Professional Documents

Culture Documents

TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)

TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)

Uploaded by

Ciarie SalgadoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)

TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)

Uploaded by

Ciarie SalgadoCopyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 42 October 2021 CPA Licensure Exam Week No. 5

TAXATION A. Tamayo G. Caiga C. Lim K. Manuel E. Buen

TAX-602: INCOME TAX RATES FOR INDIVIDUALS,

ESTATES AND TRUSTS

1. Sec. 24 (A) – The tax shall be computed on taxable income in accordance with and at the rates established in the following

schedule (resident citizens, non-resident citizens, resident alien, estate and trust):

a. Effective January 1, 2018 (until December 31, 2022)

If the taxable income is:

Over But not over The tax shall be Plus Of excess over

P 250,000 0%

P 250,000 400,000 20% P 250,000

400,000 800,000 P 30,000 25% 400,000

800,000 2,000,000 130,000 30% 800,000

2,000,000 8,000,000 490,000 32% 2,000,000

8,000,000 2,419,000 35% 8,000,000

b. Effective January 1, 2023

If the taxable income is:

Over But not over The tax shall be Plus Of excess over

P 250,000 0%

P 250,000 400,000 15% P 250,000

400,000 800,000 P 22,500 20% 400,000

800,000 2,000,000 102,500 25% 800,000

2,000,000 8,000,000 402,500 30% 2,000,000

8,000,000 2,202,500 35% 8,000,000

2. Final Tax Rates on Certain Passive Income from Philippine Sources (income from WITHIN the PHILIPPINES).

a. Rates of Tax Certain Passive Income

1) Sec. 24 (B) – For residents or citizens;

a. Interest from any currency bank deposit

b. Yield or any other monetary benefit from deposit substitute (obtained from 20 or more individual or corporate lenders)

c. Yield or any other monetary benefit from trust funds and similar arrangements

20%

d. Royalties (except royalties on books and other literary works and musical compositions)

e. Prizes (except prizes amounting to P10,000 or less which shall be subject to tax under Subsection (A) of Section 24

f. Other winnings (except winning amounting to P10,000 or less from Philippine Charity Sweepstakes and Lotto which shall be exempt)

g. Royalties on books and other literary works and musical compositions 10%

2) Sec. 25 (A) (2) – For non-resident aliens engaged in trade or business.

a. Interest from any currency bank deposit

b. Yield or any other monetary benefit from deposit substitute (obtained from 20 or more individual or corporate lenders)

c. Yield or any other monetary benefit from trust funds and similar arrangements

d. Royalties (except royalties on books and other literary works and musical compositions)

e. Prizes [except prizes amounting to P10,000 or less which shall be subject to tax under Subsection (B) (1) of Section 24, effectively

Sec. 24 (A) 20%

f. Other Winnings (except winnings from Philippine Charity Sweepstakes Office [PCSO] games amounting to P10,000 or less which

shall be exempt from income tax)

NOTE: Exemption of Lotto winnings from final taxes has been deleted.

see CREATE Act and RR No. 2-2021

g. Royalties on books and other literary works and musical compositions 10%

f. Cinematographic films and similar works shall be subject to the tax provided under Section 28 of the Tax Code 25%

3) Sec. 25 (B) – For non-resident aliens NOT engaged in trade or business

a. Interest from any currency bank deposit

b. Yield or any other monetary benefit from deposit substitute (obtained from 20 or more individual or corporate lenders)

c. Yield or any other monetary benefit from trust funds and similar arrangements

d. Royalties, in general 25%

e. Royalties on books, as well as other literary works and musical compositions

f. Prizes

g. Other winnings

Page 1 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

RES/CIT NRA-ETB NRA-NETB

a. Interest income received by individual taxpayer (except non-resident individual) from a 15%

depositary bank under expanded foreign currency deposit system (TRAIN law) Exempt* Exempt*

b. Interest income from long-term deposit or investment in the form of savings, common or

individual trust funds, deposit substitutes, investment management accounts and other Exempt Exempt 25%

investments evidenced by certificates in such form prescribed by Bangko Sentral ng

Pilipinas (BSP) NOTE: Exception applies only to Individuals

If pre-terminated before fifth year, a final tax shall be imposed based on remaining maturity:

4 years but less than 5 years 5% 5% 25%

3 years but less than 4 years 12% 12% 25%

Less than 3 years 20% 20% 25%

*also applies to non-resident citizens

4) Cash and/or Property Dividends

RES/CIT NRA-ETB NRA-NETB

a. Cash and/or property dividends actually or constructively received from a DOMESTIC CORP.

or from JOINT STOCK CO., INSURANCE or MUTUAL FUND COMPANIES and REGIONAL 10% 20% 25%

OPERATING HEADQUARTERS of multinationals (beginning January 1, 2000}

b. Share of an individual in the distributable net income after tax of a PARTNERSHIP (OTHER

THAN a general professional partnership) of which he is a partner (beginning Jan. 1, 2000) 10% 20% 25%

c. Share of an individual in the net income after tax of an ASSOCIATION, a JOINT ACCOUNT, or

a JOINT VENTURE or CONSORTIUM taxable as a corporation of which he is a member or co- 10% 20% 25%

venturer (beginning January 1, 2000)

Provided, however, that the tax on dividends shall apply only on income earned on or after Jan. 1, 1998. Income forming part

of retained earnings as of December 31, 1997 shall not, even if declared or distributed on or after January 1, 1998, be subject to this tax.

5) Exercises:

a. Identify whether the following are subject to final tax or not (year 2018). Taxpayer is RESIDENT CITIZEN unless otherwise stated (Y/N).

Final tax? Rate

1) Interest from peso bank deposit, Equitable – PCIB, Makati

2) Interest from Japanese yen bank deposit, Sumitomo Bank, Japan

3) Interest from USA dollar bank deposit, First USA Bank, New York

4) Interest income from a debt instrument not within the coverage of deposit substitute, Philippines

5) Interest income from a debt instrument within the coverage of a deposit substitute, Philippines

6) Interest on government debt instrument and securities (regardless of number of lenders at the time of the

origination)

7) Interest from overdue accounts receivable, Philippines

8) Royalties, in general, Manila

9) Royalties, books published in Manila

10) Prize amounting to P30,000, Philippines

11) Prize amounting to P10,000, Philippines

12) Prize amounting to P40,000, USA

13) Winnings amounting to P30,000, Philippines

14) Winnings amounting to P10,000, Philippines

15) USA Sweepstakes winnings

16) Philippine Lotto winnings

17) Interest received from depository bank under expanded foreign currency deposit system (jointly in the name

of a non-resident citizen and his spouse who is a resident citizen)

18) Interest income from long-term deposit or investment evidenced by certificates issued by BSP (issued by a

financial institution other than a bank in denomination of P10,000)

19) Interest income from long-term deposit or investment evidenced by certificates issued by BSP (issued by a

bank to an individual in denomination of P10,000)

20) Dividend from a domestic corporation received on April 15, 2006

21) Share in distributive net income of local business partnership received on May 15, 2006

22) Share in net income after tax of an association, a joint account, or a joint venture or consortium received on

August 15, 2006

23) Share in the net income of a general professional partnership

24) Dividend from a foreign corporation

25) Interest income from long-term deposit or investment evidenced by certificates issued by BSP received by a

NONRESIDENT ALIEN ENGAGED IN TRADE OR BUSINESS

26) Interest income from long-term deposit or investment evidenced by certificates issued by BSP received by a

NONRESIDENT ALIEN NOT ENGAGED IN TRADE OR BUSINESS

27) Interest income received by NONRESIDENT ALIEN individual from a depository bank under expanded foreign

currency deposit system

28) Interest income received by a NON-RESIDENT CITIZEN individual from a depository bank under expanded

foreign currency deposit system

29) Dividend received by a NONRESIDENT ALIEN not engaged in business in the Philippines from

a domestic corporation.

30) Dividend received by a NONRESIDENT ALIEN engaged in trade in the Philippines from a domestic corporation

Page 2 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

b. b. An instrument with a maturity period of 10 years was held by Mr. X (a resident citizen) for 2 years and was transferred to Mr. Y (a

resident alien) who, in turn, held it for 8 years. How much is final withholding tax due?

Mr. X _____

Mr. Y _____

c. An instrument with maturity period of 10 years was held by Mr. X (a non-resident citizen) for 3 years and transferred it to Mr. Y (a

resident alien). Mr. Y held it for 2 years before subsequently transferring it to Mr. Z (a resident citizen), who held it until the day of

maturity or for 5 years. How much is the final withholding tax due?

Mr. X _____ Mr. Y ________ Mr. Z __________

d. An instrument with maturity period of 10 years was held by Mr. X (a non-resident alien engaged in trade or business in the Philippines)

for 3 years and transferred it to Mr. Y (a resident citizen). Mr. Y held it for 2 years before subsequently transferring it to Mr. Z (a non-

resident alien not engaged in trade or business), who pre-terminated it after 4 years. How much is the final withholding tax due?

Mr. X _____ Mr. Y _________ Mr. Z ___________

3. Capital Gains Tax

a. Sec. 24 (C) – Capital Gains from Tax base: Net capital gains

Sale of Shares of Stock not Tax rates (old): 5% - not over P100,000

Traded in the Stock Exchange 10% - excess of P100,000

Sale, barter, transfer and/or

assignment of shares of stock of

publicly-listed companies not

compliant with mandatory Tax rate (TRAIN Law): 15%

minimum public ownership (10%

of the publicly-listed companies’

issued and outstanding shares,

exclusive of any treasury shares)

(RR No. 16-2012)

a.1 Determination of Selling Price

In case of… SP shall be

(check FMV if higher than the SP – Cash sale Total consideration per deed of sale

possible Donor’s tax Partly in money and Sum of money and the FMV of the property received

implication under Section 100) partly in kind

Exchange FMV of the property received

If FMV of shares of stock Excess of the FMV of the shares of stock sold, bartered

sold/bartered/exchanged or exchanged over the amount of money and the FMV of

> amount of money the property, if any, received as consideration shall be

and/or FMV of the deemed a gift subject to the donor's tax under Section

property received 100 of the 1997 Tax Code, as amended

Listed shares Closing price on the day when the shares are sold,

sold/transferred/ transferred, or exchanged

exchanged outside of

the trading system Note: When no sale is made in the local stock exchange on the

and/or facilities of the day when the listed shares are sold, transferred, or exchanged,

local stock exchange the closing price on the day nearest to the date of sale, transfer

or exchange of the shares shall be the FMV.

Shares of stock not Book value of the shares of stock as shown in the

listed and traded in the financial statements duly certified by an independent

local stock exchange CPA nearest to the date of sale

a.2 Determination of FMV

Type FMV of the shares sold

Listed the closing price on the day when the shares are sold, transferred, or

shares exchanged. When no sale is made in the Local Stock Exchange on the

day when the listed shares are sold, transferred, or exchanged, the

closing price on the day nearest to the date of sale, transfer or exchange

of the shares shall be the FMV.

Unlisted a. Common shares – book value (BV) based on the latest available

shares audited FS prior to the date of sale, but not earlier than immediately

preceding taxable year

b. Preferred shares – liquidation value (LV), which is equal to the

redemption price of the shares as of the balance sheet date nearest

to the transaction date, including any premium and cumulative

preferred dividends in arrears.

Page 3 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

c. With common and preferred shares – BV per common share is

computed by deducting the liquidation value of the preferred shares

from the total equity of the corporation dividing the result by the

number of the outstanding common shares as of the balance sheet

date nearest to the transaction date

For this purpose, the BV of common shares or the LV of the preferred

shares, need not be adjusted to include any appraisal surplus from any

property of the corporation not reflected or included in the latest audited

FS.

a.3 Determination of Cost

In case of… Cost shall be

If the shares of stock Actual purchase price plus all costs of acquisition,

can be identified such as commissions, DST, transfer fees, etc.

If the shares of stock Cost to be assigned shall be computed on the basis

cannot be properly of the first-in first-out (FIFO) method*

identified *If books of accounts are maintained by the seller

where every transaction of a particular stock is

recorded, moving average method shall be applied

rather than the FIFO method.

In general, stock Allocate the cost of the original shares of stock to

dividend received the total number shares held after receipt of stock

dividends (i.e., the original shares plus the shares

of stock received as stock dividends).

b. Sec. 24 (D) – Capital Gains Tax base: Gross selling price or fair market

from Sale of Real Property value whichever is higher

Classified as Capital Asset Tax rate: 6% final tax

(Located in PH)

c. Disposition of real property The tax to be imposed shall be determined either under Section 24 (A) for the normal rate of

classified as capital asset by income tax for individual citizens or residents or under Section 24 (D) (1) for the final tax on the

individual to the presumed capital gains of property at 6%, at the option of the taxpayer-seller.

government or any of its

political subdivisions or

agencies or to GOCCs

d. Exemption from 6% capital 1) Exempt proceeds

gains tax on sale/transfer Capital gains presumed to have been realized from the sale or disposition of their principal

of principal residence residence by natural persons, the proceeds of which is fully utilized in acquiring or constructing

a new principal residence within 18 calendar months from the date of sale or disposition

shall be exempt from capital gains tax.

2) Escrow agreement

The buyer/tansferee shall withhold from the seller and shall deduct from the agreed selling

price/consideration the 6% capital gains tax which shall be deposited in cash or manager’s

check in interest bearing account with an Authorized Agent Bank (AAB) under an Escrow

Agreement between the concerned Revenue District Officer, the Seller and the Transferee, and

the AAB.

e. Carry-over of historical cost The historical cost or adjusted basis of the real property sold or disposed shall be carried over to

or adjusted basis the new principal residence built or acquired.

Page 4 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

f. Expropriation of real property Not Subject to CGT.

without payment of just

compensation (CTA Case No. The transfer of property through expropriation proceedings and the payment of just compensation

9240 dated October 26, are necessary elements of "sale" or "exchange" for purposes of Sections 24 (D) and 56 (A) (3) of

2017) the 1997 Tax Code, as amended. Hence, both elements must be present in order to be considered

"sale" and be subjected to the imposition of CGT.

g. Private project contractors Exempt from payment of CGT and project-related income taxes.

participating in socialized

housing (covered by RA No. Under Section 20 (d) of RA No. 7279, members of the private sector participating in socialized

7279, otherwise known as housing shall be given the incentive of exemption from the payment of the following:

the “Urban Development and 1. Project-related income taxes;

Housing Act of 1992”) 2. CGT on raw lands used for the project; and

3. VAT for the project contractor concerned

f. Computation for the basis Historical cost of old principal residence xxx

of the new principal Add: Additional cost to acquire new principal residence xxx*

residence Adjusted cost basis of the new principal residence xxx

*Cost to acquire new principal residence xxx

Less: Gross selling price of old principal residence xxx

Additional cost to acquire new principal residence xxx

g. Notification required The Commissioner shall have been duly notified by the taxpayer within 30 days from the date of

sale or disposition through a prescribed return of his intention to avail of the tax exemption.

h. Exemption once every 10 The tax exemption can only be availed of once every 10 years.

years

i. Taxable portion if no full If there is no full utilization of the proceeds of sale or disposition of principal residence, the portion

utilization of proceeds of the gain presumed to have been realized from the sale or disposition shall be subject to capital

gains tax.

The taxable portion is computed as follows:

Unutilized portion x Tax base

Gross selling price

Computation of adjusted cost basis of the new principal residence:

Utilized portion x Historical cost

Gross selling price

j. Filing of Final Capital Gains 1) After depositing the amount representing the 6% capital gains tax, the Buyer/Transferee and

Tax Return on sale of the Seller, shall jointly file, within thirty (30) days from the date of sale or disposition of the

principal residence principal residence, with the RDO having jurisdiction over the property, in duplicate, the Final

Capital Gains Tax Return covering the property bought with no computed tax due stating that

the supposed tax due/amount so withheld by the buyer is maintained in an escrow account,

which amount will be used to satisfy future tax liability, if any, on the subject transaction.

2) For purposes of capital gains tax otherwise due on the sale, exchange or disposition of the said

Principal Residence, the execution of the Escrow Agreement shall be considered sufficient.

k. Exercises

a. An individual taxpayer holds shares of stock as investment (P120,000 par value). During the current year, he sells the shares he

bought for P100,000 for P180,000 directly to a buyer.

How much is the capital gains tax and documentary stamp tax on the sale, if any?

b. An individual taxpayer holds shares of stock as investment which he bought from a publicly-listed company for P500,000 (P500,000

par value). The shares are listed and traded in the local stock exchange. During the current year, he sells them for P750,000.

Question 1 - How much is the percentage tax, if any?

2 – How much is the documentary stamp tax, if any?

3 – How much is the capital gains tax on the sale assuming the corporation from which the shares are bought are not

compliant with the mandatory minimum public ownership?

c. An individual taxpayer invested P300,000 in the common shares of SMC Corp (P150,000 par value). During the current year, he sold

these shares to a buyer not through the local stock exchange for P250,000.

Question 1 - How much was the capital gains tax on the sale, if any?

2 – How much was the documentary stamp tax, if any?

d. During the year 2018, Ms. Kat Antonio sold her vacation house for P500,000. She acquired it for P700,000 two (2) years ago. The

fair market value of the vacation house at the time of sale was P800,000. Ms. Antonio was going to use the proceeds to build her

new principal residence within eighteen (18) months after informing BIR within thirty (30) days of such intention.

How much is the capital gain tax and the documentary stamp tax, if any?

Page 5 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

e. Mr. C. Avenido acquired his principal residence in 2016 at a cost of P1,000,000. He sold the said property on January 1, 2018, with a

fair market value of P5,000,000 for a consideration of P4,000,000. Within the 18-month reglementary period he purchased his new

principal residence at cost of P7,000,000.

Question 1 - How much is the capital gains tax due?

2 – How much is the documentary stamp tax?

3 - How much is the basis of the new principal residence?

f. Using the same data in letter e, if for example, Mr. Avenido acquired his new principal residence within the 18-month reglementary

period but did not utilize the entire proceeds of the sale in acquiring his new principal residence because he only used P3,000,000

thereof in acquiring his new principal residence.

Question 1 - How much is the capital gains tax?

2 - How much is the basis of the new principal residence?

4. Tax Rates for Special Aliens and their Filipino Counterparts

a. The provision on the preferential income tax rate of fifteen percent (15%) for qualified employees of Regional Headquarters, Regional

Operating Headquarters, Offshore Banking Units, and Petroleum Service Contractors and Subcontractors has been vetoed.

b. The preferential income tax rate of qualified employees of Regional Headquarters, Regional Operating Headquarters, Offshore Banking

Units, and Petroleum Service Contractors and Subcontractors shall no longer be applicable without prejudice to the application of

preferential tax rates under existing international tax treaties.

Persons Subject to Tax Tax Rate

Sec. 25 (C) Alien Individual 15% of gross income within the Philippines (same tax treatment shall apply to Filipinos

Employed by Regional employed and occupying the same position as those of aliens employed by these multinational

or Area Headquarters companies)

and Regional

Operating Under the TRAIN, subject to regular income tax rate under Section 24(A)(2)(a) of the Tax Code,

Headquarters of as amended, without prejudice to the application of preferential tax rates under existing

Multinational Co. international tax treaties.

Sec. 25 (D) Alien Individual 15% of gross income within the Philippines (same tax treatment to Filipinos employed and

Employed by Offshore occupying managerial and technical positions similar to those occupied by aliens employed by

Banking Units these offshore banking units).

Under the TRAIN, subject to regular income tax rate under Section 24(A)(2)(a) of the Tax Code,

as amended, without prejudice to the application of preferential tax rates under existing

international tax treaties.

Sec. 25 (E) Alien Individual 15% of gross income within the Philippines (same tax treatment to Filipinos employed and

Employed by Foreign occupying the same position as those aliens who are permanent residents of a foreign country

Petroleum Service but who are employed by petroleum service contractor and subcontractor in the Philippines).

Contractor and

Subcontractor Under the TRAIN, subject to regular income tax rate under Section 24(A)(2)(a) of the Tax Code,

as amended, without prejudice to the application of preferential tax rates under existing

international tax treaties.

Exercises

a. At the start of the year, Adriano Santos, a Filipino holding a managerial position in an RHQ, receives a monthly salary and cost of living

allowance in the amount of P70,000 and P7,000 respectively. His 13th month and 14th month pays amount to P140,000. How much

is his income tax payable?

b. Ms. CCF, an alien employed in MCUD Corporation, a Petroleum Service Contractor received compensation income of ₱5,000,000.00 for

2020, inclusive of ₱400,000.00 13th month pay and other benefits. How much is the taxable net income and the income tax due?

Page 6 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

Integrative Cases

a. A married resident citizen supports three (3) qualified dependent children and a brother-in-law who is a PWD, unmarried and not

gainfully employed. He has the following data on income and expenses for the year 2021:

Salary, Philippines P 560,000

Gross business income, Philippines (gross sales, P1,700,000) 500,000

Business expenses, Philippines 180,000

Gross business income, USA (gross sales, P1,500,000) 900,000

Business expenses, USA 300,000

Interest income from bank deposit, Philippines 50,000

Interest income from bank deposit, USA 70,000

Interest income from domestic depository bank under EFCDS 80,000

Interest income from a debt instrument not within the coverage of deposit substitute, Philippines, gross of

15% creditable withholding tax (issue price is P300,000) 50,000

Interest income from a debt instrument within the coverage of a deposit substitute, Philippines (issue price

P500,000) 60,000

Royalty on book published in the Philippines 100,000

Prize in a contest he joined in the Philippines 5,000

Philippine Charity Sweepstakes winnings 1,000,000

Gain from sale of shares of stock not traded through the local stock exchange (P200,000 par value) 150,000

Dividend received from a domestic corporation 40,000

Tax payments, first three (3) quarters 100,000

Questions:

1. How much is the total final tax on certain passive income?

2. How much is the capital gains tax and the documentary stamp taxes?

3. Can the taxpayer avail of the 8% income tax option?

4. How much is the taxable net income and income tax due?

b. A resident alien individual supports two (2) qualified dependent adopted children and a foster child. He asks you to assist him in the

preparation of his tax return for his income in 2020. He provides you the following information:

Gross business income, Philippines (gross sales, P3,000,000) P 1,000,000

Gross business income, Japan (gross sales, P7,000,000) 5,000,000

Business expenses, Philippines 200,000

Business expenses, Japan 800,000

Philippine Charity Sweepstakes winnings 500,000

Japanese Sweepstakes winnings 400,000

Interest income, Bank of Tokyo, Japan 100,000

Interest income received from a depository bank under EFCDS, Philippines 300,000

Interest on peso bank deposit, Philippines 100,000

Income taxes paid for the first three (3) quarters 50,000

Questions:

1. Can the taxpayer avail of the 8% income tax rate?

2. How much was the taxable net income and income tax due if he avails of the 8% income tax rate?

3. How much was the final tax on passive income?

4. Assuming the taxpayer failed to avail of the 8% income tax, how much is his taxable income and the income tax due?

- END -

SUGGESTED ANSWERS & SOLUTIONS

5) Exercises:

c. Identify whether the following are subject to final tax or not (year 2018). Taxpayer is RESIDENT CITIZEN unless otherwise stated (Y/N).

Final tax? Rate

1) Interest from peso bank deposit, Equitable – PCIB, Makati Yes 20%

2) Interest from Japanese yen bank deposit, Sumitomo Bank, Japan No Sec. 24 (A)

3) Interest from USA dollar bank deposit, First USA Bank, New York No Sec. 24 (A)

4) Interest income from a debt instrument not within the coverage of deposit substitute, Philippines No Sec. 24 (A)

5) Interest income from a debt instrument within the coverage of a deposit substitute, Philippines Yes 20%

6) Interest on government debt instrument and securities (regardless of number of lenders at the time of the

origination) Yes 20%

7) Interest from overdue accounts receivable, Philippines No Sec. 24 (A)

8) Royalties, in general, Manila Yes 20%

9) Royalties, books published in Manila Yes 10%

10) Prize amounting to P30,000, Philippines Yes 20%

Page 7 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

11) Prize amounting to P10,000, Philippines No Sec. 24 (A)

12) Prize amounting to P40,000, USA No Sec. 24 (A)

13) Winnings amounting to P30,000, Philippines Yes 20%

14) Winnings amounting to P10,000, Philippines Yes 20%

15) USA Sweepstakes winnings No Sec. 24 (A)

16) Philippine Lotto winnings Yea 20%

17) Interest received from depository bank under expanded foreign currency deposit system (jointly in the No Exempt

name of a non-resident citizen and his spouse who is a resident citizen) Yes (1/2)

15 % (1/2)

18) Interest income from long-term deposit or investment evidenced by certificates issued by BSP (issued by a

financial institution other than a bank in denomination of P10,000) Yes 20%

19) Interest income from long-term deposit or investment evidenced by certificates issued by BSP (issued by a

bank to an individual in denomination of P10,000) No Exempt

20) Dividend from a domestic corporation received on April 15, 2006 Yes 10%

21) Share in distributive net income of local business partnership received on May 15, 2006 Yes 10%

22) Share in net income after tax of an association, a joint account, or a joint venture or consortium received

on August 15, 2006 Yes 10%

23) Share in the net income of a general professional partnership No Sec. 24 (A)

24) Dividend from a foreign corporation No Sec. 24 (A)

25) Interest income from long-term deposit or investment evidenced by certificates issued by BSP received by a

NONRESIDENT ALIEN ENGAGED IN TRADE OR BUSINESS No Exempt

26) Interest income from long-term deposit or investment evidenced by certificates issued by BSP received by a

NONRESIDENT ALIEN NOT ENGAGED IN TRADE OR BUSINESS Yes 25%

27) Interest income received by NONRESIDENT ALIEN individual from a depository bank under expanded

foreign currency deposit system No Exempt

28) Interest income received by a NON-RESIDENT CITIZEN individual from a depository bank under expanded

foreign currency deposit system No Exempt

29) Dividend received by a NONRESIDENT ALIEN not engaged in business in the Philippines from

a domestic corporation. Yes 25%

30) Dividend received by a NONRESIDENT ALIEN engaged in trade in the Philippines from a domestic

corporation Yes 20%

d.

e. b. An instrument with a maturity period of 10 years was held by Mr. X (a resident citizen) for 2 years and was transferred to Mr. Y (a

resident alien) who, in turn, held it for 8 years. How much is final withholding tax due?

Suggested Answers:

Mr. X 20% final tax (2 years)

Mr. Y Exempt (8 years)

c. An instrument with maturity period of 10 years was held by Mr. X (a non-resident citizen) for 3 years and transferred it to Mr. Y (a

resident alien). Mr. Y held it for 2 years before subsequently transferring it to Mr. Z (a resident citizen), who held it until the day of

maturity or for 5 years. How much is the final withholding tax due?

Suggested Answers:

Mr. X 12% (3 years) Mr. Y 20% (2 years) Mr. Z Exempt (5 years)

d. An instrument with maturity period of 10 years was held by Mr. X (a non-resident alien engaged in trade or business in the Philippines)

for 3 years and transferred it to Mr. Y (a resident citizen). Mr. Y held it for 2 years before subsequently transferring it to Mr. Z (a non-

resident alien not engaged in trade or business), who pre-terminated it after 4 years. How much is the final withholding tax due?

Suggested Answers:

Mr. X 12% (3 years) Mr. Y 20% (2 years) Mr. Z 25% (4 years)

l. Exercises

g. An individual taxpayer holds shares of stock as investment (P120,000 par value). During the current year, he sells the shares he

bought for P100,000 for P180,000 directly to a buyer. How much is the capital gains tax and documentary stamp tax on the sale, if

any?

Suggested Answers/Solutions:

Selling price P180,000

Less: Cost 100,000

Capital gain P 80,000

Capital gains tax 80,000 x 15% P 12,000

h. An individual taxpayer holds shares of stock as investment which he bought from a publicly-listed company for P500,000 (P500,000

par value). The shares are listed and traded in the local stock exchange. During the current year, he sells them for P750,000.

Question 1 - How much is the percentage tax, if any?

2 – How much is the documentary stamp tax, if any?

3 – How much is the capital gains tax on the sale assuming the corporation from which the shares are bought are not

compliant with the mandatory minimum public ownership?

Page 8 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

Suggested Answers/Solutions:

Question 1 - How much is the percentage tax, if any?

Selling price P750,000

Tax rate x .006

Stock transactions tax P 4,500

Question 2 - How much is the documentary stamp tax, if any?

Par value (section 175 of the Tax Code, as amended) P500,000

Tax rate (P1.50 / P200) (section 175 of the Tax Code, as amended) x .00075

DST on transfer of shares P 3,750

Question 3 – How much is the capital gains tax on the sale assuming the corporation from which the shares are bought is not

compliant with the mandatory minimum public ownership?

Selling price P750,000

Less: Cost 500,000

Capital gain P250,000

Capital gains tax 250,000 x 15% P 37,500

i. An individual taxpayer invested P300,000 in the common shares of SMC Corp (P150,000 par value). During the current year, he sold

these shares to a buyer not through the local stock exchange for P250,000.

Question 1 - How much was the capital gains tax on the sale, if any?

2 – How much was the documentary stamp tax, if any?

Suggested Answers/Solutions:

Question 1 - How much is the capital gains tax on the sale, if any?

Selling price P250,000

Less: Cost (300,000)

Capital loss (P50,000)

Capital gains tax -

Question 2 - How much is the documentary stamp tax, if any?

Par value (section 175 of the Tax Code, as amended) P150,000

Tax rate (P1.50 / P200) (section 175 of the Tax Code, as amended) x .00075

DST on transfer of shares P 1,125

j. During the year 2018, Ms. Kat Antonio sold her vacation house for P500,000. She acquired it for P700,000 two (2) years ago. The

fair market value of the vacation house at the time of sale was P800,000. Ms. Antonio was going to use the proceeds to build her

new principal residence within eighteen (18) months after informing BIR within thirty (30) days of such intention. How much is the

capital gain tax and the documentary stamp tax, if any?

Suggested Answers/Solutions:

Fair market value P 800,000

Tax rate 6%

Capital gains tax P 48,000

k. Mr. C. Avenido acquired his principal residence in 2016 at a cost of P1,000,000. He sold the said property on January 1, 2018, with a

fair market value of P5,000,000 for a consideration of P4,000,000. Within the 18-month reglementary period he purchased his new

principal residence at cost of P7,000,000.

Question 1 - How much is the capital gains tax due?

2 – How much is the documentary stamp tax?

3 - How much is the basis of the new principal residence?

Suggested Answers/Solutions:

Question 1 –

None. Exempt from capital gains tax but must deposit in escrow the equivalent of the 6% capital gains tax.

Question 2 –

Consideration P4,000,000

Tax rate (P15 / P1,000) (section 196 of the Tax Code, as amended) x .015

DST on sale of real property P 60,000

Page 9 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

Question 3 -

Historical cost of old principal residence P1,000,000

Add: Additional cost to acquire new principal residence

Cost to acquire new principal residence 7,000,000

Less: Gross selling price of old principal residence (4,000,000) 3,000,000

Adjusted cost basis of new principal residence P4,000,000

l. Using the same data in letter e, if for example, Mr. Avenido acquired his new principal residence within the 18-month reglementary

period but did not utilize the entire proceeds of the sale in acquiring his new principal residence because he only used P3,000,000

thereof in acquiring his new principal residence.

Question 1 - How much is the capital gains tax?

2 - How much is the basis of the new principal residence?

Suggested Answers/Solutions:

Question 1

Taxable portion (1,000,000/4,000,000 x 5,000,000) P1,250,000

Tax rate 6%

Capital gains tax P 75,000

Question 2

Historical cost of old principal residence P1,000,000

Less: Portion of historical cost pertaining to the tax on utilized amount

(25% x 1,000,000) 250,000

Adjusted cost basis of new principal residence P 750,000

Or

3,000,000/4,000,000 x 1,000,000 P 750,000

Exercises

c. At the start of the year, Adriano Santos, a Filipino holding a managerial position in an RHQ, receives a monthly salary and cost of living

allowance in the amount of P70,000 and P7,000 respectively. His 13th month and 14th month pays amount to P140,000. How much

is his income tax payable?

Suggested Answer:

The tax due is based on the graduated income tax rates but cannot be determined at this time because the bonus is not yet known.

d. Ms. CCF, an alien employed in MCUD Corporation, a Petroleum Service Contractor received compensation income of ₱5,000,000.00 for

2020, inclusive of ₱400,000.00 13th month pay and other benefits. How much is the taxable net income and the income tax due?

Suggested Answer/Solution:

Compensation Income ₱ 5,000,000.00

Less: Non-taxable 13th Month Pay and other benefits (max) 90,000.00

Taxable Compensation Income P4,910,000.00

Tax due on 2,000,000.00 P 490,000.00

2,910,000.00 x 32% 931,200.00

Total tax due P1,421,200.00

* All employees of RHQs/ROHQs/OBUs, and Petroleum Service Contractors and Subcontractors. shall be subject to regular income

tax rate under Section 24(A)(2)(a) of the Tax Code, as amended, without prejudice to the application of preferential tax rates under

existing international tax treaties.

Integrative Cases

c. A married resident citizen supports three (3) qualified dependent children and a brother-in-law who is a PWD, unmarried and not

gainfully employed. He has the following data on income and expenses for the year 2020:

Salary, Philippines P 560,000

Gross business income, Philippines (gross sales, P1,700,000) 500,000

Business expenses, Philippines 180,000

Gross business income, USA (gross sales, P1,500,000) 900,000

Business expenses, USA 300,000

Interest income from bank deposit, Philippines 50,000

Interest income from bank deposit, USA 70,000

Interest income from domestic depository bank under EFCDS 80,000

Interest income from a debt instrument not within the coverage of deposit substitute,

Philippines, gross of 15% creditable withholding tax (issue price is P300,000) 50,000

Interest income from a debt instrument within the coverage of a deposit substitute, Philippines

(issue price P500,000) 60,000

Royalty on book published in the Philippines 100,000

Page 10 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

Prize in a contest he joined in the Philippines 5,000

Philippine Charity Sweepstakes winnings 1,000,000

Gain from sale of shares of stock not traded through the local stock exchange (P200,000 par

value) 150,000

Dividend received from a domestic corporation 40,000

Tax payments, first three (3) quarters 100,000

Questions:

1. How much is the total final tax on certain passive income?

2. How much is the capital gains tax and the documentary stamp taxes?

3. Can the taxpayer avail of the 8% income tax option?

4. How much is the taxable net income and income tax due and the business tax?

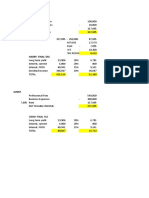

Suggested Answers/Solutions:

Question 1

Amount Rate Final tax

Interest income from bank deposit, Philippines 50,000 20% P10,000

Interest income from domestic depository bank under EFCDS 80,000 15% 12,000

Interest income from a debt instrument (a deposit substitute), Philippines 60,000 20% 12,000

Royalty on book published in the Philippines 100,000 10% 10,000

Philippine Charity Sweepstakes winnings 1,000,000 20% 200,000

Dividend received from a domestic corporation 40,000 10% 4,000

Total P248,000

Question 2

Gain from sale of shares of stock not traded through the local stock exchange P 150,000

Capital gains tax due and payable 150,000 x 15% P 22,500

Question 3 (see total gross sales/receipts if beyond the VAT threshold) and 4

Gross compensation income P 560,000

Gross business income, Philippines P 500,000

Gross business income, USA 900,000

Total gross income 1,400,000

Less: Business expenses, Philippines ( 180,000)

Business expenses, USA ( 300,000)

Net operating income 920,000

Add: Non-operating income

Interest income from bank deposit, USA 70,000

Interest income from a debt instrument not a deposit substitute, Philippines 50,000

Prize in a contest he joined 5,000 1,045,000

Taxable net income P 1,605,000

Tax due [Section 24 (A)] on P800,000 P 130,000

805,000 x 30% 241,500

Total tax due 371,500

Less: Creditable withholding tax on interest income from a debt instrument not a

deposit substitute, Philippines (50,000 x 15%) 7,500

Tax payments, first 3 quarters 100,000 107,500

Tax payable P 264,000

d. A resident alien individual supports two (2) qualified dependent adopted children and a foster child. He asks you to assist him in the

preparation

of his tax return for his income in 2020. He provides you the following information:

Gross business income, Philippines (gross sales, P3,000,000) P 1,000,000

Gross business income, Japan (gross sales, P7,000,000) 5,000,000

Business expenses, Philippines 200,000

Business expenses, Japan 800,000

Philippine Charity Sweepstakes winnings 500,000

Japanese Sweepstakes winnings 400,000

Interest income, Bank of Tokyo, Japan 100,000

Interest income received from a depository bank under EFCDS, Philippines 300,000

Interest on peso bank deposit, Philippines 100,000

Income taxes paid for the first three (3) quarters 50,000

Questions:

1. Can the taxpayer avail of the 8% income tax rate?

2. How much was the taxable net income and income tax due if he avails of the 8% income tax rate?

3. How much was the final tax on passive income?

4. Assuming the taxpayer failed to avail of the 8% income tax, how much is his taxable income and the income tax due?

Page 11 of 12 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY TAX-602

Week 5: INCOME TAX RATES for INDIVIDUALS, ESTATES & TRUSTS

Suggested Answers/Solutions:

Question 1

Yes because his gross sales from Philippine sources do not exceed the VAT threshold of P3,000,000. The 8% income tax

rate is in lieu of the graduated income tax rates and the 3% percentage tax under Section 116.

Question 2

Gross sales, Philippines P3,000,000

Less: Amount exempted under the graduated income tax rates 250,000

Taxable income P2,750,000

Tax due (2,700,000 x 8%) P 220,000

Less: Tax payments, first 3 quarters 50,000

Tax payable P 170,000

Question 3 –

Philippine Charity Sweepstakes winnings (500,000 x 20%) P100,000

Interest income received from a depository bank under EFCDS (300,000 x 15%) 45,000

Interest on peso bank deposit, Philippines (100,000 x 20%) 20,000

Total P165,000

Question 4

Gross sales, Philippines P3,000,000

Less: Cost of sales, Philippines 2,00,000

Gross business income, Philippines 1,000,000

Less: Business expenses, Philippines 200,000

Taxable income P 800,000

Tax due on P800,000 P 130,000

Less: Payments, first three quarters 50,000

Tax payable P 80, 000

Aside from income tax, the taxpayer is also liable to business tax.

END

Page 12 of 12 0915-2303213 www.resacpareview.com

You might also like

- Income Taxation Solution Manual 2019 Ed PDFDocument40 pagesIncome Taxation Solution Manual 2019 Ed PDFCah Cords100% (13)

- Individual Income TaxDocument13 pagesIndividual Income TaxDaniel Dialino100% (1)

- Alpha Graphics Company Was Organized On January 1,...Document10 pagesAlpha Graphics Company Was Organized On January 1,...Saima NargisNo ratings yet

- Income Taxation Banggawan 2019 Ed Solution ManualDocument40 pagesIncome Taxation Banggawan 2019 Ed Solution ManualVanilla VanillaNo ratings yet

- Tax Set A With Ans PDFDocument6 pagesTax Set A With Ans PDFXyza JabiliNo ratings yet

- Individual Income TaxDocument7 pagesIndividual Income TaxNadi Hood100% (3)

- 1 Taxation PreweekDocument25 pages1 Taxation PreweekJc Quismundo100% (1)

- Deductions From Gross IncomeDocument49 pagesDeductions From Gross IncomeRoronoa ZoroNo ratings yet

- Final Income TaxDocument3 pagesFinal Income Taxloonie tunesNo ratings yet

- Tax Answer-KeyDocument8 pagesTax Answer-KeyShirliz Jane Benitez100% (2)

- Reviewer in Taxation by AmponganDocument3 pagesReviewer in Taxation by AmponganTB0% (3)

- Fringe Benefit TaxDocument9 pagesFringe Benefit TaxAlexander Dimalipos100% (2)

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- (Tax) CPAR Preweek2Document7 pages(Tax) CPAR Preweek2Nor-janisah PundaodayaNo ratings yet

- Consulting 2Document2 pagesConsulting 2JL OriasNo ratings yet

- Final Tax LectureDocument7 pagesFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- TAX2 3RD ED Solutions Manual 1Document51 pagesTAX2 3RD ED Solutions Manual 1Nadine Isabelle OsisNo ratings yet

- TAX-1001 (Fringe Benefit Tax)Document6 pagesTAX-1001 (Fringe Benefit Tax)Ciarie SalgadoNo ratings yet

- SAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Document1 pageSAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Mharck Atienza100% (1)

- TAX.2811 Deductions From Gross IncomeDocument10 pagesTAX.2811 Deductions From Gross IncomeMary Ann Del PradoNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- Quiz 5B - Exclusions From Gross IncomeDocument11 pagesQuiz 5B - Exclusions From Gross IncomeMychie Lynne MayugaNo ratings yet

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- TAX 03 Fundamentals of Income Taxation PDFDocument9 pagesTAX 03 Fundamentals of Income Taxation PDFNita Costillas De MattaNo ratings yet

- Ast TX 801 Items of Gross Income (Batch 22)Document5 pagesAst TX 801 Items of Gross Income (Batch 22)Elijah MontefalcoNo ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- Income Tax ProblemsDocument6 pagesIncome Tax Problemskristian eldric BondocNo ratings yet

- Regular Income Tax: Bacc8 TaxationDocument18 pagesRegular Income Tax: Bacc8 TaxationsoonsNo ratings yet

- Taxation Final Pre Board Oct 2016Document13 pagesTaxation Final Pre Board Oct 2016Maryane AngelaNo ratings yet

- Income Tax Practice Questions 1Document8 pagesIncome Tax Practice Questions 1bamberoNo ratings yet

- H06 - Regular Income TaxationDocument7 pagesH06 - Regular Income Taxationnona galidoNo ratings yet

- Business Tax Reviewer UpdatedDocument36 pagesBusiness Tax Reviewer UpdatedCaptain ObviousNo ratings yet

- Individual Income TaxDocument4 pagesIndividual Income TaxCristopher Romero Danlog0% (1)

- Leonard 2Document8 pagesLeonard 2Leonard CañamoNo ratings yet

- (Tax) CPAR PreweekDocument4 pages(Tax) CPAR PreweekNor-janisah PundaodayaNo ratings yet

- Income Taxation QuizzerDocument41 pagesIncome Taxation QuizzerMarriz Tan100% (4)

- TAX Assessment October 2020Document8 pagesTAX Assessment October 2020FuturamaramaNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Tax Reviewer All About TaxationDocument8 pagesTax Reviewer All About TaxationJoanne MayNo ratings yet

- Ast TX 501 Individual, Estate and Trust Taxation (Batch 22)Document7 pagesAst TX 501 Individual, Estate and Trust Taxation (Batch 22)Herald Gangcuangco100% (1)

- Session 1 - Gross Income - Inclusions and ExclusionsDocument13 pagesSession 1 - Gross Income - Inclusions and ExclusionsABBIE GRACE DELA CRUZNo ratings yet

- Final Examination Income TaxDocument11 pagesFinal Examination Income TaxKristine Lumanaog100% (1)

- TAXATIONDocument24 pagesTAXATIONKriztleKateMontealtoGelogo100% (1)

- Income Taxation-IndividualDocument118 pagesIncome Taxation-Individualjovelyn labordoNo ratings yet

- CPAR Tax - CorporationDocument7 pagesCPAR Tax - CorporationChristian Mark Abarquez100% (4)

- IncomeTax Banggawan2019 Ch4Document15 pagesIncomeTax Banggawan2019 Ch4Noreen Ledda50% (8)

- IncomeTax Banggawan2019 Ch2Document10 pagesIncomeTax Banggawan2019 Ch2Noreen LeddaNo ratings yet

- Acco 4133 - Taxation: College of Accountancy and FinanceDocument10 pagesAcco 4133 - Taxation: College of Accountancy and FinanceNadi Hood100% (1)

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- Chap 6 MCQDocument3 pagesChap 6 MCQMahad SheikhNo ratings yet

- Week 2 (Principles of Taxation - Part 2)Document48 pagesWeek 2 (Principles of Taxation - Part 2)Beef TestosteroneNo ratings yet

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- (Tax) Casino First PreboardDocument5 pages(Tax) Casino First PreboardNor-janisah PundaodayaNo ratings yet

- Taxation Challenge - With Answer KeyDocument9 pagesTaxation Challenge - With Answer Keyariaseg100% (1)

- 4 Gross-IncomeDocument5 pages4 Gross-IncomeSamantha Nicole HoyNo ratings yet

- ESTATE TAX 1st Quiz Google Forms PDFDocument17 pagesESTATE TAX 1st Quiz Google Forms PDFJamaica DavidNo ratings yet

- Ast TX 502 Tax Rates For Individuals (Batch 22)Document5 pagesAst TX 502 Tax Rates For Individuals (Batch 22)CelestiaNo ratings yet

- Taxation Tax Rates For Individual Taxpayers, Estates and TrustsDocument5 pagesTaxation Tax Rates For Individual Taxpayers, Estates and TrustsSherri BonquinNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)Ciarie SalgadoNo ratings yet

- TAX-902 (Gross Income - Exclusions)Document5 pagesTAX-902 (Gross Income - Exclusions)Ciarie Salgado100% (1)

- Internship Ocular Visit: Quality/Quantity of Daily Task Accomplishments/Deadlines Communication SkillsDocument1 pageInternship Ocular Visit: Quality/Quantity of Daily Task Accomplishments/Deadlines Communication SkillsCiarie SalgadoNo ratings yet

- TAX-1001 (Fringe Benefit Tax)Document6 pagesTAX-1001 (Fringe Benefit Tax)Ciarie SalgadoNo ratings yet

- GshshahDocument113 pagesGshshahCiarie SalgadoNo ratings yet

- The Social Impact of Mobile Phones To NationalDocument9 pagesThe Social Impact of Mobile Phones To NationalCiarie SalgadoNo ratings yet

- Grade 9-POA RevisionDocument2 pagesGrade 9-POA RevisionGierome Ian BisanaNo ratings yet

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- Executive Compensation in World's Largest Corporations Increases by 5.5%Document2 pagesExecutive Compensation in World's Largest Corporations Increases by 5.5%Dumitru ErhanNo ratings yet

- Nuvama - Investor Presentation - Q2 FY 23 24 1Document50 pagesNuvama - Investor Presentation - Q2 FY 23 24 1Parasjkohli6659No ratings yet

- ACCO 2026 2nd Sem 2011 Finals SW2016 BlankDocument5 pagesACCO 2026 2nd Sem 2011 Finals SW2016 BlankSarah Quijan BoneoNo ratings yet

- Corporation - FBN SampleDocument1 pageCorporation - FBN SampleOliver EnriqueNo ratings yet

- Infosys Limited Balance Sheet As at March 31, Note 2013 2012 Equity and Liabilities Shareholders' FundsDocument29 pagesInfosys Limited Balance Sheet As at March 31, Note 2013 2012 Equity and Liabilities Shareholders' Fundsvikiabi28No ratings yet

- NSE Option Strategy PDFDocument31 pagesNSE Option Strategy PDFchanduanu2007No ratings yet

- CH-2-Study Guide PDFDocument15 pagesCH-2-Study Guide PDFnirali17No ratings yet

- Capital Structure in A Perfect Market: ©2017 Pearson Education, IncDocument10 pagesCapital Structure in A Perfect Market: ©2017 Pearson Education, IncShelby DavidsonNo ratings yet

- 2 A Study On Financial Performance of ICICI and IDBIDocument5 pages2 A Study On Financial Performance of ICICI and IDBIGUDDUNo ratings yet

- MTF (BSPL) Stock Pick - TATASTEEL - 17102023Document3 pagesMTF (BSPL) Stock Pick - TATASTEEL - 17102023riddhi SalviNo ratings yet

- How Do You Set Up A Family Trust in Hong KongDocument9 pagesHow Do You Set Up A Family Trust in Hong KongBernard ChungNo ratings yet

- 2017-2018 Company Law Subject Guide PDFDocument234 pages2017-2018 Company Law Subject Guide PDFSteven BretonNo ratings yet

- 1 - Basic DerivativesDocument154 pages1 - Basic DerivativesVipul KharwarNo ratings yet

- 1.5 Borrowing CostsDocument37 pages1.5 Borrowing CostsMinal BihaniNo ratings yet

- CorpoDocument2 pagesCorpoBerch MelendezNo ratings yet

- AP.3501 Audit of InventoriesDocument7 pagesAP.3501 Audit of InventoriesMarinoNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementTHE SHAYARI HOUSENo ratings yet

- Corporate Finance: Assignment 3 Suggested AnswersDocument10 pagesCorporate Finance: Assignment 3 Suggested AnswersvishalNo ratings yet

- Companies Act, 2013: Acceptance of Deposits by CompaniesDocument15 pagesCompanies Act, 2013: Acceptance of Deposits by Companiesniraliparekh27No ratings yet

- Statutory Compliance TrackerDocument6 pagesStatutory Compliance TrackerHemanth KanakamedalaNo ratings yet

- Outline: Master in Finance Professor: Manuel MorenoDocument22 pagesOutline: Master in Finance Professor: Manuel Morenoebi ayatNo ratings yet

- Investment BankingDocument74 pagesInvestment Bankingjoecool9969No ratings yet

- CA Final SFM Compiler Ver 6.0Document452 pagesCA Final SFM Compiler Ver 6.0Accounts Primesoft100% (1)

- Graduate School: AnswerDocument3 pagesGraduate School: AnswerIan Mark Loreto RemanesNo ratings yet

- CH 5 Returns, Discounts and Sales Tax N5Document16 pagesCH 5 Returns, Discounts and Sales Tax N5Soputivong NhemNo ratings yet

- PT Waskita Karya (Persero) TBK Dan Entitas Anak Laporan Keuangan Konsolidasian Untuk Tahun-Tahun Yang Berakhir Pada Tanggal 31 Desember 2014 Dan 2013Document134 pagesPT Waskita Karya (Persero) TBK Dan Entitas Anak Laporan Keuangan Konsolidasian Untuk Tahun-Tahun Yang Berakhir Pada Tanggal 31 Desember 2014 Dan 2013fikriaulia13No ratings yet