Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

152 viewsCost 5 Sol

Cost 5 Sol

Uploaded by

Sam Samcost accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sensitivity Analysis: Modeling Risk and UncertaintyDocument10 pagesSensitivity Analysis: Modeling Risk and UncertaintySam SamNo ratings yet

- BondsDocument19 pagesBondsSam SamNo ratings yet

- Asset Replacement DecisionsDocument6 pagesAsset Replacement DecisionsSam SamNo ratings yet

- Accounting Concepts and ConventionsDocument5 pagesAccounting Concepts and ConventionsSam SamNo ratings yet

- Annual Report 2019 PDFDocument126 pagesAnnual Report 2019 PDFSam SamNo ratings yet

- Capital Rationing, Profitability Index & Postponability IndexDocument17 pagesCapital Rationing, Profitability Index & Postponability IndexSam SamNo ratings yet

- Weighted Average Cost of CapitalDocument11 pagesWeighted Average Cost of CapitalSam SamNo ratings yet

- New ProjectDocument1 pageNew ProjectSam SamNo ratings yet

- Umair Javed S/O Javed Iqbal H No 3 ST 14 Eden Place Villas LHRDocument1 pageUmair Javed S/O Javed Iqbal H No 3 ST 14 Eden Place Villas LHRSam SamNo ratings yet

- Bank Reconciliation StatementsDocument37 pagesBank Reconciliation StatementsSam SamNo ratings yet

- Job Analysis PDFDocument4 pagesJob Analysis PDFSam SamNo ratings yet

- Prof. Dr. Muqqadas Rehman PDFDocument10 pagesProf. Dr. Muqqadas Rehman PDFSam SamNo ratings yet

- Basic Economics: Market Structures: MonopolyDocument11 pagesBasic Economics: Market Structures: MonopolySam SamNo ratings yet

- Chapter1 StatisticsDocument12 pagesChapter1 StatisticsSam SamNo ratings yet

- 1 ElasticityOfDemand 1Document23 pages1 ElasticityOfDemand 1Sam SamNo ratings yet

- Basic Economics: Cost of Production: Traditional Theory of CostDocument13 pagesBasic Economics: Cost of Production: Traditional Theory of CostSam SamNo ratings yet

- Basic Economics: Production: Law of Variable ProportionsDocument8 pagesBasic Economics: Production: Law of Variable ProportionsSam SamNo ratings yet

- Rectification of Error-IllustrationDocument18 pagesRectification of Error-IllustrationSam SamNo ratings yet

- Basic Economics: Market Structures: Perfect CompetitionDocument12 pagesBasic Economics: Market Structures: Perfect CompetitionSam SamNo ratings yet

- DR M Riaz Lecture Statistics Ch2Document8 pagesDR M Riaz Lecture Statistics Ch2Sam SamNo ratings yet

- Trial Balance ILLUSTRATION PDFDocument6 pagesTrial Balance ILLUSTRATION PDFSam SamNo ratings yet

- Economics MCQs Sir RizaviDocument20 pagesEconomics MCQs Sir RizaviSam Sam100% (1)

- Sol PDFDocument1 pageSol PDFSam SamNo ratings yet

- DR ( ) CR ( ) : Gordon Blair CaféDocument2 pagesDR ( ) CR ( ) : Gordon Blair CaféSam SamNo ratings yet

Cost 5 Sol

Cost 5 Sol

Uploaded by

Sam Sam0 ratings0% found this document useful (0 votes)

152 views29 pagescost accounting

Original Title

cost 5 sol

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcost accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

152 views29 pagesCost 5 Sol

Cost 5 Sol

Uploaded by

Sam Samcost accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 29

5-1

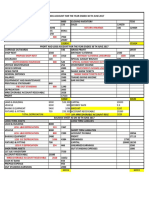

Al-Hadi Industries,

Cost of Goods Manufactured and Sold Statement,

For the Year Ended December 31, 20_.

Rs Rs

Direct materials:

Materials inventory, January 1,20__ 15,000

Add materials purchased .. 240,000

Matcrials available for use 255,000

Less mate inventory, December 31, 20__ 22,000

Direct materials used...

Direct labour ..

Factory overhead applied (75% of direct labour cost)

Total current manufacturing cost ...

Add work in process inventory, Janua

233,000

20.

Cost of goods available for manufacturing...

Less work in process inventory, December 31, 20__

Cost of goods nanutactured .......

Add finishe | goods inventory, January |, 2

Cost of goods available for sale...

Less finished goods inventory, December 31, 20,

Cost of goods sold...

315,500

18.000

497,500

30,000

00

‘anon se canter

28 Pail Syste of Accounting for Costs

AL-Ghanl Garments Factory

Income Statement

For the Month Ended Mareh 31,20 _

5-2

Marketing expenses

Ad ntinistrative expenses Rs.525.000 x 5 % : 26.250 19»

Net protit...

AL-Ghani Garments Factory

Cost af Goods Manufactured and Sold Statement

For the Month Ended Mareh 31, 20.

Direct materials: "s "

Raw materials inventory March 1, 20

Add purchase Rs

Tess returns and allowances

Cost at niatertal lable for use...

Less raw materials mventory Mareh 31, 2

Direet materials consumed,

Direet labor cust

Factory overhead:

19,500

138,000

58,500

Power, heat and light 9,600

Depreciation of plant and machinery 4.900

Repair and maimienance of plant and mach ery. 9,000

Tool expenses. -- : 4.600

Indirect labor... - 00

Fire insurance 500

200

Miscellaneous manufacturing costs

Total current manufacturing cont

Add work in prosess inventors. March |,

js availohl) ter manufacturing.

wventory, March 31 2

18.000

Sate

cat of gonds aututactured

add finished greed inventory. March | a

ost of guads 2) ihable for sale .

ished poculeinventory, Starch 7), 0%

‘anon se canter

Chapter 5: Financial Staterents 29

53

Al-Ghani Garmeats Factory

Income Statement

For the Month Ended March 31, 20__

Sas os sseussnsenessssnssetsanneesinesanaysnevansestantnsstensastnnee

Less cost of goods sold (as per statement piven below).

Gross profit. sc cscs

Less operating expenses

Marketing expenses Rs 525,000 9 100

Administrative expenses Rs.525,000 » 5°

Net profit. ccc sti

78.750

222.550

AbGhani Garments Factory

Cost of Goods Manufactured and Sold St

For the Month Ended March 31. 2

Rs, Rs.

Direct materials:

Raw materials inventory March 1. oo

Add purchase. Pes. 150,000

Less returns and allowances... 3,000, _ 147,000

Cost of materials available for use

Less raw materials inventory March 31,20

Direct materials consumed

Direct labor cost ...

Factory overhead applied (Rs $8,500 x 0%)...

19,500

138.600

38,500

Total current manufacturing cust at normal. 225.750

Add wath in process inventory, March 1, 2 __ 18,000

Cost of goods available for manufacturing 743,750

Less work in process inventory, March 31, 20

Cost of goods manufa tured at wormal....

Add finished gouds inventory, March 1,20...

Cost of gouds available for sale

Less finished goods inventory, March 31

Cost of goods sold at normal.

Add underapplied lactory overhead,

Cost of goods sold at actual ..

‘anon se canter

30 Part System of Accounting for Coste

Calculation of Under or Overapplied Factory Overhead,

Actual factory overhead Rs.

Power, heat and Ligh . 9,600

Depreciation of plant and machinery .. 4,900

Repatr and maintenance of plan 9,000

Toot expenses 4,600

Indirect labor 900

Fire insurance ...... 500, Rs.

Miscellaneous manufacturing cost 700_ 30,209

Applied factory overhead (Rs.58,500 x 50%)

Underapplied factory overhead 950

54

Al-Moghannl Manufacturers

Cost of Goods Manufactured and Sold Statement

For the Year Ended December 31, 20__

Rs. Rs.

Direct materials:

Matcrials inventory, January 1,20___.

Add materials purchased...

Materials available for us

Less materials inventory, December 31, 20__.

Direct materials used

Direct labour .....

Factory overhead applied (50% af Rs,42,000)

Total current manufacturing cost at normal

Add work in process inventory, January 1, 20__

Cost of goods available for manufacturing.

Less work in process inventory, December 31, 20__

Ct of goods manufactured at normal 182,000

Add finished goods inventory, January 1,20 18,000

Cost of ponds available for sale ...... 200,000

Less finished yoods inventory, December 31, 20__ 21,000

Cost of goods sald at normal 179,000

Less overapplied factory overhead 950

Cost of goods sold at actual... 178,050

‘anon se canter

Chapter Financial Staternonts 34

SUPPORTING CALCULATIONS,

Calculation of Under ar Overapplied Factory Overhead.

Actual factory overhead. Rs, Rs.

Factory office salarie 4,500

Heat and light costs.. 2,500

Power costs. 1,500

Insurance (fire & other),

Indirect materials used... 2,000

Superintendence $00

Depreciation of buildin $00

Depreciation of equipment... 1,500

Factory taxes 1,000

Employer's contribution to provident fund

(94% of Rs.5,000) 4,700

Tool expenses... 300

Miscellaneous factory overhead costs.

TOM eee 20,050

Applied factory overhead (Rs.42,000 x 50%) 21,000

‘Overapplied factory overhead 950

eS

‘anon se canter

32 Parts System of Accounting for Costs

5-5

MST Company Limited ;

Cost of Goods Manufactured and Sold Statemen!

For the Year Ended June 30,2019 is

Direet materials

Materials inventory, July 1, 2018. a7)

Add materials purchases

Materials available for use ‘

Less materials inventory, June 30, 2019.

Direet materials used

Direct labour...

Factory overhead applied (100% of Rs.16,000

Total current manufacturing cost at normal

Add work in process inventory, July 1, 2018

Cost of goods available for manufacturing

Less work in process inventory, June 30, 2019

Cost of goods manufactured at normal

Add finished goods inventory, July 1, 2018.

Cost of goods available for sale...

Less finished goods inventory, June 30, 201

Cost of goods sold at normal

Add underapplied factory overhead

Cost of goods sold at actual...

81,280

Supporting Calculatio

Distribution of Underapplied Factory Overhead.

Underapplied factory overhead added to:

Cost of goods sold = (RS.1,480 ~ Rs.92.500) ¥ R5.80.000 = Rs.1 989

Finished goods inventory = (Re.1,480 ~ Rs:92.500) » Rs.10.000 = Rs 169

Work in process inventory = (Rs.1,480 ~Rs.92,500) * Rs.2,500 = Re 49

‘anon se canter

Chapter § Financia! Statoments 33

(b)

MST Company Limited

ome Statement

For the Year Ended June 30,2019

: Rs

Sales..

Less cast of goods sol

Gross profit.

Less operating expenses:

Selling costs

Administration costs...

Net profit..

Id (as per statement given below)

MST Company Limited

Balance Sheet

As on June 30, 2019

Capital & Liabilities

Capital stock

Retained carnings Rs.47,050

2 0, 2019

Assets | Rs.

Cash

Accounts receivable

Add net profit 16,500

Notes payable

Notes receivable

Inventories:

Accounts payable Materials

Taxes payable Work in process Rs.2,500

Rent payable ‘Add underapplied

FOH 49

Finished goods Rs.10,000

Add underapplied

factory overhead = 160

Prepaid insurance

Machinery & equip. 93,500

Less accumulated

depreciation 20,000

‘anion se canter

34 Parti, System of Accounting for Costs.

5-6 AL-Qadir Industrial Works

Cost of Goods Manufactured and Sold Statement

For the Year Ended December 31, 20xx

Direct materials: Rs. Rs.

Materials inventory, January 1, 20xx 45,000

Add materials purchased

Less purchases returns

Net purchases... . 470,000_

Materials available for use .... 515,000

Less materials inventory, December 31, 20xx

i we 474,009

Direct labor 592,200

Factory overhea 308,800

Total current manufacturing cost 1,375,000

Less increase in work in process inventory 32,400

Cost of goods manufactured ... 1,342,600

Add decrease in finished goods inventory 57,400

* Cost of goods sold ..

1,400,000

57 Al-Mugtadir Manufacturing Concern

Cost’of Goods Manufactured and Sold Statement

For the Six Months Ended June 30,20___

Direct materials: Rs. Rs.

. Rs.

Raw materials purchased... 473,300

Add transportation in x 17,700

491,000

Less purchases returns 15,300

® Purchases discounts 8,700 24,000

Net purchases .... 467,000

Less increase in raw materials inventory 24,400

Direct materials used. 442,600

Direct labor - 316,300

Manufacturing overhead . _ 141,100

Total current manufactu 900,000

Add decrease in work in process 40,000

Cost of goods manufactured ... 940,000

Add decrease in finished goods inventory 60,000

Cost of goods sold .. 1,000,000

ee

Answers: (a) Rs.900,000, (b) Rs.940,000, (c) Rs.1,000,000

Chapter § Financial Statements 35

Al-Wajid Industry

Cost of Goods Sold Statement

For the Year Ended

Cost of goods manufactured «00.

(as per statement given below) .. :

Add finished goods inventory — beginning.

Cost of goods available for sale...

Less finished goods inventory — ending

Cost of goods sold

AEWajid Industry

Cost of Goods Manufactured Statement

For the Year Ended

Rs. Rs. Rs.

Direct materials:

Materials inventory — beginnin|

Add materials purchased

Add carriage inward ...

Materials available for use.

Less raw materials inventory — ending

Direct materials used ...

Loose tools:

Loose tools inventory — beginning 2,720

‘Add loose tools purchased 6,800

Loose tools available for use 9,520

Less loose tools inventory — ending 2.040

Loose tools consumed 7,480

Factory supplies:

Factory supplies inventory — beginning

Add factory supplies purchased

Factory supplies available for use

Less factory supplies inventory — ending,

Factory supplies consumed. : 9.220

Indirect labour... 16.600

Electricity bill of factory

Rent of factory building.

‘anon se canter

36 Parti System of Accounting for Costs

Factory office salaries. EE

Depreciation of plant .. 13,000

Total ... oe 114150

Total current mani fact 467,050

Add work in process inventory — begin 7000

$04,050

Cast of goods available for manufacturing

Less work in process inventory ~ ending

Cost of goods manu factured

24.400

59

ALMajid Industry

Cost of Goods Sold Statement

For the Month Ended May 31, 20__

Cost of goods manufactured

{as per schedule attached)...

‘Add finished goods inventory, May 1

Cost of goods available for sale

Less finished goods inventory, May 31. 20

Cost of goods sold ......++

Cost of Goods Manufactured Statement

For the Month Ended May 31, 20__

Rs. Rs, Rs

Direct materials:

Raw materials inventory, May 1, 20__

‘Add raw materials purchased

$3,000

477,000

Raw materials available for us $30,000

Less raw materials inventory, May 31 73,500

Direct materials used . 456,500

212,000

Direct labour

Factory overhead:

Fuel:

Fuel inventory, May |, 20__

‘Add fuel purchased ..

ares Oe,

- 63,300

Fuel available for use...... 68,900

Less fuel inventory, May 31, 20 7,980

Fuel consumed ., =a 60,950

Miscellancous factory overhe: 13,250

‘annoy se canter

Gtatarrente 37

Chapt New

Repairs to factory

Factory repair parts inventory, May 1,20 2,650

Add purchase of parts aso

Total to be accounted for Vaso

Less factory repaw pam invenuiry May V1, 20 5,100

Net repairs to factory = 24,150

Deprechition af plant... 10,500

Supetintendetce 7,959

Indirect factory labour 700

Total

Total current manufactuting cost

Add work in process inventory, May 1,20

Cost of poods available for manufacturing.

Leas work in process inventory, May 31, 20

Cost of poods manufactured

510

(a)

Al-Kabeer Industry

Cost of Goods Manufactured and Sold Stateme!

For the Month Ended March 31, 20__

Rs Rs

Direct materials:

Materials inventory, March |, 20___ 21,000

Add materials purchased, 90,000

inn oag

19.000.

Less materials inventory, March 31, 20.

: 92.000

Direct materials used.

Direct labour:

Assembling department (600 hours x Fé 89)... $4,000

Finishing department (800 hours x Ks 100) _ 80,000 428,000

Factory overliead applied

Assembling department (600 hours © RS 4D)..,.00 24,000

Finishing department (800 hours x 5,60)... 48,000 72,000

‘Total current manufacturing cow sooreehabetin 7 292,000

Add wark in pracess inventory, Maret 1, 0

Work in process —- Materials .. 14,500

Work in process — Labour 23.400

13,100, __$2.200

Work in process — POHL

Cowt of gouds available for manufacturing 397200"

‘eanney seh canter

38 Paittl System of Accounting for Goats

Less work in process inventory, March 31, 20.

Work in process --- Materials ,

Work in process —- Labou

Work tn process --- FOH

Cost of goods manufactured .

Add finished goods inventory, Mareh 1, 20__

16,250

28,150

_12,800__ $7,209

290,000"

Cost of goods available for sale 000,

Less finished goods inventory, March 31 — 30,000,

Cost of goods sold. 300,000

Supporting Calculation:

Calculation of ¢ Labour Hours for March, 20__-

Direct labour hours = Direct labour cost + Per hour rate

Assembling department = Rs.48,000 + Rs.80 = 600 hours

Finishing department = Rs.80,000 + Rs. 100 = 800 hours

{b) Calculation of Unit Cost of Materials, Labour and Factory Overhead.

Materials Labour FOH

Rs. Rs. Rs.

Work in process inventory, March | 18,500 23,400 13,300

Add cost put in process during month 92,000 128,000 72,000

Total cost to be accounted for 110,500 151,400 85,300

Less work in process inventory, March 31 16,250 28,150” 12,800

Cost converted into finished goods 94,250 123,250, 72,500

Units produced » 14,500 14,500 14,500

“Cost per unit: (Cost converted into

finished goods + units produced) Rs.6.50 Rs.8.50 Rs.5.00

5-11 .

Al-Khabeer Industry

Cost of Goods Manufactured and Sold Statement

For the Month Ended April 30, 20__

Rs. Rs.

Direct materials:

Materials inventory, April 1, 20__ 28,800

Add materials purchased 93,600

Materials available for use. 122,400

Less materials inventory, Apri 32,4000

Direct materials used... cnssmaewee 901000

‘annoy se canter

40° Part System of Accounting for Costs

512

May 20xx.

(1) Number of Units Manufactured during May

Units sod + ieee oe

Add units in finis red goods inventory M

Total units to be accounted for - 30xx

Less units in finished foods inventory May 1, 2

Number of units manufactured during the month.

(2)

31, 20x.

Al-Alcem Engineering Works (

Cost of Goods Manufactured Statement

For the Month Ended May 31, 20x

Direct Materials: a

Materials inventory May 1, 20x

Add materials Purchased

Add freight j

Rs.252,900 .

Rs.3,582,000

63,000

3,645,000

Less purchase discount 108,000

Net purchases + 3,537,000

Materials available for us 3,789,900

Less materials inventory May 3]

Direct materials used

Direct labour.

Rs.3,4 04,700

2.817,000

Factory overhead Applied ( ty 1.408.500

Total current Mamufacturing cast at normal. 7,630,2000

Add work 5 72.400

8,202,600

$50,800

(3) Cost Per Unit Manufactured,

Cost of goods manufactured — units Manufactured

Rs.7,651,800 ~ 2.808 units = Rs.2,725 Per unit”

(4) Value of Finishea Goods Inventory On 314 May, 20xx.,

Units in ending finished Boods inventory x Cost per unit Manufactured

36 units x Rs.2,725 = Rs.98,100

‘anon se canter

Chapter S Financial Statements 39

Direct labour:

Mixing department (1,000 hours x Rs.60)... 60,000

Finishing department (400 hours x Rs.120). 48,000 108,000

Factory ovethead applied

Mixing department (1,000 hours x Rs.36 36,000

Finishing depariment (400 hours x Rs.72 28,800 __ 64,800

262,800

Cost of work put in process...

Add work in process inventory, April

Materials in process .

Labour in process...

Factory overhead in process.

Cost of goods available for manufacturin,

Less work in process inventory, April 30, 2

Materials in proces:

Labour in proces

Factory overhead in process...

Cost of goods manufactured

Add finished goods inventory, April], 20__

Cost of goods available far sale

Less finished goods inventory, Apri

Cost of goods soll...

Calculation of Unit Cost of Materials, Labour and Factory Overhead.

Materials Labour FOH

Rs. Rs. Rs.

Work in process inventory, April 1 10,800 14,400 9,600

Add cost put in process during month 90,000 _ 108,000 64.800

Total cost to be accounted for 122,400 74,400

Less work in process inventory, April 30 9,600 7,200

Cost converted into finished goods 112,800 67.200

Units produced 6,000 6,000 6,000

Cost per unit: (Cost converted into

finished goods + units produced) Rs.14.80 Rs.18.80 Rs.11,20

‘anon se canter

GhapterS Financial Statements 41

(5)

ALAleem Engineering Works

Cost of Goods Sold Statement

For the Month Ended May 31, 200

Cos of goods manufactured Rs. 7,651,800

Add finished goods inventory May 1. 200... 242,550_

Cost of goods available for sale . 7,894,550

Less finished goods inventory Mag3 1, 208... 98,100

Cost of goods sold

(6) Gross Profit — Total and Per U

Sales 2,835 units x Rs.4,300.......

Less cost of goods sold

Rs. 12,190,500

7.796.250.

Gross profit

Gross profit ~ Units sold

35 = Rs.1,550 per unit

Gross profit per unit

Rs, 4,394,500 ~ 2,

§-13.

(1) Number of Units Manufactured."

Units sold 1,000

Add units in finished goods inventory, June 30, 20___ 10.

240

Total units to be accounted for

Less units in finished goods inventory, June 1,

‘Units manufactured .. aeseones

280.

960

(2) Cost of Closing Work in Process Inventory.

Direct materials ... =

Direct labour ..

Factory overhead (Rs. "54,000 Rs.72,000) \ Rs.3,600..

Total ..

‘anon se canter

r

ting for Costs

42 Part System of Accounting

try

0) AA ee al

atacturing Staten y Rs

For the Month Ended Ju 90.000

72,000

54,000

Direct materials 54,000

216,000

Direct labour

Factory overhead noe

Total current manufacturing cost . Bs 36.0007

Add work in process inventory, JN oe 14°400

Cost of goods available for manulacturin 501 con

Less work in process inventory, June 30, 20__ 201,600

Cost of goods manufactured...

(4) Cost of Exch Unit Manufactured,

Cost of goods manufactured = Units manufactured

Rs.201,600~ 960 units = Rs.210

(6) Ending Finished Goods Inventory.

" ctured

Units in ending finished poade inventory x Per unit cost of goods manufa

240 units x Rs.210 Rs.S0,a90

(6) Cost of Goods Sold, Rs.

Cost of, B00ds mimufactured ots » 201,600

Add finished poods inventory, June 1. 20 — 32,400.

Cost of goods available for sale 234,000

Less finished 800ds inventory, June 30,20 50,400

Cost of goods sold 183,600

5-14

Calculation of Cost of Goods Sold.

Total sales Of last five Years =Rs.7,760,000

Total gross Profit of last five Years = Rs.2,328,000

Gross profit Percentage = (Rs.2,39; 000 = Rs.7,760,000) * 100 = 309%

Cost of goods sold Percentage = 100 39 = 70%

Cost of poods Sold upto May 31, 2019 = Rs.960,000 x 70% = Rs.672,000

‘anon se canter

Chapter 9 Fan

Calculation of Work In Process Inventory Lost by Fire,

IStaiaments 43

Direct materialy Re Rs. Rs

Raw materials inventory, Jan 1, 2019 40,000,

Adal raw materials purchased ve 250,000

Add freight in... . 2,000 _262,000_

Raw materials available for use .......... 302,000

Less raw materials inventory May 31,2019 65,000

Direct materials used, 237,000

Direct labor 160,000

Factory overhead Rs. 160,000 5 75% 120,000

Total current manufacturing cost

Add work in process inventory, Jan, 1, 2019...

Cost of goods available for manufacturing:

Less work in process inventory, May 31, 201

Cost of goods manufactured

637,000

Add finished goods inventory Jan. 1, 2019 . 120,000

Cost of goods available for sale. 777,000

Less finished goods inventory May 31,2 105,000_

Cost of goods sold. 672,000

Answer: Work in process inventory lost by fire = Rs.65,000

515

Al-Haleem Industrial Co. Lid,

Income Statement

For the Year Ended

Rs. Rs. Rs.

Sales ... 675,000

Less cost of goods sold:

Direct material

Materials inventory at the beginning ....... 75,000

Add materials purchased 250,000

Materials available for use 325,000

Less materials inventory at the end 85,000

Direct materials used (Rs.400,000 x 60%) ..

240,000

Direct Labour sssssssssssstsscsssssssssses . 150,000

Factory overhead (Rs.150,000 x 40%). 60,000

| Total current manufacturing cost. 450,000

| Add work in process inventory al the begi 95,000

Cost of goods available for manufacturin $45,000

Less work in process inventory al the end. 130,000

a

‘eaney se canter

ing for Costs.

44 Pansit System of Accounting 75000"

“135.000

$50,000

150.000

Cost of goods manufactured

Add finished goods inventory at

Cost of goods available for sale...

Less finished goods inventory at the ens

Cost of goods sold

Gross profit er

Less operatmy expenses: 67,500

Selling expenses (Rs 675,000 6 10%)... "33,750 101,259

* Administrative expenses (Rs.675,000 x 5%). SEL

he profit before tan. 15.000

Income tay -

Net profit after tay... ae

S16. a Al-Kareem Industry

Cost of Goods Manufactured and Sold Statement

For the Month Ended,

Rs. Rs.

Direct materials: :

Materials inventory beginning. 34,500

Add materials purchased .. -430.000_

Materials available for use. 484,500

Less materials inventory ending. 37,700

Direct materials used . 446,800

Direct labour 296,875

Factory overhea 178,125

Total current manufacturing cost 921,800

Add work in process inventory beginning 45,600.

Cost of goods available for manufacturing "367.400"

Less work in process inventory endin 48.700

Cos of goods manufactured ..... 918.700

Add finished goods inventory beginning. 56.700

Cost of goods available for sale... 05.

Less finished goods inventory ending 73.400

Cost of goods sold. — 02st 007

910.000

—_

Total conversion cost = Rs.921,800 — Rs.446,800 = Rs.475,000,

Proportion between direct labour and factory overhead = 100:60

Direct labour Rs. 475,000 x 100/160 = Rs.296,875

Factory overhead = Rs. 475,000 x 60/161 9.1 78,125 .

‘anon se canter

Chapter § Financial Statements 45

(b) Prime Cost Charged to Work in Proce

Direct materials... ~

Direct labour

Prime cost .......

Rs.446,800

(c) Conversion Cost Charged to Work in Process:

Direet labour

Factory overhea,

Rs.296,875

17)

Conversion cost...

S47.

Al-Mateen Manufacturing Co. Ltd.

Income Statement

For the Month Ended July 31, 20«x

Rs. Rs.

Sales... 5,500,000

Less cost of goods sold (as per schedule! 3,250,000

Gross profit. 2,250,000

Less operating expenses:

Marketing expenses Rs.5,500,000 x 7.5% 412,500

Administrative expenses Rs.5,500,000 x 5% 275,000

Net profit..

Bolan Industrial Co. Ltd.

Cost of Goods Manufactured and Sold Statement

For the Month Ended July 31,2018

Rs. Rs.

Direct materials:

Materials inventory -— Beginnin; 190,000

Add purchases .. + 1,600,000

Materials available for use 1,790,000

Less materials inventory --- Ending. 150,000

Direct materials used. ~ 1,640,000

Direct labour .. 950,000

Factory overhead (Rs.950,000 + 125%)

Total current manufacturing cost .

Add work in process inventory --- Beginning

Cost of goods available for manufacturing.

Less work in process inventory -—- Ending.

Cost of goods manufactured

‘anon se canter

for Conta

46 Pann tpptern wf Accmuribing |

- Heginnling

Add Nisha ponds inventory «> Hep

Com th avallaite for sale ie

te heal goeads inventory > Lind

Cost of youde wuld ine

1 ar,

de Nisione niin Hmicrondi ducer 0% oe eo)

Cite ald ——-—

AlN nits (0 finished gonds inventory at the end ———— — Er

etal sanity y sale = .

fon, ‘ goods inventory at the beginning. <= 2,200" 2,200

Hactured during the year — — ——

(b) i

Al-Moqeet Manufacturers

Coat of Goods Manufactured Statement

Vor the Year Ended December 31,20

Direct materiaty Ks Rs.

Matetials purchased 390,000

Leas purchases return, —#.000_

Net Naver 482.000

Leas wittese in materials inventory. —34.000_

Ditcct materials used wm 348,000

Ditect labour a 290,000

Vactory overhead applied... 232/000

Total current Manutac tiring cost at ‘hormal 870,000"

Add work in Process inventory beginning: *

Materials in process

Labour in Process,

20,900

rou M1500

process 1

Cost of woods available for manufacturing, 39.6000

Hess work in process inven Hory ending. “909,600

Match 1 process 15.

Labour in jagcess ioe

TOM in precens 9 ton

Cos of pods Manufactured at nv

‘anon se canter

Chaptor 5 Financial Statements

Supporting Calculations.

Total current manufacturing cost = Cost of materials used + 40%

Rs.348,000 + 40% = Rs.870,000

Total conversion cost = Rs.870,000 ~ Rs.348,000 = R

Proportion between direct Labour and factory overhea

Direct labour = Ry.522,000 x 100/180 = Rs. 290,000

Factory overhead = Rs.522,000 x 80/180 = Rs.232,000

522,000

(c) Cost Per Unit Manufactured during the Year,

Cost of goods manufactured + units manufactured

Rs.880,000 = 2,200 units = Rs.400 per unit

(d) Value of Ending Finished Goods Inventory.

Units in ending finished goods inventory x Per unit cost

700 units x Rs 490 = Rs.280,000

(e) Al-Moqeet Manufacturers

Cost of Goods Sold Statement

For the Year Ended December 31, 20__

Rs.

Cos of goods manufactured at normal...

Add finished goods inventory beginning

Cost of goods available for sale

Less fiitished goods inventory ending

Cost of goods sold at normal

Add underapplied factory overhead (Rs.242,000 ~ Rs.232.000)

Cost of goods sold at actual...

(f) Cost Per Unit Manufactured During Previous Year.

Cost of finished goods beginning inventory ~ Units in beginning finished goods

inventory

Rs.190,000 + 500 units = Rs.380 per unit

a7

880,000

190.000

1,070,000

280,000

790,000

10.

00,

a

‘eaney se canter

43° Pama System ot Accounting tor Costs

S19 .

'y

Al-Moeed Manufacturing Compan:

Statement Showing Cost of avestane by Fire

For the Period Ended Feb. 26, = rr

Direct materials; nee

Materials inventory, Jan. 1, 20xx

Add purchases ......

Materials available for use

Less materials inventory, Fel

Direct materials used.

Direct labour

Factory overhead .

Total current manufacturing cost

Add work in process inventory, Jan. 1, 20xx.

Cost of goods available for manufacturing...

Less work in process inventory, Feb. 26, 20xx

Cost of goods manufactured

Add finished goods inventor

Cost of goods available for sal:

Less finished goods inventory, Feb. 26, 20xx

Cost of goods sold .

770,000

875,000

Supporting Calculations,

If gross profit is 40% of net sales then:

Cost of goods sold = 100 ~40 = 60% of net sales

Cost of goods sold = — Rs.2,600,000 x 60% = Rs. 1,560,000

Cost of goods manufactured x 80%

Rs. 1,500,000 x 80% = Rs.1,200,000

Direct materials = = — Prime cost - Direct labour

= Rs.1,200,000 — Rs.450,000 = Rs.730,000

If factory overhead is '/¢ of conversion cost then:

Direct labour = = 1 ~ "f= %4 of conversion cost

Conversion cost. = Rs,450,000 + */ = Rs.600,000 . :

= Conversion cost ~ direct labour

BIO ONE Neee Rs.600,000 — Rs.450,000 = Rs.150,000

Prime cost

(a) Finished goods inventory lost by fire, 5.220.999

Aehswers: (b) Work in process inventory lost by fire Rs.270,009

(c) Raw materials inventory lost by fire 125,009

a

‘anon se canter

Graptor Financial Biatarnents 49

§-20

Al-Momeet Manufacturers

Cost of Goods Manufactured and Sold Statement

For the Year Ended December 31, 20__

; Rs. Rs.

Direct materials:

Materials inventory, January 1, 20. $0,000

Add purchases. — 320,000

Materials available for use 370,000

Less materials inventory, December 31,20__

Direct materials used .. 315,000

Direct labour . 90,000

Factory overheat 45,000

Total current manufacturing cost 450,000

Add work in process inventory, January 1,20__. —60,000_

Cost of goods available for manufacturing...

Less work in process inventory, December 31,20___

Cost of goods manufactured

‘Add finished goods inventory, January 1, 20__

Cost of goods available for sale...

Less finished goods inventory, December 31,20__..«

Cost of goods sold ...

487,500

—_—

Supporting Calculations.

ee carve Direct labour + 20%

Total current manufacturing cost =

. = Rs,90,000+ 20% = Rs.450,000

If total conversion cost = 100%

Less factory overhead = 33-18%

Direct labour = 66-23%

ion cost = Direct labour + 66-2/3%

Total conversion = Rs.90,000 + 66-2/3% = Rs.135,000

‘actory = Conversion cost — Direct labour

. overeat = Rs.135,000 -Rs.90,000 = Rs.45,000

|d percent 100% — 25% = 75% of sales

a Se ct uots sold = Rs.650,000 x 75% = Rs.487,500

‘anon se canter

80 Parti fyatom of Accounting for Conte

521,

‘ Income Statement

For the Voor ne

Sales Rs. 1,200,000 + 10%

Lexs cost of goods sold

‘Girows prot 1s.12,000,000 x 40%

Less operating expenses

, 00,000

Marketing expenses Rs.12,000,000 » 15% Ve

| 762,500 3.562 5,

Administrative expenses LS 727

Net from operations yx 5% Itsy,

Less interest on bonds payable Rs.2,000,000 x 37.5% x 5% mae

Net income betire tax

5-22

Number of Units that Must be Sold.

Number of units to be sold = — Gross profit for the last year + Expected gross

profit per unit

(a) If sales price is Rs.850,

Number of units to be sold = Rs.7,500,000 + Rs.265 = 28,302 units

(b) If sales Price is Rs,875,

Number of units to be sold = Rs.7,500,000 + Rs,290 = 25,862 units

in ulatio

Calculation of Gross Profit of the Last Year,

Sales 30,000 units x Rs.750 Rs.22,500.

Less cost of goods soll Rs.22,500,000 x 667% 15.000'000

Gross profit Rs,22,500,000 x 33°%4% ———

Calculation of Unit Cost of Last Year.

Total cost per unit | Rs. Nene * 30,000 units Rs.s00

Materials cost per unit Rs.500 x 50% Row

Labor cost per unit Rs.500 x 40% nee

Factory overhead cost per unit Rs.500 x 10% 2

‘anon se canter

Chapter 5 Financsal Statements 54

Calculation of Expected Unit Cost af Coming Year.

Materials cost per unit 1ts.250 4 20%

Labor cost per unit Rs.200 41

Factory overhead cost per unit Rs, 504 10%

Total

Rs.300

20

Calculation of Expected Gross Profit Per Unit.

Gross profit per unit = Sales price per unit - Total cast per unit

Ifsales price is Rs.850 per unit

Gross profit per unit = Rs.850— Rs.585 = Rs.265

Ifsales price is Rs.875 per unit

Gross profit per unit = Rs.875 — Rs.585 = Rs.290

5-23

Number of Units to be Sold during the Next Year.

Number of units to be sold = — Gross profit for the last year + Expected gross profit

per unit

(a) If sales price is Rs.650.

Number of units to be sold = — Rs.480,000 + Rs.150 = 3,200 units

(b) If sales price is Rs.700

Number of units to be sold = —_ Rs.480,000 ~ Rs.200 = 2,400 units

Calculation of Gross Profit of the Previous Year.

Sales 2,400 units x Rs.600 Rs.1,440,000

Less cost of goods sold 960,000

Gross profit Rs.1,440,000 x 50/150 Rs._ 480,000

Calculation of Unit Cost of the Previous Year.

Total cost per unit Rs.960,000 = 2,400 units Rs.400

Materials cost per unit Rs.400 x 60% Rs.240

Labor cost per unit Rs.400 x 20% Rs. 80

Factory overhead cost per unit Rs.400 x 20% Rs 80

‘anon se canter

52 Parti System of Accounting for Costs,

Calculation of Unit Cost of Next Year.

Materials cost per unit Rs.240 + 30% Reaig

Labor cost per unit Rs, 80+ 20% %

Factory overhead cost per unit Rs. 80+ 15% ene

Total E00"

Calculation of Expected Gross Profit Per Unit for the Next Year.

Gross profit per unit = Sales price per unit ~ Total cost perunit

If sales price is Rs.650 per unit

Gross profit per cane = Rs.650 -— Rs.500 = Rs,150

If sales price is Rs.700 per unit

Gross profit per unit = Rs.700 — Rs,500 = Rs.200

5-24

Al-Momin Traders

Income Statement .

For the Year Ended Dec. 31, 20x

Sales... or . Rs.1,812,500

Less cost of goods sol:

Beginning inventory (at cost). Rs, 218,750

. _ 1,312,500

Cost of goods avail 1,531,250

Less ending inventory (at cost). 262,500, 1,268,750

Gross profit... eons 543,750

Less operating expenses?

Marketing expenses. $1,500

Administrative expenses .. 32,250° 113,750

Net profit... .» __Rs._ 430,000

s ti jculations:

Calculation of Purchases at Sales Price.

Sales Rs.1,812,500

Add ending inventory (at sales price) vy 375,000,

Goods available for sale (at sales price) 2,187,500

312,500

Less beginning inventory (at sales price) ..

Purchases at sales price..... RS1.875,000

‘anon se canter

Chaptar 8 Financial Stataments 63

© ona of Percentage af Cost to §

tes Frkee.

Purchases at cost price + Purchases at sales price) x 100

ao 312,500 + 1,875,000) x 100 = 70%

n of Inventories at Cost,

cginning inventory = Rs, 312,500 x 70% = Rs. 218,750 -

Ending inventory = Rs, 375,000 x 70%

Rs. 262,500 .

5:25

Al-Mobaimin Traders:

Income Statement

For the Year Ended Dec. 31,20__

Rs. Rs.

Sales 14,445,000

Less cost of go

Beginning, inventory (at cost) . 1,316,250

Add purchases .. 9,828,000

Cost of goods a ible for sale 11,144,250

Less ending inventory (at cost) 1,755,000 9,389,250

Gross profit . 5,055750

Less operating expenses:

Marketing expenses Rs. 14,445,000.x 7.5% 1,083,375

Administrative expenses Rs. 14,445,000 x 2.5% __ 361,125 1,444,500

Net profit. 3,611,250

Supporting Calculations:

Calculation of Purchases at Sales Price.

Sales Rs.14,445,000

Add closing inventory (at sales price) . __2,700,000_

Goods available for sale (at sales price) . 17,145,000

Less beginning inventory (at sales price) __2,025,000_

Purchases at sales price Rs.15.120,000_

Calculation of Percentage of Cost to Sales Price.

(Purchases at cost price + Purthases at sales price) x 100

(9,828,000 + 15,120,000) x 100 = 65%

Calculation of Inventories at Cost.

Beginning inventory = Rs. 2,025,000 x 65% = Rs.1,316,250

Ending inventory = Rs. 2, 700,000 x 65% = Rs.1,755,000

‘anon seh cantaner

54 Parr, System of Accounting for Costs

5.26

2) Computation of Sales Price Per Uni - fit per unit

a Sales price = Total cost per unit as given + Net pro

Sales price = Rs.1,400 + 30% of sales price

70% Sales price = Rs, 1,400

Sales price = Rs.1,400+ 70%

Sales price = Rs.2,000

(b) :

Al-Abed Industry

Estimated Income Statement for New Product

For the Year Rs.

Sales $,000 units x Rs.2,000..

Less cost of goods sold:

Direct materials $,000 units x Rs.400 2,000,000

Direct labor 5,000 units x Rs.350 1,750,000

Factory overhead 5,000 units x Rs.250 1,250,000

Gross profit

Less operating expenses:

Marketing expenses 5,000 units x Rs.300 1,500,000

Admin. expenses —$,000 units x Rs 100 500,000

Net profit... oe

5-27

(a) Computation of Sales Price Per Unit.

Sales price = Total cost as given + Royalty + Net profit

Sales price = Rs.275 + 20% of sales price + 25% of the sales price

Sales price = Rs,275 + 45 % of sales price ‘

55% Sales price = Rs.27S

Rs.275 + 55%

Rs.500

Sales pric

(b) Computation of Royalty Payable.

Royalty payable per unit = Rs.500 x 20% = Rs.100

Rs,

10,000,000

5.000.000

3,000,000

2,000,000

3,000,000

——

Royalty payable for sale of 10,000 units = Rs.100 x 10,000 units = Rs.1,000,000

‘anon se canter

() AkWahid Industry

Chapter 5 Financial Statements $5 _

Estimated Income Statement

For the Year

Sales 10,000 units x Rs.500...........

Less cost of goods sold:

Direct materials ..

Direct labor

Factory overhead

Gross profit.

Less operating expenses:

Marketing expenses

Add royalty

Administrative expenses

Net profit.

1,000,000 1,600,000

‘anon se canter

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sensitivity Analysis: Modeling Risk and UncertaintyDocument10 pagesSensitivity Analysis: Modeling Risk and UncertaintySam SamNo ratings yet

- BondsDocument19 pagesBondsSam SamNo ratings yet

- Asset Replacement DecisionsDocument6 pagesAsset Replacement DecisionsSam SamNo ratings yet

- Accounting Concepts and ConventionsDocument5 pagesAccounting Concepts and ConventionsSam SamNo ratings yet

- Annual Report 2019 PDFDocument126 pagesAnnual Report 2019 PDFSam SamNo ratings yet

- Capital Rationing, Profitability Index & Postponability IndexDocument17 pagesCapital Rationing, Profitability Index & Postponability IndexSam SamNo ratings yet

- Weighted Average Cost of CapitalDocument11 pagesWeighted Average Cost of CapitalSam SamNo ratings yet

- New ProjectDocument1 pageNew ProjectSam SamNo ratings yet

- Umair Javed S/O Javed Iqbal H No 3 ST 14 Eden Place Villas LHRDocument1 pageUmair Javed S/O Javed Iqbal H No 3 ST 14 Eden Place Villas LHRSam SamNo ratings yet

- Bank Reconciliation StatementsDocument37 pagesBank Reconciliation StatementsSam SamNo ratings yet

- Job Analysis PDFDocument4 pagesJob Analysis PDFSam SamNo ratings yet

- Prof. Dr. Muqqadas Rehman PDFDocument10 pagesProf. Dr. Muqqadas Rehman PDFSam SamNo ratings yet

- Basic Economics: Market Structures: MonopolyDocument11 pagesBasic Economics: Market Structures: MonopolySam SamNo ratings yet

- Chapter1 StatisticsDocument12 pagesChapter1 StatisticsSam SamNo ratings yet

- 1 ElasticityOfDemand 1Document23 pages1 ElasticityOfDemand 1Sam SamNo ratings yet

- Basic Economics: Cost of Production: Traditional Theory of CostDocument13 pagesBasic Economics: Cost of Production: Traditional Theory of CostSam SamNo ratings yet

- Basic Economics: Production: Law of Variable ProportionsDocument8 pagesBasic Economics: Production: Law of Variable ProportionsSam SamNo ratings yet

- Rectification of Error-IllustrationDocument18 pagesRectification of Error-IllustrationSam SamNo ratings yet

- Basic Economics: Market Structures: Perfect CompetitionDocument12 pagesBasic Economics: Market Structures: Perfect CompetitionSam SamNo ratings yet

- DR M Riaz Lecture Statistics Ch2Document8 pagesDR M Riaz Lecture Statistics Ch2Sam SamNo ratings yet

- Trial Balance ILLUSTRATION PDFDocument6 pagesTrial Balance ILLUSTRATION PDFSam SamNo ratings yet

- Economics MCQs Sir RizaviDocument20 pagesEconomics MCQs Sir RizaviSam Sam100% (1)

- Sol PDFDocument1 pageSol PDFSam SamNo ratings yet

- DR ( ) CR ( ) : Gordon Blair CaféDocument2 pagesDR ( ) CR ( ) : Gordon Blair CaféSam SamNo ratings yet