Professional Documents

Culture Documents

BHARAT ACID AND CHEMICALS Vs UoI

BHARAT ACID AND CHEMICALS Vs UoI

Uploaded by

killertapasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BHARAT ACID AND CHEMICALS Vs UoI

BHARAT ACID AND CHEMICALS Vs UoI

Uploaded by

killertapasCopyright:

Available Formats

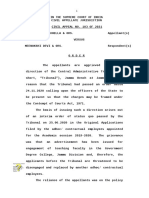

2021-TIOL-289-HC-AHM-GST

IN THE HIGH COURT OF GUJARAT

AT AHMEDABAD

R/Special Civil Application No. 2426 of 2021

M/s BHARAT ACID AND CHEMICALS

PROPRIETOR KANUBHAI MANILAL PATEL

Vs

UNION OF INDIA

J B Pardiwala & Ilesh J Vora, JJ

Dated: February 05, 2021

Appellant Rep by: Mr Hardik V Vora(7123)

Respondent Rep by: Mr Chintan Dave Agp - Advance Copy Served To Government Pleader/PP(99)

GST -

It is brought to the notice of the Bench that the writ applicant was summoned and under the guise of interrogation was kept under detention for

almost a period of 33 hours; that the mode and manner in which the respondents Nos.2 and 3 are alleged to have coerced and pressurized

the writ applicant to transfer an amount of almost Rs.9 Crore to the account of the department is shocking - Notice be issued to the

respondents, returnable on 16th February 2021 - Bench directs the respondents, more particularly, the respondents Nos.2 and 3 to file their

respective reply so that this Court is able to proceed further with the matter expeditiously: High Court [para 3, 4]

Matter posted

JUDGEMENT

Per: J B Pardiwala:

1 We have heard Mr. Hardik Vora, the learned counsel appearing for the writ applicant.

2 The facts of this case are very gross and shocking. Serious allegations have been levelled against the respondents Nos.2 and 3

respectively. The matter needs to be looked into urgently.

3 The mode and manner in which the respondents Nos.2 and 3 are alleged to have coerced and pressurized the writ applicant to transfer an

amount of almost Rs.9 Crore to the account of the department is shocking. It is brought to our notice that the writ applicant was summoned

and under the guise of interrogation was kept under detention for almost a period of 33 hours. No wonder, the State of Gujarat has topped the

list of States with the highest collection of tax under the GST Act in the country for the year 2020-21.

4 Let Notice be issued to the respondents, returnable on 16th February 2021. The respondents shall be served directly through Email. By the

next date of hearing, we direct the respondents, more particularly, the respondents Nos.2 and 3 to file their respective reply so that this Court

is able to proceed further with the matter expeditiously. Mr. Vora shall furnish one set of his entire paper book at the earliest to Mr. Devang

Vyas, the learned Additional Solicitor General of India.

2021-TIOL-289-High Court-Gujarat High Court-GST Page 1 of 2

5 We invite the attention of the respondents to a very detailed order passed by a Coordinate Bench of this Court in the case of Paresh Nathalal

Chauhan vs. State of Gujarat reported in (2020) 79 GST 105 (Gujarat) = 2020-TIOL-913-HC-AHM-GST.

(DISCLAIMER

: Though all efforts have been made to reproduce the order correctly but the access and circulation is subject to the condition that Taxindiaonline are not

responsible/liable for any loss or damage caused to anyone due to any mistake/error/omissions.)

2021-TIOL-289-High Court-Gujarat High Court-GST Page 2 of 2

You might also like

- APURVA CHEMICALS PVT LTD Vs UoIDocument2 pagesAPURVA CHEMICALS PVT LTD Vs UoIkillertapasNo ratings yet

- HEMANI INTERMEDIATES PVT LTD Vs UoIDocument2 pagesHEMANI INTERMEDIATES PVT LTD Vs UoIkillertapasNo ratings yet

- CWP 28718 2022 14 12 2022 Final OrderDocument2 pagesCWP 28718 2022 14 12 2022 Final Ordervinit deshwalNo ratings yet

- Objectionreply To Execution Geeta VS Maqsood Raza and Anr 18-04-2023Document10 pagesObjectionreply To Execution Geeta VS Maqsood Raza and Anr 18-04-2023ADVOCATE ROHIT JHANo ratings yet

- DownloadedDocument3 pagesDownloadedSenthilvel PandianNo ratings yet

- At:-Bhongir.: in The Court of The Hon'Ble Senior Civil Judge CourtDocument8 pagesAt:-Bhongir.: in The Court of The Hon'Ble Senior Civil Judge CourtYedlaNo ratings yet

- Vijay Kumar V Manoj AroraDocument5 pagesVijay Kumar V Manoj AroraAtharva Dutt PandeyNo ratings yet

- Court Orders SchoolDocument60 pagesCourt Orders Schoolshagunshekhar1507No ratings yet

- CFBCB Power PlantsDocument146 pagesCFBCB Power PlantsMohit AgarwalNo ratings yet

- Chemetall Rai India LimitedDocument6 pagesChemetall Rai India LimitedvedaNo ratings yet

- Contempt If SC Orders Not FollowedDocument8 pagesContempt If SC Orders Not FollowedSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- Contempt PetitionDocument10 pagesContempt PetitionAnkit kumar shahwalNo ratings yet

- DARSHAN SINGH VS. BBMB REPLY IN CWP 2577 of 2022Document32 pagesDARSHAN SINGH VS. BBMB REPLY IN CWP 2577 of 2022parthsharma732001No ratings yet

- This Product Is Licensed To: NAVEEN BANNINTHAYA P R ADVOCATEDocument1 pageThis Product Is Licensed To: NAVEEN BANNINTHAYA P R ADVOCATEabhishekkomeNo ratings yet

- Versus: Efore Ajasheker Eddy AND AxmanDocument1 pageVersus: Efore Ajasheker Eddy AND AxmanPriyesh KumarNo ratings yet

- 1 Judgment-WPL 11293-21.odtDocument30 pages1 Judgment-WPL 11293-21.odtAlok SinghNo ratings yet

- CRM-M 20906 2020 28 08 2020 Final OrderDocument4 pagesCRM-M 20906 2020 28 08 2020 Final OrderVilas KanaujiaNo ratings yet

- CWP 15713 2021 01 02 2023 Interim OrderDocument3 pagesCWP 15713 2021 01 02 2023 Interim OrderlslawfirmindiaNo ratings yet

- CWP 6549 2022 08 02 2023 Interim OrderDocument2 pagesCWP 6549 2022 08 02 2023 Interim OrderSayan GhoshNo ratings yet

- Water BWSSBDocument5 pagesWater BWSSBDhevrath AcNo ratings yet

- Legal Pending Cases Report 31-01-2024Document4 pagesLegal Pending Cases Report 31-01-2024Nitesh GargNo ratings yet

- Nobel Cera Coat Vs Oil and Natural Gas CorporationGJ202130092116332993COM345281Document6 pagesNobel Cera Coat Vs Oil and Natural Gas CorporationGJ202130092116332993COM345281aryan.anand304469No ratings yet

- Petition 2007 RO 2020-21Document302 pagesPetition 2007 RO 2020-21Mohit AgarwalNo ratings yet

- Jai Mangala Fuels Pvt. Ltd. v. Central Coalfields Ltd.Document16 pagesJai Mangala Fuels Pvt. Ltd. v. Central Coalfields Ltd.Shreya SinhaNo ratings yet

- Jhon VaneyDocument4 pagesJhon VaneyPu dataopNo ratings yet

- India SirimathyDocument23 pagesIndia SirimathyCamila CampilloNo ratings yet

- And Ot 2022: Writ Petition Nos.2288Document22 pagesAnd Ot 2022: Writ Petition Nos.2288B SATYANARAYANANo ratings yet

- In The High Court of Punjab and Haryana at Chandigarh CWP-15839-2022 (O&M) Date of Decision: July 25, 2022Document2 pagesIn The High Court of Punjab and Haryana at Chandigarh CWP-15839-2022 (O&M) Date of Decision: July 25, 2022mukesh kumarNo ratings yet

- Vadodara Enviro Channel Limited Vs State of Gujarat On 18 June 2021Document13 pagesVadodara Enviro Channel Limited Vs State of Gujarat On 18 June 2021Aldrin ZothanmawiaNo ratings yet

- Durga Raman Patnaik Vs Addl Comm GSTDocument70 pagesDurga Raman Patnaik Vs Addl Comm GSTHardev SinghNo ratings yet

- In The High Court of Gujarat at Ahmedabad R/Special Civil Application No. 6623 of 2022Document6 pagesIn The High Court of Gujarat at Ahmedabad R/Special Civil Application No. 6623 of 2022PraveenNo ratings yet

- SupremeCourt Order 02-May-2022Document4 pagesSupremeCourt Order 02-May-2022Mujtaba Yousuf KathjooNo ratings yet

- Huda V Kamaljit KaurDocument4 pagesHuda V Kamaljit KaurYashasvi SharmaNo ratings yet

- Annexure 6 Application of Contractor Dated 12 04 2023 Filed Before atDocument26 pagesAnnexure 6 Application of Contractor Dated 12 04 2023 Filed Before atಕೇधाR ಗೋDaसेNo ratings yet

- Letter No. 14165 Dated 23.10.2020Document4 pagesLetter No. 14165 Dated 23.10.2020Abhishek BhandariNo ratings yet

- NCLAT Appeal Resolution PlanDocument15 pagesNCLAT Appeal Resolution PlanNishant SharmaNo ratings yet

- Bharat KalraDocument5 pagesBharat Kalramayank khatriNo ratings yet

- Smart Roofing Private Limited Vs State Tax Officer Madras High CourtDocument6 pagesSmart Roofing Private Limited Vs State Tax Officer Madras High CourtTILA Shreya JainNo ratings yet

- The Hon'ble MR - Justice T.S.SIVAGNANAM and The Hon'ble Mrs - Justice S.ANANTHIDocument2 pagesThe Hon'ble MR - Justice T.S.SIVAGNANAM and The Hon'ble Mrs - Justice S.ANANTHISenthilvel PandianNo ratings yet

- MISC. PETITION (L) NO.13800 OF 2021 IN Testamentary Petition No.3148 of 2019Document2 pagesMISC. PETITION (L) NO.13800 OF 2021 IN Testamentary Petition No.3148 of 2019Pranjali RanadeNo ratings yet

- Aptel Order 10.02.2023Document3 pagesAptel Order 10.02.2023akhilvsksebNo ratings yet

- Sri Gopal and Anr V Deputy Commissioner and OrsDocument10 pagesSri Gopal and Anr V Deputy Commissioner and OrsMen RightsNo ratings yet

- Sundararaj V Registrar General 478278Document23 pagesSundararaj V Registrar General 478278Kavitha KumarNo ratings yet

- DownloadedDocument2 pagesDownloadedsowmyam28108No ratings yet

- CM 365 OF 2023 NEMO v.UOI 22.05.2023Document30 pagesCM 365 OF 2023 NEMO v.UOI 22.05.2023Sarvadaman OberoiNo ratings yet

- Arjun Kadam: For Clarification of Interim Reliefs/ Speaking To MinutesDocument3 pagesArjun Kadam: For Clarification of Interim Reliefs/ Speaking To MinutesArjun KadamNo ratings yet

- Vinod Kumar Jain Written SynopsisDocument11 pagesVinod Kumar Jain Written SynopsisRavindra Nath Pareek100% (1)

- Food Corporation of India Vs Joginderpal Mohinderpal On 3 March, 1989Document8 pagesFood Corporation of India Vs Joginderpal Mohinderpal On 3 March, 1989Avilash KumbharNo ratings yet

- Application Seeking Vacation of Stay in WP-PKD Vs State 15-11-2022Document8 pagesApplication Seeking Vacation of Stay in WP-PKD Vs State 15-11-2022Sundaram OjhaNo ratings yet

- Arjun Kadam: For Clarification of Interim Reliefs/ Speaking To MinutesDocument3 pagesArjun Kadam: For Clarification of Interim Reliefs/ Speaking To MinutesArjun KadamNo ratings yet

- WP 13482 2022 Order 01-Aug-2022 Digi PDFDocument1 pageWP 13482 2022 Order 01-Aug-2022 Digi PDFAditya JoshiNo ratings yet

- Sca200152018 GJHC240765812018 21 24122021Document6 pagesSca200152018 GJHC240765812018 21 24122021Wealth ZentralNo ratings yet

- Application To Seek PermissionDocument3 pagesApplication To Seek PermissionSana ParveenNo ratings yet

- Signature Not Verified: Digitally Signed by Narendra Prasad Date: 2019.08.08 17:05:20 IST ReasonDocument18 pagesSignature Not Verified: Digitally Signed by Narendra Prasad Date: 2019.08.08 17:05:20 IST ReasonAmit JainNo ratings yet

- In The High Court of Judicature at Patna: Civil Writ Jurisdiction Case No.18381 of 2021Document4 pagesIn The High Court of Judicature at Patna: Civil Writ Jurisdiction Case No.18381 of 2021Ritu MishraNo ratings yet

- Messrs Shree Renuka Sugars Ltd. Versus State of GujaratDocument12 pagesMessrs Shree Renuka Sugars Ltd. Versus State of Gujaratrizwanipooja89No ratings yet

- Expedicious Hearing PetitionDocument6 pagesExpedicious Hearing PetitionSoumon NandaNo ratings yet

- ARB. No. 103 of 2021 Meenu Pal Khanna & Ors. v. UoI & OrsDocument26 pagesARB. No. 103 of 2021 Meenu Pal Khanna & Ors. v. UoI & Orsaditi lakhanpal100% (1)

- CNG JudgmentDocument205 pagesCNG JudgmentkartikeyatannaNo ratings yet

- Icici Econet Internet and Technology Fund Vs CCTDocument57 pagesIcici Econet Internet and Technology Fund Vs CCTkillertapasNo ratings yet

- JSW ENERGY LTD Vs UoIDocument8 pagesJSW ENERGY LTD Vs UoIkillertapasNo ratings yet

- JSK MARKETING LTD Vs UoIDocument10 pagesJSK MARKETING LTD Vs UoIkillertapasNo ratings yet

- CNS COMNET SOLUTION PVT LTD Vs CCE & STDocument3 pagesCNS COMNET SOLUTION PVT LTD Vs CCE & STkillertapasNo ratings yet

- HEMANI INTERMEDIATES PVT LTD Vs UoIDocument2 pagesHEMANI INTERMEDIATES PVT LTD Vs UoIkillertapasNo ratings yet

- Aswath ManoharanDocument7 pagesAswath ManoharankillertapasNo ratings yet

- APURVA CHEMICALS PVT LTD Vs UoIDocument2 pagesAPURVA CHEMICALS PVT LTD Vs UoIkillertapasNo ratings yet

- Combined SummonsDocument5 pagesCombined SummonsKaino ShatipambaNo ratings yet

- Public Attorney'S Office Citizen'S Charter: MissionDocument10 pagesPublic Attorney'S Office Citizen'S Charter: MissionmharmeeNo ratings yet

- Won Molina Is Guilty of The Crime MurderDocument2 pagesWon Molina Is Guilty of The Crime MurderEJ SantosNo ratings yet

- Motion To Defer Arraignment - Google SearchDocument2 pagesMotion To Defer Arraignment - Google Searchbatusay575No ratings yet

- Firestone Tire vs. Lariosa (G.R. No. 70479 February 27, 1987)Document1 pageFirestone Tire vs. Lariosa (G.R. No. 70479 February 27, 1987)Diana HernandezNo ratings yet

- Answer To Complaint of Breach of Promise To MarryDocument8 pagesAnswer To Complaint of Breach of Promise To MarryMarilou AgustinNo ratings yet

- Sunita Types of DefamationDocument24 pagesSunita Types of DefamationSunita AdhikariNo ratings yet

- National Abaca and Other Fibers Corporation VDocument1 pageNational Abaca and Other Fibers Corporation VcyhaaangelaaaNo ratings yet

- Paat VS CaDocument1 pagePaat VS CaAr LineNo ratings yet

- 2.) Remulla Vs SandiganbayanDocument2 pages2.) Remulla Vs SandiganbayanAreeya Manalastas0% (1)

- Young v. Reed Elsevier, Inc. Et Al - Document No. 50Document2 pagesYoung v. Reed Elsevier, Inc. Et Al - Document No. 50Justia.comNo ratings yet

- 195 PEOPLE v. RECTODocument4 pages195 PEOPLE v. RECTOav783No ratings yet

- 036-People v. Goce, 247 S 780 (1995)Document6 pages036-People v. Goce, 247 S 780 (1995)Jopan SJNo ratings yet

- De Zuzuarregui vs. Hon VillarosaDocument3 pagesDe Zuzuarregui vs. Hon VillarosabusinessmanNo ratings yet

- G.R. No. 191787, June 22, 2015 - Macario Catipon, JR., Petitioner, V. Jerome Japson, RespondentDocument9 pagesG.R. No. 191787, June 22, 2015 - Macario Catipon, JR., Petitioner, V. Jerome Japson, RespondentBret MonsantoNo ratings yet

- Metrobank vs. Go Case DigestDocument2 pagesMetrobank vs. Go Case DigestRyzer Rowan100% (1)

- Samartino v. RaonDocument6 pagesSamartino v. RaonBianca LaurelNo ratings yet

- Brock v. Hastings - Document No. 4Document14 pagesBrock v. Hastings - Document No. 4Justia.comNo ratings yet

- State of South Carolina v. Vivian (Libby) Campbell DuBoseDocument4 pagesState of South Carolina v. Vivian (Libby) Campbell DuBoseKristen Faith SchneiderNo ratings yet

- Affidavit - Arlyn Parreno RevlamDocument5 pagesAffidavit - Arlyn Parreno RevlamLowell MadrilenoNo ratings yet

- Phil Rabbit vs. IACDocument8 pagesPhil Rabbit vs. IACCyruss Xavier Maronilla NepomucenoNo ratings yet

- 4P Mock Trial, Arraignment, Pretrial, Presentation of ProsecutionDocument11 pages4P Mock Trial, Arraignment, Pretrial, Presentation of ProsecutionMelencio Silverio FaustinoNo ratings yet

- ASSIGNMENT TortDocument5 pagesASSIGNMENT TortriyaNo ratings yet

- DoctrinesDocument2 pagesDoctrinesmarie deniegaNo ratings yet

- MEMORANDUM Republic of The Philippines Made by Sol For Legal Forms Midterm ExamDocument8 pagesMEMORANDUM Republic of The Philippines Made by Sol For Legal Forms Midterm ExamLee SomarNo ratings yet

- StewWebb Vs Bush Millman OrganizedCrime GrandJuryFilings 20141228Document89 pagesStewWebb Vs Bush Millman OrganizedCrime GrandJuryFilings 20141228stewwebb1100% (2)

- Gary ReversalDocument15 pagesGary Reversalthe kingfishNo ratings yet

- Alcantara v. Ponce, G.R. No. 156183, Feb. 28, 2007 FactsDocument1 pageAlcantara v. Ponce, G.R. No. 156183, Feb. 28, 2007 FactsHazel ManuelNo ratings yet

- Law 9Document7 pagesLaw 9ram RedNo ratings yet

- People v. Macal y BolascoDocument10 pagesPeople v. Macal y BolascoKim Ydela Lumagbas100% (1)