Professional Documents

Culture Documents

Tutorial 5

Tutorial 5

Uploaded by

Ramsha ShafeelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 5

Tutorial 5

Uploaded by

Ramsha ShafeelCopyright:

Available Formats

BOND MARKETS I

Section A. Discuss the following questions in your tutorial class

1) Contrast investors’ use of capital markets with their use of money markets.

Investors use capital markets for long-term investment purposes. They use money markets,

which have lower yields, primarily for temporary or transaction purposes.

2) What are the primary capital market securities, and who are the primary

purchasers of these securities?

Stocks and bonds. Most of these are purchased by and owned by households. They do this

through financial intermediaries

3) After a careful financial analysis, MacTab top management determines that it

needs to raise funds by issuing debt instruments to finance a new plant to meet

the increased demand for its products. As issuing a short-term debt instrument is

cheaper than a long-term bond, one of the managers of MacTab suggests

financing this plant by issuing money market securities, such as commercial

paper. As a financial analyst, evaluate the manager’s suggestion.

As long as interest rates do not rise, all is well: When these short-term securities mature, they

can be reissued at the same interest rate. However, if interest rates rise, as they did

dramatically in 1980, the firm may find that it does not have the cash flows or income to

support the plant because when the short-term securities mature, the firm will have to reissue

them at a higher interest rate. If long-term securities, such as bonds or stock, had been used,

the increased interest rates would not have been as critical. The primary reason that

individuals and firms choose to borrow long-term is to reduce the risk that interest rates will

rise before they pay off their debt. This reduction in risk comes at a cost, however. Most

long-term interest rates are higher than short-term rates due to risk premiums. Despite the

need to pay higher interest rates to borrow in the capital markets, these markets remain very

active.

4) What are the three types of information an investor can obtain from looking at a

bond certificate? Define each of these.

The par value is the amount the issuer will pay the holder when the bond matures. The

coupon interest rate is multiplied times the par value to determine the interest payment the

issuer must make each year. The maturity date is when the issuer must pay the holder the

par value.

5) Explain what a sinking fund is and whether investors like bonds that contain this

feature?

A sinking fund contains funds set aside by the issuer of a bond to pay for the redemption of

the bond when it matures. Because a sinking fund increases the likelihood that a firm will

have the funds to pay off the bonds as required, investors like the feature. As a result, interest

rates are lower on securities with sinking funds.

6) Discuss three characteristics of corporate bonds in details.

- Restrictive covenants:

A loan covenant is a condition in a commercial loan or bond issue that requires the borrower

to fulfil certain conditions or which forbids the borrower from undertaking certain actions, or

which possibly restricts certain activities to circumstances when other conditions are met.

Affirmative loan covenant – I will follow – requires the borrower – e.g. periodically filing

financial statement with the bank

Negative loan covenant – I will not – restrict the borrower – e.g. taking on new debt,

participating in mergers etc… must get lender approval before doing stuff.

- Call provisions:

It is a stipulation on the contract for a bond or other fixed instruments that allows the issuer to

repurchase and retire the debt security. A call provision refers to a clause in a bond

purchase…

- Conversion:

A convertible bond is a fixed income corporate debt security that yields interest payments but

can be converted into a predetermined number of common stock or equity shares. The

conversion from the bond to stock can be done at certain times during the bond’s life

7) The inflation rate has been unusually low for years and it has been ignored

easily. However, over time, like a 30-year retirement, it can still do a lot of

damage. After 20 years, inflation averaging the Federal Reserve's target of 2

percent would reduce a dollar's buying power to 67 cents. For long-term

investors, investments on stocks and real estate offer some inflation protection.

However, bonds can be badly hurt by inflation, which erodes the value of the

bond's principal and interest earnings, often driving bond prices down. As a

financial consultant recommend a bond to a conservative investor who is

concerned with maintain purchasing power. Explain the reason underlying your

recommendation.

8) You are a financial analyst providing consultancy to a fund manager who has

decided to invest in bonds backed by the full faith and credit of the government.

You inform the fund manager that the results of your analysis indicate a decline

in interest rates in the future. The fund manager tells you that he intends to take

greater exposure to price movements. As the financial analyst, recommend a

bond to the fund manager. Explain the reason underlying your recommendation.

9) Compare general obligation bonds and revenue bonds.

General obligation bonds, also called GOs, are bonds that are backed by the “full faith and

credit” of the issuer, with no specific project identified as the source of funds to repay the

bond obligation.

In other words, the municipal issuer can make interest and principal payments using any

source of revenue available to them, such as tax revenues, fees, or the issuance of new

securities. This means that if the municipality encounters fiscal difficulty, it can raise taxes to

offset the shortfall. GOs are therefore seen as being relatively safe, and defaults are rare.

It is far less likely that an entire municipal government will face serious financial difficulty

than for a specific municipal project to fail to generate its anticipated income. Investors can

buy GO bonds directly, but there are several mutual funds and exchange-traded funds (ETFs)

that make the process easier by specializing in general obligation securities. Among them is

Vanguard's Tax-Exempt Bond ETF (symbol VTEB), a passively managed municipal bond

index security. Investing in a municipal bond fund or ETF offers a degree of diversification

unavailable to all but the most affluent investors.

Revenue bonds are another type of muni bond that is backed by the revenue generated by a

specific project being financed by the bond issue. In other words, the money raised by the

bond offering directly finances the project, and the project—once complete—generates the

revenues to pay back the interest and principal on the bonds to investors.

Projects could include hospitals, airports, toll roads, housing projects, convention centres,

bridges, and similar endeavours. Revenue bonds are generally of higher risk than general

obligation bonds, and as a result, they typically offer higher yields.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CGTMSE MMS Final Summer ProjectDocument36 pagesCGTMSE MMS Final Summer ProjectSuresh Kadam50% (4)

- Gap Thesis and The Survival of Informal Financial Sector in NigeriaDocument6 pagesGap Thesis and The Survival of Informal Financial Sector in NigeriaMadiha MunirNo ratings yet

- Topic 3 Interest RatesDocument6 pagesTopic 3 Interest RatesRamsha ShafeelNo ratings yet

- How Etsy, Inc. Can Tackle The Threats of New EntrantsDocument3 pagesHow Etsy, Inc. Can Tackle The Threats of New EntrantsRamsha ShafeelNo ratings yet

- Tutorial 1: 1. What Is The Basic Functions of Financial Markets?Document6 pagesTutorial 1: 1. What Is The Basic Functions of Financial Markets?Ramsha ShafeelNo ratings yet

- Organisational StudiesDocument11 pagesOrganisational StudiesRamsha ShafeelNo ratings yet

- Appendix A Clockwork OrangeDocument11 pagesAppendix A Clockwork OrangeRamsha ShafeelNo ratings yet

- Example Who Uses The Selling ConceptDocument1 pageExample Who Uses The Selling ConceptRamsha ShafeelNo ratings yet

- Ratio Analysis of SketchersDocument8 pagesRatio Analysis of SketchersRamsha ShafeelNo ratings yet

- Company Tagline Analysis - KFC and The Body ShopDocument8 pagesCompany Tagline Analysis - KFC and The Body ShopRamsha ShafeelNo ratings yet

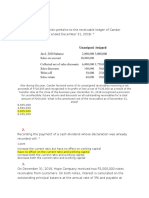

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Business Finance: Short Term and Long Term FundsDocument14 pagesBusiness Finance: Short Term and Long Term FundsJanna GunioNo ratings yet

- ULI China Goes GlobalDocument51 pagesULI China Goes GlobalMalcolm RiddellNo ratings yet

- Short Term & Long Term FinancesDocument22 pagesShort Term & Long Term Financesjaydee_atc5814100% (3)

- Project Planning and FinanceDocument79 pagesProject Planning and FinanceajayghangareNo ratings yet

- United States District Court For The District of ColumbiaDocument205 pagesUnited States District Court For The District of Columbialarry-612445No ratings yet

- 2 RTP CompressedDocument416 pages2 RTP CompressedVikash JhaNo ratings yet

- G.R. No. L-48359. March 30, 1993Document8 pagesG.R. No. L-48359. March 30, 1993sophia100% (1)

- Summary of Significant Accounting PoliciesDocument6 pagesSummary of Significant Accounting PoliciesCaptain ObviousNo ratings yet

- Loan Agreement (3743902)Document5 pagesLoan Agreement (3743902)Nichole Joy XielSera TanNo ratings yet

- Priyanka RajputDocument48 pagesPriyanka RajputNitinAgnihotriNo ratings yet

- Vodafone Mobile Services LimitedDocument3 pagesVodafone Mobile Services Limitedczarina210No ratings yet

- Understanding Mortgage Documents PDFDocument4 pagesUnderstanding Mortgage Documents PDFfarzana25No ratings yet

- Banking - Theory and Practices 18MBAFM31-1Document88 pagesBanking - Theory and Practices 18MBAFM31-1Nandeep Hêãrtrøbbér50% (2)

- Full Business Plan Module 1Document52 pagesFull Business Plan Module 1Kassim KassimNo ratings yet

- Task 1Document36 pagesTask 1Abbos KhasanOffNo ratings yet

- Pas 7Document11 pagesPas 7Princess Jullyn ClaudioNo ratings yet

- Basel II Assessing Default and Loss Characteristic of Proj Fin LoansDocument13 pagesBasel II Assessing Default and Loss Characteristic of Proj Fin LoansSoumya Ranjan PradhanNo ratings yet

- TraTax Slides - ACCA TP Event - 210412Document46 pagesTraTax Slides - ACCA TP Event - 210412vedhaNo ratings yet

- Measuring Bank PerformanceDocument8 pagesMeasuring Bank PerformanceNoor SalmanNo ratings yet

- Yes Securities - Subscribe - TMBDocument28 pagesYes Securities - Subscribe - TMBRojalin SwainNo ratings yet

- Bulk Upload Template v3.1Document38 pagesBulk Upload Template v3.1satishNo ratings yet

- Consolidated Agency Case DigestDocument41 pagesConsolidated Agency Case DigestArchie AgustinNo ratings yet

- In The High Court of Delhi at New Delhi: Reserved On: 27 January, 2022 Date of Decision: 24 March, 2022Document43 pagesIn The High Court of Delhi at New Delhi: Reserved On: 27 January, 2022 Date of Decision: 24 March, 2022Sakina AbedinNo ratings yet

- Promissory Note Legal NoticeDocument5 pagesPromissory Note Legal NoticeSagar Balu100% (1)

- Role of Financial Markets and InstitutionsDocument26 pagesRole of Financial Markets and Institutionsshomy02No ratings yet

- CBS FaqDocument138 pagesCBS FaqKallol DasNo ratings yet

- Unit - 2: Income From House Property: After Studying This Chapter, You Would Be Able ToDocument47 pagesUnit - 2: Income From House Property: After Studying This Chapter, You Would Be Able Toadityaraj purohitNo ratings yet