Professional Documents

Culture Documents

Reading Material - Derivatives & Hedge

Reading Material - Derivatives & Hedge

Uploaded by

Prince LeeCopyright:

Available Formats

You might also like

- M5 Mock Exam 1Document22 pagesM5 Mock Exam 1Eveleen Gan100% (4)

- DSC1603 2023 S2 Discussion Class 5Document24 pagesDSC1603 2023 S2 Discussion Class 5Mary MondliwaNo ratings yet

- Your Electricity Spring Electricity Statement: What's My Balance?Document1 pageYour Electricity Spring Electricity Statement: What's My Balance?Maxi KiMNo ratings yet

- Creating Your Financial GenogramDocument2 pagesCreating Your Financial Genogramdininja100% (1)

- Biological Assets: SAMPLE PROBLEMS With AnswersDocument1 pageBiological Assets: SAMPLE PROBLEMS With AnswersMary Yvonne AresNo ratings yet

- DerivativesDocument18 pagesDerivativesJay Lord FlorescaNo ratings yet

- Basic Financial Derivatives Forwards: in Finance, A Forward Contract or Simply A Forward Is A Derivative ContractDocument3 pagesBasic Financial Derivatives Forwards: in Finance, A Forward Contract or Simply A Forward Is A Derivative Contractsid1982No ratings yet

- Derivatives Note SeminarDocument7 pagesDerivatives Note SeminarCA Vikas NevatiaNo ratings yet

- Differences Between Forward and FutureDocument3 pagesDifferences Between Forward and Futureanish-kc-8151No ratings yet

- Chapter 24 FIM: DerivativesDocument15 pagesChapter 24 FIM: DerivativesrdtdtdrtdtrNo ratings yet

- Futures Contract FinalDocument6 pagesFutures Contract FinalSundus KhalidNo ratings yet

- Common Derivative ContractDocument7 pagesCommon Derivative ContractMd. Saiful IslamNo ratings yet

- Hedging Process Step by Step Guide PDFDocument10 pagesHedging Process Step by Step Guide PDFAbhijeet JacksonNo ratings yet

- WLH Finance CompilationDocument58 pagesWLH Finance CompilationSandhya S 17240No ratings yet

- Basics of DeivativesDocument9 pagesBasics of DeivativesGaurav ThigaleNo ratings yet

- Derivatives and Its Instruments: Prepared By: Nitin Kori-Roll No. 16 Khyati Mistry - Roll No. 20Document20 pagesDerivatives and Its Instruments: Prepared By: Nitin Kori-Roll No. 16 Khyati Mistry - Roll No. 20Khyati MistryNo ratings yet

- MortgageDocument4 pagesMortgageNuman NaeemNo ratings yet

- Cfa Derivados-Word: DeliveryDocument5 pagesCfa Derivados-Word: DeliverySebastian Ramirez MoranNo ratings yet

- Introduction To The Basic Concept of Derivatives: Over-The-Counter Market Mean?Document6 pagesIntroduction To The Basic Concept of Derivatives: Over-The-Counter Market Mean?Aman NegiNo ratings yet

- Credit Risk Management M.Numan Naeem BBA (Hons) 8 (Evening, B Section)Document6 pagesCredit Risk Management M.Numan Naeem BBA (Hons) 8 (Evening, B Section)Numan NaeemNo ratings yet

- ContractsDocument3 pagesContractsrohitpatel13No ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- Forward Contract Vs Futures ContractDocument4 pagesForward Contract Vs Futures ContractabdulwadoodansariNo ratings yet

- Derivatives and RMDocument35 pagesDerivatives and RMMichael WardNo ratings yet

- Gist Of Financial TermsDocument17 pagesGist Of Financial TermsSagar JadhavNo ratings yet

- Derivatives: Cash Flows Securities AssetsDocument63 pagesDerivatives: Cash Flows Securities AssetsAaron RosalesNo ratings yet

- Forward Contract Future ContractDocument10 pagesForward Contract Future ContractSanjai SivañanthamNo ratings yet

- What Does Derivative Mean?Document23 pagesWhat Does Derivative Mean?shrikantyemulNo ratings yet

- Derivative Markets and Instruments: Criticisms of DerivativesDocument10 pagesDerivative Markets and Instruments: Criticisms of DerivativesMayura KatariaNo ratings yet

- Derivatives SummaryDocument2 pagesDerivatives SummaryNurul AisyahNo ratings yet

- Financial DerivativesDocument31 pagesFinancial DerivativesSyed Roshan JavedNo ratings yet

- Off-Balance Sheet - Risk ManagementDocument18 pagesOff-Balance Sheet - Risk ManagementjoanabudNo ratings yet

- Chapter 4 Derivatives and Hedging TransactionsDocument6 pagesChapter 4 Derivatives and Hedging TransactionsOly VieenaNo ratings yet

- Derivatives PPTDocument29 pagesDerivatives PPTSangeeta SinghNo ratings yet

- Module 001 Accounting For Liabilities-Current Part 4Document5 pagesModule 001 Accounting For Liabilities-Current Part 4Gab BautroNo ratings yet

- Currency Derivatives: Forward Rate Spot Rate Spot Rate X N (Number of Day Maturity)Document2 pagesCurrency Derivatives: Forward Rate Spot Rate Spot Rate X N (Number of Day Maturity)afniNo ratings yet

- Chapter VI DerivativesDocument36 pagesChapter VI Derivativesmulutsega yacobNo ratings yet

- Mortgage Markets and Derivatives - AnswerDocument3 pagesMortgage Markets and Derivatives - AnswerSarang SNo ratings yet

- Derivatives SIGFi Finance HandbookDocument8 pagesDerivatives SIGFi Finance HandbookSneha TatiNo ratings yet

- Derivatives Concepts: What Is A Derivative?Document5 pagesDerivatives Concepts: What Is A Derivative?Fatma AbdelRehiemNo ratings yet

- TypesofswapDocument5 pagesTypesofswapshweta jaiswalNo ratings yet

- Interest Rate DerivativesDocument3 pagesInterest Rate Derivativesnits_rocks1987No ratings yet

- L2 - MS International Finance 2023 - DerivativeDocument18 pagesL2 - MS International Finance 2023 - DerivativeAli HasanovNo ratings yet

- Derivatives: Prof Mahesh Kumar Amity Business SchoolDocument56 pagesDerivatives: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- DerivativesDocument5 pagesDerivativesibong tiriritNo ratings yet

- CFA DerivativesTutorialAKBDocument57 pagesCFA DerivativesTutorialAKBsunboy moyoNo ratings yet

- Derivatives and Risk ManagementDocument4 pagesDerivatives and Risk ManagementbhumishahNo ratings yet

- DerivativesDocument8 pagesDerivativesMirzaMohtashimNo ratings yet

- Risk MGMT (Module-II - Chapter 1 & 2)Document10 pagesRisk MGMT (Module-II - Chapter 1 & 2)Kelvin SavaliyaNo ratings yet

- Chapter 11 Derivatives Hedging - ReportingDocument9 pagesChapter 11 Derivatives Hedging - ReportingEricka AlimNo ratings yet

- Financial DerivativesDocument12 pagesFinancial DerivativesNony BahgatNo ratings yet

- What Is A Derivative?Document65 pagesWhat Is A Derivative?devNo ratings yet

- Derivatives and Risk Management PDFDocument7 pagesDerivatives and Risk Management PDFYogesh GovindNo ratings yet

- Futures Contracts:: What Is A Derivative?Document6 pagesFutures Contracts:: What Is A Derivative?Marcel KouekeuNo ratings yet

- Project Report On Future, Option & SwapsDocument12 pagesProject Report On Future, Option & SwapsSiddharth RaiNo ratings yet

- Interest Rate Derivatives Credit Default Swaps Currency DerivativesDocument30 pagesInterest Rate Derivatives Credit Default Swaps Currency DerivativesAtul JainNo ratings yet

- Investment Analysis Farhan Javed M14MBA031Document76 pagesInvestment Analysis Farhan Javed M14MBA031Muhammad UsmanNo ratings yet

- What Is A "Derivative" ?Document4 pagesWhat Is A "Derivative" ?RAHULNo ratings yet

- SwapDocument3 pagesSwapJohana ReyesNo ratings yet

- Derivatives and Risk Management (2017)Document10 pagesDerivatives and Risk Management (2017)ashok kumar vermaNo ratings yet

- Derivatives 120821000932 Phpapp02Document54 pagesDerivatives 120821000932 Phpapp02Choco ChocoNo ratings yet

- What Are Futures and ForwardsDocument22 pagesWhat Are Futures and ForwardsMuneeza AzharNo ratings yet

- Unit IiDocument31 pagesUnit IiMister MarlegaNo ratings yet

- Chapter 6Document6 pagesChapter 6Millen AustriaNo ratings yet

- Secrecy of Bank DepositsDocument10 pagesSecrecy of Bank DepositsMary Yvonne AresNo ratings yet

- Ancient Era Compass: Historical AntecedentsDocument2 pagesAncient Era Compass: Historical AntecedentsMary Yvonne AresNo ratings yet

- Drill Sales 2Document2 pagesDrill Sales 2Mary Yvonne AresNo ratings yet

- Del Monte v. AragonesDocument7 pagesDel Monte v. AragonesMary Yvonne AresNo ratings yet

- IAT 2020 Final Preboard (Source SimEx4 RS)Document15 pagesIAT 2020 Final Preboard (Source SimEx4 RS)Mary Yvonne AresNo ratings yet

- Cultural DifferenceDocument3 pagesCultural DifferenceMary Yvonne AresNo ratings yet

- Rosa Lim v. CADocument4 pagesRosa Lim v. CAMary Yvonne AresNo ratings yet

- Commissioner of Internal Revenue Vs - ConstantinoDocument3 pagesCommissioner of Internal Revenue Vs - ConstantinoMary Yvonne AresNo ratings yet

- Communication ModelsDocument3 pagesCommunication ModelsMary Yvonne AresNo ratings yet

- Sample Problems - DerivativesDocument4 pagesSample Problems - DerivativesMary Yvonne AresNo ratings yet

- Lesson 6 Elements and Principles of ArtDocument16 pagesLesson 6 Elements and Principles of ArtMary Yvonne AresNo ratings yet

- Bond Valuation: Reference: Financial Management Fundamentals by E. Brigham, 12 Edition (Chapter 10)Document3 pagesBond Valuation: Reference: Financial Management Fundamentals by E. Brigham, 12 Edition (Chapter 10)Mary Yvonne AresNo ratings yet

- PFRS 13 - Fair Value MeasurementDocument7 pagesPFRS 13 - Fair Value MeasurementMary Yvonne AresNo ratings yet

- Assignment 2 - Stock ValuationDocument1 pageAssignment 2 - Stock ValuationMary Yvonne AresNo ratings yet

- Quiz - Financial Statements With SolutionDocument6 pagesQuiz - Financial Statements With SolutionMary Yvonne AresNo ratings yet

- Supplemental Notes - IAS 34Document40 pagesSupplemental Notes - IAS 34Mary Yvonne AresNo ratings yet

- Topic 5 - Single-Entry MethodDocument49 pagesTopic 5 - Single-Entry MethodMary Yvonne AresNo ratings yet

- Stock ValuationDocument4 pagesStock ValuationMary Yvonne AresNo ratings yet

- Sample Problems MCQDocument3 pagesSample Problems MCQMary Yvonne AresNo ratings yet

- Introduction To Operations Management: - Objectives of LectureDocument15 pagesIntroduction To Operations Management: - Objectives of LectureMary Yvonne AresNo ratings yet

- Accounting CycleDocument9 pagesAccounting Cyclerakshit konchadaNo ratings yet

- Quiz Questions and AnswersDocument61 pagesQuiz Questions and AnswersMarvin AndresNo ratings yet

- Elements of Book-Keeping and Accountancy (Code No. 254) CLASS-IX (2021-22)Document4 pagesElements of Book-Keeping and Accountancy (Code No. 254) CLASS-IX (2021-22)Mandowara MadhavNo ratings yet

- Income TaxDocument15 pagesIncome TaxZayed Mohammad JohnyNo ratings yet

- NRE Lecture 1Document8 pagesNRE Lecture 1yaregalNo ratings yet

- Ft2020czech RepublicDocument11 pagesFt2020czech RepublicvisegaNo ratings yet

- Bachelor of Commerce: Bcoc - 137: Corporate AccountingDocument23 pagesBachelor of Commerce: Bcoc - 137: Corporate Accountingsubhaa DasNo ratings yet

- AE 18 ReportDocument2 pagesAE 18 ReportMycka Joy HernandezNo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Chapter 25 - AnswerDocument10 pagesChapter 25 - AnswerReanne Claudine Laguna71% (7)

- By Rajesh NarayananDocument22 pagesBy Rajesh NarayananTusharNo ratings yet

- Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CityDocument70 pagesComprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CitySampath DontaNo ratings yet

- 03 Literature ReviewDocument13 pages03 Literature ReviewAmitesh KumarNo ratings yet

- Way2wealth Org Study Report 8 Nov 2022Document65 pagesWay2wealth Org Study Report 8 Nov 2022Manu DvNo ratings yet

- Jawaban Sesi 1 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 1 Ujikom Pt. BoombasstikNada NadyaNo ratings yet

- Financial and Monetary Policies in Ghana: A Review of Recent TrendsDocument11 pagesFinancial and Monetary Policies in Ghana: A Review of Recent TrendsrytchluvNo ratings yet

- ATMDocument38 pagesATMseid negashNo ratings yet

- Abdul Sattar 2018Document48 pagesAbdul Sattar 2018ABDUL sattarNo ratings yet

- Branch Banking Vs Unit BankingDocument7 pagesBranch Banking Vs Unit BankingBoruah SwapnaNo ratings yet

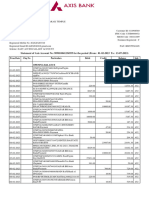

- Acct Statement - XX6955 - 13072023Document9 pagesAcct Statement - XX6955 - 13072023iblfinserv0No ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- The Privatized Dramaturgy of Capitalist Civil SocietyDocument12 pagesThe Privatized Dramaturgy of Capitalist Civil SocietyÁlvaro MoyaNo ratings yet

- Words GigiDocument102 pagesWords GigiNguyen Ha QuanNo ratings yet

- Target 3 Stock and DividendDocument5 pagesTarget 3 Stock and DividendAjeet YadavNo ratings yet

- Dalio Ebook FINAL PDFDocument48 pagesDalio Ebook FINAL PDFvuhieptran100% (1)

- Basic Financial StatementsDocument44 pagesBasic Financial Statementsfikru terfaNo ratings yet

Reading Material - Derivatives & Hedge

Reading Material - Derivatives & Hedge

Uploaded by

Prince LeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reading Material - Derivatives & Hedge

Reading Material - Derivatives & Hedge

Uploaded by

Prince LeeCopyright:

Available Formats

University of San Jose – Recoletos

College of Commerce

Accountancy and Finance Department

Accounting 106: Valuation Concepts

Mr. Jun Brian Alenton, CPA, CMA, CAT, RCA, MICB

ACCOUNTING FOR DERIVATIVES AND HEDGE RELATIONSHIPS

(PFRS 9)

Part A: Accounting for Derivatives

What is a derivative?

PAS 39 defines a derivative as a financial instrument:

Whose value changes in response to the change in an underlying variable such as an interest rate,

commodity or security price, or index;

That requires no initial investment, or one that requires a smaller investment than would be required for a

contract with similar response to changes in market factors; and

That is settled at a future date.

Types of derivatives

1. Futures

Futures are exchange-traded standardized forward contracts. There are many futures exchanges, mostly

offering trading in different contracts. For each contract there are four settlement dates in each year and

futures are bought and sold for those settlement dates. Futures can be bought or sold to create a long or a

short position. The position can subsequently be closed by selling or buying the same number of contracts

for the same settlement date, at any time up to the settlement date. When a futures position is closed,

there will be either a gain or a loss on the futures trading, depending on the difference between the buying

and the selling prices.

Most futures positions are closed before the settlement date. Open positions at settlement date are settled,

either by cash settlement for difference or by delivery of the underlying item.

A feature of futures is that initial transactions are made between a buyer and seller, but the central

counterparty for the futures exchange immediately steps in, and becomes the buying counterparty for the

seller and the selling counterparty for the buyer. In this way, buyers and sellers have reduced credit risk,

because their counterparty is the exchange itself, in all cases.

The exchange protects itself from credit risk by taking payments of deposits (‘margin’) from buyers and

sellers. Additional payments have to be made if the futures price subsequently moves adversely and creates

a loss on the position.

Although futures can be used to hedge exposures to financial risk, non-bank corporates usually arrange

forward contracts rather than deal in futures.

2. Forwards

What is a forward contract?

A forward contract is a derivative contract between two parties, one of which is usually a financial

institution, to exchange a financial product or the value of an index or other benchmark at an agreed rate on

a specified future date.

Forwards are only available to companies that have a line of credit with their bank.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 1 of 9

Comparison between futures and forwards can be summarized as follows:

What are the common types of forward contracts?

Foreign exchange forward contracts

Contract that fixes an exchange rate now for buying / selling a quantity of currency (in exchange for

another currency) at a future date.

FX forward contract is a binding obligation on both parties (bank and customer).

It removes risk of adverse movements in spot rate. It also removes opportunity to benefit from

favourable movements in spot rate.

The exchange rate in a forward contact is not the expected spot rate at the settlement date for the

contract. It is derived from current interest rate differentials between the two currencies.

Interest rate forwards

A contract to pay or receive a fixed rate of interest in exchange for a variable (benchmark) rate of

interest:

On a notional short-term amount of funds.

For a stated interest period.

Starting a date in the future (typically within 12 months).

The most common form of interest rate forward contract is the forward rate agreement (FRA).

Commodity price forwards

Forward prices for commodities are driven by:

Supply and demand

Storage and spoilage issues (warehousing costs and interest income foregone on money tied

up)

When commodities are priced in a foreign currency (usually USD) fixing a forward price involves:

A forward commodity price in foreign currency and

A forward FX contract to fix the exchange rate into domestic currency.

Forward price relative to spot price

Cotango – Forward price is greater than the spot price. This is normal for non-perishable

commodities that have a cost of carry.

Backwardation – Forward price is lesser than the spot price. Occurs when spot price is

expected to fall over time; for example, perishable commodities.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 2 of 9

3. Swaps

What is a swap?

A swap is an agreement to exchange one stream of payments in exchange for another. Swaps are usually in a

form of interest rate swaps, currency swaps, or commodity swaps.

Discuss the relevance of time value of money in accounting for swaps.

A significant feature of swaps is the long term duration of the agreement – unlike forward contracts and

futures. Thus, the effect of the time value of money is significant.

Money has time value, since it can be invested to make more money. Money available at the present time is

worth more than the same amount of money available at some time in the future.

Discounting the series of swap payments enables all cash flows to be brought back to a common base (today

or t0).

What is an interest rate swap?

An interest rate swap (IRS) is an agreement between two parties to exchange cash on a notional principal

sum that is not exchanged.

In an IRS:

One party to the contract pays a fixed rate (the swap rate) on a notional amount of principal.

The other party pays a variable (benchmark) rate on the same amount of principal.

Date for exchanges of payments are agreed in the contract.

Netting of payments: one party pays the other for the difference between the fixed swap rate and

the variable benchmark rate.

4. Options

What is an option?

An option contract gives the buyer (holder) the right but not the obligation to buy (call option) or sell (put

option) an asset at an agreed price (exercise or strike price) at or before an agreed future date (expiry date).

Options can be bought over the counter or an exchange in:

Commodities

Swaptions (options on interest rate swaps)

Short-term interest rates (underlying item = notional loan)

Foreign currency

An option buyer pays a premium to the option seller (option writer).

Option seller must fulfil the contract if the option is exercised by the buyer.

An option lapses at expiry if not exercised.

European style option – can be exercised only at expiry date.

American style option – can be exercised at any time up to and including expiry date.

Below is an outline of the four basic types of options.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 3 of 9

What are the two main components of an option premium?

An option’s premium (price) has the following main components:

Intrinsic value - represents the difference between the forward price of the underlying asset and the

option’s exercise price, or strike price.

Time value - the remaining premium in excess of intrinsic value before expiration.

When can an option be considered in-the-money?

A call option is in-the-money when the forward price is higher than the strike price.

A put option is in-the-money when the forward price is less than the strike price.

How to account for derivatives?

The basic principle is that derivatives should be recorded in the statement of financial position at their fair value,

and changes in fair value should be reported through either the income statement or through a reserve account,

depending on whether there is a hedge relationship involving the derivative.

The interaction of financial instrument classification and derivatives is outlined as follows:

Define fair value.

The original definition of fair value in PAS 39 has been replaced by the definition in IFRS 13 Fair value

measurement.

'Fair value' is the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date.

Under IFRS 13, the estimated cash flows for a derivative should be discounted to present value using a discount

rate that includes a margin for credit risk.

A margin for counterpar

\ty credit risk, when the derivative has a positive value (asset).

A margin for the company's own credit risk, when the derivative has a negative value (asset): this is

because the company will be more likely than the counterparty to default in this situation.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 4 of 9

What is an embedded derivative?

An embedded derivative is a derivative that forms part of a financial instrument or contract.

The terminology for assessing the accounting treatment of an embedded derivative is summarized as follows:

Component Terminology

Derivative Embedded derivative

Non-derivative Host contract

Total Hybrid instrument

Do embedded derivatives need to be separated?

The process of identifying embedded derivatives and determining whether they need to be separated is summarized

below.

Step 1: Is the host contract fair valued?

If a host contract is already fair valued, and movements in fair value are reflected in the income statement, there

is no need to separate the embedded derivative. The value of the embedded derivative will already be reflected

in the value of the host contract.

Step 2: Is the embedded derivative really a derivative?

The next question is whether the potential embedded derivative that has been identified meets the definition of

a derivative on its own.

Step 3: Is the embedded derivative closely related to the host contract?

Finally, the embedded derivative does not need to be separated when it is closely related to the host contract.

Assessing whether it is closely related requires an analysis of the economic characteristics and risks of the host

contract to determine whether the embedded derivative changes the nature of the risks involved in the host

contract.

If an embedded derivative is not closely related to the host contract, it must be separated from the host contract

and fair valued.

How to account for embedded derivatives?

The basic rule in PAS 39 is that embedded derivatives should be separated from the ‘host’ contract and valued at fair

value, with any gains or losses from changes in fair value taken to the income statement unless the hedge

accounting rules apply.

If an entity is required to separate an embedded derivative from its host contract but is unable to measure the

embedded derivative separately (either at acquisition or at a subsequent financial reporting date), it shall treat the

entire combined contract as a financial asset or financial liability that is held for trading and record the combined

instrument at fair value through the profit and loss statement. Such an instrument will not qualify for hedge

accounting.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 5 of 9

These rules are summarized as follows:

How to value an embedded derivative at inception date?

There are specific rules on the basis of valuing embedded derivatives at inception. These depend on whether the

embedded derivative is a non-option contract or an option derivative.

An embedded non-option derivative (i.e. an embedded forward or swap) is separated from its host

contract on the basis of its stated or implied substantive terms. This results in it having a fair value of zero at

initial recognition.

An embedded option-based derivative (i.e. an embedded put, call, cap, floor or swaption) is separated from

its host contract on the basis of the stated terms of the option feature. The initial carrying amount of the

host instrument is the residual amount after the embedded derivative has been separated.

Part B: Hedge accounting

Conditions that must be met before hedge accounting will apply

To qualify as a hedge under PAS 39, the following conditions must be satisfied:

1. At inception, there must be formal designation of hedge and documentation of hedging relationship.

2. Hedge must be highly effective (ratio between 80% and 125%).

3. For a cash flow hedge, the forecast transaction that is subject of the hedge must:

Be highly probable; and

Create and exposure that could affect profit or loss.

4. It must be possible to measure the effectiveness of the reliably.

5. The hedge is assessed on an ongoing basis and determined to have been highly effective throughout the

financial reporting periods for which the hedge was designated (PAS 39.88).

For non-financial items, including purchases and sales of non-financial assets, hedging is restricted by PAS 39 to

foreign exchange risk.

Importance of accounting rules in relation to hedging

The accounting standard provides guidance on the appropriate method to be used in accounting for hedging.

The benefits of PAS 39 include the potential to:

increase the level of transparency, given that companies must clearly document the risks being hedged

and the basis for determining that the hedges are highly effective; and

create a consistent basis for measuring derivatives—all derivatives must be measured at fair value.

What qualifies as a hedge instrument?

Typically, a hedge instrument is a derivative.

A combination of two or more derivatives can be a hedging instrument, but only if neither of them is a

written (sold) option or the combined instrument is not a new written option.

A non-derivative financial instrument (such as a foreign currency loan or deposit) can only be used as a

hedge instrument when hedging FX risk.

Written (sold) options can only be used as a written option when used in an interest rate collar

arrangement.

Derivatives may be split proportionately between two hedge relationships, but not on a time basis (not for

one hedge relationship in one year, say, and another hedge relationship in the next year).

What is a hedged item?

The hedged item can be:

a recognised asset or liability - any assets or liabilities on the balance sheet—be they financial or

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 6 of 9

non-financial.

a firm commitment - a binding agreement for the exchange of a specified quantity of resources at a

specified price on a specified future date or dates.

a highly probable forecast transaction - term ‘highly probable’ indicates a much greater likelihood of

happening than the term ‘more likely than not’.

a net investment in a foreign operation - the amount of the reporting entity’s interest in the net

assets of that operation, together with loan funds provided to the foreign operation, which are not

expected to be repaid in the foreseeable future.

It is important to note that a derivative can never hedge another derivative, as a derivative is not a

permissible hedged item.

What exactly is the risk being hedge in a hedge relationship?

A financial asset or liability could be hedged for:

overall fair value risk;

a benchmark interest rate or risk-free interest rate (the impact of interest rates on the fair value of

the hedged item);

credit risk; and

foreign exchange risk.

A hedge of non-financial items is limited to:

foreign exchange risk; or

overall price/cash flow risk.

Types of hedges and their accounting treatment

A hedge can be designated as a:

Cash flow hedge

Definition

A cash flow hedge is a hedge arrangement whereby the change in cash flows of the hedging

instrument offsets the change in cash flow of the underlying hedged item. It is also a hedge of highly

probable forecast transactions including firm commitments.

Accounting treatment

For a cash flow hedge, gains or losses in the fair value of the hedging instrument are deferred in

equity (to the extent that the hedge is effective). The gain or loss is reported in ‘other

comprehensive income’ and not in profit/loss. If the derivative has gained in value, an asset is

reported in the balance sheet, a liability for a loss on a derivative. The gain/loss deferred in equity is

subsequently transferred to profit/loss to match the loss/gain on the underlying hedged item.

If a cash flow hedge is terminated, any cumulative gain or loss deferred in equity should continue to

be deferred until the underlying hedged item affects the reported profit or loss, except when the

forecast hedged transaction is now no longer expected to occur. In this situation, all the cumulative

gain or loss held in deferred equity should be transferred immediately to profit/loss.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 7 of 9

Circumstances may result in the termination of the cash flow hedge are summarized as follows:

Where a deferred loss in equity exists and an organisation expects that all or a portion of the loss

will not be recovered in future periods, it must reclassify the amount not expected to be recovered

from equity into profit and loss.

Fair value hedge

Definition

A fair value hedge is a hedge that seeks to offset the exposure to fair value changes that affect the

profit and loss.

It is considered effective if the fair value changes of the derivative offset the value changes of the

underlying hedged item.

Per PAS 39, the following items can be hedged in a fair value hedge relationship:

a recognised asset;

a recognised liability; and

a firm commitment.

Accounting treatment

For a fair value hedge, both the hedged item and the hedging instrument are valued at fair value in

the balance sheet and gains or losses on both of them are included in profit/loss. Gains or losses

from changes in the fair value of the hedging instrument should offset losses or gains in the fair

value of the underlying item.

An organisation must terminate its fair value hedge accounting if:

the hedge derivative expires, is sold, is terminated or is exercised;

the hedge no longer qualifies for hedge accounting; or

the organisation revokes the designation.

Upon termination, the previous fair value adjustments to the loan, while in the hedge relationship,

will become part of the amortized cost base of the hedged item (the loan). The interest calculation

on the hedged item will subsequently adjust to reflect the amortization of the deferred gain or loss

on an effective yield basis over the remaining life of the loan.

Net investments in a foreign operation

Definition

A hedge of the foreign currency exposure to changes in the reporting entity’s share in the net assets

of that foreign operation.

Parent companies cannot hedge forecast profits. Profits are a net outcome of different transactions

and thus do not qualify as a hedge item under PAS 39.

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 8 of 9

Accounting treatment

Hedge is in the nature of a fair value hedge, but is of a net investment in foreign operation

accounted for like a cash flow hedge.

Gains or losses on the hedging instrument are reported in other comprehensive income and taken to

a translation reserve.

Hedge effectiveness

Some understanding of tests of effectiveness for a hedge is also required. For a cash flow hedge,

effectiveness can be measured by a ‘matched terms’ comparison/test.

If the critical terms of the hedge match those of the hedged item, it can be concluded that the

hedge is effective. This can only be used for prospective tests, not retrospective tests of

effectiveness (since actual measurements of effectiveness can be made).

For a net investment hedge, tests of effectiveness may use a hypothetical derivative. This is a

derivative that would give a perfect hedge for the risk exposure. The hypothetical derivative is

compared with the actual hedging instrument used.

If the value of the actual derivative is less than the value of the hypothetical derivative, all

gains or losses on the hedging instrument can be transferred to a translation reserve.

If the value of the actual derivative is more than the value of the hypothetical derivative,

then only a proportion of the gains of losses on the actual derivative may be transferred to

equity. The rest of the gains must be reported in profit/loss. For example, if the actual

derivative has a value of 110 compared to the value of a hypothetical derivative which is

100, only 100/110 of the changes in the value of the actual derivative can be transferred to

the translation reserve.

Hedge documentation

Hedge accounting must be documented from the inception of the transaction to be hedged.

It is important to have a hedging policy that is easily understood and can be used by front,

middle and back office staff.

At the inception of every hedge, there must be formal designation and documentation of

the hedge, with a specification of the objective for undertaking the hedge.

Foreign currency transactions

Under the rules of PAS 21, when a company has a foreign subsidiary the assets and liabilities of the

subsidiary should be translated at the closing rate and income/expenses should be translated at the

actual or average rate for the year. All resulting gains or losses are reported as other comprehensive

income and transferred directly to equity (and not reported in profit/loss).

If the company has taken out a foreign currency loan as a hedge against its foreign currency net

investment, in the absence of hedge accounting gains or losses on the loan would be reported in

profit/loss.

The accounting treatment for the three types of hedges can be summarized as follows:

ACCTG 106 PFRS 9: DERIVATIVES AND HEDGING Page 9 of 9

You might also like

- M5 Mock Exam 1Document22 pagesM5 Mock Exam 1Eveleen Gan100% (4)

- DSC1603 2023 S2 Discussion Class 5Document24 pagesDSC1603 2023 S2 Discussion Class 5Mary MondliwaNo ratings yet

- Your Electricity Spring Electricity Statement: What's My Balance?Document1 pageYour Electricity Spring Electricity Statement: What's My Balance?Maxi KiMNo ratings yet

- Creating Your Financial GenogramDocument2 pagesCreating Your Financial Genogramdininja100% (1)

- Biological Assets: SAMPLE PROBLEMS With AnswersDocument1 pageBiological Assets: SAMPLE PROBLEMS With AnswersMary Yvonne AresNo ratings yet

- DerivativesDocument18 pagesDerivativesJay Lord FlorescaNo ratings yet

- Basic Financial Derivatives Forwards: in Finance, A Forward Contract or Simply A Forward Is A Derivative ContractDocument3 pagesBasic Financial Derivatives Forwards: in Finance, A Forward Contract or Simply A Forward Is A Derivative Contractsid1982No ratings yet

- Derivatives Note SeminarDocument7 pagesDerivatives Note SeminarCA Vikas NevatiaNo ratings yet

- Differences Between Forward and FutureDocument3 pagesDifferences Between Forward and Futureanish-kc-8151No ratings yet

- Chapter 24 FIM: DerivativesDocument15 pagesChapter 24 FIM: DerivativesrdtdtdrtdtrNo ratings yet

- Futures Contract FinalDocument6 pagesFutures Contract FinalSundus KhalidNo ratings yet

- Common Derivative ContractDocument7 pagesCommon Derivative ContractMd. Saiful IslamNo ratings yet

- Hedging Process Step by Step Guide PDFDocument10 pagesHedging Process Step by Step Guide PDFAbhijeet JacksonNo ratings yet

- WLH Finance CompilationDocument58 pagesWLH Finance CompilationSandhya S 17240No ratings yet

- Basics of DeivativesDocument9 pagesBasics of DeivativesGaurav ThigaleNo ratings yet

- Derivatives and Its Instruments: Prepared By: Nitin Kori-Roll No. 16 Khyati Mistry - Roll No. 20Document20 pagesDerivatives and Its Instruments: Prepared By: Nitin Kori-Roll No. 16 Khyati Mistry - Roll No. 20Khyati MistryNo ratings yet

- MortgageDocument4 pagesMortgageNuman NaeemNo ratings yet

- Cfa Derivados-Word: DeliveryDocument5 pagesCfa Derivados-Word: DeliverySebastian Ramirez MoranNo ratings yet

- Introduction To The Basic Concept of Derivatives: Over-The-Counter Market Mean?Document6 pagesIntroduction To The Basic Concept of Derivatives: Over-The-Counter Market Mean?Aman NegiNo ratings yet

- Credit Risk Management M.Numan Naeem BBA (Hons) 8 (Evening, B Section)Document6 pagesCredit Risk Management M.Numan Naeem BBA (Hons) 8 (Evening, B Section)Numan NaeemNo ratings yet

- ContractsDocument3 pagesContractsrohitpatel13No ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- Forward Contract Vs Futures ContractDocument4 pagesForward Contract Vs Futures ContractabdulwadoodansariNo ratings yet

- Derivatives and RMDocument35 pagesDerivatives and RMMichael WardNo ratings yet

- Gist Of Financial TermsDocument17 pagesGist Of Financial TermsSagar JadhavNo ratings yet

- Derivatives: Cash Flows Securities AssetsDocument63 pagesDerivatives: Cash Flows Securities AssetsAaron RosalesNo ratings yet

- Forward Contract Future ContractDocument10 pagesForward Contract Future ContractSanjai SivañanthamNo ratings yet

- What Does Derivative Mean?Document23 pagesWhat Does Derivative Mean?shrikantyemulNo ratings yet

- Derivative Markets and Instruments: Criticisms of DerivativesDocument10 pagesDerivative Markets and Instruments: Criticisms of DerivativesMayura KatariaNo ratings yet

- Derivatives SummaryDocument2 pagesDerivatives SummaryNurul AisyahNo ratings yet

- Financial DerivativesDocument31 pagesFinancial DerivativesSyed Roshan JavedNo ratings yet

- Off-Balance Sheet - Risk ManagementDocument18 pagesOff-Balance Sheet - Risk ManagementjoanabudNo ratings yet

- Chapter 4 Derivatives and Hedging TransactionsDocument6 pagesChapter 4 Derivatives and Hedging TransactionsOly VieenaNo ratings yet

- Derivatives PPTDocument29 pagesDerivatives PPTSangeeta SinghNo ratings yet

- Module 001 Accounting For Liabilities-Current Part 4Document5 pagesModule 001 Accounting For Liabilities-Current Part 4Gab BautroNo ratings yet

- Currency Derivatives: Forward Rate Spot Rate Spot Rate X N (Number of Day Maturity)Document2 pagesCurrency Derivatives: Forward Rate Spot Rate Spot Rate X N (Number of Day Maturity)afniNo ratings yet

- Chapter VI DerivativesDocument36 pagesChapter VI Derivativesmulutsega yacobNo ratings yet

- Mortgage Markets and Derivatives - AnswerDocument3 pagesMortgage Markets and Derivatives - AnswerSarang SNo ratings yet

- Derivatives SIGFi Finance HandbookDocument8 pagesDerivatives SIGFi Finance HandbookSneha TatiNo ratings yet

- Derivatives Concepts: What Is A Derivative?Document5 pagesDerivatives Concepts: What Is A Derivative?Fatma AbdelRehiemNo ratings yet

- TypesofswapDocument5 pagesTypesofswapshweta jaiswalNo ratings yet

- Interest Rate DerivativesDocument3 pagesInterest Rate Derivativesnits_rocks1987No ratings yet

- L2 - MS International Finance 2023 - DerivativeDocument18 pagesL2 - MS International Finance 2023 - DerivativeAli HasanovNo ratings yet

- Derivatives: Prof Mahesh Kumar Amity Business SchoolDocument56 pagesDerivatives: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- DerivativesDocument5 pagesDerivativesibong tiriritNo ratings yet

- CFA DerivativesTutorialAKBDocument57 pagesCFA DerivativesTutorialAKBsunboy moyoNo ratings yet

- Derivatives and Risk ManagementDocument4 pagesDerivatives and Risk ManagementbhumishahNo ratings yet

- DerivativesDocument8 pagesDerivativesMirzaMohtashimNo ratings yet

- Risk MGMT (Module-II - Chapter 1 & 2)Document10 pagesRisk MGMT (Module-II - Chapter 1 & 2)Kelvin SavaliyaNo ratings yet

- Chapter 11 Derivatives Hedging - ReportingDocument9 pagesChapter 11 Derivatives Hedging - ReportingEricka AlimNo ratings yet

- Financial DerivativesDocument12 pagesFinancial DerivativesNony BahgatNo ratings yet

- What Is A Derivative?Document65 pagesWhat Is A Derivative?devNo ratings yet

- Derivatives and Risk Management PDFDocument7 pagesDerivatives and Risk Management PDFYogesh GovindNo ratings yet

- Futures Contracts:: What Is A Derivative?Document6 pagesFutures Contracts:: What Is A Derivative?Marcel KouekeuNo ratings yet

- Project Report On Future, Option & SwapsDocument12 pagesProject Report On Future, Option & SwapsSiddharth RaiNo ratings yet

- Interest Rate Derivatives Credit Default Swaps Currency DerivativesDocument30 pagesInterest Rate Derivatives Credit Default Swaps Currency DerivativesAtul JainNo ratings yet

- Investment Analysis Farhan Javed M14MBA031Document76 pagesInvestment Analysis Farhan Javed M14MBA031Muhammad UsmanNo ratings yet

- What Is A "Derivative" ?Document4 pagesWhat Is A "Derivative" ?RAHULNo ratings yet

- SwapDocument3 pagesSwapJohana ReyesNo ratings yet

- Derivatives and Risk Management (2017)Document10 pagesDerivatives and Risk Management (2017)ashok kumar vermaNo ratings yet

- Derivatives 120821000932 Phpapp02Document54 pagesDerivatives 120821000932 Phpapp02Choco ChocoNo ratings yet

- What Are Futures and ForwardsDocument22 pagesWhat Are Futures and ForwardsMuneeza AzharNo ratings yet

- Unit IiDocument31 pagesUnit IiMister MarlegaNo ratings yet

- Chapter 6Document6 pagesChapter 6Millen AustriaNo ratings yet

- Secrecy of Bank DepositsDocument10 pagesSecrecy of Bank DepositsMary Yvonne AresNo ratings yet

- Ancient Era Compass: Historical AntecedentsDocument2 pagesAncient Era Compass: Historical AntecedentsMary Yvonne AresNo ratings yet

- Drill Sales 2Document2 pagesDrill Sales 2Mary Yvonne AresNo ratings yet

- Del Monte v. AragonesDocument7 pagesDel Monte v. AragonesMary Yvonne AresNo ratings yet

- IAT 2020 Final Preboard (Source SimEx4 RS)Document15 pagesIAT 2020 Final Preboard (Source SimEx4 RS)Mary Yvonne AresNo ratings yet

- Cultural DifferenceDocument3 pagesCultural DifferenceMary Yvonne AresNo ratings yet

- Rosa Lim v. CADocument4 pagesRosa Lim v. CAMary Yvonne AresNo ratings yet

- Commissioner of Internal Revenue Vs - ConstantinoDocument3 pagesCommissioner of Internal Revenue Vs - ConstantinoMary Yvonne AresNo ratings yet

- Communication ModelsDocument3 pagesCommunication ModelsMary Yvonne AresNo ratings yet

- Sample Problems - DerivativesDocument4 pagesSample Problems - DerivativesMary Yvonne AresNo ratings yet

- Lesson 6 Elements and Principles of ArtDocument16 pagesLesson 6 Elements and Principles of ArtMary Yvonne AresNo ratings yet

- Bond Valuation: Reference: Financial Management Fundamentals by E. Brigham, 12 Edition (Chapter 10)Document3 pagesBond Valuation: Reference: Financial Management Fundamentals by E. Brigham, 12 Edition (Chapter 10)Mary Yvonne AresNo ratings yet

- PFRS 13 - Fair Value MeasurementDocument7 pagesPFRS 13 - Fair Value MeasurementMary Yvonne AresNo ratings yet

- Assignment 2 - Stock ValuationDocument1 pageAssignment 2 - Stock ValuationMary Yvonne AresNo ratings yet

- Quiz - Financial Statements With SolutionDocument6 pagesQuiz - Financial Statements With SolutionMary Yvonne AresNo ratings yet

- Supplemental Notes - IAS 34Document40 pagesSupplemental Notes - IAS 34Mary Yvonne AresNo ratings yet

- Topic 5 - Single-Entry MethodDocument49 pagesTopic 5 - Single-Entry MethodMary Yvonne AresNo ratings yet

- Stock ValuationDocument4 pagesStock ValuationMary Yvonne AresNo ratings yet

- Sample Problems MCQDocument3 pagesSample Problems MCQMary Yvonne AresNo ratings yet

- Introduction To Operations Management: - Objectives of LectureDocument15 pagesIntroduction To Operations Management: - Objectives of LectureMary Yvonne AresNo ratings yet

- Accounting CycleDocument9 pagesAccounting Cyclerakshit konchadaNo ratings yet

- Quiz Questions and AnswersDocument61 pagesQuiz Questions and AnswersMarvin AndresNo ratings yet

- Elements of Book-Keeping and Accountancy (Code No. 254) CLASS-IX (2021-22)Document4 pagesElements of Book-Keeping and Accountancy (Code No. 254) CLASS-IX (2021-22)Mandowara MadhavNo ratings yet

- Income TaxDocument15 pagesIncome TaxZayed Mohammad JohnyNo ratings yet

- NRE Lecture 1Document8 pagesNRE Lecture 1yaregalNo ratings yet

- Ft2020czech RepublicDocument11 pagesFt2020czech RepublicvisegaNo ratings yet

- Bachelor of Commerce: Bcoc - 137: Corporate AccountingDocument23 pagesBachelor of Commerce: Bcoc - 137: Corporate Accountingsubhaa DasNo ratings yet

- AE 18 ReportDocument2 pagesAE 18 ReportMycka Joy HernandezNo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Chapter 25 - AnswerDocument10 pagesChapter 25 - AnswerReanne Claudine Laguna71% (7)

- By Rajesh NarayananDocument22 pagesBy Rajesh NarayananTusharNo ratings yet

- Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CityDocument70 pagesComprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CitySampath DontaNo ratings yet

- 03 Literature ReviewDocument13 pages03 Literature ReviewAmitesh KumarNo ratings yet

- Way2wealth Org Study Report 8 Nov 2022Document65 pagesWay2wealth Org Study Report 8 Nov 2022Manu DvNo ratings yet

- Jawaban Sesi 1 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 1 Ujikom Pt. BoombasstikNada NadyaNo ratings yet

- Financial and Monetary Policies in Ghana: A Review of Recent TrendsDocument11 pagesFinancial and Monetary Policies in Ghana: A Review of Recent TrendsrytchluvNo ratings yet

- ATMDocument38 pagesATMseid negashNo ratings yet

- Abdul Sattar 2018Document48 pagesAbdul Sattar 2018ABDUL sattarNo ratings yet

- Branch Banking Vs Unit BankingDocument7 pagesBranch Banking Vs Unit BankingBoruah SwapnaNo ratings yet

- Acct Statement - XX6955 - 13072023Document9 pagesAcct Statement - XX6955 - 13072023iblfinserv0No ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- The Privatized Dramaturgy of Capitalist Civil SocietyDocument12 pagesThe Privatized Dramaturgy of Capitalist Civil SocietyÁlvaro MoyaNo ratings yet

- Words GigiDocument102 pagesWords GigiNguyen Ha QuanNo ratings yet

- Target 3 Stock and DividendDocument5 pagesTarget 3 Stock and DividendAjeet YadavNo ratings yet

- Dalio Ebook FINAL PDFDocument48 pagesDalio Ebook FINAL PDFvuhieptran100% (1)

- Basic Financial StatementsDocument44 pagesBasic Financial Statementsfikru terfaNo ratings yet