Professional Documents

Culture Documents

TAX-1001 (Fringe Benefit Tax)

TAX-1001 (Fringe Benefit Tax)

Uploaded by

Ciarie SalgadoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX-1001 (Fringe Benefit Tax)

TAX-1001 (Fringe Benefit Tax)

Uploaded by

Ciarie SalgadoCopyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 42 October 2021 CPA Licensure Exam Week No. 9

TAXATION A. Tamayo G. Caiga C. Lim K. Manuel E. Buen

TAX-1001: FRINGE BENEFIT TAX

1. Definition of Certain Terms

a. Fringe benefits Any good, service or other benefit furnished or granted by an employer in cash or in kind, in

addition to basic salaries to an individual employee (except rank and file employee) such as but not

limited to the items enumerated below.

b. Rank and file employees All employees who are holding neither managerial nor supervisory position.

c. Managerial employee One who is vested with powers or prerogatives to lay down and execute management policies

and/or to hire, transfer, suspend, lay–off, recall, discharge, assign or discipline employees.

d. Supervisory employees Those who, in the interest of the employer, effectively recommend such managerial actions if the

exercise of such authority is not merely routinary or clerical in nature but requires the use of

independent judgment.

2. Imposition of Fringe Benefit Tax

a. A final tax Effective January 1, 2018 and onwards, a final tax of thirty-five percent (35%) (used to be

32%) is hereby imposed on the grossed-up monetary value of fringe benefit given to citizen or

resident alien or non- resident alien engaged in trade or business within the Philippines (except rank

and file employees).

b. Imposed on the grossed- Fringe benefits tax is imposed on the grossed-up monetary value of fringe benefit furnished or

up monetary value granted to the employee (except rank and file employees) ,

c. Imposed regardless Fringe benefit tax is imposed whether the employer is an individual, professional partnership or

of who the employer corporation, regardless of whether the corporation is taxable or not, or the government or its

instrumentalities.

d. Withheld by and paid Fringe benefit tax shall be treated as a final tax on the employee, which shall be withheld and paid

employer by the employer.

The fringe benefits tax is payable by the employer which tax shall be paid in the same manner as

provided for under Section 57(A) of this Code.

e. Filing of return and On or before the 10th day of the month following the month in which the fringe benefits were

payment of fringe granted to the recipient (BIR Form No. 1603)

benefits tax

f. Return to be filed Separate return for the head office and for each branch or place of business/office or consolidated

return for the head office and all the branches/offices except in the case of large taxpayer where

only one consolidated return is required

f. Tax base and tax rate Monetary value of fringe benefit P xxx

Divided by 65%

Grossed-up monetary value xxx

Tax rate 35%

Fringe benefit tax P xxx

g. Tax base and tax rate for Monetary value of the fringe benefit P xxx

NRA-NETB Divided by 75%

Grossed-up monetary value xxx

Tax rate 25%

Fringe benefits tax P xxx

h. Tax base and tax rate Monetary value of the fringe benefit P xxx

for special aliens and Divided by 65%

their Filipino counter- Grossed-up monetary value xxx

parts and employees in Tax rate 35%

Special Economic Zone Fringe benefits tax P xxx

3. Examples of Fringe Benefits

a. Fringe benefits subject a. Housing;

to final tax b. Expense account;

c. Vehicle of any kind;

d. Household personnel, such as maid, driver and others;

e. Interest on loan at less than market rate to the extent of the difference between the market

rate and actual rate granted (12% benchmark rate);

f. Membership fees, dues and other expenses borne by the employer for the employee in social

and athletic clubs and similar organizations;

g. Expenses for foreign travel;

h. Holiday and vacation expenses;

i. Educational assistance to the employee or his dependents;

j. Life or health insurance and other non-life insurance premiums or similar amounts in excess of

what the law allows.

b. Fringe benefits not a. Fringe benefits which are authorized and exempted from income tax under the Tax Code

subject to fringe or under any special law;

benefit tax b. Contributions of the employer for the benefit of the employee to retirement, insurance and

hospitalization benefit plans;

Page 1 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1001

Week 9: FRINGE BENEFIT TAX

c. Benefits given to rank and file, whether granted under a collective bargaining agreement

or not;

d. De minimis benefits;

e. Benefits granted to employee which are required by the nature of, or necessary to the trade,

business or profession of the employer; or

f. Benefits granted for the convenience or advantage of the employer.

4. De Minimis Benefits

a. Meaning of de minimis De minimis benefits are facilities or privileges furnished or offered by an employer to his employees

benefits that are of relatively small value and are offered or furnished by the employer merely as a means

of promoting the health, goodwill, contentment, or efficiency of his employees.

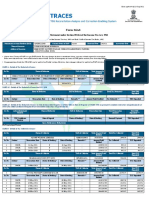

b. Examples of de minimis benefits

Item Ceiling

1) Medical benefits given to the employees by Actual medical assistance, e.g. medical allowance to cover medical

the employer and healthcare needs, annual medical/executive check-up, maternity

assistance, and routine consultations, not exceeding P10,000 per

annum

2) Employee achievement awards (e.g. for Must be in the form of a tangible personal property other than cash

length of service or safety achievement) or gift certificate with an annual monetary value not exceeding

P10,000 received by the employee under an established written

plan which does not discriminate in favor of highly paid employees

3) Benefits received by an employee by virtue P10,000per employee per taxable year (total annual monetary

of a collective bargaining (CBA) and value received from both CBA and productivity incentive schemes

productivity incentive schemes combined) RR No. 1-2015, January 5, 2015

View 1 – if the amount exceeded P10,000, the entire amount is

added to the P90,000 exempt benefit.

Vie2 2 – if the amount exceeded P10,000, the excess over P10,000

is added to the P90,000 exempt benefit.

4) Uniforms and clothing allowance given to Not exceeding P6,000 per annum (old P5,000) (RR No. 11-2018)

employees by the employer

5) Gifts given during Christmas and major Not exceeding P5,000 per employee per annum

anniversary celebrations

6) Rice subsidy granted by an employer to his P2,000 (old P1,500) or one (1) sack of 50 kg. rice per month

employees amounting to not more than P2,000 (RR 11-2018)

7) Laundry allowance Not exceeding P300 per month

8) Medical cash allowance to dependents of Not exceeding P1,500 per semester or P250 per month (RR No. 18-

employees 2018) (formerly P750 per semester or P125 per month)

9) Daily meal allowance for overtime work and Not exceeding 25% of the basic minimum wage on a per region basis

night/graveyard shift

10) Monetized unused vacation leave credits Not exceeding 10 days during the year.

of private employees

11) Monetized value of vacation and sick None

leave credits paid to government officials

and employees

Note: All other benefits given by employers Not considered as “de minimis” benefits and shall be subject to

which are not included in the above income tax as well as withholding tax as compensation income.

enumeration

*

5. Tax Accounting for the Fringe Benefit Furnished to the Employee and the Fringe Benefit Tax Due Thereon

Deductible fringe benefits and fringe benefits tax.

Basis of fringe benefits tax Amount deductible from employer’s gross income

1) General rule Taxable fringe benefits and the fringe benefit tax

2) Depreciation value Actual fringe benefit tax paid

3) Zonal value per BIR Commissioner Actual fringe benefit tax paid

4) FMV per current real property tax declaration Actual fringe benefit tax paid

Notes: 1) In cases where the basis of fringe benefit tax is the depreciation value, zonal value or FMV per current real property

tax declaration, the value of fringe benefit is not deductible because it is presumed to have been tacked on or

actually claimed as depreciation expense by the employer.

2) If the zonal value per BIR or the FMV per current real property tax declaration of the property is greater than its cost

subject to depreciation, the amortized excess amount shall be allowed as a deduction from employer’s gross income

as fringe benefit expense.

Page 2 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1001

Week 9: FRINGE BENEFIT TAX

6. Computation of Monetary Value

Basic rules a. In case of housing privilege and motor vehicle:

1) If there is no transfer of ownership, the monetary value of benefit is 50% of the value of benefit.

2) If there is transfer of ownership, the monetary value of the benefit is the same as the value of the benefit.

b. In case of other fringe benefits – The monetary value of the benefit same as the value of the benefit.

7. Monetary value of housing privilege

Value of FB

Monetary value of FB

a. Employer leases residential property for the use of the Rental paid 50% of the value of the

employee benefits

b. Employer owns residential property which was assigned to 5% of the FMV of the land 50% of the value of the

an officer for his use as residence and improvements benefits

c. Employer purchases residential property on the installment 5% of the acquisition cost 50% of the value of the

basis and allows the employee to use the same as his exclusive of interest benefits

residence

d. Employer purchases a residential property and transfers the Employer’s acquisition cost or Entire value of the benefit

ownership in the name of the employee FMV, whichever is higher

e. Employer purchases a residential property and transfers FMV xxx Entire value of the benefit

ownership to his employee for the latter’s residential use at Less: Payment by

a price less than the employer’s acquisition cost employee xxx

Value of benefit xxx

g. Exercises

a) During the year 2018, ABC Corporation paid for the monthly rental of a residential house of its branch manager,

Mr. J. de la Cruz, amounting to P68,0000.

Requirement 1 – Compute the following:

a. Value of the fringe benefit

b. Monetary value of the fringe benefit

c. Grossed-up monetary value of the fringe benefit

d. Fringe benefit tax

Requirement 2 - Prepare the necessary journal entries.

b) XYZ Corp. owns a condominium unit. During the year 2018, the said corporation furnished and granted the said property for

the residential use of its Assistant Vice President. The fair market value of the property per BIR amounts to P10,000,000

while its fair market value as shown in its current Real Property Declaration amounts to P8,000,000.

Requirement 1 – Compute the monthly fringe benefit tax.

Requirement 2 - Prepare the necessary journal entries.

c) Using the same data in illustration letter b) above and assuming that the acquisition cost of the residential property is

P7,000,000 and the remaining useful life is 15 years. Prepare the necessary journal entries.

d) In 2018, Taprolani Corporation purchased a residential house and lot for P2,300,000. The property was sold to the President

of the corporation for P1,980,000. The fair market value per BIR and per Assessor's Office were P2,500,000 and P2,607,000

respectively.

Question 1 - How much was fringe benefits tax, if any?

2 –Assuming that the property was sold to the President for P2,500,000, how much was the fringe benefits

tax?

e) A house and lot were owned by Bonafe Laundry Corporation. The ownership of the said house and lot was transferred to its

President, Mars Bonafe, in 2018. The following data were made available:

Cost P5,000,000

Fair market value per BIR 4,500,000

Fair market value per Assessor's Office 3,000,000

How much was the fringe benefits tax, if any?

f) SB Corporation bought a residential property in installment for the use of its President during the current year. The total

amount paid by the corporation was P5,500,000 (inclusive of P500,000 interest.) How much was the fringe benefits tax?

8. Monetary value of vehicles of any kind

Value of FB Monetary value of FB

a. Employer owns and maintains a fleet of motor Acquisition cost of all motor 50% of the value of the benefit

vehicles for the use of the business and vehicles not normally used for

employees business divided by 5 years

Page 3 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1001

Week 9: FRINGE BENEFIT TAX

b. Employer leases and maintains a fleet of motor Amount of rental payments for 50% of the value of the benefit

vehicles for the use of the business and the motor vehicle not normally used

employees for business purposes

c. Employer purchases the motor vehicle in the Acquisition cost Entire value of the benefit

name of the employee

d. Employer provides the employee with cash for the Amount of cash received by the Entire value of the benefit

purchase of a motor vehicle in the name of the employee

employee

e. Employer shoulders a portion of the amount of Amount shouldered by the Entire value of the benefit

the purchase price of a motor vehicle in the name employer

of the employee

f. Employer purchases the car on installment in the Acquisition cost exclusive of Entire value of the benefit

name of the employee interest divided by 5 years

g. Use of yacht, whether owned and maintained or Depreciation of a yacht at an

leased by employer estimated useful life of 20 years

h. Exercises

1) In 2021, Mata Optical Shop, sole proprietorship, purchased a motor vehicle for the use of its Manager, Dr. Malachi Mata.

It was registered in Dr. Mata's name. The cost of the vehicle was P400,000. The vehicle was used partly for the benefit of the

company. How much is the fringe benefits tax?

2) Eyes Drop, maker of the best-selling ice cream, owns a fleet of motor vehicles for use of the business and its employees. One of

the motor vehicles costing P450,000 is not used for business purposes, but for the employees' personal needs during the current

year.

Question 1 - How much is the annual fringe benefits tax, if any?

2 – Assuming one of the motor vehicles costing P450,000 is used for business purposes, and not for the employees'

personal needs, how much is the fringe benefits tax, if any?

9. Other fringe benefits

Value of the FB Monetary value of the FB

a. Expense account Amount given or paid by Entire value of the benefit

b. Household personnel, such as maid, driver and others employer

c. Interest on loan at less than market rate to the extent of the

difference between the market rate and actual rate granted (12%

benchmark rate)

d. Membership fees, dues and other expenses borne by the

employer for the employee in social and athletic clubs and

similar organizations

e. Expenses for foreign travel

f. Holiday and vacation expenses

g. Educational assistance to the employee or his dependents

h. Life or health insurance and other non-life insurance premiums or

similar amounts in excess of what the law allows.

Exercises

1) In 2021, ReSA Corporation paid the P50,000 vacation expenses of its President, Ms. Rita Ube to Dayag Rezzort.

Question 1 - How much is the value of the fringe benefit?

2- How much is the monetary value of the fringe benefit?

3- How much is grossed-up monetary value of the fringe benefit?

4– How much is the fringe benefit tax?

5- What entries will have to be made to record the fringe benefits expense and the fringe benefits tax expense?

2) In 2021, Bruce Lee, an executive of the ReSA Bank, was granted a loan by the bank. The amount of the loan was P2,000,000 at

8% interest per annum. The loan was payable in four (4) months. How much is the monthly fringe benefit tax?

10. Fringe benefits that are not subject to fringe benefits tax

a. Housing privilege

The following housing benefits are not considered as taxable fringe benefits:

1) Housing privilege of military officials of AFP consisting of officials of Philippine Army, Philippine Navy and Philippine Air Force;

2)

2) Housing unit which is situated inside or adjacent to the premises of a business or factory (within the maximum of 50 meters

from the perimeter of the business premises);

3) Temporary housing for an employee who stays in a housing unit for 3 months or less.

b. Vehicle of any kind

Use of aircraft and helicopters owned and maintained by the employer (treated as business expense)

Page 4 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1001

Week 9: FRINGE BENEFIT TAX

c. Expenses accounts

1) These are not taxable as fringe benefits when receipted in the name of the employer and do not partake the nature of

personal expense attributable to employee:

1) Expenses incurred by employees but paid by employer;

2) Expenses by employees reimbursed by employer.

2) Not treated as taxable fringe benefits but taxable as compensation income under Sec. 24 (A) - Representation and

transportation allowance given regularly on a monthly basis.

d. Expenses for foreign travel of employee paid for by employer

1) Expenses in connection with attending business meeting or convention (except lodging cost in a hotel) at an average of $300

per day are considered reasonable expenses and shall not be subject to fringe benefit tax (with documentary evidence).

2) The cost of economy and business class airplane ticket shall not be subject to fringe benefit tax.

3) 70% of the cost of first-class airplane ticket shall not be subject to fringe benefit tax.

e. Educational assistance

Cost of educational assistance is not treated as taxable fringe benefit:

1) when the study is directly connected with the employer’s trade, business or profession and there is a written contract between

the employee and employer that the former is under obligation to remain in the employ of the employer for a period of time;

2) when given to employee’s dependents through a competitive scheme under scholarship program of the company.

f. Life or health insurance and other non-life insurance premiums or similar amounts in excess of what the law allows

The following shall not be treated as taxable fringe benefits:

1) Contributions under SSS law;

2) Contributions under GSIS law;

3) Similar contributions under existing laws;

4) Premiums for group insurance of employees.

g. Exercises

1) The books of accounts of Jones Company showed the following:

Fringe benefits expense P750,000

Fringe benefits tax expense 76,470

Question 1 - How much is the grossed-up monetary value of the fringe benefits given to managers and supervisors?

2 - How much is the monetary value of fringe benefits given to managers and supervisors?

3 - How much is the value of the fringe benefits given to rank and file?

4 - How much is the total amount of deductions?

2) A resident rank-and-file private employee has two (2) qualified dependent children at the beginning of the year. He also

supports his father-in-law who is PWD and his uncle who is a senior citizen. The following date are made available for the year

2021:

Salary, net of P117,500 withholding tax, P6,975 SSS contributions,

P5,250 Philhealth contributions and P1,500 union dues P482,500

13th month pay 50,000

14th month pay 50,000

Rice subsidy (P1,500 x 12) 18,000

Uniform and clothing allowance 5,000

Monetized unused vacation leave credits (12 days) 6,000

Actual medical benefits 15,000

Christmas gift 10,000

Laundry allowance (P400 x 12) 4,800

Employee achievement award (amount of cash given) 10,000

Monetary gift given on account of birth of a child during the year 5,000

Benefits received by virtue of a collective bargaining (CBA) and productivity incentive schemes 14,000

Separation pay from a previous employer (terminated due to redundancy) 150,000

Interest income from a long-term deposit which was pre-terminated (remaining maturity is 4 years) 40,000

Dividend from regional operating headquarters of a multinational corporation in the Philippines 10,000

Philippine Lotto winnings 100,000

Gain from sale of shares of stock listed and traded in the local stock exchange 20,000

Prize in a literary contest he joined 70,000

Compute the following:

a) Tax-exempt de minimis benefits

b) De minimis benefits to be included in other benefits

c) Total exclusions/exemptions (including de minimis benefits)

d) Total final withholding taxes

e) Taxable compensation income

Page 5 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-1001

Week 9: FRINGE BENEFIT TAX

Summary of the tax treatment of compensation for services

If the benefit is either (1) furnished for the convenience of the employer or (2) necessary to the trade or business

of the employer, it is not income, not compensation, not fringe benefits and not taxable. Hence, the table above

is not applicable.

END

Page 6 of 6 0915-2303213 www.resacpareview.com

You might also like

- Donors TaxDocument83 pagesDonors TaxAndyvergys Aldrin MistulaNo ratings yet

- Corporate Income TaxDocument12 pagesCorporate Income TaxShiela Marie Sta Ana100% (1)

- Managerial Economics Assignment 2Document23 pagesManagerial Economics Assignment 2BRAMANTYO CIPTA ADINo ratings yet

- Internship Project Report Shriram Life InsuranceDocument57 pagesInternship Project Report Shriram Life InsuranceAKSHIT VERMA100% (2)

- Ampongan Chap 1Document2 pagesAmpongan Chap 1iamjan_101No ratings yet

- Estate Tax & Deductions TheoriesDocument12 pagesEstate Tax & Deductions TheoriesDanaNo ratings yet

- Fringe Benefit TaxDocument9 pagesFringe Benefit TaxAlexander Dimalipos100% (2)

- Transfer Taxes Theory QuizzerDocument15 pagesTransfer Taxes Theory QuizzerKenNo ratings yet

- 1st Tax Pre-Board Exam - October 2011 BatchDocument5 pages1st Tax Pre-Board Exam - October 2011 BatchKim Cristian MaañoNo ratings yet

- 1.1 MC - Exercises On Estate Tax (PRTC)Document8 pages1.1 MC - Exercises On Estate Tax (PRTC)marco poloNo ratings yet

- Chapter 01 Introduction To Internal Revenue TaxesDocument12 pagesChapter 01 Introduction To Internal Revenue TaxesNikki BucatcatNo ratings yet

- TAX Assessment October 2020Document8 pagesTAX Assessment October 2020FuturamaramaNo ratings yet

- Taxation Atty. Macmod, C.P.A. Estate Tax 2020 EditionDocument7 pagesTaxation Atty. Macmod, C.P.A. Estate Tax 2020 EditionKira Lim100% (1)

- Gross Estate ReviewerDocument9 pagesGross Estate ReviewerMark Noel SanteNo ratings yet

- Income Tax On CorporationDocument54 pagesIncome Tax On CorporationJamielene Tan100% (1)

- Income, Estate, Donor's Tax QuizDocument2 pagesIncome, Estate, Donor's Tax Quizkatreena ysabelle50% (2)

- TAX L002 Individual TaxationDocument18 pagesTAX L002 Individual TaxationYuri CaguioaNo ratings yet

- University of Perpetual Help System DaltaDocument9 pagesUniversity of Perpetual Help System DaltaJeanette LampitocNo ratings yet

- Section 85. Gross Estate. - The Value of The Gross Estate of TheDocument6 pagesSection 85. Gross Estate. - The Value of The Gross Estate of TheCharles RiveraNo ratings yet

- Income Tax For Corporations, PartnershipsDocument22 pagesIncome Tax For Corporations, PartnershipsKimberly parciaNo ratings yet

- TAX 56 - Business and Transfer TaxesDocument8 pagesTAX 56 - Business and Transfer TaxesAl JovenNo ratings yet

- TAX-101: Estate Taxation: - T R S ADocument10 pagesTAX-101: Estate Taxation: - T R S AFriedeagle OilNo ratings yet

- Donor S Tax Exam Answers4Document6 pagesDonor S Tax Exam Answers4Mary Joyce GarciaNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document21 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDocument23 pagesTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenNo ratings yet

- Accounting Review: TaxationDocument3 pagesAccounting Review: TaxationPatriciaNo ratings yet

- Introduction To Estate TaxDocument71 pagesIntroduction To Estate TaxMiko ArniñoNo ratings yet

- Taxation PDFDocument15 pagesTaxation PDFJaneNo ratings yet

- Tax Quiz 4Document61 pagesTax Quiz 4Seri CrisologoNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- Gross Estate Tax QuizzerDocument6 pagesGross Estate Tax QuizzerLloyd Sonica100% (1)

- Module 2 - Estate TaxDocument16 pagesModule 2 - Estate TaxMaryrose SumulongNo ratings yet

- Estate TaxDocument11 pagesEstate TaxIsabela Thea TanNo ratings yet

- 04.1 S4 VAT PPT AquinoDocument112 pages04.1 S4 VAT PPT Aquinosaeloun hrdNo ratings yet

- TAX HO1002 Individual Taxation StudentDocument12 pagesTAX HO1002 Individual Taxation StudentYuri CaguioaNo ratings yet

- Donors Tax Quali ReviewerDocument7 pagesDonors Tax Quali ReviewerRodelLaborNo ratings yet

- Donor's TaxDocument6 pagesDonor's TaxMoises A. Almendares100% (1)

- Pre-Test 1 - ProblemsDocument3 pagesPre-Test 1 - ProblemsKenneth Bryan Tegerero TegioNo ratings yet

- Afar First Preboard May 2021Document20 pagesAfar First Preboard May 2021Ciatto SpotifyNo ratings yet

- Tax 2 - Midterm ExamDocument2 pagesTax 2 - Midterm ExamMichelle MatubisNo ratings yet

- Notes in Preferential TaxationDocument57 pagesNotes in Preferential TaxationJeremae Ann Ceriaco100% (1)

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizNo ratings yet

- Tax CPAR Final Pre Board2Document5 pagesTax CPAR Final Pre Board2No Longer Existing67% (3)

- Estate Tax Mulitiple ChoiceDocument7 pagesEstate Tax Mulitiple ChoiceMina ValenciaNo ratings yet

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- HQ01 General Principles of TaxationDocument12 pagesHQ01 General Principles of TaxationRenzo RamosNo ratings yet

- TAX. M-1401 Estate Tax: Basic TerminologiesDocument33 pagesTAX. M-1401 Estate Tax: Basic TerminologiesJimmyChaoNo ratings yet

- TAX.2814 Community-Taxes AnswersDocument1 pageTAX.2814 Community-Taxes AnswersCams DlunaNo ratings yet

- Chapter 23 QUESTIONS ANSWERSDocument18 pagesChapter 23 QUESTIONS ANSWERSDizon Ropalito P.No ratings yet

- Page 1 of 24Document24 pagesPage 1 of 24Peter AhNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Nfjpia Frontliners RFBT 2019Document19 pagesNfjpia Frontliners RFBT 2019Risalyn BiongNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- CPAR Tax On Partnerships (Batch 90) - HandoutDocument4 pagesCPAR Tax On Partnerships (Batch 90) - HandoutAljur SalamedaNo ratings yet

- Report of Law1 - Other Percentage TaxDocument16 pagesReport of Law1 - Other Percentage TaxJonalyn Maraña-ManuelNo ratings yet

- Module 1 Intro To Transfer Tax, Law of SuccessionDocument33 pagesModule 1 Intro To Transfer Tax, Law of SuccessionVenice Marie ArroyoNo ratings yet

- Exam - Tax - 2019 - KeyDocument2 pagesExam - Tax - 2019 - KeyKenneth Bryan Tegerero Tegio0% (1)

- TAX-1001 (Fringe Benefit Tax)Document5 pagesTAX-1001 (Fringe Benefit Tax)Hilo MethodNo ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document8 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Julious CaalimNo ratings yet

- Fringe Benefits TaxDocument4 pagesFringe Benefits TaxKathleen Jane SolmayorNo ratings yet

- TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Document12 pagesTAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Ciarie Salgado0% (1)

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)Ciarie SalgadoNo ratings yet

- TAX-902 (Gross Income - Exclusions)Document5 pagesTAX-902 (Gross Income - Exclusions)Ciarie Salgado100% (1)

- Internship Ocular Visit: Quality/Quantity of Daily Task Accomplishments/Deadlines Communication SkillsDocument1 pageInternship Ocular Visit: Quality/Quantity of Daily Task Accomplishments/Deadlines Communication SkillsCiarie SalgadoNo ratings yet

- GshshahDocument113 pagesGshshahCiarie SalgadoNo ratings yet

- The Social Impact of Mobile Phones To NationalDocument9 pagesThe Social Impact of Mobile Phones To NationalCiarie SalgadoNo ratings yet

- Interest and DepreciationDocument34 pagesInterest and DepreciationBismuthNo ratings yet

- Risk 2Document32 pagesRisk 2Yisihak SimionNo ratings yet

- Topic 2 ExercisesDocument14 pagesTopic 2 ExercisesCLAUDIA RUIZ CUEVAS SAINZNo ratings yet

- 03 Transfer Taxes (Edited May 26) FINALDocument22 pages03 Transfer Taxes (Edited May 26) FINALArgel CosmeNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Jai BajajNo ratings yet

- 2023 CalPERS Plan RatesDocument2 pages2023 CalPERS Plan RatesJose GonzalezNo ratings yet

- BRM ProjectDocument39 pagesBRM ProjectAbhishek KumarsmNo ratings yet

- Variable Pay & Executive Compensation Submmitted BY Shweta Nayak SuchitraDocument63 pagesVariable Pay & Executive Compensation Submmitted BY Shweta Nayak SuchitrabsbhavaniNo ratings yet

- Instructions For Filling ITR 1 SAHAJ A.Y. 2021 22 General InstructionsDocument52 pagesInstructions For Filling ITR 1 SAHAJ A.Y. 2021 22 General InstructionsRakesh PrajapatiNo ratings yet

- Allianz Care Individual BrochureDocument10 pagesAllianz Care Individual BrochureYang lai liatNo ratings yet

- CSS Pastpapers - Mercantile-Law-2001-2020Document30 pagesCSS Pastpapers - Mercantile-Law-2001-2020Millat AfridiNo ratings yet

- Genpact InterviewDocument6 pagesGenpact Interviewnvishwakarma2820No ratings yet

- Withdrawal Due To Superannuation IncapacitationDocument6 pagesWithdrawal Due To Superannuation IncapacitationPUNAM RNDNo ratings yet

- Chapter-4 ProvisionsDocument18 pagesChapter-4 ProvisionsJEFFERSON CUTENo ratings yet

- ACME Shoe Rubber Plastic Corp. vs. CADocument6 pagesACME Shoe Rubber Plastic Corp. vs. CAMarkey MarqueeNo ratings yet

- Fringe Benefits and Withholding TaxDocument7 pagesFringe Benefits and Withholding TaxXiaoyu KensameNo ratings yet

- Blank Form For Regular Maintenance Contract For Generator 201819Document12 pagesBlank Form For Regular Maintenance Contract For Generator 201819Ally HamisNo ratings yet

- Doh - Nohdz ReportDocument5 pagesDoh - Nohdz ReportDhonnalyn Amene CaballeroNo ratings yet

- County of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Document37 pagesCounty of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Manuel ChavezNo ratings yet

- Sbi Infra Management Solutions PVT LTD (Wholly Owned Subsidiary of Sbi)Document34 pagesSbi Infra Management Solutions PVT LTD (Wholly Owned Subsidiary of Sbi)Anand SreelakamNo ratings yet

- RevATC 3 Buycon6.ntpc - DJDocument142 pagesRevATC 3 Buycon6.ntpc - DJAnant JainNo ratings yet

- Income Tax On Individual TaxpayersDocument7 pagesIncome Tax On Individual TaxpayersYoite MiharuNo ratings yet

- PCEIA Exam PaperDocument20 pagesPCEIA Exam PaperShiharu Comil0% (1)

- Dela Cruz V Capital InsuranceDocument1 pageDela Cruz V Capital InsuranceAlfonso Miguel LopezNo ratings yet

- BailmentDocument23 pagesBailmentMahadeoNo ratings yet

- Actuaries ProjectDocument45 pagesActuaries Projectpradnya100% (1)

- E-8, Epip, Sitapura Industrial Area, Jaipur, RAJASTHAN-302022 Contact (Toll Free) : 1800 Certificate Cum Policy ScheduleDocument1 pageE-8, Epip, Sitapura Industrial Area, Jaipur, RAJASTHAN-302022 Contact (Toll Free) : 1800 Certificate Cum Policy ScheduleAakash MotorsNo ratings yet

- True/False QuestionsDocument168 pagesTrue/False QuestionsLara FloresNo ratings yet