Professional Documents

Culture Documents

EWT Fusion Payroll Training Day 4

EWT Fusion Payroll Training Day 4

Uploaded by

suryakala meduriOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EWT Fusion Payroll Training Day 4

EWT Fusion Payroll Training Day 4

Uploaded by

suryakala meduriCopyright:

Available Formats

ERPWebTutor confidential

Fusion HCM Payroll Training – Day 4

An ERPWebTutor Presentation

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Day 4 - Agenda

• Q&A from Day 3

• Chapter 12: Elements Setup

➢ Earning elements (Standard and Supplemental)

➢ Deductions (Voluntary and Involuntary)

➢ Deferred Compensation (401k)

➢ Processing priorities

➢ Frequency rules

➢ Element Eligibility – deep dive

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

From Day 3 session

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Understanding Elements

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: What are elements in Fusion Payroll

• Elements are the building blocks for payroll processing.

• Can be of the type: earnings, deductions, taxes etc.

• Configured using predefined templates

• Never create an element with name Overtime. It is a reserved term, and including it

in user-defined elements interferes with balance initializations.

• Always created under a legislative Data Group

• Essential for integration with absence and Time and Labor

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Elements – Processing Priorities

• You can set a predefined sequence in which a payroll run will process elements. An

element's primary classification defines a default processing priority for the element in

payroll runs. Lower priority numbers process first.

• Most classifications also have a priority range.

• Can be overridden as well

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Elements – Input Values

• Input values for elements get created

automatically based on the element

classification. However additional input

values can be added if required.

Examples:

Store the legacy pay code

Store a specific value to be used in fast

formula etc.

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Elements – Processing Rules

Formulas define many of the rules that control the processing of an element. A processing

rule specifies which formula to use based on a person's assignment status. It also defines

rules to apply to the results the formula returns. For example, one result might update the

input value for a different element. Another result might issue a warning, or assign an end

date to a recurring entry.

Direct Result: The formula output feeds to

the element itself

Indirect Result: The formula output feeds

to another element’s input value

Message: Returns a message

Results Returned: Items returned by the

fast formula

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Elements – Frequency Rules

• Standard behavior is to process the element is all pay periods. Use frequency rules only

for exceptions.

• Use frequency rules when you need to process a recurring element at a frequency

other than that defined for the payroll. For example, you can deduct a medical plan

contribution on the 2nd pay period of the month or the first 2 pay periods of the

month.

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Element Eligibility

• Use this to specify who can receive entries for an element by defining eligibility

criteria.

• An element can have multiple eligibility rules, each defining a different set of eligibility

criteria.

• You can apply the automatic entry option to any eligibility rule, causing all persons who

meet the criteria for that rule to receive entries automatically.

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Element Eligibility..contd

• Use this section to set the defaults for input values based on eligibility criteria

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Element Eligibility..contd

• Use this section to enter the costing against the eligibility for one or more input value

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

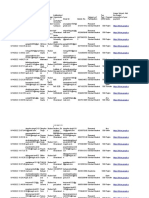

Chapter 12: Earnings Elements – Eligibility

You must define element eligibility for the following elements for costing.

Primary Classification Secondary Classification Element generated from template Input value

Earnings Calculated

Note: If you also need to cost hours, you

must cost the appropriate hours input

Standard Earnings All secondary classifications <User Element> Results value in the Results element.

Supplemental Earnings All secondary classifications <User Element> Results Earnings Calculated

Imputed Earnings All secondary classifications <User Element> Results Earnings Calculated

Nonpayroll Payment All secondary classifications <User Element> Results Earnings Calculated

Pretax Deductions Deferred Compensation 401k <User Element> Results Deduction Calculated

Deferred Compensation 401k Catch

Pretax Deductions Up <User Element> Results Catchup Deduction Calculated

Pretax Deductions All other secondary classifications <User Element> Results Pay Value

Employee Tax Deductions

(See the Employee and Employer Tax

Elements section below for additional

details.) All secondary classifications <Seeded Element> Tax Calculated

Employer Liabilities <User Element> Employer Match

(specific to Deferred Compensation) Results Employer Match Calculated

Employer Liabilities All secondary classifications <User Element> Results Pay Value

Involuntary Deductions All secondary classifications <User Element> Results DeductionsCalculated

<User Element> Organization Fee

Results

<User Element> Processing Fee

Results

Involuntary Deductions All secondary classification – Fees <User Element> Person Fee Results FeeCalculated

Voluntary Deduction All secondary classifications <User Element> Results Pay Value

Additionally, you must define eligibility for the predefined US Taxation element as an open link.

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Earnings Elements – Eligibility

Wherever applicable, you must cost the following predefined employee and employer tax

elements:

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Earnings Elements – Eligibility

Wherever applicable, you must cost the following predefined employee and employer tax elements:

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Earnings Elements – setup examples

• Creating a standard regular earnings e.g. Regular Salary (for salaried employees)

• Creating a standard regular earnings e.g. Regular Wages (for hourly employees)

• Creating a regular hours e.g. Regular Hours (to pay hourly employees)

• Creating a Supplemental gross-up earnings element (e.g. Relocation Expenses)

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Assignment : Create earnings elements

• Creating a standard Overtime Earnings e.g. XX Overtime Hours (for hourly employees)

• Creating a non-worked earnings (e.g. XX Vacation Payment)

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Deferred Compensation

• Deferred compensation plans allow you to save for retirement on a pretax or after-tax

basis.

• Employees can choose to participate in a plan and contribute pre-tax or post-tax

dollars.

• In most cases, the pretax deferred wages are not subject to federal income tax or state

income tax withholding at the time of deferral. However, they are included as wages

subject to Social Security, Medicare, and Federal Unemployment taxes.

e.g. a 401k or some other retirement plan

We will show you how to setup the elements for pre-tax and post-tax retirement plans

• Create a pretax 401k plan element (with post tax and catch-up components)

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

• Cannot start the name with a number

• DO NOT Use names like Pre-tax if you

wish to generate the post tax, Roth etc.

elements in the consolidated approach

• If not using Cloud Benefits to manage

401k and client has single assignment

then use the Assignment level option.

It allows greater flexibility for costing

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

• If Percentage of earnings option is

selected you must select No

• For Flat Amount Options, you should

set the Yes option

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

• As of 2017, on top of the $18,000 regular limit to a 401(k) plan, workers 50 and older

can add $6,000 per year in catch-up contributions, which are aimed at helping

individuals save enough for retirement.

• Employer match is rare for catch up contributions

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: 401k Element setup

This will create multiple elements depending upon your selection. Create eligibilities as

shown below:

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Chapter 12: Deductions Elements – setup examples

• Creating a Voluntary Deduction element e.g. Union Dues

• Creating a Pretax deduction e.g. Medical Pretax

• Creating an Involuntary Deduction element e.g. Child Support

After creating the elements, follow the element eligibility guidelines to add the

appropriate eligibilities.

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Create the Voluntary deduction elements starting with your initials

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

ERPWebTutor confidential

Thank you

Visit us at www.erpwebtutor.com

ERPWebTutor – Virtually a live tutor with you visit us at www.erpwebtutor.com

You might also like

- Setup Configuration On Oracle Fusion PayrollDocument15 pagesSetup Configuration On Oracle Fusion Payrolllisto100% (1)

- CP575Notice - Musharib Aziz LLCDocument2 pagesCP575Notice - Musharib Aziz LLCwaqar chNo ratings yet

- Oracle Fusion Payroll Child Education Allowance Case StudyDocument1 pageOracle Fusion Payroll Child Education Allowance Case Studyhamdy200171210% (1)

- 19A Time Collection Device Integration Activity Guide PDFDocument78 pages19A Time Collection Device Integration Activity Guide PDFAliya AmarNo ratings yet

- HCM Digital Assistant White PaperDocument36 pagesHCM Digital Assistant White PaperMuhammed NafeelNo ratings yet

- Oracle Fusion HCM Benefits r12Document334 pagesOracle Fusion HCM Benefits r12Stan Rod100% (1)

- Oracle SSHRDocument63 pagesOracle SSHRRavindra100% (3)

- Sample User Story For Use in Agile ModelsDocument2 pagesSample User Story For Use in Agile ModelsNiranjan SrinivasNo ratings yet

- EWT Fusion Payroll Training Day 6Document19 pagesEWT Fusion Payroll Training Day 6suryakala meduriNo ratings yet

- EWT Fusion Payroll Training Day 3v1Document39 pagesEWT Fusion Payroll Training Day 3v1suryakala meduriNo ratings yet

- Fusion HCM Technical Trainng SecurityDocument35 pagesFusion HCM Technical Trainng SecuritypriyankaNo ratings yet

- An Introduction To Oracle Fusion HCM SecurityDocument10 pagesAn Introduction To Oracle Fusion HCM SecurityHacene LamraouiNo ratings yet

- EWT Fusion Payroll Training Day 2Document54 pagesEWT Fusion Payroll Training Day 2suryakala meduriNo ratings yet

- Fusion Approvals - Configuring - Single - Participant - Multiple - AOR - ApprovalDocument13 pagesFusion Approvals - Configuring - Single - Participant - Multiple - AOR - ApprovalAravind AlavantharNo ratings yet

- Oracle Fusion HCM Technical Training Course Content PDFDocument5 pagesOracle Fusion HCM Technical Training Course Content PDFBala KulandaiNo ratings yet

- Oracle Fusion HRMS For UAE Payroll Setup White Paper Rel11Document173 pagesOracle Fusion HRMS For UAE Payroll Setup White Paper Rel11FerasHamdanNo ratings yet

- R12 Compensation Activity GuideDocument224 pagesR12 Compensation Activity Guidepersonifiedgenius0% (1)

- Managing Enterprise HCM InformationDocument36 pagesManaging Enterprise HCM InformationDebye101No ratings yet

- Absence Implementation and Functional Considerations For Italy August 2020Document37 pagesAbsence Implementation and Functional Considerations For Italy August 2020JAI PRATAPNo ratings yet

- Oracle HCM Cloud - Time & Labor - TrainingCourseContants2Document3 pagesOracle HCM Cloud - Time & Labor - TrainingCourseContants2khiljis100% (1)

- Hrms Interview QuestionsDocument44 pagesHrms Interview QuestionsP RajendraNo ratings yet

- Oracle Fusion Human Capital Management For US Implementation and Use White Paper PDFDocument183 pagesOracle Fusion Human Capital Management For US Implementation and Use White Paper PDFRajitha BadagalaNo ratings yet

- Oracle Hrms PayrollDocument85 pagesOracle Hrms PayrollYogita Sarang100% (1)

- HCM Cloud Service Definition Fusion HCM Taleo Integration ConnectivityDocument8 pagesHCM Cloud Service Definition Fusion HCM Taleo Integration ConnectivityJuan Pablo GasparriniNo ratings yet

- Oracle Fusion HRMS SA Payroll DataDocument27 pagesOracle Fusion HRMS SA Payroll DataFeras AlswairkyNo ratings yet

- US Operational Payroll - Activity GuideDocument136 pagesUS Operational Payroll - Activity GuideStan RodNo ratings yet

- Administering Fast FormulasDocument110 pagesAdministering Fast Formulasnykgupta21No ratings yet

- Element Upgrade Process in Oracle HCM CloudDocument17 pagesElement Upgrade Process in Oracle HCM CloudConrad RodricksNo ratings yet

- Oracle Fusion Human Capital Management For US Implementation and Use White Paper Ver17Document112 pagesOracle Fusion Human Capital Management For US Implementation and Use White Paper Ver17Saurabh ChandraNo ratings yet

- Oracle Fusion HRMS For SA-Payroll Setup White Paper Rel10Document163 pagesOracle Fusion HRMS For SA-Payroll Setup White Paper Rel10Malik Al-WadiNo ratings yet

- Payroll Dashboard Setup and Usage Updated 2017 PDFDocument34 pagesPayroll Dashboard Setup and Usage Updated 2017 PDFShaik Riyaz Peer0% (1)

- HRX UK HR Setup R12Document101 pagesHRX UK HR Setup R12Srinivasa Rao AsuruNo ratings yet

- Fusion Security Concepts-Day 8Document22 pagesFusion Security Concepts-Day 8amruthageethaNo ratings yet

- Oracle HR For Non-HR PeopleDocument41 pagesOracle HR For Non-HR PeoplenthackNo ratings yet

- Oracle Fusion HCM Seeded Reports R12Document11 pagesOracle Fusion HCM Seeded Reports R12hamdy2001No ratings yet

- Fusion Study Guide Master - HIGHLIGHTED FOR 2016 TEST-HUMAN RESOURCESDocument86 pagesFusion Study Guide Master - HIGHLIGHTED FOR 2016 TEST-HUMAN RESOURCESmamie collinsNo ratings yet

- Fusion HCM IntroductionDocument27 pagesFusion HCM IntroductionmanojNo ratings yet

- Oracle Fusion HCM Absence Management-EP, Abs Plans, Geo HierarchyDocument48 pagesOracle Fusion HCM Absence Management-EP, Abs Plans, Geo HierarchyvallipoornimaNo ratings yet

- Oracle HCM Cloud - Outbound Integration Through HCM ExtractsDocument18 pagesOracle HCM Cloud - Outbound Integration Through HCM ExtractsMohamed IbrahimNo ratings yet

- Fusion HCM HR Exam Study GuideDocument14 pagesFusion HCM HR Exam Study GuideTrui CasteleinNo ratings yet

- Oracle Fusion HRMS For Kuwait-Payroll Setup White Paper Release 9Document67 pagesOracle Fusion HRMS For Kuwait-Payroll Setup White Paper Release 9Mahesh50% (2)

- Assessment-5 ORC - Dipti 10.29Document4 pagesAssessment-5 ORC - Dipti 10.29badri chanakyaNo ratings yet

- Oracle Fusion Talent ManagementDocument26 pagesOracle Fusion Talent ManagementmadhulikaNo ratings yet

- Release 13 20D Administering Payroll FlowsDocument114 pagesRelease 13 20D Administering Payroll FlowsTimothy BaileyNo ratings yet

- HRMS Implementation Setup Process in Oracle AppsDocument20 pagesHRMS Implementation Setup Process in Oracle AppsSumit KNo ratings yet

- EBS R12.1 HCM Bootcamp Datasheet ReDocument3 pagesEBS R12.1 HCM Bootcamp Datasheet ReUzair ArainNo ratings yet

- Oracle HCM Time and Labor DsDocument3 pagesOracle HCM Time and Labor DsTarunjeet Singh SalhNo ratings yet

- Oracle Fusion HCM Cloud Absence OfferingDocument1 pageOracle Fusion HCM Cloud Absence OfferingkhiljisNo ratings yet

- Fusion Applications HCM Security Rel 8 Instructor Guide PTSDocument283 pagesFusion Applications HCM Security Rel 8 Instructor Guide PTSP RajendraNo ratings yet

- HCM Enhanced Talent Profile Office Hours 24JAN20 Updated 12MAR20Document37 pagesHCM Enhanced Talent Profile Office Hours 24JAN20 Updated 12MAR20MOhit SiNhaNo ratings yet

- Mahmoud Mootamed - Sr. Oracle Fusion Consultant C.V PDFDocument6 pagesMahmoud Mootamed - Sr. Oracle Fusion Consultant C.V PDFhamdy20017121No ratings yet

- Application, Tools& Technical Expertise: Mohamed Gaafer MahdeyDocument7 pagesApplication, Tools& Technical Expertise: Mohamed Gaafer MahdeyNewbie1 TNo ratings yet

- How To Create Eit in Oracle HrmsDocument5 pagesHow To Create Eit in Oracle HrmsMuhammad Shahidul IslamNo ratings yet

- Oracle Human Capital Management Cloud Security Upgrade GuideDocument39 pagesOracle Human Capital Management Cloud Security Upgrade GuideManimegalai INo ratings yet

- Oracle Payroll India User ManualDocument100 pagesOracle Payroll India User Manualnikhilburbure100% (1)

- HCM DataLoaderUsersGuideR10andLaterDocument74 pagesHCM DataLoaderUsersGuideR10andLaterghazouanikarimNo ratings yet

- The Business Analyst's Guide to Oracle Hyperion Interactive Reporting 11From EverandThe Business Analyst's Guide to Oracle Hyperion Interactive Reporting 11Rating: 5 out of 5 stars5/5 (1)

- Oracle SOA BPEL Process Manager 11gR1 A Hands-on TutorialFrom EverandOracle SOA BPEL Process Manager 11gR1 A Hands-on TutorialRating: 5 out of 5 stars5/5 (1)

- EWT Fusion Payroll Training Day 3v1Document39 pagesEWT Fusion Payroll Training Day 3v1suryakala meduriNo ratings yet

- EWT Fusion Payroll Training Day 6Document19 pagesEWT Fusion Payroll Training Day 6suryakala meduriNo ratings yet

- EWT Fusion Payroll Training Day 2Document54 pagesEWT Fusion Payroll Training Day 2suryakala meduriNo ratings yet

- 19D Learning Activity GuideDocument118 pages19D Learning Activity Guidesuryakala meduriNo ratings yet

- Debit Note PDFDocument3 pagesDebit Note PDFMani ShuklaNo ratings yet

- Invoice# Invoice# RCC-12 RCC-12: BIOSYST Diagnostic LabDocument3 pagesInvoice# Invoice# RCC-12 RCC-12: BIOSYST Diagnostic LabNaveed AbrarNo ratings yet

- 2023 10 10 12 21 19 LoanStatementDocument5 pages2023 10 10 12 21 19 LoanStatementRaja KrNo ratings yet

- Bill of Supply For Electricity: Due DateDocument1 pageBill of Supply For Electricity: Due DateVinnay DahiyaNo ratings yet

- Arie WDocument3 pagesArie WArie WidiyasaNo ratings yet

- BFL Platinum Choice Supercard FAQs 23012018Document10 pagesBFL Platinum Choice Supercard FAQs 23012018vivekNo ratings yet

- Law On Basic Taxation - BBAban Ch1-4Document90 pagesLaw On Basic Taxation - BBAban Ch1-4westernwound8283% (6)

- Ca Inter M24 Batch B AkDocument23 pagesCa Inter M24 Batch B Akpranaamsrivatsan46No ratings yet

- IncomeTax Banggawan2019 Ch1Document22 pagesIncomeTax Banggawan2019 Ch1Noreen Ledda100% (2)

- CIR Vs Metro Star SupremaDocument9 pagesCIR Vs Metro Star SupremaJepoy Nisperos ReyesNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepavans25No ratings yet

- Payroll For Teaching PurposeDocument2 pagesPayroll For Teaching PurposeEzy playboyNo ratings yet

- Alpha Retail PlanDocument16 pagesAlpha Retail PlanLaeth HarebNo ratings yet

- Income Tax Complete Question BankDocument281 pagesIncome Tax Complete Question BankNoorul Zaman KhanNo ratings yet

- Click Here For English Version: AVDPK3530D 2021-22 400162530310821Document8 pagesClick Here For English Version: AVDPK3530D 2021-22 400162530310821Santoshi TanguduNo ratings yet

- Chapter 4Document39 pagesChapter 4ngonh.nguyenhuyNo ratings yet

- Guidelines For Filling Pan New ApplicationDocument2 pagesGuidelines For Filling Pan New Applicationapi-250913495No ratings yet

- (Final Result) (SSC CGL 2015) Rank Wise - All Posts (Rohit Lee) 1Document57 pages(Final Result) (SSC CGL 2015) Rank Wise - All Posts (Rohit Lee) 1abhi8786No ratings yet

- B.A Laundry ShopDocument6 pagesB.A Laundry ShopMary Grace BituinNo ratings yet

- Stock Broker No 42 Laxman Babu Bhawan, Naxal, Kathmandu Kathmandu, Nepal Phone: 01-5970602Document2 pagesStock Broker No 42 Laxman Babu Bhawan, Naxal, Kathmandu Kathmandu, Nepal Phone: 01-5970602pradipNo ratings yet

- Cash Management SetupDocument10 pagesCash Management SetupCeomail001No ratings yet

- MDP On Marketing Analytics Form Value Creation - RegistrationsDocument9 pagesMDP On Marketing Analytics Form Value Creation - RegistrationsDr Ravneet SinghNo ratings yet

- Visa Master CardDocument10 pagesVisa Master CardsirvashsharmaNo ratings yet

- Earnings: Manoj Kumar Field ExecutiveDocument1 pageEarnings: Manoj Kumar Field ExecutiveSubhash SharmaNo ratings yet

- AccountStatement 7076687732 Feb16 134650Document3 pagesAccountStatement 7076687732 Feb16 134650Avignan BhattacharyaNo ratings yet

- Hsbcuk Account Closure FormDocument6 pagesHsbcuk Account Closure FormZaid SolkarNo ratings yet

- Instrukcija Za Prilive Iz Inostranstva - 30092020Document1 pageInstrukcija Za Prilive Iz Inostranstva - 30092020Miloš LazarevićNo ratings yet

- Od329231670760668100 7Document3 pagesOd329231670760668100 7Chandrakanta TripathiNo ratings yet