Professional Documents

Culture Documents

Continued: College Retirement Equities Fund 2019 Annual Report 107

Continued: College Retirement Equities Fund 2019 Annual Report 107

Uploaded by

Ljubisa MaticOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continued: College Retirement Equities Fund 2019 Annual Report 107

Continued: College Retirement Equities Fund 2019 Annual Report 107

Uploaded by

Ljubisa MaticCopyright:

Available Formats

continued

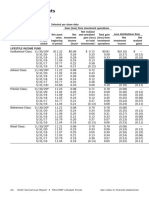

For the year ended December 31, 2019, the effect of derivative contracts on the Accounts’

Statements of operations was as follows (dollar amounts are in thousands):

Change in

unrealized

Realized appreciation

Derivative contracts Location gain (loss) (depreciation)

Stock Account

Equity contracts Purchased options $ 27,595 $ 2,674

Equity contracts Written options (13,928) (398)

Equity contracts Futures contracts 51,992 29,942

Foreign-exchange contracts Forward foreign

currency contracts (1,631) (1,542)

Global Equities Account

Equity contracts Purchased options (774) —

Equity contracts Written options 283 —

Equity contracts Futures contracts 24,749 10,804

Equity Index Account

Equity contracts Futures contracts 19,656 (2,155)

Bond Market Account

Foreign-exchange contracts Forward foreign

currency contracts 4,893 (1,602)

Credit contracts Swap contracts (1,145) (2,485)

Inflation-Linked Bond Account

Interest-rate contracts Futures contracts (815) 285

Social Choice Account

Foreign-exchange contracts Forward foreign

currency contracts 332 (122)

Options: Certain Accounts are subject to equity price risk in the normal course of

pursuing their investment objectives. Options can be settled either directly with the

counterparty (over the counter) or through a central clearinghouse (exchange traded).

To manage the risk, the Accounts may invest in both equity and index options. The

Accounts use options contracts for hedging and cash management purposes and to

seek to increase total return. Call and put equity options give the holder the right, in

return for a premium paid, to purchase or sell, respectively, a security at a specified

exercise price at any time during the period of the option. Index options are written or

purchased options in which the underlying investment is a specified index. The

exercise of an index option will not result in the physical delivery of the underlier, but

a cash transfer of the difference between the settlement price of the underlier and the

strike price of the option. Purchased options are included in the Summary portfolio of

investments, and written options are separately reflected as a liability in the

Statements of assets and liabilities. Premiums on unexercised, expired options are

recorded as realized gains or losses; premiums on exercised options are recorded as

an adjustment to the proceeds from the sale or cost of the purchase. The difference

between the premium and the amount received or paid in a closing transaction is also

treated as a realized gain or loss. Risks may arise upon entering into over the counter

College Retirement Equities Fund ■ 2019 Annual Report 107

You might also like

- Identify The Industry - Analysis of Financial Statement Data PDFDocument5 pagesIdentify The Industry - Analysis of Financial Statement Data PDFPatricio Ordoñez Baldeon0% (1)

- Overview of The Philippine Financial SystemDocument3 pagesOverview of The Philippine Financial Systemzilla62% (13)

- Company Valuation & Ratio Analysis (Tata Motors) 2021Document25 pagesCompany Valuation & Ratio Analysis (Tata Motors) 2021Manveet SinghNo ratings yet

- DerivativesDocument111 pagesDerivativesMuhammad Moazzam JavaidNo ratings yet

- Poland A2 MotorwayDocument8 pagesPoland A2 MotorwayArun Kumar K100% (4)

- Solution: P8 / (P96.50 - P2.38) 8.5%Document4 pagesSolution: P8 / (P96.50 - P2.38) 8.5%Edrielle100% (1)

- Derivatives Analysis & Valuation: Study Session 9Document10 pagesDerivatives Analysis & Valuation: Study Session 9Muskan MittalNo ratings yet

- Annual Report 2022 - Bank of AmericaDocument2 pagesAnnual Report 2022 - Bank of America张文珂No ratings yet

- Foreignex Comptroller HandbookDocument35 pagesForeignex Comptroller HandbookanzrainaNo ratings yet

- Administration and Other Fiduciary Fees Revenue Is PrimarilyDocument20 pagesAdministration and Other Fiduciary Fees Revenue Is PrimarilyORION OMAR MENDOZA SALHUANo ratings yet

- Swaps and Emerging DerivativesDocument17 pagesSwaps and Emerging DerivativesApeksha SharmaNo ratings yet

- CommerzMarketsLLC-Statement of Financial Condition JUN 2022Document15 pagesCommerzMarketsLLC-Statement of Financial Condition JUN 2022Катерина ЕгороваNo ratings yet

- Introduction To Derivatives: Corporate Finance Institute®Document70 pagesIntroduction To Derivatives: Corporate Finance Institute®SwatiNo ratings yet

- Warrants, ADR, GDR, Innovative Financial ProductsDocument22 pagesWarrants, ADR, GDR, Innovative Financial ProductsSanjeevNo ratings yet

- Week 06 2022 Topic 6 Lecture Financial Instruments Part CDocument26 pagesWeek 06 2022 Topic 6 Lecture Financial Instruments Part CErnest LeongNo ratings yet

- Intermediate Accounitng Case StudyDocument4 pagesIntermediate Accounitng Case StudykmarisseeNo ratings yet

- Pert 2 - Derivative Hedge AccountingDocument48 pagesPert 2 - Derivative Hedge AccountingDian Nur IlmiNo ratings yet

- Quarterly Report 20120331Document25 pagesQuarterly Report 20120331TshegofatsoTaunyaneNo ratings yet

- Pas 3 FormDocument5 pagesPas 3 FormAadi saklechaNo ratings yet

- Chapter 3 - MCQ SolDocument3 pagesChapter 3 - MCQ SolinasNo ratings yet

- Joint Arrangement PFRS 11Document4 pagesJoint Arrangement PFRS 11Mary Shiela Garcia MalayaNo ratings yet

- Derivatives and Derivatives MarketsDocument55 pagesDerivatives and Derivatives MarketsLulu Katima100% (1)

- Financial Markets: From Wikipedia, The Free EncyclopediaDocument24 pagesFinancial Markets: From Wikipedia, The Free Encyclopediaraden chandrajaya listiandokoNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- Final Cia SubmissionDocument44 pagesFinal Cia SubmissionGarvit GuptaNo ratings yet

- File 9 - Gabriel Resources Yukon - Financial Statements YE 2017Document34 pagesFile 9 - Gabriel Resources Yukon - Financial Statements YE 2017futurepatent20No ratings yet

- CH 21 in Class Exercises Day 1Document2 pagesCH 21 in Class Exercises Day 1Abdullah alhamaadNo ratings yet

- Mahindra and MahindraDocument1 pageMahindra and MahindraBijosh ThomasNo ratings yet

- Financial TheoryDocument173 pagesFinancial TheoryDaniele NaddeoNo ratings yet

- CH 01 Hull OFOD10 TH EditionDocument62 pagesCH 01 Hull OFOD10 TH EditionPedestal ConciergeNo ratings yet

- Islamic Accounting P 2Document60 pagesIslamic Accounting P 2Abdelnasir HaiderNo ratings yet

- Statements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019Document1 pageStatements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019LjubiNo ratings yet

- Derivative Markets 2024Document4 pagesDerivative Markets 2024Riza Mae Ramos AddatuNo ratings yet

- F45 AssetsDocument7 pagesF45 AssetsDawood Adel DhakallahNo ratings yet

- Chapter 1 Organization and Functions of SecuritiesDocument28 pagesChapter 1 Organization and Functions of SecuritiesNicole OcampoNo ratings yet

- Investments in Debt and Equity SecuritiesDocument38 pagesInvestments in Debt and Equity SecuritiesGaluh Boga KuswaraNo ratings yet

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocument38 pagesAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNo ratings yet

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocument38 pagesAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNo ratings yet

- Mechanics of Futures MarketsDocument23 pagesMechanics of Futures MarketsaliNo ratings yet

- MBA - FM6 With Added SlidesDocument46 pagesMBA - FM6 With Added SlidescharithNo ratings yet

- #16 DerivativesDocument8 pages#16 DerivativesMakoy BixenmanNo ratings yet

- Hide 1 Categorization 1.1 A Table 2 Measuring Financial Instrument's Gain or Loss 3 See Also 4 External LinksDocument5 pagesHide 1 Categorization 1.1 A Table 2 Measuring Financial Instrument's Gain or Loss 3 See Also 4 External LinksrajivkumarraiNo ratings yet

- Lesson 8 MBADocument27 pagesLesson 8 MBAsanjaya de silvaNo ratings yet

- Table. Correspondence Between The GFSM 1986 and The GFSM 2014 Summary Transaction StatementsDocument2 pagesTable. Correspondence Between The GFSM 1986 and The GFSM 2014 Summary Transaction StatementsTagenarine SinghNo ratings yet

- $P Mayank Gautam 16117047Document62 pages$P Mayank Gautam 16117047Rachit SemaltyNo ratings yet

- 2 - FIG09105 Fin. Risk MGTDocument19 pages2 - FIG09105 Fin. Risk MGTMoud KhalfaniNo ratings yet

- Market Organization & StructureDocument34 pagesMarket Organization & StructureahmedNo ratings yet

- Ch05 Practice Materials CompressDocument101 pagesCh05 Practice Materials CompressShei EngaranNo ratings yet

- Topic:-Derivatives: Arayabhatta Institute of Management & TechnologyDocument18 pagesTopic:-Derivatives: Arayabhatta Institute of Management & TechnologyParneet WaliaNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- E-Books - Cash Flow StatementDocument38 pagesE-Books - Cash Flow StatementsmartshivenduNo ratings yet

- Equity Structured Products Accumulator/ DecumulatorDocument5 pagesEquity Structured Products Accumulator/ DecumulatorRajulNo ratings yet

- Fauji Fertilizer Company Limited 20 21Document5 pagesFauji Fertilizer Company Limited 20 21Aliza IshraNo ratings yet

- Kit Valoración Cementos ArgosDocument19 pagesKit Valoración Cementos ArgosLEIDY DAYANA PARRA CARONo ratings yet

- DVL Inc 2016 Annual ReportDocument23 pagesDVL Inc 2016 Annual ReportkdwcapitalNo ratings yet

- Overview 1Document23 pagesOverview 1Ismail MarzukiNo ratings yet

- Trading in Financial MarketsDocument42 pagesTrading in Financial MarketsthandiveNo ratings yet

- Session12 Chapter1415Document44 pagesSession12 Chapter1415www.hahahaxNo ratings yet

- Balance Sheet 2021Document82 pagesBalance Sheet 2021nikhil gangwarNo ratings yet

- Alternative Risk Transfer (ART) Non Traditional ReinsuranceDocument37 pagesAlternative Risk Transfer (ART) Non Traditional ReinsuranceNeha Shah100% (1)

- Ch17,21,19 NotesDocument24 pagesCh17,21,19 NotesScott ZiplowNo ratings yet

- UntitledDocument32 pagesUntitledEvelyn YangNo ratings yet

- Chapter 11: Financial Risk Management: International Accounting, 7/eDocument31 pagesChapter 11: Financial Risk Management: International Accounting, 7/eSara AlsNo ratings yet

- Synthetic and Structured Assets: A Practical Guide to Investment and RiskFrom EverandSynthetic and Structured Assets: A Practical Guide to Investment and RiskNo ratings yet

- Statements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedDocument1 pageStatements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedLjubisa MaticNo ratings yet

- Financial Highlights: TIAA-CREF Lifestyle FundsDocument1 pageFinancial Highlights: TIAA-CREF Lifestyle FundsLjubisa MaticNo ratings yet

- See Notes To Financial Statements TIAA-CREF Lifestyle Funds 2020 Semiannual Report 45Document1 pageSee Notes To Financial Statements TIAA-CREF Lifestyle Funds 2020 Semiannual Report 45Ljubisa MaticNo ratings yet

- LS Sar Page47Document1 pageLS Sar Page47Ljubisa MaticNo ratings yet

- LS Sar Page48Document1 pageLS Sar Page48Ljubisa MaticNo ratings yet

- LS Sar Page49Document1 pageLS Sar Page49Ljubisa MaticNo ratings yet

- LS Sar Page51Document1 pageLS Sar Page51Ljubisa MaticNo ratings yet

- LS Sar Page50Document1 pageLS Sar Page50Ljubisa MaticNo ratings yet

- Glossary of AbbreviationsDocument19 pagesGlossary of AbbreviationsNatalia Gonta0% (1)

- Airline IndusDocument8 pagesAirline IndusJanani SivaNo ratings yet

- Western Telecommunication CashflowDocument3 pagesWestern Telecommunication CashflowKanishka KartikeyaNo ratings yet

- Wall Street Prep Financial Modeling Quick Lesson DCF1Document18 pagesWall Street Prep Financial Modeling Quick Lesson DCF1NuominNo ratings yet

- Equity & Preference Shares Presented By: Sushil Choudhary Roll No-116Document14 pagesEquity & Preference Shares Presented By: Sushil Choudhary Roll No-116sus2004No ratings yet

- Estimation of Project Cash FlowsDocument14 pagesEstimation of Project Cash FlowsYatin DhallNo ratings yet

- A Project Report On: Undertaken atDocument91 pagesA Project Report On: Undertaken atcashcashcashcashNo ratings yet

- Last QuizDocument5 pagesLast QuizMariah MacasNo ratings yet

- Subject: SAPM Name: Rucha Sem: 3 Roll No.:15Document18 pagesSubject: SAPM Name: Rucha Sem: 3 Roll No.:15niraliNo ratings yet

- Unit - IvDocument40 pagesUnit - IvjitendraNo ratings yet

- 10Document84 pages10Rekas SofianeNo ratings yet

- Goat RaisingDocument23 pagesGoat RaisingDian Jean Cosare GanoyNo ratings yet

- Lesson 5 Efficient Securities Market, Accounting Issues, Implications & Economic ConsiderationsDocument28 pagesLesson 5 Efficient Securities Market, Accounting Issues, Implications & Economic ConsiderationsDerek DadzieNo ratings yet

- Zarai Taraqiati Bank Limited Consolidated Statement of Financial Position As at December 31, 2015 Note 2015 2014 Rupees in '000 AssetsDocument5 pagesZarai Taraqiati Bank Limited Consolidated Statement of Financial Position As at December 31, 2015 Note 2015 2014 Rupees in '000 AssetsFaisal AwanNo ratings yet

- Prs Guide BengaliDocument23 pagesPrs Guide BengaliBittu SinghNo ratings yet

- ABM AE12 006 The Philippine Peso and The Foreign CurrencyDocument30 pagesABM AE12 006 The Philippine Peso and The Foreign CurrencyJoann Almendras Dumape100% (1)

- Formula Sheet: Managerial Finance FRL 300Document6 pagesFormula Sheet: Managerial Finance FRL 300Tooba JabeenNo ratings yet

- Philippine Valuation Standards - RT PunzalanDocument26 pagesPhilippine Valuation Standards - RT PunzalanShielaMarie MalanoNo ratings yet

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNo ratings yet

- For Questions 6Document3 pagesFor Questions 6Meghan Kaye LiwenNo ratings yet

- Arwana Citramulia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesArwana Citramulia TBK.: Company Report: January 2019 As of 31 January 2019dindakharismaNo ratings yet

- Getting Financing or FundingDocument37 pagesGetting Financing or Fundingdedila nacharNo ratings yet

- INDICATORSDocument10 pagesINDICATORSadam.szafranskijdNo ratings yet

- 01 Business Rules For SC Intermediaries - Advisers June 2021 V1.010621Document20 pages01 Business Rules For SC Intermediaries - Advisers June 2021 V1.010621MarkoNo ratings yet

- NPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudDocument8 pagesNPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudAnkit ChawlaNo ratings yet