Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

Tanvi Verekar0 ratings0% found this document useful (0 votes)

35 views6 pagesFee Based products of union bank of India insurance and investment. Mutual Funds are funds that pool the money of several investors to invest in eq uity or debt markets.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFee Based products of union bank of India insurance and investment. Mutual Funds are funds that pool the money of several investors to invest in eq uity or debt markets.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

0 ratings0% found this document useful (0 votes)

35 views6 pagesUntitled

Untitled

Uploaded by

Tanvi VerekarFee Based products of union bank of India insurance and investment. Mutual Funds are funds that pool the money of several investors to invest in eq uity or debt markets.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

You are on page 1of 6

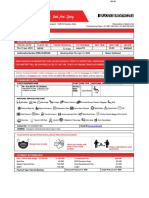

Fee Based Products of Union Bank of India

Insurance and investment

Union bank provides platforms for proper investment like Insurance, Mutual Funds

etc;

Insurance:

The Products which union bank offers:

Savings Plan

Endowment Assurance

Children Plan

Money Back Plan

Investment Plan

Single Premium Whole Life Policy

Protection Plans

Term Assurance

Loan Cover Term Assurance Plan

Retirement Plan

Personal Pension Plan

Other Attractive Plans

Key Man Insurance

Partnership Insurance Plan

Employer – Employee Insurance Plan

Unit Linked Insurance Plan.

ISSUE AGE: Issue age of the policyholder is calculated as age attained (i.e. las

t birthday).

Optional benefits:

Choice of adding optional benefits to basic plan to create ideal insurance solut

ion to suit the needs of customer is available with selected plans. Customers ca

n choose any of the following benefits.

CI*: Critical Illness Benefit,

*CI: Critical Illnesses applicable are cancer, coronary artery bypass graft sur

gery, heart attack, kidney / renal failure, major organ transplant (as recipient

) and stroke

DSA: Double Sum Assured benefit,

ADB : Accidental Death Benefit,

WOP: Wavier of Premium Benefit.

All optional benefits must be selected at the outset of the plan

Union Health Care

Mediclaim Insurance Product in tie-up with The New India Assurance Co Ltd, which

will provide the insurance cover

Scheme available for Union Bank Customers, irrespective of the fact whether they

are maintaining SB/CD/Deposit Account or having Demat, Borrower Account, Debit

Card and Credit Card

Group Floater Insurance for a family of maximum four persons (Customer, his/her

spouse and two dependent children)

Entry up to 65 years of age and it can be renewed up to the age of 80 years

Sum Assured is offered in the range of Rs.50,000/- to Rs.3,00,000/- per family,

as per the Insured’s desire

Very competitive premium due to group-floater nature of the product

Premium paid under this policy will be eligible for deduction under S/80D of Inc

ome Tax Act

Mutual Fund

Mutual funds are funds that pool the money of several investors to invest in eq

uity or debt markets. Mutual Funds could be Equity funds, Debt funds or balanced

funds.

Funds are selected on quantitative parameters like volatility, risk adjusted ret

urns, rolling return coupled with a qualitative analysis of fund performance and

investment styles through regular due diligence processes.

Mutual Fund products of all leading AMC’s are made available to their customers th

rough all major CBS branches across the country with the help of AMFI Certified

Marketing Officers.

The reason that mutual funds are so popular is that they offer the ability to ea

sily invest in increasingly more complicated financial markets. A large part of

the success of mutual funds is also the advantages they offer in terms of divers

ification, professional management and liquidity.

Union Gold

As per RBI guidelines, the precious metals Gold, Silver and Platinum can be impo

rted by the nominated agencies such as Minerals & Metals Trading Corporation and

Banks on consignment basis or on fixed price basis.

* Union Bank has been one of the Banks nominated for import of precious metals m

entioned above.

* The Import and sale of gold will be carried under the separate scheme by name

Union Gold

• Import of Gold on Consignment Basis:

Gold may be imported by the nominated agencies as mentioned above where the owne

rship of the gold will remain with the supplier of the Gold and the importer (Ba

nk) will be acting as an agent. Remittance towards the cost of import of gold sh

all be made as and when the Bank sells the gold as per the agreed terms and cond

itions with the supplier. The Import of Gold through this mode is more.

• Import of Gold on unfixed prices:

The Bank may import gold on outright purchase basis subject to the condition tha

t although ownership of the gold shall be passed on to the Bank at the time of i

mports itself. The price of the gold shall be fixed later as and when the Bank s

ells the gold to users.

As per RBI guidelines, Bank has to collect 100% margin in cash for the provision

al value of gold and suitable additional margin (normally 10%) to take care of p

rice fluctuation.

In any case, the price has to be fixed by the Bank and the payments are to be se

ttled within a period of five days.

* Bank had captive clients who were dealing in bullion with other nominated agen

cies since decades. By introducing this product, these clients have diverted the

ir business through Union Bank.

* In the process, the bank has nominated the following Branches to deal in gold;

(i) Zaveri Bazaar Branch, Mumbai.

(ii) M.SMarg Branch, Mumbai.

(iii) Overseas Branch, Kolkotta.

(iv) Ellis Bridge, Ahmadabad.

(v) IFB Branch, Bangalore.

(vi) Coimbatore Main Branch.

(vii) Overseas Branch at SEEPZ ++, Mumbai.

(viii) Ramkote Branch, Hydrabad.

(ix) Chennai Main, Chennai

(x) Overseas Branch, Ernakulam

(xi) Karol Bagh.

UNION BULLION

* In terms of Gold import guidelines of FEMA, Authorized Dealers are permitted t

o extend loan under the agreed terms with the supplier of the gold.

* In tune with this, Union Bank has also come out with its own scheme for financ

ing the working capital requirements of importers given below:

Import of gold for the purpose of export:

- The export has to be completed within a maximum period of 90 days from the dat

e of release of gold on loan basis.

- The price of gold to be fixed within 180 days from the date of shipment.

Domestic Jewellery Manufacturers:

- The price of gold has to be fixed within 90 days from the date of release of g

old on loan basis.

GOLD FORWARD

* The importers can hedge their Gold exposures by booking forward contracts with

the Bank, which will take care of their price risk.

* This forward contract can be booked for a maximum period of 180 days in terms

of RBI guidelines.

Credit cards

UNION BANK OF INDIA IN ASSOCIATION WITH VISA INTERNATIONAL

Union Bank of India in association with VISA International is offering its Inter

national credit card ‘Union Card”-Classic, Silver & Gold. The card is marketed throu

gh the Branch network of over 2000 of Union Bank of India throughout India. The

card is widely accepted across the globe at over three crore-member establishmen

ts.

ELIGIBILITY

Minimum annual income criteria of Rs.60000/per annum for salaried class, Rs.8000

0/per annum for self-employed and Professionals. Our Depositors who cannot give

any Income Proof but maintain a minimum unencumbered deposit of Rs.25000/ are al

so eligible for Credit Cards.

Category Age Eligibility Minimum Annual Gross Income Eligibility(Rs.

In lacs)

Classic Silver Gold

Salaried Over 21 years & Under 60 years 0.60 1.00 3.00

Self employed & Professional Over 21 years & Under 65 years 0.80 1.20

3.50

Union Bank deposit holders Over 21 years Any depositor with a minimum of

Rs.25000 deposit in his name, can get a Credit card upto 100% of the deposit amo

unt Free of Cost. The Deposit receipt is to be discharged and handed over to the

Branch, which will be kept under line.

GLOBAL ACCEPTANCE:

Accepted, worldwide, at all Merchant Establishments (ME) where VISA logo is disp

layed.

CASH ADVANCE:

Cardholder can have access to Cash Advance round the clock at all ATMs of Union

Bank of India, and ATMs where VISA logo is displayed, in India and abroad.

PHOTO CARDS:

Cards are issued with photograph and signature of the cardholder printed for enh

anced safety.

SPENDING LIMIT:

25% of annual income with a minimum of Rs.15000 and a maximum of Rs.5.00 lacs.

ACCIDENT INSURANCE:

Free Accident Insurance cover ranging from Rs.1 lac to Rs.8 lacs depending on th

e type of card.

Type of Card Other than Air Accident(Rs. In Lacs) Air Accident(Rs. In Lacs

)

Classic 1.0 2.0

Silver 2.0 4.0

GOLD 5.0 8.0

There are no pre conditions like, for claiming accident insurance benefits; the

cardholder must have utilized his card at least a certain number of times before

.

LOST CARD LIABILITY:

Lost card liability of the Cardholder is restricted to Rs.1000 in case of misuti

lisation after report to Bank / VISA.

REWARDS PROGRAMME:

One Reward point for every Rs.100/ worth of purchases through Merchant Establish

ments, which can be accumulated and redeemed against renewal fees.

FREE CREDIT PERIOD:

Free credit period ranging from 20 to 50 days depending on the date of purchase.

Get upto 50 days of free credit on your purchases, on payment of full bill amoun

t. Monthly bills are generated on 20th of every month, and payment due date woul

d be 10th of succeeding month.

FLEXI PAYMENT:

Option to pay a minimum of 10% of the outstanding amount and option to carry ove

r the balance.

LOWEST RATE OF INTEREST:

Lowest interest rate of 20.40% per annum only on the outstanding balance on dail

y product basis.

Classic:

a) 25% of Annual gross income reported with a minimum limit of 15000/.

Silver:

b) 25% of Annual Gross Income reported with a minimum of Rs.25000/.

Gold:

c) 25% of Annual gross income or Rs.1 lac whichever is higher.

GET CASH ANYTIME, ANYWHERE

Get quick access to cash advance upto 20% of credit limit through any of ATMs of

Union Bank of India, and any ATM where VISA logo is displayed in India and abro

ad. Interest @ 24% per annum along with Service tax will be charged on the cash

withdrawals.

ADD ON CARDS:

Cardholders have the advantage of applying for two add-on members on his/her car

d. Add on cards are issued only to the following family members: spouse, Major s

on, Major unmarried daughter & parents.

DOCUMENTS REQUIRED:

1) Salaried Class

• For Persons working in Govt./PSU/Listed Companies/ consultancies /Multinational

companies

a) Salary slip (Last one month)

b) Computer pay slip (last 1 month)

c) Salary certificate

d) Form 16

e) IT return ack copy (last financial year)

• For Persons working in Pvt ltd companies/Trading concernsProp. / Partnership fir

ms

a) Computer pay slip (last 1 month)

b) Salary certificate (As per Annexure VI)

c) Form 16

d) IT return ack copy (last financial year)

2) Self employed/Business segment

• For Proprietors / PartnershipsQualified professionals/Agents / Contractors

a) IT Return (for the last financial Year)

b) Form 16 A

LOWEST ANNUAL MEMBERSHIP FEE:

All the above features are available at a very nominal fee. We do not charge any

thing, which is not mentioned in the Schedule of charges.

Particulars Classic Silver Gold

Entrance fee Waived as an introductory offer Waived as an introductory offer

Waived as an introductory offer

Renewal Fee Rs.200 Rs.300 Rs.500

Add on card Rs.50 Rs.100 Rs.250

Finance charges on Roll over amount 20.40 % per annum 20.40 % per annu

m 20.40 % per annum

Cash Advance Charges for cash withdrawal 24% per annum 24% per annum

24% per annum

Cash advance on credit limit 10% of limit Min 2000/. 10% of limit 10% of l

imit

Cash Advance charges at our Bank ATM Rs.50 per transaction Rs.50 per transa

ction Rs.50 per transaction

Cash Advance charges at other Bank ATMsIn India Rs.75 per transaction Rs.75 pe

r transaction Rs.75 per transaction

Cash Advance charges (Overseas) Rs.125 per transaction Rs.125 per transaction

Rs.125 per transaction

Late fee payment charges Rs.100 Rs.100 Rs.100

Charges for over the credit limit usage Rs.100 for Each Occasion Rs.100 f

or Each Occasion Rs.100 for Each Occasion

Returned cheque Rs.100 per instrument Rs.100 per instrument Rs.100 per instr

ument

Limit enhancement fee Rs.100 for each occasion Rs.100 for each occasion

Rs.100 for each occasion

Card Replacement fee Rs.100 Rs.100 Rs.100

Retrieval of charge slip as levied by VISA Rs.100 or the actual charges whi

chever is higher Rs.100 or the actual charges whichever is higher

Rs.100 or the actual charges whichever is higher

PIN Replacement Fee Rs.50 Rs.50 Rs.50

Service Tax As applicable from time to time.Presently it is 10.20% As appli

cable from time to time.Presently it is 10.20% As applicable from time to time.

Presently it is 10.20%

Renewal Fee is waived if used for more than Rs. 25000 in the previous 12 months

ATM SERVICES

A T M (Automated Teller Machine) facilitates the customer to do Banking transact

ions such as Cash withdrawal, balance enquiry, obtaining mini-statement, transfe

r of funds between his/her own accounts etc. Union Bank of India tied up with Vi

sa for issuing International Debit Cards to the customers of all its branches. T

he Debit Card provides ‘ANY TIME / ANY WHERE’ Banking to the customers. Presently, B

ank has 1276 ATMs (As on 30.06.2008) which are on-line , conveniently located an

d spread across the country. The Debit Card can also be used for making purchase

s. The daily withdrawal limit through ATMs is Rs.25000/- and the limit for makin

g purchases is Rs.25,000/- (combined limit Rs.50,000/-).

Issue of ATM cum Debit Card to customer is made very simple and most convenient.

A Ready kit containing both Debit Card and Pin are handed over to the customer

immediately on opening of the account and in case of existing customers, the sam

e is provided immediately on demand. The Debit Card is activated on the next wor

king day. There is absolutely no waiting period for obtaining the Debit Card fro

m the Bank. Experience for yourself by opening an account with any of our CBS br

anches and getting the Ready kit instantly. .

The Debit card gets activated only when it is used along with PIN at ATM for cas

h withdrawal. Only after the first transaction at ATM, the customer will be able

to use the Debit Card for making purchases.

For providing better facility and wider acceptance of the Debit Card, the Bank h

as entered into ATM sharing arrangements with Cash Tree Group, SBI group, NFS gr

oup and VISA. Under these arrangements Union Bank cardholder can access over 320

00 ATMs of 42 banks across the country

Union Bank has completely freed the transaction charges for using it’s cards in an

y other Bank’s ATM all over India.

International Transactions – 2% Currency Conversion charges extra

Other Benefits:

1. Free Insurance against Accidental death of principal card holder Rs.2.00 lacs

and in case of Add on cardholder – Rs.1.00 lac.

2. Lost card liability restricted to Rs.1, 000 from the time of reporting the lo

ss.

3. Multiple account access: The customer can get 3 accounts linked to the Card.

4. Issue of Add on Card in case of Joint accounts with Either or Survivor mandat

e.

Charges:

No joining fee or Annual fee is collected during the first year of issue. From s

econd year onwards, an annual fee of Rs.100/- is collected and the same is waive

d for customers maintaining an average quarterly balance of Rs.5, 000 in the acc

ount.

Replacement of Lost card attracts charges of Rs.100/-.

Regeneration of Pin Rs.25/-.

Validity: The Debit card is valid for 5 years from the date of issue.

Cardholder should sign in the signature panel on reverse of the Card immediately

on obtaining from the Bank.

Kisan ATM

As technology is spreading its wings across the length and breadth of the countr

y, a need was felt by Bank to provide its customers in rural areas with an ATM w

hich is easy to operate, does not warrant high level of literacy, remembering PI

NS and can read out instructions on screen to get cash or services. As a solutio

n to this Bank plans to deploy Kisan ATMs in rural areas to serve the customers

of our remote rural branches. The first such ATM is installed at Sivagangai bran

ch Tamilnadu and inaugurated by the Hon’ble Finance Minister Shri P. Chidambaram.

Kisan ATMs are user-friendly cash dispensing machines, which are voice enabled a

nd work on bio-metric authentication like finger print verification. Kisan ATMs

can communicate with the users in local language. To make the operations easier

Kisan ATMs are provided with touch screen monitor. The screen options glow as th

e instructions are read out to the customer and the customer needs only to touch

the option desired by him. The ATMs also have dip-type card reader and hence en

sure that the machine never captures the card inserted by the customer. All the

above features make these ATMs so easy and convenient that people with practical

ly no exposure to technology can use it comfortably.

Kisan ATM cards

Bank has issued a new series of cards for the Kisan ATMs. The cards have an attr

active design.

ATM Functions

The ATM will support the following functions:

1. Cash Withdrawal

2. Balance Enquiry

ATM operation

Kisan ATMs are meant to bring in 24x7 banking facilities with the state of art t

echnology, which was so far available only to metro and urban population now wit

hin the reach of rural masses and thus providing an much needed fillip for Finan

cial Inclusion.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Primetel Mybill 5005970322Document4 pagesPrimetel Mybill 5005970322Cristina CrisNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nilson Report 1071Document11 pagesNilson Report 1071asdfNo ratings yet

- 2019 COSN Xentry Info Pack (Information Pack) V5 PDFDocument43 pages2019 COSN Xentry Info Pack (Information Pack) V5 PDFGEL AutomotiveNo ratings yet

- LTI CertificateDocument2 pagesLTI CertificateAkshay PatilNo ratings yet

- Refund and Compensation Policy Uolw 2019Document5 pagesRefund and Compensation Policy Uolw 2019Saloni KamatNo ratings yet

- WeLIke Project Hemant KadamataDocument50 pagesWeLIke Project Hemant Kadamataarya1017No ratings yet

- Ye Paing Kyaw (CV)Document3 pagesYe Paing Kyaw (CV)thanh nguyen trongNo ratings yet

- Research Paper Credit CardsDocument4 pagesResearch Paper Credit Cardsxfeivdsif100% (1)

- OprTxnHistDetails22 02 2020Document27 pagesOprTxnHistDetails22 02 2020BhagirathNo ratings yet

- Ergun 20 Feb 24Document10 pagesErgun 20 Feb 24GuilhermeNo ratings yet

- Bank StatementDocument8 pagesBank StatementKayla McKnightNo ratings yet

- Allstate Liability MoanoDocument4 pagesAllstate Liability MoanoMichael ClorNo ratings yet

- Cost To Cost: Cost To Cost Whatsapp No: 9971603088 No Extra Charges On Credit/Debit Card PaymentDocument8 pagesCost To Cost: Cost To Cost Whatsapp No: 9971603088 No Extra Charges On Credit/Debit Card PaymentvprNo ratings yet

- Questionnaire For BankDocument5 pagesQuestionnaire For BankRajendra Patidar100% (1)

- StatementDocument2 pagesStatementtariqmehfooz7No ratings yet

- DownloadDocument6 pagesDownloadanip amirNo ratings yet

- Customer Information Record (Cir)Document3 pagesCustomer Information Record (Cir)Mark JosephNo ratings yet

- PKI Consultant - Wajid HussainDocument5 pagesPKI Consultant - Wajid HussainWajid HussainNo ratings yet

- How To Reach Us: Account Summary Account #Document4 pagesHow To Reach Us: Account Summary Account #jmsmithNo ratings yet

- BCA Academy CourseDocument2 pagesBCA Academy Coursengsw9999No ratings yet

- Digitalization in BankingDocument18 pagesDigitalization in Bankingप्रवीण घिमिरेNo ratings yet

- Soc Wef 311017Document18 pagesSoc Wef 311017sohel311094No ratings yet

- Credit & Debit ProcessDocument57 pagesCredit & Debit ProcessLincolnNo ratings yet

- Op4291791 Let12msifnlagl Cop8366301 00000000005f5ukpDocument2 pagesOp4291791 Let12msifnlagl Cop8366301 00000000005f5ukpcanciones8652No ratings yet

- National Bank of Pakistan Internship ReportDocument74 pagesNational Bank of Pakistan Internship Reportbbaahmad89No ratings yet

- BS Wira SartikaDocument1 pageBS Wira SartikaJGL MOTORNo ratings yet

- One Network Bank 2011 Financial StatementDocument41 pagesOne Network Bank 2011 Financial StatementKathrina Grace YapNo ratings yet

- International Payment SystemsDocument2 pagesInternational Payment SystemsPrerna SharmaNo ratings yet

- Toaz - Info Spicejet Ticketpdf PRDocument2 pagesToaz - Info Spicejet Ticketpdf PRPintu Tetarwal DujodNo ratings yet

- Project Harsh - PDFDocument94 pagesProject Harsh - PDFJenisha SolankiNo ratings yet