Professional Documents

Culture Documents

Case Study Report: I. Problems Identification

Case Study Report: I. Problems Identification

Uploaded by

Feelya MonicaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study Report: I. Problems Identification

Case Study Report: I. Problems Identification

Uploaded by

Feelya MonicaCopyright:

Available Formats

Case Study Report

Borrowing Cost

31/03/2021

Prepared by:

Nandini Pramadhani

Feelya Monica

Dinny Firvidiani

I. Problems Identification

Prime View Properties ( holding) limited (PVL) is a company incorporated in Hongkong.

PVL holds a portfolio of commercial buildings for rental income . The accounting policy to use

the cost model to account property, plant, and equipment and valuation model to account for

investment properties.

One of the sources of rental income is atlantic centre. The atlantic centre is a commercial

building that consist of ground floor until second floor for shopping centre and third floor until

twenty ninth floor for office building. The purchasing cost of atlantic centre is $240 million in

1990.Because of new office tower near the atlantic centre, the major tenant of atlantic centre

moving out. And during that years, the atlantic centre was rent by small tenant for short term

period.

As response to the event, PVL as parent company decided to convert the atlantic centre

into atlantic hotel and the shopping centre convert into atlantic place. Ownership of the building

divided into 2, atlantic place would be 100% owned by atlantic centre limited and atlantic hotel

owned by atlantic hotel limited.

To realization this project, the renovation would be costs to be financed by bank loans

with interest 5% per annum. From this cases, there are two problem appear, first whether PVL

allow to capitalized the borrowing cost to finance the convertion project as cost of atlantic place

and atlantic hotel based on accounting standard?

II. Identification and Discussion of Related IFRS

Standard that concerning the cases are the IAS 23 about Borrowing Costs and IAS 27

about Separate Financial Statements (as amended in 2011).

The IAS 23 (Borrowing Costs) requires that the borrowing costs will directly attributable

to the acquisition, construction or production of a 'qualifying asset' (one that necessarily takes a

substantial period of time to get ready for its intended use or sale) are included in the cost of the

asset. By focusing on the case, the Atlantic Centre Limited 100% owned subsidiary of PVL.

From the Atlantic Centre’s prime location, PVL wants to converting the use of the AC to be a

mid-range hotel, so they change the use of the building such the 3rd until 29th becoming a hotel

and the ground and 2nd floor becoming shopping mall named Atlantic Place. For this situation the

renovation cost will be occurs and it will be financed by bank loans borrowed of 5% rate of

interest per annum.

The objective of IAS 23 is to prescribe the accounting treatment for borrowing costs.

Borrowing costs include interest on bank overdrafts and borrowings, finance charges on finance

leases and exchange differences on foreign currency borrowings where they are regarded as an

adjustment to interest costs. This is relatable with the cases which the company financed by the

bank loans.

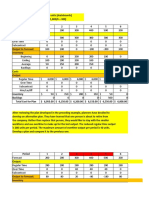

III. Proposed Solutions of The Problem

Solution of the problem the problems are, first whether PVL (trough ACL or AHL) can

capitalize the borrowing cost to finance the renovation work as cost of Atlantic Place and the

Atlantic Hotel, second how to present the capitalized amount in consolidated financial statement.

Solution for the first and second problem, based on the IAS 23 borrowing costs that are directly

attributable to construction or acquisition of an asset should be capitalized, based on the cases

7.1 borrowing cost from renovation of atlantic place and atlantic hotel can be capitalized.

Cost that will be measure to capitalize is actual costs less any income earned from temporary

investment of such borrowing. The borrowing costs should be stop to capitalized if the

renovation is interrupted and if the renovation was completed.

All of cost that are directly attributable to renovation process should be capitalized and

other borrowing cost recognized as expense. Actually in IASPLUS we can not find the specific

way to presented the capitalization, and in what account they should be presented. But we

already present the way to measure capitalization amount and what account the borrowing costs

should be recognized.

IV. Relation of the Solutions to the Conceptual Framework

The relation to the conceptual framework from this case are, first reliability because the

cost that will spend by PVL (trough ACL or AHL) to capitalize the renovation through

borrowing cost is really material, so the information must be free of material error and bias, and

not misleading. Thus, the information should faithfully represent transactions and prudently

represent estimates and uncertainties through proper disclosure.

Then, PVL must prepare relevant financial statement, information must be relevant to the

needs of the users, which is the case when the information influences their economic decisions.

This may involve reporting particularly relevant information, or information whose omission or

misstatement could influence the economic decisions of users. With this PVL can attract the

attention of potential investors to invest in their latest plans.

You might also like

- Marketing Audit ExampleDocument35 pagesMarketing Audit ExamplejanakaedNo ratings yet

- HuaweiDocument29 pagesHuaweiLi Ying100% (1)

- Review Questions: Solutions Manual To Accompany Dunn, Enterprise Information Systems: A Pattern Based Approach, 3eDocument17 pagesReview Questions: Solutions Manual To Accompany Dunn, Enterprise Information Systems: A Pattern Based Approach, 3eOpirisky ApriliantyNo ratings yet

- KASUS CUP CorporationDocument7 pagesKASUS CUP CorporationNia Azura SariNo ratings yet

- Chapter02 Solutions Hansen6eDocument16 pagesChapter02 Solutions Hansen6eJessica NoviaNo ratings yet

- ACT600 Chapter 3Document67 pagesACT600 Chapter 3Ali H. AyoubNo ratings yet

- Case Study - Kranworth Chair CorporationDocument3 pagesCase Study - Kranworth Chair CorporationMaruli Tua SianturiNo ratings yet

- Walker & CompanyDocument9 pagesWalker & Companyer4sallNo ratings yet

- Effective Execution: Building High-Performing OrganizationsFrom EverandEffective Execution: Building High-Performing OrganizationsNo ratings yet

- Chapter 4 Consolidation HWDocument4 pagesChapter 4 Consolidation HWKhanh NguyenNo ratings yet

- Cost Planning For The Product Life Cycle: Target Costing, Theory of Constraints, and Strategic PricingDocument44 pagesCost Planning For The Product Life Cycle: Target Costing, Theory of Constraints, and Strategic PricingSunny Khs100% (1)

- Signalling Theory GodfreyDocument5 pagesSignalling Theory GodfreyIndah AremanithaNo ratings yet

- Acg5205 Solutions Ch.16 - Christensen 12eDocument10 pagesAcg5205 Solutions Ch.16 - Christensen 12eRyan NguyenNo ratings yet

- Gale BrewerDocument3 pagesGale BrewerWulandariNo ratings yet

- Accounting Theory - Summary Chapter 6Document10 pagesAccounting Theory - Summary Chapter 6Boby Kristanto ChandraNo ratings yet

- Hilton MA 12e Chap002Document52 pagesHilton MA 12e Chap002vanessaNo ratings yet

- Capital Structure and Financial Performance: Evidence From IndiaDocument17 pagesCapital Structure and Financial Performance: Evidence From IndiaanirbanccimNo ratings yet

- Update Syllabus Advanced Cost & Management Accounting Gasal 2019Document8 pagesUpdate Syllabus Advanced Cost & Management Accounting Gasal 2019rief1010No ratings yet

- National Tractor and Equipment - Case Study Solution - Performance MeasurementDocument4 pagesNational Tractor and Equipment - Case Study Solution - Performance MeasurementPiotr BartenbachNo ratings yet

- AIS Group 8 Report Chapter 17 Hand-OutDocument8 pagesAIS Group 8 Report Chapter 17 Hand-OutPoy GuintoNo ratings yet

- Auditing - Hook Chapter 9 SolutionsDocument12 pagesAuditing - Hook Chapter 9 SolutionsZenni T XinNo ratings yet

- The Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceDocument21 pagesThe Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceFarwa KhalidNo ratings yet

- Ada Pharmaceutical Company Produces Three Drugs Diomycin HomycDocument2 pagesAda Pharmaceutical Company Produces Three Drugs Diomycin HomycAmit PandeyNo ratings yet

- 【PAPER】Chapter the Nature of CostDocument34 pages【PAPER】Chapter the Nature of CostRizal AlfianNo ratings yet

- Conceptual Framework: MKF 4083 Accounting Theory & PracticeDocument25 pagesConceptual Framework: MKF 4083 Accounting Theory & PracticeMohamad SolihinNo ratings yet

- Accounting Theory (AcT) (Teori Akuntansi (TA) ) - Chapter 9 (Godfrey) - PPT-revenue (14 A)Document24 pagesAccounting Theory (AcT) (Teori Akuntansi (TA) ) - Chapter 9 (Godfrey) - PPT-revenue (14 A)Pindi YulinarNo ratings yet

- Chapter 3 Appendix ADocument16 pagesChapter 3 Appendix AOxana NeckagyNo ratings yet

- Reaction Paper Strategic Cost ManagementDocument3 pagesReaction Paper Strategic Cost ManagementdeyNo ratings yet

- Acc Theory 2Document17 pagesAcc Theory 2Sarah ZulkifliNo ratings yet

- AKMEN CH 15 - Hansen MowenDocument29 pagesAKMEN CH 15 - Hansen MowenStella Tralalatrilili100% (1)

- Accounting Theory Case 7.2Document3 pagesAccounting Theory Case 7.2Lutfiana Hermawati100% (1)

- Bsz263432882inh PDFDocument4 pagesBsz263432882inh PDFMarsiniNo ratings yet

- Case Study 7 3Document7 pagesCase Study 7 3Helmi ArdhaniNo ratings yet

- Tactical Decision MakingDocument12 pagesTactical Decision MakingSiti Armayani RayNo ratings yet

- Beams10e - Ch02 Stock Investments-Investor Accounting and ReportingDocument37 pagesBeams10e - Ch02 Stock Investments-Investor Accounting and ReportingNadiaAmaliaNo ratings yet

- Resume Balance ScorecardDocument17 pagesResume Balance ScorecardNatya PratyaksaNo ratings yet

- APLI - Annual Report - 2017 PDFDocument156 pagesAPLI - Annual Report - 2017 PDFMichelle Hartasya SitompulNo ratings yet

- On January 1 2014 Paxton Company Purchased A 70 InterestDocument1 pageOn January 1 2014 Paxton Company Purchased A 70 InterestMuhammad ShahidNo ratings yet

- Worthington Industries Case 12-3Document6 pagesWorthington Industries Case 12-3jim_mcdiarmid1100% (1)

- Materi Persentasi SIA (Semester 4)Document3 pagesMateri Persentasi SIA (Semester 4)Rahmad Bari BarrudiNo ratings yet

- AUDITDocument1 pageAUDITNur Liena AmieraNo ratings yet

- Systems Design, Implementation, and Operation: Suggested Answers To Discussion QuestionsDocument25 pagesSystems Design, Implementation, and Operation: Suggested Answers To Discussion QuestionsAnton VitaliNo ratings yet

- Universitas Pakuan: Fakultas Ekonomi Dan BisnisDocument2 pagesUniversitas Pakuan: Fakultas Ekonomi Dan BisnisLianurismudjayanaNo ratings yet

- MAKSI-Silabus Internal Audit I Genap 21-22Document7 pagesMAKSI-Silabus Internal Audit I Genap 21-22anggi anythingNo ratings yet

- AAB Case For StudentsDocument24 pagesAAB Case For Studentsrana zainNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildManusha ErandiNo ratings yet

- Pengaruh Penerapan Sistem Informasi Akuntansi ManajemenDocument12 pagesPengaruh Penerapan Sistem Informasi Akuntansi ManajemenaddiniNo ratings yet

- Analisis Cost-Volume-Profit Sebagai Alat Bantu Perencanaan Laba (Multi Produk) Pada Perusahaan Pia Latief KediriDocument13 pagesAnalisis Cost-Volume-Profit Sebagai Alat Bantu Perencanaan Laba (Multi Produk) Pada Perusahaan Pia Latief KediriMuhammad FaiqNo ratings yet

- Tugas Kelompok Auditing II 14-33Document5 pagesTugas Kelompok Auditing II 14-33Lela MilasantiNo ratings yet

- Behavioral Research in Management Accounting The Past, Present, and FutureDocument24 pagesBehavioral Research in Management Accounting The Past, Present, and FutureBabelHardyNo ratings yet

- Management Control System - Revenue & Expense CenterDocument23 pagesManagement Control System - Revenue & Expense CenterCitra Dewi Wulansari0% (1)

- Rizky Purwanti Akhmad Riduwan: Pengaruh Konservatisme Akuntansi Terhadap Nilai PerusahaanDocument17 pagesRizky Purwanti Akhmad Riduwan: Pengaruh Konservatisme Akuntansi Terhadap Nilai PerusahaanRambu YanaNo ratings yet

- Penerapan Metode Activity Based CostingDocument15 pagesPenerapan Metode Activity Based CostingAira Oct SaharaNo ratings yet

- Kunci Jawaban Module 1-4Document10 pagesKunci Jawaban Module 1-4meyyNo ratings yet

- Joint Cost NewDocument54 pagesJoint Cost NewHadii SadjjaNo ratings yet

- Akuntansi Keuangan Lanjutan - Chap 007Document39 pagesAkuntansi Keuangan Lanjutan - Chap 007Gugat jelang romadhonNo ratings yet

- The Size of Government: Measurement, Methodology and Official StatisticsFrom EverandThe Size of Government: Measurement, Methodology and Official StatisticsNo ratings yet

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsFrom EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNo ratings yet

- Mohan's Task-3Document5 pagesMohan's Task-3Pampana Bala Sai Saroj RamNo ratings yet

- EntrepreneurshipDocument22 pagesEntrepreneurshipHercel Louise HernandezNo ratings yet

- Part FourDocument3 pagesPart FourHannah CorpuzNo ratings yet

- Part A. Money and Banking: B. Central Bank of The Philippines C. Greater D. Medium of Exchange Checkable DepositsDocument3 pagesPart A. Money and Banking: B. Central Bank of The Philippines C. Greater D. Medium of Exchange Checkable DepositsLovely De CastroNo ratings yet

- BBA Syllabus Sem-6 (Finance)Document10 pagesBBA Syllabus Sem-6 (Finance)Mukesh GiriNo ratings yet

- Building A Flexible Supply Chain in Low Volume High Mix IndustrialsDocument9 pagesBuilding A Flexible Supply Chain in Low Volume High Mix IndustrialsThanhquy NguyenNo ratings yet

- NPD AssignmentDocument3 pagesNPD AssignmentNicky BojeNo ratings yet

- Bus 2101 - Chapter 2Document24 pagesBus 2101 - Chapter 2HarshaBorresAlamoNo ratings yet

- Vermicompost-Business ModelDocument28 pagesVermicompost-Business Modelrupali100% (2)

- Mea Assignment WordDocument23 pagesMea Assignment WordNabila Afrin RiyaNo ratings yet

- JnNURM (Jawaharlal Nehru Urban Renewal MissionalDocument21 pagesJnNURM (Jawaharlal Nehru Urban Renewal Missionalmoni_john_1No ratings yet

- TCW Module 3 Pre FinalDocument21 pagesTCW Module 3 Pre FinalMark Jade BurlatNo ratings yet

- School Assignment On Agricultural Practices in IndiaDocument2 pagesSchool Assignment On Agricultural Practices in IndiaUma Ganesan100% (1)

- Akun Impor Ud BuanaDocument1 pageAkun Impor Ud BuanaYusnita dwi kartikaNo ratings yet

- Minesh Final MsDocument59 pagesMinesh Final MsAmey KoliNo ratings yet

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- T8-R44-P2-Hull-RMFI-Ch24-v3 - Study NotesDocument22 pagesT8-R44-P2-Hull-RMFI-Ch24-v3 - Study Notesshantanu bhargavaNo ratings yet

- ACGA 504 1 With AnswerDocument22 pagesACGA 504 1 With AnswerEliza BethNo ratings yet

- ISP GovernanceDocument12 pagesISP GovernanceFrancis Leo Gunseilan100% (1)

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- State Bank of IndiaDocument48 pagesState Bank of Indiaanshukumar87No ratings yet

- Paf FormDocument4 pagesPaf FormFauzi LyandaNo ratings yet

- 205 Finance Market & Banking OperationsDocument10 pages205 Finance Market & Banking Operationsxonline022No ratings yet

- Employees' Provident Fund Scheme, 1952: Fujitsu Employee Code: Contact Email Id: Contact Cell No.Document2 pagesEmployees' Provident Fund Scheme, 1952: Fujitsu Employee Code: Contact Email Id: Contact Cell No.adityajain104No ratings yet

- 21-01-21 Siang Bahan Paparan BIM - Herry VazaDocument33 pages21-01-21 Siang Bahan Paparan BIM - Herry Vazaeryanto mrNo ratings yet

- Warranties and Premiums Garison Music Emporium Carries A Wide Va PDFDocument1 pageWarranties and Premiums Garison Music Emporium Carries A Wide Va PDFAnbu jaromiaNo ratings yet

- Pakistan Economy EssayDocument15 pagesPakistan Economy EssayAhmad SafiNo ratings yet

- CEPLDocument18 pagesCEPLSudhanshu BaranwalNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet