Professional Documents

Culture Documents

Items 1&2 Are Based On The Following Information

Items 1&2 Are Based On The Following Information

Uploaded by

Unknown 01Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Items 1&2 Are Based On The Following Information

Items 1&2 Are Based On The Following Information

Uploaded by

Unknown 01Copyright:

Available Formats

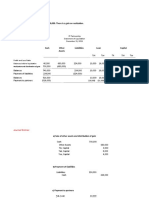

Items 1&2 are based on the following information:

Partners Manila, Pampanga and Laguna, who shareprofit and loss in the ratio of

3:5:2 respectively have decided to liquidate their partnership and use priority

program. The statement of financial position of the partnership at the time of

liquidation is shown below.

Cash 240,000

Other assets 720,000

Accounts payable 186,000

Loan from Pampanga 60,000

Manila, Capital 216,000

Pampanga, Capital 240,000

Laguna, Capital 258,000

The partners desire to prepare an instalment distribution schedule showing how

cash would be distributed to partners as assets realized.

1. Assuming that the first sale of other assets having book value of P300,000

realized P150,000 and available cash is distributed, Manila, Pampanga and Laguna

respectively would receive

a) 48,000 48,000

b) 0 36,000

c) 18,000 0

d) 126,000 0

e) none of these

2.Assuming that the second sale of other assets (assume previous first sale facts)

having book value of P180,000 realized P240,000 and all available cash is

distributed, Manila, Pampanga and Laguna, respectively would receive.

a) 36,000 0

b) 0 36,000

c) 18,000 30,000

d) 81,000 105,000

e) none of these

You might also like

- Quizzes Chapter 14 Partnership LiquidationDocument7 pagesQuizzes Chapter 14 Partnership LiquidationAmie Jane Miranda83% (6)

- Partnership Liquidation. Alynna Joy P. IbanezDocument32 pagesPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- Partnership Liquidation: Debit CreditDocument7 pagesPartnership Liquidation: Debit CreditWenjun0% (1)

- Chapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A FinalDocument26 pagesChapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A FinalAndrea Florence Guy Vidal50% (2)

- Quiz 3 Partnership DissolutionDocument6 pagesQuiz 3 Partnership DissolutionWenjun100% (1)

- Closing Entries - Branchbooks: (Branch Books) Home OfficeDocument2 pagesClosing Entries - Branchbooks: (Branch Books) Home OfficeUnknown 01No ratings yet

- Partnership Liquidation Part 1Document2 pagesPartnership Liquidation Part 1azzenethfaye.delacruz.mnlNo ratings yet

- CASE A: P700,000. There Is A Gain On Realization, P20,000: Journal EntriesDocument32 pagesCASE A: P700,000. There Is A Gain On Realization, P20,000: Journal EntriesMims ChiiiNo ratings yet

- CASE A: P700,000. There Is A Gain On Realization, P20,000: Journal EntriesDocument26 pagesCASE A: P700,000. There Is A Gain On Realization, P20,000: Journal EntriesMims ChiiiNo ratings yet

- Partnership Liquidation ProblemsDocument25 pagesPartnership Liquidation ProblemseveNo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationJeasa LapizNo ratings yet

- AbcdDocument7 pagesAbcdjehu bayaniNo ratings yet

- Partnership Liquidation: Problem MDocument8 pagesPartnership Liquidation: Problem MMiko ArniñoNo ratings yet

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocument2 pagesInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKristine Lirose BordeosNo ratings yet

- This Study Resource Was Shared Via: Mater Dei CollegeDocument2 pagesThis Study Resource Was Shared Via: Mater Dei CollegeBaby BabeNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership Liquidationyoj assenavNo ratings yet

- Midterm HahaDocument33 pagesMidterm HahaCarl Elmo Bernardo MurosNo ratings yet

- Case ADocument8 pagesCase AMary Ann LubaoNo ratings yet

- UntitledDocument7 pagesUntitledKhyell PayasNo ratings yet

- PPS DissolutionDocument13 pagesPPS DissolutionAireen Shelvie BermudezNo ratings yet

- Lumpsum ProblemDocument3 pagesLumpsum ProblemQueenie MaglalangNo ratings yet

- Chapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A FinalDocument26 pagesChapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A Finalrandom17341No ratings yet

- Partnership - Changes in Ownership Structures (Galaxy Sports - Exercise)Document6 pagesPartnership - Changes in Ownership Structures (Galaxy Sports - Exercise)PetrinaNo ratings yet

- Exercises On Formation of Partnership: Problem 1 Two Sole Proprietors Form A PartnershipDocument3 pagesExercises On Formation of Partnership: Problem 1 Two Sole Proprietors Form A PartnershipMa Lovely Bereño Moreno50% (4)

- Installment Liquidation 2Document3 pagesInstallment Liquidation 2Jamie RamosNo ratings yet

- Assignment AkaunDocument9 pagesAssignment AkaunDESIREE DESSY MAIDI STUDENTNo ratings yet

- Far Quiz 13Document3 pagesFar Quiz 13Juliana Reign RuedaNo ratings yet

- ACT1104-Final Period Quiz No.5 With AnswerDocument8 pagesACT1104-Final Period Quiz No.5 With Answermpula456No ratings yet

- Sample Problems Part FormDocument4 pagesSample Problems Part FormkenivanabejuelaNo ratings yet

- Partnership Liquidation Lump Sum - Seat WorkDocument1 pagePartnership Liquidation Lump Sum - Seat WorkWilliam LanzuelaNo ratings yet

- Retirement and Dissolution of Firm Class TestDocument2 pagesRetirement and Dissolution of Firm Class TestHarish RajputNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument8 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- Mara, Teri, and Rita Partnership Statement of Partnership Liquidation December 31, 2018Document6 pagesMara, Teri, and Rita Partnership Statement of Partnership Liquidation December 31, 2018Serenity CarlyeNo ratings yet

- Afar 2 - 3Document1 pageAfar 2 - 3Panda ErarNo ratings yet

- Case 1: Total TotalDocument10 pagesCase 1: Total TotalFETALINO, MAICANo ratings yet

- PDF Partnership Liquidation Alynna Joy P Ibanezdocx DLDocument32 pagesPDF Partnership Liquidation Alynna Joy P Ibanezdocx DLKrizia Mae Uzielle PeneroNo ratings yet

- Accounting For Special Transactions - Assignment - BSADocument2 pagesAccounting For Special Transactions - Assignment - BSAHarlyn Joy LabradorNo ratings yet

- Partnership Liquidation: Problem MDocument5 pagesPartnership Liquidation: Problem MJoeneil DamalerioNo ratings yet

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- First Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20Document2 pagesFirst Model Test Paper Part - B Time: 40 Minutes Accountancy M.M. 20surbhi singhalNo ratings yet

- Chapter2aa1sol 2012 PDFDocument18 pagesChapter2aa1sol 2012 PDFMatt David Kenneth ReyesNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- ReSA B44 AFAR Final PB Exam Questions Answers and SolutionsDocument28 pagesReSA B44 AFAR Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- SOLMAN Chapter-2Document9 pagesSOLMAN Chapter-2Na JaeminNo ratings yet

- Cash Flow Statement - 2Document9 pagesCash Flow Statement - 2Midhun PerozhiNo ratings yet

- ACT 421 Ch. 1Document6 pagesACT 421 Ch. 1Kristilyn CartaNo ratings yet

- Far - SfeDocument6 pagesFar - SfeAdrian ManongdoNo ratings yet

- A Cco ExerciseDocument13 pagesA Cco ExerciseClarisse Anne SajoniaNo ratings yet

- NSBZDocument6 pagesNSBZKenncy100% (4)

- Partnership Liquidation Do It YourselfDocument3 pagesPartnership Liquidation Do It YourselfBC qpLAN CrOwNo ratings yet

- AFAR - Partnership Formation and OperationDocument2 pagesAFAR - Partnership Formation and OperationJoanna Rose DeciarNo ratings yet

- Learning Task No.1Document3 pagesLearning Task No.1scryx bloodNo ratings yet

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- Act 6Document1 pageAct 6Unknown 01No ratings yet

- Management Advisory Services: Costs and Cost ConceptsDocument45 pagesManagement Advisory Services: Costs and Cost ConceptsUnknown 01No ratings yet

- Se The Following Information For The Next Two QuestionsDocument1 pageSe The Following Information For The Next Two QuestionsUnknown 01No ratings yet

- Use The Following Information For The Next Three QuestionsDocument1 pageUse The Following Information For The Next Three QuestionsUnknown 01No ratings yet

- Acc 6Document1 pageAcc 6Unknown 01No ratings yet

- Acc 4Document1 pageAcc 4Unknown 01No ratings yet

- Home Office Branch (DR) (CR) (DR) (CR) : HE Corporation Adjusted Trial Balances December 31, 20XXDocument1 pageHome Office Branch (DR) (CR) (DR) (CR) : HE Corporation Adjusted Trial Balances December 31, 20XXUnknown 01No ratings yet

- Aa 3Document4 pagesAa 3Unknown 01No ratings yet

- Hope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Document1 pageHope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Unknown 01No ratings yet

- Acc 9Document1 pageAcc 9Unknown 01No ratings yet

- Reconciliation of Reciprocalaccounts: Investment in Branch Account (Home Office Books)Document1 pageReconciliation of Reciprocalaccounts: Investment in Branch Account (Home Office Books)Unknown 010% (1)

- HE Corporation Combined Statement Working Paper For The Year Ended December 31, 20XXDocument2 pagesHE Corporation Combined Statement Working Paper For The Year Ended December 31, 20XXUnknown 01No ratings yet

- Principles of DesignDocument7 pagesPrinciples of DesignUnknown 01No ratings yet