Professional Documents

Culture Documents

Final Withholding Tax: BIR Quarterly, Monthly or Annually Deadline

Final Withholding Tax: BIR Quarterly, Monthly or Annually Deadline

Uploaded by

Mary Christine Formiloza MacalinaoCopyright:

Available Formats

You might also like

- Operations Management 6th Edition Test Bank Nigel SlackDocument8 pagesOperations Management 6th Edition Test Bank Nigel SlackEunice Cheslock100% (45)

- Training Manual For DFS Production For The Salt ProcessorsDocument115 pagesTraining Manual For DFS Production For The Salt ProcessorsSyed AhamedNo ratings yet

- 4 - Hydro Jetting and Sludge RemovalDocument18 pages4 - Hydro Jetting and Sludge RemovalPerwez21100% (2)

- Citizens CharterDocument3 pagesCitizens CharterChona Dabu100% (1)

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Document52 pagesMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNo ratings yet

- TAX 2 Deductions From The Gross Estate 1PPTDocument24 pagesTAX 2 Deductions From The Gross Estate 1PPTMichael AquinoNo ratings yet

- Estate TaxDocument7 pagesEstate TaxSirci RamNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- Vat On Sale of Goods or PropertiesDocument7 pagesVat On Sale of Goods or Propertiesnohair100% (3)

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- SPL ReviewerDocument6 pagesSPL Reviewerapril75No ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- Individual TaxpayerDocument17 pagesIndividual TaxpayermysterymieNo ratings yet

- 6 Estate Tax Lecture - CompressDocument5 pages6 Estate Tax Lecture - CompressbrennaNo ratings yet

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- TAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFDocument7 pagesTAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFKim Cristian MaañoNo ratings yet

- Donor's TaxDocument3 pagesDonor's TaxJohn Lexter MacalberNo ratings yet

- Accrued Liabilities and Deferred RevenuesDocument22 pagesAccrued Liabilities and Deferred Revenueschesca marie penarandaNo ratings yet

- Ch04 Taxation of Corp. TRAIN With Answers 1Document15 pagesCh04 Taxation of Corp. TRAIN With Answers 1Nicole100% (1)

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- Other Percentage TaxesDocument34 pagesOther Percentage TaxesRose Diane CabiscuelasNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- CGT Exam With SOlnDocument2 pagesCGT Exam With SOlnMinaykyuttNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Document5 pagesPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNo ratings yet

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- TAXATIONDocument9 pagesTAXATIONkekadiegoNo ratings yet

- General Provisions: The Law On PartnershipDocument38 pagesGeneral Provisions: The Law On PartnershipJoe P PokaranNo ratings yet

- SCRC 3 CorporationDocument18 pagesSCRC 3 CorporationChristine Yedda Marie AlbaNo ratings yet

- Income Tax ExamDocument4 pagesIncome Tax ExamErwin Labayog Medina0% (1)

- Other Percentage TaxesDocument40 pagesOther Percentage TaxesKay Hanalee Villanueva NorioNo ratings yet

- Exercises Corporate Income Taxation LatestDocument7 pagesExercises Corporate Income Taxation LatestTru Colors100% (1)

- (Diagnostic Exam) Advanced Studies in TaxationDocument25 pages(Diagnostic Exam) Advanced Studies in TaxationOjims Christjohn C CadungganNo ratings yet

- Far Eastern University - Manila Income Taxation TAX1101 Fringe Benefit TaxDocument10 pagesFar Eastern University - Manila Income Taxation TAX1101 Fringe Benefit TaxRyan Christian BalanquitNo ratings yet

- Under What Conditions May A Foreigner Be Allowed TDocument3 pagesUnder What Conditions May A Foreigner Be Allowed TANGELU RANE BAGARES INTOLNo ratings yet

- RCBC Controversy in The Bangladesh Bank $81 M HeistDocument3 pagesRCBC Controversy in The Bangladesh Bank $81 M HeistPam GamuedaNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Income Tax On CorporationsDocument8 pagesIncome Tax On CorporationsDevonNo ratings yet

- Liabilities 1 For Intermediate Accounting 2Document24 pagesLiabilities 1 For Intermediate Accounting 2Barredo, Joanna M.No ratings yet

- Differential-Cost-Analysis FinalDocument5 pagesDifferential-Cost-Analysis FinalRoshane Deil PascualNo ratings yet

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangNo ratings yet

- RR Filing, Penalties, RemediesDocument7 pagesRR Filing, Penalties, RemediesLisa ManobanNo ratings yet

- Exclusion of Gross IncomeDocument16 pagesExclusion of Gross IncomeAce ReytaNo ratings yet

- Summary Notes - Deductions From Gross EstateDocument3 pagesSummary Notes - Deductions From Gross EstateKiana FernandezNo ratings yet

- PNB V. Manalo: G.R. No. 174433 - February 24, 2014 - Bersamin, JDocument2 pagesPNB V. Manalo: G.R. No. 174433 - February 24, 2014 - Bersamin, JJay-ar Rivera BadulisNo ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Advocacy Paper ExampleDocument3 pagesAdvocacy Paper ExampleKiel OngtengcoNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- Bouncing Checks Law NOTESDocument2 pagesBouncing Checks Law NOTESMoniva Aiza JaneNo ratings yet

- Taxation Reviewer - REODocument202 pagesTaxation Reviewer - REOtmica7260No ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- BIR Tax DeadlinesDocument2 pagesBIR Tax Deadlinesimports.fcfilesNo ratings yet

- BIR-formsDocument4 pagesBIR-formsjanellemoralestNo ratings yet

- Bayan Ko: By: Jose Corazon de JesusDocument12 pagesBayan Ko: By: Jose Corazon de JesusMary Christine Formiloza Macalinao100% (1)

- MalaysiaDocument43 pagesMalaysiaMary Christine Formiloza MacalinaoNo ratings yet

- KejeDocument34 pagesKejeMary Christine Formiloza MacalinaoNo ratings yet

- Icj IccDocument4 pagesIcj IccMary Christine Formiloza MacalinaoNo ratings yet

- Case analysis,-WPS OfficeDocument1 pageCase analysis,-WPS OfficeMary Christine Formiloza MacalinaoNo ratings yet

- Math ResearchDocument4 pagesMath ResearchMary Christine Formiloza MacalinaoNo ratings yet

- Income TaxationDocument60 pagesIncome TaxationMary Christine Formiloza MacalinaoNo ratings yet

- Buenacosa, Astrid Hatton Case Study # 1: An Island FirestormDocument12 pagesBuenacosa, Astrid Hatton Case Study # 1: An Island FirestormAstrid BuenacosaNo ratings yet

- Chapter 13 - Basic DerivativesDocument59 pagesChapter 13 - Basic Derivativesjelyn bermudezNo ratings yet

- Analysing Mouse and Pen Flick GesturesDocument6 pagesAnalysing Mouse and Pen Flick GesturesHarini RaoNo ratings yet

- MDSW TamilNadu06Document14 pagesMDSW TamilNadu06miningnova1No ratings yet

- Inquiries and Immersion, Krg846Document33 pagesInquiries and Immersion, Krg846Hannah Louise Gutang PortilloNo ratings yet

- Unit 1 - Identifying A Problem PDFDocument16 pagesUnit 1 - Identifying A Problem PDFZanko FitnessNo ratings yet

- Intro To Career in Data Science: Md. Rabiul IslamDocument62 pagesIntro To Career in Data Science: Md. Rabiul Islamgouri67100% (1)

- ETM-OT - Electronic Temperature Monitor: DescriptionDocument3 pagesETM-OT - Electronic Temperature Monitor: DescriptionMKNo ratings yet

- Accounting ResearchDocument6 pagesAccounting ResearchAnne PanghulanNo ratings yet

- SP22 BseDocument3 pagesSP22 Bsebazm-e- wafaNo ratings yet

- A 200 Word Essay OnDocument9 pagesA 200 Word Essay OnANANDRAJ HARIHARANNo ratings yet

- CV (2) - 2Document3 pagesCV (2) - 2abhishek.berkmanNo ratings yet

- 3 Odometer DisclosureDocument1 page3 Odometer DisclosureJuan Carlos MartinezNo ratings yet

- Paper Tugas Kelompok ELT Curriculum Developing A Course SyllabusDocument5 pagesPaper Tugas Kelompok ELT Curriculum Developing A Course SyllabusAdies NuariNo ratings yet

- Shipham Special Alloy ValvesDocument62 pagesShipham Special Alloy ValvesYogi173No ratings yet

- Efficient Securities MarketDocument19 pagesEfficient Securities MarketAnnisa MuktiNo ratings yet

- Product Classification: SL110 Series Modular Jack, RJ45, Category 6, T568A/T568B, Unshielded, Without Dust Cover, BlackDocument2 pagesProduct Classification: SL110 Series Modular Jack, RJ45, Category 6, T568A/T568B, Unshielded, Without Dust Cover, BlackDWVIZCARRANo ratings yet

- Ed 807 Economics of Education MODULE-14 Activity-AnswerDocument3 pagesEd 807 Economics of Education MODULE-14 Activity-Answerjustfer johnNo ratings yet

- Business Plan DETAILDocument4 pagesBusiness Plan DETAILAnnabelle Poniente HertezNo ratings yet

- Exam Preparation Chartered Member Solutions 20080403Document36 pagesExam Preparation Chartered Member Solutions 20080403Jordy NgNo ratings yet

- A Hybrid Intrution Detection Approach Based On Deep LearningDocument16 pagesA Hybrid Intrution Detection Approach Based On Deep LearningVictor KingbuilderNo ratings yet

- DHL Strategy ModelDocument59 pagesDHL Strategy Modelfssankar100% (12)

- Gagas 2018Document233 pagesGagas 2018UnggulRajevPradanaNo ratings yet

- PNP ACG - Understanding Digital ForensicsDocument76 pagesPNP ACG - Understanding Digital ForensicsTin TinNo ratings yet

- PDFDocument1 pagePDFMiguel Ángel Gálvez FernándezNo ratings yet

- Digitales: ArchivDocument9 pagesDigitales: ArchivbanbanNo ratings yet

Final Withholding Tax: BIR Quarterly, Monthly or Annually Deadline

Final Withholding Tax: BIR Quarterly, Monthly or Annually Deadline

Uploaded by

Mary Christine Formiloza MacalinaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Withholding Tax: BIR Quarterly, Monthly or Annually Deadline

Final Withholding Tax: BIR Quarterly, Monthly or Annually Deadline

Uploaded by

Mary Christine Formiloza MacalinaoCopyright:

Available Formats

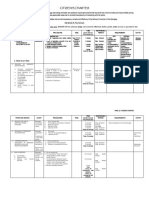

Quarterly,

BIR Definition Monthly or Deadline

Annually

FINAL WITHHOLDING TAX

Form 0619-F on or before the 10th day of the month following the

Monthly Remittance Form Monthly

months

on or before the 10th day of the month following the

Form 0619-E Expanded withholding tax Monthly

months

-For eFPS Monthly Group A – 15 days following the end of the month

Group B – 14 days following the end of the month

Group C - 13 days following the end of the month

Group D - 12 days following the end of the month

Group E - 11 days following the end of the month

- Quarterly Remittance Return Quarterly on or before the last day of the month after each

Form 1601-FQ of Final Income Taxes Withheld quarter

CAPITAL GAINS TAX

Capital gains tax return for Every transaction - Shall be filed within 30 days after each sale,

onerous transfer of shares of exchange, and other disposition of stocks.

Form 1707

stocks not traded through the

Local Stock Exchange

Annual Capital gains tax return Annually – shall be filed on or before 15th day of the 4th month

for onerous transfer of shares of following the taxable year

Form 1707-A

stocks not traded through the

Local Stock Exchange

Capital gains tax return for Every transaction -due within 30 days from the date sale or exchange

onerous transfer of Real

Form 1706 Property classified as Capital

Asset (both taxable and

exempt)

REGULAR INCOME TAX

Individuals

Purely employed taxpayer

(required if has other taxable

Form 1700 Annually

income or has more than 1

employer)

Purely in business/profession,

Form 1701A using itemized, OSD or 8% Annually

optional income tax

Mixed income earners, Estate

Form 1701 Annually On or before 15TH day of the 4th month following the

and trusts

taxable year of the taxpayer

Corporation Annually

Corporations subject only to 30%

Form 1702-RT Annually

RIT

Corporations subject to special

Form 1702-MX Annually

or combination of tax rates

Corporations that is exempt (if

Form 1702-EX with gross income, subject to RIT Annually

or special rate)

Engaged in business/profession (45 days from the end of the 1st 3 quarter)

Form 1701Q Quarterly 1st quarter May 15, same year

2nd quarter August 15. same year

rd

3 quarter November 15, same year

Corporation (60 days from the end of the quarter)

Form 1701Q Quarterly 1st quarter 60 days end of 1st q.

2nd quarter 60 days end of 2nd q

3rd quarter 60 days end of 3rd q

Improperly Accumulated Within 15 days after the close of the year

Form 1704 Earnings Tax return for immediately succeeding taxpayer’s covered taxable

Corporation year

Annual income Information

Return (For non-resident/OCW On or before 15TH day of the 4th month following the

Form 1703 Annually

and seamen – Foreign Sourced taxable year of the taxpayer

Income)

Information Return on

Transactions with Related

Form 1709

Party(International and/or

Domestic)

WITHHHOLDNG TAX ON

COMPENSATION

Monthly Remittance Return of On or before the 10th day of the following month the

Income Taxes Withheld on withholding was made except for taxes withheld for

Form 1601-C Monthly

Compensation December which shall be filed/paid on or before

January 15 of the succeeding year

Annual Information Return of

Income Taxes Withheld on

On or before January 31 of the following calendar

Form 1604-C Compensation and Final Annually

year

Withholding taxes

CERTIFICATE

Certificate of Compensation or

Form 2316 On or before January 31 of the succeeding year

Income Taxes Withheld

Certificate of final tax withheld

Form 2306

at source

Certificate of creditable tax

Form 2307

withheld at source

Certificate of income payment

Form 2304

not subject to withholding tax

You might also like

- Operations Management 6th Edition Test Bank Nigel SlackDocument8 pagesOperations Management 6th Edition Test Bank Nigel SlackEunice Cheslock100% (45)

- Training Manual For DFS Production For The Salt ProcessorsDocument115 pagesTraining Manual For DFS Production For The Salt ProcessorsSyed AhamedNo ratings yet

- 4 - Hydro Jetting and Sludge RemovalDocument18 pages4 - Hydro Jetting and Sludge RemovalPerwez21100% (2)

- Citizens CharterDocument3 pagesCitizens CharterChona Dabu100% (1)

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Document52 pagesMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNo ratings yet

- TAX 2 Deductions From The Gross Estate 1PPTDocument24 pagesTAX 2 Deductions From The Gross Estate 1PPTMichael AquinoNo ratings yet

- Estate TaxDocument7 pagesEstate TaxSirci RamNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- Vat On Sale of Goods or PropertiesDocument7 pagesVat On Sale of Goods or Propertiesnohair100% (3)

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- SPL ReviewerDocument6 pagesSPL Reviewerapril75No ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- Individual TaxpayerDocument17 pagesIndividual TaxpayermysterymieNo ratings yet

- 6 Estate Tax Lecture - CompressDocument5 pages6 Estate Tax Lecture - CompressbrennaNo ratings yet

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- TAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFDocument7 pagesTAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFKim Cristian MaañoNo ratings yet

- Donor's TaxDocument3 pagesDonor's TaxJohn Lexter MacalberNo ratings yet

- Accrued Liabilities and Deferred RevenuesDocument22 pagesAccrued Liabilities and Deferred Revenueschesca marie penarandaNo ratings yet

- Ch04 Taxation of Corp. TRAIN With Answers 1Document15 pagesCh04 Taxation of Corp. TRAIN With Answers 1Nicole100% (1)

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- Other Percentage TaxesDocument34 pagesOther Percentage TaxesRose Diane CabiscuelasNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- CGT Exam With SOlnDocument2 pagesCGT Exam With SOlnMinaykyuttNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Document5 pagesPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNo ratings yet

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- TAXATIONDocument9 pagesTAXATIONkekadiegoNo ratings yet

- General Provisions: The Law On PartnershipDocument38 pagesGeneral Provisions: The Law On PartnershipJoe P PokaranNo ratings yet

- SCRC 3 CorporationDocument18 pagesSCRC 3 CorporationChristine Yedda Marie AlbaNo ratings yet

- Income Tax ExamDocument4 pagesIncome Tax ExamErwin Labayog Medina0% (1)

- Other Percentage TaxesDocument40 pagesOther Percentage TaxesKay Hanalee Villanueva NorioNo ratings yet

- Exercises Corporate Income Taxation LatestDocument7 pagesExercises Corporate Income Taxation LatestTru Colors100% (1)

- (Diagnostic Exam) Advanced Studies in TaxationDocument25 pages(Diagnostic Exam) Advanced Studies in TaxationOjims Christjohn C CadungganNo ratings yet

- Far Eastern University - Manila Income Taxation TAX1101 Fringe Benefit TaxDocument10 pagesFar Eastern University - Manila Income Taxation TAX1101 Fringe Benefit TaxRyan Christian BalanquitNo ratings yet

- Under What Conditions May A Foreigner Be Allowed TDocument3 pagesUnder What Conditions May A Foreigner Be Allowed TANGELU RANE BAGARES INTOLNo ratings yet

- RCBC Controversy in The Bangladesh Bank $81 M HeistDocument3 pagesRCBC Controversy in The Bangladesh Bank $81 M HeistPam GamuedaNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Income Tax On CorporationsDocument8 pagesIncome Tax On CorporationsDevonNo ratings yet

- Liabilities 1 For Intermediate Accounting 2Document24 pagesLiabilities 1 For Intermediate Accounting 2Barredo, Joanna M.No ratings yet

- Differential-Cost-Analysis FinalDocument5 pagesDifferential-Cost-Analysis FinalRoshane Deil PascualNo ratings yet

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangNo ratings yet

- RR Filing, Penalties, RemediesDocument7 pagesRR Filing, Penalties, RemediesLisa ManobanNo ratings yet

- Exclusion of Gross IncomeDocument16 pagesExclusion of Gross IncomeAce ReytaNo ratings yet

- Summary Notes - Deductions From Gross EstateDocument3 pagesSummary Notes - Deductions From Gross EstateKiana FernandezNo ratings yet

- PNB V. Manalo: G.R. No. 174433 - February 24, 2014 - Bersamin, JDocument2 pagesPNB V. Manalo: G.R. No. 174433 - February 24, 2014 - Bersamin, JJay-ar Rivera BadulisNo ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Advocacy Paper ExampleDocument3 pagesAdvocacy Paper ExampleKiel OngtengcoNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- Bouncing Checks Law NOTESDocument2 pagesBouncing Checks Law NOTESMoniva Aiza JaneNo ratings yet

- Taxation Reviewer - REODocument202 pagesTaxation Reviewer - REOtmica7260No ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- BIR Tax DeadlinesDocument2 pagesBIR Tax Deadlinesimports.fcfilesNo ratings yet

- BIR-formsDocument4 pagesBIR-formsjanellemoralestNo ratings yet

- Bayan Ko: By: Jose Corazon de JesusDocument12 pagesBayan Ko: By: Jose Corazon de JesusMary Christine Formiloza Macalinao100% (1)

- MalaysiaDocument43 pagesMalaysiaMary Christine Formiloza MacalinaoNo ratings yet

- KejeDocument34 pagesKejeMary Christine Formiloza MacalinaoNo ratings yet

- Icj IccDocument4 pagesIcj IccMary Christine Formiloza MacalinaoNo ratings yet

- Case analysis,-WPS OfficeDocument1 pageCase analysis,-WPS OfficeMary Christine Formiloza MacalinaoNo ratings yet

- Math ResearchDocument4 pagesMath ResearchMary Christine Formiloza MacalinaoNo ratings yet

- Income TaxationDocument60 pagesIncome TaxationMary Christine Formiloza MacalinaoNo ratings yet

- Buenacosa, Astrid Hatton Case Study # 1: An Island FirestormDocument12 pagesBuenacosa, Astrid Hatton Case Study # 1: An Island FirestormAstrid BuenacosaNo ratings yet

- Chapter 13 - Basic DerivativesDocument59 pagesChapter 13 - Basic Derivativesjelyn bermudezNo ratings yet

- Analysing Mouse and Pen Flick GesturesDocument6 pagesAnalysing Mouse and Pen Flick GesturesHarini RaoNo ratings yet

- MDSW TamilNadu06Document14 pagesMDSW TamilNadu06miningnova1No ratings yet

- Inquiries and Immersion, Krg846Document33 pagesInquiries and Immersion, Krg846Hannah Louise Gutang PortilloNo ratings yet

- Unit 1 - Identifying A Problem PDFDocument16 pagesUnit 1 - Identifying A Problem PDFZanko FitnessNo ratings yet

- Intro To Career in Data Science: Md. Rabiul IslamDocument62 pagesIntro To Career in Data Science: Md. Rabiul Islamgouri67100% (1)

- ETM-OT - Electronic Temperature Monitor: DescriptionDocument3 pagesETM-OT - Electronic Temperature Monitor: DescriptionMKNo ratings yet

- Accounting ResearchDocument6 pagesAccounting ResearchAnne PanghulanNo ratings yet

- SP22 BseDocument3 pagesSP22 Bsebazm-e- wafaNo ratings yet

- A 200 Word Essay OnDocument9 pagesA 200 Word Essay OnANANDRAJ HARIHARANNo ratings yet

- CV (2) - 2Document3 pagesCV (2) - 2abhishek.berkmanNo ratings yet

- 3 Odometer DisclosureDocument1 page3 Odometer DisclosureJuan Carlos MartinezNo ratings yet

- Paper Tugas Kelompok ELT Curriculum Developing A Course SyllabusDocument5 pagesPaper Tugas Kelompok ELT Curriculum Developing A Course SyllabusAdies NuariNo ratings yet

- Shipham Special Alloy ValvesDocument62 pagesShipham Special Alloy ValvesYogi173No ratings yet

- Efficient Securities MarketDocument19 pagesEfficient Securities MarketAnnisa MuktiNo ratings yet

- Product Classification: SL110 Series Modular Jack, RJ45, Category 6, T568A/T568B, Unshielded, Without Dust Cover, BlackDocument2 pagesProduct Classification: SL110 Series Modular Jack, RJ45, Category 6, T568A/T568B, Unshielded, Without Dust Cover, BlackDWVIZCARRANo ratings yet

- Ed 807 Economics of Education MODULE-14 Activity-AnswerDocument3 pagesEd 807 Economics of Education MODULE-14 Activity-Answerjustfer johnNo ratings yet

- Business Plan DETAILDocument4 pagesBusiness Plan DETAILAnnabelle Poniente HertezNo ratings yet

- Exam Preparation Chartered Member Solutions 20080403Document36 pagesExam Preparation Chartered Member Solutions 20080403Jordy NgNo ratings yet

- A Hybrid Intrution Detection Approach Based On Deep LearningDocument16 pagesA Hybrid Intrution Detection Approach Based On Deep LearningVictor KingbuilderNo ratings yet

- DHL Strategy ModelDocument59 pagesDHL Strategy Modelfssankar100% (12)

- Gagas 2018Document233 pagesGagas 2018UnggulRajevPradanaNo ratings yet

- PNP ACG - Understanding Digital ForensicsDocument76 pagesPNP ACG - Understanding Digital ForensicsTin TinNo ratings yet

- PDFDocument1 pagePDFMiguel Ángel Gálvez FernándezNo ratings yet

- Digitales: ArchivDocument9 pagesDigitales: ArchivbanbanNo ratings yet