Professional Documents

Culture Documents

Lease Receivable Lease Liability Lease Receivable Lease Liability

Lease Receivable Lease Liability Lease Receivable Lease Liability

Uploaded by

Anne Liezel Prado0 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

#2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageLease Receivable Lease Liability Lease Receivable Lease Liability

Lease Receivable Lease Liability Lease Receivable Lease Liability

Uploaded by

Anne Liezel PradoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

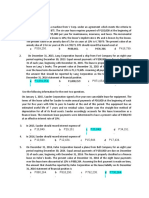

1. On January 1, 2013, Lessor Company leased a machine to Lessee Company.

The

machine had an original cost of P6,000,000. The lease term was five years and the

implicit internst rate on the leases 15%. The lease is properly classified as a direct

financing lease. The annual payments of P1,730,541 are made each December 31.

The machine reverts to Lessor at the end of the lease term, at which time the residual

value of the machine will be P400,000. The residual value is unguaranteed.

The PV of 1 at 15% for 5 periods is .4972, and the PV of an ordinary annuity of 1 at

15% for 5 periods is 3.3522. At the commencement the lease, what would be the

lease receivable on the part of the lessor and lease liability on the part of the lessee?

Lease receivable Lease liability Lease receivable Lease liability

a. 6,000,000 6,000,000 c. 6,000,000 5,801,120

b. 5,801,120 5,801,120 d. 5,801,000 6,000,000

2. Wall Company leased office premises to Fox Company for five-year term beginning

January 1, 2013. Under the terms of the operating lease, rent for the first year is

P800,000 and rent for years 2 through 5 is P1,250,000 per annum. However, as an

inducement to enter the lease, Wall granted Fox the first six months of the lease rent-

free. What amount should Wall report as rental income for 2013?

a. 1,200,000 b. 1,160,000 c. 1,080,000 d. 800,000

You might also like

- Lessor Discussion U PDFDocument4 pagesLessor Discussion U PDFadmiral spongebobNo ratings yet

- Intacc Chapt 11 18 NoneDocument24 pagesIntacc Chapt 11 18 NoneSean AustinNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocument3 pagesSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacNo ratings yet

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Special TopicsDocument77 pagesSpecial TopicsPeter Banjao100% (1)

- Special TopicsDocument89 pagesSpecial TopicsPeter Banjao100% (3)

- Assignment 02 Leases - Solution - OportoDocument4 pagesAssignment 02 Leases - Solution - OportoDevina OportoNo ratings yet

- SEATWORK - Chapter 11 - 16Document8 pagesSEATWORK - Chapter 11 - 16Kheajoy99 KimNo ratings yet

- PDF Info 1 DLDocument28 pagesPDF Info 1 DLEdrickLouise DimayugaNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- MC Questions For LeaseDocument6 pagesMC Questions For LeaseJPNo ratings yet

- Chapter 11 FinAcc2Document13 pagesChapter 11 FinAcc2Kariz Codog0% (2)

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingCristineNo ratings yet

- Operating Lease Vs Finance LeaseDocument5 pagesOperating Lease Vs Finance LeasexjammerNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- P 1Document4 pagesP 1Kenneth Bryan Tegerero TegioNo ratings yet

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- Great DepressionDocument5 pagesGreat DepressionDarrelNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Assignment 02 Leases-SolutionDocument7 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- SW-UPDATED-Leases PrintDocument2 pagesSW-UPDATED-Leases PrintMikaela Joy FloraNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- IA2Document14 pagesIA2Sitio BayabasanNo ratings yet

- Operating Lease - Lessee: Problem 1Document2 pagesOperating Lease - Lessee: Problem 1Xander MerzaNo ratings yet

- Lease Problem With SolutionDocument19 pagesLease Problem With SolutionJeane Mae Boo100% (1)

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Local Media6736412975002846091Document3 pagesLocal Media6736412975002846091reo30360No ratings yet

- Leases PS GoodsDocument4 pagesLeases PS GoodsDissentNo ratings yet

- Reviewer in LeasesDocument3 pagesReviewer in LeasesNicolaus CopernicusNo ratings yet

- FAR-II Test IFRS-16 (AB)Document2 pagesFAR-II Test IFRS-16 (AB)Waseim khan Barik zaiNo ratings yet

- Chapter 11 15FinAcc2Document55 pagesChapter 11 15FinAcc2Kariz Codog22% (9)

- 24U Lease Accounting StudentDocument17 pages24U Lease Accounting Studentvee viajeroNo ratings yet

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- Chapter 12 Ia2Document18 pagesChapter 12 Ia2JM Valonda Villena, CPA, MBA0% (1)

- Quiz Far LeaseDocument2 pagesQuiz Far Leasefrancis dungcaNo ratings yet

- Operating LeaseDocument7 pagesOperating Leasesantosashleymay7No ratings yet

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Finance Lease - Lessee: Aklan Catholic CollegeDocument9 pagesFinance Lease - Lessee: Aklan Catholic CollegeLouiseNo ratings yet

- Quiz 1 Leases PDFDocument4 pagesQuiz 1 Leases PDFken aysonNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Elec 4 Final ExaminationDocument4 pagesElec 4 Final ExaminationHatdogNo ratings yet

- Lease (Quiz Bowl)Document5 pagesLease (Quiz Bowl)hersheyskisses37No ratings yet

- Accounting For Leases Handouts FinalDocument5 pagesAccounting For Leases Handouts FinalMichael BongalontaNo ratings yet

- Orca Share Media1577676507201Document4 pagesOrca Share Media1577676507201Jayr BVNo ratings yet

- Orca Share Media1577676537770-1Document3 pagesOrca Share Media1577676537770-1Jayr BV100% (1)

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Hitech CompanyDocument1 pageHitech CompanyAnne Liezel PradoNo ratings yet

- N Connection With Your Review of Jonli Enterprises, You Noted That The Company Has ADocument1 pageN Connection With Your Review of Jonli Enterprises, You Noted That The Company Has AAnne Liezel PradoNo ratings yet

- Need LangDocument24 pagesNeed LangAnne Liezel PradoNo ratings yet

- Assignment#2 - Prado, Anne Liezel RDocument1 pageAssignment#2 - Prado, Anne Liezel RAnne Liezel PradoNo ratings yet

- Aud - Topic1,2nd PartDocument3 pagesAud - Topic1,2nd PartAnne Liezel PradoNo ratings yet

- What You Have Learned About The: Osborn ChecklistDocument2 pagesWhat You Have Learned About The: Osborn ChecklistAnne Liezel PradoNo ratings yet