Professional Documents

Culture Documents

Bankruptcy and Insolvency Bac 4402

Bankruptcy and Insolvency Bac 4402

Uploaded by

King ballerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bankruptcy and Insolvency Bac 4402

Bankruptcy and Insolvency Bac 4402

Uploaded by

King ballerCopyright:

Available Formats

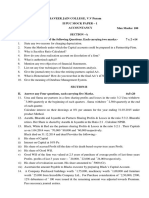

TECHNICAL UNIVERSITY OF MOMBASA

Faculty of Business and Social Studies

DEPARTMENT OF BUSINESS STUDIES

UNIVERSITY EXAMINATIONS FOR DEGREE IN

BACHELOR OF BUSINESS ADMINISTRATION

BACHELOR OF COMMERCE

BAC 4402: BANKRUPTCY AND INSOLVENCY

END OF SEMESTER EXAMINATIONS

SERIES: APRIL 2015

TIME: 2 HOURS

INSTRUCTIONS:

Answer Question ONE (Compulsory) and any other TWO questions.

Do not write on the question paper

This paper consists of Five printed pages

QUESTION 1 (Compulsory)

a) With reference to bankruptcy, discuss FIVE differences between a balance sheet and a statement of

affairs. (10 marks)

b) Omurwa, a businessman filed his own petition in bankruptcy. The balance sheet of his business as on

31st March 2013 the date of receiving order showed.

© 2015 – Technical University of Mombasa Page 1

book value Not

Value Realisable

Value

Sh. sh. sh.

Capital account as Assets

On 1st April 2012 300,000 Freehold shop

Add: Profit for the year building 600,000 700,000

the year ended 31st 25,000 share of

March 2013 100,000 sh. 20 each in

400,000 Simiti Ltd 500,000 100,000

Less: Drawings 90,000 Stock in trade 200,000 150,000

310,000 Debtors 200,000 175,000

Trade creditors Bank balance 50,000 50,000

(Including sh. 25,000

Preferred in bankruptcy 840,000

Loans (secured on freehold

Shop building 400,000 ________

1,550,000 1,550,000

Omurua’s personal assets not included in above comprised of a motor car valued at sh. 100,000, a

current account with a bank sh. 20,000 and a gold watch valued at sh. 5,000. His only personal liabilities

outside the business were sh. 3,000 due to his tailor

Required:

As at 31st March 2013 prepare

a. A statement of affairs

b. A deficiency account

(20 marks)

QUESTION 2

a) With reference to the company’s Act, discuss the order of payment of expenses, creditors and

shareholders. (10 marks)

b) Give a detailed composition of preferential creditors. (10 marks)

© 2015 – Technical University of Mombasa Page 2

QUESTION 3

Halima and Khamza were in partnership trading under the name Halimza Traders and sharing profits

and losses in the ration 1:3 respectively. On 31st December 2014 a winding up petition was lodged

against the firm on which date the balances extracted from the books of the firm and the partners

separate estate were as follows:

Current value Estimated to realize

Sh. 000 Sh. 000

Freehold property: Firm 11,000 12,000

Halima 7,000 10,000

Plant and machinery: Firm 3,000 1,500

Furniture and fixtures: Firm 1,000 8,000

Halima 1,500 1,200

Khamza 1,800 1,500

Inventory: Firm 8,000 6,500

Accounts receivable: Firm 12,000 (see note 1)

Investment: Halima 1,500 2,400

Khamza 2,000 1,900

Liabilities

Accounts payable: Firm 19,000

Halima 700

Khamza 2,400

Bank overdraft: Firm 7,000

Mortgage on Freehold property:

Firm 6,000

Halima 5,000

Additional information:

1. Of the accounts receivable, sh. 9 millons is estimated to be good, sh. 1 millions is estimated to be

good,

sh. 1 million is expected to be bad, and 50% of the remaining accounts receivable are expected to

be realized.

2. The preferential creditors for the firm, Halima and Khamza were sh. 1,100,000, sh. 300,000 and sh.

500,000 respectively.

3. The firm’s bank overdraft was secured by a second mortgage on the partnership freehold property

and by the deposit of Halima’s investment together with the personal guarantee.

Required:

Using the format laid down the Bankruptcy Act Cap. 53 prepare

a) Statement of affairs as at 31st December 2014 for Halimza.

b) Deficiency or surplus accounts as at 31st December 2014 for Halimza.

© 2015 – Technical University of Mombasa Page 3

(20 marks)

QUESTION 4

Matatizo Ltd went into voluntary liquidation on 30th November 2014. Its statement of financial position

as at that date was as follows:

Sh.

Assets

Land and buildings 5,000,000

Plant and machinery 12,500,000

Patents 2,000,000

Inventory 2,750,000

Accounts receivable 5,500,000

Cash at bank 1,500,000

Profit and loss account balance 5,625,000

34,875,000

Equity and liabilities

100,000 10% preference shares sh. 100 each fully paid 10,000,000

50,000 equity shares of sh. 100 each sh. 75 paid 3,750,000

150,000 equity share of sh. 100 each sh. 60 paid 9,000,000

15% debentures secured by a floating charge 5,000,000

Interest outstanding on the debenture 750,000

Accounts payable 6,375,000

12,670,000

Additional information:

1. The assets were realized as follows:

Sh.

Land and buildings 6,000,000

Plant and machinery 10,000,000

Patents 1,500,000

Inventory 3,000,000

Accounts receivable 4,000,000

2. Liquidation expenses amounted to sh. 545,000.

3. The final payment were made on 31st March 2015.

Required:

Liquidators final statement of account as at 31st May 2015.

(20 marks)

© 2015 – Technical University of Mombasa Page 4

QUESTION 5

Filisika Ltd is insolvent and is in the process of filing for relief under provision of Bankruptcy Act (Cap.

53). The company has no cash and its balance sheet currently shows creditors of sh. 48 millions. An

additional sh. 8 millions is owed in connection with various expenses but those amounts have not yet

been recorded. The company assets with an indication of both book value and anticipated not realizable

value as at 31st September on 2014 are as follows:

Book value Expected

To realise

Sh. 000 Sh. 000

Land 80,000 75,000

Buildings 90,000 60,000

Accumulated depreciation (38,000) -

Equipment 110,000 20,000

Accumulated depreciation (61,000) -

Investment 10,000 18,000

Inventory 48,000 36,000

Accounts receivable 31,000 9,000

Others 5,000 -

2,750,000 21,8000

Additional information.

1. Filisika Ltd has three debenture payable each with different maturity dates.

Debenture “one” due in 5 years. Sh. 120 millions secured by a mortgage lien on Filisika’s land

and buildings.

Debenture “two” due in 3 years – sh. 30 millions secured by Filisika’s investment.

Debenture “three” due in 10 years - sh. 35 millions unsecured

2. Of the creditors owed by Filisika Ltd, sh. 10 millions represents salaries to employees. However, no

individual is entitled to receive more than sh. 4,000. An additional sh. 3 millions is included in this

liability than that is due to the Kenya Government with respect to taxes.

3. The shareholders equity balance reported by the company at the current date is sh. 42 millions

composed of ordinary share capital of sh. 140 millions and a debit on the profit and loss account of

sh. 98 millions.

4. If the company is liquidated, administrative expenses of approximately sh. 20 millions would be

incurred.

Required:

A statement of affairs of and deficiency account as at 30th September 2014.

(20 marks)

© 2015 – Technical University of Mombasa Page 5

You might also like

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Exercises - Chapter 11Document19 pagesExercises - Chapter 11Jhoni Lim67% (3)

- LCCI Level 2 Certificate in Bookkeeping and Accounting ASE20093 RB Nov 2018Document8 pagesLCCI Level 2 Certificate in Bookkeeping and Accounting ASE20093 RB Nov 2018Ei Ei TheintNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Solution MC Installment LiquidationDocument5 pagesSolution MC Installment LiquidationHoney OrdoñoNo ratings yet

- 1Document15 pages1krizzmaaaayNo ratings yet

- PartnershipDocument30 pagesPartnershipClaire diane CraveNo ratings yet

- QuestionsDocument9 pagesQuestionsalexkioko708No ratings yet

- Test DissolutionDocument1 pageTest DissolutionGauri SinglaNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Tutorial Chapter 4 (TRIAL BALANCE)Document2 pagesTutorial Chapter 4 (TRIAL BALANCE)azra balqisNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Fusion Absorption Au MarocDocument8 pagesFusion Absorption Au Marocwissal tayaaNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- Zenith LTD 4 8 2022Document12 pagesZenith LTD 4 8 2022XyzNo ratings yet

- Ministry of Education, Heritage and Arts: Strand One Nature of AccountingDocument3 pagesMinistry of Education, Heritage and Arts: Strand One Nature of AccountingShyam murtiNo ratings yet

- AFM Q-BankDocument42 pagesAFM Q-Banks BNo ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Commerce Syllabus Degree Part 2Document12 pagesCommerce Syllabus Degree Part 2Dhruva AryanNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Accounts (A)Document3 pagesAccounts (A)Sameer Gupta100% (1)

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Valuation AssignmentDocument9 pagesValuation AssignmentNicole TaylorNo ratings yet

- 2BBL311 SEE IR Financial Accounting Dec 2017Document3 pages2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNo ratings yet

- 3054 Faca-V L 8Document8 pages3054 Faca-V L 8ab6154951No ratings yet

- Adv Accounting Part Accounts 2Document7 pagesAdv Accounting Part Accounts 2Srishti 2k22No ratings yet

- Trade and Nontrade Receivables FM561Document25 pagesTrade and Nontrade Receivables FM561Rose Aubrey A CordovaNo ratings yet

- CA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)Document6 pagesCA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)PizzareadNo ratings yet

- Problem 2 6Document6 pagesProblem 2 6Abe Mayores CañasNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmPrageeth Roshan WeerathungaNo ratings yet

- Ia1 Midterm Activity-1Document2 pagesIa1 Midterm Activity-1Lorraine Millama PurayNo ratings yet

- Partnership Home WorkDocument3 pagesPartnership Home WorkVinay KumarNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- Practical Question Accountancy MainDocument22 pagesPractical Question Accountancy MainDubai SheikhNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Fundamentals of AccountingDocument1 pageFundamentals of AccountinghaggaiNo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Debit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsDocument4 pagesDebit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsM JEEVARATHNAM NAIDUNo ratings yet

- Batch 93 FAR First Preboard February 2023Document15 pagesBatch 93 FAR First Preboard February 2023Ameroden AbdullahNo ratings yet

- INTACC 1 - REVIEWER - MIDTERMS (Receivables1)Document8 pagesINTACC 1 - REVIEWER - MIDTERMS (Receivables1)olerianaryzzsc.56No ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- Advanced Financial Accounting: Question Paper 2014Document3 pagesAdvanced Financial Accounting: Question Paper 2014irfanNo ratings yet

- Chapter 4 Liquidation of Companies TYBAFDocument4 pagesChapter 4 Liquidation of Companies TYBAFvikax90927No ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Accounts Dissolution Test 3rd SemesterDocument6 pagesAccounts Dissolution Test 3rd SemesterNeha agarwalNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- Single Entry System Practice ManualDocument56 pagesSingle Entry System Practice ManualNimesh GoyalNo ratings yet

- Formula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDocument10 pagesFormula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDilip KumarNo ratings yet

- Advanced Financial Accounting and Reporting ExercisesDocument6 pagesAdvanced Financial Accounting and Reporting ExercisesKi LalaNo ratings yet

- AP AnswerKeyDocument6 pagesAP AnswerKeyRosalie E. Balhag100% (2)

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- 02Document3 pages02Jodel Castro100% (1)

- Chapter 9 Plant Assets, Natural Resources and Intangible Assets PDFDocument67 pagesChapter 9 Plant Assets, Natural Resources and Intangible Assets PDFJed Riel BalatanNo ratings yet

- Cohen Finance Workbook FALL 2013Document124 pagesCohen Finance Workbook FALL 2013Nayef AbdullahNo ratings yet

- Full Text 01Document64 pagesFull Text 01rao sahabNo ratings yet

- Paper - 2: Strategic Financial Management Questions Sensitivity AnalysisDocument27 pagesPaper - 2: Strategic Financial Management Questions Sensitivity AnalysisRaul KarkyNo ratings yet

- Pallavi ProjectDocument44 pagesPallavi ProjectPallavi GargNo ratings yet

- MCQ Reviewers Ia 2Document13 pagesMCQ Reviewers Ia 2Angely MulaNo ratings yet

- TGS Kelompok PPEDocument3 pagesTGS Kelompok PPESHYAILA ANISHA DE LAVANDANo ratings yet

- Quizzer With Answer PDFDocument6 pagesQuizzer With Answer PDFGamers HubNo ratings yet

- Tax Netherlands Guide 2015Document31 pagesTax Netherlands Guide 2015Tarek FahimNo ratings yet

- Disclosures For Confirmation With Legal DepartmentDocument9 pagesDisclosures For Confirmation With Legal Departmentlito77No ratings yet

- FAR-4206 (Government Grant & Agriculture)Document6 pagesFAR-4206 (Government Grant & Agriculture)Fella GultianoNo ratings yet

- Statement of Cash Flows and Book Value Per Share - Group 4Document67 pagesStatement of Cash Flows and Book Value Per Share - Group 4Karen MagsayoNo ratings yet

- CH 12Document19 pagesCH 12Vandana GuptaNo ratings yet

- Chapter 4 DissolutionDocument24 pagesChapter 4 DissolutionJenny BernardinoNo ratings yet

- Equity ValuationDocument152 pagesEquity ValuationHashmi Syed NazeerNo ratings yet

- IAS 16 - Property, Plant & Equipment (PPE)Document63 pagesIAS 16 - Property, Plant & Equipment (PPE)ali muzamilNo ratings yet

- Training Hand Out - Economic Evaluation and Modeling of Mining ProjectsDocument73 pagesTraining Hand Out - Economic Evaluation and Modeling of Mining ProjectsAriyanto WibowoNo ratings yet

- Date of Valuation: Default AssumptionsDocument55 pagesDate of Valuation: Default AssumptionsSiva Ramakrishna ValluriNo ratings yet

- Examination: Subject CA1 - Core Applications Concepts Paper 1 (Assets)Document12 pagesExamination: Subject CA1 - Core Applications Concepts Paper 1 (Assets)Saad MalikNo ratings yet