Professional Documents

Culture Documents

Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in India

Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in India

Uploaded by

Craft DealCopyright:

Available Formats

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Dividend Decision AT Icici: Master of Business AdministrationDocument71 pagesDividend Decision AT Icici: Master of Business AdministrationSaas4989 Saas4989No ratings yet

- On Buy Back Shares - NikhilDocument8 pagesOn Buy Back Shares - Nikhilnikhilgirhepunje100% (3)

- A Study On Impact of Dividend Announcements On Stock Prices in IndiaDocument5 pagesA Study On Impact of Dividend Announcements On Stock Prices in IndiaManju MahanandiaNo ratings yet

- Raju Research Paper 28Document10 pagesRaju Research Paper 28Sanju ChopraNo ratings yet

- IJCRT2302547Document9 pagesIJCRT2302547Aparna SHARMANo ratings yet

- Capital Structure Pattern of Companies in India: With Special Reference To The Companies Listed in National Stock ExchangeDocument10 pagesCapital Structure Pattern of Companies in India: With Special Reference To The Companies Listed in National Stock ExchangeSREEVISAKH V SNo ratings yet

- International Journal 13Document5 pagesInternational Journal 13Zain BukhariNo ratings yet

- Qualified Institutional Placements - An Exploratory Study in The Indian ContextDocument36 pagesQualified Institutional Placements - An Exploratory Study in The Indian ContextBRIJESHA MOHANTYNo ratings yet

- A Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesDocument22 pagesA Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesAnkit SarkarNo ratings yet

- Impact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaDocument3 pagesImpact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaBilal AhmedNo ratings yet

- Dividend Declaration and Stock Price Behavior: Indian EvidencesDocument11 pagesDividend Declaration and Stock Price Behavior: Indian EvidencesAKASHNo ratings yet

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaNo ratings yet

- Sectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketDocument18 pagesSectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketChan Hui YanNo ratings yet

- Impact of Corporate Governance On Dividend Policy A Systematic Literature Review of Last Two DecadesDocument19 pagesImpact of Corporate Governance On Dividend Policy A Systematic Literature Review of Last Two Decadesmrzia996No ratings yet

- A Study On Impact of Dividend Policy On Shareholders' Wealth of Selected Information Technology CompaniesDocument6 pagesA Study On Impact of Dividend Policy On Shareholders' Wealth of Selected Information Technology CompaniesMitesh JodhaNo ratings yet

- Dividend Announcements and The Abnormal Stock Returns For The Event Firm and Its RivalsDocument5 pagesDividend Announcements and The Abnormal Stock Returns For The Event Firm and Its RivalsLila GulNo ratings yet

- PaperpublishedDocument9 pagesPaperpublishedhammadshah786No ratings yet

- Factors Affecting Dividend Policy On LQDocument12 pagesFactors Affecting Dividend Policy On LQAnggiNo ratings yet

- Sip Shubham Ghodke C12Document43 pagesSip Shubham Ghodke C12shubhamghodke414No ratings yet

- Impact of DividendDocument17 pagesImpact of DividendHime Silhouette GabrielNo ratings yet

- The Effect of Dividend Policy On Stock Price: Evidence From The Indian MarketDocument9 pagesThe Effect of Dividend Policy On Stock Price: Evidence From The Indian MarketWilson SimbaNo ratings yet

- Merger Dan Akuisisi IndiaDocument277 pagesMerger Dan Akuisisi Indiamuhammad hayel wallaNo ratings yet

- Determinants of Dividend Policy of Indian Companies: A Panel Data AnalysisDocument20 pagesDeterminants of Dividend Policy of Indian Companies: A Panel Data Analysisshital_vyas1987No ratings yet

- An Analysis of Corporate Governance Imbroglio at InfosysDocument5 pagesAn Analysis of Corporate Governance Imbroglio at InfosysBen HiranNo ratings yet

- ImpactofGConDivPolicy Farheenpaper2Document15 pagesImpactofGConDivPolicy Farheenpaper2mrzia996No ratings yet

- Comparative Analysis of Total Corporate Disclosure of Selected IT Companies of IndiaDocument3 pagesComparative Analysis of Total Corporate Disclosure of Selected IT Companies of IndiaEditor IJTSRDNo ratings yet

- Ijerv 10 I 5 So 6 A CEOOverconfidenceDocument14 pagesIjerv 10 I 5 So 6 A CEOOverconfidenceMariam AlraeesiNo ratings yet

- Working CapitalDocument12 pagesWorking Capitalchirag PatwariNo ratings yet

- Research Paper On Dividend Policy in IndiaDocument7 pagesResearch Paper On Dividend Policy in Indiakpqirxund100% (1)

- MF 07 2019 0344Document17 pagesMF 07 2019 0344Julyanto Candra Dwi CahyonoNo ratings yet

- PRAVALLIKA - DaDocument13 pagesPRAVALLIKA - DaMohmmed KhayyumNo ratings yet

- Relationship Between Financial Leverage and Profitability Research PaperDocument16 pagesRelationship Between Financial Leverage and Profitability Research PaperDaksh BhandariNo ratings yet

- Impact of Ownership Sturcture On Dividend Policy of Firm: (Evidence From Pakistan)Document5 pagesImpact of Ownership Sturcture On Dividend Policy of Firm: (Evidence From Pakistan)Fahri FitrianaNo ratings yet

- The Impactof Credit Rating ChangesDocument17 pagesThe Impactof Credit Rating ChangesArpita ArtaniNo ratings yet

- IndianJournalofCorporateGovernance 2015 Roy 1 33Document34 pagesIndianJournalofCorporateGovernance 2015 Roy 1 33mrzia996No ratings yet

- Audit and Accounting Review (AAR) : Issn: 2790-8267 ISSN: 2790-8275 HomepageDocument24 pagesAudit and Accounting Review (AAR) : Issn: 2790-8267 ISSN: 2790-8275 HomepageAudit and Accounting ReviewNo ratings yet

- Chapter - 2 Literature ReviewDocument23 pagesChapter - 2 Literature ReviewMotiram paudelNo ratings yet

- Determinants of Dividend Payout: Evidence From Financial Sector of PakistanDocument12 pagesDeterminants of Dividend Payout: Evidence From Financial Sector of PakistanMayaz AhmedNo ratings yet

- 2 PBDocument7 pages2 PBBaekkichanNo ratings yet

- Impact of Dividend Policy On Shareholders Value A Study of Indian FirmsDocument39 pagesImpact of Dividend Policy On Shareholders Value A Study of Indian FirmsMilica Igic0% (1)

- 1 PBDocument12 pages1 PBsainada osaNo ratings yet

- Quantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesDocument6 pagesQuantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesPoonam KilaniyaNo ratings yet

- Artikel Penunjang 2Document14 pagesArtikel Penunjang 2AWash LaundryNo ratings yet

- Corporate Governance in An Emerging Market - What Does The Market Trust?Document23 pagesCorporate Governance in An Emerging Market - What Does The Market Trust?karlmedhoraNo ratings yet

- Comparative Study On Financial PerformanceDocument8 pagesComparative Study On Financial PerformancedurranibroseNo ratings yet

- Icciah 1Document7 pagesIcciah 1AadiNo ratings yet

- Financial Ratio Interpretation (ITC)Document12 pagesFinancial Ratio Interpretation (ITC)Gorantla SindhujaNo ratings yet

- Measures To Improve Life Insurance ProfitabilityDocument9 pagesMeasures To Improve Life Insurance ProfitabilityTirth ShahNo ratings yet

- Determinants of Dividend Policy: A Study of Sensex Incorporated CompaniesDocument7 pagesDeterminants of Dividend Policy: A Study of Sensex Incorporated CompaniesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- 4 CB 8Document9 pages4 CB 8maruzaks123No ratings yet

- Dividend Analysis at India Bulls: Project Report ON " "Document77 pagesDividend Analysis at India Bulls: Project Report ON " "Sankar BukkapatnamNo ratings yet

- Qualified Institutional Placement Vs Preferential Allotment: Choice of Seasoned Offering For Private Equity Placement in IndiaDocument6 pagesQualified Institutional Placement Vs Preferential Allotment: Choice of Seasoned Offering For Private Equity Placement in IndiaGedela BharadwajNo ratings yet

- An Empirical Analysis of Factors Influencing InvesDocument12 pagesAn Empirical Analysis of Factors Influencing InvesParthNo ratings yet

- EvolutionofMFinIndia PaperDocument22 pagesEvolutionofMFinIndia PaperSindhuNo ratings yet

- Impact of Dividend Announcements On Share Price of Selected PDFDocument5 pagesImpact of Dividend Announcements On Share Price of Selected PDFImtiaz BashirNo ratings yet

- Cheng Wan - Article 6Document14 pagesCheng Wan - Article 6Miss BakiaNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Benefits Management: How to Increase the Business Value of Your IT ProjectsFrom EverandBenefits Management: How to Increase the Business Value of Your IT ProjectsRating: 4 out of 5 stars4/5 (1)

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Chapter 2: Company Profile: Introduction About KIA MotorsDocument8 pagesChapter 2: Company Profile: Introduction About KIA MotorsCraft Deal100% (1)

- BB CH 4Document6 pagesBB CH 4Craft DealNo ratings yet

- Chapter 2: Company Profile: Introduction About TATA MotorsDocument5 pagesChapter 2: Company Profile: Introduction About TATA MotorsCraft DealNo ratings yet

- CH 5 Bharat BenzDocument2 pagesCH 5 Bharat BenzCraft DealNo ratings yet

- Basics of A DividendDocument4 pagesBasics of A DividendCraft DealNo ratings yet

- Chapter: - 5: 1) Tata Motors Recruitment & Selection ProcessDocument5 pagesChapter: - 5: 1) Tata Motors Recruitment & Selection ProcessCraft DealNo ratings yet

- KeywordDocument4 pagesKeywordCraft DealNo ratings yet

- A Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaDocument7 pagesA Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaCraft DealNo ratings yet

- In Billion Indian Rupees: Raw Material UseDocument4 pagesIn Billion Indian Rupees: Raw Material UseCraft DealNo ratings yet

- Ashok Leyland Chapter 5Document6 pagesAshok Leyland Chapter 5Craft DealNo ratings yet

- Bharat Benz ch-5Document4 pagesBharat Benz ch-5Craft DealNo ratings yet

- Symbol Series Date Close Price %: Asianpaint EQ 26/06/2020 1686.75 - 0.13%Document52 pagesSymbol Series Date Close Price %: Asianpaint EQ 26/06/2020 1686.75 - 0.13%Craft DealNo ratings yet

- Finding Not UseDocument4 pagesFinding Not UseCraft DealNo ratings yet

- Research MethodologyDocument8 pagesResearch MethodologyCraft DealNo ratings yet

- Mahindra and Mahindra Company of Marketing Department Mahindra of Products and ServicesDocument8 pagesMahindra and Mahindra Company of Marketing Department Mahindra of Products and ServicesCraft DealNo ratings yet

- A Study On Customer Satisfaction Towards Bharat Benz, Trident Automobiles PVT LTD, BangaloreDocument77 pagesA Study On Customer Satisfaction Towards Bharat Benz, Trident Automobiles PVT LTD, BangaloreCraft DealNo ratings yet

- Kia Motors Chapter 3Document8 pagesKia Motors Chapter 3Craft Deal100% (1)

- Intraduction of Automobile CompanyDocument4 pagesIntraduction of Automobile CompanyCraft DealNo ratings yet

- Honda Motors CH 3Document6 pagesHonda Motors CH 3Craft DealNo ratings yet

- CF (Collected)Document76 pagesCF (Collected)Akhi Junior JMNo ratings yet

- Homework 3Document2 pagesHomework 3Ishrat PopyNo ratings yet

- Advantages of The Depository SystemDocument7 pagesAdvantages of The Depository SystemKARISHMAATA2No ratings yet

- Finalproject SharekhanDocument89 pagesFinalproject SharekhanRam Krishna KrishNo ratings yet

- Investment & Portfolio Management - Assignment Four - Smart 3BDocument6 pagesInvestment & Portfolio Management - Assignment Four - Smart 3BAhmed AzazyNo ratings yet

- Gitman Chapter 12Document21 pagesGitman Chapter 12Hannah Jane UmbayNo ratings yet

- Analisis Fundamentalde EmpresasDocument6 pagesAnalisis Fundamentalde EmpresasJHON JANER RODRIGUEZ MONTERONo ratings yet

- Select Emerging Manager ProgramsDocument2 pagesSelect Emerging Manager ProgramsDavid Toll100% (2)

- Pecking Order When "Style"Document52 pagesPecking Order When "Style"Akshay RawatNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- Contemporary Financial Management 13th Edition Moyer Test Bank DownloadDocument31 pagesContemporary Financial Management 13th Edition Moyer Test Bank DownloadWilliam Hopkins100% (36)

- FSB - 01 - Idcl (1) 2Document3 pagesFSB - 01 - Idcl (1) 2Siri VallabhaneniNo ratings yet

- A Study On Performance Evaluation of Equity Share and Mutual FundsDocument33 pagesA Study On Performance Evaluation of Equity Share and Mutual FundsDev ChoudharyNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- Old Bridge Mutual Fund - Factsheet March 2024Document8 pagesOld Bridge Mutual Fund - Factsheet March 2024Bharathi 3280No ratings yet

- COST OF CAPITAL PLUS OBJsDocument5 pagesCOST OF CAPITAL PLUS OBJsEmmmanuel ArthurNo ratings yet

- ClassSession 26 - Dell Case - HandoutsDocument43 pagesClassSession 26 - Dell Case - Handoutsdrey baxterNo ratings yet

- Assignment # 6Document9 pagesAssignment # 6Ahtsham Ilyas RajputNo ratings yet

- 7 - Dematerialisation DemutualisationDocument4 pages7 - Dematerialisation DemutualisationPriyadarshi Kirti GouravNo ratings yet

- Thomas J. Ivey: Partner, Palo AltoDocument2 pagesThomas J. Ivey: Partner, Palo AltoMike AmbrosinoNo ratings yet

- Wa0021.Document16 pagesWa0021.Ahmed GaberNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- ADRIAN MANZ First Hour Super StrategiesDocument37 pagesADRIAN MANZ First Hour Super StrategiesAnonymous LhmiGjO100% (4)

- The Fidelity Guide To Equity InvestingDocument16 pagesThe Fidelity Guide To Equity Investingmandar LawandeNo ratings yet

- Chapter 7 Investment in Equity SecuritiesDocument12 pagesChapter 7 Investment in Equity SecuritiesGirlie Ann JimenezNo ratings yet

- Chapter 13 Problems (Ch. 12 in The 4 Edition) : (After Tax)Document2 pagesChapter 13 Problems (Ch. 12 in The 4 Edition) : (After Tax)Ahad SultanNo ratings yet

- What Is A StockDocument16 pagesWhat Is A StockRomeo Bea BaynosaNo ratings yet

- Adani Gas (2020)Document165 pagesAdani Gas (2020)insaafduggal33No ratings yet

- AUBDocument33 pagesAUBbsu.gurlsNo ratings yet

Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in India

Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in India

Uploaded by

Craft DealOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in India

Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in India

Uploaded by

Craft DealCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/308277131

EFFECT OF EX-DIVIDEND DATE ON STOCK RETURNS OF NIFTY STOCKS IN

INDIA

Article · September 2016

DOI: 10.20319/pijss.2016.s21.236248

CITATIONS READS

0 218

2 authors:

Lakshmi Rawat Mary Jessica Velugu

Vishwa Vishwani Institute of Systems & Management University of Hyderabad

2 PUBLICATIONS 0 CITATIONS 3 PUBLICATIONS 0 CITATIONS

SEE PROFILE SEE PROFILE

All content following this page was uploaded by Lakshmi Rawat on 09 November 2018.

The user has requested enhancement of the downloaded file.

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Lakshmi Rawat & Mary Jessica

Special Issue Volume 2 Issue 1, pp. 236-248

DOI-http://dx.doi.org/10.20319/ pijss.2016.s21.236248

EFFECT OF EX-DIVIDEND DATE ON STOCK RETURNS OF

NIFTY STOCKS IN INDIA

Lakshmi Rawat

Research Scholar, School of Management Studies, University of Hyderabad, Telangana, India

f11lakshmir@iima.ac.in

f11lakshmir@iimahd.ernet.in

Mary Jessica

Associate Professor, School of Management Studies, University of Hyderabad, Telangana, India

Abstract

In the present study we examine the impact of ex-dividend day on stock returns to Indian

companies listed under Nifty 50 companies during the period 2011-2015 both inclusive. We

examine the daily abnormal returns for 61 days, 31 days and 11 days event window using event

study methodology with an estimation period of 250 days prior to ex-dividend date. Abnormal

returns have been calculated using Market Model with Nifty index as proxy for market returns.

To test the significant of Average Abnormal Returns both parametric and non-parametric tests

has been used, that is paired t –test and Wilcoxon Signed Rank Test. We conclude from the

analysis of the study that AAR have been statistically significant for 31 days event window, with

an average mean of 0.0944 during preannouncement and -.0960 average mean during post

announcement. This implies that, there had been very high actual returns during the pre-

announcement period indicating positive market reaction.

Keywords

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 236

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Dividend, Market Model, Average Abnormal Returns, Event Study

1. Introduction:

Indian corporate sector has been on a high development phase ever since the

Liberalization, Privatization and Globalization policy was introduced in 1990’s. Supply of

investment in Indian is sourced from government, semi-government, LIC, Corporate and other

institutions sources which are from India and Foreign origin. However, a small portion is owned

by individual investors as well. There are two major indices that are National Stock Exchange

(NSE) established in 1992 and Bombay Stock Exchange (BSE) established in 1875 which

operative from Mumbai, Maharashtra in India. NSE and BSE have about 5163 and 1635

companies listed as on July, 2013 respectively. The main index of BSE is SENSEX – Sensitivity

Index and comprises of 30 major stocks whereas, NSE major index is NIFTY and it comprises of

50 stocks of companies from various industries.

Dividends have been a means of attracting investors as it increases overall returns.

Information about dividend is one of the most awaited one by stock holders and react market

much before the ex-dividend date. According to Securities and Exchange Board of India (SEBI)

companies announce Dividend Payment and Ex-dividend dates during Annual General Meeting

along with other important and relevant information. All companies during AGM preset details

on the declaration of dividends, dividend payout ratio; ex-dividend dates after the consent of

board members and henceforth publishes such information through different channels of

information. Now, this becomes public information.

A dividend on stock is the proportion of profit the company pays to its shareholders.

There are two major types of dividend (1) Cash Dividends and (2) Stock Dividends (Bonus). A

Cash dividend is payment made from earnings of the company for a particular period to its

shareholders in the form of cash/cheque or electronic transfers. Shareholders also receive tax

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 237

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

burden along with cash dividend therefore lowering the final value of stock returns through

dividend, however this is a source of regular income to their investment.

Stock dividend implies distribution of shares in addition to cash dividend (known as

bonus shares in India) to the existing shareholders of the company. It increases the volume of

company’s shares and reduces the retained earnings of the company. Whereas, dividends

generally meaning cash dividend have an impact on the financial position of corporates by

reducing the retained earnings, stock dividend do not have an impact on financial position of the

companies. From the market perspective however, dividends information may bring in good or

bad news for investors.

2. Literature Review:

Some important theories of dividend policy in financial management are

2.1 Walter Model

With the assumption of retained earnings as a source of financial investment for firms,

constant rate of return on equity and endless life of firm; the model proposes that the firm has

two ways of using retained earnings either distribute it in the form of dividends or use it for other

investment opportunities. Therefore, if rate of return (r) from investment is less than Ke (cost of

equity) the firm should have no investment from retained earnings, if r>Ke then firm should have

zero payout and no investment and incase of r=Ke, firm is indifferent.

2.2 Gordon Model

The assumptions are similar to Walter Model and in addition they believe that growth

rate of the firm is determined by the product of retention ratio (b) and rate of return ® and the

cost of equity capital (Ke) is higher than growth rate (g). Gordon’s growth model is also known

as “Bird in Hand Theory” which states that current dividends are important in determining the

future value of the firm. Therefore, if (r) is the rate of return on investment and (k) is the cost of

capital, then if (r>K) it implies that decrease in share price, (r<k) implies increase in share price

and (r=k) no change.

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 238

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

2.3 Modigliani and Miller Hypothesis

The dividend policy would not influence market price. In a case of investment of

retained earnings in other opportunities with higher returns would cause an increase in the

earnings of the firm consequently generating income for investors. Therefore in a case where

retained earnings are distributed in the form of dividends or otherwise invested in better

opportunities would generate returns for investors. It can therefore we concluded that it’s the

investment pattern and earnings of the firm that affect stock prices or value of the firm. There

are relevant assumptions of the theory.

2.4 Clientele Effect Theory

Companies stock prices change along with the changes in investor goals and demands.

These return influenced by changes in tax, dividend or any other policy change that affect

corporates.

Other corporate announcements include Stock Splits and Rights Issue announcements.

Stock Splits are an event where corporates divide existing shares into new shares (Baker, 2009)

so that the proportional ownership of the share does not change. This leads to a reduced share

price per share and no change in the stock market capitalization. (Fama, Fisher, Jensen, & Roll,

1909) in the seminal paper on stock splits using event study reported positive residuals for stock

splits in the months around stock splits.

One of the earliest research by (Kalay, 1982) which explains that the correlation between

ex-dividend date price drop and the dividend yield is positive which is consistent with a tax

effect and a tax induced clientele effect. (Garrett & Priestley, 2000) find significant evidence of

dividend smoothing and dividend conveying information regarding unexpected positive changes

in current permanent earnings. (Mehta, Jain, & Yadav, 2014) Study on Stock dividend shows

that announcements induce an increase in the wealth of the shareholders. In India there is price

stability. (Bashir, 2013) Study in Karachi Stock Exchange for 31 rights issue announcements

during 2008-2011 using event study analysis conclude that there is no indication of

announcement effect (i.e.) no wealth. Maximum of investors (Conroy et.al., 1999) reveal

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 239

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

through their study that stock Splits are designed by managers to achieve the company’s stock

price to the level achieved after the last split. It is interpreted as positive information by

investors and managers. (Baker, 2009) gives interesting conclusions from the study, stock prices

are not significant affected by such new stock distribution per se whether or not these

distribution are splits or stock dividends, and whether or not the distributions are processed

during bull, bear or no change markets. Therefore, decisions regarding such distributions should

be based on the costs to the firm and its stockholders. If process cost of a new stock distribution

is large, the new distribution may not be useful to the firm’s advantage.

3. Need for Study

There have been very few comprehensive studies to understand the effect of dividend

announcement using ex-dividend date on stock returns in Indian perspective in recent times.

With the emerging trends in financial sectors and recent development in regulation system in

India and outreach of media, there is a need to study this aspect. Therefore consider Nifty 50

stocks in the sample as they have a better visibility in the market.

4. Objectives of the Study

To investigate the effect of ex-dividend date on stock returns of Stocks listed in Nifty 50.

To understand the trend of CAAR during the pre-announcement and post-announcement

window.

Testable Hypotheses:

Hypothesis 1: H0 - There are no significant AAR during event window for 61 days.

Hypothesis 2: H0 - There are no significant AAR during event window for 31 days.

Hypothesis 3: H0 - There are no significant AAR during event window for 11 days.

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 240

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

5. Research Methodology:

One of the most popularly used methods is event study analysis, to capture effect of an

event on stock returns. (Brown & Warner, 1980, 1985); (Bowman, 1983) following terms are

important value before we start using this methodology.

5.1 Event:

It is the occurrence of a particular action occurring at a specific time, and is expected to

convey some information. Day “0” is the event day for each announcement/security.

5.2 Estimation Period

It is the period for which daily returns observations for the period before the event

window are drawn and used for estimating expected returns. In present case we use 250 days

event period which is commonly used in most of the event study analysis.

5.3 Event Window

The time duration selected before and after the event being considered to study the

variance in abnormal return. In present study we use three different event windows that are 61

days, 31 days and 11 days.

5.4 Estimation Model: the model used to calculate estimated returns for each security. Market

model is a statistical model which relates the return of any given security to the return of the

market portfolio. Models with linear specification follow from the assumed joint normality of

asset returns. For any security ‘i’ the market models abnormal returns are calculated using the

market model, which is commonly used in event studies to measure abnormal returns (Strong,

1992).

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 241

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Figure 1: Event Study Estimation Period

We use the single factor market model for estimating the expected returns from the

estimation period of 250 days prior to 30 days of ex-dividend date. Daily returns are calculated

for each day using data from NSE website for 50 companies listed in Table :1 in appendix. The

Nifty 50 Index represents 50 companies from 13 sectors with 65% of free float market

capitalization of stocks listed with Nifty as on 31st, March 2016. It is used mostly for

benchmarking of portfolios, index based derivatives and index funds. As mentioned by NSE

India the impact cost of the Nifty 50 for a portfolio size of Rs.50 lakhs is 0.04% for the month

March 2016. Nifty 50 is professionally maintained and is ideal for derivatives trading.

The equation used is :

Ri, t = αi + βi * Rm + ε i,t……………………………….. (1)

Where, Ri, t is the return from stock i at time t, αi and βi are the estimated values and ε i,t is the

error term which is assumed to be ‘0’.

Abnormal returns calculated using:

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 242

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

ARi,t = Ri, t – ( αi + βi * Rm )…………..(2)

The Average Abnormal Returns:

……………………….(3)

CARi (t1, t2) where t1< t2 < t3 <……..t

Cumulative Average Abnormal Returns: Abnormal Returns must be aggregated to

draw overall inference for each announcement across two dimensions, through time and across

securities. CAR is used to accommodate multiple period event windows.

Significance of Abnormal Returns:

Using parametric tests such as t test the assumption of normality is different to test. As

tells in India with t-d was on time. Estimate of standard division of the average Abnormal

returns under the null hypothesis of normal performance. Non-parametric tests reject the

hypothesis of positive abnormal returns, few times when testing for negative abnormal data (as

in the data relevant to daily stock prices. Generalised sign test, Wilcoxon signed ranks test as it

connects both sign and magnitude of abnormal returns. The assumption of Wilcoxon test is that

numbers of absolute values are equal and each is different from zero.

5.6 Samples for the Study:

The sample for present study includes dividend announcement from 50 stocks listed with

Nifty 50. Initial actual dates of ex-dividend were collected NSE website and

www.moneycontrol.com website. Overall there were 249 dividend announcements, from which

there was overlap of ex-dividend dates for 104 events; hence a sample of 125 events is used for

further analysis from the period 2011 to 2015. Exclusion of the overlapping dates is done to

ensure that the event window is not influence by any other announcement which occurs

simultaneously.

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 243

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

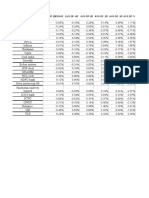

AAR(%)

0.5

0.4

0.3

0.2

0.1

0 AAR(%)

-0.1 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 55 58 61

-0.2

-0.3

-0.4

-0.5

Figure 2: Analysis of Ex-dividend dates AAR

A visual inspection of the trend of AAR indicates that during the preannouncement

period day 1 to 30 the trend is mostly positive and most positive around day 19, whereas we find

that during the post announcement period that is from day 31 to 61 most of AAR’s are negative

and mostly around day 37. Cumulative Abnormal Returns show a positive trend during days 14

to day 26 after which CAR’s have declined to negative.

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 244

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

CAR(%)

1

0.5

0

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 55 58 61

-0.5 CAR(%)

-1

-1.5

-2

Figure 3: Analysis of Ex-dividend dates CAAR

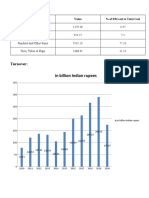

Table 1: Results of Ex-Dividend Date Analysis

Paired Samples Statistics

Sig. (2-tailed) Test Sig. at 5%

Mean N t df t-test Wilcoxen Test Decision

DIVPRE30 .0215 30 Cannot

Pair 1

DIVPOST30 -.0636 30 1.98 29 0.058 0.125 Reject

DIVPRE15 .0945 15

Pair 2

DIVPOST15 -.0960 15 3.00 14 0.009 0.015 Rejected

DIVPRE5 -.0447 5 Cannot

Pair 3

DIVPOST5 -.0780 5 1.41 4 0.231 0.225 Reject

On account of frequent fluctuation in abnormal returns in the present study we have

analysed data for three event periods Pair 1 for 61 days, (i.e.) 30 days during pre-announcement

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 245

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

and 30 days post-announcement similarly for Pair 2 for 31 days and Pair 3 for 11 days. Paired

sample t-test is generally used for testing the significance of variance in mean for event study

methodology for parametric test, and Wilcoxen Test as non-parametric test. From the above

table we understand that Pair 2 indicates statistically significant results at 95% confidence

interval for both t-test and Wilcoxen test. Therefore we find that there is a significant difference

in abnormal returns during 15 days before and after announcement. Both tests confirm with

similar results.

6. Conclusions

From the results we draw conclusion that CAR are positive mostly during day 19 to day

27 of event window. A positive CAR is an indication to investors in market that the stocks are

doing better than the estimated returns hence; investors can get higher returns if they invest in

stocks during the time when CAR is negative and withdraw when CAR becomes positive. From

figure 3, we understand CAR are negative during day 14, so this could perhaps be the right time

to make buy decision, and then hold until day 25-26, where we find CAR are at the peak so this

is the right time to sell the stocks to make highest returns.

It can also be confirmed from the results that 31 days event window has attracted lot of

investor attention, we can be found from Table 1 results, there is a significant difference in

means of Abnormal Returns for 15 days pre announcement and 15 days post announcement

period. Results of paired t- test at 95% confidence interval shows that the p values are 0.009,

95% and when tested using Non-parametric test (i.e.) Wilcoxon Sign Test at 95% confidence

interval p values are 0.015. As both values for 31 days estimation period are less than 0.05, we

conclude that there is statistically significant difference.

Efficient market theory states about the presence of three form of market efficiency for

information, the present research is inclined to test for the presence of semi-strong form of

market efficiency. Information about ex-dividend dates is publicly available information and

from the present study it can be concluded that Indian markets has reacted to this information.

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 246

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

The present study is restricted to 50 companies listed with Nifty and only annual dividend

announcement has been considered the scope of the study was limited. There is further scope to

investigate the effect of dividend announcements in Indian markets for different types of

dividend announcements and sector wise study of companies.

Table 2: List of Nifty Companies used as Sample for Study

S.No. COMPANY NAME INDUSTRY

1 ACC Ltd. CEMENT & CEMENT PRODUCTS

2 Ambuja Cements Ltd. CEMENT & CEMENT PRODUCTS

3 Asian Paints Ltd. CONSUMER GOODS

4 Axis Bank FINANCIAL SERVICES

5 Bajaj Auto Ltd. AUTOMOBILE

6 Bank of Baroda FINANCIAL SERVICES

7 Bharat Heavy Electricals Ltd. INDUSTRIAL MANUFACTURING

8 Bharat Petroleum Corporation Ltd. ENERGY

9 Bharti Airtel Ltd. TELECOM

10 Cairn India Ltd. ENERGY

11 Cipla Ltd. PHARMA

12 Coal India Ltd. METALS

13 DLF Ltd. CONSTRUCTION

14 Dr. Reddy's Laboratories Ltd. PHARMA

15 GAIL (India) Ltd. ENERGY

16 Grasim Industries Ltd. CEMENT & CEMENT PRODUCTS

17 HCL Technologies Ltd. IT

18 HDFC Bank Ltd. FINANCIAL SERVICES

19 Hero MotoCorp Ltd. AUTOMOBILE

20 Hindalco Industries Ltd. METALS

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 247

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

21 Hindustan Unilever Ltd. CONSUMER GOODS

22 Housing Development Finance Corporation Ltd. FINANCIAL SERVICES

23 I T C Ltd. CONSUMER GOODS

24 ICICI Bank Ltd. FINANCIAL SERVICES

25 IDFC Ltd. FINANCIAL SERVICES

26 IndusInd Bank Ltd. FINANCIAL SERVICES

27 Infosys Ltd. IT

28 Jaiprakash Associates Ltd. CONSTRUCTION

29 Jindal Steel & Power Ltd. METALS

30 Kotak Mahindra Bank Ltd. FINANCIAL SERVICES

31 Larsen & Toubro Ltd. CONSTRUCTION

32 Lupin Ltd. PHARMA

33 Mahindra & Mahindra Ltd. AUTOMOBILE

34 Maruti Suzuki India Ltd. AUTOMOBILE

35 NMDC Ltd. METALS

36 NTPC Ltd. ENERGY

37 Oil & Natural Gas Corporation Ltd. ENERGY

38 Power Grid Corporation of India Ltd. ENERGY

39 Punjab National Bank FINANCIAL SERVICES

40 Ranbaxy Laboratories Ltd. PHARMA

41 Reliance Industries Ltd. ENERGY

42 Sesa Sterlite Ltd. METALS

43 State Bank of India FINANCIAL SERVICES

44 Sun Pharmaceutical Industries Ltd. PHARMA

45 Tata Consultancy Services Ltd. IT

46 Tata Motors Ltd. AUTOMOBILE

47 Tata Power Co. Ltd. ENERGY

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 248

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

48 Tata Steel Ltd. METALS

49 Ultra Tech Cement Ltd. CEMENT & CEMENT PRODUCTS

50 Wipro Ltd. IT

REFERENCES

Baker, Kent. (2009). Dividends and Dividend Policy. (1st ed.). Retrieved 2nd , January, 2014,

fromhttps://books.google.co.in/books?id=3m6URysvb3QC&printsec=frontcover&source

=gbs_ge_summary_r&cad=0#v=onepage&q&f=false.

Bashir, Adnan. (2013). Impact of Right Issues Announcement on Shareholders Wealth: Case

Study of Pakistani Listed Companies. International Journal of Contemporary Business

Studies, 4(3), 6-12. Retrieved from doi: http://www.akpinsight.webs.com.

Brown, Stephen. J., & Jerold, B. Warner. (1985). Using Daily Stock Returns : A Case of Event

Studies. Journal of Financial Economics, 14,pp-3-34. Retrieved from doi:

http://dx.doi.org/10.1016/0304-405X(85)90042-X7.

Conroy, Robert S., & Bruce, Harris. (1990). The Effects of Stock Splits on Bid- Ask Spreads.

Journal of Finance, 4(4), 1285-1295.

Eugene, F. Fama., Fisher, Lawrence., Jensen, Michael C., & Roll, Richard. (1969). The

Adjustment of Stock Prices to New Information, International Economic Review,

Volume 10, Issue 1 (Feb., 1969), l-2l.

Garrett, Ian., & Priestley, Richard. (2000). Dividend Behavior and Signaling, Journal of

Financial and Quantitative Analysis, 35(2), 173-189.

Kalay, Avner. (1982). The Ex-Dividend Day Behavior of Stock Prices: A Re-Examination of the

Clientele Effect. The Journal of Finance, 37(4). 1059-1070. Retrieved from doi:

http://dx.doi.org/10.1111/j.1540-6261.1982.tb03598.x

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 249

PEOPLE: International Journal of Social Sciences

ISSN 2454-5899

Mehta, Chhavi., Jain, P.K., & Yadav, S. Surender. (2014). Market Reaction to Stock Dividends:

Evidence from India. Vikalpa, 39(4), pp- 55-74.

© 2016 The author and GRDS Publishing. All rights reserved.

Available Online at: http://grdspublishing.org/journals-PEOPLE-home 250

View publication stats

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Dividend Decision AT Icici: Master of Business AdministrationDocument71 pagesDividend Decision AT Icici: Master of Business AdministrationSaas4989 Saas4989No ratings yet

- On Buy Back Shares - NikhilDocument8 pagesOn Buy Back Shares - Nikhilnikhilgirhepunje100% (3)

- A Study On Impact of Dividend Announcements On Stock Prices in IndiaDocument5 pagesA Study On Impact of Dividend Announcements On Stock Prices in IndiaManju MahanandiaNo ratings yet

- Raju Research Paper 28Document10 pagesRaju Research Paper 28Sanju ChopraNo ratings yet

- IJCRT2302547Document9 pagesIJCRT2302547Aparna SHARMANo ratings yet

- Capital Structure Pattern of Companies in India: With Special Reference To The Companies Listed in National Stock ExchangeDocument10 pagesCapital Structure Pattern of Companies in India: With Special Reference To The Companies Listed in National Stock ExchangeSREEVISAKH V SNo ratings yet

- International Journal 13Document5 pagesInternational Journal 13Zain BukhariNo ratings yet

- Qualified Institutional Placements - An Exploratory Study in The Indian ContextDocument36 pagesQualified Institutional Placements - An Exploratory Study in The Indian ContextBRIJESHA MOHANTYNo ratings yet

- A Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesDocument22 pagesA Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesAnkit SarkarNo ratings yet

- Impact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaDocument3 pagesImpact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaBilal AhmedNo ratings yet

- Dividend Declaration and Stock Price Behavior: Indian EvidencesDocument11 pagesDividend Declaration and Stock Price Behavior: Indian EvidencesAKASHNo ratings yet

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaNo ratings yet

- Sectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketDocument18 pagesSectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketChan Hui YanNo ratings yet

- Impact of Corporate Governance On Dividend Policy A Systematic Literature Review of Last Two DecadesDocument19 pagesImpact of Corporate Governance On Dividend Policy A Systematic Literature Review of Last Two Decadesmrzia996No ratings yet

- A Study On Impact of Dividend Policy On Shareholders' Wealth of Selected Information Technology CompaniesDocument6 pagesA Study On Impact of Dividend Policy On Shareholders' Wealth of Selected Information Technology CompaniesMitesh JodhaNo ratings yet

- Dividend Announcements and The Abnormal Stock Returns For The Event Firm and Its RivalsDocument5 pagesDividend Announcements and The Abnormal Stock Returns For The Event Firm and Its RivalsLila GulNo ratings yet

- PaperpublishedDocument9 pagesPaperpublishedhammadshah786No ratings yet

- Factors Affecting Dividend Policy On LQDocument12 pagesFactors Affecting Dividend Policy On LQAnggiNo ratings yet

- Sip Shubham Ghodke C12Document43 pagesSip Shubham Ghodke C12shubhamghodke414No ratings yet

- Impact of DividendDocument17 pagesImpact of DividendHime Silhouette GabrielNo ratings yet

- The Effect of Dividend Policy On Stock Price: Evidence From The Indian MarketDocument9 pagesThe Effect of Dividend Policy On Stock Price: Evidence From The Indian MarketWilson SimbaNo ratings yet

- Merger Dan Akuisisi IndiaDocument277 pagesMerger Dan Akuisisi Indiamuhammad hayel wallaNo ratings yet

- Determinants of Dividend Policy of Indian Companies: A Panel Data AnalysisDocument20 pagesDeterminants of Dividend Policy of Indian Companies: A Panel Data Analysisshital_vyas1987No ratings yet

- An Analysis of Corporate Governance Imbroglio at InfosysDocument5 pagesAn Analysis of Corporate Governance Imbroglio at InfosysBen HiranNo ratings yet

- ImpactofGConDivPolicy Farheenpaper2Document15 pagesImpactofGConDivPolicy Farheenpaper2mrzia996No ratings yet

- Comparative Analysis of Total Corporate Disclosure of Selected IT Companies of IndiaDocument3 pagesComparative Analysis of Total Corporate Disclosure of Selected IT Companies of IndiaEditor IJTSRDNo ratings yet

- Ijerv 10 I 5 So 6 A CEOOverconfidenceDocument14 pagesIjerv 10 I 5 So 6 A CEOOverconfidenceMariam AlraeesiNo ratings yet

- Working CapitalDocument12 pagesWorking Capitalchirag PatwariNo ratings yet

- Research Paper On Dividend Policy in IndiaDocument7 pagesResearch Paper On Dividend Policy in Indiakpqirxund100% (1)

- MF 07 2019 0344Document17 pagesMF 07 2019 0344Julyanto Candra Dwi CahyonoNo ratings yet

- PRAVALLIKA - DaDocument13 pagesPRAVALLIKA - DaMohmmed KhayyumNo ratings yet

- Relationship Between Financial Leverage and Profitability Research PaperDocument16 pagesRelationship Between Financial Leverage and Profitability Research PaperDaksh BhandariNo ratings yet

- Impact of Ownership Sturcture On Dividend Policy of Firm: (Evidence From Pakistan)Document5 pagesImpact of Ownership Sturcture On Dividend Policy of Firm: (Evidence From Pakistan)Fahri FitrianaNo ratings yet

- The Impactof Credit Rating ChangesDocument17 pagesThe Impactof Credit Rating ChangesArpita ArtaniNo ratings yet

- IndianJournalofCorporateGovernance 2015 Roy 1 33Document34 pagesIndianJournalofCorporateGovernance 2015 Roy 1 33mrzia996No ratings yet

- Audit and Accounting Review (AAR) : Issn: 2790-8267 ISSN: 2790-8275 HomepageDocument24 pagesAudit and Accounting Review (AAR) : Issn: 2790-8267 ISSN: 2790-8275 HomepageAudit and Accounting ReviewNo ratings yet

- Chapter - 2 Literature ReviewDocument23 pagesChapter - 2 Literature ReviewMotiram paudelNo ratings yet

- Determinants of Dividend Payout: Evidence From Financial Sector of PakistanDocument12 pagesDeterminants of Dividend Payout: Evidence From Financial Sector of PakistanMayaz AhmedNo ratings yet

- 2 PBDocument7 pages2 PBBaekkichanNo ratings yet

- Impact of Dividend Policy On Shareholders Value A Study of Indian FirmsDocument39 pagesImpact of Dividend Policy On Shareholders Value A Study of Indian FirmsMilica Igic0% (1)

- 1 PBDocument12 pages1 PBsainada osaNo ratings yet

- Quantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesDocument6 pagesQuantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesPoonam KilaniyaNo ratings yet

- Artikel Penunjang 2Document14 pagesArtikel Penunjang 2AWash LaundryNo ratings yet

- Corporate Governance in An Emerging Market - What Does The Market Trust?Document23 pagesCorporate Governance in An Emerging Market - What Does The Market Trust?karlmedhoraNo ratings yet

- Comparative Study On Financial PerformanceDocument8 pagesComparative Study On Financial PerformancedurranibroseNo ratings yet

- Icciah 1Document7 pagesIcciah 1AadiNo ratings yet

- Financial Ratio Interpretation (ITC)Document12 pagesFinancial Ratio Interpretation (ITC)Gorantla SindhujaNo ratings yet

- Measures To Improve Life Insurance ProfitabilityDocument9 pagesMeasures To Improve Life Insurance ProfitabilityTirth ShahNo ratings yet

- Determinants of Dividend Policy: A Study of Sensex Incorporated CompaniesDocument7 pagesDeterminants of Dividend Policy: A Study of Sensex Incorporated CompaniesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- 4 CB 8Document9 pages4 CB 8maruzaks123No ratings yet

- Dividend Analysis at India Bulls: Project Report ON " "Document77 pagesDividend Analysis at India Bulls: Project Report ON " "Sankar BukkapatnamNo ratings yet

- Qualified Institutional Placement Vs Preferential Allotment: Choice of Seasoned Offering For Private Equity Placement in IndiaDocument6 pagesQualified Institutional Placement Vs Preferential Allotment: Choice of Seasoned Offering For Private Equity Placement in IndiaGedela BharadwajNo ratings yet

- An Empirical Analysis of Factors Influencing InvesDocument12 pagesAn Empirical Analysis of Factors Influencing InvesParthNo ratings yet

- EvolutionofMFinIndia PaperDocument22 pagesEvolutionofMFinIndia PaperSindhuNo ratings yet

- Impact of Dividend Announcements On Share Price of Selected PDFDocument5 pagesImpact of Dividend Announcements On Share Price of Selected PDFImtiaz BashirNo ratings yet

- Cheng Wan - Article 6Document14 pagesCheng Wan - Article 6Miss BakiaNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Benefits Management: How to Increase the Business Value of Your IT ProjectsFrom EverandBenefits Management: How to Increase the Business Value of Your IT ProjectsRating: 4 out of 5 stars4/5 (1)

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Chapter 2: Company Profile: Introduction About KIA MotorsDocument8 pagesChapter 2: Company Profile: Introduction About KIA MotorsCraft Deal100% (1)

- BB CH 4Document6 pagesBB CH 4Craft DealNo ratings yet

- Chapter 2: Company Profile: Introduction About TATA MotorsDocument5 pagesChapter 2: Company Profile: Introduction About TATA MotorsCraft DealNo ratings yet

- CH 5 Bharat BenzDocument2 pagesCH 5 Bharat BenzCraft DealNo ratings yet

- Basics of A DividendDocument4 pagesBasics of A DividendCraft DealNo ratings yet

- Chapter: - 5: 1) Tata Motors Recruitment & Selection ProcessDocument5 pagesChapter: - 5: 1) Tata Motors Recruitment & Selection ProcessCraft DealNo ratings yet

- KeywordDocument4 pagesKeywordCraft DealNo ratings yet

- A Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaDocument7 pagesA Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaCraft DealNo ratings yet

- In Billion Indian Rupees: Raw Material UseDocument4 pagesIn Billion Indian Rupees: Raw Material UseCraft DealNo ratings yet

- Ashok Leyland Chapter 5Document6 pagesAshok Leyland Chapter 5Craft DealNo ratings yet

- Bharat Benz ch-5Document4 pagesBharat Benz ch-5Craft DealNo ratings yet

- Symbol Series Date Close Price %: Asianpaint EQ 26/06/2020 1686.75 - 0.13%Document52 pagesSymbol Series Date Close Price %: Asianpaint EQ 26/06/2020 1686.75 - 0.13%Craft DealNo ratings yet

- Finding Not UseDocument4 pagesFinding Not UseCraft DealNo ratings yet

- Research MethodologyDocument8 pagesResearch MethodologyCraft DealNo ratings yet

- Mahindra and Mahindra Company of Marketing Department Mahindra of Products and ServicesDocument8 pagesMahindra and Mahindra Company of Marketing Department Mahindra of Products and ServicesCraft DealNo ratings yet

- A Study On Customer Satisfaction Towards Bharat Benz, Trident Automobiles PVT LTD, BangaloreDocument77 pagesA Study On Customer Satisfaction Towards Bharat Benz, Trident Automobiles PVT LTD, BangaloreCraft DealNo ratings yet

- Kia Motors Chapter 3Document8 pagesKia Motors Chapter 3Craft Deal100% (1)

- Intraduction of Automobile CompanyDocument4 pagesIntraduction of Automobile CompanyCraft DealNo ratings yet

- Honda Motors CH 3Document6 pagesHonda Motors CH 3Craft DealNo ratings yet

- CF (Collected)Document76 pagesCF (Collected)Akhi Junior JMNo ratings yet

- Homework 3Document2 pagesHomework 3Ishrat PopyNo ratings yet

- Advantages of The Depository SystemDocument7 pagesAdvantages of The Depository SystemKARISHMAATA2No ratings yet

- Finalproject SharekhanDocument89 pagesFinalproject SharekhanRam Krishna KrishNo ratings yet

- Investment & Portfolio Management - Assignment Four - Smart 3BDocument6 pagesInvestment & Portfolio Management - Assignment Four - Smart 3BAhmed AzazyNo ratings yet

- Gitman Chapter 12Document21 pagesGitman Chapter 12Hannah Jane UmbayNo ratings yet

- Analisis Fundamentalde EmpresasDocument6 pagesAnalisis Fundamentalde EmpresasJHON JANER RODRIGUEZ MONTERONo ratings yet

- Select Emerging Manager ProgramsDocument2 pagesSelect Emerging Manager ProgramsDavid Toll100% (2)

- Pecking Order When "Style"Document52 pagesPecking Order When "Style"Akshay RawatNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- Contemporary Financial Management 13th Edition Moyer Test Bank DownloadDocument31 pagesContemporary Financial Management 13th Edition Moyer Test Bank DownloadWilliam Hopkins100% (36)

- FSB - 01 - Idcl (1) 2Document3 pagesFSB - 01 - Idcl (1) 2Siri VallabhaneniNo ratings yet

- A Study On Performance Evaluation of Equity Share and Mutual FundsDocument33 pagesA Study On Performance Evaluation of Equity Share and Mutual FundsDev ChoudharyNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- Old Bridge Mutual Fund - Factsheet March 2024Document8 pagesOld Bridge Mutual Fund - Factsheet March 2024Bharathi 3280No ratings yet

- COST OF CAPITAL PLUS OBJsDocument5 pagesCOST OF CAPITAL PLUS OBJsEmmmanuel ArthurNo ratings yet

- ClassSession 26 - Dell Case - HandoutsDocument43 pagesClassSession 26 - Dell Case - Handoutsdrey baxterNo ratings yet

- Assignment # 6Document9 pagesAssignment # 6Ahtsham Ilyas RajputNo ratings yet

- 7 - Dematerialisation DemutualisationDocument4 pages7 - Dematerialisation DemutualisationPriyadarshi Kirti GouravNo ratings yet

- Thomas J. Ivey: Partner, Palo AltoDocument2 pagesThomas J. Ivey: Partner, Palo AltoMike AmbrosinoNo ratings yet

- Wa0021.Document16 pagesWa0021.Ahmed GaberNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- ADRIAN MANZ First Hour Super StrategiesDocument37 pagesADRIAN MANZ First Hour Super StrategiesAnonymous LhmiGjO100% (4)

- The Fidelity Guide To Equity InvestingDocument16 pagesThe Fidelity Guide To Equity Investingmandar LawandeNo ratings yet

- Chapter 7 Investment in Equity SecuritiesDocument12 pagesChapter 7 Investment in Equity SecuritiesGirlie Ann JimenezNo ratings yet

- Chapter 13 Problems (Ch. 12 in The 4 Edition) : (After Tax)Document2 pagesChapter 13 Problems (Ch. 12 in The 4 Edition) : (After Tax)Ahad SultanNo ratings yet

- What Is A StockDocument16 pagesWhat Is A StockRomeo Bea BaynosaNo ratings yet

- Adani Gas (2020)Document165 pagesAdani Gas (2020)insaafduggal33No ratings yet

- AUBDocument33 pagesAUBbsu.gurlsNo ratings yet