Professional Documents

Culture Documents

Risk Management Policy

Risk Management Policy

Uploaded by

sandeepOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management Policy

Risk Management Policy

Uploaded by

sandeepCopyright:

Available Formats

RISK MANAGEMENT POLICY

BACKGROUND

Across industries and organizations, there is now a recognition that risks are no longer hazards to

be avoided, but, in many cases, opportunities to be embraced. Risk, therefore, needs to be

understood, priced and managed. In this context, Enterprise Risk Management (ERM) has

emerged as important business trend. ERM is a structured and disciplined approach aligning

strategy, processes, people, technology and knowledge for evaluating and managing

uncertainties faced by an enterprise. Business needs should, therefore, seek to analyze critical

risks and balance them with business objectives for improved returns and to drive value.

OBJECTIVE

In order to enhance stakeholder value and improve Corporate Governance, a structured ERM

approach has to be introduced in the Company. This policy seeks to define a process for adoption

so that a structured, disciplined and consistent risk strategy, providing guidance for risk activity

within the Company by embedding ERM within the culture of the business. This Policy will more

than meet the mandatory requirement of Risk Management under Clause 49 of the Listing

Agreement.

RISK MANAGEMENT PROCESSES

1. Risk Strategy:

a. A risk strategy will be framed to minimize the risk and to align further to the objective of

the company.

b. Corporate Management Team (CMT) will be responsible to initiate benchmarking efforts in

external similar industries to ensure that risk factors identified are exhaustive action plans

drawn are realistic and implementation rate is adequate.

c. The Company has appointed CFO as its Risk Champion.

d. Risk Champion shall define risk taking capacity or risk appetite considering the Company’s

existing business processes.

e. Risk Champions shall identify controls, which are existing, to mitigate identified risk. For

the purpose Risk Champion would interview management personnel and review

operations/documents, as may be necessary, to identify and evaluate existing controls.

f. Existing controls will be validated for existence and effectiveness and will be matched

against specific risk, to ascertain residual risk. If the residual risk is beyond the risk appetite,

action points for reducing residual risk to acceptable level will be developed.

Ipca Laboratories Limited Page 1/4

RISK MANAGEMENT POLICY

g. Action points/risk response will be developed for top risk. Risk response will range

between avoidance, sharing, reduction or acceptance.

2. Formulation of Risk Processes:

a. CMT will define and recommend a risk appetite, risk strategy, key performance

indicators/success measures and a monitoring process for implementation/ feedback in

order to embed Enterprise Risk Management (ERM) in the business culture.

b. CMT shall validate existing risk processes and formulate new risk processes, wherever

necessary. CMT along with CFO and Internal Audit Department, will be responsible for

formulating the said risk processes.

c. In order to facilitate risk management activities for the future, the Company will initiate

efforts to prepare manuals for critical procedures in all functional areas such as finance,

materials and sales, information technology, cGMP etc. All these manuals would be made

ready by March, 2015.

d. All company personnel have a responsibility for maintaining good internal control and

managing risk in order to achieve personal, team and corporate objectives. Hence, it is

essential that every responsible person in the organisation is aware of the risk they are

empowered to take, risk which needs to be avoided and needs to be reported upwards.

e. In order to enhance risk structure, the Company will have a document of delegated

powers in order to define responsibilities and authorities at various levels of management.

3. Identification and Assessment of Risks:

a. CMT shall consider all relevant questions for identification and assessment of risks.

b. Process owners of each key processes undertake detailed study and prepare a list of

potential risk. Internal Auditors will facilitate process owners for identification of risk

through interviews with process owners and by reviewing process documents for

validating and acceptance and adequacy of risk identification mechanism.

c. Risk Champion will review and assess various risk/opportunities for each key process of

the business, whether internal or external. An understanding of the objectives and

associated critical factors will be gained through a review of business plans. External

factors covering aspects of risks such as economy, technology, natural environment,

political and social risk and internal factors covering risk of infrastructure, personnel and

process technology will be covered through interviews with management personnel at all

levels.

Ipca Laboratories Limited Page 2/4

RISK MANAGEMENT POLICY

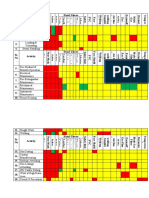

4. Quantification of Risks:

a. All risk and opportunities emanating from the review will be quantified for inherent

impact and likelihood of using pre-defined scale of measurement and an inherent risk

exposure will be worked out at the company, division and business levels, as detailed

below:

Impact Likelihood

Insignificant Rare

Minor Unlikely

Moderate Moderate

Major Likely

Catastrophic Almost certain

All efforts would be made for mitigating risks between moderate and certain likelihoods

and moderate and catastrophic impacts.

b. All the significant recurring and abnormal risks and opportunities identified and grouped,

as above, would be presented before CMT in order to gain acceptability and to arrive at a

consensus score for likelihood and impact and to establish accountability for risk

mitigation.

5. Monitoring/Reporting Process:

a. A risk register providing all details of risk and action plans will be maintained by both chief

internal auditor and CFO so that tracking is done at the corporate level.

b. Internal Audit Department for consideration with CMT will develop reporting templates

for reports to Board.

c. Internal Audit Department, in consultation with CMT will evolve an audit plan based on

the nature of risk.

d. Risk management is a continual activity. For ease of implementation and convenience, risk

review will be carried out on quarterly basis and reports also will be tabled before audit

committee periodically for subsequent action.

Ipca Laboratories Limited Page 3/4

RISK MANAGEMENT POLICY

6. Training:

a. To ensure widespread understanding, Chief Internal Auditors/CFO would make a

presentation before the CMT as also operational/business unit managers to elucidate and

clarify the concept of risk management.

b. Internal Audit Department in consultation with CMT will assess and define training

requirements for company’s personnel, including process owners and Risk Champion.

c. CMT and Chief Internal Auditor would undertake training programme for its

business/operational managers to acquaint them with the risk management concept,

define their requirements thereunder, clarify process to be adopted in future and to keep

them abreast of the latest technology/knowledge in existence globally.

7. Legal Compliances:

In order to ensure an appropriate legal compliance, the following procedure will be followed:

a. Presently, under the Certification Procedure in place with the Company the applicable

laws of land have already been identified for various functions.

b. The functional heads furnish Certificates of Compliance to the Corporate Counsel &

Company Secretary which is based upon the Certification given by operational heads

responsible for Compliance within their function. The Company Secretary places the

Compliance Certificate before the Board of Directors.

c. The Internal Auditor of the Company will undertake a Due Diligence as part of their

Internal Audit Programme that the Certification at the operating level and functional level

is being adhered to.

d. The Chief Internal Auditor would prepare a report of non-compliance for every function

and send copy of the report to the Company Secretary along with action plans with

responsibility and time frame for implementation. This will also be tabled before the

Board.

Ipca Laboratories Limited Page 4/4

You might also like

- Summative Test - Attempt Review PDFDocument27 pagesSummative Test - Attempt Review PDFJohair BilaoNo ratings yet

- Compliance Risk ManagementDocument6 pagesCompliance Risk Managementarefayne wodajoNo ratings yet

- Small Company AuditDocument38 pagesSmall Company AuditShardulWaikarNo ratings yet

- Internal Audit CharterDocument3 pagesInternal Audit CharterMehmood Zubair WarraichNo ratings yet

- Slide 2 Introduction To Corporate GovernanceDocument20 pagesSlide 2 Introduction To Corporate Governancecohen.herreraNo ratings yet

- BDO-2019-Sustainability Report PDFDocument72 pagesBDO-2019-Sustainability Report PDFJohn Michael Dela CruzNo ratings yet

- Security Program ManualDocument39 pagesSecurity Program ManualBert CruzNo ratings yet

- Ethics Fraud Schemes and Fraud DetectionDocument31 pagesEthics Fraud Schemes and Fraud DetectionJosephine CristajuneNo ratings yet

- Substantive Audit For AssetsDocument7 pagesSubstantive Audit For AssetsHenry MapaNo ratings yet

- Vigil Mechanism Whistle Blower Policy, 25th April, 2019Document12 pagesVigil Mechanism Whistle Blower Policy, 25th April, 2019RashmiNo ratings yet

- Accepting An EngagementDocument4 pagesAccepting An EngagementRalph Ean BrazaNo ratings yet

- Internal Control WeaknessesDocument3 pagesInternal Control WeaknessesRosaly JadraqueNo ratings yet

- Annual Internal Audit PlanDocument8 pagesAnnual Internal Audit PlanMuri EmJayNo ratings yet

- Audit CharterDocument2 pagesAudit CharterbukhariNo ratings yet

- Credit Monitoring Policy - A Glimpse: Digital TrainingDocument9 pagesCredit Monitoring Policy - A Glimpse: Digital TrainingAjay Singh PhogatNo ratings yet

- PGIAM (October 6, 2011)Document295 pagesPGIAM (October 6, 2011)Michael CanaresNo ratings yet

- Section X 185 - Internal Control SystemDocument12 pagesSection X 185 - Internal Control SystemThessaloe B. FernandezNo ratings yet

- 4 To 6 CH AIS (Business Process and AIS)Document60 pages4 To 6 CH AIS (Business Process and AIS)arefayne wodajoNo ratings yet

- Credit MGT TraineesDocument20 pagesCredit MGT TraineesTewodros2014No ratings yet

- Source and Evaluation of Risks: Learning OutcomesDocument34 pagesSource and Evaluation of Risks: Learning OutcomesNATURE123No ratings yet

- Importance of Domestic InquiryDocument4 pagesImportance of Domestic InquiryizyanNo ratings yet

- Audit of Insurance Business - 2Document5 pagesAudit of Insurance Business - 2ANMOL GUMBERNo ratings yet

- Core Risks in BankingDocument9 pagesCore Risks in BankingVenkatsubramanian R IyerNo ratings yet

- Internal AuditDocument4 pagesInternal AuditeeghobamienNo ratings yet

- APP Company Profile FDocument5 pagesAPP Company Profile FMuhamad Alghifari AtmadjaNo ratings yet

- Auditing in CIS EnvironmentDocument35 pagesAuditing in CIS Environmentcyrileecalata31No ratings yet

- Audit Programme - Order To CashDocument14 pagesAudit Programme - Order To CashTang SamNo ratings yet

- EBC - Understand The Business TemplateDocument6 pagesEBC - Understand The Business TemplateBenjie AquinoNo ratings yet

- Asset Disposal PolicyDocument6 pagesAsset Disposal PolicySivasakti MarimuthuNo ratings yet

- Topic 2: Fraud Prevention: Bkaa3013 Forensic Accounting Semester A 182Document27 pagesTopic 2: Fraud Prevention: Bkaa3013 Forensic Accounting Semester A 182Riri MorganaNo ratings yet

- SOG - Internal Audit - BanksDocument19 pagesSOG - Internal Audit - BanksKofi GyanNo ratings yet

- Anti Bribery Anti Corruption PolicyDocument15 pagesAnti Bribery Anti Corruption PolicySrikanth TummalaNo ratings yet

- Financial Risk Management of Eurosystem Monetary Policy Operations 201507.enDocument52 pagesFinancial Risk Management of Eurosystem Monetary Policy Operations 201507.enZerohedgeNo ratings yet

- Audit: Airline CompanyDocument4 pagesAudit: Airline CompanyArianna Maouna Serneo BernardoNo ratings yet

- A. Engagement Letter From Client To CPA - PALACIODocument2 pagesA. Engagement Letter From Client To CPA - PALACIOPinky DaisiesNo ratings yet

- At 04 Auditing PlanningDocument8 pagesAt 04 Auditing PlanningJelyn RuazolNo ratings yet

- Ceo and Cfo CertificationDocument6 pagesCeo and Cfo CertificationNeha GeorgeNo ratings yet

- Internal Audit PlanDocument16 pagesInternal Audit PlankokoNo ratings yet

- Mechanisms For Complaints ResolutionDocument19 pagesMechanisms For Complaints ResolutionSmart Campaign100% (1)

- Daibb - Mfi: Default Risk PremiumDocument14 pagesDaibb - Mfi: Default Risk Premiumanon_904021637No ratings yet

- Audit and Working PapersDocument2 pagesAudit and Working PapersJoseph PamaongNo ratings yet

- General Audit Program ExampleDocument7 pagesGeneral Audit Program ExampleJane Michelle EmanNo ratings yet

- Instructor Mr. Shyamasundar Tripathy Management Faculty (HR)Document30 pagesInstructor Mr. Shyamasundar Tripathy Management Faculty (HR)Aindrila BeraNo ratings yet

- Week 2 CasesDocument11 pagesWeek 2 CasesRyan Christian LuposNo ratings yet

- Risk Management FrameworkDocument22 pagesRisk Management FrameworkGARUIS MELINo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementlintoNo ratings yet

- ALM Policy of HFCDocument13 pagesALM Policy of HFCSrinivasan IyerNo ratings yet

- Corporate Governance-As Defined by SECP (Pakistan)Document1 pageCorporate Governance-As Defined by SECP (Pakistan)tehreemNo ratings yet

- Internal Auditing and Fraud Investigation JobetaDocument12 pagesInternal Auditing and Fraud Investigation JobetatebogojobetaNo ratings yet

- National Bank of Ethiopia - Directives No. SBB-46-2010 - Customer Due Diligence of BanksDocument10 pagesNational Bank of Ethiopia - Directives No. SBB-46-2010 - Customer Due Diligence of Banksarefayne wodajoNo ratings yet

- Zelalem G. Audit II CHAP - THREE AUDIT OF RECIVABLE AND SALEDocument3 pagesZelalem G. Audit II CHAP - THREE AUDIT OF RECIVABLE AND SALEalemayehuNo ratings yet

- Audit MethodologyDocument20 pagesAudit MethodologyVikasAgarwalNo ratings yet

- Tests of ControlsDocument6 pagesTests of ControlsEvan RoymanNo ratings yet

- Credit Risk Management in BanksDocument34 pagesCredit Risk Management in BanksDhiraj K DalalNo ratings yet

- Tiner Insurance ReportDocument44 pagesTiner Insurance ReportNikhil FatnaniNo ratings yet

- Accounting Information Systems Basic Concepts and Current Issues 2nd Edition Hurt Test BankDocument5 pagesAccounting Information Systems Basic Concepts and Current Issues 2nd Edition Hurt Test BankSunny MaeNo ratings yet

- A1 - ICQ Agency Level ControlsDocument7 pagesA1 - ICQ Agency Level ControlsReihannah Paguital-MagnoNo ratings yet

- Sample Engagement LetterDocument5 pagesSample Engagement LetterRafaelDelaCruz100% (1)

- AssertionsDocument2 pagesAssertionsHaseeb KhanNo ratings yet

- Drug Free Work Place PolicyDocument6 pagesDrug Free Work Place PolicyGylleNo ratings yet

- National Fire Protection Association-GoogleDocument2 pagesNational Fire Protection Association-GooglesandeepNo ratings yet

- Ppe MatrixDocument2 pagesPpe MatrixsandeepNo ratings yet

- Ppe GoogleDocument2 pagesPpe GooglesandeepNo ratings yet

- Petition To WHO To Set Safe Air Quality Standard For PM1 - 1Document4 pagesPetition To WHO To Set Safe Air Quality Standard For PM1 - 1sandeepNo ratings yet

- National Fire Protection Association NFPA DiamondDocument13 pagesNational Fire Protection Association NFPA DiamondsandeepNo ratings yet

- 04 Organic ChemistryDocument17 pages04 Organic ChemistrysandeepNo ratings yet

- General ChemistryDocument2 pagesGeneral ChemistrysandeepNo ratings yet

- Compliance Specialist ResumeDocument8 pagesCompliance Specialist Resumeafjwfealtsielb100% (2)

- Aud4033 Isa - 220Document17 pagesAud4033 Isa - 220ALYA AFIQAH BINTI MAT RAMLANNo ratings yet

- HPCL CSR Social Audit ReportDocument56 pagesHPCL CSR Social Audit Reportllr_ka_happaNo ratings yet

- Annual Report 201819 PageIndustriesDocument126 pagesAnnual Report 201819 PageIndustriesRayana Bhargav Sai100% (1)

- Security Assessment and TestingDocument43 pagesSecurity Assessment and Testingsubas khanalNo ratings yet

- Compulsory Report Format and Procedures To Be PerformedDocument4 pagesCompulsory Report Format and Procedures To Be PerformedgoranacurgusNo ratings yet

- 1 Cost AccountingDocument31 pages1 Cost Accountingarchana_anuragiNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument26 pagesAuditing and Assurance Services: Seventeenth Edition, Global Edition賴宥禎No ratings yet

- Pfa Act 2011Document21 pagesPfa Act 2011Asif MerajNo ratings yet

- BAC3664 Topic 2 Regulation of Fin Reporting MMLR Trisem 3-2016Document67 pagesBAC3664 Topic 2 Regulation of Fin Reporting MMLR Trisem 3-2016Hanif NasrunNo ratings yet

- Situational Prevention and The Reduction of White Collar Crime by Dr. Neil R. VanceDocument22 pagesSituational Prevention and The Reduction of White Collar Crime by Dr. Neil R. VancePedroNo ratings yet

- Laporan Keuangan CMRY 31 Des 2021 (Audited)Document123 pagesLaporan Keuangan CMRY 31 Des 2021 (Audited)Annisa JasmineNo ratings yet

- F101-1 Client Information Form and ApprovalDocument4 pagesF101-1 Client Information Form and ApprovalgoyalpramodNo ratings yet

- Slsus500 - Audit EvidenceDocument12 pagesSlsus500 - Audit EvidencesamaanNo ratings yet

- The Charles Wolfson Charitable Trust Accounts 2008Document25 pagesThe Charles Wolfson Charitable Trust Accounts 2008Spin WatchNo ratings yet

- Agreed-Upon-Procedures by Outside Cpa Firm: The Episcopal Diocese of AtlantaDocument27 pagesAgreed-Upon-Procedures by Outside Cpa Firm: The Episcopal Diocese of AtlantaRonnelson PascualNo ratings yet

- APEDA Quality Manual PDFDocument77 pagesAPEDA Quality Manual PDFGANDHINo ratings yet

- Laporan Keuangan RAPP 2019Document50 pagesLaporan Keuangan RAPP 2019Mikhael Yudha Damara PurbaNo ratings yet

- Ethiopian SecretDocument16 pagesEthiopian SecretSofonias M. OpsNo ratings yet

- Hindalco 2014 PDFDocument211 pagesHindalco 2014 PDFAbhimanyu GuptaNo ratings yet

- Contemporary Issues in Business EthicsDocument215 pagesContemporary Issues in Business EthicsPooja Shrivastava100% (1)

- Class Examples On Conso AccDocument4 pagesClass Examples On Conso AccPrince Wayne SibandaNo ratings yet

- Engr Syed Noor Mustafa Shah CVDocument2 pagesEngr Syed Noor Mustafa Shah CVSyed Noor Mustafa ShahNo ratings yet

- Classic Diamonds India LTDDocument50 pagesClassic Diamonds India LTDrasonaliNo ratings yet

- Clause by Clause Explanation of ISO 9001 2015 enDocument21 pagesClause by Clause Explanation of ISO 9001 2015 enGayeGabriel100% (2)

- Audit EvidenceDocument2 pagesAudit EvidenceShariful HoqueNo ratings yet

- Integrated Management SystemDocument18 pagesIntegrated Management SystemMoatz Hamed100% (2)

- 2015 NIKL NIKL Annual Report 2015Document202 pages2015 NIKL NIKL Annual Report 2015Mochamad Khairudin50% (2)

- Introduction To Software Quality Assurance 1210258325202994 9Document31 pagesIntroduction To Software Quality Assurance 1210258325202994 9abbasamir2998No ratings yet