Professional Documents

Culture Documents

Ms Abrial

Ms Abrial

Uploaded by

Ashley Gana0 ratings0% found this document useful (0 votes)

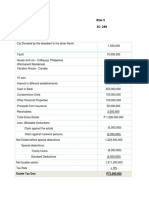

44 views1 pageThe document compares two methods for calculating income tax due on P1,650,000 total taxable income: a) Using an 8% fixed tax rate would result in P112,000 tax due. b) Using the graduated tax table, P420,000 taxable income after expenses is taxed at 30% on the first P400,000 and 25% on the excess P20,000, resulting in P35,000 tax due.

Original Description:

Original Title

ms-abrial

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares two methods for calculating income tax due on P1,650,000 total taxable income: a) Using an 8% fixed tax rate would result in P112,000 tax due. b) Using the graduated tax table, P420,000 taxable income after expenses is taxed at 30% on the first P400,000 and 25% on the excess P20,000, resulting in P35,000 tax due.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

44 views1 pageMs Abrial

Ms Abrial

Uploaded by

Ashley GanaThe document compares two methods for calculating income tax due on P1,650,000 total taxable income: a) Using an 8% fixed tax rate would result in P112,000 tax due. b) Using the graduated tax table, P420,000 taxable income after expenses is taxed at 30% on the first P400,000 and 25% on the excess P20,000, resulting in P35,000 tax due.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

a) Use 8% fixed rate

Gross sales P1,200,000

Gross receipts 450,000

Total taxable income P1,650,000

Income Tax due: (1,650,000 – P250,000) x 8% = P112,000

b) Use graduated tax table

Gross receipts P450,000

Gross sales P1,200,000

Less COS 850,000

Net income P 350,000

Less Operating expenses 380,000

Net loss 30,000

Taxable income P420,000

Income Tax due:

1st P400,000 P30,000

Excess P20,000 x 25% 5,000

P35,000

You might also like

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- ANSWERS Post Test Regular Income Taxation For PartnershipsDocument8 pagesANSWERS Post Test Regular Income Taxation For Partnershipslena cpa100% (1)

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Income Taxation - Chapter 2 - Individual TaxpayersDocument5 pagesIncome Taxation - Chapter 2 - Individual TaxpayerscurlybambiNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Income Taxation Chap. 4 & 6Document1 pageIncome Taxation Chap. 4 & 6curlybambiNo ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- 2807-Corporations PPT PDFDocument61 pages2807-Corporations PPT PDFMay Grethel Joy Perante100% (1)

- Exercises in Corporation SolutionsDocument6 pagesExercises in Corporation Solutionsdiane camansagNo ratings yet

- Che Che H. Datingaling OMGT-2102: Answer: Taxable Income Is P700,000Document4 pagesChe Che H. Datingaling OMGT-2102: Answer: Taxable Income Is P700,000cheche datingalingNo ratings yet

- Elec Melven JDocument2 pagesElec Melven JMelven Jordan IINo ratings yet

- TaxationDocument3 pagesTaxationHamot KentNo ratings yet

- TaxationDocument3 pagesTaxationHamot KentNo ratings yet

- Taxation CompressDocument3 pagesTaxation CompressJulie BagaresNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesIncome Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersolafedNo ratings yet

- Accbusco Chapter 16Document14 pagesAccbusco Chapter 16PaupauNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Problem Solving Posttest Week2Document3 pagesProblem Solving Posttest Week2Cale HenituseNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- New Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsDocument8 pagesNew Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsSD AccountingNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- 3.3 Exercise - Improperly Accumulated Earnings TaxDocument2 pages3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNo ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Taxation On IndividualsDocument10 pagesTaxation On IndividualsHERNANDO REYESNo ratings yet

- Sales 3,000,000.00: Invoice Price 112,000.00Document11 pagesSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoNo ratings yet

- 8.2 Assignment - Regular Income Tax For IndividualsDocument8 pages8.2 Assignment - Regular Income Tax For Individualssam imperialNo ratings yet

- Exercises - Individual IT - TLDocument1 pageExercises - Individual IT - TLClyde SaulNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Individual Taxpayers ProblemsDocument15 pagesIndividual Taxpayers ProblemsRaiNo ratings yet

- Tax AssigmentDocument1 pageTax Assigmentasdfg qwertNo ratings yet

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Principles of DeductionsDocument12 pagesPrinciples of DeductionsJUSTINEJADE PEREZNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- BUSITAX (Final Output)Document5 pagesBUSITAX (Final Output)Ivan AnaboNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet