Professional Documents

Culture Documents

Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants

Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants

Uploaded by

Yekini AyobamideleCopyright:

Available Formats

You might also like

- Bills of Lading PDFDriveDocument873 pagesBills of Lading PDFDriveDallace Mirza100% (2)

- BRF - Purchase ContractDocument8 pagesBRF - Purchase Contracthanna75% (4)

- Transpo BookDocument872 pagesTranspo BookIra Francia AlcazarNo ratings yet

- Maritime Law by Christopher Hill 6th Edition. 2003 PDFDocument38 pagesMaritime Law by Christopher Hill 6th Edition. 2003 PDFchad donioNo ratings yet

- MCQ - 20 04 2015 - FinalDocument36 pagesMCQ - 20 04 2015 - FinalKawoser Ahammad100% (2)

- Freight Forwarding DocumentsDocument3 pagesFreight Forwarding Documentsmanolito rufinoNo ratings yet

- Double Entry Interim AccountsDocument6 pagesDouble Entry Interim AccountsKashish ChhabraNo ratings yet

- Introduction To Transaction ProcessingDocument20 pagesIntroduction To Transaction ProcessingSatrio MangkunegoroNo ratings yet

- Lecture 2 Traditional Accounting Information SystemsDocument12 pagesLecture 2 Traditional Accounting Information SystemsCrispus KimingichNo ratings yet

- Traditional Accounting System VsDocument9 pagesTraditional Accounting System VsErra PeñafloridaNo ratings yet

- Accounting - Dr. Chandra ShekaDocument419 pagesAccounting - Dr. Chandra ShekaEjaz AhmadNo ratings yet

- AISDocument11 pagesAISSANCHEZ, Janna Rosh Hashana M.No ratings yet

- Nature of AccountingDocument3 pagesNature of Accountinga manikantaNo ratings yet

- Comparative Analysis of Traditional and Modern Accounting ApproachDocument3 pagesComparative Analysis of Traditional and Modern Accounting ApproachAnas DeshmukhNo ratings yet

- CS 34Document3 pagesCS 34akshNo ratings yet

- The Traditional Accounting Information System ArchitectureDocument14 pagesThe Traditional Accounting Information System ArchitectureAshraf ZamanNo ratings yet

- Computerized Accounting in Ghana The Shi PDFDocument8 pagesComputerized Accounting in Ghana The Shi PDFKhalid AhmedNo ratings yet

- (Simkin, Rose y Norman, 2012, Pp. 4-9) Core Concepts of AISDocument6 pages(Simkin, Rose y Norman, 2012, Pp. 4-9) Core Concepts of AISCristian MsbNo ratings yet

- The Relevance of Auditing in A Computerized Accounting SystemDocument5 pagesThe Relevance of Auditing in A Computerized Accounting SystemEmebet TesemaNo ratings yet

- BOOKKEEPING LessonDocument3 pagesBOOKKEEPING LessonGaililian GerangayaNo ratings yet

- Module 5678 Dicussion Quest.Document13 pagesModule 5678 Dicussion Quest.Rufina B VerdeNo ratings yet

- (Accounting Information System) : Module Duration: FEB 3 - March.12,2022Document9 pages(Accounting Information System) : Module Duration: FEB 3 - March.12,2022Gaba, Yna MarieNo ratings yet

- (FGW HN) - 441752 - 0Document6 pages(FGW HN) - 441752 - 0Minh Thu Nguyen TranNo ratings yet

- PurComm ResearchDocument13 pagesPurComm ResearchPrincess May Letada MutyaNo ratings yet

- Fundamentals of Accountancy: By: Win Ballada, CPA 2017 Edition For ABMDocument15 pagesFundamentals of Accountancy: By: Win Ballada, CPA 2017 Edition For ABMBellNo ratings yet

- Accounting Information System Term PaperDocument5 pagesAccounting Information System Term Paperafdtuwxrb100% (1)

- Ch01 Considine3eDocument20 pagesCh01 Considine3eBandile MhlongoNo ratings yet

- Literature Review On Computerised Accounting SystemDocument6 pagesLiterature Review On Computerised Accounting SystemafdtuwxrbNo ratings yet

- Overview of AISDocument8 pagesOverview of AISBulelwa HarrisNo ratings yet

- Ch.1 1Document5 pagesCh.1 1Maurren SalidoNo ratings yet

- Computerized Accounting System: Key On Establishing An Efficient Decision Making AND Business DevelopmentDocument36 pagesComputerized Accounting System: Key On Establishing An Efficient Decision Making AND Business Developmentsheryl ann dizonNo ratings yet

- Introduction To Accounting: Earning BjectivesDocument22 pagesIntroduction To Accounting: Earning BjectivesSonia SNo ratings yet

- Record Keeping To Book Keeping To E RecoDocument5 pagesRecord Keeping To Book Keeping To E Recogladys wanguiNo ratings yet

- Computerised AccountingDocument54 pagesComputerised AccountingsuezanwarNo ratings yet

- Group2 Researchpaper - Docx UPDATEDDocument21 pagesGroup2 Researchpaper - Docx UPDATEDWerpa PetmaluNo ratings yet

- Entrepreneurship Taxes Lesson 1 PDFDocument4 pagesEntrepreneurship Taxes Lesson 1 PDFAlejito HNo ratings yet

- Introduction To Computerized Accounting NotesDocument8 pagesIntroduction To Computerized Accounting Notesallan kumkeyaniNo ratings yet

- Ae20 Lesson1 2ndsemDocument3 pagesAe20 Lesson1 2ndsemangellachavezlabalan.cpalawyerNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerAbe Loran PelandianaNo ratings yet

- Local Media3594291794869200412Document9 pagesLocal Media3594291794869200412WenjunNo ratings yet

- The Traditional Accounting Information SystemDocument18 pagesThe Traditional Accounting Information SystemShaheen Mahmud0% (1)

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDocument8 pagesDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNo ratings yet

- A20 MIDTERM NotesDocument10 pagesA20 MIDTERM NotesAguilan, Alondra JaneNo ratings yet

- EL201 Accounting Learning Module Lessons 1Document12 pagesEL201 Accounting Learning Module Lessons 1Code BoredNo ratings yet

- Sample Research ProposalDocument14 pagesSample Research ProposalTafadzwa James ZibakoNo ratings yet

- Chapter 1.PDF IIIDocument48 pagesChapter 1.PDF IIIChera HabebawNo ratings yet

- Recorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksDocument52 pagesRecorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksAnnie RapanutNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- Name: Aisha Iman MohamedDocument5 pagesName: Aisha Iman MohamedAisha ImanNo ratings yet

- A Report On Computerized Accounting-AishaDocument4 pagesA Report On Computerized Accounting-AishaShadrack MurithiNo ratings yet

- Chapter 2Document17 pagesChapter 2Joyce JadulcoNo ratings yet

- Chapter Two: An Introduction To Data ProcessingDocument7 pagesChapter Two: An Introduction To Data ProcessingmohammedNo ratings yet

- Chapter 1Document13 pagesChapter 1Marwin Ace100% (1)

- Advanced Computer Application (Tally Accounting Package) : ITU - 07305, IRU-07303, SPU-07307 2019/20Document42 pagesAdvanced Computer Application (Tally Accounting Package) : ITU - 07305, IRU-07303, SPU-07307 2019/20Macheas IbrahimNo ratings yet

- IntroDocument9 pagesIntroKarolJosifMorcillosNo ratings yet

- 5 Dr. Abhay UpadhyayaDocument8 pages5 Dr. Abhay UpadhyayaRavi ModiNo ratings yet

- Application of Accounting PrinciplesDocument2 pagesApplication of Accounting PrinciplesWNWDNo ratings yet

- Chapter Four Accounting SystemsDocument7 pagesChapter Four Accounting SystemsMathewos Woldemariam Birru100% (3)

- Write The Principles of An Accounting Information SystemDocument10 pagesWrite The Principles of An Accounting Information SystemSuleyman TesfayeNo ratings yet

- AF The World of AccountingDocument11 pagesAF The World of AccountingEduardo Enriquez0% (1)

- TOPIK 3-Accounting System and ControlDocument24 pagesTOPIK 3-Accounting System and Controlfalina88No ratings yet

- What Is AccountingDocument22 pagesWhat Is AccountingFredalyn Joy VelaqueNo ratings yet

- Verview OF Omputerised Ccounting Ystem: O C A SDocument16 pagesVerview OF Omputerised Ccounting Ystem: O C A SswathiNo ratings yet

- Chapter 1Document23 pagesChapter 1yvergara00No ratings yet

- Set Up and Operate A Computerized Accounting SystemDocument10 pagesSet Up and Operate A Computerized Accounting Systemabebe kumelaNo ratings yet

- Fosfa InternationalDocument29 pagesFosfa InternationaljesusNo ratings yet

- Iron Bulk Shipping Philippines VS Remington Industrial Sales CorporationDocument8 pagesIron Bulk Shipping Philippines VS Remington Industrial Sales Corporationmelody dayagNo ratings yet

- Law of Carriage of GoodsDocument11 pagesLaw of Carriage of Goodsswa291No ratings yet

- David Vs Misamis Occidental II Electric CoopDocument9 pagesDavid Vs Misamis Occidental II Electric CoopJan Veah CaabayNo ratings yet

- Servando VS Philippine Steam Navigation CoDocument3 pagesServando VS Philippine Steam Navigation Cojoy dayagNo ratings yet

- Everett Steamship Corporation Vs Court of Appeals and Hernandez Trading CoDocument2 pagesEverett Steamship Corporation Vs Court of Appeals and Hernandez Trading CoAndrea GerongaNo ratings yet

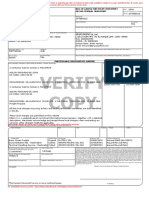

- Verify Copy: Bill of Lading For Ocean Transport or Multimodal TransportDocument2 pagesVerify Copy: Bill of Lading For Ocean Transport or Multimodal TransportCarolina Rojas IsuizaNo ratings yet

- Comercial Invoice: Exporter Arazayito ConsigneeDocument5 pagesComercial Invoice: Exporter Arazayito Consigneeerika yulieth vargasNo ratings yet

- Acct: Naza Shipping Pte LTDDocument2 pagesAcct: Naza Shipping Pte LTDToni SantosoNo ratings yet

- Document of Foreign TradeDocument11 pagesDocument of Foreign TradeAleena ShahNo ratings yet

- Organizing For Export and Import OperationsDocument14 pagesOrganizing For Export and Import OperationsmahasagarNo ratings yet

- Article 354 Code of Commerce - in The: D. Actionable DocumentDocument6 pagesArticle 354 Code of Commerce - in The: D. Actionable DocumentBianca Marie FlorNo ratings yet

- Carta de PorteDocument4 pagesCarta de PorteAdilson Patrício Quibata SamucanoNo ratings yet

- Hindustan Copper Limited: (A Govt - of India Enterprise)Document35 pagesHindustan Copper Limited: (A Govt - of India Enterprise)Tamal SarkarNo ratings yet

- Act No. 2616 - The Salvage LawDocument5 pagesAct No. 2616 - The Salvage LawAlvin Ryan KipliNo ratings yet

- 04 Asian Terminals, Inc v. Simon Enterprises, Inc., G.R. No. 177116, 27 February 2013Document8 pages04 Asian Terminals, Inc v. Simon Enterprises, Inc., G.R. No. 177116, 27 February 2013Andrei Da JoseNo ratings yet

- United Commercial Bank LimitedDocument23 pagesUnited Commercial Bank LimitedJames BlackNo ratings yet

- TDT Report SampleDocument42 pagesTDT Report Samplekhine zin thawNo ratings yet

- Gafta No.38: Contract For Grain in Bulk From Argentina Fob TermsDocument6 pagesGafta No.38: Contract For Grain in Bulk From Argentina Fob TermsMaria Ines CastelluccioNo ratings yet

- UCP 600 Revision 2Document81 pagesUCP 600 Revision 2rohit.htc18012017No ratings yet

- Comm Rev Cases Transpo First Batch 1Document42 pagesComm Rev Cases Transpo First Batch 1André BragaNo ratings yet

- Traders Manual SFAAZ ExamsDocument18 pagesTraders Manual SFAAZ ExamsBewovicNo ratings yet

- Carriage and BondingDocument8 pagesCarriage and BondingLukeNo ratings yet

- TLHT QTXNK Phu LucDocument116 pagesTLHT QTXNK Phu LucVg ChillingNo ratings yet

Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants

Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants

Uploaded by

Yekini AyobamideleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants

Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants

Uploaded by

Yekini AyobamideleCopyright:

Available Formats

Research Article ISSN 2313-4747 (Print); ISSN 2313-4755 (Online)

Traditional Accounting vs. Computer Based

Accounting: Challenges Faced by Accountants

Mohd. Takdir Hossan

Senior Lecturer, Faculty of Business, ASA University Bangladesh, Dhaka, BANGLADESH

*E-mail for correspondence: takdir21@gmail.com

Received: Jun 12, 2017; Accepted: Jun 27, 2017; Published: Feb 20, 2017

Source of Support: None No Conflict of Interest: Declared

ABSTRACT

To face much more difficult and challenging the business world in the challenging professional areas,

depth knowledge about any particular filed is very much more compulsory. Accounting is essential

function for any commerce and industry. All commerce and industries must keep a record of their

revenue and expenses.

Keywords: Manually Record, E-Accounting, Using Accounting Software like Quick Books, Tally

INTRODUCTION Methodology

The world is changing rapidly. The traditional manual Data has been collected from secondary sources only

system is going to be improved into technology-based because there is no scope to use the information from a

modern system thoroughly. Nowadays, it is not possible in primary source. Or on the other hand, the primary sources

modern world about the accounting without technology. are not available. To get information from the secondary

Traditional accounting system refers to the recommended sources for collecting data and visited some libraries to

by the father of accounting Luca De Pacioli. The accounting collect some sorts of books related to the topic. I have also

information system is based on what is typically called the visited computer lab to collect the information from the

accounting cycle and based on the accounting equation. internet. I have read the books, magazines, newspapers,

journals and the articles from internet. However, the data

Computerized based Accounting System refers to the

used in the study has been further analyzed and processed

integration of different element systems to produce

for the study.

computerized books of accounts, records and documents.

Certainly, Pacioli’s original thoughts were nothing short of

brilliant regarding proposing a method for recording,

LITERATURE REVIEW

maintain, and reporting economic data with a-fairly initial Traditional Accounting

information technology. However, modern world and the Traditional accounting refers to the accounting

profession’s desire to move forward allow AIS designers to transactions according to the method suggested by the

reconsider the fundamental architecture of the AIS. father of accounting Luca De Pacioli. Luca Pacioli was a

Moreover, today’s technology makes rethinking AIS Franciscan monk. He lived in Italy during the 1500s. He is

possible. Although there were stewards, auditors, and often called the father of double-entry bookkeeping.

bookkeepers in ancient periods, the professional Pacioli was not the inventor, but he was “the first

accountant is a 19th-century development. accountant to combine his knowledge with Johan

Objectives of the Study Gutenberg’s technology to instruct the world on the subject

in print (Crosby, 1997).”

The meaning and details of traditional accounting and

Computer-based accounting. The traditional accounting information based on what is

The scope of Computer-based accounting. naturally called the accounting cycle and is based on the

The differences in recording the entries in traditional basic accounting equation. Although the concepts

accounting and computer-based accounting. documented by Pacioli have been adapting over the years,

The challenges of an Accountant. the essence of his original proposal remains constant.

CC-BY-NC 2014, Asian Business Consortium | AJTP Page 73

Hossan: Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants (73-80)

The accounting cycle is a series of sequential steps leading rather than traditional accounting system. In this chapter,

to the creation of the financial statements and each the scope of computer based accounting will be shown by

reporting period. The first there steps in the accounting differentiating between the process of traditional

cycle require the prime amount of time, and occur accounting and computer based accounting.

continuously throughout the period. The frequency of step

Traditional Sales and Collection Process

3, posting, depends on the volume and nature of the

recorded transactions. For example, firms with many daily In a manual sales or collection process, a paper is using as

cash transactions often post to the cash account daily. Steps the primary means to capture and store business data and

4 through 9 occur only at the fiscal year-end. And 10, communicate information to customers. Paper records also

reversing entries, is optional and occurs at the beginning of serve as the audit trial tor documenting the process. Data

the next accounting period (Hollander et al. 2000). about the sales or collection process are captured and

maintained by various business functions that participate

Weaknesses of Traditional Accounting System

in the process. As a result, process data are scattered across

There are so many weaknesses in the traditional various departments (e.g. the Sales Order Department, the

accounting system. The professionals, who want to Shipping Department, the Billing Department, and the

provide business solutions, are not capable of providing Warehousing Department). Because no unit has a complete

efficient and effective business solutions by traditional picture of the sales or collection data, various departments

accounting. Sometimes a total of 24 entries are used to store duplicate data. Paper is also used to communicate

record two simple events! These transactions do not take authorizations between departments and to external

into account any discounts, currency exchange rates, parties (Cherrington, 2000).

billing adjustments, or the possibility of value-added taxes

The sample data flows commonly associated with the sales

for crossing international boundaries. So it is very hard to

or collection process is given below.

quickly get out of hand in promulgating hundreds of

different ledger and subsidiary ledger systems to Customer order: A data flow originated by and sent from

accommodate the variety of information and processing the customer. It typically includes data about the customer,

requirements across an organization (D. P. Andros, 1992). where to ship the goods, order terms and conditions, the

items the customer wants to order, and payment terms.

There are so many groups in the company and outside who

The customer order is used to create the sales order.

wants to use the accounting information such as

production people, marketing people, personnel people, Sales order: A data flow created internally to document

executive people, investors, suppliers, and creditors. They order and the approval the tan order. It often includes the

want different types of information of the same same data items as the customer order. Copies of the sales

transactions. Traditionally, system designers have order are used to be communicating authorization to

addressed the diversity of information customer needs by initiate other activities in the process.

building a different system for each desired view. Each

Picking slips: A data flow that is sent to the warehouse to

system captures slightly different data about the same

authorize the movement of ordered goods from

business event, with each system using its own

warehousing to shipping. It is often a copy of the sales order.

classification scheme to select and record a subset of

available data about the event. It is time-consuming and Packing slips: A data flow that is sent with the goods

difficult to keep the records (Thomas Walther, 1997). shipped to a customer. Often, the data flow is labeled with

a “This is not a bill” message.

Computer Based Accounting

Shipping notice: A data flow that describes the packages

Computerized based Accounting System refers to the

shipped the carrier, the route, and customer information.

integration of different component systems to produce

computerized books of accounts and computer-generated Sales invoice: A data flow listing the merchandise, with

accounting records and documents. Undoubtedly Pacioli’s prices, that have been delivered or sent to a buyer. It is a

original thoughts were nothing tiny of brilliant in terms of statement of money owned for goods or services supplied.

proposing a method for recording, maintain, and reporting

economic data with a fairly primitive information Remittance advice: A data flow accompanying customer

technology. However, today’s world and the profession’s payment.

desire to move forward allow AIS designers to rethink the Deposit slip: A data flow listing the monies actually

basic architecture of the AIS. Moreover, today’s technology transferred from an organization to a financial institution.

makes rethinking AIS possible (McCarthy, 1998).

Customer check: A data flow that authorizes the transfer

SCOPE OF COMPUTER BASED ACCOUNTING SYSTEMS of funds from the customer to the seller.

There are some areas where the computer-based Open sales order: An open sales order considered when

accounting is used broadly. Obviously, there are some the order has not been physically delivered. They remain

merits to use the computer-based accounting systems open until they are shipped and billed.

Page 74 American Journal of Trade and Policy ● Vol 5 ● Issue 2/2018

Research Article ISSN 2313-4747 (Print); ISSN 2313-4755 (Online)

Open sales invoice: An open sales invoice is consider Receiving report: A data flow used to summarize the

detailed documents. They remain open until customers are receipt of raw materials or merchandise from vendors. The

paid. receiving department usually prepares the receiving report

upon acceptance of each shipment of goods.

Automated Sales and Collection Process

Packing slip: A data flow that be sent with the goods

Typical information technology applications automated

shipped to a customer. The vendor or supplier creates the

the business and information process rules of the manual

packing slip.

system. An automated system is very similar to a

traditional manual system; document flow is similar, as is Bill of lading: A written receipts given by a carrier for

a large amount of duplicate data. However, since goods accepted for transportation. The carrier that delivers

authorizations and data access can be providing through or transport cargo will usually provide a bill of lading to

computer screens there is a potential decrease in the the company shipping the items (vendor).

amount of paper (Hollander et al. 2000).

Vendor’s invoice: The vendor sends the invoice to the

Each computer-processing symbol denotes computer buyer as a request for payment for merchandise delivered

programs that include a list of instructions for the or services provided.

computer. Each program can include screens for collecting

Check: A data flow used to draw money from a bank

data; edit checks on the data entered, instructions for

account and transfer it to another entity. Treasury

processing and storing the data, security procedures (e. g.

Department is frequently used to pay for items purchased

limiting access via passwords or user IDs), and steps for

by a company.

generating and displaying output. To understand the files

and their use, it is essential to consider their contents (their Material requirement planning: The Software program

record layouts). The input documents and the files must that identifies the raw materials essential, and the timing

contain the data necessary to generate the desired output. of the requirement, to produce a particular number of units

of finished goods. This planning is used to determine the

The content of the computer-readable files used in an

number of raw materials needed to meet production levels

automated system is similar to the paper files used in the

projected for the next period.

manual. Data collection and storage be still define by the

chart of accounts that govern this process: Sales, Sales Open purchase request: Purchase request that has not

Returns and Allowances, sales Discounts, Cost of Goods been yet officially unused or upgraded to purchase order

Sold, Bad Debt Expenses, Marketing Expenses, Cash, status.

Accounts Receivable, Allowance for Doubtful Accounts,

and Inventory. The automated sales or collection process Open purchase order: Purchase order that has been sent to

can use batch processing (by accumulating a group of a vendor, but the items ordered has not been yet received

customer orders before processing) or online processing and a liability has not been recognized. A copy of the

(by processing order information as it occurs) (Joseph W. purchase order which has been issued to a vendor and

Wildnson, 1997). frequently maintained by Accounts Payable in an open

purchase order file until the goods or services have been

Traditional Acquisition and Payment Process received.

The acquisition or payment process includes the business Open invoice: The purchases related bills that have been

events associated with buying, maintaining, and paying approved for payment, but cash has not yet been disbursed

for goods and services needed by the organization. These to pay the liability.

processes are acquiring raw materials, parts, and other

resources contained in finished products or services. It also Stock status report: A report on each inventory sold by a

includes the acquiring, and paying for a variety goods and company, including information about items out of stock,

services (e. g. utilities, supplies, insurance, repairs, below a minimum stock level, and turnover analysis.

maintenance, research, development, and professional and Vendor performance report: These reports are

legal services) (Michael Hammer, 1990). summarizing each vendor’s performance for a given time.

The flows and reports commonly associated with the Items on the report may include time between order and

acquisition or payment process: delivery, the frequency of back-ordered items, a quantity

of merchandise received, and volume of purchases.

Purchase requisition: An internal data flow requesting the

purchase of specific goods or services. Various people Automated Acquisition and Payment Process

throughout the organization use this data flow to request Some organizations are beginning to use information

particular items. technology to acquisition and payment process and

Purchase order: A data flow sent to a vendor as a formal develop the efficiency of the purchaser or supplier

request for the vendor to sell and deliver specified affiliation. Many companies require or encourage the use

products or services at a designated price. of electronic data interchange (EDI), a form of electronic

commerce. EDI is the transmission of business data flows

CC-BY-NC 2014, Asian Business Consortium | AJTP Page 75

Hossan: Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants (73-80)

between or within organizations in a structured, machine- on the records and paying them for the time they did not

retrievable format. Electronic data interchange work. Authorization duties (performed by personnel) are

transmission differs from a fax or unformatted electronic separated from record-keeping duties (performed by

mail. EDI is typically batch related, rather than interactive, Timekeeping, Payroll, Accounts Payable, and Cost

and predominantly used for business-to-business, rather Accounting) and custodial activities (Henry Johansson,

than business-to-consumer, communications (D. P. 1997).

Andros, 1992).

Computerized Payroll Process

EDI communication often requires specialized hardware

A time ticket, or similar recording process, continues to

and software. The electronic data flow is called a

serve as input to the payroll process. Time and attendance

transmission set, and the format adheres to some specified

are determined by calculating the time between when

standard such as ANSI X12 (American National Standards

employees enter work and when they leave work (as well

Institute) or EDIFACT (Electronic Data Exchange for

as the department they work in for a process costing

Administration Commerce and Transport). A

system or the jobs they worked on for a job order costing

communication interface gives a computer the ability to

system). A payroll clerk prepares some batch total early in

transmit and receive transaction sets. This EDI interface

the process, preferably as soon as the time tickets are first

moves data to and from the appropriate application

accumulated. The batch total could be the number of

software. The application software then uses the EDI

employees who worked (a record count), the total hours

transaction set data as the input for internal processing

worked (a “financial” total), or the total of the employees’

(Michael Hammer, 1990).

identification numbers (a hash total). The batch total is

Traditional Manual Payroll Process used to verify the accuracy of the payroll process. For

example, if a record count were used for the control total,

The non-sophisticated manual payroll process uses an

we would expect the number of checks printed by the

extensive amount of paper to capture, convey, store, and

computer to equal the record count. If total hours worked

report information. The process begins in the personnel

were used, we would expect the total of the hours paid on

function when an employee is hired. The personnel

the summary report generated by the computer to equal

division appointed the employee, authorizes a rate of pay,

total hours worked (John Dunleavy, 1997).

and collects information about marital status and number

of dependents for payroll deduction purposes. As A control group executes one added control in a

employees arrive and leave work they record their hours computerized system. This group of people has the

on time cards with Timekeeping to show the time they responsibility to review the activities of the Data

entry and exit. As they work during the day, employees Processing Department. For the payroll process, the

record on job time ticket the amount of time they spend control group receives the batch totals and the two

working on individual jobs. The job time tickets are exception and summary reports. They compare the batch

reviewed by the production supervisors and transferred to totals with information on the exception and summary

Timekeeping to be reconciled with the time cards. If reports to verify that data have not been added or lost

employees properly punch in and out, accurately record during processing. They follow up on errors and

time worked on job tickets, and has no wasted time exceptions to identify their cause and see the appropriate

between jobs, the total time on the job time tickets should corrections are made. For example, if an employee has time

equal the time recorded on the time cards (Thomas card data, but is not listed as a valid employee in the

Walther, 1997). masters file, the control group will want to know why.

Also, if an employee has 90 hours of work in a week, the

This process has several primary data flows and control

control group will want to see if it is legitimate, why

points. Key data flows include the job time tickets, time

someone is working so many hours, or how 90 hours was

cards, payroll register, voucher, and checks to the payroll

recorded when the person worked few hours (Elizabeth

account and individual employees. There are also several

Hjelm, 1997).

significant control points. Controls include a review of the

job time tickets by the factory supervisor and

Timekeeping’s reconciliation of the job time tickets and the

THE CHALLENGES FACED BY ACCOUNTANTS

time cards. Such adjustments and reviews can identify The Changing Patterns of Accounting

errors or discrepancies. For example, if an employee can The information technology will affect the accounting

bypass the timekeeping control and punch in for a friend, profession since the early days of modern information

it is difficult to post time to jobs for the friend during the technology. Bob Elliot, a national partner with the

day without a supervisor discovering it. Finally, the accounting firm of KPMG or Peat Marwick, is one of the

separation of duties between the various departments is more outspoken accounting futurists. In his 1992

also important in a manual system. By only paying “Accounting Horizons” article, Elliot begins with

employees who have been hired by personnel and who “Information Technology (IT) is changing everything.”

have worked time that has been approved by a supervisor, Drawing on the work of Alvin Toffler, Elliot uses the

people are prevented from entering fictitious employees

Page 76 American Journal of Trade and Policy ● Vol 5 ● Issue 2/2018

Research Article ISSN 2313-4747 (Print); ISSN 2313-4755 (Online)

imagery of the “third wave” to predict impending and The computer-based accounting systems can provide any

significant changes in accounting practice, education, and updated accounting information within a few seconds. So,

research. Elliot concludes his article with the following: if the dependency on the accountant is decreased rapidly,

the accountant profession in the future will face the

“IT is creating a wave of change that is crashing over

challenges (Hollander et al. 2000).

accounting’s shoreline. It crashed across the industry in the

1970s. Then it crashed across the services in the 1980s. And Auditor’s activities are decreasing

it will crash across accounting in the 1990s. It is changing

Periodically auditing was very much necessary for the

the way business is done and the problems faced by

company in the past. The period may be quarterly, half

managers. Managers now need new types of information

yearly, or yearly. When a company needed to know about

in order to make decisions, so internal and external

the accuracy of the accounting data or transaction, it was

accounting must be changed. Higher education can simply

necessary to go to the accountant to prove the accuracy of

react to these changes, or it can take a more active role,

the records. But, it is not necessary now. The computer-

embracing the future, adapting rapidly, and facilitating the

based accounting system is built up in such a way that, it

adaptations of others. The challenges to academic

will update all the accounting information within very

accountants are to invent the third wave accounting

short time, even it can be daily. So, in the past, the

paradigm and produce the graduates who can function

accountant was necessary to audit more times. But, now it

effectively in the third-wave organizations they will be

is not necessary to audit so many times in years. Even only

joining. The challenges to non-academic accountants are to

one audit per year is enough for the company. So, it is a big

make the organizational and political changes to

challenge for the accountant. And these challenges are

implement the new accounting paradigm (B. Elliott,

creating only for the developing of the computer-based

1992).”

accounting system (Hollander et al. 2000).

The Challenges of Accountants

Use of Technology

The world is changing very rapidly. The traditional

While business technology can provide numerous benefits

accounting is being computer-based accounting in all the

to a company, management accountants can struggle using

perspectives. In very near future there will not be any

internal applications for accounting purposes. The

perspective of traditional accounting which will not be

inability to develop reports accurately and prompt using

brought into computer based accounting systems. So there

technology can result in accountants having to prepare

are so many challenges waiting for the accountants. In

manual reports, delaying their job functions. So, it is a

light of the financial crisis that hit the world scene

challenge for the accountant to know the application of the

beginning in 2008, financial authorities have placed a

accounting software.

greater emphasis on accountability and transparency in all

financial sectors. As the International Auditing and

Assurance Standards Board notes, the accounting industry

Fair Value Accounting

has been affected by this need for greater transparency

also. As financial regulators move forward, and as the The International Auditing and Assurance Standards

world economic scene continues to change, accountants Board note the need for accountants to be able to perform

will face several different challenges (Jared Lewis, 2011). audits by fair value for financial investment vehicles. In the

aftermath of the financial problems that began to emerge

The Demand for Accountant is decreasing

in 2008 and 2009, accountants must be aware of the

In the past, the accounting information was recorded by potential for accountants to either misinterpret financial

manually. So, it was necessary to keep number of skilled data or be misled because of the inability to obtain accurate

accountants in the company to keep the accounting records market information. Accountants must have extensive

correctly and efficiently. But, now the technology has knowledge of market valuation techniques to ensure that

changed this situation. A company can keep the huge they are assigning the proper value to investments

number of accounting information easily by using the (Thomas Walther, 1997).

technology. So, now it is not necessary to maintain large

number of accountants in the company. That’s why; the FINDINGS

demand of the accountant has been decreased. In the After analyzing the literature review, some findings have

future, it may be further decreased (Hollander et al. 2000). been observed. The findings are:

Dependency on the Accountant is decreasing The world is changing rapidly: Technological

In the long-ago, if a company wanted to decide about any development is improving rapidly. All the manual

matter related to the accounting information, the company systems are going to be converted into computerized

would depend on the accountant to know the updated systems. In very near future, it may be noticed; there

accounting information. But, at the present time, it is not will be no manual system of operation. So, it is high

necessary for the company to depend on the accountants. time to cope with the technological development.

CC-BY-NC 2014, Asian Business Consortium | AJTP Page 77

Hossan: Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants (73-80)

The Traditional accounting system is going to be Even only one audit per year is enough for the

eliminated: In the present time, there are some scopes company.

of traditional accounting. But, in very near future, it is

The professional judgment is still necessary: Although

observed and estimated that, the scope of traditional

the technology has covered the areas of recording and

accounting systems may be gone forever. The

transferring the accounting transactions, the

computer-based accounting system will be only the

professional judgment is still essential to make the

system to keep the record of accounting transactions.

effective decisions. For example, computer based

Three main reasons of dependency on computer based accounting system may be able to record the

accounting system: The computer-based accounting depreciation. Sometimes it is able to transfer the

system is being used for three reasons. The main depreciation by making proper entry. But computer

reason is to eliminate the human errors. When the system is not able to make any professional judgment

accounting records are kept manually, there is a about what should be the expected economic life of the

greater chance of errors. Secondly, it is not possible to assets and what should be the appropriate method to

be more efficient is the work is done manually than if calculate the depreciation. It depends on an

it is done by computer. Finally, the use of paper will accountant.

be reduced by using a computer. That will reduce the

costs and time. RECOMMENDATIONS

There are some scopes of traditional accounting still now: The accountants should be able to cope with the

Although the technology is developing rapidly, there changing world. The accountants should be able to be

are some scopes of traditional accounting systems expert in the use of technology.

right now. The main reason is the cost of traditional Traditional accounting is going to be eliminated. So,

accounting system in some cases is lower than the the main task for the accountants is to keep the

computer-based accounting system in those areas. In accounting secure in the changing world by keeping

the future the scenario may be changed, but, right now touch with the technology.

it is going on with the traditional accounting system The non-accounting background people are getting

efficiently and effectively. the accounting jobs. They can work with the

technology, but they are not able to make any

The Scope of the Accounting Jobs is decreasing: For the

professional judgment, that’s why accounting is facing

technological involvement in the accounting sectors,

some problem. So, the organizations should recruit the

accounting software is enough for keeping the large

accounting background people for the accounting

number of accounting records. The scope of the

jobs.

accounting jobs is decreasing day by day. The more

The scope of the accounting jobs is going to be

people are going to be jobless.

decreased. So, it is the duty of the accountants to be

Organizations can make an immediate decision: If able to skilled in the use of technology to get the scared

organizations want to make any decision by accounting job.

considering the accounting information, it is not The technological development should be in such a

necessary to wait for a long time to get the accounting way that will lead the world to keep the accounting

information. It is only a matter of one click to get the record and transferring at low cost. If it is possible the

relevant accounting information to make the decision. development of accounting areas will get the new

The dependency on the accountants has been reduced dimension.

dramatically. At last, it is now the duty for the accountants to secure

the accounting in the very near future. The

Costs, time and labor have been saved: The cost of paper

accountants should maintain good ethics. The

has been saved by using a computer to keep the record

technology can give everything but not ethics. It is the

of accounting transactions. So many transactions can

main challenge for the accountants to maintain the

be recorded and transferred within very short time.

ethics in the accounting profession to make this

The employee in the organization has been reduced.

profession reliable to the public.

So again the extra cost of having extra employees has

been reduced in the organization by using computer-

based accounting system.

CONCLUSION

While the only change is constant and everything other

The Scope of auditing has been decreased: The computer- than change is changing in the world. So, it is clear that,

based accounting system is built up in such a way that, accounting system must be changed and it is changing

it will update all the accounting information within actually. The traditional accounting system is being

very few time, even it can be daily. So, in the past, the converted into computer-based accounting system. The

accountant was necessary to audit more times. But, traditional sales and collection process has been changed

now it is not necessary to audit so many times in years. to automated sales and collection process. The traditional

Page 78 American Journal of Trade and Policy ● Vol 5 ● Issue 2/2018

Research Article ISSN 2313-4747 (Print); ISSN 2313-4755 (Online)

acquisition and payment process has been changed to GEOFFREY SMITH (1992) “The New Realism in Office Systems:

automated acquisition and payment process. The Computers Can’t Take the Place of Good Management—But

traditional payroll process has been changed to the They Can Help,” Business Week, June 15, pp. 128-133.

automated payroll process. Everything is changing from H. T. JOHNSON and R. S. KAPLAN (1987) Relevance Lost: The Rise

manual process to automated computerized process. and Fall of Management Accounting (8th Ed.), Harvard Business

School Press, London, U. K.

The computer-based accounting system is being popular.

J. CARLTON (1996) “Think Big: The Net Gives Small Business a

Although, there are so many areas of accounting where Reach They Once Only Dreamed of,” The Wall Street, June

computer based accounting is not cost effective till now. 17, pp. R27.

Those areas are maintaining the traditional accounting

JARED LEWIS (2011) ‘Challenges of Accountant,’ [online] (cited

system. The research is going on to apply the computer 24 July 2011) Available from

based accounting system in those areas. We can expect http://smallbusiness.chron.com/challenges-of-

that, in very near future, those areas will be brought into accountants.html

the scope of computer based areas. L. T. PERRY and E. L. DENNA (1995) “Reengineering Redux,”

Accountants are facing some challenges because of Business Process Re-engineering & Major Organizational

development of computer-based accounting system. The Change, February.

accounting jobs are being unavailable for the people LINDA ACKERMAN (1986) “Development, Transition or

because, it is not necessary to recruit so many employees Transformation: The Question of Change in Organizations,”

to keep the accounting records for the organizations. OD Practitioner, December, pp. 1-8.

Technology can keep the accounting records correctly and M. PORTER (1985) Competitive Advantage: Creating and Sustaining

efficiently. But is does not imply that, accountant is nothing Superior Performance (12th Ed.), the Free Press, New York,

in the present world. There is the scope of professional U.S.A.

judgment in the accounting related areas. Although the MARSHALL B. ROMNEY, and PAUL JOHN STEINBART (2003)

technology has covered the areas of recording and Accounting Information Systems (9th Ed.), Pearson Education

transferring the accounting transactions, the professional (Singapore) Pte. Ltd., F.I.E. Patparganj, Delhi, India.

judgment is still necessary to make the effective decisions. MICHEAL HAMMER (1990) “Business Process Reengineering:

Don’t Automate, Obliterate,” Harvard Business Review,

BIBLIOGRAPHY July—August, pp. 104-112.

A. CROSBY (1997) The Measure of Reality: Quantification and N. GROSS, P. C. JUDGE, O. PORT, and H. WILDSTROM (1998)

Western Society (2nd Ed.), Cambridge University Press, “Let’s Talk: Speech Technology Is the Next Big Thing in

Melbourne, Australia. Computing,” Business Week, February 23, pp. 60-72.

A. PIPKIN (1989) “The 21st Century Controller,” Management NEAL TEMPLIN (1998) “Big Cars and Little Spaces Cause

Accounting, p. 24 Mayhem,” The Wall Street Journal, March 11, pp. B1, 8.

A. TOFFLER (1990) The Third Wave (5th Ed.), Bantam Books, New PENERBIT (2009) ‘Computer-Based Accounting Systems,’

York, U.S. A. [online] (cited 01 August 2011) Available from

http://www.penerbit.utm.my/onlinejournal/39/E/JTKK39E2.pdf

B. ELLIOTT (1992) The Third Wave Breaks on the Shores of

Accounting (2nd Ed.), Accounting Horizons, New Jersey, R. ECCLES (1991) “The Performance Measurement Manifesto,”

U.S.A. Harvard Business Review, January-February, p. 131.

B. P. SHAPIRO, V. K. RANGAN and J. J. SVIOKLA (1992) “Staple R. KAPLAN and D. NORTON, (1992) “The Balanced Scorecard-

Yourself to an Order,” Harvard Business Review, July- Measures That Drive Performance,” Harvard Business

August, pp. 113-122. Review, January-February, pp. 71-79.

D. P. ANDROS, J. O. CHERRINGTON, and E. L. DENNA (1992) RECHARD GREEN and KATHERINE BARRETT (1994)

Reengineer Your Accounting System the IBM Way (4th Ed.), “Auditing the Accounting Firms: Under Heavy Fire, the Big

Financial Executive, U.S.A. Six Firms Are Finally Changing How They Do Business,”

Financial World, September 27, pp. 30-34.

DRUCKER, (1997) “The Future That Has Already Happened,”

Harvard Business Review, September- October, pp. 20-24. SMALL BUSINESS (2010) ‘Differences Between Traditional

Accounting and Computer-Based Accounting,’ [online]

ENOTES (2011) ‘Accounting Information systems,’ [online] (cited (cited 28 July 2011) Available from

24 July 2011) Available from http://smallbusiness.chron.com/difference-between-

http://www.enotes.com/business-finance- traditional-accounting-computerized-accounting-4021.html

encyclopedia/accounting-information-systems.html

THOMAS WALTHER, HENRY JOHANSON, JOHN

G. A. MILLER (1956) “The Magical Number Seven, Plus or Minus Two: DUNLEABY, and ELIZABETH HJELM (1997) Reinventing the

Some Limits on Our Capability for Processing Information,” The CFO: Moving from Financial Management to Strategic

Psychological Review 63, no. 2, March, pp. 81-97.

Management (2nd Ed.), McGraw-Hill, New York, U.S.A.

G. SAMUELS (1994) “CD-ROM’s First Big Victim,” Forbes, February

WHITE STAG (2011) ‘Getting and Giving Information’, [online]

28, pp. 42-44. HOLLANDER, DENNA and CHERRIGTON

(cited 28 July 2011) Available from

(2000) Accounting, Information, Technology, and Business http://www.whitestag.org/skills/getting_giving_information.html

Solutions (2nd Ed.), Irwin McGraw Hill, New York, U.S.A.

--0--

CC-BY-NC 2014, Asian Business Consortium | AJTP Page 79

Hossan: Traditional Accounting vs. Computer Based Accounting: Challenges Faced by Accountants (73-80)

---------------------

How to Cite: Hossan, M. (2018). Traditional Accounting vs. Computer Based Accounting: Challenges Faced by

Accountants. American Journal of Trade and Policy, 5(2), 73-80.

2171 Monroe Avenue, Suite 203, Rochester, NY 14618, USA

http://www.ssrn.com/en/

SSRN Link: http://www.ssrn.com/link/American-Journal-Trade-Policy.html

Page 80 American Journal of Trade and Policy ● Vol 5 ● Issue 2/2018

You might also like

- Bills of Lading PDFDriveDocument873 pagesBills of Lading PDFDriveDallace Mirza100% (2)

- BRF - Purchase ContractDocument8 pagesBRF - Purchase Contracthanna75% (4)

- Transpo BookDocument872 pagesTranspo BookIra Francia AlcazarNo ratings yet

- Maritime Law by Christopher Hill 6th Edition. 2003 PDFDocument38 pagesMaritime Law by Christopher Hill 6th Edition. 2003 PDFchad donioNo ratings yet

- MCQ - 20 04 2015 - FinalDocument36 pagesMCQ - 20 04 2015 - FinalKawoser Ahammad100% (2)

- Freight Forwarding DocumentsDocument3 pagesFreight Forwarding Documentsmanolito rufinoNo ratings yet

- Double Entry Interim AccountsDocument6 pagesDouble Entry Interim AccountsKashish ChhabraNo ratings yet

- Introduction To Transaction ProcessingDocument20 pagesIntroduction To Transaction ProcessingSatrio MangkunegoroNo ratings yet

- Lecture 2 Traditional Accounting Information SystemsDocument12 pagesLecture 2 Traditional Accounting Information SystemsCrispus KimingichNo ratings yet

- Traditional Accounting System VsDocument9 pagesTraditional Accounting System VsErra PeñafloridaNo ratings yet

- Accounting - Dr. Chandra ShekaDocument419 pagesAccounting - Dr. Chandra ShekaEjaz AhmadNo ratings yet

- AISDocument11 pagesAISSANCHEZ, Janna Rosh Hashana M.No ratings yet

- Nature of AccountingDocument3 pagesNature of Accountinga manikantaNo ratings yet

- Comparative Analysis of Traditional and Modern Accounting ApproachDocument3 pagesComparative Analysis of Traditional and Modern Accounting ApproachAnas DeshmukhNo ratings yet

- CS 34Document3 pagesCS 34akshNo ratings yet

- The Traditional Accounting Information System ArchitectureDocument14 pagesThe Traditional Accounting Information System ArchitectureAshraf ZamanNo ratings yet

- Computerized Accounting in Ghana The Shi PDFDocument8 pagesComputerized Accounting in Ghana The Shi PDFKhalid AhmedNo ratings yet

- (Simkin, Rose y Norman, 2012, Pp. 4-9) Core Concepts of AISDocument6 pages(Simkin, Rose y Norman, 2012, Pp. 4-9) Core Concepts of AISCristian MsbNo ratings yet

- The Relevance of Auditing in A Computerized Accounting SystemDocument5 pagesThe Relevance of Auditing in A Computerized Accounting SystemEmebet TesemaNo ratings yet

- BOOKKEEPING LessonDocument3 pagesBOOKKEEPING LessonGaililian GerangayaNo ratings yet

- Module 5678 Dicussion Quest.Document13 pagesModule 5678 Dicussion Quest.Rufina B VerdeNo ratings yet

- (Accounting Information System) : Module Duration: FEB 3 - March.12,2022Document9 pages(Accounting Information System) : Module Duration: FEB 3 - March.12,2022Gaba, Yna MarieNo ratings yet

- (FGW HN) - 441752 - 0Document6 pages(FGW HN) - 441752 - 0Minh Thu Nguyen TranNo ratings yet

- PurComm ResearchDocument13 pagesPurComm ResearchPrincess May Letada MutyaNo ratings yet

- Fundamentals of Accountancy: By: Win Ballada, CPA 2017 Edition For ABMDocument15 pagesFundamentals of Accountancy: By: Win Ballada, CPA 2017 Edition For ABMBellNo ratings yet

- Accounting Information System Term PaperDocument5 pagesAccounting Information System Term Paperafdtuwxrb100% (1)

- Ch01 Considine3eDocument20 pagesCh01 Considine3eBandile MhlongoNo ratings yet

- Literature Review On Computerised Accounting SystemDocument6 pagesLiterature Review On Computerised Accounting SystemafdtuwxrbNo ratings yet

- Overview of AISDocument8 pagesOverview of AISBulelwa HarrisNo ratings yet

- Ch.1 1Document5 pagesCh.1 1Maurren SalidoNo ratings yet

- Computerized Accounting System: Key On Establishing An Efficient Decision Making AND Business DevelopmentDocument36 pagesComputerized Accounting System: Key On Establishing An Efficient Decision Making AND Business Developmentsheryl ann dizonNo ratings yet

- Introduction To Accounting: Earning BjectivesDocument22 pagesIntroduction To Accounting: Earning BjectivesSonia SNo ratings yet

- Record Keeping To Book Keeping To E RecoDocument5 pagesRecord Keeping To Book Keeping To E Recogladys wanguiNo ratings yet

- Computerised AccountingDocument54 pagesComputerised AccountingsuezanwarNo ratings yet

- Group2 Researchpaper - Docx UPDATEDDocument21 pagesGroup2 Researchpaper - Docx UPDATEDWerpa PetmaluNo ratings yet

- Entrepreneurship Taxes Lesson 1 PDFDocument4 pagesEntrepreneurship Taxes Lesson 1 PDFAlejito HNo ratings yet

- Introduction To Computerized Accounting NotesDocument8 pagesIntroduction To Computerized Accounting Notesallan kumkeyaniNo ratings yet

- Ae20 Lesson1 2ndsemDocument3 pagesAe20 Lesson1 2ndsemangellachavezlabalan.cpalawyerNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerAbe Loran PelandianaNo ratings yet

- Local Media3594291794869200412Document9 pagesLocal Media3594291794869200412WenjunNo ratings yet

- The Traditional Accounting Information SystemDocument18 pagesThe Traditional Accounting Information SystemShaheen Mahmud0% (1)

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDocument8 pagesDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNo ratings yet

- A20 MIDTERM NotesDocument10 pagesA20 MIDTERM NotesAguilan, Alondra JaneNo ratings yet

- EL201 Accounting Learning Module Lessons 1Document12 pagesEL201 Accounting Learning Module Lessons 1Code BoredNo ratings yet

- Sample Research ProposalDocument14 pagesSample Research ProposalTafadzwa James ZibakoNo ratings yet

- Chapter 1.PDF IIIDocument48 pagesChapter 1.PDF IIIChera HabebawNo ratings yet

- Recorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksDocument52 pagesRecorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksAnnie RapanutNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- Name: Aisha Iman MohamedDocument5 pagesName: Aisha Iman MohamedAisha ImanNo ratings yet

- A Report On Computerized Accounting-AishaDocument4 pagesA Report On Computerized Accounting-AishaShadrack MurithiNo ratings yet

- Chapter 2Document17 pagesChapter 2Joyce JadulcoNo ratings yet

- Chapter Two: An Introduction To Data ProcessingDocument7 pagesChapter Two: An Introduction To Data ProcessingmohammedNo ratings yet

- Chapter 1Document13 pagesChapter 1Marwin Ace100% (1)

- Advanced Computer Application (Tally Accounting Package) : ITU - 07305, IRU-07303, SPU-07307 2019/20Document42 pagesAdvanced Computer Application (Tally Accounting Package) : ITU - 07305, IRU-07303, SPU-07307 2019/20Macheas IbrahimNo ratings yet

- IntroDocument9 pagesIntroKarolJosifMorcillosNo ratings yet

- 5 Dr. Abhay UpadhyayaDocument8 pages5 Dr. Abhay UpadhyayaRavi ModiNo ratings yet

- Application of Accounting PrinciplesDocument2 pagesApplication of Accounting PrinciplesWNWDNo ratings yet

- Chapter Four Accounting SystemsDocument7 pagesChapter Four Accounting SystemsMathewos Woldemariam Birru100% (3)

- Write The Principles of An Accounting Information SystemDocument10 pagesWrite The Principles of An Accounting Information SystemSuleyman TesfayeNo ratings yet

- AF The World of AccountingDocument11 pagesAF The World of AccountingEduardo Enriquez0% (1)

- TOPIK 3-Accounting System and ControlDocument24 pagesTOPIK 3-Accounting System and Controlfalina88No ratings yet

- What Is AccountingDocument22 pagesWhat Is AccountingFredalyn Joy VelaqueNo ratings yet

- Verview OF Omputerised Ccounting Ystem: O C A SDocument16 pagesVerview OF Omputerised Ccounting Ystem: O C A SswathiNo ratings yet

- Chapter 1Document23 pagesChapter 1yvergara00No ratings yet

- Set Up and Operate A Computerized Accounting SystemDocument10 pagesSet Up and Operate A Computerized Accounting Systemabebe kumelaNo ratings yet

- Fosfa InternationalDocument29 pagesFosfa InternationaljesusNo ratings yet

- Iron Bulk Shipping Philippines VS Remington Industrial Sales CorporationDocument8 pagesIron Bulk Shipping Philippines VS Remington Industrial Sales Corporationmelody dayagNo ratings yet

- Law of Carriage of GoodsDocument11 pagesLaw of Carriage of Goodsswa291No ratings yet

- David Vs Misamis Occidental II Electric CoopDocument9 pagesDavid Vs Misamis Occidental II Electric CoopJan Veah CaabayNo ratings yet

- Servando VS Philippine Steam Navigation CoDocument3 pagesServando VS Philippine Steam Navigation Cojoy dayagNo ratings yet

- Everett Steamship Corporation Vs Court of Appeals and Hernandez Trading CoDocument2 pagesEverett Steamship Corporation Vs Court of Appeals and Hernandez Trading CoAndrea GerongaNo ratings yet

- Verify Copy: Bill of Lading For Ocean Transport or Multimodal TransportDocument2 pagesVerify Copy: Bill of Lading For Ocean Transport or Multimodal TransportCarolina Rojas IsuizaNo ratings yet

- Comercial Invoice: Exporter Arazayito ConsigneeDocument5 pagesComercial Invoice: Exporter Arazayito Consigneeerika yulieth vargasNo ratings yet

- Acct: Naza Shipping Pte LTDDocument2 pagesAcct: Naza Shipping Pte LTDToni SantosoNo ratings yet

- Document of Foreign TradeDocument11 pagesDocument of Foreign TradeAleena ShahNo ratings yet

- Organizing For Export and Import OperationsDocument14 pagesOrganizing For Export and Import OperationsmahasagarNo ratings yet

- Article 354 Code of Commerce - in The: D. Actionable DocumentDocument6 pagesArticle 354 Code of Commerce - in The: D. Actionable DocumentBianca Marie FlorNo ratings yet

- Carta de PorteDocument4 pagesCarta de PorteAdilson Patrício Quibata SamucanoNo ratings yet

- Hindustan Copper Limited: (A Govt - of India Enterprise)Document35 pagesHindustan Copper Limited: (A Govt - of India Enterprise)Tamal SarkarNo ratings yet

- Act No. 2616 - The Salvage LawDocument5 pagesAct No. 2616 - The Salvage LawAlvin Ryan KipliNo ratings yet

- 04 Asian Terminals, Inc v. Simon Enterprises, Inc., G.R. No. 177116, 27 February 2013Document8 pages04 Asian Terminals, Inc v. Simon Enterprises, Inc., G.R. No. 177116, 27 February 2013Andrei Da JoseNo ratings yet

- United Commercial Bank LimitedDocument23 pagesUnited Commercial Bank LimitedJames BlackNo ratings yet

- TDT Report SampleDocument42 pagesTDT Report Samplekhine zin thawNo ratings yet

- Gafta No.38: Contract For Grain in Bulk From Argentina Fob TermsDocument6 pagesGafta No.38: Contract For Grain in Bulk From Argentina Fob TermsMaria Ines CastelluccioNo ratings yet

- UCP 600 Revision 2Document81 pagesUCP 600 Revision 2rohit.htc18012017No ratings yet

- Comm Rev Cases Transpo First Batch 1Document42 pagesComm Rev Cases Transpo First Batch 1André BragaNo ratings yet

- Traders Manual SFAAZ ExamsDocument18 pagesTraders Manual SFAAZ ExamsBewovicNo ratings yet

- Carriage and BondingDocument8 pagesCarriage and BondingLukeNo ratings yet

- TLHT QTXNK Phu LucDocument116 pagesTLHT QTXNK Phu LucVg ChillingNo ratings yet