Professional Documents

Culture Documents

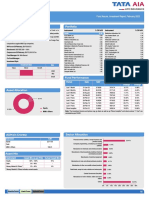

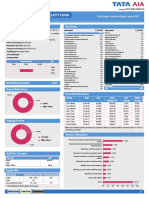

Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110

Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110

Uploaded by

Prafful TriPathi0 ratings0% found this document useful (0 votes)

43 views1 pageThe Top 200 fund invests primarily in stocks that are part of the BSE 200 Index, with a focus on long-term capital appreciation. As of April 30, 2021, the fund had a NAV of Rs. 77.6387 per unit and AUM of Rs. 346.80 crores. Over the last year, the fund generated a return of 78.45% compared to 52.13% for its benchmark, the S&P BSE 200 Index. The fund is managed by Mr. Nitin Bansal with an equity allocation of 97.06% of its portfolio.

Original Description:

Original Title

Tata Top 200 Fund

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Top 200 fund invests primarily in stocks that are part of the BSE 200 Index, with a focus on long-term capital appreciation. As of April 30, 2021, the fund had a NAV of Rs. 77.6387 per unit and AUM of Rs. 346.80 crores. Over the last year, the fund generated a return of 78.45% compared to 52.13% for its benchmark, the S&P BSE 200 Index. The fund is managed by Mr. Nitin Bansal with an equity allocation of 97.06% of its portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

43 views1 pageTop 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110

Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110

Uploaded by

Prafful TriPathiThe Top 200 fund invests primarily in stocks that are part of the BSE 200 Index, with a focus on long-term capital appreciation. As of April 30, 2021, the fund had a NAV of Rs. 77.6387 per unit and AUM of Rs. 346.80 crores. Over the last year, the fund generated a return of 78.45% compared to 52.13% for its benchmark, the S&P BSE 200 Index. The fund is managed by Mr. Nitin Bansal with an equity allocation of 97.06% of its portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

TOP 200 FUND Fund Assure, Investment Report, April 2021

ULIF 027 12/01/09 ITT 110

Fund Details Portfolio

Investment Objective: The Top 200 fund will invest primarily in select stocks and Instrument % Of NAV Instrument % Of NAV

equity linked instruments which are a part of BSE 200 Index with a focus on Equity 97.06 Bharti Airtel Ltd. 2.32

generating long term capital appreciation. The fund will not replicate the index but ICICI Bank Ltd. 6.04 Amber Enterprises India Ltd. 2.23

Reliance Industries Ltd. 5.00 Dr. Reddys Laboratories Ltd. 2.23

aim to attain performance better than the performance of the Index. As a defensive

Infosys Ltd. 4.94 Tata Consultancy Services Ltd. 2.01

strategy arising out of market conditions, the scheme may also invest in debt and Axis Bank Ltd. 4.54 Bosch Ltd. 2.00

money market instruments. HDFC Bank Ltd 4.20 Ambuja Cements Ltd. 1.96

APL Apollo Tubes Ltd. 3.55 UPL Ltd. 1.93

NAV as on 30 April, 21: `77.6387

Laurus Labs Ltd 3.46 MRF Ltd 1.87

Benchmark: S&P BSE 200 - 100%

Ultratech Cement Ltd. 3.20 SRF Ltd 1.85

Corpus as on 30 April, 21: `346.80 Crs. LIC Housing Finance Ltd. 1.75

Deepak Nitrite Ltd 2.96

Fund Manager: Mr. Nitin Bansal Aarti Industries Ltd 2.93 AIA Engineering Ltd. 1.72

Co-Fund Manager: - The Federal Bank Ltd 2.66 Other Equity 26.83

Investment Style Polycab India Ltd. 2.54 MMI & Others 2.94

Navin Fluorine International Ltd 2.33 Total 100.00

Investment Style Size

Value Blend Growth

Large Fund Performance

Mid Period Date NAV S&P BSE 200 NAV INDEX

Small Change Change

Last 1 Month 31-Mar-21 76.5396 6290.20 1.44% 0.14%

Last 3 Months 29-Jan-21 67.7696 5790.35 14.56% 8.78%

Last 6 Months 30-Oct-20 55.6641 4910.04 39.48% 28.28%

Modified Duration 0.01 Last 1 Year 30-Apr-20 43.5076 4140.41 78.45% 52.13%

Last 2 Years 30-Apr-19 46.6987 4915.46 28.94% 13.20%

Asset Allocation Last 3 Years 30-Apr-18 45.3975 4723.51 19.59% 10.07%

Last 4 Years 28-Apr-17 39.0923 4082.97 18.71% 11.45%

Last 5 Years 29-Apr-16 31.6100 3321.63 19.69% 13.65%

97.06% Since Inception 12-Jan-09 10.0000 1091.37 18.12% 15.31%

2.94%

Note: The investment income and prices may go down as well as up.“Since Inception” and returns above “1 Year” are

calculated as per CAGR.

Equity

MMI & Others

Asset Mix

Instrument Asset Mix as per F&U Actual Asset Mix

Equity 60% - 100% 97%

Money Market & Others * 0% - 40% 3%

Rating Profile * Money Market & Others includes current assets

Sector Allocation

Financial service activities, except insurance and

26.79%

Sovereign pension funding

100.00% Manufacture of chemicals and chemical products 13.36%

Computer programming, consultancy and related

6.95%

activities

Manufacture of electrical equipment 5.22%

Manufacture of other non-metallic mineral products 5.16%

AUM (in Crores)

Manufacture of motor vehicles, trailers and semi-trailers 5.10%

Instrument Hybrid Fund AUM

Equity 336.60 Manufacture of coke and refined petroleum products 5.00%

Debt - Manufacture of fabricated metal products, except

4.69%

machinery and equipment

MMI & Others 10.20

Manufacture of pharmaceuticals,medicinal chemical and

4.65%

botanical products

Scientific research and development 4.57%

Others 18.49%

0% 5% 10% 15% 20% 25% 30%

Equity Fund Debt Fund Hybrid Fund 11

You might also like

- Layer Farming (10000 Birds)Document17 pagesLayer Farming (10000 Birds)webscanz80% (45)

- Deed of Assignment of ARDocument2 pagesDeed of Assignment of ARCampbell HezekiahNo ratings yet

- Bond Price VolatilityDocument56 pagesBond Price Volatilityanurag71500100% (1)

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNo ratings yet

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Document1 pageMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundJeremiah SolomonNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundHarsh SrivastavaNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Tata Emerging Opportunities FundDocument1 pageTata Emerging Opportunities FundJeremiah SolomonNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundsanoobkarimNo ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Whole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Document1 pageWhole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Abhishek BadalNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundAbdulazeezNo ratings yet

- Tata Whole Life Mid Cap Equity FundDocument1 pageTata Whole Life Mid Cap Equity FundK Dviya VennelaNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- Sbi Life Top 300 Fund PerformanceDocument1 pageSbi Life Top 300 Fund PerformanceVishal Vijay SoniNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Utimidcapfund 16020220823 053119Document2 pagesUtimidcapfund 16020220823 053119meghaNo ratings yet

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Document3 pagesUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20No ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Sbi Life Bond Optimiser Fund PerformanceDocument1 pageSbi Life Bond Optimiser Fund PerformanceVishal Vijay SoniNo ratings yet

- Kotak Equity OpportunitiesDocument8 pagesKotak Equity OpportunitiesKiran VidhaniNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Tata Mid Cap Growth Fund December 2019Document2 pagesTata Mid Cap Growth Fund December 2019ChromoNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- BOP One Pager Jan 2019Document1 pageBOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- Utiniftyindexfund 12820200210 213216Document2 pagesUtiniftyindexfund 12820200210 213216VarathavasuNo ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Midcap FundDocument1 pageMidcap FundAman KumarNo ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- 578380618monthly Communique May, 2022Document12 pages578380618monthly Communique May, 2022Dhairya BuchNo ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- Factsheet Mirae Asset Mid Cap Fund Reg (G) 61541Document2 pagesFactsheet Mirae Asset Mid Cap Fund Reg (G) 61541ksenpriNo ratings yet

- LIC Flexi Smart Growth FundDocument1 pageLIC Flexi Smart Growth FundbamneekhilNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Sbi Life Midcap Fund PerformanceDocument1 pageSbi Life Midcap Fund PerformanceVishal Vijay SoniNo ratings yet

- DSP Dec 2021Document97 pagesDSP Dec 2021RUDRAKSH KARNIKNo ratings yet

- BLACKSTONEDocument32 pagesBLACKSTONESeoNaYoungNo ratings yet

- Rawat Bhaskar SinghDocument13 pagesRawat Bhaskar SinghBhaskar RawatNo ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- LST ProtfolioDocument14 pagesLST ProtfolioPranjay ChauhanNo ratings yet

- Kotak Small Cap Fund - 20220201190020276Document1 pageKotak Small Cap Fund - 20220201190020276Kunal SinhaNo ratings yet

- Stocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic TimesDocument4 pagesStocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic Timeserkant007No ratings yet

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- Sbi Mutual FundDocument1 pageSbi Mutual Fundramana purushothamNo ratings yet

- Daily Notes: Friday, 03 May 2024Document4 pagesDaily Notes: Friday, 03 May 2024philnabank1217No ratings yet

- SBI Focused Equity Fund (1) 09162022Document4 pagesSBI Focused Equity Fund (1) 09162022chandana kumarNo ratings yet

- Sbi Life Pure Fund PerformanceDocument1 pageSbi Life Pure Fund PerformanceVishal Vijay SoniNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Sbi Life Midcap Fund Latest Fund Performance (Jan 2024)Document1 pageSbi Life Midcap Fund Latest Fund Performance (Jan 2024)Vishal Vijay SoniNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- June 30, 2017: Portfolio Characteristics StatisticsDocument2 pagesJune 30, 2017: Portfolio Characteristics StatisticsAnonymous 5mSMeP2jNo ratings yet

- Model Portfolio of Mutual FundDocument7 pagesModel Portfolio of Mutual FundJAYESH TIBREWALNo ratings yet

- Factsheet Nifty500 ShariahDocument2 pagesFactsheet Nifty500 ShariahAejaz shaikhNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Final Business PlanDocument32 pagesFinal Business PlanCOPY TECH CYBERNo ratings yet

- Chu de 3 Nhom 6 Hay PDFDocument10 pagesChu de 3 Nhom 6 Hay PDFNhư NhưNo ratings yet

- Kamal Kant Sharma MBA 02313703920 FMDocument22 pagesKamal Kant Sharma MBA 02313703920 FMKANISHKA SHARMANo ratings yet

- Tesda Perpetual GuidelinesDocument12 pagesTesda Perpetual GuidelinesMichael Angelo Laguna Dela FuenteNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Chap 18-2 PPT Presentation Group 8 (Macroeconomis)Document25 pagesChap 18-2 PPT Presentation Group 8 (Macroeconomis)Như HảoNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- H20124 - Ajay VermaDocument13 pagesH20124 - Ajay VermaajayNo ratings yet

- Guide Emerging Market Currencies 2010Document128 pagesGuide Emerging Market Currencies 2010ferrarilover2000No ratings yet

- Educ 206 LM 8 AnswerDocument3 pagesEduc 206 LM 8 AnswerTARROZA, Lorraine S.100% (1)

- 1 Financial Statements AnalysisDocument6 pages1 Financial Statements AnalysisJamaica DavidNo ratings yet

- Chapter 09: Long-Lived Assets Land 5,000 Additional 15K CASH 100,000 MACHINE 30 or 52 Debt X 100,000Document14 pagesChapter 09: Long-Lived Assets Land 5,000 Additional 15K CASH 100,000 MACHINE 30 or 52 Debt X 100,000mostakNo ratings yet

- Godley (1992) - Maastricht and All ThatDocument5 pagesGodley (1992) - Maastricht and All ThatmarceloscarvalhoNo ratings yet

- Drainage and Water Search: Property Address About Your SearchDocument17 pagesDrainage and Water Search: Property Address About Your SearchTong WangNo ratings yet

- JFK Vs The Fed - Fractional BankingDocument8 pagesJFK Vs The Fed - Fractional BankingAprajita SinghNo ratings yet

- Exampundit - In: Insurance Awareness Expected Questions - Part 1Document3 pagesExampundit - In: Insurance Awareness Expected Questions - Part 1ANNENo ratings yet

- Quiz 3Document131 pagesQuiz 3afeeraNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasKate Crystel reyesNo ratings yet

- Braun - American Asset Manager CapitalismDocument35 pagesBraun - American Asset Manager Capitalismmannix carneyNo ratings yet

- Wollo University Final 2014Document26 pagesWollo University Final 2014yonas getachewNo ratings yet

- Account Statement From 1 Jan 2019 To 12 Feb 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Jan 2019 To 12 Feb 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday DhfmNo ratings yet

- Green Banking: Barson Singh Mithun 111172033 Section: ADocument4 pagesGreen Banking: Barson Singh Mithun 111172033 Section: ABarson MithunNo ratings yet

- NBFC Mfi AnalysisDocument10 pagesNBFC Mfi AnalysisNeeraj KumarNo ratings yet

- Memorandum Corp FDDocument27 pagesMemorandum Corp FDMoneylife FoundationNo ratings yet

- Kores India LTD 2010Document10 pagesKores India LTD 2010Sriram RanganathanNo ratings yet

- Econet Data Bundles On Airtime Uat ScriptDocument16 pagesEconet Data Bundles On Airtime Uat ScriptSarah ManiwaNo ratings yet

- GTCA Presentation InternationalDocument9 pagesGTCA Presentation InternationalNacho López ArgudoNo ratings yet