Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

34 viewsACC316-Asynchronous-Activity-John Bernard Mejia

ACC316-Asynchronous-Activity-John Bernard Mejia

Uploaded by

Anonymous YtThe document provides an instruction to compare the accounting for joint arrangements under PFRS 11, PFRS for Small Entities, and PFRS for SMEs. Specifically, the student is asked to distinguish the definition, types of joint arrangements/joint ventures, and accounting methods under each standard. In response, the student provides a table that summarizes the key differences between the three standards according to the dimensions specified in the instruction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Differences Between A JV and ConsortiumDocument3 pagesDifferences Between A JV and ConsortiumIsa Maj63% (8)

- PFRS 11-Joint ArrangementsDocument93 pagesPFRS 11-Joint ArrangementsStephiel Sump100% (5)

- Afar01 Joint Arrangements ReviewersDocument13 pagesAfar01 Joint Arrangements ReviewersPam G.No ratings yet

- Joint Arrangement UeueueuueDocument34 pagesJoint Arrangement UeueueuuechiNo ratings yet

- Syllabus For The Next Batch - Doc Version 1Document59 pagesSyllabus For The Next Batch - Doc Version 1ami habib0% (1)

- Practical Accounting 2 Joint ArrangementDocument70 pagesPractical Accounting 2 Joint ArrangementMary Jescho Vidal AmpilNo ratings yet

- 6 - Joint ArrangementDocument8 pages6 - Joint ArrangementDarlene Faye Cabral RosalesNo ratings yet

- 03 Joint ArrangementsxxDocument62 pages03 Joint ArrangementsxxAnaliza OndoyNo ratings yet

- Practical Accounting 2 - Joint ArrangementDocument37 pagesPractical Accounting 2 - Joint ArrangementJeane Bongalan82% (17)

- CMPC 131 04 Module 02Document7 pagesCMPC 131 04 Module 02Fernando III PerezNo ratings yet

- Chapter 1Document18 pagesChapter 1Nigusu TadeseNo ratings yet

- 74535bos60448 Indas111Document7 pages74535bos60448 Indas111pave.scgroupNo ratings yet

- AFAR-13 (Joint Arrangements)Document6 pagesAFAR-13 (Joint Arrangements)MABI ESPENIDONo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsfrondagericaNo ratings yet

- Afar10joint ArrangementDocument8 pagesAfar10joint ArrangementJohn DomingoNo ratings yet

- Module 7Document5 pagesModule 7trixie maeNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- Module 1.6 - Joint Arrangements PDFDocument3 pagesModule 1.6 - Joint Arrangements PDFMila MercadoNo ratings yet

- Kashifadeel - IFRS 11Document2 pagesKashifadeel - IFRS 11zahidsiddiqui75No ratings yet

- PFRS 11 NotesDocument4 pagesPFRS 11 NotesAngel Lea RegaladoNo ratings yet

- Equity Joint Ventures Cooperative Joint Ventures Wholly Foreign Owned Enterprises (Wfoes) Foreign Investment Companies Limited by Shares (Ficlbs)Document27 pagesEquity Joint Ventures Cooperative Joint Ventures Wholly Foreign Owned Enterprises (Wfoes) Foreign Investment Companies Limited by Shares (Ficlbs)Salil SheikhNo ratings yet

- Konsolidasi Lap Keuangan@17 Apr 24Document78 pagesKonsolidasi Lap Keuangan@17 Apr 24Lily TanNo ratings yet

- Adfa I & II Module NewDocument36 pagesAdfa I & II Module NewEyob EyobaNo ratings yet

- Contractually Agreed Sharing Relevant Activities Unanimous ConsentDocument3 pagesContractually Agreed Sharing Relevant Activities Unanimous ConsentKathleen MarcialNo ratings yet

- Joint Arrangements: International Financial Reporting Standard 11Document24 pagesJoint Arrangements: International Financial Reporting Standard 11Obet LimNo ratings yet

- 3 Joint Arrange. Ifrs 11Document6 pages3 Joint Arrange. Ifrs 11DM BuenconsejoNo ratings yet

- Advanced Financial Accounting and Reporting (Afar) Accounting For Joint ArrangementsDocument4 pagesAdvanced Financial Accounting and Reporting (Afar) Accounting For Joint ArrangementsJasmine Marie Ng CheongNo ratings yet

- Joint ArrangementsDocument19 pagesJoint ArrangementsAndyvergys Aldrin MistulaNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- Sitara Chemicals: Note #01Document3 pagesSitara Chemicals: Note #01AKNo ratings yet

- Joint ArrangementsDocument22 pagesJoint ArrangementsJhoanNo ratings yet

- PWC Indonesia Energy, Utilities & Mining Newsflash: A Practical Guide To Psak 66Document8 pagesPWC Indonesia Energy, Utilities & Mining Newsflash: A Practical Guide To Psak 66Lynx SuitonNo ratings yet

- Pfrs 11Document2 pagesPfrs 11Gezalyn GuevarraNo ratings yet

- Joint Venture: Jointly Controlled Operations Jointly Controlled Assets Jointly Controlled EntitiesDocument6 pagesJoint Venture: Jointly Controlled Operations Jointly Controlled Assets Jointly Controlled EntitiesJoanne TolentinoNo ratings yet

- As-27 (Financial Reporting of Interests in Joint Ventures)Document10 pagesAs-27 (Financial Reporting of Interests in Joint Ventures)api-3828505No ratings yet

- General de Jesus CollegeDocument16 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- PFRS 11 Joint ArrangementsDocument2 pagesPFRS 11 Joint ArrangementsElla MaeNo ratings yet

- IFRS 11 For Oil and Gas Joint Arrangements 2012Document8 pagesIFRS 11 For Oil and Gas Joint Arrangements 2012Ashanti Cherish HernandezNo ratings yet

- Deegan5e SM Ch34Document6 pagesDeegan5e SM Ch34Rachel TannerNo ratings yet

- Module 2 - Joint ArrangementsDocument9 pagesModule 2 - Joint ArrangementsRodelLaborNo ratings yet

- Joint Venture - FranquiciaDocument16 pagesJoint Venture - FranquiciaDiana GuevaraNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewerstheresaazuresNo ratings yet

- Indian Accounting Standard (Ind AS) 31 Interests in Joint VenturesDocument16 pagesIndian Accounting Standard (Ind AS) 31 Interests in Joint VenturessatishNo ratings yet

- PFRS 11 SummaryDocument2 pagesPFRS 11 SummaryHakdog SadNo ratings yet

- 11 Ind As 111 Joint ArrangementsDocument29 pages11 Ind As 111 Joint Arrangementsadipawar2824No ratings yet

- Joint ArrangementsDocument4 pagesJoint ArrangementsgeexellNo ratings yet

- Special Transactions Chapter 6Document3 pagesSpecial Transactions Chapter 6Maria DyNo ratings yet

- CH 1 Advanced AccDocument9 pagesCH 1 Advanced Accfitsum tesfayeNo ratings yet

- Definition of Terms:: Unit V - Joint ArrangementsDocument20 pagesDefinition of Terms:: Unit V - Joint ArrangementsMary DenizeNo ratings yet

- BSA 3202 Topic 2 - Joint ArrangementsDocument14 pagesBSA 3202 Topic 2 - Joint ArrangementsjenieNo ratings yet

- Adv 1Document26 pagesAdv 1liyneh mebrahituNo ratings yet

- Module 3 Joint ArrangementsDocument19 pagesModule 3 Joint ArrangementsNiki DimaanoNo ratings yet

- Chap 002Document55 pagesChap 002abel JemalNo ratings yet

- Chapter 2 Joint ArrangementsDocument3 pagesChapter 2 Joint ArrangementsAngelica B. MartinNo ratings yet

- Special Transaction Chap 6Document9 pagesSpecial Transaction Chap 6balidleahluna20No ratings yet

- Joint Venture AFADocument26 pagesJoint Venture AFAdemeketeme2013No ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewersmixxNo ratings yet

- Ch-1 Joint Arreangment and Investment in Associate 2024Document33 pagesCh-1 Joint Arreangment and Investment in Associate 2024yesuqal tesfayeNo ratings yet

- Joint Arrangements: Arrangements, Which Establishes Principles For Financial Reporting by Parties To A Joint ArrangementDocument11 pagesJoint Arrangements: Arrangements, Which Establishes Principles For Financial Reporting by Parties To A Joint ArrangementJohn Rey LabasanNo ratings yet

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- AU - 8 - Audit Planning - PSA 300 To 320Document20 pagesAU - 8 - Audit Planning - PSA 300 To 320Anonymous YtNo ratings yet

- AU 7 Client AcceptanceDocument5 pagesAU 7 Client AcceptanceAnonymous YtNo ratings yet

- AU 6 NO AnswersDocument75 pagesAU 6 NO AnswersAnonymous YtNo ratings yet

- Advanced Financial Accounting & Reporting Business CombinationDocument8 pagesAdvanced Financial Accounting & Reporting Business CombinationAnonymous YtNo ratings yet

- TAX - 001 - MC Questions - For PostingDocument5 pagesTAX - 001 - MC Questions - For PostingAnonymous YtNo ratings yet

- (Regulatory Framework For Business Transactions) : PartnershipDocument10 pages(Regulatory Framework For Business Transactions) : PartnershipAnonymous YtNo ratings yet

- Resume, John Bernard MejiaDocument3 pagesResume, John Bernard MejiaAnonymous YtNo ratings yet

- Mejia, John Bernard C. ELEC 2 Midterm ExamDocument3 pagesMejia, John Bernard C. ELEC 2 Midterm ExamAnonymous YtNo ratings yet

- Kpop Reflection PaperDocument2 pagesKpop Reflection PaperAnonymous YtNo ratings yet

- University of Luzon: College of Accountancy Course Plan: It21 1st Semester SY 2019-2020Document5 pagesUniversity of Luzon: College of Accountancy Course Plan: It21 1st Semester SY 2019-2020Anonymous YtNo ratings yet

- College of Accountancy: University of Luzon Dagupan City Syllabus inDocument7 pagesCollege of Accountancy: University of Luzon Dagupan City Syllabus inAnonymous YtNo ratings yet

- 01 Mindset, Poor, RichDocument23 pages01 Mindset, Poor, RichJoy Superales SalaoNo ratings yet

- 288897Document2 pages288897Jeffrey s dayNo ratings yet

- Fiori AppDocument26 pagesFiori Appamguna4056No ratings yet

- Internship Report On Coca Cola MultanDocument47 pagesInternship Report On Coca Cola MultanRohullahIbrahimi0% (1)

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- Analysis of Cement Sector in Pakistan Focusing Lucky Cement LTDDocument7 pagesAnalysis of Cement Sector in Pakistan Focusing Lucky Cement LTDM Faisal Panawala100% (1)

- M08 - Gitman14 - MF - C08 Risk and ReturnDocument71 pagesM08 - Gitman14 - MF - C08 Risk and ReturnLeman SingleNo ratings yet

- Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012Document4 pagesBasic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012cutiepattotieNo ratings yet

- Financial Statement Analysis 13th Edition Gibson Test BankDocument25 pagesFinancial Statement Analysis 13th Edition Gibson Test Bankcleopatramabelrnnuqf100% (29)

- PD1270Document2 pagesPD1270Ronadale Zapata-AcostaNo ratings yet

- Atlas Fertilizer vs. CommissionerDocument10 pagesAtlas Fertilizer vs. CommissionerBenedick LedesmaNo ratings yet

- Real Estate Development Finance PartDocument43 pagesReal Estate Development Finance PartspacevibesNo ratings yet

- Businessfinance12 q3 Mod1.1 Introduction To Financial ManagementDocument20 pagesBusinessfinance12 q3 Mod1.1 Introduction To Financial ManagementAsset Dy93% (14)

- FATCA Application Form AnnexureDocument3 pagesFATCA Application Form AnnexureblossomkdcNo ratings yet

- Olympus ADocument24 pagesOlympus Aivychan2024No ratings yet

- Income Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. OgrimenDocument18 pagesIncome Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. Ogrimenlayla scotNo ratings yet

- Accounting AssignmentDocument22 pagesAccounting AssignmentEveryday LearnNo ratings yet

- Economics Assignment: Amity Law SchoolDocument11 pagesEconomics Assignment: Amity Law SchoolShivanshu KatareNo ratings yet

- Pinkerton (B)Document3 pagesPinkerton (B)Anupam Chaplot100% (1)

- Payment System Courses 2018Document18 pagesPayment System Courses 2018a0% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument69 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancefuturefinance2017No ratings yet

- E Receipt 1712098415114Document1 pageE Receipt 1712098415114gringhidu gehtdichnichtsangoogleNo ratings yet

- Unit 2Document5 pagesUnit 2Andra BordeaNo ratings yet

- Notice U/S 148 OF Income Tax Act 1961Document34 pagesNotice U/S 148 OF Income Tax Act 1961CA Sumit GohilNo ratings yet

- Estimación de Costos - FlotasDocument8 pagesEstimación de Costos - FlotasJhonny MendozaNo ratings yet

- 66 Tan Tiong Bio V Cir, GR No. L-15778, April 23, 1962, 4 Scra 986Document9 pages66 Tan Tiong Bio V Cir, GR No. L-15778, April 23, 1962, 4 Scra 986Edgar Calzita AlotaNo ratings yet

- Otherwise Indicated Therein With Reasonable Certainty. Signed by The Maker or Fixed or Determinable Future TimeDocument5 pagesOtherwise Indicated Therein With Reasonable Certainty. Signed by The Maker or Fixed or Determinable Future TimeDarla GreyNo ratings yet

- Adobe Scan 16 Dec 2023Document1 pageAdobe Scan 16 Dec 2023dsrikanth1031No ratings yet

- Gas Station QuestionnaireDocument4 pagesGas Station QuestionnairepeeteoNo ratings yet

ACC316-Asynchronous-Activity-John Bernard Mejia

ACC316-Asynchronous-Activity-John Bernard Mejia

Uploaded by

Anonymous Yt0 ratings0% found this document useful (0 votes)

34 views3 pagesThe document provides an instruction to compare the accounting for joint arrangements under PFRS 11, PFRS for Small Entities, and PFRS for SMEs. Specifically, the student is asked to distinguish the definition, types of joint arrangements/joint ventures, and accounting methods under each standard. In response, the student provides a table that summarizes the key differences between the three standards according to the dimensions specified in the instruction.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an instruction to compare the accounting for joint arrangements under PFRS 11, PFRS for Small Entities, and PFRS for SMEs. Specifically, the student is asked to distinguish the definition, types of joint arrangements/joint ventures, and accounting methods under each standard. In response, the student provides a table that summarizes the key differences between the three standards according to the dimensions specified in the instruction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

34 views3 pagesACC316-Asynchronous-Activity-John Bernard Mejia

ACC316-Asynchronous-Activity-John Bernard Mejia

Uploaded by

Anonymous YtThe document provides an instruction to compare the accounting for joint arrangements under PFRS 11, PFRS for Small Entities, and PFRS for SMEs. Specifically, the student is asked to distinguish the definition, types of joint arrangements/joint ventures, and accounting methods under each standard. In response, the student provides a table that summarizes the key differences between the three standards according to the dimensions specified in the instruction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Name: John Bernard C.

Mejia

University of Luzon

College of Accountancy

ACC316

2nd semester 2020-2021

RESEARCH WORK

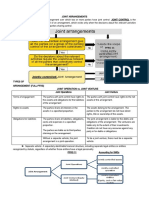

INSTRUCTION: Download a copy of PFRS for Small Entities and PFRS for SMEs as your

resource materials. Compare Accounting for Joint Arrangements of PFRS 11 with Accounting for

Joint Venture under PFRS for SEs and SMEs. Provide a distinction, at least, for the following

dimensions: Definition, Types of joint arrangements/joint venture, Accounting methods.

Attach in the google classroom no later than 23:59 march 2, 2021

ANSWER:

PFRS 11: Accounting PFRS for Small PFRS for SMEs:

for Joint Entities: Accounting Accounting for Joint

Arrangements for Joint Venture Venture

DEFINITION Joint arrangement is an Joint arrangement is an Joint venture is a

arrangement of which arrangement of which contractual arrangement

two or more parties two or more parties where two or more

have joint control. have joint control. parties undertake an

economic activity that

is subject to joint

control.

TYPE 1. Joint operation is a 1. Joint operation is a Jointly controlled

joint arrangement joint arrangement operations are the

whereby the parties that whereby the parties that operations of some joint

have joint control of the have joint control of the ventures involving the

arrangement have rights arrangement have rights use of the assets and

to the assets, and to the assets, and other resources of the

obligations for the obligations for the ventures rather than the

liabilities, relating to the liabilities, relating to establishment of a

arrangement. Those the arrangement. Those corporation, partnership

parties are called joint parties are called joint or other entity, or a

operators. operators. financial structure that

2. Joint Ventureis a 2. Joint Ventureis a is separate from the

joint arrangement joint arrangement ventures themselves.

whereby the parties that whereby the parties that Jointly controlled

have joint control of the have joint control of the assetssome joint

arrangement have rights arrangement have rights venture involve the

to the net assets of the to the net assets of the joint control, and often

arrangement.Those arrangement.Those the joint ownership, by

parties are called joint parties are called joint the venturers of one or

venturers. venturers. more assets contributed

Name: John Bernard C. Mejia

to, or acquired for the

purpose of, the joint

venture and dedicated

to the purposes of the

joint venture

Jointly controlled

entity is a joint venture

that involves the

establishment of a

corporation,

partnership, or other

entity in which each

venturer has an interest.

ACCOUNTING Joint Operationthe Joint Operationthe The accounting for

METHODS operators have the operators have the jointly controlled assets

rights to assets and rights to assets and and jointly controlled

obligations for the obligations for the operations is similar to

liabilities. They also liabilities. They also accounting for joint

account for the assets, account for the assets, operations. For a

liabilities, revenues and liabilities, revenues and controlled entity, either

expenses according to expenses according to one of the following

the contractual the contractual methods may be used to

arrangement. arrangement. account for the

investment: the equity

method, the cost

method, or the fair

value method.

Name: John Bernard C. Mejia

You might also like

- Differences Between A JV and ConsortiumDocument3 pagesDifferences Between A JV and ConsortiumIsa Maj63% (8)

- PFRS 11-Joint ArrangementsDocument93 pagesPFRS 11-Joint ArrangementsStephiel Sump100% (5)

- Afar01 Joint Arrangements ReviewersDocument13 pagesAfar01 Joint Arrangements ReviewersPam G.No ratings yet

- Joint Arrangement UeueueuueDocument34 pagesJoint Arrangement UeueueuuechiNo ratings yet

- Syllabus For The Next Batch - Doc Version 1Document59 pagesSyllabus For The Next Batch - Doc Version 1ami habib0% (1)

- Practical Accounting 2 Joint ArrangementDocument70 pagesPractical Accounting 2 Joint ArrangementMary Jescho Vidal AmpilNo ratings yet

- 6 - Joint ArrangementDocument8 pages6 - Joint ArrangementDarlene Faye Cabral RosalesNo ratings yet

- 03 Joint ArrangementsxxDocument62 pages03 Joint ArrangementsxxAnaliza OndoyNo ratings yet

- Practical Accounting 2 - Joint ArrangementDocument37 pagesPractical Accounting 2 - Joint ArrangementJeane Bongalan82% (17)

- CMPC 131 04 Module 02Document7 pagesCMPC 131 04 Module 02Fernando III PerezNo ratings yet

- Chapter 1Document18 pagesChapter 1Nigusu TadeseNo ratings yet

- 74535bos60448 Indas111Document7 pages74535bos60448 Indas111pave.scgroupNo ratings yet

- AFAR-13 (Joint Arrangements)Document6 pagesAFAR-13 (Joint Arrangements)MABI ESPENIDONo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsfrondagericaNo ratings yet

- Afar10joint ArrangementDocument8 pagesAfar10joint ArrangementJohn DomingoNo ratings yet

- Module 7Document5 pagesModule 7trixie maeNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- Module 1.6 - Joint Arrangements PDFDocument3 pagesModule 1.6 - Joint Arrangements PDFMila MercadoNo ratings yet

- Kashifadeel - IFRS 11Document2 pagesKashifadeel - IFRS 11zahidsiddiqui75No ratings yet

- PFRS 11 NotesDocument4 pagesPFRS 11 NotesAngel Lea RegaladoNo ratings yet

- Equity Joint Ventures Cooperative Joint Ventures Wholly Foreign Owned Enterprises (Wfoes) Foreign Investment Companies Limited by Shares (Ficlbs)Document27 pagesEquity Joint Ventures Cooperative Joint Ventures Wholly Foreign Owned Enterprises (Wfoes) Foreign Investment Companies Limited by Shares (Ficlbs)Salil SheikhNo ratings yet

- Konsolidasi Lap Keuangan@17 Apr 24Document78 pagesKonsolidasi Lap Keuangan@17 Apr 24Lily TanNo ratings yet

- Adfa I & II Module NewDocument36 pagesAdfa I & II Module NewEyob EyobaNo ratings yet

- Contractually Agreed Sharing Relevant Activities Unanimous ConsentDocument3 pagesContractually Agreed Sharing Relevant Activities Unanimous ConsentKathleen MarcialNo ratings yet

- Joint Arrangements: International Financial Reporting Standard 11Document24 pagesJoint Arrangements: International Financial Reporting Standard 11Obet LimNo ratings yet

- 3 Joint Arrange. Ifrs 11Document6 pages3 Joint Arrange. Ifrs 11DM BuenconsejoNo ratings yet

- Advanced Financial Accounting and Reporting (Afar) Accounting For Joint ArrangementsDocument4 pagesAdvanced Financial Accounting and Reporting (Afar) Accounting For Joint ArrangementsJasmine Marie Ng CheongNo ratings yet

- Joint ArrangementsDocument19 pagesJoint ArrangementsAndyvergys Aldrin MistulaNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- Sitara Chemicals: Note #01Document3 pagesSitara Chemicals: Note #01AKNo ratings yet

- Joint ArrangementsDocument22 pagesJoint ArrangementsJhoanNo ratings yet

- PWC Indonesia Energy, Utilities & Mining Newsflash: A Practical Guide To Psak 66Document8 pagesPWC Indonesia Energy, Utilities & Mining Newsflash: A Practical Guide To Psak 66Lynx SuitonNo ratings yet

- Pfrs 11Document2 pagesPfrs 11Gezalyn GuevarraNo ratings yet

- Joint Venture: Jointly Controlled Operations Jointly Controlled Assets Jointly Controlled EntitiesDocument6 pagesJoint Venture: Jointly Controlled Operations Jointly Controlled Assets Jointly Controlled EntitiesJoanne TolentinoNo ratings yet

- As-27 (Financial Reporting of Interests in Joint Ventures)Document10 pagesAs-27 (Financial Reporting of Interests in Joint Ventures)api-3828505No ratings yet

- General de Jesus CollegeDocument16 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- PFRS 11 Joint ArrangementsDocument2 pagesPFRS 11 Joint ArrangementsElla MaeNo ratings yet

- IFRS 11 For Oil and Gas Joint Arrangements 2012Document8 pagesIFRS 11 For Oil and Gas Joint Arrangements 2012Ashanti Cherish HernandezNo ratings yet

- Deegan5e SM Ch34Document6 pagesDeegan5e SM Ch34Rachel TannerNo ratings yet

- Module 2 - Joint ArrangementsDocument9 pagesModule 2 - Joint ArrangementsRodelLaborNo ratings yet

- Joint Venture - FranquiciaDocument16 pagesJoint Venture - FranquiciaDiana GuevaraNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewerstheresaazuresNo ratings yet

- Indian Accounting Standard (Ind AS) 31 Interests in Joint VenturesDocument16 pagesIndian Accounting Standard (Ind AS) 31 Interests in Joint VenturessatishNo ratings yet

- PFRS 11 SummaryDocument2 pagesPFRS 11 SummaryHakdog SadNo ratings yet

- 11 Ind As 111 Joint ArrangementsDocument29 pages11 Ind As 111 Joint Arrangementsadipawar2824No ratings yet

- Joint ArrangementsDocument4 pagesJoint ArrangementsgeexellNo ratings yet

- Special Transactions Chapter 6Document3 pagesSpecial Transactions Chapter 6Maria DyNo ratings yet

- CH 1 Advanced AccDocument9 pagesCH 1 Advanced Accfitsum tesfayeNo ratings yet

- Definition of Terms:: Unit V - Joint ArrangementsDocument20 pagesDefinition of Terms:: Unit V - Joint ArrangementsMary DenizeNo ratings yet

- BSA 3202 Topic 2 - Joint ArrangementsDocument14 pagesBSA 3202 Topic 2 - Joint ArrangementsjenieNo ratings yet

- Adv 1Document26 pagesAdv 1liyneh mebrahituNo ratings yet

- Module 3 Joint ArrangementsDocument19 pagesModule 3 Joint ArrangementsNiki DimaanoNo ratings yet

- Chap 002Document55 pagesChap 002abel JemalNo ratings yet

- Chapter 2 Joint ArrangementsDocument3 pagesChapter 2 Joint ArrangementsAngelica B. MartinNo ratings yet

- Special Transaction Chap 6Document9 pagesSpecial Transaction Chap 6balidleahluna20No ratings yet

- Joint Venture AFADocument26 pagesJoint Venture AFAdemeketeme2013No ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewersmixxNo ratings yet

- Ch-1 Joint Arreangment and Investment in Associate 2024Document33 pagesCh-1 Joint Arreangment and Investment in Associate 2024yesuqal tesfayeNo ratings yet

- Joint Arrangements: Arrangements, Which Establishes Principles For Financial Reporting by Parties To A Joint ArrangementDocument11 pagesJoint Arrangements: Arrangements, Which Establishes Principles For Financial Reporting by Parties To A Joint ArrangementJohn Rey LabasanNo ratings yet

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- AU - 8 - Audit Planning - PSA 300 To 320Document20 pagesAU - 8 - Audit Planning - PSA 300 To 320Anonymous YtNo ratings yet

- AU 7 Client AcceptanceDocument5 pagesAU 7 Client AcceptanceAnonymous YtNo ratings yet

- AU 6 NO AnswersDocument75 pagesAU 6 NO AnswersAnonymous YtNo ratings yet

- Advanced Financial Accounting & Reporting Business CombinationDocument8 pagesAdvanced Financial Accounting & Reporting Business CombinationAnonymous YtNo ratings yet

- TAX - 001 - MC Questions - For PostingDocument5 pagesTAX - 001 - MC Questions - For PostingAnonymous YtNo ratings yet

- (Regulatory Framework For Business Transactions) : PartnershipDocument10 pages(Regulatory Framework For Business Transactions) : PartnershipAnonymous YtNo ratings yet

- Resume, John Bernard MejiaDocument3 pagesResume, John Bernard MejiaAnonymous YtNo ratings yet

- Mejia, John Bernard C. ELEC 2 Midterm ExamDocument3 pagesMejia, John Bernard C. ELEC 2 Midterm ExamAnonymous YtNo ratings yet

- Kpop Reflection PaperDocument2 pagesKpop Reflection PaperAnonymous YtNo ratings yet

- University of Luzon: College of Accountancy Course Plan: It21 1st Semester SY 2019-2020Document5 pagesUniversity of Luzon: College of Accountancy Course Plan: It21 1st Semester SY 2019-2020Anonymous YtNo ratings yet

- College of Accountancy: University of Luzon Dagupan City Syllabus inDocument7 pagesCollege of Accountancy: University of Luzon Dagupan City Syllabus inAnonymous YtNo ratings yet

- 01 Mindset, Poor, RichDocument23 pages01 Mindset, Poor, RichJoy Superales SalaoNo ratings yet

- 288897Document2 pages288897Jeffrey s dayNo ratings yet

- Fiori AppDocument26 pagesFiori Appamguna4056No ratings yet

- Internship Report On Coca Cola MultanDocument47 pagesInternship Report On Coca Cola MultanRohullahIbrahimi0% (1)

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- Analysis of Cement Sector in Pakistan Focusing Lucky Cement LTDDocument7 pagesAnalysis of Cement Sector in Pakistan Focusing Lucky Cement LTDM Faisal Panawala100% (1)

- M08 - Gitman14 - MF - C08 Risk and ReturnDocument71 pagesM08 - Gitman14 - MF - C08 Risk and ReturnLeman SingleNo ratings yet

- Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012Document4 pagesBasic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012cutiepattotieNo ratings yet

- Financial Statement Analysis 13th Edition Gibson Test BankDocument25 pagesFinancial Statement Analysis 13th Edition Gibson Test Bankcleopatramabelrnnuqf100% (29)

- PD1270Document2 pagesPD1270Ronadale Zapata-AcostaNo ratings yet

- Atlas Fertilizer vs. CommissionerDocument10 pagesAtlas Fertilizer vs. CommissionerBenedick LedesmaNo ratings yet

- Real Estate Development Finance PartDocument43 pagesReal Estate Development Finance PartspacevibesNo ratings yet

- Businessfinance12 q3 Mod1.1 Introduction To Financial ManagementDocument20 pagesBusinessfinance12 q3 Mod1.1 Introduction To Financial ManagementAsset Dy93% (14)

- FATCA Application Form AnnexureDocument3 pagesFATCA Application Form AnnexureblossomkdcNo ratings yet

- Olympus ADocument24 pagesOlympus Aivychan2024No ratings yet

- Income Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. OgrimenDocument18 pagesIncome Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. Ogrimenlayla scotNo ratings yet

- Accounting AssignmentDocument22 pagesAccounting AssignmentEveryday LearnNo ratings yet

- Economics Assignment: Amity Law SchoolDocument11 pagesEconomics Assignment: Amity Law SchoolShivanshu KatareNo ratings yet

- Pinkerton (B)Document3 pagesPinkerton (B)Anupam Chaplot100% (1)

- Payment System Courses 2018Document18 pagesPayment System Courses 2018a0% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument69 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancefuturefinance2017No ratings yet

- E Receipt 1712098415114Document1 pageE Receipt 1712098415114gringhidu gehtdichnichtsangoogleNo ratings yet

- Unit 2Document5 pagesUnit 2Andra BordeaNo ratings yet

- Notice U/S 148 OF Income Tax Act 1961Document34 pagesNotice U/S 148 OF Income Tax Act 1961CA Sumit GohilNo ratings yet

- Estimación de Costos - FlotasDocument8 pagesEstimación de Costos - FlotasJhonny MendozaNo ratings yet

- 66 Tan Tiong Bio V Cir, GR No. L-15778, April 23, 1962, 4 Scra 986Document9 pages66 Tan Tiong Bio V Cir, GR No. L-15778, April 23, 1962, 4 Scra 986Edgar Calzita AlotaNo ratings yet

- Otherwise Indicated Therein With Reasonable Certainty. Signed by The Maker or Fixed or Determinable Future TimeDocument5 pagesOtherwise Indicated Therein With Reasonable Certainty. Signed by The Maker or Fixed or Determinable Future TimeDarla GreyNo ratings yet

- Adobe Scan 16 Dec 2023Document1 pageAdobe Scan 16 Dec 2023dsrikanth1031No ratings yet

- Gas Station QuestionnaireDocument4 pagesGas Station QuestionnairepeeteoNo ratings yet