Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

21 viewsKey Performance Indicators Y/E March

Key Performance Indicators Y/E March

Uploaded by

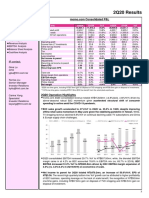

retrov andros1) Quarterly revenues for a company declined year-over-year in the first three quarters of FY21 but increased in the fourth quarter, with overall revenues down 12% for the year. EBITDA margins declined from 11.2% to 9.2% between FY20 and FY21 estimates.

2) Domestic vehicle sales volumes declined sharply in the first quarter of FY21 due to pandemic-related disruptions but recovered in subsequent quarters, with full-year volumes estimated to be down 9.6% year-over-year.

3) Realizations per vehicle declined in the first half of FY21 compared to the previous year but increased in the second half, while

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Mahindra & Mahindra: 3 August 2009Document8 pagesMahindra & Mahindra: 3 August 2009Chandni OzaNo ratings yet

- Matrimony Fact Sheet Q2fy18 PDFDocument1 pageMatrimony Fact Sheet Q2fy18 PDFKanchanNo ratings yet

- Investor Presentation 30.09.2023Document30 pagesInvestor Presentation 30.09.2023amitsbhatiNo ratings yet

- Axiata Data Financials 4Q21bDocument11 pagesAxiata Data Financials 4Q21bhimu_050918No ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- Modelling SolutionDocument45 pagesModelling SolutionLyricsical ViewerNo ratings yet

- NH FInancialsDocument3 pagesNH FInancialsmailtoyadavshwetaNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Cummins India Financial ModelDocument52 pagesCummins India Financial ModelJitendra YadavNo ratings yet

- Key Financial Figures (Consolidated) : April 28, 2017 Ricoh Company, LTDDocument4 pagesKey Financial Figures (Consolidated) : April 28, 2017 Ricoh Company, LTDLouis ChenNo ratings yet

- Starhub FY21Document20 pagesStarhub FY21SurachaiNo ratings yet

- Saito Solar ExcelDocument5 pagesSaito Solar ExcelArjun NairNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Pirelli in Figures 2023 9MDocument11 pagesPirelli in Figures 2023 9Mvictorfarima1385No ratings yet

- Ten Year ReviewDocument10 pagesTen Year Reviewmaruthi631No ratings yet

- Saito Solar-Teaching Notes ExhibitsDocument10 pagesSaito Solar-Teaching Notes Exhibitssebastien.parmentierNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- Manappuram Finance Investor PresentationDocument43 pagesManappuram Finance Investor PresentationabmahendruNo ratings yet

- Financial Highlights For The Fiscal Year Ended March 2011: Summary of Income StatementDocument4 pagesFinancial Highlights For The Fiscal Year Ended March 2011: Summary of Income StatementChristopher BowenNo ratings yet

- Annual Report 2019 PIERER Mobility AGDocument180 pagesAnnual Report 2019 PIERER Mobility AGThanhco LamNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- Ringkasan Finansial Per September 2017Document3 pagesRingkasan Finansial Per September 2017Dwi UdayanaNo ratings yet

- KKCL - Investor Presentation Q2 & H1FY24Document45 pagesKKCL - Investor Presentation Q2 & H1FY24Variable SeperableNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- BPFL Monthly Presentation April 2024Document4 pagesBPFL Monthly Presentation April 2024tanvir.ahmed.chowdhury204No ratings yet

- Dixon InvestorPresentationJan2022Document12 pagesDixon InvestorPresentationJan2022raguramrNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- Bear Stearns 4q2005 - TablesDocument4 pagesBear Stearns 4q2005 - Tablesjoeyn414No ratings yet

- Trent LTDDocument23 pagesTrent LTDpulkitnarang1606No ratings yet

- Analyst Presentation and Factsheet - Q4 FY16Document17 pagesAnalyst Presentation and Factsheet - Q4 FY16indpubg0611No ratings yet

- Annual Trading Report: Strictly ConfidentialDocument3 pagesAnnual Trading Report: Strictly ConfidentialMunazza FawadNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- Tata MotorsDocument5 pagesTata Motorsinsurana73No ratings yet

- (In $ Million) : WHX Corporation (WHX)Document3 pages(In $ Million) : WHX Corporation (WHX)Amit JainNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Household Savings Financial Savings Non Financial Savings Savings in Equities % of Equities in Financial SavingsDocument12 pagesHousehold Savings Financial Savings Non Financial Savings Savings in Equities % of Equities in Financial SavingsAvengers HeroesNo ratings yet

- Investor Update For December 31, 2016 (Company Update)Document17 pagesInvestor Update For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Zalando SE - Q4 - FY - 2021 - Financials - VFDocument7 pagesZalando SE - Q4 - FY - 2021 - Financials - VFsophiedehaan2006No ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAnuj SaxenaNo ratings yet

- Performance ReportDocument24 pagesPerformance ReportJuan VegaNo ratings yet

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- Total Income - Annual: Sales Sales YoyDocument16 pagesTotal Income - Annual: Sales Sales YoyKshatrapati SinghNo ratings yet

- Team7 FMPhase2 Trent SENIORSDocument75 pagesTeam7 FMPhase2 Trent SENIORSNisarg Rupani100% (1)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Minor Project SynopsisDocument3 pagesMinor Project Synopsisretrov androsNo ratings yet

- Anxious / Preoccupied Attachment: Your Personal ReportDocument8 pagesAnxious / Preoccupied Attachment: Your Personal Reportretrov andros100% (1)

- Akriti Goel - Ethics Home Assignment - 7CSE1Y - A2305218043Document11 pagesAkriti Goel - Ethics Home Assignment - 7CSE1Y - A2305218043retrov androsNo ratings yet

- Module V - QuizDocument8 pagesModule V - Quizretrov androsNo ratings yet

- Second DraftDocument69 pagesSecond Draftretrov androsNo ratings yet

- Employee Engagementand Empowermentas Gatewaytowards RetentionDocument12 pagesEmployee Engagementand Empowermentas Gatewaytowards Retentionretrov androsNo ratings yet

- Chapter SNAandLawEnforcement DuijnKlerksDocument40 pagesChapter SNAandLawEnforcement DuijnKlerksretrov androsNo ratings yet

- Format For Course Curriculum: Deep LearningDocument3 pagesFormat For Course Curriculum: Deep Learningretrov androsNo ratings yet

- Annexure V 7cse13Document10 pagesAnnexure V 7cse13retrov androsNo ratings yet

- Case Study On Maruti Suzuki: Ibusiness March 2021Document11 pagesCase Study On Maruti Suzuki: Ibusiness March 2021retrov androsNo ratings yet

- Sonica Tyagi Friend: Chapter-1Document89 pagesSonica Tyagi Friend: Chapter-1retrov androsNo ratings yet

- Finance 5Document1 pageFinance 5retrov androsNo ratings yet

- Samsung in IndiaDocument1 pageSamsung in Indiaretrov androsNo ratings yet

- Finance 4Document1 pageFinance 4retrov androsNo ratings yet

- Yagnam:: A Nexus of Globalisation and MarginalisationDocument11 pagesYagnam:: A Nexus of Globalisation and Marginalisationm.chandu chowdaryNo ratings yet

- ISPDataDocument495 pagesISPDataSabitra RudraNo ratings yet

- Diss Final Examination SY 22 23Document3 pagesDiss Final Examination SY 22 23Raiza CabreraNo ratings yet

- CANGRA Talents Commercials - IKYADocument9 pagesCANGRA Talents Commercials - IKYAasdf asdfNo ratings yet

- Time Series Using Stata (Oscar Torres-Reyna Version) : December 2007Document32 pagesTime Series Using Stata (Oscar Torres-Reyna Version) : December 2007Humayun KabirNo ratings yet

- Office Address Ro BangaloreDocument3 pagesOffice Address Ro Bangaloresandeep naikNo ratings yet

- Demand Andrews ChecksDocument2 pagesDemand Andrews ChecksCo AlexinneNo ratings yet

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- TDI Válvula Relevadora Mca. TDIDocument14 pagesTDI Válvula Relevadora Mca. TDIJorge CalcaneoNo ratings yet

- MONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDocument47 pagesMONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDDE1964100% (1)

- Ba 302 Lesson 2Document46 pagesBa 302 Lesson 2ピザンメルビンNo ratings yet

- Design and Development of Mini Tractor Operated Installer and Retriever of Drip LineDocument12 pagesDesign and Development of Mini Tractor Operated Installer and Retriever of Drip Line01fe18bme033No ratings yet

- Volferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDocument1 pageVolferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDigy MaleachiqNo ratings yet

- 5052-H112 Aluminum: Related SpecificationsDocument1 page5052-H112 Aluminum: Related SpecificationsDamon CiouNo ratings yet

- Setting Product StrategyDocument30 pagesSetting Product StrategyAfik 178No ratings yet

- Stone-Geary Utility Function - выводDocument3 pagesStone-Geary Utility Function - выводМаксим НовакNo ratings yet

- Chap - 22.measuring A Nation's IncomeDocument55 pagesChap - 22.measuring A Nation's IncomeellieNo ratings yet

- 1e0001 - Steel - Heat Treated Cold Finished BarDocument3 pages1e0001 - Steel - Heat Treated Cold Finished BarPuneet EnterprisesNo ratings yet

- Pengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan Dan Pertumbuhan Perusahaan Terhadap Opini Audit Going ConcernDocument10 pagesPengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan Dan Pertumbuhan Perusahaan Terhadap Opini Audit Going ConcernPraharsini MadasNo ratings yet

- Brief Intro of IsraelDocument28 pagesBrief Intro of Israel王郁妘No ratings yet

- ASHRAEJour 83Document6 pagesASHRAEJour 83Phong QuáchNo ratings yet

- Organization Structure 2016: Head Office Pt. Saptaindra SejatiDocument2 pagesOrganization Structure 2016: Head Office Pt. Saptaindra SejatiAhMad FajRi DefaNo ratings yet

- Indian FinalDocument65 pagesIndian Final04 Sourabh BaraleNo ratings yet

- Kendriya Vidyalaya Dipatoli Formative Assessment - III, (2015-16) Time-Class-V (FIVE) M.M - Grade A+ Subject - Environmental StudiesDocument5 pagesKendriya Vidyalaya Dipatoli Formative Assessment - III, (2015-16) Time-Class-V (FIVE) M.M - Grade A+ Subject - Environmental StudiesSUBHANo ratings yet

- Sumif, Sumifs, Countif, AverageifDocument9 pagesSumif, Sumifs, Countif, AverageifRaghavendraNo ratings yet

- The Trading NuggetsDocument31 pagesThe Trading NuggetsZiaur RahmanNo ratings yet

- Sag DRG-1Document6 pagesSag DRG-1rupesh417No ratings yet

- Module 2 - 3 Cost Benefit Evaluation TechniquesDocument15 pagesModule 2 - 3 Cost Benefit Evaluation TechniquesKarthik GoudNo ratings yet

- Exercise Class No. 2 - Financial Mathematics I:, S, S S (1) (1, 4, 8), S (2) (1, 7, 11), S (3) (1, 1, 1)Document3 pagesExercise Class No. 2 - Financial Mathematics I:, S, S S (1) (1, 4, 8), S (2) (1, 7, 11), S (3) (1, 1, 1)josemoragmxNo ratings yet

- Minitest - International TradeDocument2 pagesMinitest - International TradePhan Hà TrangNo ratings yet

Key Performance Indicators Y/E March

Key Performance Indicators Y/E March

Uploaded by

retrov andros0 ratings0% found this document useful (0 votes)

21 views1 page1) Quarterly revenues for a company declined year-over-year in the first three quarters of FY21 but increased in the fourth quarter, with overall revenues down 12% for the year. EBITDA margins declined from 11.2% to 9.2% between FY20 and FY21 estimates.

2) Domestic vehicle sales volumes declined sharply in the first quarter of FY21 due to pandemic-related disruptions but recovered in subsequent quarters, with full-year volumes estimated to be down 9.6% year-over-year.

3) Realizations per vehicle declined in the first half of FY21 compared to the previous year but increased in the second half, while

Original Description:

Original Title

finance 6 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Quarterly revenues for a company declined year-over-year in the first three quarters of FY21 but increased in the fourth quarter, with overall revenues down 12% for the year. EBITDA margins declined from 11.2% to 9.2% between FY20 and FY21 estimates.

2) Domestic vehicle sales volumes declined sharply in the first quarter of FY21 due to pandemic-related disruptions but recovered in subsequent quarters, with full-year volumes estimated to be down 9.6% year-over-year.

3) Realizations per vehicle declined in the first half of FY21 compared to the previous year but increased in the second half, while

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

21 views1 pageKey Performance Indicators Y/E March

Key Performance Indicators Y/E March

Uploaded by

retrov andros1) Quarterly revenues for a company declined year-over-year in the first three quarters of FY21 but increased in the fourth quarter, with overall revenues down 12% for the year. EBITDA margins declined from 11.2% to 9.2% between FY20 and FY21 estimates.

2) Domestic vehicle sales volumes declined sharply in the first quarter of FY21 due to pandemic-related disruptions but recovered in subsequent quarters, with full-year volumes estimated to be down 9.6% year-over-year.

3) Realizations per vehicle declined in the first half of FY21 compared to the previous year but increased in the second half, while

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

5/A Quarterly Performance (INR m)

Y/E March FY20 FY21E FY20 FY21E FY21E

1Q 2Q 3Q 4Q 1Q 2Q 3QE 4QE 2QE

Net operating revenues 1,97,198 1,69,853 2,07,068 1,81,987 41,065 1,87,445 2,22,318 2,28,080 7,56,106 6,78,908 1,88,469

Change (%) -12.2 -23.6 5.3 -15.2 -79.2 10.4 7.4 25.3 -12.1 -10.2 11.0

EBITDA 20,478 16,063 21,021 15,464 -8,634 19,336 25,055 26,542 84,772 62,299 20,687

EBITDA Margins (%) 10.4 9.5 10.2 8.5 -21.0 10.3 11.3 11.6 11.2 9.2 11.0

Depreciation 9,186 9,261 8,580 8,230 7,833 7,659 7,800 8,124 35,257 31,416 7,900

EBIT 11,292 6,802 12,441 7,234 -16,467 11,677 17,255 18,418 49,515 30,883 12,787

EBIT Margins (%) 5.7 4.0 6.0 4.0 -40.1 6.2 7.8 8.1 6.5 4.5 6.8

Non-Operating Income 8,364 9,200 7,840 8,804 13,183 6,025 7,400 7,863 34,208 34,471 7,500

PBT 19,109 15,720 20,064 15,755 -3,457 17,478 24,425 26,059 82,394 64,504 20,047

Effective Tax Rate (%) 24.9 13.6 22.0 18.0 27.9 21.5 20.5 20.3 17.2 20.3 20.5

Adjusted PAT 14,355 13,586 15,648 12,917 -2,494 13,716 19,418 20,756 68,252 51,396 15,937

Change (%) -27.3 -35.3 5.1 -28.1 -117.4 1.0 24.1 60.7 -15.1 -24.7 17.3

Key Performance Indicators

Y/E March FY20 FY21E FY20 FY21E

1Q 2Q 3Q 4Q 1Q 2Q 3QE 4QE 2QE

Dom. PV Market Sh (%) 51.6 49.5 51.9 54.4 47.3 54.3 51.9 59

Volumes ('000 units) 402.6 338.3 4374 384.4 76.6 393.1 467.4 475.2 1,562.6

1,412A 393.1

Change (%) -17.9 -30.2 2.0 -16.2 -81.0 16.2 6.9 23.6 -16.1 -9.6 16.2

Discounts (INR '000/car) 16.9 25.8 33.0 19.1 25.0 17.3 23.9 0.0

% of Net Realn 3.5 5.1 7.0 4.0 4.7 3.6 4.9 0.0

Net Realizations (INR '000/car) 489.8 502.1 473.4 473.5 536.1 476.8 4754 479.9 483.9 480.7 479.4

Change (%) 7.0 9.5 3.2 1.2 9.4 -5.0 0.5 1.4 4.8 -0.7 -4.5

Cost Break-up

RM Cost (% of sales) 70.1 71.2 70.9 70.3 71.5 70.0 70.5 70.3 70.3 70.3 70.0

Staff Cost (% of sales) 4.4 4.9 4.2 4.5 17.8 4.4 4.0 3.9 4.5 4.9 4.2

Other Cost (% of sales) 15.2 14.4 14.8 16.7 31.7 15.3 14.2 14.1 14.0 15.5 14.8

Gross Margins (%) 29.9 28.8 29.1 29.7 28.5 30.0 29.5 29.7 29.7 29.7 30.0

EBITDA Margins (%) 10.4 9.5 10.2 8.5 -21.0 10.3 11.3 11.6 11.2 9.2 11

EBIT Margins (%) 5.7 4.0 6.0 4.0 -40.1 6.2 7.8 8.1 6.5 4.5 6.8

E:MOFSL Estimates

You might also like

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Mahindra & Mahindra: 3 August 2009Document8 pagesMahindra & Mahindra: 3 August 2009Chandni OzaNo ratings yet

- Matrimony Fact Sheet Q2fy18 PDFDocument1 pageMatrimony Fact Sheet Q2fy18 PDFKanchanNo ratings yet

- Investor Presentation 30.09.2023Document30 pagesInvestor Presentation 30.09.2023amitsbhatiNo ratings yet

- Axiata Data Financials 4Q21bDocument11 pagesAxiata Data Financials 4Q21bhimu_050918No ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- Modelling SolutionDocument45 pagesModelling SolutionLyricsical ViewerNo ratings yet

- NH FInancialsDocument3 pagesNH FInancialsmailtoyadavshwetaNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Cummins India Financial ModelDocument52 pagesCummins India Financial ModelJitendra YadavNo ratings yet

- Key Financial Figures (Consolidated) : April 28, 2017 Ricoh Company, LTDDocument4 pagesKey Financial Figures (Consolidated) : April 28, 2017 Ricoh Company, LTDLouis ChenNo ratings yet

- Starhub FY21Document20 pagesStarhub FY21SurachaiNo ratings yet

- Saito Solar ExcelDocument5 pagesSaito Solar ExcelArjun NairNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Pirelli in Figures 2023 9MDocument11 pagesPirelli in Figures 2023 9Mvictorfarima1385No ratings yet

- Ten Year ReviewDocument10 pagesTen Year Reviewmaruthi631No ratings yet

- Saito Solar-Teaching Notes ExhibitsDocument10 pagesSaito Solar-Teaching Notes Exhibitssebastien.parmentierNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- Manappuram Finance Investor PresentationDocument43 pagesManappuram Finance Investor PresentationabmahendruNo ratings yet

- Financial Highlights For The Fiscal Year Ended March 2011: Summary of Income StatementDocument4 pagesFinancial Highlights For The Fiscal Year Ended March 2011: Summary of Income StatementChristopher BowenNo ratings yet

- Annual Report 2019 PIERER Mobility AGDocument180 pagesAnnual Report 2019 PIERER Mobility AGThanhco LamNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- Ringkasan Finansial Per September 2017Document3 pagesRingkasan Finansial Per September 2017Dwi UdayanaNo ratings yet

- KKCL - Investor Presentation Q2 & H1FY24Document45 pagesKKCL - Investor Presentation Q2 & H1FY24Variable SeperableNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- BPFL Monthly Presentation April 2024Document4 pagesBPFL Monthly Presentation April 2024tanvir.ahmed.chowdhury204No ratings yet

- Dixon InvestorPresentationJan2022Document12 pagesDixon InvestorPresentationJan2022raguramrNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- Bear Stearns 4q2005 - TablesDocument4 pagesBear Stearns 4q2005 - Tablesjoeyn414No ratings yet

- Trent LTDDocument23 pagesTrent LTDpulkitnarang1606No ratings yet

- Analyst Presentation and Factsheet - Q4 FY16Document17 pagesAnalyst Presentation and Factsheet - Q4 FY16indpubg0611No ratings yet

- Annual Trading Report: Strictly ConfidentialDocument3 pagesAnnual Trading Report: Strictly ConfidentialMunazza FawadNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- Tata MotorsDocument5 pagesTata Motorsinsurana73No ratings yet

- (In $ Million) : WHX Corporation (WHX)Document3 pages(In $ Million) : WHX Corporation (WHX)Amit JainNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Household Savings Financial Savings Non Financial Savings Savings in Equities % of Equities in Financial SavingsDocument12 pagesHousehold Savings Financial Savings Non Financial Savings Savings in Equities % of Equities in Financial SavingsAvengers HeroesNo ratings yet

- Investor Update For December 31, 2016 (Company Update)Document17 pagesInvestor Update For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Zalando SE - Q4 - FY - 2021 - Financials - VFDocument7 pagesZalando SE - Q4 - FY - 2021 - Financials - VFsophiedehaan2006No ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAnuj SaxenaNo ratings yet

- Performance ReportDocument24 pagesPerformance ReportJuan VegaNo ratings yet

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- Total Income - Annual: Sales Sales YoyDocument16 pagesTotal Income - Annual: Sales Sales YoyKshatrapati SinghNo ratings yet

- Team7 FMPhase2 Trent SENIORSDocument75 pagesTeam7 FMPhase2 Trent SENIORSNisarg Rupani100% (1)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Minor Project SynopsisDocument3 pagesMinor Project Synopsisretrov androsNo ratings yet

- Anxious / Preoccupied Attachment: Your Personal ReportDocument8 pagesAnxious / Preoccupied Attachment: Your Personal Reportretrov andros100% (1)

- Akriti Goel - Ethics Home Assignment - 7CSE1Y - A2305218043Document11 pagesAkriti Goel - Ethics Home Assignment - 7CSE1Y - A2305218043retrov androsNo ratings yet

- Module V - QuizDocument8 pagesModule V - Quizretrov androsNo ratings yet

- Second DraftDocument69 pagesSecond Draftretrov androsNo ratings yet

- Employee Engagementand Empowermentas Gatewaytowards RetentionDocument12 pagesEmployee Engagementand Empowermentas Gatewaytowards Retentionretrov androsNo ratings yet

- Chapter SNAandLawEnforcement DuijnKlerksDocument40 pagesChapter SNAandLawEnforcement DuijnKlerksretrov androsNo ratings yet

- Format For Course Curriculum: Deep LearningDocument3 pagesFormat For Course Curriculum: Deep Learningretrov androsNo ratings yet

- Annexure V 7cse13Document10 pagesAnnexure V 7cse13retrov androsNo ratings yet

- Case Study On Maruti Suzuki: Ibusiness March 2021Document11 pagesCase Study On Maruti Suzuki: Ibusiness March 2021retrov androsNo ratings yet

- Sonica Tyagi Friend: Chapter-1Document89 pagesSonica Tyagi Friend: Chapter-1retrov androsNo ratings yet

- Finance 5Document1 pageFinance 5retrov androsNo ratings yet

- Samsung in IndiaDocument1 pageSamsung in Indiaretrov androsNo ratings yet

- Finance 4Document1 pageFinance 4retrov androsNo ratings yet

- Yagnam:: A Nexus of Globalisation and MarginalisationDocument11 pagesYagnam:: A Nexus of Globalisation and Marginalisationm.chandu chowdaryNo ratings yet

- ISPDataDocument495 pagesISPDataSabitra RudraNo ratings yet

- Diss Final Examination SY 22 23Document3 pagesDiss Final Examination SY 22 23Raiza CabreraNo ratings yet

- CANGRA Talents Commercials - IKYADocument9 pagesCANGRA Talents Commercials - IKYAasdf asdfNo ratings yet

- Time Series Using Stata (Oscar Torres-Reyna Version) : December 2007Document32 pagesTime Series Using Stata (Oscar Torres-Reyna Version) : December 2007Humayun KabirNo ratings yet

- Office Address Ro BangaloreDocument3 pagesOffice Address Ro Bangaloresandeep naikNo ratings yet

- Demand Andrews ChecksDocument2 pagesDemand Andrews ChecksCo AlexinneNo ratings yet

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- TDI Válvula Relevadora Mca. TDIDocument14 pagesTDI Válvula Relevadora Mca. TDIJorge CalcaneoNo ratings yet

- MONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDocument47 pagesMONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDDE1964100% (1)

- Ba 302 Lesson 2Document46 pagesBa 302 Lesson 2ピザンメルビンNo ratings yet

- Design and Development of Mini Tractor Operated Installer and Retriever of Drip LineDocument12 pagesDesign and Development of Mini Tractor Operated Installer and Retriever of Drip Line01fe18bme033No ratings yet

- Volferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDocument1 pageVolferda VL-PB02 Luxury Prefabricated Small House Hotel High-End Hotel Tempered Glass Room InsulatioDigy MaleachiqNo ratings yet

- 5052-H112 Aluminum: Related SpecificationsDocument1 page5052-H112 Aluminum: Related SpecificationsDamon CiouNo ratings yet

- Setting Product StrategyDocument30 pagesSetting Product StrategyAfik 178No ratings yet

- Stone-Geary Utility Function - выводDocument3 pagesStone-Geary Utility Function - выводМаксим НовакNo ratings yet

- Chap - 22.measuring A Nation's IncomeDocument55 pagesChap - 22.measuring A Nation's IncomeellieNo ratings yet

- 1e0001 - Steel - Heat Treated Cold Finished BarDocument3 pages1e0001 - Steel - Heat Treated Cold Finished BarPuneet EnterprisesNo ratings yet

- Pengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan Dan Pertumbuhan Perusahaan Terhadap Opini Audit Going ConcernDocument10 pagesPengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan Dan Pertumbuhan Perusahaan Terhadap Opini Audit Going ConcernPraharsini MadasNo ratings yet

- Brief Intro of IsraelDocument28 pagesBrief Intro of Israel王郁妘No ratings yet

- ASHRAEJour 83Document6 pagesASHRAEJour 83Phong QuáchNo ratings yet

- Organization Structure 2016: Head Office Pt. Saptaindra SejatiDocument2 pagesOrganization Structure 2016: Head Office Pt. Saptaindra SejatiAhMad FajRi DefaNo ratings yet

- Indian FinalDocument65 pagesIndian Final04 Sourabh BaraleNo ratings yet

- Kendriya Vidyalaya Dipatoli Formative Assessment - III, (2015-16) Time-Class-V (FIVE) M.M - Grade A+ Subject - Environmental StudiesDocument5 pagesKendriya Vidyalaya Dipatoli Formative Assessment - III, (2015-16) Time-Class-V (FIVE) M.M - Grade A+ Subject - Environmental StudiesSUBHANo ratings yet

- Sumif, Sumifs, Countif, AverageifDocument9 pagesSumif, Sumifs, Countif, AverageifRaghavendraNo ratings yet

- The Trading NuggetsDocument31 pagesThe Trading NuggetsZiaur RahmanNo ratings yet

- Sag DRG-1Document6 pagesSag DRG-1rupesh417No ratings yet

- Module 2 - 3 Cost Benefit Evaluation TechniquesDocument15 pagesModule 2 - 3 Cost Benefit Evaluation TechniquesKarthik GoudNo ratings yet

- Exercise Class No. 2 - Financial Mathematics I:, S, S S (1) (1, 4, 8), S (2) (1, 7, 11), S (3) (1, 1, 1)Document3 pagesExercise Class No. 2 - Financial Mathematics I:, S, S S (1) (1, 4, 8), S (2) (1, 7, 11), S (3) (1, 1, 1)josemoragmxNo ratings yet

- Minitest - International TradeDocument2 pagesMinitest - International TradePhan Hà TrangNo ratings yet