise Module 4Document5 pagesExercise Module 4Quarl SanjuanNo ratings yet

- Mathematics in The Modern World: Measures of Variation/DispersionDocument8 pagesMathematics in The Modern World: Measures of Variation/DispersionGodwin Howard AbainciaNo ratings yet

- GM21CM043 - ASDM Exam - SolutionsDocument15 pagesGM21CM043 - ASDM Exam - SolutionsRavi ParekhNo ratings yet

- Chapter 1 - Solutions of ExercisesDocument4 pagesChapter 1 - Solutions of ExercisesDanyValentinNo ratings yet

- Hypothesis PractiseDocument19 pagesHypothesis PractiseaaaaNo ratings yet

- Exam 1 Objectives Summer 2012Document2 pagesExam 1 Objectives Summer 2012funkythunderstuffNo ratings yet

- 3) State Your Population.: Column1Document7 pages3) State Your Population.: Column1Thanes RawNo ratings yet

- SPSS WidiDocument18 pagesSPSS Widilisantidesy89No ratings yet

- Summary Output Regression StatistikDocument4 pagesSummary Output Regression Statistikputri amaliaNo ratings yet

- Part IDocument11 pagesPart Iritz meshNo ratings yet

- Model SummaryDocument2 pagesModel SummaryForza RagazziNo ratings yet

- First Term Ss2 Mathematics Lesson NotesDocument37 pagesFirst Term Ss2 Mathematics Lesson NotesagbemudiaevansNo ratings yet

- Young Double SlitDocument5 pagesYoung Double SlitFarzanaNo ratings yet

- 3.20. The Response Time in Milliseconds Was Determined For Three Different Types of Circuits That Could Be Used in AnDocument4 pages3.20. The Response Time in Milliseconds Was Determined For Three Different Types of Circuits That Could Be Used in AnMamta sheoranNo ratings yet

- First Term SS2 Maths E-NoteDocument39 pagesFirst Term SS2 Maths E-NotePraise Alonyenu0% (1)

- 8102 Assignment 2 - Probability DistributionDocument1 page8102 Assignment 2 - Probability DistributiontNo ratings yet

- 1st Term s2 MathematicsDocument38 pages1st Term s2 MathematicsBarbara0% (1)

- Lampiran 6. 7. Statistik DeskriptifDocument3 pagesLampiran 6. 7. Statistik DeskriptiffatmaNo ratings yet

- Pre Ph.D. Exam 2019-20: 9009-Ruhs PHD Exam (Pharmaceutical Chemistry) Question Paper With Answer Key Common SectionDocument20 pagesPre Ph.D. Exam 2019-20: 9009-Ruhs PHD Exam (Pharmaceutical Chemistry) Question Paper With Answer Key Common SectionFarhadz Sailama BarahamaNo ratings yet

- MS Excel NNNDocument41 pagesMS Excel NNNNARENDERNo ratings yet

- Astm e 2262 - 03Document48 pagesAstm e 2262 - 03Francisco GuerraNo ratings yet

- Analysing Seasonal Health DataDocument174 pagesAnalysing Seasonal Health DataIsmailNo ratings yet

- Assignment-2 Noc18 Ma07 5Document9 pagesAssignment-2 Noc18 Ma07 5maherkamel100% (2)

- SBT1002Document198 pagesSBT1002Kannan ThangaveluNo ratings yet

- Sample BB ProjectDocument68 pagesSample BB ProjectSMAKNo ratings yet

- FN 211 Self Test 4: Data Summary, Confidence Intervals, and Hypothesis TestingDocument10 pagesFN 211 Self Test 4: Data Summary, Confidence Intervals, and Hypothesis TestingRaiNz SeasonNo ratings yet

- Topic 4A. Descripitve Statistics - ProbabilityDocument80 pagesTopic 4A. Descripitve Statistics - ProbabilityZEEL PATELNo ratings yet

- Biostat MCQDocument8 pagesBiostat MCQShabd akshar100% (1)

- Bay 2012Document13 pagesBay 2012Sixto Gutiérrez SaavedraNo ratings yet

- Advanced Level StatisticsDocument10 pagesAdvanced Level StatisticsPAUL KOLERENo ratings yet

- DMPA-2 Powerpoint Slides - Modified AudioDocument38 pagesDMPA-2 Powerpoint Slides - Modified AudioAli Khan SachwaniNo ratings yet

- MCQ Measures of Central Tendency With Correct Answers PDFDocument10 pagesMCQ Measures of Central Tendency With Correct Answers PDFSalman Shakir100% (1)

- MEANDocument6 pagesMEANfarmanking78698No ratings yet

- Dip1 BPDocument5 pagesDip1 BPKrishna MoorthyNo ratings yet

- Statistics and Probability PracticeDocument16 pagesStatistics and Probability PracticeRey James DominguezNo ratings yet

- Exploratory Data Analysis ReferenceDocument49 pagesExploratory Data Analysis ReferenceafghNo ratings yet

- MPH TestDocument47 pagesMPH Testahmedhaji_sadik50% (2)

- Test Bank For Basic Statistical Analysis 9E 9th EditionDocument15 pagesTest Bank For Basic Statistical Analysis 9E 9th EditionAya50% (2)

- 4 61 60603 MQGM Prel SM 3E 10Document11 pages4 61 60603 MQGM Prel SM 3E 10Zacariah SaadiehNo ratings yet

- M 301 - Ch1 - Introduction To StatisticsDocument96 pagesM 301 - Ch1 - Introduction To StatisticsJustice LeagueNo ratings yet

- 1b11 Koksal Ozgul MarketingstrategiesineconomiccrisisDocument23 pages1b11 Koksal Ozgul MarketingstrategiesineconomiccrisisUtibe EdemNo ratings yet

- Stat MidtermsDocument3 pagesStat MidtermsPat Bautista RaonNo ratings yet

- Measures of Central Tendency: Example 1: Find A MeanDocument9 pagesMeasures of Central Tendency: Example 1: Find A MeanRafaelaAndrea Horan PayteNo ratings yet

- Nonparametric Methods: Analysis of Ordinal DataDocument38 pagesNonparametric Methods: Analysis of Ordinal DataRadityaNo ratings yet

- Economic Instructor ManualDocument30 pagesEconomic Instructor Manualclbrack100% (2)

- Business Analytics Data Analysis and Decision Making 6th Edition Albright Solutions ManualDocument24 pagesBusiness Analytics Data Analysis and Decision Making 6th Edition Albright Solutions ManualAngelaLewisyqza100% (32)

Solutions To End-of-Section and Chapter Review Problems 137

Solutions To End-of-Section and Chapter Review Problems 137

Uploaded by

JasoncampbellOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions To End-of-Section and Chapter Review Problems 137

Solutions To End-of-Section and Chapter Review Problems 137

Uploaded by

JasoncampbellCopyright:

Available Formats

Solutions to End-of-Section and Chapter Review Problems 137

CHAPTER 3

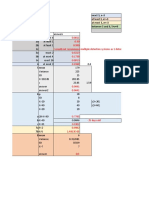

3.1 (a) Excel output:

X

Mean 6.5

Median 6.5

Mode N/A

Standard Deviation 2.428992

Sample Variance 5.9

Range 7

Minimum 3

Maximum 10

Sum 39

Count 6

First Quartile 5

Third Quartile 8

Interquartile Range 3

Coefficient of Variation 37.3691%

Mean = 6.5 Median = 6.5 Mode = None.

(b) Range = 7 Variance = 5.9

Standard deviation = 2.42899

Coefficient of variation = (2.428992/6.5)*100% = 37.3691

(c)

X Z

8 0.61754

5 –.61754

10 1.440927

7 0.205847

3 –1.44093

6 –0.20585

There are no outliers since there is no Z score greater than 3 or less than –3.

(d) Mean = Median so the distribution is symmetrical.

3.2 (a) Excel output:

X

Mean 7

Median 6

Mode NA

Standard Deviation 3.559026

Sample Variance 12.66667

Range 10

Minimum 3

Maximum 13

Sum 49

Count 7

First Quartile 4

Third Quartile 10

Interquartile Range 6

Coefficient of Variation 50.84323%

Mean = 7 Median = 6 Mode = None

© 2015 Pearson Education Ltd.

138 Chapter 3: Numerical Descriptive Measures

(b) Range = 10 Variance = 12.66667

Standard deviation = 3.559026

Coefficient of variation = (3.559026/7)*100% = 50.84323%

(c)

X Z

8 0.280976

3 –1.1239

10 0.842927

6 –0.28098

4 –0.84293

13 1.685855

5 –0.56195

There are no outliers since there is no Z score greater than 3 or less than –3.

(d) Mean > Median so the distribution is skewed right.

3.3 (a) Excel output:

X

Mean 6.625

Median 6.5

Mode NA

Standard Deviation 4.138236

Sample Variance 11.49451

Kurtosis 13

Minimum 1

Maximum 14

Sum 53

Count 8

First Quartile 3

Third Quartile 10

Interquartile Range 7

Coefficient of Variation 62.46394%

Mean = 6.625 Median = 6.5 Mode = None

(b) Range = 13 Variance = 11.49451 Standard deviation = 4.138236

Coefficient of variation = (4.138236/6.625)*100% = 62.46394%

(c)

X Z

14 0.641611

6 –0.05437

3 –0.31537

10 0.293618

1 –0.48936

8 0.119622

4 –0.22837

7 0.032624

There are no outliers since there is no Z score greater than 3 or less than –3.

(d) Mean > Median then the distribution is skewed right.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 139

3.4 (a)

X

Mean 2

Median 2.5

Mode NA

Standard Deviation 5.477225575

Sample Variance 30

Range 13

Minimum –5

Maximum 8

Sum 8

Count 4

First Quartile –5

Third Quartile 8

Interquartile Range 13

Coefficient of Variation 273.8612788

Mean = 2 Median = 2.5 Mode = None

(b) Range = 2.5 Variance = 30

Standard deviation = 5.477225575

Coefficient of variation = (5.477225575/2)*100% = 273.86%

(c)

X Z

–5 –1.278

8 1.0954

4 0.3651

1 –0.183

There are no outliers since there is no Z score greater than 3 or less than –3.

(d) Mean < Median then the distribution is skewed left.

1/2

3.5 RG = ⎡⎣(1 + 0.12 )(1 + 0.28 )⎤⎦ − 1 = 19.73%

,

3.6 𝑅" = 1 + 0.22 1 − 0.28 - − 1 = −6.28%

3.7 Half of the Saveur readers have an income of no more than $163,108 while half of the

Saveur.com readers have an income of no more than $84,548.

3.8 (a) Measure Type 1 Type 2

Mean 12.17 12.83

Median 12 13

Standard Deviation 1.169 1.169

Range 3 3

(b) In comparison both sets have the same standard deviation but the Type 1 average is

closer to the expected value of 12 mm when compared with Type 2. If consistency is

the measure, then both types have equal values for the standard deviation and there

would be no difference in the brake pads. The range for type 1 and type 2 show no

difference in value.

(c) If the last value of Type 2 is changed to 24 mm, the mean for Type 2 becomes 14.5 mm,

which is larger than the diameter of Type 1 (12.17 mm). The standard deviation for

© 2015 Pearson Education Ltd.

140 Chapter 3: Numerical Descriptive Measures

Type 2 gets affected (4.764) in comparison with Type 1 (1.169) and is therefore not

acceptable when compared with Type 1.

3.9 (a) Mean = 13.6 Median = 14 Mode = 14

(b) Variance = 3.257143

Standard Deviation = 1.804756

Range = 6

Coefficient of Variation = 13.27026

Score Z-Score

14 0.122807

15 0.429825

12 –0.49123

11 –0.79825

16 0.736842

14 0.122807

15 0.429825

13 –0.18421

12 –0.49123

11 –0.79825

13 –0.18421

17 1.04386

12 –0.49123

15 0.429825

14 0.122807

(c) Mean is slightly smaller than the median and is also slightly smaller than the mode

which indicates that the data is skewed left.

(d) Mean = 16.6

Median = 17

Mode = 17

Variance = 3.257143

Standard Deviation = 1.804756

Range = 6

Coefficient of Variation 10.87202

Score Z-Score

17 0.122807

18 0.429825

15 –0.49123

14 –0.79825

19 0.736842

17 0.122807

18 0.429825

16 –0.18421

15 –0.49123

14 –0.79825

16 –0.18421

20 1.04386

15 –0.49123

18 0.429825

17 0.122807

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 141

In comparison with the original data there is an indication that the mean, median, mode

all have increased by a value of 3 as well. The values for the standard deviation, the

variance, and range did not change. There was no notable change as expected for the

corresponding values of the z score. The data show slight skewedness to the left with no

change noted.

3.10 (a) Mean = 6.647

Median = 6.42

(b) Variance = 6.734593

Standard Deviation = 2.595109

Range = 10.2

Coefficient of Variation = 39.04181

(c) The mean is only slightly smaller than the median which indicates that the data is

skewed left.

(d) The mean of the data and median are $6.73 and $6.88 respectively. The average data

dispersion around the mean is $2.595. The data shows a range of $10.2.

3.11 (a), (b)

MPG

Mean 27.12

Standard Error 1.005518

Median 26

Mode 26

Standard Deviation 5.027591

Sample Variance 25.27667

Kurtosis 0.749384

Skewness 1.182692

Range 18

Minimum 21

Maximum 39

Sum 678

Count 25

First Quartile 24

Third Quartile 29.5

CV 18.54%

© 2015 Pearson Education Ltd.

142 Chapter 3: Numerical Descriptive Measures

3.11 (b)

cont.

MPG Z Score MPG Z Score

38 2.164058 23 -0.81948

26 -0.22277 25 -0.42167

30 0.572839 26 -0.22277

26 -0.22277 31 0.771741

25 -0.42167 26 -0.22277

27 -0.02387 37 1.965156

22 -1.01838 22 -1.01838

27 -0.02387 29 0.373937

39 2.362961 25 -0.42167

24 -0.62058 33 1.169546

24 -0.62058 21 -1.21728

26 -0.22277 21 -1.21728

25 -0.42167

(c) The mean is only slightly larger than the median, so the data are only slightly right-

skewed.

(d) The distribution of MPG of the sedans is slightly right-skewed while that of the SUVs

is symmetrical. The mean MPG of sedans is 4.59 higher than that of SUVs. The average

scatter of the MPG of sedans is almost 3 times that of SUVs. The range of sedans is

slightly more than 2.5 times that of SUVs.

3.12 (a) Mean = 36

Median = 35

Mode = 35

(b) Variance = 9.5

Standard Deviation = 3.082207

Range = 12

Coefficient of Variation = 8.561686

Score Z-Score

35 –0.32444

30 –1.94666

37 0.324443

35 –0.32444

34 –0.64889

35 –0.32444

35 –0.32444

42 1.946657

40 1.297771

37 0.324443

42 1.946657

38 0.648886

35 –0.32444

34 –0.64889

35 –0.32444

34 –0.64889

34 –0.64889

(c) Mean is larger than both median and mode, hence the data is skewed right.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 143

(d) Mean = 39

Median = 38

Mode = 38

Variance = 9.5

Standard Deviation = 3.082207

Range = 12

Coefficient of Variation = 8.561686

Score Z-Score

38 0.648886

33 –0.97333

40 1.297771

38 0.648886

37 0.324443

38 0.648886

38 0.648886

45 2.919986

43 2.2711

40 1.297771

45 2.919986

41 1.622214

38 0.648886

37 0.324443

38 0.648886

37 0.324443

37 0.324443

The mean is larger than the median and the mode; hence data is slightly skewed right.

3.13 (a), (b)

Number of Partners

Mean 17.71429

Standard Error 1.110357

Median 16

Mode 12

Standard Deviation 6.568962

Sample Variance 43.15126

Kurtosis -0.53274

Skewness 0.621375

Range 23

Minimum 9

Maximum 32

Sum 620

Count 35

First Quartile 12

Third Quartile 22

CV 37.08%

3.13 (a), (b)

cont.

© 2015 Pearson Education Ltd.

144 Chapter 3: Numerical Descriptive Measures

Firm Number of Partners Z Score

Prager Metis International 25 1.1091

Wolf & Co. 18 0.0435

Brown Smith Wallace 23 0.8046

Padgett, Stratemann & Co. 16 -0.2610

Clark Nuber 16 -0.2610

Skoda Minotti 14 -0.5654

Yeo & Yeo 22 0.6524

Kreischer Miller 17 -0.1087

Gursey|Schneider 9 -1.3266

Brady, Martz & Associates 32 2.1747

Bennett Thrasher 22 0.6524

Cotton & Co. 12 -0.8699

Anders 18 0.0435

Frost 9 -1.3266

Brown , Edwards & Co. 25 1.1091

GHP Horwath 9 -1.3266

Anderson ZurMuehlen & Co. 28 1.5658

RBZ 14 -0.5654

Jackson Thornton & Co. 22 0.6524

Windes & McClaughry 18 0.0435

Yount, Hyde & Barbour 22 0.6524

Briggs & Veselka Co. 16 -0.2610

Green Hasson Janks 12 -0.8699

Hutchinson and Bloodgood 31 2.0225

LaPorte 17 -0.1087

Johnson Lambert 12 -0.8699

Wolfe & Co. 14 -0.5654

Mizer Houser & Co. 16 -0.2610

Bouley, Heutmaker, Zibell & Co. 30 1.8703

Gelman, Rosenberg & Freedman 12 -0.8699

Keiter 12 -0.8699

Gainer Donnelly 10 -1.1744

Lutz & Co. 24 0.9569

PKF Texas 12 -0.8699

Ellin & Tucker Chartered 11 -1.0221

There is no outlier since none of the Z scores is greater than 3 or smaller than -3.

(c) The data is quite symmetrical since the mean and the median are about the same.

(d) The mean number of partners is 17.7143 while the median number of partners is 16.

The average scatter of the number of partners around the mean is 6.5690. The

difference between the highest and the lowest number of partners is 23.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 145

3.14 (a) Mean = 33.65

Median = 32.54

Mode = NA

(b) Variance = 160.375

Standard Deviation = 12.66393

Range = 48.09

Coefficient of Variation = 37.63425

X Z Score

42.56 0.703573

32.09 –0.12318

5.37 –2.23311

19.51 –1.11656

32.54 –0.08765

42.69 0.713838

51.63 1.41978

30.14 –0.27717

39.47 0.459573

30.52 –0.24716

38.16 0.35613

19.35 –1.12919

27.14 –0.51406

53.46 1.564285

40.12 0.5109

(c) Mean is larger than the median; hence data is skewed right.

(d) The mean cost is $33.65 and the median cost is $32.54. The difference between the

extreme values is $48.

3.15 (a)

One-Year Five-Year

Mean 0.645652 1.276087

Standard Error 0.064859 0.085282

Median 0.8 1.41

Mode 0.9 1.2

Standard Deviation 0.311051 0.408998

Sample Variance 0.096753 0.167279

Kurtosis -1.34232 0.635713

Skewness -0.51054 -1.11364

Range 0.95 1.5

Minimum 0.1 0.35

Maximum 1.05 1.85

Sum 14.85 29.35

Count 23 23

First Quartile 0.3 1.05

Third Quartile 0.9 1.54

CV 48.18% 32.05%

(b) The one-year CDs have about the same standard deviation but a roughly 1/3 lower

range in the yields offered than the five-year CD. Hence, you might conclude that the

five-year CDs have a larger amount of variation in the yields offered as compared to the

© 2015 Pearson Education Ltd.

146 Chapter 3: Numerical Descriptive Measures

one-year CDs. But the one-year CDs have a higher variation relative to the average in

the yields offered than the five-year CDs.

3.16 (a) Mean = 156

Median = 157.5

Mode = 156

(b) Variance = 256.8571

Standard Deviation = 16.02676

(c) Mean is smaller than the median which indicates that the data is skewed left and the

majority of the people attending the function spent lesser money than the median.

(d) Mean = 168.5

Median = 157.5

Mode = 156

Variance = 1849.714

Standard Deviations = 43.0083

The new data summary shows that the data became right skewed due to the change in

data, also the amount of data dispersion increased.

3.17 (a) Mean = 4.346

Median = 4.15

(b) Variance = 0.582726

Standard Deviations = 0.763365

Range = 8.55

CV = 17.56477

X Z-Score

3.56 –1.34873

5.2 1.465409

4.03 –0.54224

5.1 1.293815

3.4 –1.62327

3.2 –1.96646

4.01 –0.57655

5.35 1.722799

4.52 0.298573

4.68 0.573122

5.23 1.516887

4.15 –0.33632

3.45 –1.53748

4 –0.59371

5.31 1.654162

Since none of the z values are larger than 3 or smaller than –3 then there are no outliers

for the data.

(c) Mean is larger than median then data is skewed right.

(d) Both the mean and median are greater than four and the mean is greater than the median

indicating the data is skewed to the right. The latter indicate that there are values in the

wait time that are rather high. 47% of the data values had a more than 4 minutes of

waiting time. According to the data analysis it shows that the written statement does not

reflect accurately on the customer waiting time and should be revised.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 147

3.18 Excel output:

Waiting Time

Mean 7.114667

Median 6.68

Mode #N/A

Standard Deviation 2.082189

Sample Variance 4.335512

Range 6.67

Minimum 3.82

Maximum 10.49

Sum 106.72

Count 15

First Quartile 5.64

Third Quartile 8.73

Interquartile Range 3.09

Coefficient of Variation 29.2662%

(a) Mean = 7.114 Median = 6.68

(b) Variance = 4.336 Standard deviation = 2.082 Range = 6.67

Coefficient of variation = 29.27%

Waiting Time Z Score

9.66 1.222431

5.90 -0.58336

8.02 0.434799

5.79 -0.63619

8.73 0.775786

3.82 -1.58231

8.01 0.429996

8.35 0.593286

10.49 1.62105

6.68 -0.20875

5.64 -0.70823

4.08 -1.45744

6.17 -0.45369

9.91 1.342497

5.47 -0.78987

(b) There is no outlier since none of the observations are greater than 3 standard

deviations away from the mean.

(c) Because the mean is greater than the median, the distribution is right-skewed.

(d) The mean and median are both greater than 5 minutes. The distribution is right-skewed,

meaning that there are some unusually high values. Further, 13 of the 15 bank

customers sampled (or 86.7%) had waiting times greater than 5 minutes. So the

customer is likely to experience a waiting time in excess of 5 minutes. The manager

overstated the bank’s service record in responding that the customer would “almost

certainly” not wait longer than 5 minutes for service.

1/2

3.19 (a) RG = ⎡⎣(1 + 0.014 )(1 + 0.172 )⎤⎦ − 1 = 9.01%

© 2015 Pearson Education Ltd.

148 Chapter 3: Numerical Descriptive Measures

(b) If you purchased $1,000 of GE stock at the start of 2011, its value at the end of 2012

2

was $ 1000 (1 + 0.1559 ) = $1188.41.

(c) The result for Taser was better than the result for GE, which was worth $1,336.08.

1/2

3.20 (a) RG = ⎡⎣(1 + 0.024 )(1 + 0.746 )⎤⎦ − 1 = 33.71%%

(b) If you purchased $1,000 of TASER stock at the start of 2011, its value at the end of

2

2012 was $1000 (1 + 0.3371) = $ 1,787.904.

(c) The result for Taser was better than the result for GE, which was worth $1188.41.

3.21 (a)

Year DJIA S&P 500 Nasdaq

2012 7.26 13.41 15.91

2011 5.5 0 -1.8

2010 11 12.8 16.9

2009 18.8 23.5 43.9

Geometric mean 10.52% 12.11% 17.63%

(b) The rate of return of Nasdaq 500 is the best at 17.63% followed by S&P 500 at 12.11%

and DJIA at 10.52%.

(c) Silver had a much higher return than the DJIA, the S&P 500, and the NASDAQ; gold’s

return was worse than the NASDAQ but better than the S&P 500 and DJIA; platinum’s

return was better than S&P 500 and DJIA but worse than NASDAQ.

3.22 (a)

Year Platinum Gold Silver

2012 8.7 0.1 7.1

2011 -21.1 10.2 -9.8

2010 21.5 29.8 83.7

2009 55.9 23.9 49.3

Geometric mean 12.90% 15.41% 27.58%

(b) Silver had the highest return, followed by gold and then platinum.

(c) Silver had a much higher return than the DJIA, the S&P 500, and the NASDAQ; gold’s

return was worse than the NASDAQ but better than the S&P 500 and DJIA; platinum’s

return was better than S&P 500 and DJIA but worse than NASDAQ.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 149

3.23 (a)

Average of 1YrReturn% Risk

Type Average High Low Grand Total

Growth 13.0524 17.7170 14.6717 14.2780

Large 16.5860 33.7200 14.9747 15.6771

Mid-Cap 12.7726 13.6354 13.2160

Small 12.1717 10.8586 15.3638 12.9771

Value 17.1012 15.4133 14.0751 14.6982

Large 14.9375 5.9800 13.6391 13.5898

Mid-Cap 19.9675 15.9400 16.7879

Small 16.7889 20.1300 13.1467 15.4840

Grand Total 13.8088 17.1854 14.4775 14.3963

(b)

StdDev of 1YrReturn% Risk

Type Average High Low Grand Total

Growth 6.0163 11.3821 3.3562 5.0041

Large 5.3697 0.2946 3.3913 4.7615

Mid-Cap 7.2161 3.0773 5.4705

Small 4.0632 3.3723 3.4576 4.0854

Value 4.4488 8.4131 4.1475 4.4651

Large 4.1739 #DIV/0! 3.9596 4.0592

Mid-Cap 3.0589 3.1527 3.4837

Small 4.7941 2.8426 5.8336 5.4861

Grand Total 5.9494 10.4872 3.6336 4.8551

(c) The mean one-year return of growth funds is higher than that of the value funds for the

large-cap and the various risk ratings while the mean one-year return of value funds is

higher than that of the growth funds for the mid-cap and small-cap and the various risk

ratings with the exception of the small-cap with low rating.

The standard deviation of the one-year return of growth funds is generally higher than

that of the value funds for the large and mid-cap and average risk rating while the

standard deviation of the one-year return of value funds is higher than that of the

growth funds for the three different market caps with low risk rating.

© 2015 Pearson Education Ltd.

150 Chapter 3: Numerical Descriptive Measures

3.24 (a)

Average of 1YrReturn% Star Rating

Type Five Four One Three Two Grand Total

Growth 16.5544 15.2193 10.3575 13.9957 13.6058 14.2780

Large 18.0756 15.4971 12.3320 14.8743 17.1257 15.6771

Mid-Cap 15.5200 15.0400 10.0875 13.4140 8.7046 13.2160

Small 13.3300 15.0082 9.1014 12.7676 12.4722 12.9771

Value 17.2820 12.7295 13.4957 15.3603 15.4863 14.6982

Large 16.4150 11.7515 12.1120 14.5648 14.1633 13.5898

Mid-Cap 16.4400 16.1625 16.7267 17.4680 16.7879

Small 18.5700 12.5260 16.9550 16.0950 15.8860 15.4840

Grand Total 16.7126 14.6604 11.3126 14.4423 14.1821 14.3963

(b)

StdDev of 1YrReturn% Star Rating

Type Five Four One Three Two Grand Total

Growth 4.0813 3.6946 5.0187 3.8308 7.6709 5.0041

Large 4.3119 4.1374 4.6690 2.7064 7.4925 4.7615

Mid-Cap 3.3099 3.1017 8.7458 4.8023 7.6199 5.4705

Small 4.4265 3.9244 2.2479 4.3906 2.9127 4.0854

Value 6.9822 4.5679 4.3343 4.1815 3.6530 4.4651

Large 1.1384 3.6990 4.3732 4.5739 2.5803 4.0592

Mid-Cap #DIV/0! 4.1910 3.1676 4.5127 3.4837

Small 13.7179 6.3546 1.6476 3.9994 4.1620 5.4861

Grand Total 4.6722 4.0202 4.9474 3.9820 6.7243 4.8551

(c) The mean one-year return of small-cap value funds is higher than that of the small-cap

growth funds across the different star ratings with the exception of those rated as four-

star. On the other hand, the mean one-year return of large-cap value funds is lower

than that of the growth funds across the different star ratings but the mid-cap value

funds are higher across the different star ratings.

The standard deviation of the one-year return of growth funds is generally higher than

that of the value funds across all the star ratings and market caps with the exception of

the large-cap and three-star, mid-cap and five-star, mid-cap and four-star, mid-cap and

one-star, small-cap and five-star, small-cap and four-star, and small-cap and two-star.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 151

3.25 (a)

Average of 1YrReturn% Star Rating

Market Cap Five Four One Three Two Grand Total

Large 17.7736 14.3905 12.2220 14.7622 16.2370 14.9950

Average 13.6000 18.6750 15.1833 15.6675 16.6100 16.1150

High 5.9800 33.7200 26.7850

Low 18.1910 14.1864 11.7817 14.6952 13.8917 14.5295

Mid-Cap 15.6350 15.1803 10.0875 14.4421 11.1389 13.9618

Average 18.0000 17.1671 11.1933 14.8262 10.3157 13.5105

Low 14.8467 14.6240 6.7700 14.1300 14.0200 14.3002

Small 15.9500 14.4441 10.8467 13.6357 13.6914 13.6735

Average 28.2700 14.3050 10.8967 12.5211 13.1910 13.2653

High 14.6100 10.8217 14.5900 22.1400 12.9189

Low 11.8433 14.4887 18.4125 12.5433 14.5656

Grand Total 16.7126 14.6604 11.3126 14.4423 14.1821 14.3963

(b)

StdDev of 1YrReturn% Star Rating

Market Cap Five Four One Three Two Grand Total

Large 3.9313 4.3301 4.2664 3.4625 6.5160 4.6358

Average #DIV/0! 10.4440 5.2235 4.9464 4.4221 4.9577

High #DIV/0! 0.2946 13.8721

Low 3.8785 4.0082 2.9262 3.3827 2.4161 3.6313

Mid-Cap 3.0815 3.1971 8.7458 4.5770 7.8798 5.3072

Average 2.4466 2.7400 10.3633 5.7755 8.7829 7.2263

Low 3.0190 3.1388 #DIV/0! 3.4910 1.8296 3.2442

Small 8.8550 4.5342 4.0152 4.4595 3.6650 4.6175

Average #DIV/0! 5.4572 4.2430 3.8630 3.2572 4.6282

High #DIV/0! 4.3118 #DIV/0! #DIV/0! 5.1239

Low 4.0531 4.4934 4.8060 0.8041 4.4716

Grand Total 4.6722 4.0202 4.9474 3.9820 6.7243 4.8551

(c) The mean one-year return of five-star funds is generally the highest, followed by the

four-star, three-star, two-star and one-star funds across the various market caps and risk

ratings with the exception of the small-cap funds rated at the various star ratings,

There is no obvious pattern in the standard deviation of the one-year return.

© 2015 Pearson Education Ltd.

152 Chapter 3: Numerical Descriptive Measures

3.26 (a)

Average of 1YrReturn% Star Rating

Type Five Four One Three Two Grand Total

Growth 16.5544 15.2193 10.3575 13.9957 13.6058 14.2780

Average 16.5333 16.2233 11.6467 13.0514 10.8005 13.0524

High 14.6100 9.3620 14.5900 33.7200 17.7170

Low 16.5587 14.9785 9.8060 14.5700 13.6822 14.6717

Value 17.2820 12.7295 13.4957 15.3603 15.4863 14.6982

Average 28.2700 13.9800 16.4786 17.5267 17.1012

High 12.0500 22.1400 15.4133

Low 14.5350 12.7295 14.2150 15.0903 13.9117 14.0751

Grand Total 16.7126 14.6604 11.3126 14.4423 14.1821 14.3963

(b)

StdDev of 1YrReturn% Star Rating

Type Five Four One Three Two Grand Total

Growth 4.0813 3.6946 5.0187 3.8308 7.6709 5.0041

Average 3.0735 4.9524 7.6948 4.9654 6.9272 6.0163

High #DIV/0! 2.6945 #DIV/0! 0.2946 11.3821

Low 4.3448 3.3483 3.0114 2.8818 2.1220 3.3562

Value 6.9822 4.5679 4.3343 4.1815 3.6530 4.4651

Average #DIV/0! 4.0506 2.9673 3.8277 4.4488

High 8.5843 #DIV/0! 8.4131

Low 3.8335 4.5679 0.5445 4.4251 2.4852 4.1475

Grand Total 4.6722 4.0202 4.9474 3.9820 6.7243 4.8551

(c) In general, the mean one-year return of the five-star rated growth funds is highest,

followed by that of the four-star, three-star, two-star and one-star rated growth funds

across the various risk levels. However, similar pattern does not hold through among

the value funds.

There is no obvious pattern in the standard deviation of the one-year return.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 153

3.27 (a) Q1 = 4, Q3 = 10, interquartile range = 6

(b) Min = 1, Max = 11, Q1 = 4, Q2 = 6, Q3 = 10

(c)

Data is skewed right.

(d) (a, b, c) all the values will be shifted by adding 2 such as Min = 3, Q1 = 6, Q2 =8,

Q3 = 12, Max = 13.

The boxplot will remain the same but will shift to the right by 2. The data will stay

skewed to the right.

3.28 (a) Q1 = 6, Q3 = 11, interquartile range = 5

(b) Min = 3, Q1 = 6, Q2 = 8, Q3 = 11, Max = 15

(c)

Data is slightly skewed to the right.

(d) Each of 1, Q2, Q3, Min, and Max will be subtracted by 2 as well. The boxplot will shift

2 to the left.

3.29 (a) Q1 = 5, Q3 = 12, interquartile range = 7

(b) Min = 2, Q1 = 5, Q2 = 7, Q3 = 12, Max = 13

(c)

Data shows slight skewedness to the right.

(d) Each of 1, Q2, Q3, Min, and Max will be subtracted by 2 as well. The boxplot will shift

2 to the left.

© 2015 Pearson Education Ltd.

154 Chapter 3: Numerical Descriptive Measures

3.30 (a) Q1 = -6.5, Q3 = 8, interquartile range = 14.5

(b) Five-number summary: – 8 – 6.5 7 8 9

(c)

Box-and-whisker Plot

-10 -5 0 5 10

The distribution is left-skewed.

(d) This is consistent with the answer in 3.4 (d).

3.31 (a), (b)

Five-Number Summary

Minimum 9

First Quartile 12

Median 16

Third Quartile 22

Maximum 32

Interquartile Range 10

(c)

Boxplot

Number of

Partners

0 10 20 30

The number of partners is right-skewed.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 155

3.32 (a), (b)

Five-Number Summary

Minimum 5.37

First Quartile 30.12

Median 38.16

Third Quartile 49.35

Maximum 53.45

Interquartile Range 19.23

(c)

Boxplot

Facebook

Penetration

0 10 20 30 40 50

The penetration value is left-skewed.

3.33 (a) Q1 = 235, Q3 = 278, IQR = 43

(b) Min = 141, Q1 = 235, Q2 = 261, Q3 = 278, Max = 450

(c)

Data indicates skewedness to the right.

3.34 (a) Q1 = 34.5, Q3 = 37.5, IQR = 3

(b) Min = 30, Q1 = 34.5, Q2 = 35, Q3 = 37.5, Max = 42

(c)

Data indicates skewedness to the right.

© 2015 Pearson Education Ltd.

156 Chapter 3: Numerical Descriptive Measures

3.35 (a), (b)

Five-Number Summary

One-Year Five-Year

Minimum 0.1 0.35

First Quartile 0.3 1.05

Median 0.8 1.41

Third Quartile 0.9 1.54

Maximum 1.05 1.85

Interquartile Range 0.6 0.49

(c)

Boxplot

Five-Year

One-Year

0 0.5 1 1.5 2

(d) Both the one-year CDs’ and five-year CDs’ yields are left-skewed.

3.36 Excel output for Residential Area:

Waiting Time

Mean 7.114667

Median 6.68

Mode #N/A

Standard Deviation 2.082189

Sample Variance 4.335512

Range 6.67

Minimum 3.82

Maximum 10.49

Sum 106.72

Count 15

First Quartile 5.64

Third Quartile 8.73

Interquartile Range 3.09

Coefficient of Variation 29.2662%

Excel output for Residential Area:

Box-and-whisker Plot

Five-number Summary

Minimum 3.82

First Quartile 5.64

Median 6.68

Third Quartile 8.73

Maximum 10.49

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 157

Excel output for Commercial District:

Waiting Time

Mean 4.286667

Standard Error 0.422926

Median 4.5

Mode #N/A

Standard Deviation 1.637985

Sample Variance 2.682995

Kurtosis 0.832925

Skewness -0.83295

Range 6.08

Minimum 0.38

Maximum 6.46

Sum 64.3

Count 15

First Quartile 3.2

Third Quartile 5.55

Interquartile Range 2.35

Coefficient of Variation 38.2112%

Box-and-whisker Plot

Five-number Summary

Minimum 0.38

First Quartile 3.2

Median 4.5

Third Quartile 5.55

Maximum 6.46

(a) Commercial district: Five-number summary: 0.38 3.2 4.5 5.55 6.46

Residential area: Five-number summary: 3.82 5.64 6.68 8.73 10.49

(b) Commercial district:

Box-and-whisker Plot

Waiting Time

0 2 4 6 8

The distribution is skewed to the left.

© 2015 Pearson Education Ltd.

158 Chapter 3: Numerical Descriptive Measures

3.36

cont. Residential area:

Box-and-whisker Plot

Waiting Time

0 2 4 6 8 10 12

The distribution is skewed slightly to the right.

(c) The central tendency of the waiting times for the bank branch located in the commercial

district of a city is lower than that of the branch located in the residential area. There

are a few longer than normal waiting times for the branch located in the residential area

whereas there are a few exceptionally short waiting times for the branch located in the

commercial area.

12

∑ 1

xi

3.37 (a) Population Mean = µ = = 6.615385

N

12

∑ 1

( xi − µ )2

(b) Standard Deviation = σ= = 2.843034

N

3.38 (a) Population Mean = 6

(b) σ 2 = 2.8 σ = 1.67

50 N

2

∑ Xi 514 ∑( X i − µ)

204.92

3.39 (a) µ= i =1

= = 10.28 σ2 = i =1

= = 4.0984

N 50 N 50

(b)

σ

64%

= 2.0245

94% 100%

(c) These percentages are lower than the empirical rule would suggest.

3.40 (a) 68% (b) 95% (c) not calculable 75% 88.89%

(d) µ − 4σ to µ + 4σ or -2.8 to 19.2

3.41 (a) µ = 1.477 σ 2 = 0.9123

(b)

σ = 0.9551

On average, the cigarette tax is $1.48. The average distances between the cigarette tax

in each of the 50 states and the population mean cigarette tax is $ 0.96.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 159

3.42 (a) Excel output:

Kilowatt Hours

Mean 12999.22

Standard Error 546.9863

Median 13255

Mode #N/A

Standard Deviation 3906.264

Sample Variance 15258895

Kurtosis 0.232784

Skewness 0.468115

Range 18171

Minimum 6396

Maximum 24567

Sum 662960

Count 51

mean = 12999.2158, variance = 14959700.52, std. dev. = 3867.7772

(b) 64.71%, 98.04% and 100% of these states have average per capita energy consumption

within 1, 2 and 3 standard deviations of the mean, respectively.

(c) This is consistent with the 68%, 95% and 99.7% according to the empirical rule.

(d) Excel output:

Kilowatt Hours

Mean 12857.74

Standard Error 539.0489

Median 12999

Mode #N/A

Standard Deviation 3811.651

Sample Variance 14528684

Kurtosis 0.464522

Skewness 0.494714

Range 18171

Minimum 6396

Maximum 24567

Sum 642887

Count 50

(a) mean = 12857.7402, variance = 14238110.67, std. dev. = 3773.3421

(b) 66%, 98% and 100% of these states have average per capita energy

consumption within 1, 2 and 3 standard deviation of the mean, respectively.

(c) This is consistent with the 68%, 95% and 99.7% according to the empirical rule.

3.43 (a) µ = $ 142.9 billion σ = $ 86.8602 billion

(b) On average, the market capitalization for this population of 30 companies is

$142.9 billion. The average distances between the market capitalization and the

mean market capitalization for this population of 30 companies $86.8602 billion.

3.44 (a) cov(X,Y) = 64.11818

(b) S-X = 4.665151, S-Y = 13.75103

© 2015 Pearson Education Ltd.

160 Chapter 3: Numerical Descriptive Measures

cov( X , Y )

r= = 0.999494

Sx * S y

(c) There is a strong positive linear relationship between the two data sets.

3.45 (a) The study suggests that time spent on Facebook and grade point average are negatively

correlated.

(b) There could be a cause-and-effect relationship between time spent on Facebook and

grade point average. The more time spent on Facebook, the less time a student would

have available for study and, hence, results in lower grade point average holding

constant all the other factors that could have affected grade point average.

3.46 (a) cov(X,Y) = 133.3333

(b) S X2 = 2200, SY2 = 11.4762

cov ( X , Y )

r= = 0.8391

S X SY

(c) The correlation coefficient is more valuable for expressing the relationship between

calories and sugar because it does not depend on the units used to measure calories and

sugar.

(d) There is a strong positive linear relationship between calories and sugar.

3.47 (a)

First Weekend US Gross Worldwide Gross

First Weekend 947.4799

US Gross 890.3014 1576.679

Worldwide Gross 4001.782 6045.573 24934.48

(b)

First Weekend US Gross Worldwide Gross

First Weekend 1

US Gross 0.728417 1

Worldwide Gross 0.823319 0.964197 1

(c) The correlation coefficient is more valuable for expressing the relationship because

it does not depend on the units used.

(d) There is a strong positive linear relationship between U.S. gross and worldwide gross,

first weekend gross and worldwide gross and first weekend gross and U.S. gross.

3.48 (a) cov(X,Y) = 1.43478 ×1013

(b) S X2 = 1.4339 ×1012 , SY2 = 2.3890 ×1014

cov ( X , Y )

r= = 0.7752

S X SY

(c) There is a positive linear relationship between the coaches’ pay and revenue.

3.49 (a) cov(X,Y) = 133302.7571

(b) S X2 = 194992743.3, SY2 = 183.7904762

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 161

cov ( X , Y )

r= = 0.7042

S X SY

(c) There is a strong positive linear relationship between the GDP and social media use.

3.50 We should look for ways to describe the typical value, the variation, and the distribution of the

data within a range.

3.51 Central tendency or location refers to the fact that most sets of data show a distinct tendency to

group or cluster about a certain central point.

3.52 The arithmetic mean is a simple average of all the values, but is subject to the effect of extreme

values. The median is the middle ranked value, but varies more from sample to sample than the

arithmetic mean, although it is less susceptible to extreme values. The mode is the most

common value, but is extremely variable from sample to sample.

3.53 The first quartile is the value below which ¼ of the total ranked observations will fall, the

median is the value that divides the total ranked observations into two equal halves and the third

quartile is the observation above which ¼ of the total ranked observations will fall.

3.54 Variation is the amount of dispersion, or “spread,” in the data.

3.55 The Z score measures how many standard deviations an observation in a data set is away from

the mean.

3.56 The range is a simple measure, but only measures the difference between the extremes. The

interquartile range measures the range of the center fifty percent of the data. The standard

deviation measures variation around the mean while the variance measures the squared variation

around the mean, and these are the only measures that take into account each observation. The

coefficient of variation measures the variation around the mean relative to the mean. The range,

standard deviation, variance and coefficient of variation are all sensitive to outliers while the

interquartile range is not.

3.57 The empirical rule relates the mean and standard deviation to the percentage of values that will

fall within a certain number of standard deviations of the mean.

3.58 The Chebyshev rule applies to any type of distribution while the empirical rule applies only to

data sets that are approximately bell-shaped. The empirical rule is more accurate than the

Chebyshev rule in approximating the concentration of data around the mean.

3.59 Shape is the manner in which the data are distributed. The shape of a data set can be

symmetrical or asymmetrical (skewed).

3.60 The arithmetic mean is appropriate if you want to obtain a typical value and serves as a

“balance point” in a set of data, similar to the fulcrum on a seesaw. The geometric mean is

appropriate when you want to measure the rate of change of a variable over time.

3.61 Skewness measures the extent to which the data values are not symmetrical around the mean.

Kurtosis measures the extent to which values that are very different from the mean affect the

shape of the distribution of a set of data.

© 2015 Pearson Education Ltd.

162 Chapter 3: Numerical Descriptive Measures

3.62 The covariance measures the strength of the linear relationship between two numerical variables

while the coefficient of correlation measures the relative strength of the linear relationship. The

value of the covariance depends very much on the units used to measure the two numerical

variables while the value of the coefficient of correlation is totally free from the units used.

3.63 On average, the Master Black Belt has the highest average salary ($112,946), followed by the

managers ($91,878), the quality engineers ($79,575), and then the Green Belts ($74,173). The

middle rank salary for the Master Black Belt ($110,000) is also the highest, followed by the

managers ($89,000), the quality engineers ($78,000), and then the Green Belts ($70,500). The

overall spread between the highest and lowest salary for the managers ($694,000) is the highest,

followed by the quality engineers ($160,000), the Master Black Belt ($157,000), and then the

Green Belts ($99,000). However, the average spread of the salary around the mean of the

manager ($27,906) is the highest, followed by the Master Black Belt ($27,474), the Green Belts

($23,399) and then the Quality Engineer ($21,933). Relative dispersion (CV) for Green Belt is

highest at 31.55% and lowest for Master Black Belts at 24.32%.

3.64 Excel output:

Time

Mean 43.88889

Standard Error 4.865816

Median 45

Mode 17

Standard Deviation 25.28352

Sample Variance 639.2564

Range 76

Minimum 16

Maximum 92

First Quartile 18

Third Quartile 63

interquartile range 45

c.v 57.61%

(a) mean = 43.89 median = 45 1st quartile = 18 3rd quartile = 63

(b) range = 76 interquartile range = 45 variance = 639.2564

standard deviation = 25.28 coefficient of variation = 57.61%

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 163

(c)

Box-and-whisker Plot

Time

10 30 50 70 90

The distribution is skewed to the right because there are a few policies that require an

exceptionally long period to be approved even though the mean is smaller than the

median.

(d) The mean approval process takes 43.89 days with 50% of the policies being approved

in less than 45 days. 50% of the applications are approved between 18 and 63 days.

About 67% of the applications are approved between 18.6 to 69.2 days.

3.65 Excel output:

Days

Mean 43.04

Median 28.5

Mode 5

Standard Deviation 41.92606

Sample Variance 1757.794

Range 164

Minimum 1

Maximum 165

First Quartile 14

Third Quartile 54

Interquartile Range 40

CV 97.41%

(a) Mean = 43.04 Median = 28.5 Q1 = 14 Q3 = 54

(b) Range = 164 Interquartile range = 40 Variance = 1,757.79

Standard deviation = 41.926 Coefficient of variation = 97.41%

© 2015 Pearson Education Ltd.

164 Chapter 3: Numerical Descriptive Measures

(c) Box-and-whisker plot for Days to Resolve Complaints

Box-and-whisker Plot

Days

0 50 100 150

The distribution is right-skewed.

(d) Half of all customer complaints that year were resolved in less than a month (median =

28.5 days), 75% of them within 54 days. There were five complaints that were

particularly difficult to settle which brought the overall mean up to 43 days. No

complaint took longer than 165 days to resolve.

3.66 Excel output:

Width

Mean 8.420898

Standard Error 0.006588

Median 8.42

Mode 8.42

Standard Deviation 0.046115

Sample Variance 0.002127

Kurtosis 0.035814

Skewness -0.48568

Range 0.186

Minimum 8.312

Maximum 8.498

Sum 412.624

Count 49

First Quartile 8.404

Third Quartile 8.459

Interquartile Range 0.055

CV 0.55%

(a) mean = 8.421, median = 8.42, range = 0.186 and standard deviation = 0.0461. On

average, the width is 8.421 inches. The width of the middle ranked observation is 8.42.

The difference between the largest and smallest width is 0.186 and majority of the

widths fall between 0.0461 inches around the mean of 8.421 inches.

(b) Minimum = 8.312, 1st quartile = 8.404, median = 8.42, 3rd quartile = 8.459 and

maximum = 8.498

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 165

Box-and-whisker Plot

Width

8.2 8.3 8.4 8.5 8.6

(c) Even though the median is equal to the mean, the distribution is not symmetrical but

skewed to the left.

(d) All the troughs fall within the limit of 8.31 and 8.61 inches.

3.67 Excel output:

Force

Mean 1723.4

Standard Error 16.34967

Median 1735

Mode 1662

Standard Deviation 89.55083

Sample Variance 8019.352

Kurtosis -0.24355

Skewness -0.36714

Range 348

Minimum 1522

Maximum 1870

Sum 51702

Count 30

First Quartile 1662

Third Quartile 1784

Interquartile Range 122

CV 5.1962%

(a) mean = 1723.4 median = 1735 range = 348 standard deviation = 89.55

(b) The mean force required to break the insulators in the sample is 1723.4 pounds. The

middle ranked breaking force is 1735 pounds. The differences between the smallest

and largest breaking force is 348 pounds. Roughly about 68% of the insulators will

have breaking force that falls within 89.55 pounds of 1723.4 pounds.

(c) Five-number summary: 1522 1662 1735 1784 1870.

© 2015 Pearson Education Ltd.

166 Chapter 3: Numerical Descriptive Measures

Box-and-whisker Plot

Force

1500 1600 1700 1800 1900

The distribution is skewed to the left.

(d) All the observations in the sample have breaking force that is greater than 1500 pounds

and, hence, will fulfill the company's requirement.

3.68 (a), (b)

Bundle Score Typical Cost ($)

Mean 54.775 24.175

Standard Error 4.367344951 2.866224064

Median 62 20

Mode 75 8

Standard Deviation 27.62151475 18.12759265

Sample Variance 762.9480769 328.6096154

Kurtosis -0.845357193 2.766393511

Skewness -0.48041728 1.541239625

Range 98 83

Minimum 2 5

Maximum 100 88

Sum 2191 967

Count 40 40

First Quartile 34 9

Third Quartile 75 31

Interquartile Range 41 22

CV 50.43% 74.98%

(c)

Boxplot

Typical Cost

($)

Bundle

Score

0 20 40 60 80 100

The typical cost is right-skewed, while the bundle score is left-skewed.

cov ( X , Y )

(d) r= = 0.3465

S X SY

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 167

(e) The mean typical cost is $24.18, with an average spread around the mean equaling

$18.13. The spread between the lowest and highest costs is $83. The middle 50% of the

typical cost fall over a range of $22 from $9 to $31, while half of the typical cost is

below $20. The mean bundle score is 54.775, with an average spread around the mean

equaling 27.6215. The spread between the lowest and highest scores is 98. The middle

50% of the scores fall over a range of 41 from 34 to 75, while half of the scores are

below 62. The typical cost is right-skewed, while the bundle score is left-skewed. There

is a weak positive linear relationship between typical cost and bundle score.

3.69 Excel output:

Teabags

Mean 5.5014

Standard Error 0.014967

Median 5.515

Mode 5.53

Standard Deviation 0.10583

Sample Variance 0.0112

Kurtosis 0.127022

Skewness -0.15249

Range 0.52

Minimum 5.25

Maximum 5.77

Sum 275.07

Count 50

First Quartile 5.44

Third Quartile 5.57

Interquartile Range 0.13

CV 1.9237%

(a) mean = 5.5014, median = 5.515, first quartile = 5.44, third quartile = 5.57

(b) range = 0.52, interquartile range = 0.13, variance = 0.0112,

standard deviation = 0.10583, coefficient of variation = 1.924%

(c) The mean weight of the tea bags in the sample is 5.5014 grams while the middle ranked

weight is 5.515. The company should be concerned about the central tendency because

that is where the majority of the weight will cluster around. The average of the squared

differences between the weights in the sample and the sample mean is 0.0112 whereas

the square-root of it is 0.106 gram. The difference between the lightest and the heaviest

tea bags in the sample is 0.52. 50% of the tea bags in the sample weigh between 5.44

and 5.57 grams. According to the empirical rule, about 68% of the tea bags produced

will have weight that falls within 0.106 grams around 5.5014 grams. The company

producing the tea bags should be concerned about the variation because tea bags will

not weigh exactly the same due to various factors in the production process, e.g.

temperature and humidity inside the factory, differences in the density of the tea, etc.

Having some idea about the amount of variation will enable the company to adjust the

production process accordingly.

© 2015 Pearson Education Ltd.

168 Chapter 3: Numerical Descriptive Measures

3.69 (d)

cont.

Box-and-whisker Plot

Teabags

5 5.2 5.4 5.6 5.8 6

The data is slightly left skewed.

(e) On average, the weight of the teabags is quite close to the target of 5.5 grams. Even

though the mean weight is close to the target weight of 5.5 grams, the standard

deviation of 0.106 indicates that about 75% of the teabags will fall within 0.212 grams

around the target weight of 5.5 grams. The interquartile range of 0.13 also indicates

that half of the teabags in the sample fall in an interval 0.13 grams around the median

weight of 5.515 grams. The process can be adjusted to reduce the variation of the

weight around the target mean.

3.70 (a) Excel output:

Five-number Summary

Boston Vermont

Minimum 0.04 0.02

First Quartile 0.17 0.13

Median 0.23 0.2

Third 0.32 0.28

Quartile

Maximum 0.98 0.83

(b)

Box-and-whisker Plot

Vermont

Boston

0 0.2 0.4 0.6 0.8 1

Both distributions are right skewed.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 169

3.70 (c) Both sets of shingles did quite well in achieving a granule loss of 0.8 gram or less.

cont. The Boston shingles had only two data points greater than 0.8 gram. The next highest to

these was 0.6 gram. These two data points can be considered outliers. Only 1.176% of

the shingles failed the specification. In the Vermont shingles, only one data point was

greater than 0.8 gram. The next highest was 0.58 gram. Thus, only 0.714% of the

shingles failed to meet the specification.

3.71 (a) PHStat output:

Five-Number Summary

City Suburban

Minimum 25 26

First Quartile 37 35

Median 46.5 43.5

Third Quartile 60 51

Maximum 80 71

(b)

Boxplot

Suburban

City

20 30 40 50 60 70 80

The distribution of the cost is right-skewed for both city and suburban restaurants.

(c) r = 0.7388. There is a moderate positive linear relationship between the

cost and rating of the restaurants. The higher priced restaurants tend to receive higher

rating than the lower priced restaurants.

3.72 (a), (b), (c)

Calories Protein Cholesterol

Calories 1

Protein 0.464411 1

Cholesterol 0.177665 0.141673 1

(d) There is a rather weak positive linear relationship between calories and protein with a

correlation coefficient of 0.46. The positive linear relationship between calories and

cholesterol is quite weak at .178.

© 2015 Pearson Education Ltd.

170 Chapter 3: Numerical Descriptive Measures

3.73 (a),(b) PHStat output:

Two-Star Three-Star Four-Star

Mean 63.90698 87.18605 123.0233

Standard Error 2.970101 3.987141 5.281918

Median 70 88 121

Mode 82 84 74

Standard Deviation 19.47625 26.14543 34.63585

Sample Variance 379.3245 683.5836 1199.642

Kurtosis -0.51632 0.029995 -0.74668

Skewness -0.1917 0.136329 0.265007

Range 82 122 131

Minimum 23 33 67

Maximum 105 155 198

Sum 2748 3749 5290

Count 43 43 43

First Quartile 46 69 98

Third Quartile 80 105 151

CV 30.48% 29.99% 28.15%

Interquartile Range 34 36 53

(c) The average prices of the two-star, three-star and four-star hotels are 63.91, 87.19 and

123.02 British pounds, respectively while the middle rank prices are 70, 88 and 121

British pounds, respectively. The difference in prices between the lowest and highest

price hotels of the two-star, three-star and four-star hotels are 82, 122 and 131 British

pounds, respectively while the difference in prices among the middle 50% hotels are 34,

36 and 53 British pounds, respectively. The average spread of the prices around the

mean for the two-star, three-star and four-star hotels are 19.48, 26.15 and 34.64 British

pounds, respectively. The amount of average spread around the mean in relative to the

mean prices of the two-star, three-star and four-star hotels are 30.48%, 29.99% and

28.15%, respectively.

(d)

Boxplot

Four-Star

Three-Star

Two-Star

20 70 120 170

The prices of the three-star and four-star hotels are slightly right-skewed while the

prices of the two-star hotels are slightly left-skewed.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 171

3.73 (e) Covariance Matrix

cont.

Two-Star Three-Star Four-Star

Two-Star 379.3245

Three-Star 401.113 683.5836

Four-Star 431.4784 791.3289 1199.642

(f) Correlation coefficient matrix

Two-Star Three-Star Four-Star

Two-Star 1

Three-Star 0.787708 1

Four-Star 0.639628 0.873847 1

(g) The correlation coefficient is more valuable for expressing the relationship because it

does not depend on the units used.

(h) The average price of a room at two-star, three-star, and four-star hotels are all linearly

positively related to each other.

3.74 (a), (b)

Property Taxes Per Capita ($)

Mean 1332.235

Standard Error 80.91249

Median 1230

Mode #N/A

Standard Deviation 577.8308

Sample Variance 333888.4

Kurtosis 0.539467

Skewness 0.918321

Range 2479

Minimum 506

Maximum 2985

Sum 67944

Count 51

First Quartile 867

Third Quartile 1633

Interquartile Range 766

6 * std.dev 3466.985

1.33 * std.dev 768.515

© 2015 Pearson Education Ltd.

172 Chapter 3: Numerical Descriptive Measures

3.74 (c)

cont.

Boxplot

Property

Taxes Per

Capita ($)

500 1000 1500 2000 2500 3000

(d) The distribution of the property taxes per capita is right-skewed with an average value

of $1,332.24, a median of $1,230 and an average spread around the mean of $577.83.

There is an outlier in the right tail at $2985 while the standard deviation is about

43.37% of the average. Twenty-five percent of the states have property taxes that fall

below $864 while twenty-five percent have property taxes higher than $1,633.

3.75 (a), (b)

Compensation ($ millions) Return in 2012 (%)

Mean 10.94658824 20.52647059

Standard Error 0.468543426 1.977423312

Median 9.6 18

Mode 10.3 19

Standard Deviation 6.109058858 25.78244562

Sample Variance 37.32060013 664.7345023

Kurtosis 3.056261448 1.86456751

Skewness 1.536390516 0.942997976

Range 36.68 165

Minimum 0.42 -46

Maximum 37.1 119

Sum 1860.92 3489.5

Count 170 170

First Quartile 7 5

Third Quartile 12.8 29

Interquartile Range 5.8 24

CV 55.81% 125.61%

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 173

3.75 (c)

cont.

Boxplot

Return in 2012

(%)

Compensation

($ millions)

-50 0 50 100

The data are right-skewed.

(d) The average total compensation is $ 10.9466 million. Half of the CEOs have a total

compensation of less than $9.6 million. One-quarter of the CEOs have a total

compensation of less than $7 million while another one-quarter have a total

compensation in excess of $ 12.8 million. The spread of the total compensation among

all CEOs is $36.68 million. The middle 50% of the total compensation is spread over $

5.8 million. The average spread of the total compensation around the mean is 6.1091

million.

(e) Correlation coefficient between compensation and the investment return in 2012, r =

0.1719.

(f) There does not appear to be any linear relationship between compensation and the

investment return in 2012.

3.76 (a), (b)

Abandonment rate in % (7:00AM-3:00PM)

Mean 13.86363636

Standard Error 1.625414306

Median 10

Mode 9

Standard Deviation 7.623868875

Sample Variance 58.12337662

Kurtosis 0.723568739

Skewness 1.180708144

Range 29

Minimum 5

Maximum 34

Sum 305

Count 22

First Quartile 9

Third Quartile 20

Interquartile Range 11

CV 54.99%

© 2015 Pearson Education Ltd.

174 Chapter 3: Numerical Descriptive Measures

(c)

Boxplot

Abandonment

rate in %

(7:00AM-

3:00PM)

0 5 10 15 20 25 30 35

The data are right-skewed.

(d) r = 0.7575

(e) The average abandonment rate is 13.86%. Half of the abandonment rates are less than

10%. One-quarter of the abandonment rates are less than 9% while another one-quarter

are more than 20%. The overall spread of the abandonment rates is 29%. The middle

50% of the abandonment rates are spread over 11%. The average spread of

abandonment rates around the mean is 7.62%. The abandonment rates are right-

skewed.

3.77 (a), (b)

Annual Time Sitting in Traffic (hours) Cost of Sitting in Traffic($)

Mean 39.12903226 770.3548387

Standard Error 2.605099191 52.39189686

Median 37 746

Mode 35 512

Standard Deviation 14.50457844 291.7057362

Sample Variance 210.3827957 85092.23656

Kurtosis 0.161745918 0.534793444

Skewness 0.714517855 0.694052033

Range 55 1223

Minimum 19 345

Maximum 74 1568

Sum 1213 23881

Count 31 31

First Quartile 27 512

Third Quartile 47 942

Interquartile Range 20 430

CV 37.07% 37.87%

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 175

(c)

Boxplot

Cost of Sitting

in Traffic($)

Annual Time

Sitting in Traffic

(hours)

10 510 1010 1510

Both the time spent sitting in traffic and the cost of sitting in traffic are right-skewed.

(d) r = 0.7970.

(e) The average time spent sitting in traffic is 39.1290 hours. Half of the time spent sitting

in traffic is less than 37 hours. One-quarter of the time spent sitting in traffic is less

than 27 hours while another one-quarter is more than 47 hours. The overall spread of

the time spent sitting in traffic is 55 hours. The middle 50% of the time spent sitting in

traffic spreads over 20 hours. The average spread of time spend sitting in traffic around

the mean is 14.5046.

The average cost of sitting in traffic is $770.35. Half of the cost of sitting in traffic is

less than $746. One-quarter of the cost of sitting in traffic is less than $512 while

another one-quarter is more than $942. The overall spread of the cost of sitting in traffic

is $1223. The middle 50% of the cost of sitting in traffic spreads over $430. The

average spread of cost of sitting in traffic around the mean is $ 291.71.

© 2015 Pearson Education Ltd.

176 Chapter 3: Numerical Descriptive Measures

3.78 (a), (b)

Average Credit Score

Mean 746.2238

Standard Error 1.821396

Median 749

Mode 760

Standard Deviation 21.78073

Sample Variance 474.4003

Kurtosis -0.83035

Skewness -0.22982

Range 89

Minimum 700

Maximum 789

Sum 106710

Count 143

First Quartile 730

Third Quartile 763

Interquartile Range 33

CV 2.92%

(c)

Boxplot

Average Credit

Score

690 740 790 840

The data are quite symmetrical.

(d) The average of the average credit scores is 746.2238. Half of the average credit scores

are less than 749. One-quarter of the average credit scores are less than 730 while

another one-quarter is more than 763. The overall spread of average credit scores is 89.

The middle 50% of the average credit scores spread over 33. The average spread of

average credit scores around the mean is 21.7807.

© 2015 Pearson Education Ltd.

Solutions to End-of-Section and Chapter Review Problems 177

3.80 Excel output:

Alcohol % Calories Carbohydrates

Mean 5.235592105 154.3092105 11.96394737

Standard Error 0.115998617 3.616003621 0.399234292

Median 4.9 150 12.055

Mode 4.2 110 12

Standard Deviation 1.430126995 44.58108671 4.922090919

Sample Variance 2.045263223 1987.473292 24.22697902

Kurtosis 4.370842968 2.960631343 1.238172847

Skewness 1.434987665 1.211924335 0.478507837

Range 11.1 275 30.2

Minimum 0.4 55 1.9

Maximum 11.5 330 32.1

Sum 795.81 23455 1818.52

Count 152 152 152

First Quartile 4.4 129 8.3

Third Quartile 5.6 166 14.5

Interquartile Range 1.2 37 6.2

CV 27.32% 28.89% 41.14%

Boxplot

Carbohydrates

Calories

Alcohol %

0 50 100 150 200 250 300 350

The amount of % alcohol is right skewed and average at 5.24%. Half of the beers have %

alcohol below 4.9%. The middle 50% of the beers have alcohol content spread over a range of

1.2%. The highest alcohol content is at 11.5% while the lowest is at 0.4%. The average scatter

of alcohol content around the mean is 1.4301%.

The number of calories is right-skewed and average at 154.3092. Half of the beers have

calories below 150. The middle 50% of the beers have calories spread over a range of 37. The

highest number of calories is 330 while the lowest is 55. The average scatter of calories around

the mean is 44.5811.

The number of carbohydrates is right-skewed from the boxplot and average at 11.9639, which is

slightly lower than median at 12.055. Half of the beers have carbohydrates below 12.055. The

© 2015 Pearson Education Ltd.

178 Chapter 3: Numerical Descriptive Measures

middle 50% of the beers have carbohydrates spread over a range of 6.2. The highest number of

carbohydrates is 32.1 while the lowest is 1.9. The average scatter of carbohydrates around the

mean is 4.9221.

© 2015 Pearson Education Ltd.

You might also like

- Statistics For Managers Using Microsoft Excel 7th Edition Levine Solutions ManualDocument25 pagesStatistics For Managers Using Microsoft Excel 7th Edition Levine Solutions ManualEvelynSchneiderqwfi100% (32)

- Assignment IC104Document7 pagesAssignment IC104Zeon tvNo ratings yet

- Metropolitan Research Inc. ReportDocument8 pagesMetropolitan Research Inc. ReportYati GuptaNo ratings yet

- Report of Sales-SalaryDocument13 pagesReport of Sales-SalaryĐào ĐứcNo ratings yet

- SUSS BSBA: BUS105 Jul 2020 TOA AnswersDocument10 pagesSUSS BSBA: BUS105 Jul 2020 TOA AnswersAzido Azide100% (1)

- Assignment IV OC Download Shakher S070Document2 pagesAssignment IV OC Download Shakher S070Shakher SainiNo ratings yet

- Uoc Luong Tham SoDocument38 pagesUoc Luong Tham SoLinh MạnhNo ratings yet

- Dwnload Full Statistics For Managers Using Microsoft Excel 7th Edition Levine Solutions Manual PDFDocument21 pagesDwnload Full Statistics For Managers Using Microsoft Excel 7th Edition Levine Solutions Manual PDFbunkerlulleruc3s100% (16)

- Dwnload Full Statistics For Managers Using Microsoft Exce Global 8th Edition Levine Solutions Manual PDFDocument36 pagesDwnload Full Statistics For Managers Using Microsoft Exce Global 8th Edition Levine Solutions Manual PDFbunkerlulleruc3s100% (12)

- Assig 10 Problems Fundamentals of StatisticsDocument3 pagesAssig 10 Problems Fundamentals of Statisticsnelly818No ratings yet

- C/a/d Expressing Dollars and Employees in Thousands, The Weighted Mean Expenditure Per Employee IsDocument22 pagesC/a/d Expressing Dollars and Employees in Thousands, The Weighted Mean Expenditure Per Employee Iskdk4916No ratings yet

- Explore: Case Processing SummaryDocument2 pagesExplore: Case Processing SummaryFebry AndikaNo ratings yet

- HW 2Document12 pagesHW 2Munish RanaNo ratings yet

- (STATS) WordDocument7 pages(STATS) WordRIYA RIYANo ratings yet

- SIDM ChisquareDocument8 pagesSIDM ChisquareESHAN CHATTERJEENo ratings yet

- Representing and Describing Data: Descriptive StatisticsDocument30 pagesRepresenting and Describing Data: Descriptive StatisticsInês MariaNo ratings yet

- Reaserch Assignment Part IDocument21 pagesReaserch Assignment Part IYoseph BekeleNo ratings yet

- Intro To Statistics: Final ProjectDocument7 pagesIntro To Statistics: Final ProjectKumayl AzharNo ratings yet

- Homework - StatisticsDocument8 pagesHomework - StatisticsIsra'a Abed KhaderNo ratings yet

- Descriptive StatisticsDocument11 pagesDescriptive StatisticsRosemaribel TorresNo ratings yet

- PN 24524 SolutionsDocument7 pagesPN 24524 SolutionsSastry75No ratings yet

- Numerical Descriptive Measures: Tea-BagsDocument6 pagesNumerical Descriptive Measures: Tea-BagspinkyNo ratings yet

- MuklisDocument23 pagesMuklisVajri Mulya PratamaNo ratings yet

- Topic 1 Numerical MeasureDocument11 pagesTopic 1 Numerical MeasureNedal AbuzwidaNo ratings yet

- Stats Lecture 04. Central Tendency DataDocument21 pagesStats Lecture 04. Central Tendency DataShair Muhammad hazaraNo ratings yet

- Template For CH 6-9Document22 pagesTemplate For CH 6-9prabhjot kaurNo ratings yet

- Module 5 Sampling DistributionsDocument22 pagesModule 5 Sampling Distributionsyapemariel0No ratings yet

- MS8 IGNOU MBA Assignment 2009Document6 pagesMS8 IGNOU MBA Assignment 2009rakeshpipadaNo ratings yet

- (VCE Further) 2006 MAV Unit 34 Exam 1 SolutionsDocument12 pages(VCE Further) 2006 MAV Unit 34 Exam 1 SolutionsKawsarNo ratings yet

- Exact 3, X 3 at Least 3, X 3 at Most 3, X 3 Between 5 and 9, 5 X 9Document4 pagesExact 3, X 3 at Least 3, X 3 at Most 3, X 3 Between 5 and 9, 5 X 9Ehron RiveraNo ratings yet

- Number 3Document2 pagesNumber 3Jewel AlegreNo ratings yet

- Econ 299 Chapter 6.0Document19 pagesEcon 299 Chapter 6.0Elon MuskNo ratings yet

- Math Cat 3Document17 pagesMath Cat 3Nikhil SharmaNo ratings yet

- Case Processing SummaryDocument6 pagesCase Processing SummaryRenanda Rifki Ikhsandarujati RyanNo ratings yet

- CH 03Document33 pagesCH 03Nur Anugrah YusufNo ratings yet

- Stats Lecture 03. Summarizing of Data - NewDocument20 pagesStats Lecture 03. Summarizing of Data - NewShair Muhammad hazaraNo ratings yet

- Case Processing SummaryDocument2 pagesCase Processing Summarysari ruswatiNo ratings yet

- Worksheet 12: Averages and Measures of Spread: Answers To Core Revision Exercises: Data HandlingDocument2 pagesWorksheet 12: Averages and Measures of Spread: Answers To Core Revision Exercises: Data Handlingmk hatNo ratings yet

- Unit 3 Descriptive StatisticsPart2Document47 pagesUnit 3 Descriptive StatisticsPart2CZARINA JANE ACHUMBRE PACTURANNo ratings yet

- Stat... ICS Part-II 2022Document52 pagesStat... ICS Part-II 2022NasirNo ratings yet

- StatisticsDocument4 pagesStatisticsClaire ParoNo ratings yet

- RIVERA ECE11 Laboratory Exercise 3Document3 pagesRIVERA ECE11 Laboratory Exercise 3Ehron RiveraNo ratings yet

- Exercise Module 4Document5 pagesExercise Module 4Quarl SanjuanNo ratings yet