Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

26 viewsElida Bianca Marcial: Simple Transfer (Land &

Elida Bianca Marcial: Simple Transfer (Land &

Uploaded by

Asterio MagootThis document outlines the process for issuing a tax declaration in the Municipal Assessor's office for reasons such as a simple transfer of ownership, property being declared for the first time, or reassessment/reclassification of a property. The key steps involve submitting requirements like titles and tax clearance, processing the documents which includes inspection and verification, approval by the Municipal Assessor, encoding the data and printing the tax declaration, and releasing the completed documents. The total estimated processing time is 2 hours and 37 minutes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- 58-1 Spreader Beam & Lifting BeamDocument2 pages58-1 Spreader Beam & Lifting BeamAkhilNo ratings yet

- MPDO Citizen's Charter SampleDocument11 pagesMPDO Citizen's Charter Sampleryanpacabis23No ratings yet

- QC Government - Transfer of OwnershipDocument24 pagesQC Government - Transfer of OwnershipLorish ArguellesNo ratings yet

- Steps in Application For Development Permit, Certificate of Registration and License To Sell For Condotel As of August 5, 2020Document17 pagesSteps in Application For Development Permit, Certificate of Registration and License To Sell For Condotel As of August 5, 2020Crest PedrosaNo ratings yet

- Eyden - Air Transport Management PDFDocument526 pagesEyden - Air Transport Management PDFLê Đức Anh100% (1)

- Office of The Secretary To The Sangguniang PanlungsodDocument2 pagesOffice of The Secretary To The Sangguniang PanlungsodJames James100% (1)

- Requirements For Reassessment of Land and ImprovementDocument1 pageRequirements For Reassessment of Land and ImprovementCrisanta MarieNo ratings yet

- List of Frontline ServicesDocument21 pagesList of Frontline ServicesRms CrsNo ratings yet

- Municipal Assessor'S Office External ServicesDocument10 pagesMunicipal Assessor'S Office External ServicesMarven JuadiongNo ratings yet

- Arta TRDocument2 pagesArta TRTajimi CastañoNo ratings yet

- Step Applicant/Client Service Provider Duration of Activity (Under Normal Circumstances) Person in Charge Fees FormDocument1 pageStep Applicant/Client Service Provider Duration of Activity (Under Normal Circumstances) Person in Charge Fees FormGra syaNo ratings yet

- Citizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantDocument4 pagesCitizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantcarmanvernonNo ratings yet

- Citizen'S Charter No.R6-05.Request For Certification As To Alienable and Disposable, Residential, Commercial and Agricultural LotDocument3 pagesCitizen'S Charter No.R6-05.Request For Certification As To Alienable and Disposable, Residential, Commercial and Agricultural LotPongSkee TVNo ratings yet

- Tax Mapping Division: Basic FunctionDocument3 pagesTax Mapping Division: Basic Function0888modestoestoestaNo ratings yet

- Certificate of Adjoining OwnershipDocument3 pagesCertificate of Adjoining OwnershipKurt Anthony BaclayonNo ratings yet

- Step Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)Document1 pageStep Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)jaciemNo ratings yet

- Assr Declaring Unrevised or Missing Tax DeclarationDocument1 pageAssr Declaring Unrevised or Missing Tax DeclarationmaningassharamaeNo ratings yet

- Admin and FinDocument148 pagesAdmin and Fincenro staritaNo ratings yet

- CTO Citizens Charter 2020Document58 pagesCTO Citizens Charter 2020miron68No ratings yet

- 2019 Assessor PDFDocument15 pages2019 Assessor PDFJohn Karlo P. FernandezNo ratings yet

- Assr Declaring Underclared or Unknown PropertiesDocument1 pageAssr Declaring Underclared or Unknown PropertiesAIKA MARIENo ratings yet

- Municipal Assessors OfficeDocument13 pagesMunicipal Assessors Officevvct7wcrgnNo ratings yet

- R.A. 9048 Petition For Correction of Clerical ORDocument2 pagesR.A. 9048 Petition For Correction of Clerical ORMarianne Grace de VeraNo ratings yet

- 2 Issuance of Survey Authority-EdDocument2 pages2 Issuance of Survey Authority-EdJayson MelgarNo ratings yet

- Real Property AssessmentDocument9 pagesReal Property AssessmentRichard TiongNo ratings yet

- Service: Issuance of Governor'S Certification For Tree Cutting PermitDocument1 pageService: Issuance of Governor'S Certification For Tree Cutting PermitScionNo ratings yet

- COA Region IV-B Procedural Flow-Appeal On Audit DisallowancesDocument2 pagesCOA Region IV-B Procedural Flow-Appeal On Audit DisallowancesChristopher IgnacioNo ratings yet

- City Treasurer's OfficeDocument17 pagesCity Treasurer's OfficekokiNo ratings yet

- CITIZENS CHARTER NO. RO-F-03a. ISSUANCE OF CERTIFICATE OF VERIFICATION COV FOR THE TRANSPORT OF PLANTED TREES WITHIN PRIVATE LAND NON-TIMBER FOREST PRODUCTS EXCEPT RATTAN AND BAMBOODocument3 pagesCITIZENS CHARTER NO. RO-F-03a. ISSUANCE OF CERTIFICATE OF VERIFICATION COV FOR THE TRANSPORT OF PLANTED TREES WITHIN PRIVATE LAND NON-TIMBER FOREST PRODUCTS EXCEPT RATTAN AND BAMBOOJimmy JoseNo ratings yet

- Registration of Street Vendors in Designated Temporary Vending SitesDocument1 pageRegistration of Street Vendors in Designated Temporary Vending SitesEnrico CausapinNo ratings yet

- Office of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of SablayanDocument4 pagesOffice of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of Sablayanbhem silverioNo ratings yet

- TRANSFER - ISO - CAO Transaction Application Forms - Revised - v02 - 02262018Document1 pageTRANSFER - ISO - CAO Transaction Application Forms - Revised - v02 - 02262018miron68No ratings yet

- Municipal Assessors OfficeDocument7 pagesMunicipal Assessors OfficeNene CanjaNo ratings yet

- For Printing BPLO MISC Cit CharterDocument11 pagesFor Printing BPLO MISC Cit CharterMC Ivana PerezNo ratings yet

- Citizens CharterDocument2 pagesCitizens CharterMaricon RiveraNo ratings yet

- Hlurb Buyers GuideDocument10 pagesHlurb Buyers GuideAxl PagdangananNo ratings yet

- CPDO Services 2020Document26 pagesCPDO Services 2020MarvinPatricioNarcaNo ratings yet

- Treas - Payment of Real Property TaxDocument1 pageTreas - Payment of Real Property TaxCristine LectoninNo ratings yet

- Application FOR THE Temporary Philippine Registration Under /bareboat Charter/Renewal/Extension of Bareboat CharterDocument5 pagesApplication FOR THE Temporary Philippine Registration Under /bareboat Charter/Renewal/Extension of Bareboat CharterDC ANo ratings yet

- L 02 Issuance of Survey Authority 110519Document4 pagesL 02 Issuance of Survey Authority 110519Maria Crestina ZapantaNo ratings yet

- VSU Tolosa: Citizen's Charter DODocument3 pagesVSU Tolosa: Citizen's Charter DOKim Kenneth RocaNo ratings yet

- Supplemental To The Citizen - S Charter 2021 EditionDocument4 pagesSupplemental To The Citizen - S Charter 2021 EditionChristian Romar H. DacanayNo ratings yet

- L 02 Issuance of Survey Authority 110519Document4 pagesL 02 Issuance of Survey Authority 110519Asther YuNo ratings yet

- Issuance-of-Certification PROPERTYDocument1 pageIssuance-of-Certification PROPERTYAngela I.No ratings yet

- Issuance of Certificate of Irrigation CoverageDocument1 pageIssuance of Certificate of Irrigation CoverageLenie Ricardo Dela CruzNo ratings yet

- Citizen Charter of City of Manila TreasuryDocument25 pagesCitizen Charter of City of Manila TreasuryJohnny CruzNo ratings yet

- Building Permission ProcessDocument40 pagesBuilding Permission ProcessGuru Prasad KarriNo ratings yet

- Citizen Charter April 2023Document25 pagesCitizen Charter April 2023Parody CentralNo ratings yet

- Issuance of Real Property Tax ClearanceDocument2 pagesIssuance of Real Property Tax ClearanceJam Lean TorrevillasNo ratings yet

- Engp-Exgp ProcedureDocument7 pagesEngp-Exgp Proceduremenandro l salazarNo ratings yet

- Online Accreditation Process 2017Document3 pagesOnline Accreditation Process 2017Lucena City Tourism Office0% (1)

- Issuance of Certified True Copy of Tax Declaration, Certification of Property Holdings and or Certificate of No Property HoldingsDocument3 pagesIssuance of Certified True Copy of Tax Declaration, Certification of Property Holdings and or Certificate of No Property HoldingsLenal IsotdisiNo ratings yet

- Citizen'S Charter No. Ro-L-02. Application For Sales Nafco Patent (Agricultural)Document4 pagesCitizen'S Charter No. Ro-L-02. Application For Sales Nafco Patent (Agricultural)Krstn QbdNo ratings yet

- Application For Free Patent - ProcessDocument6 pagesApplication For Free Patent - ProcessJen BalaneNo ratings yet

- Sec CCHQ 2023Document1,411 pagesSec CCHQ 2023Z FNo ratings yet

- Consultancy Service Enrique ManalacDocument3 pagesConsultancy Service Enrique ManalacFrancis Edgardo LavarroNo ratings yet

- Step Applicant/Client Service Provider Duration of Activity Person in Fees ChargeDocument1 pageStep Applicant/Client Service Provider Duration of Activity Person in Fees ChargeNoel Ephraim AntiguaNo ratings yet

- Citizen Charter Finance UnitDocument88 pagesCitizen Charter Finance Unitlindsay boncodinNo ratings yet

- Citizen Charter 04 Oimb 17 Securing SCC For DealerDocument4 pagesCitizen Charter 04 Oimb 17 Securing SCC For Dealerrendee reyesNo ratings yet

- Provincial Assessment Office: 1. Frontline ServicesDocument2 pagesProvincial Assessment Office: 1. Frontline ServicesGalaxy TAB ANo ratings yet

- 6-11 Regional Offices CCT 03312022Document105 pages6-11 Regional Offices CCT 03312022Wesley Z.EspinosaNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Factors Affecting ProductivityDocument16 pagesFactors Affecting ProductivityArslan MunawarNo ratings yet

- ECON August 20, 2022531 - Lecture Notes 4A1Document7 pagesECON August 20, 2022531 - Lecture Notes 4A1Sam K. Flomo JrNo ratings yet

- MujiDocument5 pagesMujiHương PhanNo ratings yet

- Unit 1Document26 pagesUnit 1PRASHANTNo ratings yet

- GREED & Fear Pressure Cooker Adjusted - JefferiesDocument25 pagesGREED & Fear Pressure Cooker Adjusted - JefferiesVivek AgNo ratings yet

- Development of Capital Markets in ZambiaDocument9 pagesDevelopment of Capital Markets in ZambiaBernard SimwanzaNo ratings yet

- Background Vision MissionDocument6 pagesBackground Vision MissionShimelis Tesema83% (6)

- Accounting Primer 1Document39 pagesAccounting Primer 1Mad BullNo ratings yet

- Performance Evaluation of Nepal Investment Bank LimitedDocument9 pagesPerformance Evaluation of Nepal Investment Bank LimitedRabnoos GNo ratings yet

- Arcelormittal Signs Landmark Agreement With Government of Liberia Signals Commencement of One of The Largest Mining Projects in West AfricaDocument3 pagesArcelormittal Signs Landmark Agreement With Government of Liberia Signals Commencement of One of The Largest Mining Projects in West AfricaDuyan M. PeweeNo ratings yet

- Bond Valuation and Risk Recits NotesDocument6 pagesBond Valuation and Risk Recits NotesNikki AlistadoNo ratings yet

- Black Book AjayDocument59 pagesBlack Book AjayMarshall CountyNo ratings yet

- GMMFDocument2 pagesGMMFHussein NazzalNo ratings yet

- Andrew Jackson - Where Does Money Come From - Positive Money PDF FromDocument374 pagesAndrew Jackson - Where Does Money Come From - Positive Money PDF FromLocal Money86% (7)

- PM Case 1Document1 pagePM Case 1Chaithra Y CNo ratings yet

- The Largest Fundraisers in Focus: A Guide To The Evolution of The Market and Investing in The Asset ClassDocument36 pagesThe Largest Fundraisers in Focus: A Guide To The Evolution of The Market and Investing in The Asset ClassPierreNo ratings yet

- MODULE 16 Share-Based PaymentDocument8 pagesMODULE 16 Share-Based PaymentJanelleNo ratings yet

- National Digital Taxes - Lessons From EuropeDocument20 pagesNational Digital Taxes - Lessons From EuropeJenny NatividadNo ratings yet

- Chapter 3 and 4 ReviewerDocument8 pagesChapter 3 and 4 ReviewerJerome SombilonNo ratings yet

- CH 09 Bonds ValuationDocument28 pagesCH 09 Bonds ValuationAbdus Salam ShaikhNo ratings yet

- Money - First Certificate Language PracticeDocument4 pagesMoney - First Certificate Language PracticeOlena KlymenkoNo ratings yet

- Agraga ProfileDocument25 pagesAgraga ProfileKeerun GNo ratings yet

- 1Q19 Presentation EECL VFDocument45 pages1Q19 Presentation EECL VFHelena AraujoNo ratings yet

- Who Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)Document294 pagesWho Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)dev guptaNo ratings yet

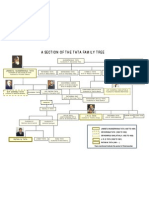

- TATA Family TreeDocument1 pageTATA Family Treemehulchauhan_9950% (2)

- FINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIADocument11 pagesFINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIAAarushi PawarNo ratings yet

- Of Bunga Telur and Bally ShoesDocument4 pagesOf Bunga Telur and Bally Shoesselinna1518No ratings yet

- PHILIPPINE TRUST COMPANY v. MARCIANO RIVERADocument2 pagesPHILIPPINE TRUST COMPANY v. MARCIANO RIVERABenjie SalesNo ratings yet

Elida Bianca Marcial: Simple Transfer (Land &

Elida Bianca Marcial: Simple Transfer (Land &

Uploaded by

Asterio Magoot0 ratings0% found this document useful (0 votes)

26 views2 pagesThis document outlines the process for issuing a tax declaration in the Municipal Assessor's office for reasons such as a simple transfer of ownership, property being declared for the first time, or reassessment/reclassification of a property. The key steps involve submitting requirements like titles and tax clearance, processing the documents which includes inspection and verification, approval by the Municipal Assessor, encoding the data and printing the tax declaration, and releasing the completed documents. The total estimated processing time is 2 hours and 37 minutes.

Original Description:

Original Title

Issuance of new TD

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the process for issuing a tax declaration in the Municipal Assessor's office for reasons such as a simple transfer of ownership, property being declared for the first time, or reassessment/reclassification of a property. The key steps involve submitting requirements like titles and tax clearance, processing the documents which includes inspection and verification, approval by the Municipal Assessor, encoding the data and printing the tax declaration, and releasing the completed documents. The total estimated processing time is 2 hours and 37 minutes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views2 pagesElida Bianca Marcial: Simple Transfer (Land &

Elida Bianca Marcial: Simple Transfer (Land &

Uploaded by

Asterio MagootThis document outlines the process for issuing a tax declaration in the Municipal Assessor's office for reasons such as a simple transfer of ownership, property being declared for the first time, or reassessment/reclassification of a property. The key steps involve submitting requirements like titles and tax clearance, processing the documents which includes inspection and verification, approval by the Municipal Assessor, encoding the data and printing the tax declaration, and releasing the completed documents. The total estimated processing time is 2 hours and 37 minutes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

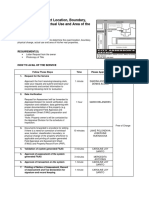

MUNICIPAL ASSESSOR- ISSUANCE OF TAX DECLARATION FOR: SIMPLE

TRANSFER OF OWNERSHIP; REAL PROPERTY DECLARED FOR THE FIRST TIME;

RE-ASSESSMENT OF REAL PROPERTY; RECLASSIFICATION OF REAL PROPERTY;

DISCOVERY OF REAL PROPERTY

by Elida Bianca Marcial

This Tax Declaration is being issued by this office for the following

reasons:

1. for Mortgage/Loan/Bank or Financial Institution requirement

2. for B.I.R./Pag-IBIG Fund and/or other government agency

requirement

3. for foreign government embassy requirement

ABOUT THE SERVICE

4. for legal purposes

5. for personal file copy

6. Re-assessment of Land and/or Improvement, if there is

Additional Floor Area Introduced, Renovation, Additional

Improvement, Reclassification, and Unrevised, therefore

Subject for Adjustment.

CLIENT GROUP General Public

Certified True Copy of Transfer Certificate of Title

Deed of Conveyance

BIR Tax Clearance Certificate

Certificate Authorizing Registration

REQUIREMENTS FOR Updated Real Property Tax Payment

SIMPLE TRANSFER (Land & Transfer Fee Receipt

Improvement) Sworn Statement of True and Fair Market Value of Real

Property

3”x5” colored picture of Improvement (if there is improvement)

Late filing fee receipts and Annotation of Mortgage fee (if

applicable)

PhP100.00 – for late filing fee, if applicable

FEES/PAYMENT REQUIRED: PhP100.00 – for Annotation fee, if applicable

Php 100.00- for Registration Fee

Monday to Friday

SERVICE SCHEDULE

8:00am – 5:00pm

TOTAL PROCESSING TIME Two (2) hours and 37 minutes

ACTIONS OF THE OFFICE OF THE TRANSACTION PERSON/S

STEPS INVOLVED

MUNICIPAL ASSESSOR TIME RESPONSIBLE

1. Submit the Accommodate/Receive/Check/Examine 15 minutes Receiving Clerk

requirements the completeness of the

requirements. Accomplish Forms.

Verify ownership. Attached

processing slip. The presenter shall

be advised to return on specific date.

System Validation

Field Validation. Inspection of

Record Section /

Property. Prepare Appraiser

2. Processed the Appraisal

inspection report. 108 minutes

documents Section / Tax

Verification of PIN

Mapping Section

Preparation of FAAS

Validation of FAAS

Signs the documents / Assigns TD Municipal

Approval 3 minutes

Number Assessor

Encoding of data & electronically

approved the encoded data.

Printing of Tax Declaration &

Encoding / e-Approval / IT Section /

Notice of Assessment. 39 minutes

Updating Record Section

Updating of Records. Stamp

markings, Segregation &

bookbinding of the documents

Releasing of the

Releases 1 minute Releasing Clerk

documents

You might also like

- 58-1 Spreader Beam & Lifting BeamDocument2 pages58-1 Spreader Beam & Lifting BeamAkhilNo ratings yet

- MPDO Citizen's Charter SampleDocument11 pagesMPDO Citizen's Charter Sampleryanpacabis23No ratings yet

- QC Government - Transfer of OwnershipDocument24 pagesQC Government - Transfer of OwnershipLorish ArguellesNo ratings yet

- Steps in Application For Development Permit, Certificate of Registration and License To Sell For Condotel As of August 5, 2020Document17 pagesSteps in Application For Development Permit, Certificate of Registration and License To Sell For Condotel As of August 5, 2020Crest PedrosaNo ratings yet

- Eyden - Air Transport Management PDFDocument526 pagesEyden - Air Transport Management PDFLê Đức Anh100% (1)

- Office of The Secretary To The Sangguniang PanlungsodDocument2 pagesOffice of The Secretary To The Sangguniang PanlungsodJames James100% (1)

- Requirements For Reassessment of Land and ImprovementDocument1 pageRequirements For Reassessment of Land and ImprovementCrisanta MarieNo ratings yet

- List of Frontline ServicesDocument21 pagesList of Frontline ServicesRms CrsNo ratings yet

- Municipal Assessor'S Office External ServicesDocument10 pagesMunicipal Assessor'S Office External ServicesMarven JuadiongNo ratings yet

- Arta TRDocument2 pagesArta TRTajimi CastañoNo ratings yet

- Step Applicant/Client Service Provider Duration of Activity (Under Normal Circumstances) Person in Charge Fees FormDocument1 pageStep Applicant/Client Service Provider Duration of Activity (Under Normal Circumstances) Person in Charge Fees FormGra syaNo ratings yet

- Citizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantDocument4 pagesCitizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantcarmanvernonNo ratings yet

- Citizen'S Charter No.R6-05.Request For Certification As To Alienable and Disposable, Residential, Commercial and Agricultural LotDocument3 pagesCitizen'S Charter No.R6-05.Request For Certification As To Alienable and Disposable, Residential, Commercial and Agricultural LotPongSkee TVNo ratings yet

- Tax Mapping Division: Basic FunctionDocument3 pagesTax Mapping Division: Basic Function0888modestoestoestaNo ratings yet

- Certificate of Adjoining OwnershipDocument3 pagesCertificate of Adjoining OwnershipKurt Anthony BaclayonNo ratings yet

- Step Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)Document1 pageStep Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)jaciemNo ratings yet

- Assr Declaring Unrevised or Missing Tax DeclarationDocument1 pageAssr Declaring Unrevised or Missing Tax DeclarationmaningassharamaeNo ratings yet

- Admin and FinDocument148 pagesAdmin and Fincenro staritaNo ratings yet

- CTO Citizens Charter 2020Document58 pagesCTO Citizens Charter 2020miron68No ratings yet

- 2019 Assessor PDFDocument15 pages2019 Assessor PDFJohn Karlo P. FernandezNo ratings yet

- Assr Declaring Underclared or Unknown PropertiesDocument1 pageAssr Declaring Underclared or Unknown PropertiesAIKA MARIENo ratings yet

- Municipal Assessors OfficeDocument13 pagesMunicipal Assessors Officevvct7wcrgnNo ratings yet

- R.A. 9048 Petition For Correction of Clerical ORDocument2 pagesR.A. 9048 Petition For Correction of Clerical ORMarianne Grace de VeraNo ratings yet

- 2 Issuance of Survey Authority-EdDocument2 pages2 Issuance of Survey Authority-EdJayson MelgarNo ratings yet

- Real Property AssessmentDocument9 pagesReal Property AssessmentRichard TiongNo ratings yet

- Service: Issuance of Governor'S Certification For Tree Cutting PermitDocument1 pageService: Issuance of Governor'S Certification For Tree Cutting PermitScionNo ratings yet

- COA Region IV-B Procedural Flow-Appeal On Audit DisallowancesDocument2 pagesCOA Region IV-B Procedural Flow-Appeal On Audit DisallowancesChristopher IgnacioNo ratings yet

- City Treasurer's OfficeDocument17 pagesCity Treasurer's OfficekokiNo ratings yet

- CITIZENS CHARTER NO. RO-F-03a. ISSUANCE OF CERTIFICATE OF VERIFICATION COV FOR THE TRANSPORT OF PLANTED TREES WITHIN PRIVATE LAND NON-TIMBER FOREST PRODUCTS EXCEPT RATTAN AND BAMBOODocument3 pagesCITIZENS CHARTER NO. RO-F-03a. ISSUANCE OF CERTIFICATE OF VERIFICATION COV FOR THE TRANSPORT OF PLANTED TREES WITHIN PRIVATE LAND NON-TIMBER FOREST PRODUCTS EXCEPT RATTAN AND BAMBOOJimmy JoseNo ratings yet

- Registration of Street Vendors in Designated Temporary Vending SitesDocument1 pageRegistration of Street Vendors in Designated Temporary Vending SitesEnrico CausapinNo ratings yet

- Office of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of SablayanDocument4 pagesOffice of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of Sablayanbhem silverioNo ratings yet

- TRANSFER - ISO - CAO Transaction Application Forms - Revised - v02 - 02262018Document1 pageTRANSFER - ISO - CAO Transaction Application Forms - Revised - v02 - 02262018miron68No ratings yet

- Municipal Assessors OfficeDocument7 pagesMunicipal Assessors OfficeNene CanjaNo ratings yet

- For Printing BPLO MISC Cit CharterDocument11 pagesFor Printing BPLO MISC Cit CharterMC Ivana PerezNo ratings yet

- Citizens CharterDocument2 pagesCitizens CharterMaricon RiveraNo ratings yet

- Hlurb Buyers GuideDocument10 pagesHlurb Buyers GuideAxl PagdangananNo ratings yet

- CPDO Services 2020Document26 pagesCPDO Services 2020MarvinPatricioNarcaNo ratings yet

- Treas - Payment of Real Property TaxDocument1 pageTreas - Payment of Real Property TaxCristine LectoninNo ratings yet

- Application FOR THE Temporary Philippine Registration Under /bareboat Charter/Renewal/Extension of Bareboat CharterDocument5 pagesApplication FOR THE Temporary Philippine Registration Under /bareboat Charter/Renewal/Extension of Bareboat CharterDC ANo ratings yet

- L 02 Issuance of Survey Authority 110519Document4 pagesL 02 Issuance of Survey Authority 110519Maria Crestina ZapantaNo ratings yet

- VSU Tolosa: Citizen's Charter DODocument3 pagesVSU Tolosa: Citizen's Charter DOKim Kenneth RocaNo ratings yet

- Supplemental To The Citizen - S Charter 2021 EditionDocument4 pagesSupplemental To The Citizen - S Charter 2021 EditionChristian Romar H. DacanayNo ratings yet

- L 02 Issuance of Survey Authority 110519Document4 pagesL 02 Issuance of Survey Authority 110519Asther YuNo ratings yet

- Issuance-of-Certification PROPERTYDocument1 pageIssuance-of-Certification PROPERTYAngela I.No ratings yet

- Issuance of Certificate of Irrigation CoverageDocument1 pageIssuance of Certificate of Irrigation CoverageLenie Ricardo Dela CruzNo ratings yet

- Citizen Charter of City of Manila TreasuryDocument25 pagesCitizen Charter of City of Manila TreasuryJohnny CruzNo ratings yet

- Building Permission ProcessDocument40 pagesBuilding Permission ProcessGuru Prasad KarriNo ratings yet

- Citizen Charter April 2023Document25 pagesCitizen Charter April 2023Parody CentralNo ratings yet

- Issuance of Real Property Tax ClearanceDocument2 pagesIssuance of Real Property Tax ClearanceJam Lean TorrevillasNo ratings yet

- Engp-Exgp ProcedureDocument7 pagesEngp-Exgp Proceduremenandro l salazarNo ratings yet

- Online Accreditation Process 2017Document3 pagesOnline Accreditation Process 2017Lucena City Tourism Office0% (1)

- Issuance of Certified True Copy of Tax Declaration, Certification of Property Holdings and or Certificate of No Property HoldingsDocument3 pagesIssuance of Certified True Copy of Tax Declaration, Certification of Property Holdings and or Certificate of No Property HoldingsLenal IsotdisiNo ratings yet

- Citizen'S Charter No. Ro-L-02. Application For Sales Nafco Patent (Agricultural)Document4 pagesCitizen'S Charter No. Ro-L-02. Application For Sales Nafco Patent (Agricultural)Krstn QbdNo ratings yet

- Application For Free Patent - ProcessDocument6 pagesApplication For Free Patent - ProcessJen BalaneNo ratings yet

- Sec CCHQ 2023Document1,411 pagesSec CCHQ 2023Z FNo ratings yet

- Consultancy Service Enrique ManalacDocument3 pagesConsultancy Service Enrique ManalacFrancis Edgardo LavarroNo ratings yet

- Step Applicant/Client Service Provider Duration of Activity Person in Fees ChargeDocument1 pageStep Applicant/Client Service Provider Duration of Activity Person in Fees ChargeNoel Ephraim AntiguaNo ratings yet

- Citizen Charter Finance UnitDocument88 pagesCitizen Charter Finance Unitlindsay boncodinNo ratings yet

- Citizen Charter 04 Oimb 17 Securing SCC For DealerDocument4 pagesCitizen Charter 04 Oimb 17 Securing SCC For Dealerrendee reyesNo ratings yet

- Provincial Assessment Office: 1. Frontline ServicesDocument2 pagesProvincial Assessment Office: 1. Frontline ServicesGalaxy TAB ANo ratings yet

- 6-11 Regional Offices CCT 03312022Document105 pages6-11 Regional Offices CCT 03312022Wesley Z.EspinosaNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Factors Affecting ProductivityDocument16 pagesFactors Affecting ProductivityArslan MunawarNo ratings yet

- ECON August 20, 2022531 - Lecture Notes 4A1Document7 pagesECON August 20, 2022531 - Lecture Notes 4A1Sam K. Flomo JrNo ratings yet

- MujiDocument5 pagesMujiHương PhanNo ratings yet

- Unit 1Document26 pagesUnit 1PRASHANTNo ratings yet

- GREED & Fear Pressure Cooker Adjusted - JefferiesDocument25 pagesGREED & Fear Pressure Cooker Adjusted - JefferiesVivek AgNo ratings yet

- Development of Capital Markets in ZambiaDocument9 pagesDevelopment of Capital Markets in ZambiaBernard SimwanzaNo ratings yet

- Background Vision MissionDocument6 pagesBackground Vision MissionShimelis Tesema83% (6)

- Accounting Primer 1Document39 pagesAccounting Primer 1Mad BullNo ratings yet

- Performance Evaluation of Nepal Investment Bank LimitedDocument9 pagesPerformance Evaluation of Nepal Investment Bank LimitedRabnoos GNo ratings yet

- Arcelormittal Signs Landmark Agreement With Government of Liberia Signals Commencement of One of The Largest Mining Projects in West AfricaDocument3 pagesArcelormittal Signs Landmark Agreement With Government of Liberia Signals Commencement of One of The Largest Mining Projects in West AfricaDuyan M. PeweeNo ratings yet

- Bond Valuation and Risk Recits NotesDocument6 pagesBond Valuation and Risk Recits NotesNikki AlistadoNo ratings yet

- Black Book AjayDocument59 pagesBlack Book AjayMarshall CountyNo ratings yet

- GMMFDocument2 pagesGMMFHussein NazzalNo ratings yet

- Andrew Jackson - Where Does Money Come From - Positive Money PDF FromDocument374 pagesAndrew Jackson - Where Does Money Come From - Positive Money PDF FromLocal Money86% (7)

- PM Case 1Document1 pagePM Case 1Chaithra Y CNo ratings yet

- The Largest Fundraisers in Focus: A Guide To The Evolution of The Market and Investing in The Asset ClassDocument36 pagesThe Largest Fundraisers in Focus: A Guide To The Evolution of The Market and Investing in The Asset ClassPierreNo ratings yet

- MODULE 16 Share-Based PaymentDocument8 pagesMODULE 16 Share-Based PaymentJanelleNo ratings yet

- National Digital Taxes - Lessons From EuropeDocument20 pagesNational Digital Taxes - Lessons From EuropeJenny NatividadNo ratings yet

- Chapter 3 and 4 ReviewerDocument8 pagesChapter 3 and 4 ReviewerJerome SombilonNo ratings yet

- CH 09 Bonds ValuationDocument28 pagesCH 09 Bonds ValuationAbdus Salam ShaikhNo ratings yet

- Money - First Certificate Language PracticeDocument4 pagesMoney - First Certificate Language PracticeOlena KlymenkoNo ratings yet

- Agraga ProfileDocument25 pagesAgraga ProfileKeerun GNo ratings yet

- 1Q19 Presentation EECL VFDocument45 pages1Q19 Presentation EECL VFHelena AraujoNo ratings yet

- Who Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)Document294 pagesWho Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)dev guptaNo ratings yet

- TATA Family TreeDocument1 pageTATA Family Treemehulchauhan_9950% (2)

- FINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIADocument11 pagesFINANCIAL PERFORMANCE EVALUATION OF RRBs IN INDIAAarushi PawarNo ratings yet

- Of Bunga Telur and Bally ShoesDocument4 pagesOf Bunga Telur and Bally Shoesselinna1518No ratings yet

- PHILIPPINE TRUST COMPANY v. MARCIANO RIVERADocument2 pagesPHILIPPINE TRUST COMPANY v. MARCIANO RIVERABenjie SalesNo ratings yet