Professional Documents

Culture Documents

Accounting 1 (SHS) - Week 7 - BOOK OF ACCOUNTS

Accounting 1 (SHS) - Week 7 - BOOK OF ACCOUNTS

Uploaded by

Austin Capal Dela Cruz0 ratings0% found this document useful (0 votes)

55 views11 pagesThe document discusses the requirements for keeping books of accounts for businesses in the Philippines according to the Bureau of Internal Revenue. Books of accounts typically include a journal and ledger or their equivalents, which are used to systematically record all business transactions on a regular basis. The journal is the initial record of transactions, while the ledger sorts and groups the transactions by individual accounts to facilitate financial statement preparation. There are two main types of each - general and special journals, and general and subsidiary ledgers. Maintaining proper books of accounts provides several advantages including ensuring accurate accounting of revenues/expenses and monitoring of business performance.

Original Description:

BOOK OF ACCOUNTS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the requirements for keeping books of accounts for businesses in the Philippines according to the Bureau of Internal Revenue. Books of accounts typically include a journal and ledger or their equivalents, which are used to systematically record all business transactions on a regular basis. The journal is the initial record of transactions, while the ledger sorts and groups the transactions by individual accounts to facilitate financial statement preparation. There are two main types of each - general and special journals, and general and subsidiary ledgers. Maintaining proper books of accounts provides several advantages including ensuring accurate accounting of revenues/expenses and monitoring of business performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

55 views11 pagesAccounting 1 (SHS) - Week 7 - BOOK OF ACCOUNTS

Accounting 1 (SHS) - Week 7 - BOOK OF ACCOUNTS

Uploaded by

Austin Capal Dela CruzThe document discusses the requirements for keeping books of accounts for businesses in the Philippines according to the Bureau of Internal Revenue. Books of accounts typically include a journal and ledger or their equivalents, which are used to systematically record all business transactions on a regular basis. The journal is the initial record of transactions, while the ledger sorts and groups the transactions by individual accounts to facilitate financial statement preparation. There are two main types of each - general and special journals, and general and subsidiary ledgers. Maintaining proper books of accounts provides several advantages including ensuring accurate accounting of revenues/expenses and monitoring of business performance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 11

BOOK OF ACCOUNTS

The Bureau of Internal Revenue in the

Philippines requires that all business or

persons, required by law, to pay

internal revenue taxes shall keep

permanently-bound books of accounts

for registration or stamping. Books of

accounts are records in which all

accounts and transactions of a

business are maintained on a regular

basis.

This books of accounts are typically a

journal and a ledger or their

equivalents such as subsidiary ledgers

and simplified books of accounts.

JOURNAL

A journal functions as a financial diary. It is

used to record chronologically all

transactions of a business as they occur.

Since it is the first evidence of a formally-

recorded transaction, it is commonly

referred to as the book of original entry.

ADVANTAGES OF JOURNAL

1. It provides a systematic and chronological

record of transactions

2. It simplifies the ledger as some details in

the journal need not be written in the

ledger

3. It provides adequate explanation of each

entry and presents necessary information

about the transactions such as the account

debited and credited and related amounts

ADVANTAGES OF JOURNAL

4. It ensures that the double-entry

bookkeeping system is observed when

recording transactions

5. It helps in solving misunderstanding in

business because it serves as proof and

legal evidence.

2 types of journal

1. Special Journal = are journals used to

record recurring transactions.

2. General Journal = which looks like a

two column columnar notebook, is the

journal used to record all other business

transactions not recorded in the special

journal

Ledger

Is a collective record of individual

accounts used by a business. It is used

to sort all entries in the journal in

chronological order and to group all

transactions that affect individual

accounts in order to facilitate the

preparation of financial statement.

2 types of ledger

1. General ledger = is used to accumulate

and classify individual transactions

2. Subsidiary ledger = is used to

provide detailed information

about a specific ledger account.

ADVANTAGES OF LEDGER

1. It provides detailed information about

revenues and expenses in one place

2. It provides detailed information about assets,

liabilities and owners equity of the business

3. It assists management in monitoring business

performance through information in individual

ledger accounts.

4. It serves as tool for auditors to track the flow

of business transactions for a given period of

time

You might also like

- Introduction To Accounting by T.S GrewalDocument199 pagesIntroduction To Accounting by T.S GrewalSonakshi Behl61% (69)

- Contoh Reading Comprehension ExerciseDocument3 pagesContoh Reading Comprehension ExerciseAnonymous Fn7Ko5riKT75% (8)

- Accounting: Step by Step Guide to Accounting Principles & Basic Accounting for Small businessFrom EverandAccounting: Step by Step Guide to Accounting Principles & Basic Accounting for Small businessRating: 4.5 out of 5 stars4.5/5 (9)

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 13Document9 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 13Austin Capal Dela Cruz100% (4)

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 8Document7 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 8Austin Capal Dela Cruz100% (1)

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 7Document8 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 7Austin Capal Dela Cruz50% (2)

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 2Document8 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 2Austin Capal Dela Cruz100% (2)

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 3Document11 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 3Austin Capal Dela Cruz100% (1)

- Chapter 1 SolutionsDocument44 pagesChapter 1 Solutionsaevium0% (1)

- Books of AccountsDocument13 pagesBooks of AccountsKeith Elisa OlivaNo ratings yet

- Accounting 1 Module 9 - The Books of Accounts - Journals Part 1Document19 pagesAccounting 1 Module 9 - The Books of Accounts - Journals Part 1Blanche MargateNo ratings yet

- Accounts Journals TB P10Document22 pagesAccounts Journals TB P10varadu1963No ratings yet

- 2 - Account - IBBIDocument33 pages2 - Account - IBBIRajwinder Singh Bansal100% (1)

- Ledger: Title of An Account Dr. Cr. Dat e Particulars JF Amount Rs. Dat e Particular J F Amount RsDocument2 pagesLedger: Title of An Account Dr. Cr. Dat e Particulars JF Amount Rs. Dat e Particular J F Amount Rsazra khanNo ratings yet

- Co 1 Fabm 1Document23 pagesCo 1 Fabm 1Eddie MabaleNo ratings yet

- The Following Are Main Objectives of Ledger Accounts: 1. To Provide Classified Financial InformationDocument3 pagesThe Following Are Main Objectives of Ledger Accounts: 1. To Provide Classified Financial InformationMatanguihan Bueno ReinaNo ratings yet

- Rac 101 - Journals and LedgersDocument13 pagesRac 101 - Journals and LedgersKevin TamboNo ratings yet

- Module 4 JournalizingDocument8 pagesModule 4 JournalizingJay Anthony CabreraNo ratings yet

- Financial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Document20 pagesFinancial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Aldeguer Joy PenetranteNo ratings yet

- CH-2 Financial Accounting ConceptsDocument40 pagesCH-2 Financial Accounting Conceptsnemik007No ratings yet

- Mefa Iv 1Document23 pagesMefa Iv 120-M-140 HrushikeshNo ratings yet

- Bca Fam Unit 2Document21 pagesBca Fam Unit 2ayushsingh96510No ratings yet

- Ledger in Financial Accounting!Document9 pagesLedger in Financial Accounting!Ram mauryaNo ratings yet

- Accounts Balance Sheet: Actual Accounting FunctionDocument2 pagesAccounts Balance Sheet: Actual Accounting FunctionAllen Jade PateñaNo ratings yet

- Accounting ProcessDocument5 pagesAccounting Process23unnimolNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- EntrepreneurshipDocument21 pagesEntrepreneurshipLoraine CastilloNo ratings yet

- Accountancy Notes-Jayakumar SirDocument31 pagesAccountancy Notes-Jayakumar SirSouvik Aich100% (1)

- 1Q) What Is Accounting State Its ObjectivesDocument9 pages1Q) What Is Accounting State Its ObjectivesMd FerozNo ratings yet

- JOURNAL: The Primary Book: Meaning: A Journal Is The Book Where Transactions of A Business AreDocument1 pageJOURNAL: The Primary Book: Meaning: A Journal Is The Book Where Transactions of A Business AreLipika haldarNo ratings yet

- TLE10-books of AccountsDocument12 pagesTLE10-books of AccountsRoda ReyesNo ratings yet

- 4TH Reviewer (Fabm)Document13 pages4TH Reviewer (Fabm)Jihane TanogNo ratings yet

- Accounting FOR Decision Making: Unit-Ii Ledger AccountsDocument5 pagesAccounting FOR Decision Making: Unit-Ii Ledger AccountsVishal ChandakNo ratings yet

- 2.2 - LedgerDocument3 pages2.2 - LedgerABHAYNo ratings yet

- Notes On Introduction To AccountingDocument6 pagesNotes On Introduction To AccountingVRINDA TOSHNIWAL DPSN-STDNo ratings yet

- Compound Journal Entry. A Compound Journal Entry Is A Combination of Two or MoreDocument1 pageCompound Journal Entry. A Compound Journal Entry Is A Combination of Two or MoreYusuf HusseinNo ratings yet

- Book Keeping and AccountancyDocument3 pagesBook Keeping and AccountancyDeepika SoniNo ratings yet

- Accounting For APARAJITADocument18 pagesAccounting For APARAJITAAjay SahooNo ratings yet

- JournalDocument1 pageJournalDoha HamraniNo ratings yet

- Books of AccountDocument1 pageBooks of AccountFraulien Legacy MaidapNo ratings yet

- Chapter 2 Introduction To Transaction Processing 03Document1 pageChapter 2 Introduction To Transaction Processing 03Marklein DumangengNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentFarooq HaiderNo ratings yet

- Accounting Project (Final Accounts)Document20 pagesAccounting Project (Final Accounts)PowerPoint GoNo ratings yet

- Accounting Final AccountsDocument18 pagesAccounting Final AccountsAjay Sahoo100% (3)

- Moocs Based Report AayushDocument19 pagesMoocs Based Report AayushSarita RanaNo ratings yet

- Chapter 1 Introduction To Accounting PDFDocument18 pagesChapter 1 Introduction To Accounting PDFHussain DilawerNo ratings yet

- Answer: Book-Keeping Is Mainly Concerned With Record Keeping orDocument7 pagesAnswer: Book-Keeping Is Mainly Concerned With Record Keeping orRisha RoyNo ratings yet

- Accounting For LIPSADocument20 pagesAccounting For LIPSAAjay Sahoo100% (1)

- Matter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDocument7 pagesMatter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDanica MamontayaoNo ratings yet

- Financial AccountingDocument1 pageFinancial AccountingCindy The GoddessNo ratings yet

- Taller ConceptosDocument3 pagesTaller ConceptosBreynner LiloyNo ratings yet

- Accounting For JULLYDocument20 pagesAccounting For JULLYAjay SahooNo ratings yet

- Journals: Financial Transactions Debits and Credits Debit CreditDocument1 pageJournals: Financial Transactions Debits and Credits Debit CreditMJ BotorNo ratings yet

- Chapter 1Document8 pagesChapter 1Trisha SinghNo ratings yet

- TOPIC 7 Bookkeeping Journal Ledger Trial BalanceDocument4 pagesTOPIC 7 Bookkeeping Journal Ledger Trial BalanceMarc Ivan AwatNo ratings yet

- Week 1-9 JSS3 AGRICDocument7 pagesWeek 1-9 JSS3 AGRICopeyemiquad123No ratings yet

- FA IntroDocument53 pagesFA IntroSUJAL MOLIYA 2220861No ratings yet

- What Is Management AccountingDocument5 pagesWhat Is Management AccountingGagan Gunjan Prasad YadavNo ratings yet

- Accounting CycleDocument2 pagesAccounting CycleCarl Railey TaperlaNo ratings yet

- Accounting NotesDocument22 pagesAccounting NotesSrikanth Vasantada67% (3)

- Metalanguage: BIG PICTURE IN FOCUS: SLO (7) Record The Transactions Using Special JournalsDocument13 pagesMetalanguage: BIG PICTURE IN FOCUS: SLO (7) Record The Transactions Using Special JournalsAllan LopezNo ratings yet

- Accounting Final AccountsDocument20 pagesAccounting Final AccountsAjay SahooNo ratings yet

- Accounting BooksDocument30 pagesAccounting BooksAshley Keith CadizNo ratings yet

- Coperative Society FinalDocument41 pagesCoperative Society Finalvenkynaidu100% (1)

- CHAPTER 2 - Accounting CycleDocument11 pagesCHAPTER 2 - Accounting CycleFranz Josef MereteNo ratings yet

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 11Document3 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 11Austin Capal Dela Cruz100% (1)

- CSS 2 InfoSheet Week 9Document39 pagesCSS 2 InfoSheet Week 9Austin Capal Dela CruzNo ratings yet

- CSS 2 InfoSheet Week 8Document19 pagesCSS 2 InfoSheet Week 8Austin Capal Dela CruzNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 10Document6 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 10Austin Capal Dela Cruz100% (1)

- CSS 2 InfoSheet Week 10Document29 pagesCSS 2 InfoSheet Week 10Austin Capal Dela CruzNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 12Document5 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 12Austin Capal Dela Cruz100% (1)

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 9Document10 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 9Austin Capal Dela CruzNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 4Document10 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 4Austin Capal Dela CruzNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 1Document7 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 1Austin Capal Dela Cruz50% (2)

- Develop Designs For Product PackagingDocument36 pagesDevelop Designs For Product PackagingAustin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 16Document9 pagesEarth and Life Module Week 16Austin Capal Dela CruzNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 5Document8 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 5Austin Capal Dela CruzNo ratings yet

- DETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 6Document6 pagesDETAILED LESSON PLAN Earth and Life Sciences Grade 11 Week 6Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 8Document70 pagesEarth and Life Module Week 8Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 15Document19 pagesEarth and Life Module Week 15Austin Capal Dela Cruz100% (1)

- Earth and Life Module Week 13Document10 pagesEarth and Life Module Week 13Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 10Document36 pagesEarth and Life Module Week 10Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 14Document12 pagesEarth and Life Module Week 14Austin Capal Dela CruzNo ratings yet

- Basic Sketchup Tools and FunctionsDocument61 pagesBasic Sketchup Tools and FunctionsAustin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 1Document11 pagesEarth and Life Module Week 1Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 2Document25 pagesEarth and Life Module Week 2Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 3Document23 pagesEarth and Life Module Week 3Austin Capal Dela CruzNo ratings yet

- Earth and Life Module Week 6Document38 pagesEarth and Life Module Week 6Austin Capal Dela CruzNo ratings yet

- Graphic Design Tutorial: Adobe Illustrator BasicsDocument41 pagesGraphic Design Tutorial: Adobe Illustrator BasicsAustin Capal Dela CruzNo ratings yet

- Syllabus-Media and Information Literacy-2021Document7 pagesSyllabus-Media and Information Literacy-2021Austin Capal Dela CruzNo ratings yet

- Flowcharts of ISAsDocument22 pagesFlowcharts of ISAskillerj911No ratings yet

- Corporate Governance Problems and Financial Reporting Problems Issues Taken From Local, National and International Case StudiesDocument17 pagesCorporate Governance Problems and Financial Reporting Problems Issues Taken From Local, National and International Case StudiesHans Even Dela CruzNo ratings yet

- Training Plan: Qualification: BOOKKEEPING NC IIIDocument2 pagesTraining Plan: Qualification: BOOKKEEPING NC IIIarnold mamanoNo ratings yet

- Effect of Earnings Management On The Firm Value of The Listed Nigerian Oil and Gas CompaniesDocument23 pagesEffect of Earnings Management On The Firm Value of The Listed Nigerian Oil and Gas CompaniesAudit and Accounting ReviewNo ratings yet

- Sime AnnualReport2004Document112 pagesSime AnnualReport2004LimYikMayNo ratings yet

- CA - Cjs Nanda PresentationDocument68 pagesCA - Cjs Nanda PresentationAmit PrajapatiNo ratings yet

- PTL 2022 Q2Document10 pagesPTL 2022 Q2thirurajaNo ratings yet

- CH 6 Audit IIDocument14 pagesCH 6 Audit IIsamuel debebeNo ratings yet

- 18th Annual Report of BVFCL For The Year 2019-20Document129 pages18th Annual Report of BVFCL For The Year 2019-20udiptya_papai2007No ratings yet

- Elizabeth Dominguez - ResumeDocument1 pageElizabeth Dominguez - ResumeecdominguezNo ratings yet

- Role PlayDocument2 pagesRole PlayPraise Buenaflor100% (1)

- Error and Fraud NoresDocument17 pagesError and Fraud NoresTehreem MujiebNo ratings yet

- 2015 Annual Report PDFDocument80 pages2015 Annual Report PDFFuaad DodooNo ratings yet

- 7 Annual 20200109182422Document290 pages7 Annual 20200109182422Dwi Green PropertyNo ratings yet

- 00 PBC Guideline Edition 1.1Document208 pages00 PBC Guideline Edition 1.1MukabiNo ratings yet

- Use The Balance Column Format To Set Up Each Ledger Account Listed in Its Chart of AccountsDocument9 pagesUse The Balance Column Format To Set Up Each Ledger Account Listed in Its Chart of AccountsHo Trong Tan (K15 HCM)No ratings yet

- Candao v. People, G.R. Nos.186659-710, October 19, 2011, 659 SCRA 696Document23 pagesCandao v. People, G.R. Nos.186659-710, October 19, 2011, 659 SCRA 696Christiaan Castillo0% (1)

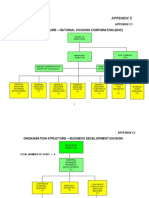

- Organisation Structure - National Housing Corporation (NHC) : Appendix CDocument22 pagesOrganisation Structure - National Housing Corporation (NHC) : Appendix Cbluearrow88100% (1)

- CARD Leasing and Finance CorporationDocument37 pagesCARD Leasing and Finance CorporationMa Fatima FabricanteNo ratings yet

- DAYAG Management Accounting ConceptsDocument15 pagesDAYAG Management Accounting ConceptsHazel PabloNo ratings yet

- Check List To Open A Cbse SchoolDocument7 pagesCheck List To Open A Cbse SchoolAmay suzoriya50% (2)

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Literature Review On Small and Medium Scale Enterprises in NigeriaDocument4 pagesLiterature Review On Small and Medium Scale Enterprises in Nigeriac5g10bt2No ratings yet

- Dhinakar Balakrishnan - Administration Updated On 29 May 2011Document8 pagesDhinakar Balakrishnan - Administration Updated On 29 May 2011Dhinakar BalakrishnanNo ratings yet

- Conventional Versus Non Conventional Cash4079Document10 pagesConventional Versus Non Conventional Cash4079Amna SaeedNo ratings yet

- Discussion Questions - Audit Risksaudit Procedures and EthicsDocument10 pagesDiscussion Questions - Audit Risksaudit Procedures and EthicsCIA190116 STUDENTNo ratings yet

- FCA NV 2018 Annual Report PDFDocument323 pagesFCA NV 2018 Annual Report PDFKulbhushan ChaddhaNo ratings yet

- Gun Jeg A Onkar MeghaDocument6 pagesGun Jeg A Onkar MeghaDev SinghNo ratings yet