Professional Documents

Culture Documents

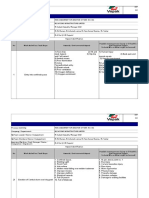

Risk Business Analyst

Risk Business Analyst

Uploaded by

arpit guptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Business Analyst

Risk Business Analyst

Uploaded by

arpit guptaCopyright:

Available Formats

Location Mumbai

Designation Manager/ Senior Manager – Business Analyst - Risk Function

Reporting to Risk Business Analyst Team Lead

Reportees N.A.

● Functional Business Analyst in Risk domain catering to Credit / Enterprise Risk / ORM / ALM / Market Risk

● You will be the Project Manager for identified developments and will be responsible for

Role Summary Business Requirement Gathering, Business Requirement Documentation (BRD), Outlining Operating

Processes, Partnering with Technology team in Systems development, Performing UAT, Project delivery,

Assisting technology team in User training, Identifying Opportunities for Improvement and Contributing to

End User Training.

● End to End project management of the system developments / enhancement

● Liaise with Functional teams and Technology team of the Bank to:

✔ Garner requirements from Functional teams for new system development / system enhancements

✔ Leverage business and functional knowledge to solve problems through proposals developed in

close partnership with internal stakeholders and vendors.

✔ Develop detailed plans and accurate estimates for completion of requirements and acceptance

Key Responsibilities phases of projects

✔ Contribute to design and development of the project-level roadmap, ensuring sufficient business

benefit is realized within each phase

✔ Prioritize requirements and create conceptual prototypes & test cases

✔ Conduct UAT based on test cases discussed with Functional teams

● Resolve conflicts and issues of medium complexity and escalating others, as appropriate

● Ensure adequate end-user documentation and training

● Participate in evaluation of 3rd-party vendors and software

● MBA (Finance / IT)

Qualifications ● CFA / FRM / Credit Risk / ALM / Treasury related certifications will be an added advantage

● Knowledge of SQL / R programming / Python / Robotics would be an added advantage

● Understanding of Project management & knowledge of Credit Risk / ALM / ERM / Market Risk

● Understanding and application of necessary regulatory environments (RBI / Basel)

● Awareness of Risk measurement tools and practices for Credit / Treasury products and Risk function

(Rating methodology / Basel norms / IRB calculation and framework/Early Warning Signals)

● Knowledge of Expected Credit Loss, PD, LGD computation / modelling, Value at Risk, Counterparty

Competencies Exposure, Valuation & Understanding of Data Mart framework will be an added advantage

● Acquaintance of latest technologies & trends in banking

● Teamwork & Cooperation

● Analytical thinking & problem solving abilities

● Proficient in Microsoft Excel

You might also like

- Risk Management Solution Manual Chapter 01Document7 pagesRisk Management Solution Manual Chapter 01DanielLam100% (5)

- Jsa For Complete Erection of Tank-001Document52 pagesJsa For Complete Erection of Tank-001Ashutosh80% (10)

- Minium-Opening Secondary TheatersDocument10 pagesMinium-Opening Secondary TheatersScott MiniumNo ratings yet

- Adeel Anwar: Career SummaryDocument4 pagesAdeel Anwar: Career SummaryadeelzzzNo ratings yet

- Mail Bhattacherjee Subhrajit Gmail COMDocument4 pagesMail Bhattacherjee Subhrajit Gmail COMAnkit butolaNo ratings yet

- Sudeep C Sawant - Program ManagerDocument4 pagesSudeep C Sawant - Program ManagerAniket mishraNo ratings yet

- Keyur Modi SAP-IT Project Manager - V1Document10 pagesKeyur Modi SAP-IT Project Manager - V1Yashpal SinghNo ratings yet

- PI IT Gurgaon Functional Consultant (FICO) M1 Solid Line - Head Functional Delivery & Projects Dotted Line - CFODocument3 pagesPI IT Gurgaon Functional Consultant (FICO) M1 Solid Line - Head Functional Delivery & Projects Dotted Line - CFOVikasNo ratings yet

- Resume 4Document2 pagesResume 4Ram NNo ratings yet

- Yashpal Profile SAP MM WM FDocument9 pagesYashpal Profile SAP MM WM FYashpal SinghNo ratings yet

- Sakthi Priya ResumeDocument6 pagesSakthi Priya ResumeSakthipriya JeganathanNo ratings yet

- CV Mukesh SinghDocument3 pagesCV Mukesh SinghgavhaleparagNo ratings yet

- Manoj Chauhan Project Manager +91-9953712722 Executive SummaryDocument6 pagesManoj Chauhan Project Manager +91-9953712722 Executive SummaryManoj ChauhanNo ratings yet

- XLRI PM BrochureDocument6 pagesXLRI PM BrochureKosHanNo ratings yet

- Associate Lead Business Analyst 91-9884494035: Sensitivity: Internal & RestrictedDocument4 pagesAssociate Lead Business Analyst 91-9884494035: Sensitivity: Internal & RestrictedCherub CuddlyNo ratings yet

- CV Example in PDFDocument1 pageCV Example in PDFManperta NegaraNo ratings yet

- Michelle Vega CVDocument5 pagesMichelle Vega CVHemlata GuptaNo ratings yet

- Scrum Master: Work ExperienceDocument4 pagesScrum Master: Work ExperienceAnoop ThakurNo ratings yet

- Resume - Tapasya Suri Chhabra - 11 Feb 2023Document4 pagesResume - Tapasya Suri Chhabra - 11 Feb 2023database.mnrsolutionsNo ratings yet

- Abhishek RanjanDocument6 pagesAbhishek RanjanSAPNA tyagiNo ratings yet

- Business Analyst (Capital Market & Insurance)Document3 pagesBusiness Analyst (Capital Market & Insurance)Prafful Srivastava100% (1)

- Dice Resume CV AdsdDocument7 pagesDice Resume CV AdsdsandeepntcNo ratings yet

- Venn and The Art of PM TPMDocument15 pagesVenn and The Art of PM TPMDevesh BharathanNo ratings yet

- Dimple Savla - ResumeDocument4 pagesDimple Savla - ResumeShivani MalhotraNo ratings yet

- Anil Kumar: Profile Summary Core CompetenciesDocument4 pagesAnil Kumar: Profile Summary Core CompetenciesAnil Singh SonuNo ratings yet

- Hiral Kumar Bhatt Toronto, Canada: SummaryDocument8 pagesHiral Kumar Bhatt Toronto, Canada: SummarySARVAGYA PANDEYNo ratings yet

- Rohit Singla - PMP® - Cspo®Document2 pagesRohit Singla - PMP® - Cspo®Rohit0506No ratings yet

- Simple CV ExampleDocument1 pageSimple CV ExampleManperta NegaraNo ratings yet

- Pulak - Das - Resume - 1683745965542 - PULAK RANJAN DASDocument4 pagesPulak - Das - Resume - 1683745965542 - PULAK RANJAN DASmaitrarimi7No ratings yet

- Chetan Sharma - ProductOwner - BusinessAnalystDocument5 pagesChetan Sharma - ProductOwner - BusinessAnalystVishvesh UpadhyayaNo ratings yet

- Alok Singh - NG - PreSales - Mar'23Document2 pagesAlok Singh - NG - PreSales - Mar'23Rohit Ved SharmaNo ratings yet

- Vijaykumar Vaghela Salesforce Business Analyst/ Scrum Master Contact No: 405-486-9210 Professional SummaryDocument8 pagesVijaykumar Vaghela Salesforce Business Analyst/ Scrum Master Contact No: 405-486-9210 Professional Summaryashish ojhaNo ratings yet

- Business - Analyst SampleDocument2 pagesBusiness - Analyst Samplegautam8882No ratings yet

- Position (Post Code 4) Business Analyst Role & ResponsibilitiesDocument2 pagesPosition (Post Code 4) Business Analyst Role & ResponsibilitiesMohd RzaNo ratings yet

- Project #1Document3 pagesProject #1Rishu SrivastavaNo ratings yet

- Previous Work Experience Includes Some of The Top Tier Organizations Across The Globe Such As J.P MorganDocument5 pagesPrevious Work Experience Includes Some of The Top Tier Organizations Across The Globe Such As J.P MorganAditya MujumdarNo ratings yet

- IT Project Manager (JesPM) - JDDocument4 pagesIT Project Manager (JesPM) - JDAbdul KarimNo ratings yet

- Banking - 11 Yrs - BADocument6 pagesBanking - 11 Yrs - BALalatenduNo ratings yet

- Bhulinder - BA With PCDocument4 pagesBhulinder - BA With PCiteam INCNo ratings yet

- RESUME SATYARTHGAUR 2023 TechMDocument14 pagesRESUME SATYARTHGAUR 2023 TechMsatyarthgaurNo ratings yet

- Keerthi KaturiDocument5 pagesKeerthi Katuribharadwaj1906No ratings yet

- Resume AnannyaDocument5 pagesResume AnannyaVickyKumarNo ratings yet

- Viraj Kansara ResumeDocument5 pagesViraj Kansara ResumeViraj Kansara100% (1)

- Poornima Moharil: Executive ProfileDocument3 pagesPoornima Moharil: Executive ProfileGuruRakshithNo ratings yet

- Rajesh Sample White PaperDocument7 pagesRajesh Sample White PaperRajesh RamadossNo ratings yet

- CV Project ManagerDocument3 pagesCV Project ManagerMegha NandiwalNo ratings yet

- Project MagDocument67 pagesProject MagMAIMONA KHALIDNo ratings yet

- Employee Competency MatrixDocument7 pagesEmployee Competency Matrixsrikarchandu0% (1)

- Kusha Sethi - Scrum MasterDocument4 pagesKusha Sethi - Scrum MasterKusha SharmaNo ratings yet

- NIEYEx5Uiv - Technology Business AnalystDocument2 pagesNIEYEx5Uiv - Technology Business AnalystYASH KALA PGP 2021-23 BatchNo ratings yet

- Adarsh Gole - BADocument6 pagesAdarsh Gole - BAAnkit ButiyaNo ratings yet

- Project Management XLRI Brochure 4Document7 pagesProject Management XLRI Brochure 4Praful KaulNo ratings yet

- PMO Set-Up Playbook, Tools and TemplatesDocument29 pagesPMO Set-Up Playbook, Tools and Templateshydro farmerNo ratings yet

- BNPParibas BusinessAnalyst (GBIT) MumbaiDocument3 pagesBNPParibas BusinessAnalyst (GBIT) MumbaiYatin MayekarNo ratings yet

- Profile of IT Core Banking Head of Delivery Resource.v02Document4 pagesProfile of IT Core Banking Head of Delivery Resource.v02yakobeNo ratings yet

- Professional SummaryDocument9 pagesProfessional SummarykirtiNo ratings yet

- Requirement Sheet - EkoiosDocument9 pagesRequirement Sheet - EkoiosAnh VuongNo ratings yet

- Resume - Krishna RaypureddyDocument6 pagesResume - Krishna Raypureddykris_krNo ratings yet

- Sampath Rachoti - AEMDocument4 pagesSampath Rachoti - AEMvalandecentrapriseNo ratings yet

- Neeraj - Nepal Resume - D365Document9 pagesNeeraj - Nepal Resume - D365Saurabh GoswamiNo ratings yet

- Resume - Banjo Fowosire - Business Analyst - 5yrsDocument2 pagesResume - Banjo Fowosire - Business Analyst - 5yrsMoyeed MaXxNo ratings yet

- Statement of PurposeDocument2 pagesStatement of Purposearpit guptaNo ratings yet

- SCM Pro24Document7 pagesSCM Pro24arpit guptaNo ratings yet

- Raw Material (5 Kgs @Rs.8) Rs.40 Direct Labour (2 Hours @Rs.5) 10 Variable Manufacturing Overheads 10 Fixed Manufacturing Overheads 20 Total 80Document1 pageRaw Material (5 Kgs @Rs.8) Rs.40 Direct Labour (2 Hours @Rs.5) 10 Variable Manufacturing Overheads 10 Fixed Manufacturing Overheads 20 Total 80arpit guptaNo ratings yet

- Strategic Cost Management MCQDocument1 pageStrategic Cost Management MCQarpit guptaNo ratings yet

- GUESSTIMATESDocument1 pageGUESSTIMATESarpit guptaNo ratings yet

- Additional Linked QuestionsDocument1 pageAdditional Linked Questionsarpit guptaNo ratings yet

- Book 2Document1 pageBook 2arpit guptaNo ratings yet

- FLP AssignmentDocument12 pagesFLP Assignmentarpit guptaNo ratings yet

- New Doc 2019-07-08 23.01.55Document2 pagesNew Doc 2019-07-08 23.01.55arpit guptaNo ratings yet

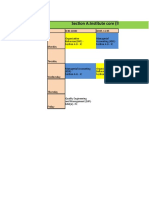

- Section A:Institute Core (IE/MM/IM/PM/ISEM), Room No. - CR 201Document2 pagesSection A:Institute Core (IE/MM/IM/PM/ISEM), Room No. - CR 201arpit guptaNo ratings yet

- Legal Provisions: Doctrine of Frustration of Contracts Case in BriefDocument1 pageLegal Provisions: Doctrine of Frustration of Contracts Case in Briefarpit guptaNo ratings yet

- Section A:Institute Core (IE/MM/IM/PM/ISEM), Room No. - CR 201Document2 pagesSection A:Institute Core (IE/MM/IM/PM/ISEM), Room No. - CR 201arpit guptaNo ratings yet

- Section C QTFORDM Assignment GroupsDocument2 pagesSection C QTFORDM Assignment Groupsarpit guptaNo ratings yet

- Asg 2Document3 pagesAsg 2arpit guptaNo ratings yet

- GUESSTIMATESDocument1 pageGUESSTIMATESarpit guptaNo ratings yet

- This Is To Certify That MRDocument1 pageThis Is To Certify That MRarpit guptaNo ratings yet

- Secular India:Divided by Sonu Nigam, United by Snap ChatDocument1 pageSecular India:Divided by Sonu Nigam, United by Snap Chatarpit guptaNo ratings yet

- Life Is Like An Onion You Peel Off One Layer at A Time and Sometimes You Weep."Document2 pagesLife Is Like An Onion You Peel Off One Layer at A Time and Sometimes You Weep."arpit guptaNo ratings yet

- Contract FarmingDocument63 pagesContract Farmingpranvirkaur100% (1)

- Zerosicks She-Ms: (Approach)Document56 pagesZerosicks She-Ms: (Approach)Alfian AtjehNo ratings yet

- Reliability Engineering and System Safety: SciencedirectDocument8 pagesReliability Engineering and System Safety: SciencedirectElif OguzNo ratings yet

- Hta 11 02 PDFDocument9 pagesHta 11 02 PDFgasiasiNo ratings yet

- POPIA Code of Conduct For ResearchDocument12 pagesPOPIA Code of Conduct For ResearchKayla RobinsonNo ratings yet

- Project Report On Treasury ManagementDocument6 pagesProject Report On Treasury ManagementnoordonNo ratings yet

- Iosh Certificat Ed CoursesDocument30 pagesIosh Certificat Ed CoursesVishnu BhaskarNo ratings yet

- IOCLDocument94 pagesIOCLDebabrat SaikiaNo ratings yet

- Risk Analysis For Cost EstimationDocument27 pagesRisk Analysis For Cost Estimationፊልም አፍቃሪዎችNo ratings yet

- Certified Facility ManagerDocument11 pagesCertified Facility ManagerYoga PristlinNo ratings yet

- Training and Recruitment in Bharti AxaDocument49 pagesTraining and Recruitment in Bharti AxaAshutoshSharmaNo ratings yet

- Risk Assessment Completed by Location/Venue Date Describe The Activity & LocationDocument4 pagesRisk Assessment Completed by Location/Venue Date Describe The Activity & LocationRemae GarciNo ratings yet

- Risk Register TemplateDocument3 pagesRisk Register TemplateMalcolm ShroffNo ratings yet

- CISO ResponsibilitiesDocument7 pagesCISO Responsibilitieskachaveswapnil3No ratings yet

- Meridium Mechanical Integrity Standard Practice 2013 Rev 4Document400 pagesMeridium Mechanical Integrity Standard Practice 2013 Rev 4Tommy100% (1)

- Principles of InsuranceDocument45 pagesPrinciples of Insurancethe origin mediaNo ratings yet

- Shell MRPL AviationDocument100 pagesShell MRPL AviationRithesh KNo ratings yet

- JSEA - Hydro Test - 2833Document13 pagesJSEA - Hydro Test - 2833Amit Sharma100% (1)

- Heritage Lottery Conservation Management Plans-GuideDocument34 pagesHeritage Lottery Conservation Management Plans-GuideAngela WheelerNo ratings yet

- Critical Components For Maintenance Outage Scheduling Considering Weather Conditions and Common Mode Outages in Reconfigurable Distribution SystemsDocument10 pagesCritical Components For Maintenance Outage Scheduling Considering Weather Conditions and Common Mode Outages in Reconfigurable Distribution SystemsXupisgoleNo ratings yet

- Cia Review: Part 2 Study Unit 2: Assurance and Compliance EngagementsDocument20 pagesCia Review: Part 2 Study Unit 2: Assurance and Compliance EngagementsjorgeNo ratings yet

- Igc1 نيبوش انجليزي بترو اسيلDocument53 pagesIgc1 نيبوش انجليزي بترو اسيلكاتم الاسرارNo ratings yet

- Basel Committee On Banking SupervisionDocument14 pagesBasel Committee On Banking SupervisionRijesh RNNo ratings yet

- ICoC Signatory Companies, August 2013Document269 pagesICoC Signatory Companies, August 2013Feral Jundi0% (1)

- AGRT01-18 Guide To Road Tunnels Part 1 IntroductionDocument68 pagesAGRT01-18 Guide To Road Tunnels Part 1 IntroductionLa FoliakNo ratings yet

- BPSA 2014 Recommendations For Testing, Evaluation, and Control of Particulates From Single-Use Process EquipmentDocument28 pagesBPSA 2014 Recommendations For Testing, Evaluation, and Control of Particulates From Single-Use Process EquipmentbioNo ratings yet

- SASSI13 ProceedingsDocument508 pagesSASSI13 ProceedingsLuhur Akbar DeviantoNo ratings yet