Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

99 viewsBM3

BM3

Uploaded by

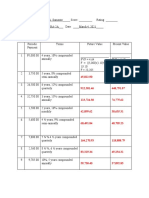

Evelyn YuMark sold a vehicle for P1,118,000 with a down payment of P78,000 and monthly installments of P22,494 over 6 years. The car dealer received a 5% commission on the sale.

Kaye took out a housing loan of P810,000 at 8% interest per year to be paid over 5 years in monthly installments of P16,423.88.

An individual's sales amounted to P140,950. Their commissions were calculated at different rates depending on the amount sold.

Karen receives a monthly basic salary along with allowances. Her overtime, deductions, gross and net earnings were calculated for a pay period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- ECON - MODULE - 2. For PrintingDocument15 pagesECON - MODULE - 2. For PrintingMarcial Jr. Militante75% (4)

- Case 4 (1-6) GabungDocument12 pagesCase 4 (1-6) GabungFadhila HanifNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Cpa Review School of The Philippines: Management Advisory Services AGE OFDocument9 pagesCpa Review School of The Philippines: Management Advisory Services AGE OFJohn Carlo CruzNo ratings yet

- Chapter 5 FinmanDocument4 pagesChapter 5 FinmanGen LibertadNo ratings yet

- Activity 1 Engineering Economy: I PRTDocument5 pagesActivity 1 Engineering Economy: I PRTtaliya cocoNo ratings yet

- UntitledDocument3 pagesUntitledMarie Alexis J MoniñoNo ratings yet

- AEFMANDocument3 pagesAEFMANJohn Domenic LuceroNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Present and CompoundDocument3 pagesPresent and CompoundTricia LuceroNo ratings yet

- Muskan Valbani PGP/24/456Document6 pagesMuskan Valbani PGP/24/456Muskan ValbaniNo ratings yet

- Mod 3 - HW2-TVMDocument3 pagesMod 3 - HW2-TVMsophiashezley.stefanowitzNo ratings yet

- Module - 3act2 - Financial ManagementDocument21 pagesModule - 3act2 - Financial ManagementAngelene Buenafe100% (1)

- Assignment - Managerial FinanceDocument20 pagesAssignment - Managerial FinanceBoyNo ratings yet

- Tutorial 5 ADocument12 pagesTutorial 5 ANguyên NguyênNo ratings yet

- Finance I: Tutorial TwoDocument5 pagesFinance I: Tutorial TwoLumumba KuyelaNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Prefinals - Investment ManagementDocument6 pagesPrefinals - Investment ManagementCharles John DolNo ratings yet

- EEDocument3 pagesEEzaphaniah triciaNo ratings yet

- #2-Simple Interest and Bank DiscountDocument3 pages#2-Simple Interest and Bank Discountmname7612No ratings yet

- Prelim Problem Set #3: Interests, Inflation, Escalation, AnnuityDocument1 pagePrelim Problem Set #3: Interests, Inflation, Escalation, AnnuityHane Minasalbas0% (1)

- Bsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDocument6 pagesBsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDerek LowNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- Bsa 2Document3 pagesBsa 2Gray JavierNo ratings yet

- Chapter 9Document24 pagesChapter 9Latifah MunassarNo ratings yet

- AnnuityDocument3 pagesAnnuitySharina Mhyca SamonteNo ratings yet

- Review - Chapter 10 Questions & AnswersDocument3 pagesReview - Chapter 10 Questions & AnswersDivyansh SinghNo ratings yet

- EF343. CFS (AL-I) Solution CMA May-2023 Exam.Document8 pagesEF343. CFS (AL-I) Solution CMA May-2023 Exam.GT Moringa LimitedNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Assingment FullDocument12 pagesAssingment FullAzman Scx100% (1)

- Workshop 1 Financial MathematicsDocument9 pagesWorkshop 1 Financial MathematicsScribdTranslationsNo ratings yet

- CBE 5 Module 5 TrueDocument8 pagesCBE 5 Module 5 TrueChristian John Resabal BiolNo ratings yet

- I. Time Value of Money: PortfolioDocument7 pagesI. Time Value of Money: PortfoliocarlaNo ratings yet

- DocumentDocument3 pagesDocumentMaria Kathreena Andrea AdevaNo ratings yet

- Commissions and OverridesDocument25 pagesCommissions and OverridesCarlaRiotetaNo ratings yet

- Week 7&8: AssignmentDocument11 pagesWeek 7&8: AssignmentkmarisseeNo ratings yet

- Future Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700Document9 pagesFuture Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700CloeNo ratings yet

- BFIN001 Week 3 Tutorial - MadelineDocument3 pagesBFIN001 Week 3 Tutorial - MadelinemadelineNo ratings yet

- Quiz 3 in Fm-Elec 101Document6 pagesQuiz 3 in Fm-Elec 101Krizia Mae ColegaNo ratings yet

- ACF 103 Revision Qns Solns 20141Document11 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Time Value Compiled DocsDocument12 pagesTime Value Compiled DocsaprilNo ratings yet

- Quiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Document4 pagesQuiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Ferry PratamaNo ratings yet

- The Time Value of MoneyDocument14 pagesThe Time Value of MoneyBudi RistantoNo ratings yet

- Assignment2 SolutionDocument5 pagesAssignment2 SolutionAnonymous dpWU6H5Lx2No ratings yet

- Question 1 A: (2 Marks) (1 Mark)Document3 pagesQuestion 1 A: (2 Marks) (1 Mark)shaneice_lewisNo ratings yet

- Topic 3 SolutionDocument10 pagesTopic 3 Solutiontijopaulose00No ratings yet

- Gitman IM Ch09Document24 pagesGitman IM Ch09Imran FarmanNo ratings yet

- MOI Lesson FinalsDocument78 pagesMOI Lesson FinalsPie CanapiNo ratings yet

- Mendoza 1 1 ProbSet5Document8 pagesMendoza 1 1 ProbSet5Marilyn M. MendozaNo ratings yet

- 4.discounted Cash Flows and Fundamentals of ValuationDocument5 pages4.discounted Cash Flows and Fundamentals of Valuationjoel pvargheseNo ratings yet

- Chapter 9Document3 pagesChapter 9Chan ZacharyNo ratings yet

- Chapter 5 - 14thDocument18 pagesChapter 5 - 14thLNo ratings yet

- SBE211-Regular ExamDocument4 pagesSBE211-Regular ExamThanh Hoa TrầnNo ratings yet

- Ans 2 Question ReviewDocument3 pagesAns 2 Question ReviewabdulmajeedNo ratings yet

- Bond ValuationDocument5 pagesBond ValuationNAVYA MITTAL 2224070No ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 2-3 - Solutions: Homework ProblemDocument5 pagesACF 103 - Fundamentals of Finance Tutorial 2-3 - Solutions: Homework ProblemRiri FahraniNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

BM3

BM3

Uploaded by

Evelyn Yu0 ratings0% found this document useful (0 votes)

99 views1 pageMark sold a vehicle for P1,118,000 with a down payment of P78,000 and monthly installments of P22,494 over 6 years. The car dealer received a 5% commission on the sale.

Kaye took out a housing loan of P810,000 at 8% interest per year to be paid over 5 years in monthly installments of P16,423.88.

An individual's sales amounted to P140,950. Their commissions were calculated at different rates depending on the amount sold.

Karen receives a monthly basic salary along with allowances. Her overtime, deductions, gross and net earnings were calculated for a pay period.

Original Description:

business math

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMark sold a vehicle for P1,118,000 with a down payment of P78,000 and monthly installments of P22,494 over 6 years. The car dealer received a 5% commission on the sale.

Kaye took out a housing loan of P810,000 at 8% interest per year to be paid over 5 years in monthly installments of P16,423.88.

An individual's sales amounted to P140,950. Their commissions were calculated at different rates depending on the amount sold.

Karen receives a monthly basic salary along with allowances. Her overtime, deductions, gross and net earnings were calculated for a pay period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

99 views1 pageBM3

BM3

Uploaded by

Evelyn YuMark sold a vehicle for P1,118,000 with a down payment of P78,000 and monthly installments of P22,494 over 6 years. The car dealer received a 5% commission on the sale.

Kaye took out a housing loan of P810,000 at 8% interest per year to be paid over 5 years in monthly installments of P16,423.88.

An individual's sales amounted to P140,950. Their commissions were calculated at different rates depending on the amount sold.

Karen receives a monthly basic salary along with allowances. Her overtime, deductions, gross and net earnings were calculated for a pay period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

1. Mark was able to sell a vehicle whose suggested retail price is P1,118,000.

The

vehicle will be financed through a bank. The required down payment was P78,000

and the monthly installment payment for 6 years will be P22,494. The car dealer

gave a 5% commission rate.

a. 78,000/1,118,000 x 100 = 6.97 = 7%

b. 1,118,000 - 78,000 = P1,040,000

c. 1,040,000 x 9.29% x 6 = P579,696

d. 1,118,000 x 5% = 55,900

1,040,000 x 1% = 10,400

55,900 + 10,400 = P66,300

2. Kaye’s housing loan worth P810,000 for 5 years was approved by the bank with an

interest rate of 8% per annum. How much will be her monthly amortization?

810,000(8%/12) / 1 - (1 + 8%/12)^-12(5) = P16,423.88

3. Suppose your sales amounted to P140,950.

a. 50,000 x 3% = 1,500

50,000 x 6% = 3,000

40,950 x 10% = 4,095

1,500 + 3,000 + 4095 = P8,595

b. 15,000 + 140,950 x 12% = P31,914

c. 25,000 + 90,950 x 8% = P32,276

4. Karen receives a semi-monthly basic salary of P14,250 and a transportation

allowance of 925 and a rice allowance of 750 (NT). Her overtime pay for the pay

period amounted to P7,730.47.

a. 14,250 x 2 = 28,500 (monthly salary)

28,500 + 925 + 750 + 7,730.47 = 37,905.47

PhilHealth: 37,905.47 x 3% = P1,137.16

Pag-ibig: 37,905.47 x 2% = P758.11

SSS: P1,600

b. Witholding Tax (semi-monthly based):

P14,250 - P10,417 = 3833

3833 x 20% = P766.6

(monthly based): 2,500 + 4572.47 x 25% = P3,643.12

c. Gross Earning: P37,905.47

d. Net Earning: 37,905.47 - 1,137.16 - 758.11 - 1,600 - 3,643.12 = P30,767.08

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- ECON - MODULE - 2. For PrintingDocument15 pagesECON - MODULE - 2. For PrintingMarcial Jr. Militante75% (4)

- Case 4 (1-6) GabungDocument12 pagesCase 4 (1-6) GabungFadhila HanifNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Cpa Review School of The Philippines: Management Advisory Services AGE OFDocument9 pagesCpa Review School of The Philippines: Management Advisory Services AGE OFJohn Carlo CruzNo ratings yet

- Chapter 5 FinmanDocument4 pagesChapter 5 FinmanGen LibertadNo ratings yet

- Activity 1 Engineering Economy: I PRTDocument5 pagesActivity 1 Engineering Economy: I PRTtaliya cocoNo ratings yet

- UntitledDocument3 pagesUntitledMarie Alexis J MoniñoNo ratings yet

- AEFMANDocument3 pagesAEFMANJohn Domenic LuceroNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Present and CompoundDocument3 pagesPresent and CompoundTricia LuceroNo ratings yet

- Muskan Valbani PGP/24/456Document6 pagesMuskan Valbani PGP/24/456Muskan ValbaniNo ratings yet

- Mod 3 - HW2-TVMDocument3 pagesMod 3 - HW2-TVMsophiashezley.stefanowitzNo ratings yet

- Module - 3act2 - Financial ManagementDocument21 pagesModule - 3act2 - Financial ManagementAngelene Buenafe100% (1)

- Assignment - Managerial FinanceDocument20 pagesAssignment - Managerial FinanceBoyNo ratings yet

- Tutorial 5 ADocument12 pagesTutorial 5 ANguyên NguyênNo ratings yet

- Finance I: Tutorial TwoDocument5 pagesFinance I: Tutorial TwoLumumba KuyelaNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Prefinals - Investment ManagementDocument6 pagesPrefinals - Investment ManagementCharles John DolNo ratings yet

- EEDocument3 pagesEEzaphaniah triciaNo ratings yet

- #2-Simple Interest and Bank DiscountDocument3 pages#2-Simple Interest and Bank Discountmname7612No ratings yet

- Prelim Problem Set #3: Interests, Inflation, Escalation, AnnuityDocument1 pagePrelim Problem Set #3: Interests, Inflation, Escalation, AnnuityHane Minasalbas0% (1)

- Bsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDocument6 pagesBsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDerek LowNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- Bsa 2Document3 pagesBsa 2Gray JavierNo ratings yet

- Chapter 9Document24 pagesChapter 9Latifah MunassarNo ratings yet

- AnnuityDocument3 pagesAnnuitySharina Mhyca SamonteNo ratings yet

- Review - Chapter 10 Questions & AnswersDocument3 pagesReview - Chapter 10 Questions & AnswersDivyansh SinghNo ratings yet

- EF343. CFS (AL-I) Solution CMA May-2023 Exam.Document8 pagesEF343. CFS (AL-I) Solution CMA May-2023 Exam.GT Moringa LimitedNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Assingment FullDocument12 pagesAssingment FullAzman Scx100% (1)

- Workshop 1 Financial MathematicsDocument9 pagesWorkshop 1 Financial MathematicsScribdTranslationsNo ratings yet

- CBE 5 Module 5 TrueDocument8 pagesCBE 5 Module 5 TrueChristian John Resabal BiolNo ratings yet

- I. Time Value of Money: PortfolioDocument7 pagesI. Time Value of Money: PortfoliocarlaNo ratings yet

- DocumentDocument3 pagesDocumentMaria Kathreena Andrea AdevaNo ratings yet

- Commissions and OverridesDocument25 pagesCommissions and OverridesCarlaRiotetaNo ratings yet

- Week 7&8: AssignmentDocument11 pagesWeek 7&8: AssignmentkmarisseeNo ratings yet

- Future Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700Document9 pagesFuture Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700CloeNo ratings yet

- BFIN001 Week 3 Tutorial - MadelineDocument3 pagesBFIN001 Week 3 Tutorial - MadelinemadelineNo ratings yet

- Quiz 3 in Fm-Elec 101Document6 pagesQuiz 3 in Fm-Elec 101Krizia Mae ColegaNo ratings yet

- ACF 103 Revision Qns Solns 20141Document11 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Time Value Compiled DocsDocument12 pagesTime Value Compiled DocsaprilNo ratings yet

- Quiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Document4 pagesQuiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Ferry PratamaNo ratings yet

- The Time Value of MoneyDocument14 pagesThe Time Value of MoneyBudi RistantoNo ratings yet

- Assignment2 SolutionDocument5 pagesAssignment2 SolutionAnonymous dpWU6H5Lx2No ratings yet

- Question 1 A: (2 Marks) (1 Mark)Document3 pagesQuestion 1 A: (2 Marks) (1 Mark)shaneice_lewisNo ratings yet

- Topic 3 SolutionDocument10 pagesTopic 3 Solutiontijopaulose00No ratings yet

- Gitman IM Ch09Document24 pagesGitman IM Ch09Imran FarmanNo ratings yet

- MOI Lesson FinalsDocument78 pagesMOI Lesson FinalsPie CanapiNo ratings yet

- Mendoza 1 1 ProbSet5Document8 pagesMendoza 1 1 ProbSet5Marilyn M. MendozaNo ratings yet

- 4.discounted Cash Flows and Fundamentals of ValuationDocument5 pages4.discounted Cash Flows and Fundamentals of Valuationjoel pvargheseNo ratings yet

- Chapter 9Document3 pagesChapter 9Chan ZacharyNo ratings yet

- Chapter 5 - 14thDocument18 pagesChapter 5 - 14thLNo ratings yet

- SBE211-Regular ExamDocument4 pagesSBE211-Regular ExamThanh Hoa TrầnNo ratings yet

- Ans 2 Question ReviewDocument3 pagesAns 2 Question ReviewabdulmajeedNo ratings yet

- Bond ValuationDocument5 pagesBond ValuationNAVYA MITTAL 2224070No ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 2-3 - Solutions: Homework ProblemDocument5 pagesACF 103 - Fundamentals of Finance Tutorial 2-3 - Solutions: Homework ProblemRiri FahraniNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet