Professional Documents

Culture Documents

Financial Accounting - IA QP

Financial Accounting - IA QP

Uploaded by

Shreeniwas BhawnaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting - IA QP

Financial Accounting - IA QP

Uploaded by

Shreeniwas BhawnaniCopyright:

Available Formats

DEPARTMENT OF

MANAGEMENT STUDIES

(BBA)

I Internal Assessment – January 2021

Semester: I Semester BBA

Subject Name: Financial Accounting

Time: 1 hour TOTAL: 25 MARKS

Instructions:

Answers should be written in English only.

All the answers should be handwritten only.

Presentation carries One mark.

Section – A

Answer any TWO questions. Each question carries 2 marks 2 X 2 = 04

1.

a) Define Accounting?

b) What is a Journal

c) Write the golden rules of Accounting.

Section – B

Answer any TWO of the following questions. 2 X 5 = 10

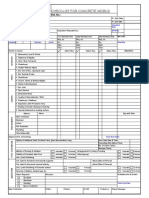

2. The following Balances have been extracted from the books of M/s DSSBL Pvt.

Ltd., Kolkata, on 31st March 2020. You are required to draw out a Trial Balance.

Particulars ₹ Particulars ₹

Capital 11,60,000 Purchases 2,25,000

Cash balance 1,20,000 M/s DTTC-Dr 3,00,000

M/s CLTS (Cr) 1,00,000 General Expenses 75,000

Furniture 80,000 Land & Buildings 1,30,000

Goods 45,000 Return outwards 25,000

Drawings 75,000 Advertisement 60,000

Sundry Debtors 1,45,000 Salaries 35,000

Commission Received 3,000 Discount (Cr) 2,000

3. Classify the following into Personal, Real and Nominal A/cs

Furniture A/c, Interest A/c, Outstanding Wages A/c, Capital A/c, Bindu Sagar A/c,

Investment A/c Repairs A/c, Goodwill A/c

4. Deepak is a dealer in stationery items. From the following transactions, pass journal

entries for the month of January 2018.

Jan. 1 Commenced business with cash Rs.2,00,000

2 Opened a bank account by depositing cash Rs. 1,00,000

3 ‘A 4 papers’ sold on credit to Padmini and Co. Rs. 60,000

4 Bills received from Padmini and Co. for the amount due

5 Bills received from Padmini & Co. discounted with the bank Rs.58,000

Section – C

Answer any ONE of the following questions. 1X10 = 10

5. Joshita is a sole proprietor having a provisions store. Following are the transactions

during the month of January, 2018. Journalise the transactions.

Jan. Rs.

1. Commenced business with cash 80,000

2. Deposited cash with bank 40,000

3. Purchased goods by paying cash 5,000

4. Purchased goods from Lipton & Co. on credit 10,000

5. Sold goods to Joy and received cash 11,000

6. Paid salaries by cash 5,000

7. Paid Lipton & Co. by cheque for the purchases made on 4th Jan.

8. Bought furniture by cash 4,000

9. Paid electricity charges by cash 1,000

10. Bank paid insurance premium on furniture as per standing instructions 300

6. Prepare Pavan’s Account in the Ledger of Rajesh and Rajesh A/c in the Ledger of

Pavan from the following transactions between them: Rs.

2019 Jan 1 Opening debt of Rajesh to Pavan 700

5 Pavan sold goods to Rajesh 3,000

9 Rajesh sold goods to Pavan on Credit 2,000

14 Rajesh returned goods to Pavan 200

17 Pavan received cash from Rajesh 2,000

Discount to Rajesh 300

20 Pavan returned goods to Rajesh 400

25 Rajesh received cash from Pavan 1,500

*** ALL THE BEST***

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- L'Oréal of Paris: Bringing "Class To Mass" With PlénitudeDocument30 pagesL'Oréal of Paris: Bringing "Class To Mass" With Plénitudeariefakbar100% (6)

- 1bba FOA Prep QPDocument2 pages1bba FOA Prep QPSuhail AhmedNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Fundamentals of Accounting Model Question PaperDocument3 pagesFundamentals of Accounting Model Question Paperabhishek509.pNo ratings yet

- REVIEW QUESTIONS-Chp.1 2-G113Document2 pagesREVIEW QUESTIONS-Chp.1 2-G113muhammadreza vatanparastNo ratings yet

- Afm Assignment 1Document3 pagesAfm Assignment 1ನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Financial Accounting Unit 1Document7 pagesFinancial Accounting Unit 1MOAAZ AHMEDNo ratings yet

- XI Commerce Accounting Practice - Paper: TIME: 1 Hour, 10 MinutesDocument4 pagesXI Commerce Accounting Practice - Paper: TIME: 1 Hour, 10 MinutesSYED HAIDER ALI ZAIDINo ratings yet

- Accounting I Terminal Spring 2021Document3 pagesAccounting I Terminal Spring 2021GuryiaNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- ZR Ics Oray WFF 4 o YVGRi 7Document46 pagesZR Ics Oray WFF 4 o YVGRi 7RahulNo ratings yet

- Karnataka I PUC Accountancy 2019 Model Question Paper 1Document7 pagesKarnataka I PUC Accountancy 2019 Model Question Paper 1Lokesh Rao100% (1)

- B.SC & Bca Degree Examination: Fourth SemesterDocument11 pagesB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNo ratings yet

- Incomplete Records QDocument34 pagesIncomplete Records Qcharliedry1920No ratings yet

- Accounting For Managers - Practical ProblemsDocument33 pagesAccounting For Managers - Practical ProblemsdeepeshmahajanNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- Xicomm HHWDocument5 pagesXicomm HHWSSAV ALL IN ONE CHANNELNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- Financial Accounting. (Sem-1) 2017-20Document39 pagesFinancial Accounting. (Sem-1) 2017-20Rahul DasNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- 1Document5 pages1Steve JacobNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- Management Accounting and Analysis Assignment Term - 1Document9 pagesManagement Accounting and Analysis Assignment Term - 1gayathri saranNo ratings yet

- June, 2004 Q.P JRDocument4 pagesJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- March, 2007 QuestionssDocument4 pagesMarch, 2007 QuestionssM JEEVARATHNAM NAIDUNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanDocument4 pagesGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarNo ratings yet

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Thirty Questions For Thirty Minutes Only. Maintain The TimeDocument3 pagesThirty Questions For Thirty Minutes Only. Maintain The TimeANo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- Accountancy 17Document12 pagesAccountancy 17Manav GargNo ratings yet

- Revision Test FinalDocument4 pagesRevision Test FinalRitaNo ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- Revision ch1&2 1thDocument23 pagesRevision ch1&2 1thYousefNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFDocument46 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFQueen MNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Document1 pageVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Additional IllustrationsDocument4 pagesAdditional Illustrationsledaj19139No ratings yet

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Document15 pagesAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaNo ratings yet

- Finl Exm Et 2, 2024Document6 pagesFinl Exm Et 2, 2024Vishavpreet SinghNo ratings yet

- Class 11 AccountsDocument3 pagesClass 11 Accountssamarthj.9390No ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- Question Bank (Accounting Problems)Document11 pagesQuestion Bank (Accounting Problems)Abhishek MohantyNo ratings yet

- PPE Part 2 ModuleDocument13 pagesPPE Part 2 ModuleNatalie SerranoNo ratings yet

- FIN 630.assignmentDocument2 pagesFIN 630.assignmentMuhammad ArbazNo ratings yet

- Chapter 3 Appendix ADocument16 pagesChapter 3 Appendix AJingjing ZhuNo ratings yet

- Elegant LadyDocument1 pageElegant LadyongshazNo ratings yet

- Portfolio Theory Exam 2020 With SolutionDocument4 pagesPortfolio Theory Exam 2020 With SolutionFARAH BENDALINo ratings yet

- Data Sheet A1 A15 BidimDocument2 pagesData Sheet A1 A15 BidimEmil ElkinNo ratings yet

- Festoon Systems For I-Beams Program 0314 - 0320 - 0325 - 0330Document24 pagesFestoon Systems For I-Beams Program 0314 - 0320 - 0325 - 0330Andrea CussighNo ratings yet

- 146-Article Text-959-2-10-20230221Document12 pages146-Article Text-959-2-10-20230221unangsutisna195No ratings yet

- GPH-BUET Test ReportDocument24 pagesGPH-BUET Test ReportAtikur RahmanNo ratings yet

- Microeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test Bank 1Document7 pagesMicroeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test Bank 1shirley100% (58)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)UP Vlogger Sheetal SharmaNo ratings yet

- How To Successfully Use Pitchforks and Median Lines To TradeDocument60 pagesHow To Successfully Use Pitchforks and Median Lines To TradekhangphongnguyengmaiNo ratings yet

- Deed of Conditional SaleDocument2 pagesDeed of Conditional SaleVincent VincentNo ratings yet

- Boarding Pass (COK HYD)Document20 pagesBoarding Pass (COK HYD)Nathan ManiNo ratings yet

- Geographical IndicationsDocument11 pagesGeographical Indicationsdeeksha tewariNo ratings yet

- Data Inventory Shipments of MTCDocument10 pagesData Inventory Shipments of MTCLNPTNo ratings yet

- GoldsmithDocument7 pagesGoldsmithKamala VermaNo ratings yet

- Data - Sheet - FP1 - 2102-100 - Active - Digital - 1060 (Refurb or Newer)Document2 pagesData - Sheet - FP1 - 2102-100 - Active - Digital - 1060 (Refurb or Newer)Basil HwangNo ratings yet

- DS (Pan Africanism)Document59 pagesDS (Pan Africanism)Eden Alvaro EmilyNo ratings yet

- Changing Down - Why Money Is Changing Hands Much Less Frequently - Finance & Economics - The EconomistDocument8 pagesChanging Down - Why Money Is Changing Hands Much Less Frequently - Finance & Economics - The EconomistviniciusltNo ratings yet

- Ebook Economics A Contemporary Introduction 10Th Edition Mceachern Solutions Manual Full Chapter PDFDocument36 pagesEbook Economics A Contemporary Introduction 10Th Edition Mceachern Solutions Manual Full Chapter PDFpauldiamondwe8100% (13)

- Malang Batu Tour Package Itinerary 2 Days 1 NightDocument3 pagesMalang Batu Tour Package Itinerary 2 Days 1 NightSepta SuryadiNo ratings yet

- ADAMA SCIENCE TripDocument4 pagesADAMA SCIENCE TripeyobNo ratings yet

- OEMAND RETROFITRTF4 Installation List - Mineral ProcessingDocument2 pagesOEMAND RETROFITRTF4 Installation List - Mineral ProcessingRaymond BalladNo ratings yet

- Checklist For Concrete Works: Name of Work: Employer: Contract No.: ContractorDocument1 pageChecklist For Concrete Works: Name of Work: Employer: Contract No.: Contractormallikarjuna ketheNo ratings yet

- Chapter - 5: Brick Work: Item No. Description of Item Unit Rate (RS.) Cement Qty. (QTL.)Document8 pagesChapter - 5: Brick Work: Item No. Description of Item Unit Rate (RS.) Cement Qty. (QTL.)ravi rajNo ratings yet

- Riverside Recreation Center at BiruliaDocument19 pagesRiverside Recreation Center at BiruliaAr. Sheikh Md. RezwanNo ratings yet

- Bhavna Road Ways: Transporter NameDocument12 pagesBhavna Road Ways: Transporter NameKunal JainNo ratings yet

- Apex Revision JuneDocument71 pagesApex Revision JuneEhsan Bahrami Gol SorkhdanNo ratings yet