Professional Documents

Culture Documents

Nielsen Newsletter Jul 2011-Eng

Nielsen Newsletter Jul 2011-Eng

Uploaded by

Dago PressCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nielsen Newsletter Jul 2011-Eng

Nielsen Newsletter Jul 2011-Eng

Uploaded by

Dago PressCopyright:

Available Formats

Nielsen Newsletter

EDITION 19 • July 29, 2011

Data Highlights

Viewers are Into Talent Search, Animation and

Religious TV Shows

TV viewing does not change much in the second quarter of 2011 as the

viewers number increased by 2% only from an average of 6.8 million

people (aged above 5 years old in 10 major cities) in the first quarter to 7

million people. However, children viewers (5-14 years old) increased the

highest during this period, which was by 7% to 1.4 million children, while

the number of 15+ viewers increased by 1% only.

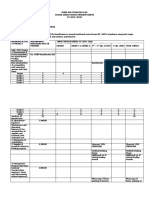

Rating & Average Number of Viewers

Period: January - June 2011

Target Audience: 5-14 year old, Male 15+ and Female 15+

Market: Jakarta, Surabaya, Medan, Semarang, Bandung, Makassar, Yogyakarta,

Palembang, Denpasar, Banjarmasin

4,000

14.5 15.0

Avg number of viewer in thousand

14.3

13.5

nd 3,500 12.6 12.3

12.2

During the 2 quarter, viewers’ interest to watch 12.0

2,979 3,020

series (sinetron) seem to go down as they 3,000

Rating (%)

reduced their time spent watching on the sinetron 2,533 2,556 9.0

from 69 hours (27% of total watching time) in the 2,500

1st quarter to 63 hours (24%) in the 2nd quarter of 6.0

2,000

their total watching time. Contrarily, the time

spent watching of entertainment program, 1,500 1,350

1,442 3.0

especially music and game show, grew from a

total of 45 hours (18%) to 53 hours (20%) , time 1,000 0.0

5-14 MALE 15+ FEMALE 15+

spent watching of children program expanded

from a total of 17 hours (7%) to 23 hours (9%), Q1 2011 Q2 2011 Q1 2011 Q2 2011

while time spent watching of religious programs

increased from a total of 3 hours (1%) to 5 hours (2%).

Along with the increase of time spent watching, children and religious programs also reached more viewers. The

average number of religious program viewers rose by 41% from an average of 215 thousand to 303 thousand people,

while the average number of children program viewers went up by 36% from an average of 545 thousand people to 743

thousand people.

Talent Search Show Draws More Viewers

Though the time spent watching of music and game shows increased, the highest increase in terms of number of

audience is the talent search program. Compared to other entertainment programs (e.g. music, game show, talk show,

reality show, comedy, etc.), number of talent search viewers enlarged by 50% from an average of 800 thousand (1.5

Copyright © 2007 The Nielsen Company. All rights reserved

Nielsen and Nielsen logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C. www.agbnielsen.co.id; www.nielsen.com 1

Nielsen Newsletter – Edition 19 | July 29, 2011

rating points) to 1.2 million (2.3 rating points). The significant growth of audience was particularly seen since April which

was conducted by Tarung Dangdut and Master Chef.

nd

Talent search program that attracted the most viewers during the 2 quarter of 2011 is Master Chef with an average of

nearly 2 million people watched it.

Top 5 Talent Search Program

Period: April - June 2011

Target audience: Age 5 years and above (TV population: 52,213,275 individuals)

Market: Jakarta, Surabaya, Medan, Semarang, Bandung, Makassar, Yogyakarta, Palembang, Denpasar, Banjarmasin

Average number Rating

Program Share (%)

of audience (%)

MASTER CHEF INDONESIA 1,980,000 3.8 21.1

SIRKU[S]PEKTA INDONESIA 1,300,000 2.5 18.1

TARUNG DANGDUT 1,276,000 2.4 10.6

MASTER CHEF INDONESIA(R) 1,173,000 2.2 18.4

DANCING WITH THE STARS INDONES 786,000 1.5 8.0

The biggest advertisers in talent search programs were Clove Cigarettes (553 spots or about Rp 15,3 billion),

Telecommunications (485 spots or Rp 11 billion) and Hair Care (460 spots or Rp 10.4 billion).

More Children Watch TV in Holiday Season

nd

In the 2 quarter of 2011, children spent 16 minutes longer to watch TV to an average of nearly 4.5 hours per day.

Similar to talent search program, the number of children viewers started moving up in April and peaked in school holiday

in June.

In terms of number of audience, children viewer particularly increased by 41% to 265 thousand viewers (2.5 rating

points) in series animation program. Some animation programs that were significantly watched by more children were

Shaun the Sheep, Ooglies and Ikhlas dari Hati.

Children program that managed to attract the most children viewers was Ikhlas dari Hati, a series of Ipin & Upin, with an

average of 612 thousand children viewers (5.7 rating points).

Top 5 Children Programs

Period: April - June 2011

Target audience: Age 5-14 year old (TV population: 10,698,988 individuals)

Market: Jakarta, Surabaya, Medan, Semarang, Bandung, Makassar, Yogyakarta, Palembang, Denpasar, Banjarmasin

Average number Rating

Program Share (%)

of audience (%)

IKHLAS DARI HATI 612 5.7 19.8

OSCAR'S OASIS 603 5.6 18.7

TERSENTUH HATI 593 5.5 19.2

POWER OF 10 CENT 574 5.4 19.4

SHAUN THE SHEEP 555 5.2 18.1

In children program category, the largest advertisers were Snacks & Biscuits (9634 spots or Rp 74.5 billion), Growing Up

Milk (5669 spots or Rp 73.5 billion) and Canned/processed Food (3407 spots or Rp 48.8 billion) .

Religious Program Has Attracted Viewers Before Ramadhan

Though the fasting month has not arrived yet, religious program began to attract viewers’ attention. The average number

Copyright © 2007 The Nielsen Company. All rights reserved

Nielsen and Nielsen logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C. www.agbnielsen.co.id; www.nielsen.com 2

Nielsen Newsletter – Edition 19 | July 29, 2011

nd st

of religious program viewers in the 2 quarter is 41% bigger than the 1 quarter, with 303 thousand people. It has been

increasing since April. The increase was primarily contributed by the religious speech program category, which viewers

increased by 45% to 312 thousand people.

As some religious programs broadcast in prime time (6 to 10 pm), the number of religious program viewers increased

five-fold to an average of 854 thousand people. Meanwhile, the increment was also quite large in the morning (5 to 9

am). The number was nearly double to 633 thousand people. In general, religious program that gained the biggest

number of viewers was Taman Hati, a one off program that was aired in prime time, amounting to 1.2 million people.

Top 5 Religious Program

Period: April - June 2011

Target audience: Aged 5 years and above (TV population: 52,213,275 individuals)

Market: Jakarta, Surabaya, Medan, Semarang, Bandung, Makassar, Yogyakarta, Palembang, Denpasar, Banjarmasin

Average number

Program Program Type Rating (%) Share (%)

of audience

TAMAN HATI Preach/Dialog 1,205 2.3 10.4

ISLAM ITU INDAH Preach/Dialog 1,191 2.3 21.2

INDAHNYA SORE Preach/Dialog 704 1.3 10.3

U2 UJE & UDIN Variety Show 653 1.3 9.6

BAITUL GAUL Preach/Dialog 540 1.0 8.7

The biggest ad spending on religious program was contributed by Government & Politic Organization Category (582

spots or Rp 6.4 billion), Hair Care (586 spots or Rp 4.9 billion) and Telecommunication (411 spots or Rp 4.3 billion).

Note: the above advertising expenditure information is based on gross rate card issued by TV stations, regardless of

discounts, bonuses and other sales packages.

Data Highlights

How’s the newspaper?

Though the use of Internet, including reading e-newspaper, is increasingly

popular, print media has not abandoned completely. In choosing newspapers,

55.8% of consumer choose newspaper for its trusted news, 28.2% prefer

newspaper for its sport news. Meanwhile, 20.8% interested in reading newspapers

because of the crime news, and 19,4% for its political news. Newspaper readers

are generally males aged 20-29 years old from upper class (whose monthly

household expenditure is above Rp 2.000.000, -).

Newspaper readers spend about 32-33 minutes to read newspaper (yesterday).

Apparently, not many newspaper readers are subscriber. Most of them (27.8%)

buy newspaper without subscribing, 26.3% read newspaper in the office, school or

library, 20.6% borrow newspaper from friends, and only 9.2% who subscribe for

newspapers.

In general, newspapers readership increase from 13.4% in early 2011 to 13.7% in

the mid-year. Some cities that shows positive growth in the readership are

Palembang (from 25.1% to 26.8%), Greater Yogyakarta (from 23.6% to 25.2% ),

Greater Bandung (from 6.7% to 7%), and Greater Jakarta (from 11.3% to 11.8%).

Copyright © 2007 The Nielsen Company. All rights reserved

Nielsen and Nielsen logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C. www.agbnielsen.co.id; www.nielsen.com 3

Nielsen Newsletter – Edition 19 | July 29, 2011

Penetration by cities

Period: Oct-Dec 2010 vs. Jan-Mar 2011

Market: 9 cities

* Survey for newspaper readership is

conducted in 9 major cities in Indonesia:

Greater Jakarta (including Bogor, Depok,

Tangerang, Bekasi), Greater Bandung

(Lembang, Padalarang, Cimahi,

Soreang, Majalaya, Cicalengka), Greater

Surabaya (Gresik , Jakarta, Mojokerto,

Tasikmalaya, Lamongan), Greater

Semarang (Kendal, Ambarawa, Demak),

Medan, Makassar, Greater Yogyakarta

(Sleman, Bantul), Denpasar, and

Palembang.

Data Highlights

Advertising Insight: Targeted Advertising Strategy

When industry needs not only the figure of advertising spending to measure the success of a campaign, Advertising

Insight answers the needs. As already informed in previous edition, Advertising Insight provides information on

promotional spending across competitors, identifying opportunities to optimize media mix and creative messaging,

evaluating co-op strategies and marketing investment, as well as integrating creative messaging with survey to correlate

advertising’s impact on consumer behavior.

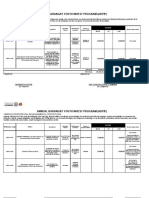

In Telecommunications category, for example, Advertising Insight discovers changes in advertising strategy in terms of

the creative types and the target (consumer). Based on the creative types, telecom ads focused on mobile/wireless

provider, or also known as SIM card, in the last three months (April-June 2011). Compared to April, ads on

mobile/wireless provider increased by 10% in June to 52%.

In addition, telecom ads on bundled service, 5% 4% 2%

2%

which combine the handset with SIM card, also 3% 3%

OTHER

increased in June; from only 15% to 24%. There

was also a slight increase of telecom ads

featuring broadband services, from 3% in April to 42% RETAILER

47% 52%

6% in June.

MOBILE/WIRELESS

Meanwhile, the percentage of telecom ads that

promoted device manufacturer, such as Nokia,

DEVICE MANUFACTURER

Sony Ericsson, Samsung, etc., decreased from 21% 15%

33%

33% in April to just 15% in June.

BUNDLED SERVICE

24%

Advertising Insight by Creative Type 20%

15%

Communication equipment and services category BROADBAND

5% 6%

only, in all media type; 3%

Period: April-June 2011 APRIL MAY JUNE

Copyright © 2007 The Nielsen Company. All rights reserved

Nielsen and Nielsen logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C. www.agbnielsen.co.id; www.nielsen.com 4

Nielsen Newsletter – Edition 19 | July 29, 2011

Based on the consumer segment targeted by the advertisers, the majority of telecom ads are aimed to general

consumer (94%). Some others target the family, women, youth and business. However, in the last three months, there

was a shift in the ads target. Ads those aimed to the general segment lessened from 94% in April to 83% in June. So did

telecom ads targeted for women and business segments. Contrarily, more telecom ads target young people. The portion

of ads that were intended for this segment increased from only 3% in April to 17% in June.

Advertising Insight by Target

Communication equipment and services category only, in all media type

Period: April-June 2011

3% 4%

1% 17%

YOUTH

WOMEN

94% 95% GENERAL CONSUMER

83%

GENERAL BUSINESS

FAMILY

1%

1% 1% 1%

APRIL MAY JUNE

THE MOST WATCHED BRAND IN JULY 2011

NO. OF

PRODUCT GRP

SPOTS

MARJAN BOUDOIN - SYRUP 7,041 4,163

ABC - SYRUP 5,372 2,454

POND'S WHITE BEAUTY NATURALS - SKIN LIGH 3,170 1,739

INDOSAT MOBILE KARTU INDOSAT - SIMCARD 3,156 1,925

MOLTO ULTRA - FABRIC SOFTENER 3,150 2,325

1-28 July 2011, All people 5+, Commercial TV, GRP (Gross Rating Points) in %, all commercial products only

Copyright © 2007 The Nielsen Company. All rights reserved

Nielsen and Nielsen logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C. www.agbnielsen.co.id; www.nielsen.com 5

You might also like

- Simple Mobile Phone Jammer Circuit DiagramDocument1 pageSimple Mobile Phone Jammer Circuit Diagramsanapashok100% (1)

- MTCNA Course PDFDocument80 pagesMTCNA Course PDFlgonzalez2010100% (1)

- HardwareDocument71 pagesHardwarehoangtrongtuyen93100% (2)

- Case 3 - Bulacan Province A Gate Way To The NorthDocument6 pagesCase 3 - Bulacan Province A Gate Way To The NorthJohn Eliel BaladjayNo ratings yet

- Sustainable Cities and Communities: 2015-2019 Output, Impact, CollaborationDocument1 pageSustainable Cities and Communities: 2015-2019 Output, Impact, CollaborationJessie ForpublicuseNo ratings yet

- 04 CCI4002 Process Making-Value-EthicsDocument28 pages04 CCI4002 Process Making-Value-EthicsSukie HoNo ratings yet

- Teks Report B.ing Icas 3Document3 pagesTeks Report B.ing Icas 3ɢᴀʙʀɪᴇʟ ᴍᴜʜᴀᴍᴍᴀᴅ ᴍᴏʀʟᴇʏNo ratings yet

- Tos Mil 1ST QTRDocument5 pagesTos Mil 1ST QTRAna Marie ViñasNo ratings yet

- Q3 - Periodical Test HEALTHDocument2 pagesQ3 - Periodical Test HEALTHPrimalyn SupnadNo ratings yet

- Monitoring Local Plans of SK Form PNR SiteDocument2 pagesMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosNo ratings yet

- Karpa - Compiled Forms and QuestionnairesDocument23 pagesKarpa - Compiled Forms and QuestionnairesKarpaNo ratings yet

- PH Congress CongSuansingDocument28 pagesPH Congress CongSuansingMadzJacksonNo ratings yet

- Baroda Pioneer Short Term BondDocument1 pageBaroda Pioneer Short Term BondYogi173No ratings yet

- SK Abyip202444Document11 pagesSK Abyip202444Aya VanessaNo ratings yet

- Ipcrf 2021Document28 pagesIpcrf 2021Janice Flores - MonterozoNo ratings yet

- PlayDefense FI UITsDocument2 pagesPlayDefense FI UITsag rNo ratings yet

- Sponsorship Proposal - Sounds of DowntownDocument21 pagesSponsorship Proposal - Sounds of DowntownAdnan PrasojoNo ratings yet

- Millennials On Millennials Report Aug 2017Document10 pagesMillennials On Millennials Report Aug 2017Spesific purposes onlyNo ratings yet

- A Study On Consumer Buying Behaviour and Level of User Satisfaction of Laptop With Special Reference To Coimbatore CityDocument7 pagesA Study On Consumer Buying Behaviour and Level of User Satisfaction of Laptop With Special Reference To Coimbatore CityMittal Kirti MukeshNo ratings yet

- Primer - ATRAM Global Consumer Trends Feeder FundDocument2 pagesPrimer - ATRAM Global Consumer Trends Feeder Fundkeith tambaNo ratings yet

- Public Media 2014 Localore by The NumbersDocument7 pagesPublic Media 2014 Localore by The NumbersAngelynn GrantNo ratings yet

- Compro Sonora Sby 2023Document9 pagesCompro Sonora Sby 2023Karir LailiNo ratings yet

- BKD Project PlanDocument7 pagesBKD Project PlanLester Jao SegubanNo ratings yet

- Project Proposal - CampDocument5 pagesProject Proposal - CampElbekNo ratings yet

- Financial PlanDocument5 pagesFinancial PlanApril Rose AninNo ratings yet

- Annual Budget SK - 051340Document5 pagesAnnual Budget SK - 051340Nesreen Panasilan MobenNo ratings yet

- To Study On Customer Awareness, Prefrence &Document10 pagesTo Study On Customer Awareness, Prefrence &Vardan MakhijaniNo ratings yet

- NFT District MediaKit 2022Document5 pagesNFT District MediaKit 2022SHAHEEN ALAMNo ratings yet

- Morning Star Report 20191102055140Document1 pageMorning Star Report 20191102055140Yogi173No ratings yet

- Annual Barangay Youth Invest Program (Abyip) : Global MobilityDocument28 pagesAnnual Barangay Youth Invest Program (Abyip) : Global MobilityClim Jalipa100% (1)

- IELTS Passport Task 1 - Slide Bu I 8Document18 pagesIELTS Passport Task 1 - Slide Bu I 8Hoàng Minh ChiếnNo ratings yet

- Perceived Value Dan Perceived Quality Terhadap Behavioral Intention Wisatawan Di Taplau PadangDocument11 pagesPerceived Value Dan Perceived Quality Terhadap Behavioral Intention Wisatawan Di Taplau PadangGdniel TrashyNo ratings yet

- 2021 07 19 Placement Report 2020 21Document7 pages2021 07 19 Placement Report 2020 21ChhayankNo ratings yet

- AALI Pubex Materi 2022Document13 pagesAALI Pubex Materi 2022SteveNo ratings yet

- Divorce DemographicDocument5 pagesDivorce DemographicdimatulacjobelleNo ratings yet

- Look Up Look in Presentation RubricDocument2 pagesLook Up Look in Presentation Rubricapi-742944047No ratings yet

- Investment Planning For Children Education-What Strategies ShouldDocument24 pagesInvestment Planning For Children Education-What Strategies Shouldnurul_raminoNo ratings yet

- Chinese TycoonDocument1 pageChinese TycoonCenon Aquino100% (1)

- GAD Plan and Budget 2021Document6 pagesGAD Plan and Budget 2021magrocapalonga24No ratings yet

- Abyip MagcagongDocument10 pagesAbyip MagcagongJhon TutorNo ratings yet

- Source MaterialDocument6 pagesSource MaterialTanishq SainiNo ratings yet

- SK Monitoring TemplateDocument7 pagesSK Monitoring Templatedavid durianNo ratings yet

- Barangay Peace and Order and Public Safety Plan (Bpops Plan)Document4 pagesBarangay Peace and Order and Public Safety Plan (Bpops Plan)Rene Fabria100% (1)

- Erroneous Expenditure: Kashmiriyat at A Boot ShopDocument1 pageErroneous Expenditure: Kashmiriyat at A Boot ShopFirdous AhmadNo ratings yet

- DBCL Investor Presentation - August 2020Document26 pagesDBCL Investor Presentation - August 2020S Vijay KumarNo ratings yet

- Quality Objective PRSDocument1 pageQuality Objective PRSKurt ClaveriaNo ratings yet

- Cbydp Rio ChicoDocument9 pagesCbydp Rio ChicoJon100% (3)

- Abyip - Melvin (1) FinalsDocument6 pagesAbyip - Melvin (1) FinalsskfederationdinapigueNo ratings yet

- SK CBYDP RevisedDocument12 pagesSK CBYDP RevisedNikki BautistaNo ratings yet

- My Coach Final Presentation CompressedDocument50 pagesMy Coach Final Presentation Compressedapi-336639469No ratings yet

- Jpbafm 25 03 2013 b003Document162 pagesJpbafm 25 03 2013 b003daniel parapatNo ratings yet

- Supplemental App: Jan Feb Mar April May June July Aug SeptDocument2 pagesSupplemental App: Jan Feb Mar April May June July Aug Septlymieng Star limoicoNo ratings yet

- A Study On Customer Satisfaction Towards Airtel With Special Reference To Chennai CityDocument5 pagesA Study On Customer Satisfaction Towards Airtel With Special Reference To Chennai Cityarcherselevators100% (3)

- KMTR - Public Expose - 30885683 - Lamp1Document10 pagesKMTR - Public Expose - 30885683 - Lamp1andra anggrawijayaNo ratings yet

- ABYIP2021Document10 pagesABYIP2021barangay bal-asonNo ratings yet

- Original Research Paper: Ph.D. Research Scholar, Bharathiar University. Director, Department of Management, BIT, SathyDocument4 pagesOriginal Research Paper: Ph.D. Research Scholar, Bharathiar University. Director, Department of Management, BIT, SathysairamNo ratings yet

- Book My ShowDocument26 pagesBook My ShowMuddassir BaigNo ratings yet

- HMIS 001 2024 VersionDocument29 pagesHMIS 001 2024 Versionmmidu681No ratings yet

- 724pm - 35.EPRA JOURNALS-5660Document4 pages724pm - 35.EPRA JOURNALS-5660karthik gNo ratings yet

- UTM - INTEGRATING SDGs WITH UN WORLD DAYS ACROSS THE CURRICULUMDocument43 pagesUTM - INTEGRATING SDGs WITH UN WORLD DAYS ACROSS THE CURRICULUMSEKOLAH MENENGAH KEBANGSAAN BANDAR TENGGARA 2 MoeNo ratings yet

- Newsletter Jan 2016Document5 pagesNewsletter Jan 2016rk_rkaushikNo ratings yet

- 2021 Regional Social and Economic Trends CALABARZONDocument916 pages2021 Regional Social and Economic Trends CALABARZONCherry KimNo ratings yet

- The Network Devices FunctionDocument2 pagesThe Network Devices FunctionJhea ArponNo ratings yet

- Huawei OMU Commissioning DOC LastDocument2 pagesHuawei OMU Commissioning DOC LastDeepak KaushalNo ratings yet

- Multiband MIMO Antenna For GSM, DCS, and LTE Indoor ApplicationsDocument4 pagesMultiband MIMO Antenna For GSM, DCS, and LTE Indoor ApplicationsSHUDHANSHU JAISWAL 17GCEBEC127No ratings yet

- Jaringan Lan, Wan, Man by Packet TracerDocument15 pagesJaringan Lan, Wan, Man by Packet TracerMerysawati DianeNo ratings yet

- Lab 6 4 1 Basic Inter VLAN Routing TopolDocument8 pagesLab 6 4 1 Basic Inter VLAN Routing TopolAnastasia KalliNo ratings yet

- GPON FundamentalsDocument69 pagesGPON FundamentalsNatanael Acencio Rijo100% (1)

- KAMATA MPUNGA English Release - Docx (SWAHILI)Document4 pagesKAMATA MPUNGA English Release - Docx (SWAHILI)khalfan saidNo ratings yet

- Study On UMTSLTE in 900 MHZ Band and Coexistence With 850 MHZ BandDocument34 pagesStudy On UMTSLTE in 900 MHZ Band and Coexistence With 850 MHZ BandLuis Ernesto Castillo100% (1)

- RACAL 6113 DatasheetDocument7 pagesRACAL 6113 DatasheetMinh DucNo ratings yet

- Asmi-52: 2/4-Wire SHDSL Modem/MultiplexerDocument6 pagesAsmi-52: 2/4-Wire SHDSL Modem/MultiplexerJairson Gomez BolañosNo ratings yet

- Comunicações Industriais Industrial Communications: Lecture 6 - The Modbus TCP Protocol Stack Luís Almeida Lda@fe - Up.ptDocument14 pagesComunicações Industriais Industrial Communications: Lecture 6 - The Modbus TCP Protocol Stack Luís Almeida Lda@fe - Up.ptjnoll01No ratings yet

- Secure SwitchDocument10 pagesSecure Switchepeace2009No ratings yet

- How People Live and Should Live Through TechDocument4 pagesHow People Live and Should Live Through TechJanmarc CorpuzNo ratings yet

- h14958 Unity Hybrid Family SsDocument9 pagesh14958 Unity Hybrid Family SsNiamun BadhonNo ratings yet

- Ic 78Document4 pagesIc 78Rigoberto Gonzales GabrielNo ratings yet

- Signals Sampling TheoremDocument3 pagesSignals Sampling TheoremBhuvan Susheel MekaNo ratings yet

- CH 1 Optical Fiber Introduction - 2Document18 pagesCH 1 Optical Fiber Introduction - 2Krishna Prasad PheluNo ratings yet

- 3GPP TS 23.031Document17 pages3GPP TS 23.031Ahmad Mustafa AtharNo ratings yet

- Datasheet Compass 888 889 v2Document2 pagesDatasheet Compass 888 889 v2Olugbenga Usman AtobateleNo ratings yet

- NBTC 5G Preparation in ThailandDocument18 pagesNBTC 5G Preparation in ThailandPreeda TeerakulvanichNo ratings yet

- Unit 4Document8 pagesUnit 4PriyanshuNo ratings yet

- Lyric Controller Quick Install GuideDocument4 pagesLyric Controller Quick Install GuideAlarm Grid Home Security and Alarm MonitoringNo ratings yet

- C091 (J) Aisg C091 (K) 25MDocument2 pagesC091 (J) Aisg C091 (K) 25MMariNo ratings yet

- Multiplexing and SpreadingDocument51 pagesMultiplexing and SpreadingBUSETNo ratings yet

- Cellular ConceptDocument27 pagesCellular ConceptAsit Panda100% (2)

- TAC Xenta Server Gateway Technical Manual TAC Xenta 700 5.Document180 pagesTAC Xenta Server Gateway Technical Manual TAC Xenta 700 5.Peli JorroNo ratings yet