Professional Documents

Culture Documents

Consolidated Results 4Q20: AT&T 4Q20 Highlights

Consolidated Results 4Q20: AT&T 4Q20 Highlights

Uploaded by

田原純平Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Results 4Q20: AT&T 4Q20 Highlights

Consolidated Results 4Q20: AT&T 4Q20 Highlights

Uploaded by

田原純平Copyright:

Available Formats

AT&T 4Q20 Highlights

Following are certain 4Q20 highlights. The full set of earnings materials with all reported results

and non-GAAP reconciliations is posted here, including trend schedules.

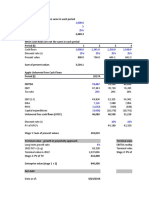

Consolidated Results 4Q20

EPS Reported ($1.95) 4Q20 adj. EPS down ($0.14); including ($0.08) of estimated

EPS Adjusted $0.75 COVID impacts

Revenues $45.7 billion Down ($1.1B) YOY; sequential growth of $3.4B

~($2.5B) estimated YOY impact from COVID partially offset

by higher Mobility revenue +$1.4B

Adj. EBITDA $12.9 billion Down ($1.5); including ($0.7B) estimated impact from COVID

2020 free cash flow of $27.5B

Free Cash Flow $7.7 billion

Total dividend payout ratio of ~55% for full year;

Capex $2.4 billion Expect 2021 free cash flow in $26B range and gross capital

Gross Cap Investment $4.3 billion investment in the $21B range

$147.5B net debt; ~$10B cash on hand at end of 4Q20

Net Debt to Adj. EBITDA 2.70x

Reduced ~$33B in net debt since closing of TWX transaction

Restructured ’21-’25 debt maturities in 2020

Revenues ($M) 4Q20 4Q19 % Change $ Change COVID impact

(estimated)

Mobility 20,119 18,700 7.6% 1,419 (250)

Wireless service revenue 14,022 13,948 0.5% 74 (250)

Video1 7,168 8,075 -11.2% (907) (210)

Broadband1 3,116 3,161 -1.4% (45) 0

Business Wireline1 6,319 6,586 -4.1% (267) (100)

WarnerMedia2 8,554 9,453 -9.5% (899) (1,550)

Latin America 1,498 1,758 -14.8% (260) (350)

2,3,4

Other (1,083) (912) - (171) (20)

Total Revenues 45,691 46,821 -2.4% (1,130) (2,480)

Adj. EBITDA ($M) 4Q20 4Q19 % Change $ Change COVID impact

(estimated)

Mobility 7,096 7,530 -5.8% (434) (240)

Video1 619 628 -1.4% (9) (60)

Broadband1 1,104 1,412 -21.8% (308) 0

Business Wireline1 2,326 2,530 -8.1% (204) (100)

WarnerMedia2 2,719 3,005 -9.5% (286) (20)

Latin America 95 205 -53.7% (110) (155)

Other 2,3,4 (1,071) (945) - (126) (75)

Total Adj. EBITDA 12,889 14,365 -10.3% (1,476) (650)

Adj. Operating Income ($M) 4Q20 4Q19 % Change $ Change

Total 7,814 9,188 -15.0% (1,374)

Adj. Operating Income Margin 17.1% 19.6% -250bps

1

Entertainment Group results have been recast for all periods into Video and Broadband business units. Business wireline results have been recast to exclude

commercial video, which is now included in the Video busines unit.

2

WarnerMedia segment results have been recast for all periods to include Xandr and exclude Crunchyroll, which is now classified as held-for-sale in 4Q20.

3

4Q20 is primarily Communications segment content eliminations ($761) and Video advertising eliminations ($603) offset by Corp/Other revenues +$388.

4

4Q20 Corp. EBITDA ($506) and advertising eliminations ($565)

Key Statistics - Volumes 4Q20

AT&T Communications

Total US Wireless Net Adds 5.9M 1.2M postpaid; 14k prepaid; 4.8M connected devices

US Postpaid Net adds 1.2M

Postpaid Phone Net Adds 800k Higher device adoption and retention promotions

Postpaid Phone Churn 0.76% Record-low for a 4th quarter; 0.79% full year

Postpaid Phone ARPU $54.46 Down ($1.06) due to lower international roaming

US Prepaid Net Adds 14k Prepaid churn ~3%

AT&T Fiber Net Adds 273k -2k broadband net adds

IP Broadband ARPU $53.72 Up 4.6%; mix shift impact with 1M+ fiber adds in 2020

Premium Video Net Adds (617k) Lower churn due to higher-quality base

Premium Video ARPU $137.64 Up 5.1% with focus on life-time value of subscribers

WarnerMedia

HBO/HBO Max domestic 41.5M Domestic HBO/HBO Max subscribers up ~7 million in

subscribers 2020

Latin America

Mexico Wireless Net Adds 529k Driven by lower YOY churn

Vrio Video Net adds 49k 24k improvement YOY

Select Financial Results 4Q20

AT&T Communications

Mobility

Revenue $20,119 M Up $1.4B with higher device sales;

6.5% upgrade rate

Service Revenue $14,022 M Up 0.5%, even with ~($200M) lower international

roaming revenues

EBITDA $7,096 M Down ($434M), due to COVID and successful growth

EBITDA Svc Margin 50.6% and promotions

Video

Revenue $7,168 M Down ($0.9B) due to fewer video subscribers and

COVID impacts

EBITDA $619 M Continued focus on cash generation

8.6% Margins reflect NFL Sunday Ticket seasonality

EBITDA Margin

Broadband

Revenue $3,116 M Down (1.4%) as broadband revenue growth was

offset by legacy declines

EBITDA $1,104 M Down ~($300M) due to investment in customer base

EBITDA Margin 35.4% and higher non-cash amortization

WarnerMedia2 4Q20

Revenue $8,554 M Down ($0.9B); ~($1.6B) estimated COVID impact

from lower TV and theatrical revenues and sports

timing; HBO Max drove higher subscription revenues

Op. Income $2,542 M Down ($0.3B) due to HBO Max investment offset by

lower content costs and higher election year

advertising revenues

4Q20 COVID Impact Summary

Three Months Ended December 31, 2020

Estimated

Revenues Estimated

Dollars in millions Impact EBITDA Impacts

Revenues:

WarnerMedia Content and Other $ (1,490) $ (280)

WarnerMedia Advertising (sports) and Other (120) 50

Video Advertising1 60 60

Video (210) (60)

Mobility Wireless Service (250) (240)

Business Wireline (100) (100)

Latin America (350) (155)

Other (20) (15)

Total $ (2,480) $ (740)

1

Includes certain Xandr advertising revenues which are reported in the WarnerMedia and

Communications segments and are eliminated in consolidation.

Three Months Ended December 31, 2020

EBITDA Impacts

Included in

Reported

Dollars in millions Results

Expenses:

Production Disruption Costs $ (30)

Business Disruption Recoveries 180

Other Costs (60)

Total $ 90

You might also like

- Canales M3uDocument3 pagesCanales M3unotificacionesinterwirelessNo ratings yet

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- Netflix: Will Content Be Enough?: The Ebb and Flow of An Industry Historical ContextDocument16 pagesNetflix: Will Content Be Enough?: The Ebb and Flow of An Industry Historical Contextcarol babyNo ratings yet

- Value Chain Analysis of HBO Now: Presentation By: Purav ShahDocument3 pagesValue Chain Analysis of HBO Now: Presentation By: Purav ShahAchal PatelNo ratings yet

- FiOS Channel GuideDocument4 pagesFiOS Channel Guidechevellejnj72100% (1)

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- Q223 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q223 - Form8K - Exhibit99-1 - Earnings - Release - TablesDocument9 pagesQ223 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q223 - Form8K - Exhibit99-1 - Earnings - Release - TablesAndrei CucuNo ratings yet

- Kotak - Investor Presentation Q1fy21Document38 pagesKotak - Investor Presentation Q1fy21Divya MukherjeeNo ratings yet

- 2020 LBG q1 Ims Excel Download v2Document16 pages2020 LBG q1 Ims Excel Download v2saxobobNo ratings yet

- Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables-FinalDocument9 pagesQ324 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q324 - Form8K - Exhibit99-1 - Earnings - Release - Tables-FinalAndrei CucuNo ratings yet

- Pag BankDocument24 pagesPag Bankandre.torresNo ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- Lloyds Banking Group PLC Q1 2019 Interim Management StatementDocument5 pagesLloyds Banking Group PLC Q1 2019 Interim Management StatementsaxobobNo ratings yet

- Finance ProjectDocument19 pagesFinance Projectapi-351760386No ratings yet

- Sampa Video Solution Harvard Case Solution 1Document10 pagesSampa Video Solution Harvard Case Solution 1Héctor SilvaNo ratings yet

- 2024 q1 Nokia Earnings Release EnglishDocument31 pages2024 q1 Nokia Earnings Release EnglishrmdirfantvNo ratings yet

- Alcoa 3Q09 Earnings PresentationDocument45 pagesAlcoa 3Q09 Earnings PresentationychartsNo ratings yet

- Business CaseDocument11 pagesBusiness CasesomeshNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- Deepak Fertilizers and ChemicalsDocument17 pagesDeepak Fertilizers and ChemicalsnakilNo ratings yet

- Nokia Results 2023 q2Document31 pagesNokia Results 2023 q2yalemorgan69No ratings yet

- Factbook 2020Document99 pagesFactbook 2020Mohamed KadriNo ratings yet

- Kogas Ar 2020Document11 pagesKogas Ar 2020Vinaya NaralasettyNo ratings yet

- Lloyds Banking Group PLC Q1 2018 Interim Management StatementDocument3 pagesLloyds Banking Group PLC Q1 2018 Interim Management StatementsaxobobNo ratings yet

- Docshare - Tips - Sampa Video Solution Harvard Case Solution PDFDocument10 pagesDocshare - Tips - Sampa Video Solution Harvard Case Solution PDFnimarNo ratings yet

- Fact SheetDocument4 pagesFact SheetSadanand MahatoNo ratings yet

- 2020 4q Presentation enDocument22 pages2020 4q Presentation enHassan PansariNo ratings yet

- Investor Presentation FY20Document49 pagesInvestor Presentation FY20Nitin ParasharNo ratings yet

- Grasim Q3FY09 PresentationDocument47 pagesGrasim Q3FY09 PresentationJasmine NayakNo ratings yet

- 22 2Q Earning Release of LGEDocument18 pages22 2Q Earning Release of LGEThảo VũNo ratings yet

- 2019 LBG q1 Ims CombinedDocument19 pages2019 LBG q1 Ims CombinedsaxobobNo ratings yet

- Interim Management StatementDocument10 pagesInterim Management StatementsaxobobNo ratings yet

- UntitledDocument77 pagesUntitledPak CVBankNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- Q4FY20 Earning UpdateDocument28 pagesQ4FY20 Earning UpdateSumit SharmaNo ratings yet

- Fourth Quarter 2010 Earnings Review: January 18, 2011Document36 pagesFourth Quarter 2010 Earnings Review: January 18, 2011oliverzzeng1152No ratings yet

- Mediaset (MS - MI) : 3Q03 Results On TuesdayDocument8 pagesMediaset (MS - MI) : 3Q03 Results On Tuesdaypoutsos1984No ratings yet

- P&L ExemploDocument1 pageP&L ExemploEduardo OliveiraNo ratings yet

- Keydata ForecastDocument3 pagesKeydata ForecastMun Fei CheahNo ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Análise HCB 260323Document4 pagesAnálise HCB 260323IlidiomozNo ratings yet

- EYFR - Budget Briefing - 2022Document75 pagesEYFR - Budget Briefing - 2022Tariq HussainNo ratings yet

- q2 Fy23 EarningsDocument19 pagesq2 Fy23 EarningsGan ZhiHanNo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- POSCO INTERNATIONAL 2Q 2020 Earnings Release1 PDFDocument10 pagesPOSCO INTERNATIONAL 2Q 2020 Earnings Release1 PDFredevils86No ratings yet

- DCF Guide Example2020Document6 pagesDCF Guide Example2020jam manNo ratings yet

- Indra Results 1H19Document13 pagesIndra Results 1H19Twobirds Flying PublicationsNo ratings yet

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Document6 pagesDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalNo ratings yet

- YE'22Document12 pagesYE'22parshvaj0312No ratings yet

- 2023 - Q1 Supplemental - BAM - FinalDocument40 pages2023 - Q1 Supplemental - BAM - FinalJ Pierre Richer100% (1)

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- 1Q21 Operating EBITDA Below COL Estimates On Lower-Than-Expected RevenuesDocument8 pages1Q21 Operating EBITDA Below COL Estimates On Lower-Than-Expected RevenuesJajahinaNo ratings yet

- 2020.Q3 Earnings Release FinalDocument16 pages2020.Q3 Earnings Release FinalAhmed EldessoukyNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet

- Earnings Estimates Answer q3 2021Document1 pageEarnings Estimates Answer q3 2021LT COL VIKRAM SINGH EPGDIB 2021-22No ratings yet

- ADRO ADMR May 2023 - 230811 - 000428Document48 pagesADRO ADMR May 2023 - 230811 - 000428Aditya Dani NugrahaNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- Q1FY22 KIP REIT Results (Bursa)Document17 pagesQ1FY22 KIP REIT Results (Bursa)seeme55runNo ratings yet

- BudgetBrief 2015 PDFDocument85 pagesBudgetBrief 2015 PDFFarukh MalikNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Ott Faq Unifi TV Content Update 24april2024 v7 08042024Document11 pagesOtt Faq Unifi TV Content Update 24april2024 v7 08042024youchiyagamiNo ratings yet

- Codigo LineDocument16 pagesCodigo LineMilton NavarreteNo ratings yet

- Lista IPTV KanalaDocument3 pagesLista IPTV KanalaGordana Dokic - SegedinNo ratings yet

- UntitledDocument147 pagesUntitledaabuelshiekhNo ratings yet

- Test 17Document23 pagesTest 17Joe StoneNo ratings yet

- CLU Channel Line Up IndiHome TV Mei 2024 - 2024 - 05 - 06 - 10 - 05 - 06Document21 pagesCLU Channel Line Up IndiHome TV Mei 2024 - 2024 - 05 - 06 - 10 - 05 - 06Muhammad Fadil SidqiNo ratings yet

- CanaisDocument5 pagesCanaissaiaziekNo ratings yet

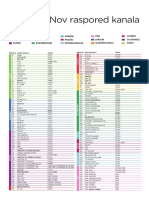

- Raspored Kanala: Pozicija Kanal PaketDocument2 pagesRaspored Kanala: Pozicija Kanal PaketK MusampaNo ratings yet

- Group 1 Netflixs Inc.Document10 pagesGroup 1 Netflixs Inc.Mark Anthony Llovit BabaoNo ratings yet

- x1223 HBO Max Premium AccountsDocument32 pagesx1223 HBO Max Premium AccountsadammarusiewiczNo ratings yet

- Selectividad Castilla y Leon InglesDocument2 pagesSelectividad Castilla y Leon Inglesmacortijo16No ratings yet

- TV Channel ListDocument8 pagesTV Channel ListPOLOPO POLUYHNo ratings yet

- Time Warner Annual ReportDocument49 pagesTime Warner Annual ReporthyhabaNo ratings yet

- Truckee Channel LineupDocument2 pagesTruckee Channel LineupschlittyNo ratings yet

- ENG PR Astro Welcomes The New Year With HITS NOW and 6 FREE Channel PreviewsDocument2 pagesENG PR Astro Welcomes The New Year With HITS NOW and 6 FREE Channel Previewsg-79300284No ratings yet

- Grila Digital PDFDocument1 pageGrila Digital PDFVVVVVVNo ratings yet

- U Verse Channel DirectoryDocument2 pagesU Verse Channel DirectoryChu P100% (1)

- D3 Programska ShemaDocument3 pagesD3 Programska ShemaAmir KaticaNo ratings yet

- Pelli Choopulu CartoonsDocument21 pagesPelli Choopulu CartoonsRamji RaoNo ratings yet

- Codes Xtream IPTV - 2023 VIP Premium Date 10-2023 Group - 24Document820 pagesCodes Xtream IPTV - 2023 VIP Premium Date 10-2023 Group - 24lecomteNo ratings yet

- Jackson Historical Society Raspberry Festival: 18th Annual Event Will Be Sept. 13Document12 pagesJackson Historical Society Raspberry Festival: 18th Annual Event Will Be Sept. 13Hometown Publications - Express NewsNo ratings yet

- DirecTV Channels LineupDocument2 pagesDirecTV Channels LineupMaxSpeed988No ratings yet

- Auburn Trader - August 17, 2011Document12 pagesAuburn Trader - August 17, 2011GCMediaNo ratings yet

- Totaltv Raspored Kanala PDFDocument2 pagesTotaltv Raspored Kanala PDFVladimir PetrovićNo ratings yet

- Soft CamDocument45 pagesSoft CamAnonymous KzSh7DpE100% (3)

- 1 Digi Sport 1Document5 pages1 Digi Sport 1Florian MarinNo ratings yet