Professional Documents

Culture Documents

Profit or Loss From Business: I I I I I I I I

Profit or Loss From Business: I I I I I I I I

Uploaded by

dolapo BalogunOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit or Loss From Business: I I I I I I I I

Profit or Loss From Business: I I I I I I I I

Uploaded by

dolapo BalogunCopyright:

Available Formats

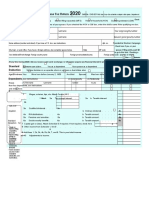

SCHEDULEC Profit or Loss From Business 0MB No.

1545-0074

(Form 1040)

Department of the Treasury ► Go to www.irs.gov/ScheduleC for instructions and the latest information.

(Sole Proprietorship)

�@19

Attachment

Internal Revenue Service (99) ► Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09

I

U

I

BERNARD RICHARD

Business address (including suite or room no.) ►

I I I I I I I I

E

N

a

m

e

o

f

p

r

o

p

r

i

e

t

o

r

S

o

c

i

a

l

s

e

c

u

r

i

t

n

u

m

b

e

r

(

S

S

N

)

B

E

R

N

post office, state, and ZIP code 287 PARTRIDGE ---------------------------------

town or FAIRFIELD CT 06430 ---------------------------------------------· City,

0

J

1

1

9

-

5

6

-

0

0

0

5

Accounting method: (1) Cash (2) Accrual (3) Other (specify) ► D D

F

A

P

r

i

n

c

i

p

a

l

b

u

s

i

n

e

s

s

o

r

p

r

o

f

e

s

s

i

o

n

,

i

n

c

l

u

d

i

n

g

p

r

o

d

u

c

t

o

r

s

e

r

v

i

c

e

(

s

e

e

i

n

s

t

r

u

c

t

i

o

n

s

)

B

E

n

t

e

r

c

o

d

e

f

r

o

m

i

n

s

t

r

u

c

t

i

o

n

s

G

Did you "materially participate" in the operation of this business during 2020? If "No," see instructions for limit on losses 0Yes D No If you

S

E

C

U

R

I

T

Y

G

U

A

R

D

S

►

1

l

2

l

2

I

3

l

3

l

o

started or acquired this business during 2020, check here . ►□

□

H

C

B

u

s

i

n

e

s

s

n

a

m

e

.

I

f

n

o

s

e

p

a

r

a

t

e

b

u

s

i

n

e

s

s

n

a

m

e

,

l

e

a

v

e

b

l

a

n

k

.

D

E

m

p

l

o

y

e

r

I

D

n

u

m

b

e

r

(

E

I

N

)

(

s

e

e

i

n

s

t

r

.

)

I Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions . Yes

J

■ ::m-.,ill ■

If "Yes," did you or will you file required Form(s) 1099? . ov es0

Income

1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on

Form W-2 and the "Statutory employee" box on that form was checked .►□ 1 100,000

2 Returns and allowances . 2

3 Subtract line 2 from line 1 3 100,000

4 Cost of goods sold (from line 42) 4

5 Gross profit. Subtract line 4 from line 3 5 100,000

6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 6

7 Gross income. Add lines 5 and 6 . ► 7 85,000

■ ::r.111II ■

Expenses. Enter expenses for business use of your home only on line 30.

8 Advertising . 8 5,700 18 Office expense (see instructions) 18

9 Car and truck expenses (see 19 Pension and profit-sharing plans 19

instructions) . 9 20 Rent or lease (see instructions): ,_

10 Commissions and fees 10 4,800 a Vehicles, machinery, and equipment 20a

11 Contract labor (see instructions) 11 b Other business property 20b

12 Depletion 12 21 Repairs and maintenance . 21 983

13 Depreciation and section 179 22 Supplies (not included in Part Ill) 22 10,240

expense deduction (not

included in Part Ill) (see 23 Taxes and licenses . 23

instructions) . 13 24 Travel and meals: ,_

14 Employee benefit programs a Travel . 24a

(other than on line 19) . 14 b Deductible meals (see

15 Insurance (other than health) 15 4,000 instructions) . 24b

16 Interest (see instructions): ,_ 25 Utilities 25

a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) . 26

b Other 16b 27a Other expenses (from line 48) . 27a

17 Legal and professional services 3,200 b Reserved for future use 17 27b I

28 Total expenses before expenses for business use of home. Add lines 8 through 27a . ► 28 28,923

29 Tentative profit or (loss). Subtract line 28 from line 7 . 29

30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829

unless using the simplified method. See instructions.

Simplified method filers only: Enter the total square footage of (a) your home:

and (b) the part of your home used for business: . Use the Simplified

Method Worksheet in the instructions to figure the amount to enter on line 30 30

l

31 Net profit or {loss). Subtract line 30 from line 29.

•

If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 97,500

• If a loss, you must go to line 32.

32 If you have a loss, check the box that describes your investment in this activity. See instructions.

l

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule

SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on 32a 0 All investment is at risk.

Form 1041, line 3. 32b D Some investment is not

at risk.

• If you checked 32b, you must attach Form 6198. Your loss may be limited.

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2019

You might also like

- PSW Certificate 4Document1 pagePSW Certificate 4dolapo BalogunNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- UCC3Document2 pagesUCC3Thomas Bull Rearden86% (7)

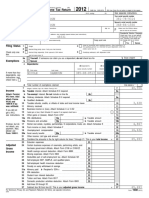

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatuspeachyNo ratings yet

- F1040es 2020Document12 pagesF1040es 2020Job SchwartzNo ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMJackson kaylaNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusfelix angomasNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- Form990 2021 1661373681961Document58 pagesForm990 2021 1661373681961Jeremy Joseph EhlingerNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDocument1 pageShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- US Internal Revenue Service: f1040nr - 2005Document5 pagesUS Internal Revenue Service: f1040nr - 2005IRSNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- New York Corporation Tax ReturnDocument4 pagesNew York Corporation Tax Returnbshahn1189No ratings yet

- 34 Wihh 504331 H 0714320240524151104202Document3 pages34 Wihh 504331 H 0714320240524151104202jamelmhunt22No ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- Oji 2Document2 pagesOji 2brent_barthanyNo ratings yet

- Ahtasham Ahmed Case - CompressedDocument19 pagesAhtasham Ahmed Case - CompressedarsssyNo ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Prity PandeyNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- 1099 Ssdi 2010Document1 page1099 Ssdi 2010Gary McclainNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- Maverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Document19 pagesMaverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Vignesh EswaranNo ratings yet

- Employee Paystub EditedDocument1 pageEmployee Paystub EditedSandra ChrisNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- 70 Kevin Lin PDFDocument8 pages70 Kevin Lin PDFKenneth LinNo ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-351598796No ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- Return 2019 BOY FIRST MAKEDocument6 pagesReturn 2019 BOY FIRST MAKEshahabNo ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- 2018 FederalDocument19 pages2018 Federalnischal.khatri07No ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- Tuition StatementDocument7 pagesTuition StatementAnonymous 9FlDK6YrJNo ratings yet

- Profit or Loss From Farming: Schedule FDocument2 pagesProfit or Loss From Farming: Schedule FJacen BondsNo ratings yet

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Document2 pagesSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNo ratings yet

- Jack & Lori Turbo Tax 2012 PDFDocument3 pagesJack & Lori Turbo Tax 2012 PDFKeith CooperNo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- 2019 03 27 19 17 48 254 - DGCPK4360Q - 2018Document5 pages2019 03 27 19 17 48 254 - DGCPK4360Q - 2018TAX GURUNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusCoen WalterNo ratings yet

- TML Form MGT 7 2021-22Document15 pagesTML Form MGT 7 2021-22VINOTH kumarNo ratings yet

- SectionE 37Document1 pageSectionE 37NikNo ratings yet

- Child SupportDocument4 pagesChild Supportdolapo BalogunNo ratings yet

- Ticket-TIMELESS DAVIDO 2Document1 pageTicket-TIMELESS DAVIDO 2dolapo BalogunNo ratings yet

- FormDocument1 pageFormdolapo BalogunNo ratings yet

- Screenshot 2022-06-13 at 12.24.26 PMDocument42 pagesScreenshot 2022-06-13 at 12.24.26 PMdolapo BalogunNo ratings yet

- Car Sales ReceiptDocument1 pageCar Sales Receiptdolapo BalogunNo ratings yet

- PSW Certificate 2Document1 pagePSW Certificate 2dolapo BalogunNo ratings yet

- Health Registration Form - InternationalDocument3 pagesHealth Registration Form - Internationaldolapo BalogunNo ratings yet

- Screenshot 2022-10-03 at 6.15.00 PMDocument2 pagesScreenshot 2022-10-03 at 6.15.00 PMdolapo BalogunNo ratings yet

- Scott Luman 5929 FM 711 CENTER, TX 75935-000Document6 pagesScott Luman 5929 FM 711 CENTER, TX 75935-000dolapo BalogunNo ratings yet

- Form 1099 MISC David Kovach-1Document1 pageForm 1099 MISC David Kovach-1dolapo BalogunNo ratings yet

- Wells Fargo Combined Statement of AccountsDocument6 pagesWells Fargo Combined Statement of Accountsdolapo Balogun100% (1)

- David Jennings: Debit Account Transactions Date Description Type Amount Available Matthew SteversonDocument4 pagesDavid Jennings: Debit Account Transactions Date Description Type Amount Available Matthew Steversondolapo BalogunNo ratings yet

- Raymond William Enyeart PO Box 1527 Calipatria CA 92233-1527Document1 pageRaymond William Enyeart PO Box 1527 Calipatria CA 92233-1527dolapo BalogunNo ratings yet

- Account Summary: 1-800-427-2200 EnglishDocument2 pagesAccount Summary: 1-800-427-2200 Englishdolapo Balogun100% (1)

- Mary White: Simonette GeraldDocument2 pagesMary White: Simonette Geralddolapo BalogunNo ratings yet

- My Answers: More OptionsDocument1 pageMy Answers: More Optionsdolapo BalogunNo ratings yet

- Crdi System PDFDocument20 pagesCrdi System PDFsanath santhoshNo ratings yet

- NWO - Crossroad - Bill Gates Teams Up With UNESCODocument3 pagesNWO - Crossroad - Bill Gates Teams Up With UNESCOMick RynningNo ratings yet

- InterrelatedDocument2 pagesInterrelatedRaz MahariNo ratings yet

- Overview of Global Fashion IndustryDocument12 pagesOverview of Global Fashion Industrysatheeshpag123No ratings yet

- Simple Trick To Remember CurrenciesDocument4 pagesSimple Trick To Remember CurrenciesSukant Makhija100% (1)

- Statement - Jul 2016 PDFDocument2 pagesStatement - Jul 2016 PDFAnonymous 52yAaJidzNo ratings yet

- Is Globalization OverDocument188 pagesIs Globalization OverDiego A. Odchimar IIINo ratings yet

- Financial Oligarchy and The Crisis: Simon Johnson MITDocument10 pagesFinancial Oligarchy and The Crisis: Simon Johnson MITJack LintNo ratings yet

- Good Manufacturing PracticesDocument12 pagesGood Manufacturing PracticesRambabu komati - QA100% (4)

- Deposit Slip PDFDocument2 pagesDeposit Slip PDFLalit PardasaniNo ratings yet

- Sustainable Urban Mobility in Rapid Urbanization in China - BP/TsinghuaDocument425 pagesSustainable Urban Mobility in Rapid Urbanization in China - BP/TsinghuaSteveWKENo ratings yet

- Global Currency Reset and NDA ContractDocument4 pagesGlobal Currency Reset and NDA ContractRedza75% (4)

- 2024 001 Appropriation OrdinanceDocument4 pages2024 001 Appropriation OrdinancePoblacion North PinanNo ratings yet

- Stine StubDocument1 pageStine Stubraheemtimo1No ratings yet

- Special Power of Attorney: HEREBY GIVING AND GRANTING Unto My Attorney-In-Fact Full Power andDocument2 pagesSpecial Power of Attorney: HEREBY GIVING AND GRANTING Unto My Attorney-In-Fact Full Power andWendell MaunahanNo ratings yet

- Company ProfileDocument31 pagesCompany ProfileSubhash BajajNo ratings yet

- 10000018482Document34 pages10000018482Chapter 11 DocketsNo ratings yet

- Draft Case AnalysisDocument2 pagesDraft Case AnalysisaaaaaNo ratings yet

- Stock Mock - Backtest Index Strategies+-50 ATM Nifty 9.20 To 1.10Document6 pagesStock Mock - Backtest Index Strategies+-50 ATM Nifty 9.20 To 1.10CA Rakesh PatelNo ratings yet

- Cash Inadequacy and Cash Insolvency-4Document21 pagesCash Inadequacy and Cash Insolvency-4Girish KumarNo ratings yet

- Stock - Share Market Investment, Live BSE - NSE Sensex & Nifty, Mutual Funds, Commodity Market, Finance Portfolio Investment - Management, Startup News India, Financial News - MoneycontrolDocument5 pagesStock - Share Market Investment, Live BSE - NSE Sensex & Nifty, Mutual Funds, Commodity Market, Finance Portfolio Investment - Management, Startup News India, Financial News - Moneycontrolmeet kumarNo ratings yet

- Chapter 1: Introduction: International Accounting, 7/eDocument19 pagesChapter 1: Introduction: International Accounting, 7/eadhitiyaNo ratings yet

- Murphy and Nagel The Myth of Ownership PDFDocument239 pagesMurphy and Nagel The Myth of Ownership PDFDaisy Anita SusiloNo ratings yet

- RSL StewardingDocument8 pagesRSL StewardingZila Saidin0% (1)

- FCM01934989518 BNZDocument2 pagesFCM01934989518 BNZMitesh PrajapatiNo ratings yet

- Social Policy and AdministrationDocument15 pagesSocial Policy and AdministrationRoxana HoteaNo ratings yet

- Forex Market - 2Document18 pagesForex Market - 2Emad TabassamNo ratings yet

- Marketing Segmentation Targeting and Positioning PF AirTelDocument11 pagesMarketing Segmentation Targeting and Positioning PF AirTelAkanksha GuptaNo ratings yet

- EconomicsDocument136 pagesEconomicsAbdi Teshome100% (1)