Professional Documents

Culture Documents

Manulife Group Protect Brochure

Manulife Group Protect Brochure

Uploaded by

Gericho DiazCopyright:

Available Formats

You might also like

- Hca 500k TemporalDocument12 pagesHca 500k TemporalMiguel IgnacioNo ratings yet

- Sun Maxilink 100Document15 pagesSun Maxilink 100Princess Lheakyrie CasilaoNo ratings yet

- Pig Calculation Tables: Date Batch Nr. Number of PigletsDocument7 pagesPig Calculation Tables: Date Batch Nr. Number of PigletsUrs SchaffnerNo ratings yet

- Lacsa FM Mlprime 04112021204534Document14 pagesLacsa FM Mlprime 04112021204534GarthNo ratings yet

- 19a415x BM5270 Ica1Document12 pages19a415x BM5270 Ica1Daphne TayNo ratings yet

- Product Disclosure Sheet: AIA General BerhadDocument9 pagesProduct Disclosure Sheet: AIA General BerhadMusk BengshengNo ratings yet

- Epf KWSPDocument2 pagesEpf KWSPWan HusnaNo ratings yet

- Sunlife Booklet Jan-1-2017 enDocument63 pagesSunlife Booklet Jan-1-2017 enbianca7sallesNo ratings yet

- Metro OccciDocument16 pagesMetro OccciJuLievee Lentejas100% (3)

- Sme Product Brochure PDFDocument37 pagesSme Product Brochure PDFNoor Azman YaacobNo ratings yet

- Allianz SME Choice Plus BrochureDocument35 pagesAllianz SME Choice Plus BrochureSyafik JaafarNo ratings yet

- ManuplanDocument12 pagesManuplanYiu man LamNo ratings yet

- Health Start: Ms. Mariam Castalla SoloDocument13 pagesHealth Start: Ms. Mariam Castalla SolokeithNo ratings yet

- Prudential PruPersonal AccidentDocument13 pagesPrudential PruPersonal AccidentpriscillasooNo ratings yet

- Loan SecureDocument22 pagesLoan SecureDayana DawnieNo ratings yet

- Insurance DigestVDocument140 pagesInsurance DigestVRaprnaNo ratings yet

- Pen PalsDocument26 pagesPen PalsAjit DasNo ratings yet

- Outpatient HandbookDocument62 pagesOutpatient Handbookxuyi2014No ratings yet

- New Business Annual Premium Equivalent (NBAPE) of Life Insurance CompaniesDocument1 pageNew Business Annual Premium Equivalent (NBAPE) of Life Insurance CompaniesRon CatalanNo ratings yet

- Life Rankings 2020 Based On Q4 Net Income 1Document1 pageLife Rankings 2020 Based On Q4 Net Income 1Ron CatalanNo ratings yet

- Columbres J Mlprime 24052021030741Document16 pagesColumbres J Mlprime 24052021030741Sibin PiptiNo ratings yet

- NBAPE Life Insurance Companies EQRSFS Q4 2023Document1 pageNBAPE Life Insurance Companies EQRSFS Q4 2023Kim MagtibayNo ratings yet

- Sun Wealth Protect I A5 Brochure V5 - 270521Document4 pagesSun Wealth Protect I A5 Brochure V5 - 270521ARIF AHMAD HASSANNo ratings yet

- Mindef Mha Product SummaryDocument40 pagesMindef Mha Product SummaryJedrek TeoNo ratings yet

- Financial Markets: Saint Columban College Pagadian CityDocument11 pagesFinancial Markets: Saint Columban College Pagadian CityangelNo ratings yet

- The Mauritius Union Assurance Co LTD ProfileDocument13 pagesThe Mauritius Union Assurance Co LTD ProfileSundeep El-NinoNo ratings yet

- Mapacpac J Mlprime 14112021160254Document19 pagesMapacpac J Mlprime 14112021160254Jonas MapacpacNo ratings yet

- SC - 7783oooDocument7 pagesSC - 7783ooosantoshkumarNo ratings yet

- The Last Word in The World Of: RakshakaranDocument4 pagesThe Last Word in The World Of: RakshakaranNAGASAI BNo ratings yet

- Sun Maxilink 100Document11 pagesSun Maxilink 100Maloucel DiazNo ratings yet

- Allysamarie 1 MDocument13 pagesAllysamarie 1 MAlyssa Marie CastillonNo ratings yet

- rptHealthMax Robert1 PDFDocument14 pagesrptHealthMax Robert1 PDFJULIUS TIBERIONo ratings yet

- Takafulink Flexi v2.0 31122014Document4 pagesTakafulink Flexi v2.0 31122014amnasufiyaNo ratings yet

- USA Full-Time Employee Benefits Summary - All GradesDocument2 pagesUSA Full-Time Employee Benefits Summary - All Gradesvktm9r2x7nNo ratings yet

- Net Income Life Insurance Companies EQRSFS Q4 2023Document1 pageNet Income Life Insurance Companies EQRSFS Q4 2023Kim MagtibayNo ratings yet

- Axa Sme Life BrochureDocument28 pagesAxa Sme Life BrochuremiazainuddinNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Document10 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Jaymar Odtojan AbaloNo ratings yet

- Seasons 100 ProposalDocument3 pagesSeasons 100 ProposalAlvin Dela Cruz100% (1)

- Nuñez R Mlprime 02102021182517Document16 pagesNuñez R Mlprime 02102021182517Rommel Capinpin NunezNo ratings yet

- Insuring T&Cs - Accident Secure Max (Family) - PrimeDocument8 pagesInsuring T&Cs - Accident Secure Max (Family) - PrimeTolits MillabasNo ratings yet

- Health Start: A Sample Health Start Family Coverage Plan For A 1 Million, 20-Pay PlanDocument2 pagesHealth Start: A Sample Health Start Family Coverage Plan For A 1 Million, 20-Pay PlanYranj Dave FortalezaNo ratings yet

- CBA FM PE - Life Insurance - Group2Document7 pagesCBA FM PE - Life Insurance - Group2Janna Glaiza FernandezNo ratings yet

- Aquino AP Ml100 With-Complete-RidersDocument16 pagesAquino AP Ml100 With-Complete-RidersAldrin Paul AquinoNo ratings yet

- PRULink Exact ProtectorDocument5 pagesPRULink Exact ProtectorJul Lester CastilloNo ratings yet

- Benefits Summary IndiaDocument9 pagesBenefits Summary IndiaABHISHEK BAGHNo ratings yet

- Virgilio Reyes 2024-03-12 03 - 01 - 57Document15 pagesVirgilio Reyes 2024-03-12 03 - 01 - 57Cyber ZoneNo ratings yet

- Life Rankings 2020 Based On Q4 Investments 1Document1 pageLife Rankings 2020 Based On Q4 Investments 1Ron CatalanNo ratings yet

- Manulife Student Protect BrochureDocument2 pagesManulife Student Protect BrochurePhan Gia HuấnNo ratings yet

- Compensation Proposal (iHRM) GROUPDocument4 pagesCompensation Proposal (iHRM) GROUPAjar NairNo ratings yet

- File 1403Document78 pagesFile 1403Neha MongaNo ratings yet

- Faculty of Business and Management: Life and Health Insurance (Ins535)Document11 pagesFaculty of Business and Management: Life and Health Insurance (Ins535)Rienah SanariNo ratings yet

- Product Disclosure Sheet: GolifeDocument13 pagesProduct Disclosure Sheet: GolifeSiput TurboNo ratings yet

- Flex PA Brochure FADocument18 pagesFlex PA Brochure FAAIA Sunnie YapNo ratings yet

- Sun Maxilink PrimeDocument9 pagesSun Maxilink PrimeGracie Sugatan PlacinoNo ratings yet

- Death in The WorkplaceDocument3 pagesDeath in The WorkplaceAlvin CabralNo ratings yet

- National Management College: Department of Management StudiesDocument24 pagesNational Management College: Department of Management StudiesKarina ZetaNo ratings yet

- Mrs. Maria Eloisa Lim Chu Gungon: When You Reach Age 75 When You Reach Age 75 If The Insured Passes Away at Age 75Document11 pagesMrs. Maria Eloisa Lim Chu Gungon: When You Reach Age 75 When You Reach Age 75 If The Insured Passes Away at Age 75John Philip TiongcoNo ratings yet

- Net Worth Life Insurance Companies EQRSFS Q4 2023Document1 pageNet Worth Life Insurance Companies EQRSFS Q4 2023Kim MagtibayNo ratings yet

- Life Rankings 2020 Based On Q4 NW 1Document1 pageLife Rankings 2020 Based On Q4 NW 1Ron CatalanNo ratings yet

- Traditional Reflection EssayDocument3 pagesTraditional Reflection Essayapi-282199358No ratings yet

- Commercial LessonDocument8 pagesCommercial LessonSnowdenKonan100% (1)

- 撰写一篇简短的演讲稿Document6 pages撰写一篇简短的演讲稿cjbw63weNo ratings yet

- Prosperos DreamDocument8 pagesProsperos Dreamapi-336553511No ratings yet

- Financial - Analysis (SCI and SFP)Document4 pagesFinancial - Analysis (SCI and SFP)Joshua BristolNo ratings yet

- San Agustin Institute of Technology: Bible Month Culminating ActivityDocument4 pagesSan Agustin Institute of Technology: Bible Month Culminating ActivityErwin Y. CabaronNo ratings yet

- Estabilidade TrelicaDocument2 pagesEstabilidade TrelicaAna Carolina SaavedraNo ratings yet

- Internal Training Project Job Costing: Sage ERP X3Document37 pagesInternal Training Project Job Costing: Sage ERP X3Niko Christian ArnaldoNo ratings yet

- Bamu Essay PandemicDocument2 pagesBamu Essay Pandemicbamlak teshomeNo ratings yet

- Process Realization Plan: Recruitment and Terminal Benefits ProcessDocument24 pagesProcess Realization Plan: Recruitment and Terminal Benefits ProcessAliIrfanNo ratings yet

- Skilled Manpower Turnover and Its ManagementDocument109 pagesSkilled Manpower Turnover and Its Managementfikru terfaNo ratings yet

- Fullan - Leading in A Culture of Change PDFDocument15 pagesFullan - Leading in A Culture of Change PDFapi-262786958No ratings yet

- The Role of Business Model Innovation For Corporate SustainabilityDocument33 pagesThe Role of Business Model Innovation For Corporate Sustainabilitykhan MuntazirNo ratings yet

- Audit Practice Manual For ICABDocument223 pagesAudit Practice Manual For ICABhridimamalik80% (5)

- Voice Phrases and Their SpecifiersDocument39 pagesVoice Phrases and Their SpecifiersAndreas SitompulNo ratings yet

- Just Lather, That's All Reading QuestionsDocument2 pagesJust Lather, That's All Reading QuestionsEmily JohnNo ratings yet

- Cap - 12 - Betas by Sector DamodaranDocument4 pagesCap - 12 - Betas by Sector DamodaranVanessa José Claudio IsaiasNo ratings yet

- A Framework For Planning A Listening Skills LessonDocument6 pagesA Framework For Planning A Listening Skills LessonMa Eugenia Amezquita AcostaNo ratings yet

- Leah Klein - GDDocument1 pageLeah Klein - GDAbi C. WareNo ratings yet

- Branches of PhilosophyDocument16 pagesBranches of PhilosophyDarlito AblasNo ratings yet

- Gwinnett Incident Report VanpoolDocument2 pagesGwinnett Incident Report VanpoolbernardepatchNo ratings yet

- WYOPCC Triage Assessment Composite Report and Analysis - ANTHONY RAMSDEN Case.Document16 pagesWYOPCC Triage Assessment Composite Report and Analysis - ANTHONY RAMSDEN Case.PoliceCorruptionNo ratings yet

- Tibetan Buddhist Medicine and Psychiatry 282p PDFDocument282 pagesTibetan Buddhist Medicine and Psychiatry 282p PDFDharmaMaya Chandrahas89% (9)

- Aaakdog. The City of Davao NuguidpptDocument16 pagesAaakdog. The City of Davao NuguidpptAubreyNuguidNo ratings yet

- AQRFDocument45 pagesAQRFLouraine Baltazar LptNo ratings yet

- Agreement of License To Use TrademarkDocument12 pagesAgreement of License To Use TrademarkHimanshu Kumar100% (1)

- Company Law SynopsisDocument3 pagesCompany Law SynopsisAnand SinghNo ratings yet

- TOEFL Itp Test Taker HandbookDocument3 pagesTOEFL Itp Test Taker HandbookXuan Xuan NguyenNo ratings yet

- Sufyan Al ThawriDocument4 pagesSufyan Al ThawriUmarRR11100% (1)

Manulife Group Protect Brochure

Manulife Group Protect Brochure

Uploaded by

Gericho DiazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manulife Group Protect Brochure

Manulife Group Protect Brochure

Uploaded by

Gericho DiazCopyright:

Available Formats

Group Protect

Behind every About Manulife

Manulife Financial Corporation is a leading international financial

company's success services group that helps people make their decisions easier and

lives better. We operate primarily as John Hancock in the United

are its employees. States and Manulife elsewhere. We provide financial advice,

insurance, as well as wealth and asset management solutions for

individuals, groups and institutions. At the end of 2018, we had

more than 34,000 employees, over 82,000 agents, and thousands

of distribution partners, serving almost 28 million customers. As of

March 31, 2019, we had over $1.1 trillion (US$849 billion) in assets

under management and administration, and in the previous 12

months we made $29.4 billion in payments to our customers. Our

principal operations in Asia, Canada and the United States are

where we have served customers for more than 100 years. With our

global headquarters in Toronto, Canada, we trade as 'MFC' on the

Toronto, New York, and the Philippine stock exchanges and under

'945' in Hong Kong.

About Manulife Philippines

The Manufacturers Life Insurance Company opened its doors for

business in the Philippines in 1907. Since then, Manulife’s Philippine

Branch and later The Manufacturers Life Insurance Co. (Phils.), Inc.

(Manulife Philippines) has grown to become one of the leading life

insurance companies in the country. Manulife Philippines is a

wholly-owned domestic subsidiary of Manulife Financial

Corporation, among the world’s largest life insurance companies by

market capitalization. Learn more about Manulife Philippines by

visiting their website www.manulife.com.ph and following them on

Facebook (www.facebook.com/ManulifePH), Twitter (@ManulifePH),

and Instagram (@manulifeph).

Ask your Manulife

Insurance Advisor for a

full presentation.

Manulife

Secure them with The Manufacturers Life Insurance Co. (Phils.), Inc.

Group Protect

Manulife

(02) 884 7000

phcustomercare@manulife.com

manulifeph

Group www.manulife.com.ph

For the people who drive your

Protect.

Disclaimer: This material contains only a brief description of the product.

The complete terms and conditions are found in the Policy contract.

In the event of conflict between this material and the Policy, the Policy shall prevail. business to greater heights

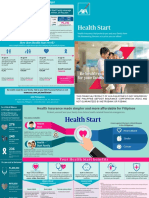

Manulife Group Protect

is a comprehensive benefit package that provides

employees and their loved ones protection from

Watch your business grow when you invest in your

life's uncertainties. company's biggest asset - your employees!

Basic Plan

Guaranteed Financial Assistance AVAILABLE PACKAGES***

The family of your employee will receive a death benefit Be the preferred employer when you award your employees any of the following packages:

to protect them from financial difficulties caused by

unexpected events such as the sudden demise of their

breadwinner.

Manulife Group Protect

Basic Plan* 100,000 200,000 300,000 400,000 500,000

Comprehensive Accident Protection

(ADD&D) Age Bracket Annual Premium

In case of accidental dismemberment or disablement, 18 - 30 256 497 737 978 1,219

your employee will receive a death benefit. Or, in case 31 - 40 256 497 737 978 1,219

of the employee's death due to an accident,

41 - 50 504 993 1,481 1,970 2,459

beneficiaries will receive a death benefit double the

51 - 59 1,179 2,343 3,506 4,670 5,834

basic life insurance.

60 - 64** 1,852 3,690 5,527 7,364 9,202

Total and Permanent Disability

Benefit (TPD) Optional Benefits

Your employee will be paid a lump sum amount

equivalent to the death benefit if he/she becomes Daily Hospital

totally and permanently disabled for six (6) consecutive Income Benefit 500 600 700 900 1,000

months, and is unable to work or will be unable to work

18 - 30 431 518 604 777 863

for life due to disability.

31 - 40 783 940 1,097 1,410 1,566

41 - 50 1,204 1,445 1,686 2,168 2,409

Optional Riders 51 - 59 1,658 1,989 2,321 2,984 3,315

Daily Hospital Income Benefit (HIB) Accidental Medical

A daily hospital cash benefit up to a maximum of 31 Reimbursement

Benefit 10,000 20,000 30,000 40,000 50,000

days will be given to your employee while he is confined

in the hospital for treatment or hospital care expenses. 18 - 64 110 215 320 425 530

Accidental Medical Reimbursement Cancer Benefit 100,000 200,000 300,000 400,000 500,000

Benefit (AMR)

Manulife will reimburse medical expenses, not 18 - 30 84 168 252 336 420

exceeding what they are covered for, if your employee 31 - 40 298 596 894 1,192 1,490

receives treatment or care from a physician or hospital 41 - 50 812 1,624 2,436 3,248 4,060

due to any injury occurring within 30 days of accident.

51 - 55 1,606 3,212 4,818 6,424 8,030

Cancer Benefit

* Basic Plan covers Guaranteed Financial Assistance, Comprehensive Accident Protection, Double Indemnity, Triple Indemnity and Total and

If your employee is diagnosed with cancer, occurring

Permanent Disability Benefit

after 90 days from the effective date of the plan,

Manulife will pay the covered amount to your employee ** Exclusive of Total and Permanent Disability Benefit

to help with the costs associated with treatment.

*** Applicable to selected occupation only

You might also like

- Hca 500k TemporalDocument12 pagesHca 500k TemporalMiguel IgnacioNo ratings yet

- Sun Maxilink 100Document15 pagesSun Maxilink 100Princess Lheakyrie CasilaoNo ratings yet

- Pig Calculation Tables: Date Batch Nr. Number of PigletsDocument7 pagesPig Calculation Tables: Date Batch Nr. Number of PigletsUrs SchaffnerNo ratings yet

- Lacsa FM Mlprime 04112021204534Document14 pagesLacsa FM Mlprime 04112021204534GarthNo ratings yet

- 19a415x BM5270 Ica1Document12 pages19a415x BM5270 Ica1Daphne TayNo ratings yet

- Product Disclosure Sheet: AIA General BerhadDocument9 pagesProduct Disclosure Sheet: AIA General BerhadMusk BengshengNo ratings yet

- Epf KWSPDocument2 pagesEpf KWSPWan HusnaNo ratings yet

- Sunlife Booklet Jan-1-2017 enDocument63 pagesSunlife Booklet Jan-1-2017 enbianca7sallesNo ratings yet

- Metro OccciDocument16 pagesMetro OccciJuLievee Lentejas100% (3)

- Sme Product Brochure PDFDocument37 pagesSme Product Brochure PDFNoor Azman YaacobNo ratings yet

- Allianz SME Choice Plus BrochureDocument35 pagesAllianz SME Choice Plus BrochureSyafik JaafarNo ratings yet

- ManuplanDocument12 pagesManuplanYiu man LamNo ratings yet

- Health Start: Ms. Mariam Castalla SoloDocument13 pagesHealth Start: Ms. Mariam Castalla SolokeithNo ratings yet

- Prudential PruPersonal AccidentDocument13 pagesPrudential PruPersonal AccidentpriscillasooNo ratings yet

- Loan SecureDocument22 pagesLoan SecureDayana DawnieNo ratings yet

- Insurance DigestVDocument140 pagesInsurance DigestVRaprnaNo ratings yet

- Pen PalsDocument26 pagesPen PalsAjit DasNo ratings yet

- Outpatient HandbookDocument62 pagesOutpatient Handbookxuyi2014No ratings yet

- New Business Annual Premium Equivalent (NBAPE) of Life Insurance CompaniesDocument1 pageNew Business Annual Premium Equivalent (NBAPE) of Life Insurance CompaniesRon CatalanNo ratings yet

- Life Rankings 2020 Based On Q4 Net Income 1Document1 pageLife Rankings 2020 Based On Q4 Net Income 1Ron CatalanNo ratings yet

- Columbres J Mlprime 24052021030741Document16 pagesColumbres J Mlprime 24052021030741Sibin PiptiNo ratings yet

- NBAPE Life Insurance Companies EQRSFS Q4 2023Document1 pageNBAPE Life Insurance Companies EQRSFS Q4 2023Kim MagtibayNo ratings yet

- Sun Wealth Protect I A5 Brochure V5 - 270521Document4 pagesSun Wealth Protect I A5 Brochure V5 - 270521ARIF AHMAD HASSANNo ratings yet

- Mindef Mha Product SummaryDocument40 pagesMindef Mha Product SummaryJedrek TeoNo ratings yet

- Financial Markets: Saint Columban College Pagadian CityDocument11 pagesFinancial Markets: Saint Columban College Pagadian CityangelNo ratings yet

- The Mauritius Union Assurance Co LTD ProfileDocument13 pagesThe Mauritius Union Assurance Co LTD ProfileSundeep El-NinoNo ratings yet

- Mapacpac J Mlprime 14112021160254Document19 pagesMapacpac J Mlprime 14112021160254Jonas MapacpacNo ratings yet

- SC - 7783oooDocument7 pagesSC - 7783ooosantoshkumarNo ratings yet

- The Last Word in The World Of: RakshakaranDocument4 pagesThe Last Word in The World Of: RakshakaranNAGASAI BNo ratings yet

- Sun Maxilink 100Document11 pagesSun Maxilink 100Maloucel DiazNo ratings yet

- Allysamarie 1 MDocument13 pagesAllysamarie 1 MAlyssa Marie CastillonNo ratings yet

- rptHealthMax Robert1 PDFDocument14 pagesrptHealthMax Robert1 PDFJULIUS TIBERIONo ratings yet

- Takafulink Flexi v2.0 31122014Document4 pagesTakafulink Flexi v2.0 31122014amnasufiyaNo ratings yet

- USA Full-Time Employee Benefits Summary - All GradesDocument2 pagesUSA Full-Time Employee Benefits Summary - All Gradesvktm9r2x7nNo ratings yet

- Net Income Life Insurance Companies EQRSFS Q4 2023Document1 pageNet Income Life Insurance Companies EQRSFS Q4 2023Kim MagtibayNo ratings yet

- Axa Sme Life BrochureDocument28 pagesAxa Sme Life BrochuremiazainuddinNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Document10 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Jaymar Odtojan AbaloNo ratings yet

- Seasons 100 ProposalDocument3 pagesSeasons 100 ProposalAlvin Dela Cruz100% (1)

- Nuñez R Mlprime 02102021182517Document16 pagesNuñez R Mlprime 02102021182517Rommel Capinpin NunezNo ratings yet

- Insuring T&Cs - Accident Secure Max (Family) - PrimeDocument8 pagesInsuring T&Cs - Accident Secure Max (Family) - PrimeTolits MillabasNo ratings yet

- Health Start: A Sample Health Start Family Coverage Plan For A 1 Million, 20-Pay PlanDocument2 pagesHealth Start: A Sample Health Start Family Coverage Plan For A 1 Million, 20-Pay PlanYranj Dave FortalezaNo ratings yet

- CBA FM PE - Life Insurance - Group2Document7 pagesCBA FM PE - Life Insurance - Group2Janna Glaiza FernandezNo ratings yet

- Aquino AP Ml100 With-Complete-RidersDocument16 pagesAquino AP Ml100 With-Complete-RidersAldrin Paul AquinoNo ratings yet

- PRULink Exact ProtectorDocument5 pagesPRULink Exact ProtectorJul Lester CastilloNo ratings yet

- Benefits Summary IndiaDocument9 pagesBenefits Summary IndiaABHISHEK BAGHNo ratings yet

- Virgilio Reyes 2024-03-12 03 - 01 - 57Document15 pagesVirgilio Reyes 2024-03-12 03 - 01 - 57Cyber ZoneNo ratings yet

- Life Rankings 2020 Based On Q4 Investments 1Document1 pageLife Rankings 2020 Based On Q4 Investments 1Ron CatalanNo ratings yet

- Manulife Student Protect BrochureDocument2 pagesManulife Student Protect BrochurePhan Gia HuấnNo ratings yet

- Compensation Proposal (iHRM) GROUPDocument4 pagesCompensation Proposal (iHRM) GROUPAjar NairNo ratings yet

- File 1403Document78 pagesFile 1403Neha MongaNo ratings yet

- Faculty of Business and Management: Life and Health Insurance (Ins535)Document11 pagesFaculty of Business and Management: Life and Health Insurance (Ins535)Rienah SanariNo ratings yet

- Product Disclosure Sheet: GolifeDocument13 pagesProduct Disclosure Sheet: GolifeSiput TurboNo ratings yet

- Flex PA Brochure FADocument18 pagesFlex PA Brochure FAAIA Sunnie YapNo ratings yet

- Sun Maxilink PrimeDocument9 pagesSun Maxilink PrimeGracie Sugatan PlacinoNo ratings yet

- Death in The WorkplaceDocument3 pagesDeath in The WorkplaceAlvin CabralNo ratings yet

- National Management College: Department of Management StudiesDocument24 pagesNational Management College: Department of Management StudiesKarina ZetaNo ratings yet

- Mrs. Maria Eloisa Lim Chu Gungon: When You Reach Age 75 When You Reach Age 75 If The Insured Passes Away at Age 75Document11 pagesMrs. Maria Eloisa Lim Chu Gungon: When You Reach Age 75 When You Reach Age 75 If The Insured Passes Away at Age 75John Philip TiongcoNo ratings yet

- Net Worth Life Insurance Companies EQRSFS Q4 2023Document1 pageNet Worth Life Insurance Companies EQRSFS Q4 2023Kim MagtibayNo ratings yet

- Life Rankings 2020 Based On Q4 NW 1Document1 pageLife Rankings 2020 Based On Q4 NW 1Ron CatalanNo ratings yet

- Traditional Reflection EssayDocument3 pagesTraditional Reflection Essayapi-282199358No ratings yet

- Commercial LessonDocument8 pagesCommercial LessonSnowdenKonan100% (1)

- 撰写一篇简短的演讲稿Document6 pages撰写一篇简短的演讲稿cjbw63weNo ratings yet

- Prosperos DreamDocument8 pagesProsperos Dreamapi-336553511No ratings yet

- Financial - Analysis (SCI and SFP)Document4 pagesFinancial - Analysis (SCI and SFP)Joshua BristolNo ratings yet

- San Agustin Institute of Technology: Bible Month Culminating ActivityDocument4 pagesSan Agustin Institute of Technology: Bible Month Culminating ActivityErwin Y. CabaronNo ratings yet

- Estabilidade TrelicaDocument2 pagesEstabilidade TrelicaAna Carolina SaavedraNo ratings yet

- Internal Training Project Job Costing: Sage ERP X3Document37 pagesInternal Training Project Job Costing: Sage ERP X3Niko Christian ArnaldoNo ratings yet

- Bamu Essay PandemicDocument2 pagesBamu Essay Pandemicbamlak teshomeNo ratings yet

- Process Realization Plan: Recruitment and Terminal Benefits ProcessDocument24 pagesProcess Realization Plan: Recruitment and Terminal Benefits ProcessAliIrfanNo ratings yet

- Skilled Manpower Turnover and Its ManagementDocument109 pagesSkilled Manpower Turnover and Its Managementfikru terfaNo ratings yet

- Fullan - Leading in A Culture of Change PDFDocument15 pagesFullan - Leading in A Culture of Change PDFapi-262786958No ratings yet

- The Role of Business Model Innovation For Corporate SustainabilityDocument33 pagesThe Role of Business Model Innovation For Corporate Sustainabilitykhan MuntazirNo ratings yet

- Audit Practice Manual For ICABDocument223 pagesAudit Practice Manual For ICABhridimamalik80% (5)

- Voice Phrases and Their SpecifiersDocument39 pagesVoice Phrases and Their SpecifiersAndreas SitompulNo ratings yet

- Just Lather, That's All Reading QuestionsDocument2 pagesJust Lather, That's All Reading QuestionsEmily JohnNo ratings yet

- Cap - 12 - Betas by Sector DamodaranDocument4 pagesCap - 12 - Betas by Sector DamodaranVanessa José Claudio IsaiasNo ratings yet

- A Framework For Planning A Listening Skills LessonDocument6 pagesA Framework For Planning A Listening Skills LessonMa Eugenia Amezquita AcostaNo ratings yet

- Leah Klein - GDDocument1 pageLeah Klein - GDAbi C. WareNo ratings yet

- Branches of PhilosophyDocument16 pagesBranches of PhilosophyDarlito AblasNo ratings yet

- Gwinnett Incident Report VanpoolDocument2 pagesGwinnett Incident Report VanpoolbernardepatchNo ratings yet

- WYOPCC Triage Assessment Composite Report and Analysis - ANTHONY RAMSDEN Case.Document16 pagesWYOPCC Triage Assessment Composite Report and Analysis - ANTHONY RAMSDEN Case.PoliceCorruptionNo ratings yet

- Tibetan Buddhist Medicine and Psychiatry 282p PDFDocument282 pagesTibetan Buddhist Medicine and Psychiatry 282p PDFDharmaMaya Chandrahas89% (9)

- Aaakdog. The City of Davao NuguidpptDocument16 pagesAaakdog. The City of Davao NuguidpptAubreyNuguidNo ratings yet

- AQRFDocument45 pagesAQRFLouraine Baltazar LptNo ratings yet

- Agreement of License To Use TrademarkDocument12 pagesAgreement of License To Use TrademarkHimanshu Kumar100% (1)

- Company Law SynopsisDocument3 pagesCompany Law SynopsisAnand SinghNo ratings yet

- TOEFL Itp Test Taker HandbookDocument3 pagesTOEFL Itp Test Taker HandbookXuan Xuan NguyenNo ratings yet

- Sufyan Al ThawriDocument4 pagesSufyan Al ThawriUmarRR11100% (1)