Professional Documents

Culture Documents

Example Problem

Example Problem

Uploaded by

Lara Camille CelestialCopyright:

Available Formats

You might also like

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- Comprehensive Application On PayrollDocument18 pagesComprehensive Application On PayrollLara Camille CelestialNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Exercise 5.2 & 5.3 SolvedDocument15 pagesExercise 5.2 & 5.3 SolvedArslan QaviNo ratings yet

- Chapter-1: "A Study On Effectiveness of Cost Control and Techniques in Medopharm PVT LTD., Malur"Document106 pagesChapter-1: "A Study On Effectiveness of Cost Control and Techniques in Medopharm PVT LTD., Malur"Shravani Shrav50% (2)

- AFAR - Final Preboard With AnswersDocument9 pagesAFAR - Final Preboard With AnswersLuiNo ratings yet

- Chapter 8 BudgetingDocument11 pagesChapter 8 BudgetingAira Kristel RomuloNo ratings yet

- Answer Question One: Assignment-1 Managerial AccountingDocument8 pagesAnswer Question One: Assignment-1 Managerial AccountingMina OsamaNo ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- Master Budget Sample ProblemsDocument14 pagesMaster Budget Sample ProblemscykablyatNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- DAIBB Accounting 2020Document14 pagesDAIBB Accounting 2020BelalHossainNo ratings yet

- Exercise in SCIDocument2 pagesExercise in SCIRizty CabibilNo ratings yet

- Problems and Exercises in Introduction in Acctg and CVPDocument4 pagesProblems and Exercises in Introduction in Acctg and CVPJanelleNo ratings yet

- Costing Series 2-2009Q6Document2 pagesCosting Series 2-2009Q6May CcmNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- 09 Quiz 1Document2 pages09 Quiz 1ChiLL MooDNo ratings yet

- Cost Sheet HandoutDocument7 pagesCost Sheet HandoutSidhant AirenNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (28)

- Asynchronous - 01Document8 pagesAsynchronous - 01Joshua SantiagoNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- Chapter 3 Cost AccountingDocument2 pagesChapter 3 Cost AccountingJacob DiazNo ratings yet

- Proj CostDocument64 pagesProj CostCarlisle ChuaNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Midterm Manacc 1Document16 pagesMidterm Manacc 1Maricar PinedaNo ratings yet

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Product Production Units Sales Units: Selling Price Per UnitDocument3 pagesProduct Production Units Sales Units: Selling Price Per UnitKamisiro RizeNo ratings yet

- CHAPTER 10 Exercises 123Document4 pagesCHAPTER 10 Exercises 123freaann03No ratings yet

- CHAPTER 10 Exercises 123Document4 pagesCHAPTER 10 Exercises 123freaann03No ratings yet

- Exercises E2 42b On Cogm With SolutionDocument3 pagesExercises E2 42b On Cogm With SolutionSUNNY BHUSHANNo ratings yet

- Answer c21Document8 pagesAnswer c21Võ Huỳnh BăngNo ratings yet

- MGT 6753 - Mgrl. Acct.,2018Document36 pagesMGT 6753 - Mgrl. Acct.,2018Victor Ng100% (1)

- Kings Inc - Cost AcctgDocument2 pagesKings Inc - Cost AcctgShinjiNo ratings yet

- PRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023Document6 pagesPRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023honguyenkimkhanh55No ratings yet

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Mock Test 3 Online AnswerDocument4 pagesMock Test 3 Online AnswerLucia XIIINo ratings yet

- JOC (Discussion)Document10 pagesJOC (Discussion)Luisa ColumbinoNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- Master Budget Illustrationv2Document16 pagesMaster Budget Illustrationv2Rianne NavidadNo ratings yet

- Variable (Direct) CostingDocument3 pagesVariable (Direct) CostingMela carlonNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- TUTORIAL Manufacturing With SolutionDocument10 pagesTUTORIAL Manufacturing With SolutionmaiNo ratings yet

- 1.3 เฉลย File 1.1 Ch 1 2-2022Document14 pages1.3 เฉลย File 1.1 Ch 1 2-2022Chokthawee RattanawetwongNo ratings yet

- Pgp26 Cma 4 CostsheetDocument15 pagesPgp26 Cma 4 CostsheetRaghav khannaNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument38 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialMinni BegumNo ratings yet

- Cost Concepts Building Blocks (S) - 1Document12 pagesCost Concepts Building Blocks (S) - 1Manan ShahNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementShakir IsmailNo ratings yet

- Chapter 3: Job CostingDocument4 pagesChapter 3: Job CostingmurtleNo ratings yet

- December 2007 Exam - Case 1 - AcmeGameDocument3 pagesDecember 2007 Exam - Case 1 - AcmeGamesherif_awadNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- 1.5 manact เฉลย file 1.2 extra class 2-2022Document32 pages1.5 manact เฉลย file 1.2 extra class 2-2022Chokthawee RattanawetwongNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- CA2 Four Cases SolDocument1 pageCA2 Four Cases SolArshia EmamiNo ratings yet

- bài tập ôn MA1Document34 pagesbài tập ôn MA1Thái DươngNo ratings yet

- Assignment FINALSDocument1 pageAssignment FINALShae1234No ratings yet

- PRACTICE-EXERCISES-Management AccountingDocument7 pagesPRACTICE-EXERCISES-Management AccountingEdric JadeNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Business Genetics: Understanding 21st Century Corporations using xBMLFrom EverandBusiness Genetics: Understanding 21st Century Corporations using xBMLNo ratings yet

- Ratio AnalysisDocument24 pagesRatio AnalysisLara Camille CelestialNo ratings yet

- Logistics AND Supply Chain Managemen TDocument24 pagesLogistics AND Supply Chain Managemen TLara Camille CelestialNo ratings yet

- The Balanced Scorecard: By: Macalinao, Mary Christine Valledor, Blanca LouiseDocument48 pagesThe Balanced Scorecard: By: Macalinao, Mary Christine Valledor, Blanca LouiseLara Camille CelestialNo ratings yet

- m3 Answer KeyDocument8 pagesm3 Answer KeyLara Camille CelestialNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- BA2002 Module 3Document13 pagesBA2002 Module 3Lara Camille CelestialNo ratings yet

- Derivatives Qs PDFDocument5 pagesDerivatives Qs PDFLara Camille CelestialNo ratings yet

- M1. Introduction To Cost and Management AccountingDocument11 pagesM1. Introduction To Cost and Management AccountingLara Camille CelestialNo ratings yet

- Module 1 - Enterprise RiskDocument10 pagesModule 1 - Enterprise RiskLara Camille CelestialNo ratings yet

- 1.4 Different Types of Logistics ManagementDocument21 pages1.4 Different Types of Logistics ManagementLara Camille CelestialNo ratings yet

- Cost Assignment: Bsba MM 1Document11 pagesCost Assignment: Bsba MM 1Lara Camille CelestialNo ratings yet

- Module 2 - Risk Management ProcessDocument13 pagesModule 2 - Risk Management ProcessLara Camille CelestialNo ratings yet

- Guide To Enterprise Risk Management: Freque NT Ly Aske D Que Stion SDocument154 pagesGuide To Enterprise Risk Management: Freque NT Ly Aske D Que Stion SLara Camille Celestial100% (1)

- Module 2 - Intrinsic ValuationDocument11 pagesModule 2 - Intrinsic ValuationLara Camille CelestialNo ratings yet

- Module 3 - Relative ValuationDocument11 pagesModule 3 - Relative ValuationLara Camille CelestialNo ratings yet

- Income TaxDocument38 pagesIncome TaxLara Camille CelestialNo ratings yet

- 2 Ratio AnalysisDocument24 pages2 Ratio AnalysisLara Camille CelestialNo ratings yet

- Corpo TheoriesDocument19 pagesCorpo TheoriesLara Camille CelestialNo ratings yet

- Corpo TheoriesDocument19 pagesCorpo TheoriesLara Camille CelestialNo ratings yet

- Potential Investment OpportunitiesDocument5 pagesPotential Investment OpportunitiesLara Camille CelestialNo ratings yet

- Cash Receipts Process Flowchart: Receives Payment Receive Bank Statement andDocument11 pagesCash Receipts Process Flowchart: Receives Payment Receive Bank Statement andLara Camille CelestialNo ratings yet

- 12 BcashdisbursementsDocument2 pages12 BcashdisbursementsLara Camille CelestialNo ratings yet

- 12 B Cash DisbursementsDocument1 page12 B Cash DisbursementsLara Camille CelestialNo ratings yet

- WRD CSR 2019-20Document188 pagesWRD CSR 2019-20Murali GawandeNo ratings yet

- Kinney8e PPT Ch07Document46 pagesKinney8e PPT Ch07Michelle RotairoNo ratings yet

- Assignment 1Document2 pagesAssignment 1ilyas muhammadNo ratings yet

- Master BudgetDocument6 pagesMaster BudgetPia LustreNo ratings yet

- 04 Absorption & Variable Costing With Pricing DecisionsDocument6 pages04 Absorption & Variable Costing With Pricing Decisionsrandomlungs121223No ratings yet

- Budgeting BUDGET - Is A Detailed Plan, Expressed in Quantitative Terms, About Business Operations For ADocument3 pagesBudgeting BUDGET - Is A Detailed Plan, Expressed in Quantitative Terms, About Business Operations For AMarielle CastañedaNo ratings yet

- Papers of Cost AccountingDocument8 pagesPapers of Cost AccountingTalha BukhariNo ratings yet

- CPA BEC - BudgetingDocument15 pagesCPA BEC - Budgetingpambia2000No ratings yet

- BUS254 - Lecture01 Cost Concepts - 1slideperpageDocument57 pagesBUS254 - Lecture01 Cost Concepts - 1slideperpageJohnNo ratings yet

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument38 pagesAuditing and Assurance Services: Seventeenth Edition, Global Edition賴宥禎No ratings yet

- Production CostDocument6 pagesProduction CostSigrid BoerNo ratings yet

- Topic 1Document59 pagesTopic 1anesuNo ratings yet

- Project Report 2Document11 pagesProject Report 2praveen83362No ratings yet

- Business BudgetingDocument77 pagesBusiness BudgetingDewanFoysalHaqueNo ratings yet

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- Integrated Case Study Complete EditionDocument34 pagesIntegrated Case Study Complete EditionWan Ramss Jr.100% (10)

- Unit 8: Accounting For Spoilage, Reworked Units and Scrap ContentDocument26 pagesUnit 8: Accounting For Spoilage, Reworked Units and Scrap Contentዝምታ ተሻለ0% (1)

- WRD Data Rates (P & M Works 2016-17)Document112 pagesWRD Data Rates (P & M Works 2016-17)Darshan CrNo ratings yet

- Acc 102Document8 pagesAcc 102Wijdan saleemNo ratings yet

- Chapter-1 - Initial PagesDocument28 pagesChapter-1 - Initial PagesAdi PrajapatiNo ratings yet

- Name: Student No.: Exercises For Decision MakingDocument7 pagesName: Student No.: Exercises For Decision MakingShohnura FayzulloevaNo ratings yet

- BALANCE SHEET BUDGET - Makalah-1 VitaDocument13 pagesBALANCE SHEET BUDGET - Makalah-1 VitaNur SallamahNo ratings yet

- The Denim Hub ReportDocument15 pagesThe Denim Hub ReportHamid SohailNo ratings yet

- ACC F3 Inventory Lecture NotesDocument17 pagesACC F3 Inventory Lecture NotesAbdullah ZakariyyaNo ratings yet

Example Problem

Example Problem

Uploaded by

Lara Camille CelestialOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example Problem

Example Problem

Uploaded by

Lara Camille CelestialCopyright:

Available Formats

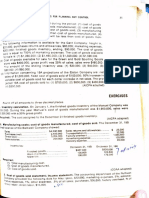

X COMPANY has provided the following data for the month of March:

REQUIRED:

BEGINNING ENDING

DM inventory $25,000 $30,000

WIP inventory 16,000 18,000 1. Total DM available

Finished Goods inv. 36,000 59,000 2. Total DM

MARCH ACTIVITY 3. Total Manufacturing

$71,000

Overhead

DM purchases

4. Total Manufacturing Cost

83,000

DL incurred 5. Cost of Goods

Variable Overhead 58,000 Manufactured

Fixed Overhead

11,000 6. Cost of Goods Sold

Sales Commission 13,500 7. Sales Revenue

8. Gross Profit

Property Taxes on office 8,600

9. Operating Expenses

Sales Office Salaries 13,000

10. Operating Income

Shipping fee on customers 17,800

President’s Salaries 30,000

X COMPANY completed 100,000 units at a price of $8 each.

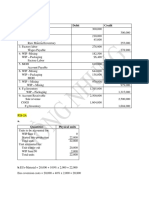

SOLUTIONS:

1. Total DM Available = (DM beg + DM purchases) = 25,000 + 71,000 = 96,000

2. Total DM = (Total DM Available – DM end) = 96,000 – 30,000 = 66,000

3. Total Manufacturing Overhead = (Variable Overhead + Fixed Overhead) = 58,000 + 11,000 = 69,000

4. Total Manufacturing Cost = DM + DL + MO = 66,000 + 83,000 + 69,000 = 218,000

5. Cost of Goods Manufactured = Total Man. Cost + WIP beg – WIP end= 218,000 + 16,000 – 18,000 = 216,000

6. Cost of Goods Sold = COGM + FG beg – FG end) = 216,000 + 36,000 – 59,000 = 193,000

7. Sales Revenue = Units x unit price = 100,000 x 8 = 800,000

8. Gross Profit = (Sales – COGS) = 800,000 – 193,000 = 607,000

9. Operating Expenses:

SE: 13,500 + 17,800 + 13,000 = 44,300

AE: 8,600 + 30,000 = 38,600

OE: 82,900

10. Operating Income = (SR – COGS – OE) = 800,000 – 193,000 – 82,900 = 524,100

You might also like

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- Comprehensive Application On PayrollDocument18 pagesComprehensive Application On PayrollLara Camille CelestialNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Exercise 5.2 & 5.3 SolvedDocument15 pagesExercise 5.2 & 5.3 SolvedArslan QaviNo ratings yet

- Chapter-1: "A Study On Effectiveness of Cost Control and Techniques in Medopharm PVT LTD., Malur"Document106 pagesChapter-1: "A Study On Effectiveness of Cost Control and Techniques in Medopharm PVT LTD., Malur"Shravani Shrav50% (2)

- AFAR - Final Preboard With AnswersDocument9 pagesAFAR - Final Preboard With AnswersLuiNo ratings yet

- Chapter 8 BudgetingDocument11 pagesChapter 8 BudgetingAira Kristel RomuloNo ratings yet

- Answer Question One: Assignment-1 Managerial AccountingDocument8 pagesAnswer Question One: Assignment-1 Managerial AccountingMina OsamaNo ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- Master Budget Sample ProblemsDocument14 pagesMaster Budget Sample ProblemscykablyatNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- DAIBB Accounting 2020Document14 pagesDAIBB Accounting 2020BelalHossainNo ratings yet

- Exercise in SCIDocument2 pagesExercise in SCIRizty CabibilNo ratings yet

- Problems and Exercises in Introduction in Acctg and CVPDocument4 pagesProblems and Exercises in Introduction in Acctg and CVPJanelleNo ratings yet

- Costing Series 2-2009Q6Document2 pagesCosting Series 2-2009Q6May CcmNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- 09 Quiz 1Document2 pages09 Quiz 1ChiLL MooDNo ratings yet

- Cost Sheet HandoutDocument7 pagesCost Sheet HandoutSidhant AirenNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (28)

- Asynchronous - 01Document8 pagesAsynchronous - 01Joshua SantiagoNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- Chapter 3 Cost AccountingDocument2 pagesChapter 3 Cost AccountingJacob DiazNo ratings yet

- Proj CostDocument64 pagesProj CostCarlisle ChuaNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Midterm Manacc 1Document16 pagesMidterm Manacc 1Maricar PinedaNo ratings yet

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Product Production Units Sales Units: Selling Price Per UnitDocument3 pagesProduct Production Units Sales Units: Selling Price Per UnitKamisiro RizeNo ratings yet

- CHAPTER 10 Exercises 123Document4 pagesCHAPTER 10 Exercises 123freaann03No ratings yet

- CHAPTER 10 Exercises 123Document4 pagesCHAPTER 10 Exercises 123freaann03No ratings yet

- Exercises E2 42b On Cogm With SolutionDocument3 pagesExercises E2 42b On Cogm With SolutionSUNNY BHUSHANNo ratings yet

- Answer c21Document8 pagesAnswer c21Võ Huỳnh BăngNo ratings yet

- MGT 6753 - Mgrl. Acct.,2018Document36 pagesMGT 6753 - Mgrl. Acct.,2018Victor Ng100% (1)

- Kings Inc - Cost AcctgDocument2 pagesKings Inc - Cost AcctgShinjiNo ratings yet

- PRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023Document6 pagesPRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023honguyenkimkhanh55No ratings yet

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Mock Test 3 Online AnswerDocument4 pagesMock Test 3 Online AnswerLucia XIIINo ratings yet

- JOC (Discussion)Document10 pagesJOC (Discussion)Luisa ColumbinoNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- Master Budget Illustrationv2Document16 pagesMaster Budget Illustrationv2Rianne NavidadNo ratings yet

- Variable (Direct) CostingDocument3 pagesVariable (Direct) CostingMela carlonNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- TUTORIAL Manufacturing With SolutionDocument10 pagesTUTORIAL Manufacturing With SolutionmaiNo ratings yet

- 1.3 เฉลย File 1.1 Ch 1 2-2022Document14 pages1.3 เฉลย File 1.1 Ch 1 2-2022Chokthawee RattanawetwongNo ratings yet

- Pgp26 Cma 4 CostsheetDocument15 pagesPgp26 Cma 4 CostsheetRaghav khannaNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument38 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialMinni BegumNo ratings yet

- Cost Concepts Building Blocks (S) - 1Document12 pagesCost Concepts Building Blocks (S) - 1Manan ShahNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementShakir IsmailNo ratings yet

- Chapter 3: Job CostingDocument4 pagesChapter 3: Job CostingmurtleNo ratings yet

- December 2007 Exam - Case 1 - AcmeGameDocument3 pagesDecember 2007 Exam - Case 1 - AcmeGamesherif_awadNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- 1.5 manact เฉลย file 1.2 extra class 2-2022Document32 pages1.5 manact เฉลย file 1.2 extra class 2-2022Chokthawee RattanawetwongNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- CA2 Four Cases SolDocument1 pageCA2 Four Cases SolArshia EmamiNo ratings yet

- bài tập ôn MA1Document34 pagesbài tập ôn MA1Thái DươngNo ratings yet

- Assignment FINALSDocument1 pageAssignment FINALShae1234No ratings yet

- PRACTICE-EXERCISES-Management AccountingDocument7 pagesPRACTICE-EXERCISES-Management AccountingEdric JadeNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Business Genetics: Understanding 21st Century Corporations using xBMLFrom EverandBusiness Genetics: Understanding 21st Century Corporations using xBMLNo ratings yet

- Ratio AnalysisDocument24 pagesRatio AnalysisLara Camille CelestialNo ratings yet

- Logistics AND Supply Chain Managemen TDocument24 pagesLogistics AND Supply Chain Managemen TLara Camille CelestialNo ratings yet

- The Balanced Scorecard: By: Macalinao, Mary Christine Valledor, Blanca LouiseDocument48 pagesThe Balanced Scorecard: By: Macalinao, Mary Christine Valledor, Blanca LouiseLara Camille CelestialNo ratings yet

- m3 Answer KeyDocument8 pagesm3 Answer KeyLara Camille CelestialNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- BA2002 Module 3Document13 pagesBA2002 Module 3Lara Camille CelestialNo ratings yet

- Derivatives Qs PDFDocument5 pagesDerivatives Qs PDFLara Camille CelestialNo ratings yet

- M1. Introduction To Cost and Management AccountingDocument11 pagesM1. Introduction To Cost and Management AccountingLara Camille CelestialNo ratings yet

- Module 1 - Enterprise RiskDocument10 pagesModule 1 - Enterprise RiskLara Camille CelestialNo ratings yet

- 1.4 Different Types of Logistics ManagementDocument21 pages1.4 Different Types of Logistics ManagementLara Camille CelestialNo ratings yet

- Cost Assignment: Bsba MM 1Document11 pagesCost Assignment: Bsba MM 1Lara Camille CelestialNo ratings yet

- Module 2 - Risk Management ProcessDocument13 pagesModule 2 - Risk Management ProcessLara Camille CelestialNo ratings yet

- Guide To Enterprise Risk Management: Freque NT Ly Aske D Que Stion SDocument154 pagesGuide To Enterprise Risk Management: Freque NT Ly Aske D Que Stion SLara Camille Celestial100% (1)

- Module 2 - Intrinsic ValuationDocument11 pagesModule 2 - Intrinsic ValuationLara Camille CelestialNo ratings yet

- Module 3 - Relative ValuationDocument11 pagesModule 3 - Relative ValuationLara Camille CelestialNo ratings yet

- Income TaxDocument38 pagesIncome TaxLara Camille CelestialNo ratings yet

- 2 Ratio AnalysisDocument24 pages2 Ratio AnalysisLara Camille CelestialNo ratings yet

- Corpo TheoriesDocument19 pagesCorpo TheoriesLara Camille CelestialNo ratings yet

- Corpo TheoriesDocument19 pagesCorpo TheoriesLara Camille CelestialNo ratings yet

- Potential Investment OpportunitiesDocument5 pagesPotential Investment OpportunitiesLara Camille CelestialNo ratings yet

- Cash Receipts Process Flowchart: Receives Payment Receive Bank Statement andDocument11 pagesCash Receipts Process Flowchart: Receives Payment Receive Bank Statement andLara Camille CelestialNo ratings yet

- 12 BcashdisbursementsDocument2 pages12 BcashdisbursementsLara Camille CelestialNo ratings yet

- 12 B Cash DisbursementsDocument1 page12 B Cash DisbursementsLara Camille CelestialNo ratings yet

- WRD CSR 2019-20Document188 pagesWRD CSR 2019-20Murali GawandeNo ratings yet

- Kinney8e PPT Ch07Document46 pagesKinney8e PPT Ch07Michelle RotairoNo ratings yet

- Assignment 1Document2 pagesAssignment 1ilyas muhammadNo ratings yet

- Master BudgetDocument6 pagesMaster BudgetPia LustreNo ratings yet

- 04 Absorption & Variable Costing With Pricing DecisionsDocument6 pages04 Absorption & Variable Costing With Pricing Decisionsrandomlungs121223No ratings yet

- Budgeting BUDGET - Is A Detailed Plan, Expressed in Quantitative Terms, About Business Operations For ADocument3 pagesBudgeting BUDGET - Is A Detailed Plan, Expressed in Quantitative Terms, About Business Operations For AMarielle CastañedaNo ratings yet

- Papers of Cost AccountingDocument8 pagesPapers of Cost AccountingTalha BukhariNo ratings yet

- CPA BEC - BudgetingDocument15 pagesCPA BEC - Budgetingpambia2000No ratings yet

- BUS254 - Lecture01 Cost Concepts - 1slideperpageDocument57 pagesBUS254 - Lecture01 Cost Concepts - 1slideperpageJohnNo ratings yet

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument38 pagesAuditing and Assurance Services: Seventeenth Edition, Global Edition賴宥禎No ratings yet

- Production CostDocument6 pagesProduction CostSigrid BoerNo ratings yet

- Topic 1Document59 pagesTopic 1anesuNo ratings yet

- Project Report 2Document11 pagesProject Report 2praveen83362No ratings yet

- Business BudgetingDocument77 pagesBusiness BudgetingDewanFoysalHaqueNo ratings yet

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- Integrated Case Study Complete EditionDocument34 pagesIntegrated Case Study Complete EditionWan Ramss Jr.100% (10)

- Unit 8: Accounting For Spoilage, Reworked Units and Scrap ContentDocument26 pagesUnit 8: Accounting For Spoilage, Reworked Units and Scrap Contentዝምታ ተሻለ0% (1)

- WRD Data Rates (P & M Works 2016-17)Document112 pagesWRD Data Rates (P & M Works 2016-17)Darshan CrNo ratings yet

- Acc 102Document8 pagesAcc 102Wijdan saleemNo ratings yet

- Chapter-1 - Initial PagesDocument28 pagesChapter-1 - Initial PagesAdi PrajapatiNo ratings yet

- Name: Student No.: Exercises For Decision MakingDocument7 pagesName: Student No.: Exercises For Decision MakingShohnura FayzulloevaNo ratings yet

- BALANCE SHEET BUDGET - Makalah-1 VitaDocument13 pagesBALANCE SHEET BUDGET - Makalah-1 VitaNur SallamahNo ratings yet

- The Denim Hub ReportDocument15 pagesThe Denim Hub ReportHamid SohailNo ratings yet

- ACC F3 Inventory Lecture NotesDocument17 pagesACC F3 Inventory Lecture NotesAbdullah ZakariyyaNo ratings yet