Professional Documents

Culture Documents

Revision 5 Economics IB

Revision 5 Economics IB

Uploaded by

Sean CalvinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision 5 Economics IB

Revision 5 Economics IB

Uploaded by

Sean CalvinCopyright:

Available Formats

REVISION 5: EQUITY AND EQUALITY

FINAL EXAMINATION MAY 2019

AFY – 2018 JULY, AUGUST & OCTOBER INTAKES

QUESTION FIVE: EQUITY AND EQUALITY

A. Tim’s annual salary is $84,565. Explain how the salary and the

disposable income for the year will be very much different. You should

use figures to support your answer if possible.

(2 marks)

A. Differentiate between Marginal Tax Rate (MTR) and Average Tax Rate

(ATR). Use your answer from (A) above to support your answer.

(2 marks)

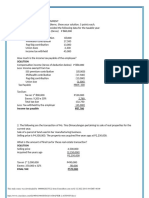

Income Tax Rates - 2018

Using the tax rate given above and an income of $84,565 calculate:

(i) Total tax payable $_________________

(ii) Average tax rate___________________

(iii) Marginal tax rate___________________

(3 marks)

FINAL EXAMINATION MAY 2016

AFY – 2015 JULY, AUGUST & OCTOBER INTAKES

QUESTION THREE: EQUITY AND EFFICIENCY 8 Marks

(a) Explain using an example why most people will consider it fair (equitable)

that someone is paid a much higher income than another.

(2marks)

(b) Using the current tax table given below, calculate the disposable income if

income is $46,000 and $120,000 per annum.

Table 2: NZ Income Tax Rates 2016

$46,000 $120,000

(4 marks)

ECONOMICS REVISION 5 FOR FINAL EXAMS 2020 JULY AUGUST OCTOBER

INTAKES Page 2

(c) Graph 3: Lorenz Curve

% total Income

% total households

(i) On the graph above show the impact of increase of tax on income

over $70,000 from 33% to 35 % by the government. Label the new

curve L1.

(1 mark)

(ii) With reference to the graph above, explain how the change will

affect the a country’s income distribution

(1 mark)

ECONOMICS REVISION 5 FOR FINAL EXAMS 2020 JULY AUGUST OCTOBER

INTAKES Page 3

FINAL EXAMINATION MAY 2015

TAFY – 2014 JULY/AUGUST/OCTOBER INTAKE

QUESTION TWO: EQUITY AND EFFICIENCY 8 Marks

A. Explain why most people will consider it fair (equitable) that a lawyer is

paid a much higher income than a cashier at a supermarket.

(2 marks)

B. One person earns $100,000 a year and the other is unemployed.

Explain two reasons why there may be more equality between them

than obvious.

(2 marks)

C. Using the current tax table given below, calculate the disposable

income of a person earning $120,000 per annum.

Table 1: NZ Income Tax Rates 2014

ECONOMICS REVISION 5 FOR FINAL EXAMS 2020 JULY AUGUST OCTOBER

INTAKES Page 4

Additional Question

Use production possibility curve to explain equity and efficiency.

ECONOMICS REVISION 5 FOR FINAL EXAMS 2020 JULY AUGUST OCTOBER

INTAKES Page 5

You might also like

- Direct Tax Volume 2Document171 pagesDirect Tax Volume 2Přêm Pŕâkåśh Shařmâ100% (1)

- Topic 4: Product Market: Topic Questions For Revision s2 2020Document3 pagesTopic 4: Product Market: Topic Questions For Revision s2 2020eugene antonyNo ratings yet

- RecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBDocument8 pagesRecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBdavid barnwellNo ratings yet

- Economics Revision 2: Section B: Short Answer Questions Question One: Circular Flow ModelDocument6 pagesEconomics Revision 2: Section B: Short Answer Questions Question One: Circular Flow ModelSean CalvinNo ratings yet

- Revision 4 International Trade Economics IBDocument6 pagesRevision 4 International Trade Economics IBSean CalvinNo ratings yet

- Economics Past Papers 2014 - 2016Document22 pagesEconomics Past Papers 2014 - 2016Shane ThomasNo ratings yet

- ECON 203 - Midterm - 2010F - AncaAlecsandru - Solution PDFDocument6 pagesECON 203 - Midterm - 2010F - AncaAlecsandru - Solution PDFexamkillerNo ratings yet

- CAT 2-Fundamentals of EconomicsDocument7 pagesCAT 2-Fundamentals of Economicstrevor.gatuthaNo ratings yet

- ECON 203 Midterm 2013W FaisalRabbyDocument7 pagesECON 203 Midterm 2013W FaisalRabbyexamkillerNo ratings yet

- (A) Value of The Marginal Propensity To Save Decreases.: Income 100 150Document4 pages(A) Value of The Marginal Propensity To Save Decreases.: Income 100 150Ashutosh SharmaNo ratings yet

- BECO260 Final Examination Revision SheetDocument36 pagesBECO260 Final Examination Revision Sheetbill haddNo ratings yet

- Tutorial Test Question PoolDocument6 pagesTutorial Test Question PoolAAA820No ratings yet

- Final Exam December 2020Document5 pagesFinal Exam December 2020Ikhwan RizkyNo ratings yet

- Revision 3 National Income Economics IBDocument4 pagesRevision 3 National Income Economics IBSean CalvinNo ratings yet

- 2021 Fort Street HSC Economics TrialDocument12 pages2021 Fort Street HSC Economics Triallg019 workNo ratings yet

- Edexcel Paper 2 June 2018Document20 pagesEdexcel Paper 2 June 2018.No ratings yet

- ECON 203 Midterm 2012W AncaAlecsandru SolutionDocument8 pagesECON 203 Midterm 2012W AncaAlecsandru SolutionexamkillerNo ratings yet

- Business Studies: Junior Cycle Final Examination Sample PaperDocument24 pagesBusiness Studies: Junior Cycle Final Examination Sample PaperisabellemahonNo ratings yet

- Edexcel Paper 2 October 2020Document22 pagesEdexcel Paper 2 October 2020.No ratings yet

- Ec100 2021Document5 pagesEc100 2021yuanyuyue0330No ratings yet

- DBA Macroeconomics Tutorial Questions 2017Document10 pagesDBA Macroeconomics Tutorial Questions 2017Limatono Nixon 7033RVXLNo ratings yet

- Assignment 1, Macroeconomics 2016-2017Document3 pagesAssignment 1, Macroeconomics 2016-2017Laurenţiu-Cristian CiobotaruNo ratings yet

- Midterm 1 Answer Key StudentsDocument8 pagesMidterm 1 Answer Key Studentsshush10No ratings yet

- Hmci-201 End Sem Test ADocument4 pagesHmci-201 End Sem Test ARAHULNo ratings yet

- ECON 203 Midterm 2013W FillippiadisDocument5 pagesECON 203 Midterm 2013W FillippiadisexamkillerNo ratings yet

- 2019 HSC EconomicsDocument24 pages2019 HSC Economicscohennguyen21No ratings yet

- Economics PQDocument9 pagesEconomics PQash kathumNo ratings yet

- Cbse Class 12 Economics - PQDocument21 pagesCbse Class 12 Economics - PQMurtaza JamaliNo ratings yet

- ECO-12 CBSE Additional Practice Questions 2023-24Document20 pagesECO-12 CBSE Additional Practice Questions 2023-24Sadjaap SinghNo ratings yet

- Economics Previous PapersDocument6 pagesEconomics Previous PapersmurthyNo ratings yet

- Economics 1B Final OSADocument8 pagesEconomics 1B Final OSAsamkelodazoNo ratings yet

- Eco 210 - MacroeconomicsDocument5 pagesEco 210 - MacroeconomicsRahul raj SahNo ratings yet

- Chapter 11 Online TestDocument3 pagesChapter 11 Online TestGodfreyFrankMwakalingaNo ratings yet

- Econ Replacement Test Unit 2Document3 pagesEcon Replacement Test Unit 2Manil FernandoNo ratings yet

- 2020 HSC Eco Topic TestDocument23 pages2020 HSC Eco Topic TestJohnNo ratings yet

- Econ 203 Tt2Document7 pagesEcon 203 Tt2examkillerNo ratings yet

- 202324XII ECONOMICS PBQPScience Along With Answer KeyDocument18 pages202324XII ECONOMICS PBQPScience Along With Answer Keyashu3670No ratings yet

- ECO 102 - Assignment IIDocument2 pagesECO 102 - Assignment IISayeeda JahanNo ratings yet

- Ned University of Engineering & Technology: Principles of Economics - MT-153Document2 pagesNed University of Engineering & Technology: Principles of Economics - MT-153Syed AliainNo ratings yet

- Economics QuestionsDocument7 pagesEconomics QuestionsAnvi ChoudharyNo ratings yet

- Question Paper For MA Economics Entrance 2012Document18 pagesQuestion Paper For MA Economics Entrance 2012ARUPARNA MAITYNo ratings yet

- June 2020 QPDocument8 pagesJune 2020 QPpolojermainNo ratings yet

- CBE Practice Exam Revised July 2015Document8 pagesCBE Practice Exam Revised July 2015Haymanot GirmaNo ratings yet

- PS4Document7 pagesPS4Steven Hyosup KimNo ratings yet

- Macro PDF Important QuestionsDocument2 pagesMacro PDF Important Questionsakhilsharmac1140No ratings yet

- Work Sheet # 2Document4 pagesWork Sheet # 2Sashina GrantNo ratings yet

- 2021 HSC EconomicsDocument24 pages2021 HSC EconomicspotpalNo ratings yet

- Intermediate Accounting III: Pre-Test - Errors and ChangesDocument2 pagesIntermediate Accounting III: Pre-Test - Errors and ChangesMay RamosNo ratings yet

- Assignment 1-Đã G PDocument6 pagesAssignment 1-Đã G Plinhhobi13062013No ratings yet

- Financial Reporting (FR) Sept/Dec 2021 Examiner's ReportDocument28 pagesFinancial Reporting (FR) Sept/Dec 2021 Examiner's ReportOmid BasirNo ratings yet

- Reading 24 Income TaxesDocument43 pagesReading 24 Income TaxesNeerajNo ratings yet

- s2 Revision PERTAMADocument2 pagess2 Revision PERTAMAeugene antonyNo ratings yet

- University of Mauritius: Instructions To CandidatesDocument8 pagesUniversity of Mauritius: Instructions To Candidates80tekNo ratings yet

- Macro Modified FRQs For 2020 Exam No GraphsDocument17 pagesMacro Modified FRQs For 2020 Exam No GraphsShirin JNo ratings yet

- June 2019 QPDocument8 pagesJune 2019 QPpolojermainNo ratings yet

- Economics Prepboard 1SET - BDocument6 pagesEconomics Prepboard 1SET - Bjainehalll28No ratings yet

- SLC ACCT5 2019S3 101 Assignment04Document8 pagesSLC ACCT5 2019S3 101 Assignment04kasad jdnfrnasNo ratings yet

- MA 习题强化 Chapter 14-18Document15 pagesMA 习题强化 Chapter 14-18roseliu.521.jackNo ratings yet

- Spec 2008 - Unit 2 - Paper 1Document11 pagesSpec 2008 - Unit 2 - Paper 1capeeconomics83% (12)

- (25 Marks) : Table 1Document7 pages(25 Marks) : Table 1Atashi ChakrabortyNo ratings yet

- Term I Report - FA - Berger PaintsDocument8 pagesTerm I Report - FA - Berger PaintsSumant IssarNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 4Document6 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 4JordanNo ratings yet

- Soparfi Holding and Financing Company Scheme: ScopeDocument2 pagesSoparfi Holding and Financing Company Scheme: ScopeAlexbepsNo ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- 1a. Investment in Associate - LectureDocument14 pages1a. Investment in Associate - Lecturekyle GipulanNo ratings yet

- Acct Case 1 - 211123 - 122050Document4 pagesAcct Case 1 - 211123 - 122050HADTUGINo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Tax Quiz 4Document6 pagesTax Quiz 4Adah Micah PlarisanNo ratings yet

- Uncollected Social Security and Medicare Tax On WagesDocument2 pagesUncollected Social Security and Medicare Tax On Wagesnujahm1639No ratings yet

- Income Tax 2023-24 Statement - Mahesh R1Document2 pagesIncome Tax 2023-24 Statement - Mahesh R1akhilhed100% (1)

- Agricultural IncomeDocument16 pagesAgricultural Incomesuyash dugarNo ratings yet

- May 2020 - AP Drill 1 (SHE & Liabs) - Answer KeyDocument10 pagesMay 2020 - AP Drill 1 (SHE & Liabs) - Answer KeyROMAR A. PIGANo ratings yet

- Income CertificateDocument1 pageIncome Certificatechalansonu41No ratings yet

- Taxation Major Exam Final QuestionnaireDocument16 pagesTaxation Major Exam Final QuestionnaireSec PishNo ratings yet

- Accounts Important QuestionDocument3 pagesAccounts Important Questionankitchauhan9630No ratings yet

- Test 1 Question PaperDocument12 pagesTest 1 Question PaperNaveen R HegadeNo ratings yet

- Week 4Document22 pagesWeek 4Lawprep TutorialgovNo ratings yet

- AC4301 FinalExam 2020-21 SemA QuestionsDocument12 pagesAC4301 FinalExam 2020-21 SemA QuestionslawlokyiNo ratings yet

- Our Lady of The Pillar College - CauayanDocument5 pagesOur Lady of The Pillar College - CauayanAnnhtak PNo ratings yet

- Tax Filing Basics For Stock Plan TransactionsDocument8 pagesTax Filing Basics For Stock Plan Transactionshananahmad114No ratings yet

- Chapter 1 Introduction To GSTDocument5 pagesChapter 1 Introduction To GSTabhay javiyaNo ratings yet

- Introduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualDocument42 pagesIntroduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualberthaNo ratings yet

- Financial Statements I Class 11 NotesDocument40 pagesFinancial Statements I Class 11 NotesAshna vargheseNo ratings yet

- Sample Notes Low Chin Ann ACCA ATX Genesis OrigoDocument22 pagesSample Notes Low Chin Ann ACCA ATX Genesis OrigoLow Chin AnnNo ratings yet

- ACTBFAR - Exercise Set #1Document7 pagesACTBFAR - Exercise Set #1Cha PampolinaNo ratings yet

- Telangana Professional TaxDocument8 pagesTelangana Professional TaxAnjaneyulu ReddyNo ratings yet

- Problem Set 4Document2 pagesProblem Set 4Haseeb RazaNo ratings yet

- CIR vs. The Stanley Work SalesDocument3 pagesCIR vs. The Stanley Work SalesKate DomingoNo ratings yet

- Revisiting Kenneth Brown's "10-Point Test"Document6 pagesRevisiting Kenneth Brown's "10-Point Test"DEDY KURNIAWANNo ratings yet