Professional Documents

Culture Documents

InTax Unit 2

InTax Unit 2

Uploaded by

ElleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

InTax Unit 2

InTax Unit 2

Uploaded by

ElleCopyright:

Available Formats

.

UNIT 2 (INCOME TAX ON INDIVIDUALS) ■ An alien who has acquired residence in the Philippines and retains his

• Income Tax – a tax on a person's income, emoluments, profits arising from status as such until he abandons the same and actually departs from the

property, practice of profession, conduct of trade or business or on the Philippines.

pertinent items of gross income specified in the Tax Code of 1997 (Tax

Code), as amended, less the deductions and/or personal and additional • Non-resident alien (NRA)

exemptions, if any, authorized for such types of income, by the Tax Code, as

■ An alien who comes to the Philippines for a definite purpose which in its

amended, or other special laws.

nature may be promptly accomplished.

■ Stay for an aggregate of more than 180 days and has a business in the

▲ Requisites of Income Philippines shall be deemed a NRAETB

• There must be gain or profit

• The gain must be realized or received

• The gain must not be excluded by law or treaty from taxation

Kat, a citizen, stayed in japan for 180 days Resident citizen

▲ Types of Persons

Pat, citizen, maintained her residence in Australia Non-resident citizen

• Natural Persons (Human beings)

Jay-R, Filipino singer, visited Canada for three days to Resident citizen

Type Earned within the Earned outside the sing for her cousin’s wedding

Philippines Philippines

Jay, a Filipino, departed from PH to work as therapist in Non-resident citizen

Resident citizen Taxable Taxable the US

Non-resident citizen Taxable Non-taxable Rihanna, American Citizen, engaged in 1 week concert in NRANETB

the Philippines

Resident alien Taxable Non-taxable

Gelo, British computer expert was hired by San Miguel to Resident alien

Non-resident alien assist in their computer installation which will take 7

months

engaged in trade or Taxable Non-taxable

business

Non-resident alien not • Artificial Persons (Entities)

engaged in trade or Taxable Non-taxable

business Earned within the Earned outside the

Type

Philippines Philippines

Domestic corporations Taxable Taxable

• Resident Citizens – a citizen of the Philippines residing therein.

Resident foreign

■ Citizen of the Philippines Under Sec. 1, Art. IV of the 1987 Taxable Non-taxable

corporations

Constitution

◊ Those who are citizens of the Philippines at the time of the adoption of this Non-resident foreign

Taxable Non-taxable

Constitution corporations

◊ Those whose fathers or mothers are citizens of the Philippines

◊ Those born before January 17, 1973, of Filipino Mothers, who elect ▲ Sources of Income

Philippine citizenship upon reaching the age of majority; and (4) Those who • Compensation Income – remuneration received for services performed by

are naturalized in accordance with law. an employee for his employer under an employee-employer relationship.

- Includes salaries, wages, emoluments and honoraria, allowances,

• Non-resident citizen commissions, fees including director's fees, taxable bonuses and fringe

■ A citizen of the Philippines whose physical presence abroad is with a benefits, taxable pensions and retirement pay, and other income of a similar

definite intention to reside therein nature.

■ A citizen of the Philippines who leaves the Philippines during the taxable

year to reside abroad, either as an immigrant or for employment on a • Business or Professional Income – income earned by an individual from

permanent basis. his sole proprietorship business, from the practice of profession, or share in

■ A citizen of the Philippines who works and derives income from abroad the income of a general professional partnership

and whose employment thereat requires him to be physically present abroad

most of the time (183 days) during the taxable year. • Passive Income – income generated without any active conduct.

■ A citizen who has been previously considered as non-resident citizen and - These are income generated by assets which can be in the form of real

who arrives in the Philippines at any time during the taxable year to reside properties that return rental income, shares of stock in a corporation that earn

permanently in the Philippines dividends or interest income received from savings.

• Resident Alien • Capital Gains – those arising from the sale of capital assets which may be

■ An alien who lives in the Philippines with no definite intention as to his subject to Capital Gains Tax, for sale of real property and shares of stock not

stay (floating intention) traded in a local stock exchange, or as part of gross income subject to income

■ One who comes to the Philippines for a definite purpose which in its nature tax for all other types of capital assets.

would require an extended stay and to that end makes his home temporarily

in the Philippines

Pagatpat, Aischelle Mhae R.

.

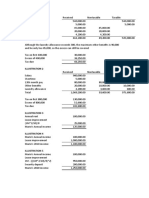

▲ Rules On Situs ▲ Basic Format of Computations

Income Situs • Pure Compensation

Interest Residence of the debtor

Dividends Within if coming from:

a. Domestic corporation

b. Foreign corporation (50% of

gross income earned within PH)

Services Where performed

Rentals and Royalties Where the property is located/place

of use intangible

- Non-taxable compensation income includes those benefits provided by the

Sale of real property Where the property is located employer which are considered de minimis or otherwise exempted from

Sale of personal property Purchase: Where the property sold income tax such as mandatory government and other contributions.

Produced: Partly within/without

• Pure Business or Professional Income

Income partly within and partly Pro rata

without ■ Graduated Rates

▲ Allowable Deductions For Individual Taxpayers

• Itemized Deductions

- Expenses incurred in conducting the business or in the practice of

profession are allowed as deductions for income tax purposes provided that

they meet all the requirements for deductibility.

• Optional Standard Deduction (OSD) ■ 8% Income Tax

- The OSD is 40% of Gross Sales or Receipts.

- If the individual has mixed income (from business and compensation) the

basis for the 40% will not include compensation income.

- Non-resident aliens: The OSD cannot be claimed by Non-Resident Aliens.

- The use of OSD or Itemized Expenses shall be made on the first quarter of

the taxable year, upon filing of the first quarter return and shall be

irrevocable for the said year.

• Special Allowable Itemized Deductions • Mixed Income Earners

- Deductions allowed by regular and special laws such as Rooming-in and ■ Compensation Income

Breast-feeding Practices under RA 7600, Adopt a School Program under RA - Always subject to the graduated rights.

8525, Senior Citizen Discount under RA 9257, etc.

■ Income from Business/Practice Of Profession

▲ Graduated Income Tax Rate for Individuals ◊ If the taxpayer's gross sales/receipts, together with other non-operating

income, do not exceed P3,000,000

8% income tax rate without the first P250,000 exempt

Graduated rates

◊ If the taxpayer's gross sales/receipts, together with other non-operating

income, exceeds P3,000,000 - graduated rates.

Pagatpat, Aischelle Mhae R.

.

Pagatpat, Aischelle Mhae R.

You might also like

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Drag and Flight Conveyors Design CalculationDocument3 pagesDrag and Flight Conveyors Design Calculationsudip giri100% (1)

- Reviewer Chapter 2Document6 pagesReviewer Chapter 2Ken NavarroNo ratings yet

- Handout 3Document51 pagesHandout 3Jilian Kate Alpapara Bustamante100% (1)

- Taxation 1 NotesDocument15 pagesTaxation 1 NotesTricia SandovalNo ratings yet

- Introduction To Income Taxation - 625041052Document21 pagesIntroduction To Income Taxation - 625041052ANGELA JOY FLORESNo ratings yet

- Types of TaxpayerDocument23 pagesTypes of TaxpayerReina Rose LebrillaNo ratings yet

- (TAX) Income Taxation Updated Jan 9 2022Document133 pages(TAX) Income Taxation Updated Jan 9 2022Reginald ValenciaNo ratings yet

- Kinds of Taxpayers and Situs of IncomeDocument2 pagesKinds of Taxpayers and Situs of IncomeMelanie SamsonaNo ratings yet

- G.Income Tax-Kinds of TaxpayerDocument1 pageG.Income Tax-Kinds of TaxpayerVinteNo ratings yet

- Inroduction To Income TaxationDocument20 pagesInroduction To Income TaxationW-304-Bautista,PreciousNo ratings yet

- Individual Taxpayers (Ordinary Income and Fringe Benefits)Document86 pagesIndividual Taxpayers (Ordinary Income and Fringe Benefits)ipbsalanguitNo ratings yet

- Classification of Individual Income TaxpayersDocument3 pagesClassification of Individual Income TaxpayersOdessa De JesusNo ratings yet

- Features of Philippine Income Tax SystemDocument9 pagesFeatures of Philippine Income Tax SystemPATRICIA ANGELICA VINUYANo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Classification of Tax PayersDocument24 pagesClassification of Tax PayersHilarie JeanNo ratings yet

- CLWTAXN NotesDocument7 pagesCLWTAXN NotesErin Leigh Marie SyNo ratings yet

- Citizenship and Residency Inside RP Outside RPDocument2 pagesCitizenship and Residency Inside RP Outside RPRhea Royce CabuhatNo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Income TaxationDocument31 pagesIncome TaxationJuanVictorNo ratings yet

- Individual TaxpayersDocument3 pagesIndividual TaxpayersJoy Orena100% (2)

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerMichael SanchezNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Income Taxation - Part 2Document12 pagesIncome Taxation - Part 2Prie DitucalanNo ratings yet

- Individual TaxpayerDocument10 pagesIndividual TaxpayerLL. yangzNo ratings yet

- Written Output - Intro To Income Tax & Tax Schemes, Periods, and Methods and ReportingDocument10 pagesWritten Output - Intro To Income Tax & Tax Schemes, Periods, and Methods and ReportingDiana BellenNo ratings yet

- Quickie PreFi Tax PDFDocument12 pagesQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- PreFi Tax PDFDocument21 pagesPreFi Tax PDFJoesil Dianne SempronNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErvin Ray FernandezNo ratings yet

- Group - 2 - Individual Taxpayer Part 1Document45 pagesGroup - 2 - Individual Taxpayer Part 1Ems TeopeNo ratings yet

- Income Taxation Midterm ReviewerDocument16 pagesIncome Taxation Midterm ReviewerRAMIREZ, MARVIN L.No ratings yet

- Income Recognition, Measurement and Reporting and Taxpayer ClassificationsDocument27 pagesIncome Recognition, Measurement and Reporting and Taxpayer ClassificationsAries Queencel Bernante BocarNo ratings yet

- Income TaxDocument38 pagesIncome TaxLara Camille CelestialNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Train Individual INCOME TAXDocument48 pagesTrain Individual INCOME TAXMeireen Ann100% (2)

- Cream Neutral Minimalist Finance Basics Webinar PresentationDocument35 pagesCream Neutral Minimalist Finance Basics Webinar PresentationRein MalabanaNo ratings yet

- Lesson 2 Taxation of IndividualsDocument40 pagesLesson 2 Taxation of IndividualsQuenie De la CruzNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErwin TorresNo ratings yet

- Tax 1 MidtermsDocument18 pagesTax 1 MidtermsElaine Yap100% (1)

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Withholding Tax On Wages: Ruther N. Martinez Tax Reporting and Operations Group (TROG)Document183 pagesWithholding Tax On Wages: Ruther N. Martinez Tax Reporting and Operations Group (TROG)Johnallen MarillaNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- Taxation of IndividualsDocument49 pagesTaxation of IndividualsAnastasha Grey100% (1)

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- Midterm Assignment Number 1 - CABINASDocument3 pagesMidterm Assignment Number 1 - CABINASJoshua CabinasNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- Tax Reviewer PDFDocument6 pagesTax Reviewer PDFdave excelleNo ratings yet

- Introduction To Income TaxationDocument4 pagesIntroduction To Income TaxationJean Diane JoveloNo ratings yet

- Share Taxpayer and Elements of Gross IncomeDocument24 pagesShare Taxpayer and Elements of Gross IncomeJessa Mae IgotNo ratings yet

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- Tax CompiledDocument379 pagesTax Compiledlayla scotNo ratings yet

- Income Taxation: Income Tax For IndividualsDocument8 pagesIncome Taxation: Income Tax For IndividualsJohnnoff Bagacina0% (1)

- Basic Principles On Income TaxationDocument7 pagesBasic Principles On Income TaxationMark Kyle P. AndresNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- Corporation and PartnershipDocument1 pageCorporation and PartnershipMichael V. SalubreNo ratings yet

- M2u Classification Individual Taxation P1Document30 pagesM2u Classification Individual Taxation P1Xehdrickke FernandezNo ratings yet

- Bar TaxDocument29 pagesBar TaxMaisie ZabalaNo ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- How to Buy a Home in USA; Complete Guide to American Dream: Foreign Consulting, #1From EverandHow to Buy a Home in USA; Complete Guide to American Dream: Foreign Consulting, #1No ratings yet

- Bernie Madoff - Overview, History, and The Ponzi SchemeDocument7 pagesBernie Madoff - Overview, History, and The Ponzi SchemeElleNo ratings yet

- Enron Scandal - The Fall of A Wall Street DarlingDocument11 pagesEnron Scandal - The Fall of A Wall Street DarlingElleNo ratings yet

- Enron Scandal - Summary, Explained, History, & Facts - BritannicaDocument4 pagesEnron Scandal - Summary, Explained, History, & Facts - BritannicaElleNo ratings yet

- Bernie Madoff Dead at 82 Disgraced Investor Ran Biggest Ponzi Scheme in History - WSJDocument4 pagesBernie Madoff Dead at 82 Disgraced Investor Ran Biggest Ponzi Scheme in History - WSJElleNo ratings yet

- StratCost Chapter 5Document2 pagesStratCost Chapter 5ElleNo ratings yet

- Chapter 8 (Differential Cost Analysis) : Pagatpat, Aischelle Mhae RDocument3 pagesChapter 8 (Differential Cost Analysis) : Pagatpat, Aischelle Mhae RElleNo ratings yet

- InTax Unit 7Document1 pageInTax Unit 7ElleNo ratings yet

- InTax Quiz 3Document7 pagesInTax Quiz 3ElleNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- AST Chapter 3 MCPDocument20 pagesAST Chapter 3 MCPElleNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- InTax Quiz 1Document7 pagesInTax Quiz 1ElleNo ratings yet

- AST Chapter 2 MCPDocument4 pagesAST Chapter 2 MCPElleNo ratings yet

- Cost Acc Chapter 9Document5 pagesCost Acc Chapter 9ElleNo ratings yet

- InTax Final Quiz (Unit 7-9)Document15 pagesInTax Final Quiz (Unit 7-9)ElleNo ratings yet

- BusLaw Chapter 1Document4 pagesBusLaw Chapter 1ElleNo ratings yet

- AST Chapter 1Document4 pagesAST Chapter 1ElleNo ratings yet

- Cost Acc Chapter 3Document2 pagesCost Acc Chapter 3ElleNo ratings yet

- Ast Chapter 1 MCPDocument14 pagesAst Chapter 1 MCPElleNo ratings yet

- Cost Acc Chapter 12Document8 pagesCost Acc Chapter 12ElleNo ratings yet

- Cost Acc Chapter 2Document4 pagesCost Acc Chapter 2ElleNo ratings yet

- Cost Acc Chapter 11Document10 pagesCost Acc Chapter 11ElleNo ratings yet

- Cost Acc Chapter 5Document7 pagesCost Acc Chapter 5ElleNo ratings yet

- Cost Acc Chapter 7Document14 pagesCost Acc Chapter 7ElleNo ratings yet

- May 2004Document83 pagesMay 2004DeepakSehrawatNo ratings yet

- ASD Vs LRFDDocument5 pagesASD Vs LRFDUsman AfzalNo ratings yet

- Paper BHR AVSI Eng 28 MarDocument86 pagesPaper BHR AVSI Eng 28 MarMurdoc Alphonce NicallsNo ratings yet

- BOILER PrestigeDocument2 pagesBOILER PrestigeJaime Rodri Millapan AlianteNo ratings yet

- Emergency Nle Post Test Feb. 2 2024 AnswerDocument29 pagesEmergency Nle Post Test Feb. 2 2024 Answeriglesias.breindenver.lNo ratings yet

- Parts List For AstraLux 820DDocument10 pagesParts List For AstraLux 820DAstraluxNo ratings yet

- Hypothesis TestingDocument19 pagesHypothesis TestingShahariar KabirNo ratings yet

- Software Requirements Specification: Wildlife Areas Habitat Conservation PlanDocument25 pagesSoftware Requirements Specification: Wildlife Areas Habitat Conservation PlanAnony MousNo ratings yet

- MSDS-Sodium Dibuthyl DithiophosphateDocument5 pagesMSDS-Sodium Dibuthyl DithiophosphatemishaNo ratings yet

- Chapter 7Document4 pagesChapter 7ram sunderNo ratings yet

- In Flight JapaneseDocument20 pagesIn Flight JapaneseRizal Pena100% (1)

- De Lima Vs Reyes - Case DigestDocument6 pagesDe Lima Vs Reyes - Case DigestOnilyn MolinoNo ratings yet

- 2022 National Veteran Suicide Prevention Annual ReportDocument43 pages2022 National Veteran Suicide Prevention Annual ReportWSYX/WTTENo ratings yet

- NASSCOM Assessment of CompetenceDocument6 pagesNASSCOM Assessment of CompetenceSagar KorlamNo ratings yet

- Engineering Forum 2023Document19 pagesEngineering Forum 2023Kgosi MorapediNo ratings yet

- WeldingDocument151 pagesWeldingwoodlandsoup7No ratings yet

- AWS Solutions Architect Associate Master Cheat SheetDocument124 pagesAWS Solutions Architect Associate Master Cheat SheetSapna Popat SitarNo ratings yet

- The Leatherwork School Guide To Hand Sewing ThreadDocument15 pagesThe Leatherwork School Guide To Hand Sewing ThreadPhung Ngoc DungNo ratings yet

- Comp Carlyle Torque PDFDocument125 pagesComp Carlyle Torque PDFjsnavarro1o100% (2)

- Geogrid Reinforced Soil Structures Reach New Heights - Geosynthetics MagazineDocument15 pagesGeogrid Reinforced Soil Structures Reach New Heights - Geosynthetics MagazineFranz Joseph R. BonjeNo ratings yet

- A Study On Green Marketing Strategies of HUL (Hemlata) MBA 1st Sem-1Document56 pagesA Study On Green Marketing Strategies of HUL (Hemlata) MBA 1st Sem-1shashank rangareNo ratings yet

- AWS Virtual CloudDocument28 pagesAWS Virtual Cloudnaveengangumalla9No ratings yet

- Rail Infrastructure in Africa - Financing Policy Options - AfDBDocument202 pagesRail Infrastructure in Africa - Financing Policy Options - AfDBOkponkuNo ratings yet

- A-V - Papayya Sastry Ors Vs Government of A-P - Ors On 7 March 2007Document13 pagesA-V - Papayya Sastry Ors Vs Government of A-P - Ors On 7 March 2007Aditi ReddyNo ratings yet

- Curso Minitab 15Document407 pagesCurso Minitab 15Álvaro NogueiraNo ratings yet

- Urban Studio PDFDocument19 pagesUrban Studio PDFShantanuShahNo ratings yet

- Six Floors, Endless StoriesDocument16 pagesSix Floors, Endless StoriesJeff FroggieNo ratings yet

- Eizaz Fakhrullah Bin Abd Razak - 2020885252 - Individual ReportDocument13 pagesEizaz Fakhrullah Bin Abd Razak - 2020885252 - Individual ReportEizaz RazakNo ratings yet