Professional Documents

Culture Documents

Financial Markets Overview

Financial Markets Overview

Uploaded by

Mary Benedict AbraganOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets Overview

Financial Markets Overview

Uploaded by

Mary Benedict AbraganCopyright:

Available Formats

Name: Abragan, Mary Benedict T.

Section: BSA – 1C

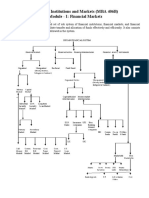

The first chapter of the book Financial Markets and Institution by Saunders talks about

the fundamentals of the basic operations of the domestic and foreign financial markets and

institutions. It does describe the ways in which how the funds flow through the system of

economy from the transactions of both the lenders to borrowers and outlined the markets and

instruments that lenders and borrowers do employ in order to complete the process. Beyond

that, the first chapter also discussed the need for Financial Institute managers to fully

comprehend the function and how do the domestic international markets works. It is also

identified the other various factors that do impacts the specialness of the services Financial

Institute to provide and the manner in which they improve the efficiency of the funds that flow

from the supplier of funds to the ultimate users of the funds. Though some of the forces like the

usage of technology and especially the Internet are powerful enough that in the future Financial

Institutes that have historically relied on making profits by performing traditional special

functions such as brokerage will need to expand the array of their financial services that they

sell as well as the way that such services are distributed or sold to their customers.

Chapter 1 Overview:

Financial Markets: It is the institutions that perform the essential function of channeling

funds from those with surplus funds to those with shortages of funds.

Primary Markets: Markets in in which corporations raise funds through new issues of

securities.

Secondary markets: Markets that do trade the financial instruments once they are

issued.

Money markets: Markets that trades debt securities or instruments with maturities

of less than one year.

Capital markets: Markets that trade debt (bonds) and equity (stocks) instruments with

maturities of more than one year.

Foreign exchange markets: Markets in which the cash flows from the sale of products or

assets denominated in a foreign currency are transacted.

Derivative markets: Markets in which derivative securities are trade

Financial Market Regulation

o Securities and Exchange Commission

o Main emphasis on full and fair disclosure of information on securities issues to

actual and potential investors

o Required to register securities with the SEC an full describe them

You might also like

- Bank Account Data SheetDocument38 pagesBank Account Data SheetAnonymous bAuRxYHPW33% (3)

- 12 Powerful Trading Set UpsDocument78 pages12 Powerful Trading Set Upsmmanojj63% (49)

- Sample Mortgage Assumption Agreement FormDocument5 pagesSample Mortgage Assumption Agreement FormPen PanasilanNo ratings yet

- FIDIC Green Book Standard Template PDFDocument29 pagesFIDIC Green Book Standard Template PDFMahandhika Putra100% (3)

- Casa Statement 220603101301821Document2 pagesCasa Statement 220603101301821DoniNo ratings yet

- Business Plan LengkapDocument85 pagesBusiness Plan Lengkapzul_zamoska69100% (2)

- Fxchief Profit Plan: ForexDocument6 pagesFxchief Profit Plan: ForexJosgenda ClatituaNo ratings yet

- Financial System of BangladeshDocument14 pagesFinancial System of BangladeshMosharraf SauravNo ratings yet

- MGT of Financial MKT & Instu CH-3Document7 pagesMGT of Financial MKT & Instu CH-3fitsumNo ratings yet

- Fi CHapter 4 Editeddd FFFDocument16 pagesFi CHapter 4 Editeddd FFFLencho MusaNo ratings yet

- Chapter 1 - Financial System - 2023Document42 pagesChapter 1 - Financial System - 2023lehaiha226No ratings yet

- FMI All ModulesDocument81 pagesFMI All ModulesSandeepMishraNo ratings yet

- Financial Institution and MarketDocument21 pagesFinancial Institution and Marketmba2013No ratings yet

- Unit - I: Markets and Financial InstrumentsDocument57 pagesUnit - I: Markets and Financial Instrumentsrajat vermaNo ratings yet

- Structure of Financial SystemDocument21 pagesStructure of Financial Systemkhalid hossainNo ratings yet

- Notes On Financial SystemsDocument62 pagesNotes On Financial SystemsamitNo ratings yet

- Introduction To Financial MarketsDocument18 pagesIntroduction To Financial MarketsMostafa ElgendyNo ratings yet

- Structure of Financial SystemDocument18 pagesStructure of Financial SystemTarequr RahmanNo ratings yet

- Mgt-205: Financial Markets and InstitutionsDocument78 pagesMgt-205: Financial Markets and InstitutionsBishal ShresthaNo ratings yet

- Chapter 4Document10 pagesChapter 4Tasebe GetachewNo ratings yet

- Financial Institutions and Markets: Prof. Manisha SanghviDocument85 pagesFinancial Institutions and Markets: Prof. Manisha SanghviinderpretationNo ratings yet

- Financial Markets - Group 3 20.11.2023Document30 pagesFinancial Markets - Group 3 20.11.2023muasyalizNo ratings yet

- Proiectul REIDocument21 pagesProiectul REICorneliu1decNo ratings yet

- 1-Bond MarketDocument85 pages1-Bond Marketdharmtamanna80% (5)

- It Is The Market For Sale and Purchase of Stocks (Shares), Bonds, BillsDocument14 pagesIt Is The Market For Sale and Purchase of Stocks (Shares), Bonds, BillsDr-Shefali GargNo ratings yet

- Bac821 Financial SystemsDocument13 pagesBac821 Financial SystemsLinet OrigiNo ratings yet

- 2.1 To 2.6 CONCEPT & FINANCIAL MARKET STRUCTURE IN INDIA PDFDocument30 pages2.1 To 2.6 CONCEPT & FINANCIAL MARKET STRUCTURE IN INDIA PDFImran KhanNo ratings yet

- Capital N Money MarketDocument22 pagesCapital N Money MarketColin Castor FdesNo ratings yet

- Functions and Importance of Financial MarketDocument4 pagesFunctions and Importance of Financial Marketbvyas2808No ratings yet

- Fim Ug 4Document21 pagesFim Ug 4Nahum DaichaNo ratings yet

- TOPIC 3 Types of Market - Money MarketDocument26 pagesTOPIC 3 Types of Market - Money Marketbojing.valenzuelaNo ratings yet

- Fi Assignment 1Document3 pagesFi Assignment 1Burhan HadiNo ratings yet

- Components of Financial SystemDocument9 pagesComponents of Financial SystemromaNo ratings yet

- UNIT-1 Financial System and Money MarketDocument28 pagesUNIT-1 Financial System and Money MarketashishNo ratings yet

- Financial Markets and InstrumentDocument30 pagesFinancial Markets and InstrumentAbdul Fattaah Bakhsh 1837065No ratings yet

- Vikas B Com Pass Course Eafm Sem Ii Paper Ii Public Fin & Fsi EnglishDocument32 pagesVikas B Com Pass Course Eafm Sem Ii Paper Ii Public Fin & Fsi EnglishPriyankNo ratings yet

- Financial MarketDocument97 pagesFinancial MarketPawan Kumar DubeyNo ratings yet

- Financial Institutions and Markets (MBA 406B) Module - I: Financial MarketsDocument62 pagesFinancial Institutions and Markets (MBA 406B) Module - I: Financial MarketsMothish Chowdary GenieNo ratings yet

- Deranatung Government College Itanagar Arumachal Pradesh Departnment of CommerceDocument16 pagesDeranatung Government College Itanagar Arumachal Pradesh Departnment of CommerceAbhinandan soniNo ratings yet

- Financial Markets Notes-1Document2 pagesFinancial Markets Notes-1munna bhaiyaNo ratings yet

- Introduction To Financial MarketsDocument28 pagesIntroduction To Financial MarketsUttam Gaurav100% (2)

- MujibDocument104 pagesMujibaheikh mujibNo ratings yet

- GR12 Business Finance Module 3-4Document8 pagesGR12 Business Finance Module 3-4Jean Diane JoveloNo ratings yet

- Chapter 4Document10 pagesChapter 4Muhammed YismawNo ratings yet

- Financial Markets and InstitutionsDocument78 pagesFinancial Markets and Institutionsamol_more37100% (1)

- Capital Market Chapter 1 2Document13 pagesCapital Market Chapter 1 2psychowriterrrrrNo ratings yet

- MF0010 SLM Unit 02 PDFDocument23 pagesMF0010 SLM Unit 02 PDFKavish BablaNo ratings yet

- Topic 1 Introduction of The Financial MarketDocument10 pagesTopic 1 Introduction of The Financial Markettraquena.zaira.bshsNo ratings yet

- UNIT-1 Financial System and Money MarketDocument28 pagesUNIT-1 Financial System and Money MarketashishNo ratings yet

- 02 Financial SystemDocument19 pages02 Financial SystemGhulam HassanNo ratings yet

- Raja Shekar ReddyDocument42 pagesRaja Shekar ReddypavithrajiNo ratings yet

- Money Market NotesDocument5 pagesMoney Market NotesNeelanjan MitraNo ratings yet

- Assignment Money & Banking 6666Document12 pagesAssignment Money & Banking 6666Yousif RazaNo ratings yet

- Cfi1203 Module 1 Intro To Financial Markets and RegulationDocument20 pagesCfi1203 Module 1 Intro To Financial Markets and RegulationLeonorahNo ratings yet

- Financial Market and Institutions Lecture-1, 2, 3Document4 pagesFinancial Market and Institutions Lecture-1, 2, 3Tyler vanPersieNo ratings yet

- Financial Markets: Department of Finance and Accounting G: 01Document5 pagesFinancial Markets: Department of Finance and Accounting G: 01Ismail AbderrahimNo ratings yet

- FIN 437 Financial Institutions and MarketsDocument171 pagesFIN 437 Financial Institutions and MarketsRojan ShresthaNo ratings yet

- FIM-BBA BI 1stDocument52 pagesFIM-BBA BI 1stRojan ShresthaNo ratings yet

- IAPM Unit-1Document21 pagesIAPM Unit-1aditya.ss12345No ratings yet

- ECON75 Lecture IV. Financial MarketDocument27 pagesECON75 Lecture IV. Financial MarketJoshua De VeraNo ratings yet

- Bba Notes 6Document53 pagesBba Notes 6RAJATNo ratings yet

- Money MarketDocument19 pagesMoney Marketramesh.kNo ratings yet

- Finl Markets and FinDocument24 pagesFinl Markets and FinLunaNo ratings yet

- International Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCEFrom EverandInternational Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCENo ratings yet

- My Insights To The Video That I Have Watched Regarding To Fringe Benefit Tax Is ThatDocument1 pageMy Insights To The Video That I Have Watched Regarding To Fringe Benefit Tax Is ThatMary Benedict AbraganNo ratings yet

- EncodedDocument8 pagesEncodedMary Benedict AbraganNo ratings yet

- Answer: eDocument17 pagesAnswer: eMary Benedict AbraganNo ratings yet

- Ethical Dilemma Faced by Theses Technological Advancements 2Document1 pageEthical Dilemma Faced by Theses Technological Advancements 2Mary Benedict AbraganNo ratings yet

- Is Our Reverence For Science JustifiedDocument4 pagesIs Our Reverence For Science JustifiedMary Benedict AbraganNo ratings yet

- Portfolio Return CalcDocument5 pagesPortfolio Return CalcMary Benedict AbraganNo ratings yet

- Macro IntroDocument21 pagesMacro IntroMary Benedict AbraganNo ratings yet

- Self-Test QuestionsDocument14 pagesSelf-Test QuestionsMary Benedict AbraganNo ratings yet

- What Is The CartoonistDocument1 pageWhat Is The CartoonistMary Benedict Abragan100% (1)

- What Is HistoryDocument2 pagesWhat Is HistoryMary Benedict AbraganNo ratings yet

- Financial Market RegulationsDocument4 pagesFinancial Market RegulationsMary Benedict AbraganNo ratings yet

- Ballroom Dancing Activity 1Document1 pageBallroom Dancing Activity 1Mary Benedict AbraganNo ratings yet

- Define Group and Work TeamDocument2 pagesDefine Group and Work TeamMary Benedict AbraganNo ratings yet

- Learning Outcome 2: Discuss The Traditional Approaches To Job DesignDocument16 pagesLearning Outcome 2: Discuss The Traditional Approaches To Job DesignMary Benedict AbraganNo ratings yet

- Expected ValueDocument8 pagesExpected ValueMAHESH.RNo ratings yet

- RamasDocument2 pagesRamasRis Samar100% (1)

- Tower 1, Office Block, 4th Floor, Plate-A, Adjacent To Ring Road, NBCC, Kidwai Nagar (East), New Delhi - 110023Document4 pagesTower 1, Office Block, 4th Floor, Plate-A, Adjacent To Ring Road, NBCC, Kidwai Nagar (East), New Delhi - 110023Mantu KumarNo ratings yet

- Executive LetterDocument1 pageExecutive LetterMichael KovachNo ratings yet

- General Knowledge June 2013Document279 pagesGeneral Knowledge June 2013Swarup MishraNo ratings yet

- Accounting Specialist Responsibilities IncludeDocument2 pagesAccounting Specialist Responsibilities IncludeAman SisodiaNo ratings yet

- Kajal Mini Project 2Document31 pagesKajal Mini Project 2Anjali GaurNo ratings yet

- MCOM Syllabus 2016Document54 pagesMCOM Syllabus 2016Rahul ThapaNo ratings yet

- AdasdDocument4 pagesAdasdPrime JavateNo ratings yet

- Ningbo L & M International Trading Co., LTDDocument1 pageNingbo L & M International Trading Co., LTDوليد سالمNo ratings yet

- Social Security SecretsDocument13 pagesSocial Security SecretsCrane SMS0% (1)

- AlphaIndicator ADVE 20200426 PDFDocument11 pagesAlphaIndicator ADVE 20200426 PDFarcheryNo ratings yet

- BP Annual Report and Form 20F 2013Document288 pagesBP Annual Report and Form 20F 2013falagous7No ratings yet

- TigerDocument95 pagesTigerraviNo ratings yet

- General Motors Vs FordDocument12 pagesGeneral Motors Vs FordAlexloh67% (3)

- Business Organisation PowerpointDocument29 pagesBusiness Organisation PowerpointVikas JainNo ratings yet

- Reserve Bank of IndiaDocument46 pagesReserve Bank of Indiarafishaik786No ratings yet

- A Comparative Study of Recruitment Process Between HDFC Bank and Sbi Bank at Moradabad RegionDocument86 pagesA Comparative Study of Recruitment Process Between HDFC Bank and Sbi Bank at Moradabad RegionbuddysmbdNo ratings yet

- 74703bos60485 Inter p1 cp6 U2Document25 pages74703bos60485 Inter p1 cp6 U2Just KiddingNo ratings yet

- Greater Noida: Management Submitted By: Ankit Kumar Sangal Post Graduate Diploma in Management (PGDM) 2009-11Document27 pagesGreater Noida: Management Submitted By: Ankit Kumar Sangal Post Graduate Diploma in Management (PGDM) 2009-11Ankit SangalNo ratings yet

- W 8ben TdaDocument1 pageW 8ben TdaAnamaria Suciu100% (1)

- Return On Investments.: Measuring Rate of ReturnDocument10 pagesReturn On Investments.: Measuring Rate of ReturnSaloniNo ratings yet

- Exam (3) ASDocument6 pagesExam (3) ASUsama AslamNo ratings yet