Professional Documents

Culture Documents

Guide To Debit and Credits (Accounting)

Guide To Debit and Credits (Accounting)

Uploaded by

Fersaudy AlibbunCopyright:

Available Formats

You might also like

- Acc BasicsDocument7 pagesAcc BasicsAung TikeNo ratings yet

- Numerical Reasoning Test Practice Exercise: (Level One)Document15 pagesNumerical Reasoning Test Practice Exercise: (Level One)Fersaudy AlibbunNo ratings yet

- Introduction To Debits and CreditsDocument12 pagesIntroduction To Debits and CreditskjvillNo ratings yet

- Chapter 3 Receivables Exercises T1AY2021Document6 pagesChapter 3 Receivables Exercises T1AY2021Cale Robert RascoNo ratings yet

- Central Banking and Monetary Policy PDFDocument43 pagesCentral Banking and Monetary Policy PDFWindyee TanNo ratings yet

- Debits and CreditsDocument17 pagesDebits and Creditsfahadkhanmughal8No ratings yet

- Basic AccountingDocument23 pagesBasic AccountingEthan Manuel CarriedoNo ratings yet

- Charts of Accounts (Accounting)Document1 pageCharts of Accounts (Accounting)Fersaudy AlibbunNo ratings yet

- Debits and CreditsDocument6 pagesDebits and CreditsmelisaNo ratings yet

- What Is Accounting?: Menyajikan Data, Mencatat Transaksi Apapun Yang Berhubungan Dengan Keuangan SehinggaDocument36 pagesWhat Is Accounting?: Menyajikan Data, Mencatat Transaksi Apapun Yang Berhubungan Dengan Keuangan SehinggawilliamNo ratings yet

- Ebook Bookkeeping Accounting Basics PDFDocument30 pagesEbook Bookkeeping Accounting Basics PDFRohit Kumar MohantyNo ratings yet

- Accounting Made Simple - Accounting Explained in 100 Pages or Less (PDFDrive)Document119 pagesAccounting Made Simple - Accounting Explained in 100 Pages or Less (PDFDrive)HOANG HA100% (2)

- What Is A Loan ReceivableDocument2 pagesWhat Is A Loan ReceivableArt B. EnriquezNo ratings yet

- Debits and CreditsDocument14 pagesDebits and CreditsLyca SorianoNo ratings yet

- Accounting BasicsDocument13 pagesAccounting BasicsJerusa May CabinganNo ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- The Balance SheetDocument14 pagesThe Balance SheetHeherson CustodioNo ratings yet

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)From EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)No ratings yet

- TDocument6 pagesTAgatha GomezNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Double Entry SystemDocument17 pagesDouble Entry Systemhansali diasNo ratings yet

- Learn Acc 7 DaysDocument181 pagesLearn Acc 7 DaysAffaaf TVNo ratings yet

- Basic Accounting TermsDocument3 pagesBasic Accounting TermsAllyza VillapandoNo ratings yet

- 2 Rules of Debit and CreditDocument3 pages2 Rules of Debit and Creditapi-2992659160% (1)

- JKWCPA Accounting 101 For Small Businesses EGuideDocument13 pagesJKWCPA Accounting 101 For Small Businesses EGuideAlthaf CassimNo ratings yet

- Accounting - Basic Accounting: General LedgerDocument10 pagesAccounting - Basic Accounting: General LedgerEstelarisNo ratings yet

- Debits and Credits: (Cheat Sheet)Document9 pagesDebits and Credits: (Cheat Sheet)Sasha JaffeNo ratings yet

- 5 Types of AccountsDocument9 pages5 Types of Accountsvignesh RNo ratings yet

- Debit and Credit Rules of AccountingDocument6 pagesDebit and Credit Rules of AccountingsbcluincNo ratings yet

- Introduction To AccountsDocument35 pagesIntroduction To Accountswiq001No ratings yet

- Futurpreneur - Ebook - Mentees-June21Document15 pagesFuturpreneur - Ebook - Mentees-June21Jawid WeesaaNo ratings yet

- 01 - Basic ConceptsDocument20 pages01 - Basic ConceptsSyed Mudussir HusainNo ratings yet

- Cash Conversion CycleDocument7 pagesCash Conversion Cyclebarakkat72No ratings yet

- The Entrepreneur S Guide To Small Business FinanceDocument34 pagesThe Entrepreneur S Guide To Small Business FinanceAbdelhay Alm100% (1)

- 7 Adjusting Entry For Bad Debts ExpenseDocument2 pages7 Adjusting Entry For Bad Debts Expenseapi-299265916No ratings yet

- Assets Owners Equity + Liabilities: The Whole of Accounting Is Based On One Single EquationDocument16 pagesAssets Owners Equity + Liabilities: The Whole of Accounting Is Based On One Single Equationfennie ilinah molinaNo ratings yet

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- Bank Reconciliation Quiz - Accounting CoachDocument3 pagesBank Reconciliation Quiz - Accounting CoachSudip Bhattacharya100% (1)

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument11 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income Statementpri_dulkar4679No ratings yet

- Accounting LedgerDocument5 pagesAccounting LedgerlekalonzoNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Understanding Accounting Basics (ALOE and Balance Sheets) : So What's Accounting About, Anyway?Document6 pagesUnderstanding Accounting Basics (ALOE and Balance Sheets) : So What's Accounting About, Anyway?Arcelli Dela CruzNo ratings yet

- $FFRXQWLQJ%DVLFV: Accountedge Accountedge Plus Accountedge Plus Network EditionDocument21 pages$FFRXQWLQJ%DVLFV: Accountedge Accountedge Plus Accountedge Plus Network EditionCarl Vincent BarituaNo ratings yet

- The Role That Bank Accounts Play in An Enterprise LifeDocument3 pagesThe Role That Bank Accounts Play in An Enterprise LifeMary Joy Villaflor HepanaNo ratings yet

- Build a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82From EverandBuild a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82No ratings yet

- Basic Accounting Terminology 101Document2 pagesBasic Accounting Terminology 101Kamal UddinNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Modern Treasury - Accounting For Developers Parts I-IIIDocument32 pagesModern Treasury - Accounting For Developers Parts I-IIIfelipeap92No ratings yet

- Super Sample Accounting Transactions: Must Equal The Total Amount of The CreditDocument3 pagesSuper Sample Accounting Transactions: Must Equal The Total Amount of The CreditjpgamasNo ratings yet

- Financial Words You Should Know: Over 1,000 Essential Investment, Accounting, Real Estate, and Tax WordsFrom EverandFinancial Words You Should Know: Over 1,000 Essential Investment, Accounting, Real Estate, and Tax WordsRating: 4 out of 5 stars4/5 (12)

- 5 Major AccountsDocument4 pages5 Major AccountsKayelle BelinoNo ratings yet

- Radical AccountingDocument13 pagesRadical AccountingHost_PaulNo ratings yet

- Introduction To Debits and CreditsDocument16 pagesIntroduction To Debits and CreditsMeiRose100% (1)

- 2 Debits and CreditsDocument16 pages2 Debits and Creditswannisa maheswari100% (1)

- Common Mistakes in AccountingDocument9 pagesCommon Mistakes in AccountingPrabir Kumer RoyNo ratings yet

- Accounting Basics: Accountedge Accountedge Plus Accountedge Plus Network EditionDocument21 pagesAccounting Basics: Accountedge Accountedge Plus Accountedge Plus Network EditionIsramanNo ratings yet

- Accounting - Group 2Document30 pagesAccounting - Group 2Angeline EsguerraNo ratings yet

- Reconcilling AccountsDocument8 pagesReconcilling AccountsMaimai DuranoNo ratings yet

- Accounting 101 8 Steps To Set Your Business Up For Sucess by BenchDocument16 pagesAccounting 101 8 Steps To Set Your Business Up For Sucess by BenchDr-Mohammed FaridNo ratings yet

- Food and NutritionDocument8 pagesFood and NutritionFersaudy AlibbunNo ratings yet

- Powerpoint in Problem Solving in Mathematics (MMW)Document25 pagesPowerpoint in Problem Solving in Mathematics (MMW)Fersaudy Alibbun100% (1)

- Charts of Accounts (Accounting)Document1 pageCharts of Accounts (Accounting)Fersaudy AlibbunNo ratings yet

- Numerical Reasoning Formula Sheet: ContentsDocument9 pagesNumerical Reasoning Formula Sheet: ContentsFersaudy AlibbunNo ratings yet

- Services of Askari BankDocument3 pagesServices of Askari BankAdeel KhanNo ratings yet

- 10 Ways To Deal With Car Salesmen Successfully... !!!Document4 pages10 Ways To Deal With Car Salesmen Successfully... !!!a rahNo ratings yet

- Review of Operational Shipyards in Serbia: M.C.I. Shipyard, Novi BecejDocument3 pagesReview of Operational Shipyards in Serbia: M.C.I. Shipyard, Novi BecejDarko GrobarNo ratings yet

- Resume Albert H Manwaring VDocument1 pageResume Albert H Manwaring VKaarthik MandhulaNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Financial Appraisal Chapter 3Document36 pagesFinancial Appraisal Chapter 3mahlet tesfayeNo ratings yet

- Lecture 05 - Capital BudgetingDocument141 pagesLecture 05 - Capital BudgetingSagorNo ratings yet

- Process FlowsDocument76 pagesProcess FlowsRaj KumarNo ratings yet

- Exercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Document2 pagesExercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Gede Tristan Desirata RamaNo ratings yet

- Derivatives - Futures and ForwardsDocument56 pagesDerivatives - Futures and ForwardsSriram VasudevanNo ratings yet

- Upper Tamakoshi Hydropower ProjectDocument5 pagesUpper Tamakoshi Hydropower ProjectShreya ChitrakarNo ratings yet

- International Equity MarketDocument14 pagesInternational Equity MarketGirlie BalingbingNo ratings yet

- Basic Economic Study MethodsDocument53 pagesBasic Economic Study MethodsDrix ReyesNo ratings yet

- Chap 23Document12 pagesChap 23Sakshi GuptaNo ratings yet

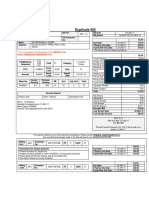

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallNarendra VermaNo ratings yet

- FDFGDocument3 pagesFDFGHemanth DevaiahNo ratings yet

- ST Harry PDFDocument10 pagesST Harry PDFharjinder singhNo ratings yet

- Multi FactorDocument22 pagesMulti FactorAnanda Rea KasanaNo ratings yet

- Module. Partnership AccountingDocument45 pagesModule. Partnership AccountingRonalie Alindugan100% (4)

- Fresh Schedule 2021Document268 pagesFresh Schedule 2021bagas waraNo ratings yet

- Chapter 3 Current LiabilitiesDocument21 pagesChapter 3 Current LiabilitiesEzy playboy100% (2)

- Table 1 - Recommended Etfs: Financial Products ResearchDocument3 pagesTable 1 - Recommended Etfs: Financial Products ResearchBobNo ratings yet

- 06 Cafmst14 - CH - 04Document35 pages06 Cafmst14 - CH - 04Mahabub AlamNo ratings yet

- CDS Presentation With ReferencesDocument42 pagesCDS Presentation With ReferencesJohn ReedNo ratings yet

- #13 Convertible NotesDocument1 page#13 Convertible NotesSeth RogersNo ratings yet

- CFA Level 1 - 2020 Curriculum Changes (300hours)Document1 pageCFA Level 1 - 2020 Curriculum Changes (300hours)priyanka kumariNo ratings yet

- Account StatementDocument12 pagesAccount StatementManick SantraNo ratings yet

- Local Media4930298822971004354Document17 pagesLocal Media4930298822971004354Haks MashtiNo ratings yet

Guide To Debit and Credits (Accounting)

Guide To Debit and Credits (Accounting)

Uploaded by

Fersaudy AlibbunOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide To Debit and Credits (Accounting)

Guide To Debit and Credits (Accounting)

Uploaded by

Fersaudy AlibbunCopyright:

Available Formats

!"#$%&'()*'+,"*$%&-'.

'

/$012"3'4$&5(2'65$*"

By Nick Zarzycki on January 24, 2019

Contents

What are debits and credits?

Debits and credits in action

How debits and credits affect liability

accounts

How debits and credits affect equity

accounts

Debits and credits chart

Tired of doing your own books?

Try Bench.

If there’s one piece of accounting jargon

that trips people up the most, it’s “debits

and credits.”

What exactly does it mean to “debit” and

“credit” an account? Why is it that debiting

some accounts makes them go up, but

debiting other accounts makes them go

down? And why is any of this important for

your business?

Here’s everything you need to know.

What are debits and credits?

In a nutshell: debits (dr) record all of the

money flowing into an account, while

credits (cr) record all of the money flowing

out of an account.

What does that mean?

Most businesses these days use the

double-entry method for their accounting.

Under this system, your entire business is

organized into individual accounts. Think

of these as individual buckets full of money

representing each aspect of your company.

For example:

One bucket might represent all of the

cash you have in your business bank

account (the “cash” bucket)

Another bucket might represent the

total value of all the furniture your

business has in its office (the

“furniture” bucket)

Another bucket might represent a

bank loan you recently took out (the

“bank loan” bucket)

When your business does anything—buy

furniture, take out a loan, spend money on

research and development—the amount of

money in the buckets changes.

Recording what happens to each of these

buckets using full English sentences would

be tedious, so we need a shorthand. That’s

where debits and credits come in.

When money flows into a bucket, we

record that as a debit (sometimes

accountants will abbreviate this to just

“dr.”)

For example, if you deposited $300 in cash

into your business bank account:

An accountant would say we are “debiting”

the cash bucket by $300, and would enter

the following line into your accounting

system:

Account Debit Credit

Cash $300

When money flows out of a bucket, we

record that as a credit (sometimes

accountants will abbreviate this to just

“cr.”)

For example, if you withdrew $600 in cash

from your business bank account:

An accountant would say you are

“crediting” the cash bucket by $600 and

write down the following:

Account Debit Credit

Cash $600

Meet Kaitlyn.

Your new bookkeeper.

Start a free trial with Bench. We’ll take

bookkeeping off your hands, pairing you with a

real, human bookkeeper—like Kaitlyn—at a price

you can afford. We’ll even get your taxes filed for

you.

Learn More

Debits and credits in action

There’s one thing missing from the

examples above. Money doesn’t just

disappear or appear out of nowhere. It has

to come from somewhere, and go

somewhere.

That’s what credits and debits let you see:

where your money is going, and where it’s

coming from.

Let’s say that one day, you visit your

friend’s startup. After taking a tour of the

office, your friend shows you a beautiful

ergonomic standing desk. You’ve been

looking for this model for months, but all

the furniture stores are sold out. Your friend

ordered an extra one, and she can sell it to

you for cheap. You agree to buy it from her

for $600.

Here’s what that would look like using our

bucket system. First, we move $600 out of

your cash bucket.

Just like in the above section, we credit

your cash account, because money is

flowing out of it.

But this isn’t the only bucket that changes.

Your “furniture” bucket, which represents

the total value of all the furniture your

company owns, also changes.

In this case, it increases by $600 (the value

of the chair).

You debit your furniture account, because

value is flowing into it (a desk).

In double-entry accounting, every debit

(inflow) always has a corresponding credit

(outflow). So we record them together in

one entry.

In this case, the entry would be:

Account Debit Credit

Furniture $600

Cash $600

An accountant would say that we are

crediting the bank account $600 and

debiting the furniture account $600.

How debits and credits

affect liability accounts

The two buckets we used in the above

example—cash and furniture—are both

asset buckets. (That is, they keep track of

something you own.)

But not all buckets are asset buckets. Some

buckets keep track of what you owe

(liabilities), and other buckets keep track of

the total value of your business (equity).

Let’s imagine that after buying that

expensive desk, you want to get some extra

cash for your business. So you take out a

$1,000 bank loan, and you increase (debit)

your cash account by $1,000.

Now here’s the tricky part.

In addition to adding $1,000 to your cash

bucket, we would also have to increase

your “bank loan” bucket by $1,000.

Why? Because your “bank loan bucket”

measures not how much you have, but how

much you owe. The more you owe, the

larger the value in the bank loan bucket is

going to be.

In this case, we’re crediting a bucket, but

the value of the bucket is increasing. That’s

because the bucket keeps track of a debt,

and the debt is going up in this case.

An accountant would record that the

following way:

Account Debit Credit

Cash $1,000

Bank Loan $1,000

How debits and credits

affect equity accounts

Let’s do one more example, this time

involving an equity account.

Let’s say your mom invests $1,000 of her

own cash into your company. Using our

bucket system, your transaction would look

like the following.

First, your cash account would go up by

$1,000, because you now have $1,000 more

from mom.

But that’s not the only bucket that changes.

You mom now has a $1,000 equity stake in

your business—so the bucket labelled

“equity (Mom)” also increases by $1,000:

An accountant would record that the

following way:

Account Debit Credit

Cash $1,000

Equity (Mom) $1,000

Why is it that crediting an equity account

makes it go up, rather than down? That’s

because equity accounts don’t measure

how much your business has. Rather, they

measure all of the claims that investors

have against your business.

The Equity (Mom) bucket keeps track of

your Mom’s claims against your business.

That’s her equity, not your business’s. In

this case, those claims have increased,

which means the number inside the bucket

increases.

Meet Kaitlyn.

Your new bookkeeper.

Start a free trial with Bench. We’ll take

bookkeeping off your hands, pairing you with a

real, human bookkeeper—like Kaitlyn—at a price

you can afford. We’ll even get your taxes filed for

you.

Learn More

Debits and credits chart

Most people will use a list of accounts so

they know how to record debits and credits

properly.

A cheat sheet like this is an easy way to

remember debits and credits in accounting:

Debit Credit

Increases an asset Decreases an asset

account account

Increases an expense Decreases an expense

account account

Decreases a liability Increases a liability

account account

Decreases an equity Increases an equity

account account

Decreases revenue Increases revenue

Always recorded on the Always recorded on the

left right

And if that’s too much to remember, just

remember the words of accountant Charles

E. Sprague:

“Debit all that comes in and credit all that

goes out.”

This post is to be used for informational purposes only

and does not constitute legal, business, or tax advice.

Each person should consult his or her own attorney,

business advisor, or tax advisor with respect to matters

referenced in this post. Bench assumes no liability for

actions taken in reliance upon the information

contained herein.

Friends don’t let friends do their own bookkeeping.

Share this article.

Want a free month of

bookkeeping?

Sign up for a trial of Bench. We’ll do one month

of your bookkeeping and prepare a set of

financial statements for you to keep. No

pressure, no credit card required.

Get Started

COMPANY PRODUCT

About Us How It Works

Careers Pricing

Press Security

RESOURCES PARTNERS

Education Partner Programs

Tools & Guides Refer A Friend

FAQ Bench For Accountants

Customer Reviews Partner Marketplace

1 (888) 760 1940 help@bench.co

© Bench 2011-2021

Terms of Service

Privacy Policy

Terms of Use

Cookie Policy

Security Practices

You might also like

- Acc BasicsDocument7 pagesAcc BasicsAung TikeNo ratings yet

- Numerical Reasoning Test Practice Exercise: (Level One)Document15 pagesNumerical Reasoning Test Practice Exercise: (Level One)Fersaudy AlibbunNo ratings yet

- Introduction To Debits and CreditsDocument12 pagesIntroduction To Debits and CreditskjvillNo ratings yet

- Chapter 3 Receivables Exercises T1AY2021Document6 pagesChapter 3 Receivables Exercises T1AY2021Cale Robert RascoNo ratings yet

- Central Banking and Monetary Policy PDFDocument43 pagesCentral Banking and Monetary Policy PDFWindyee TanNo ratings yet

- Debits and CreditsDocument17 pagesDebits and Creditsfahadkhanmughal8No ratings yet

- Basic AccountingDocument23 pagesBasic AccountingEthan Manuel CarriedoNo ratings yet

- Charts of Accounts (Accounting)Document1 pageCharts of Accounts (Accounting)Fersaudy AlibbunNo ratings yet

- Debits and CreditsDocument6 pagesDebits and CreditsmelisaNo ratings yet

- What Is Accounting?: Menyajikan Data, Mencatat Transaksi Apapun Yang Berhubungan Dengan Keuangan SehinggaDocument36 pagesWhat Is Accounting?: Menyajikan Data, Mencatat Transaksi Apapun Yang Berhubungan Dengan Keuangan SehinggawilliamNo ratings yet

- Ebook Bookkeeping Accounting Basics PDFDocument30 pagesEbook Bookkeeping Accounting Basics PDFRohit Kumar MohantyNo ratings yet

- Accounting Made Simple - Accounting Explained in 100 Pages or Less (PDFDrive)Document119 pagesAccounting Made Simple - Accounting Explained in 100 Pages or Less (PDFDrive)HOANG HA100% (2)

- What Is A Loan ReceivableDocument2 pagesWhat Is A Loan ReceivableArt B. EnriquezNo ratings yet

- Debits and CreditsDocument14 pagesDebits and CreditsLyca SorianoNo ratings yet

- Accounting BasicsDocument13 pagesAccounting BasicsJerusa May CabinganNo ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- The Balance SheetDocument14 pagesThe Balance SheetHeherson CustodioNo ratings yet

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)From EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)No ratings yet

- TDocument6 pagesTAgatha GomezNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Double Entry SystemDocument17 pagesDouble Entry Systemhansali diasNo ratings yet

- Learn Acc 7 DaysDocument181 pagesLearn Acc 7 DaysAffaaf TVNo ratings yet

- Basic Accounting TermsDocument3 pagesBasic Accounting TermsAllyza VillapandoNo ratings yet

- 2 Rules of Debit and CreditDocument3 pages2 Rules of Debit and Creditapi-2992659160% (1)

- JKWCPA Accounting 101 For Small Businesses EGuideDocument13 pagesJKWCPA Accounting 101 For Small Businesses EGuideAlthaf CassimNo ratings yet

- Accounting - Basic Accounting: General LedgerDocument10 pagesAccounting - Basic Accounting: General LedgerEstelarisNo ratings yet

- Debits and Credits: (Cheat Sheet)Document9 pagesDebits and Credits: (Cheat Sheet)Sasha JaffeNo ratings yet

- 5 Types of AccountsDocument9 pages5 Types of Accountsvignesh RNo ratings yet

- Debit and Credit Rules of AccountingDocument6 pagesDebit and Credit Rules of AccountingsbcluincNo ratings yet

- Introduction To AccountsDocument35 pagesIntroduction To Accountswiq001No ratings yet

- Futurpreneur - Ebook - Mentees-June21Document15 pagesFuturpreneur - Ebook - Mentees-June21Jawid WeesaaNo ratings yet

- 01 - Basic ConceptsDocument20 pages01 - Basic ConceptsSyed Mudussir HusainNo ratings yet

- Cash Conversion CycleDocument7 pagesCash Conversion Cyclebarakkat72No ratings yet

- The Entrepreneur S Guide To Small Business FinanceDocument34 pagesThe Entrepreneur S Guide To Small Business FinanceAbdelhay Alm100% (1)

- 7 Adjusting Entry For Bad Debts ExpenseDocument2 pages7 Adjusting Entry For Bad Debts Expenseapi-299265916No ratings yet

- Assets Owners Equity + Liabilities: The Whole of Accounting Is Based On One Single EquationDocument16 pagesAssets Owners Equity + Liabilities: The Whole of Accounting Is Based On One Single Equationfennie ilinah molinaNo ratings yet

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- Bank Reconciliation Quiz - Accounting CoachDocument3 pagesBank Reconciliation Quiz - Accounting CoachSudip Bhattacharya100% (1)

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument11 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income Statementpri_dulkar4679No ratings yet

- Accounting LedgerDocument5 pagesAccounting LedgerlekalonzoNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Understanding Accounting Basics (ALOE and Balance Sheets) : So What's Accounting About, Anyway?Document6 pagesUnderstanding Accounting Basics (ALOE and Balance Sheets) : So What's Accounting About, Anyway?Arcelli Dela CruzNo ratings yet

- $FFRXQWLQJ%DVLFV: Accountedge Accountedge Plus Accountedge Plus Network EditionDocument21 pages$FFRXQWLQJ%DVLFV: Accountedge Accountedge Plus Accountedge Plus Network EditionCarl Vincent BarituaNo ratings yet

- The Role That Bank Accounts Play in An Enterprise LifeDocument3 pagesThe Role That Bank Accounts Play in An Enterprise LifeMary Joy Villaflor HepanaNo ratings yet

- Build a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82From EverandBuild a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82No ratings yet

- Basic Accounting Terminology 101Document2 pagesBasic Accounting Terminology 101Kamal UddinNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Modern Treasury - Accounting For Developers Parts I-IIIDocument32 pagesModern Treasury - Accounting For Developers Parts I-IIIfelipeap92No ratings yet

- Super Sample Accounting Transactions: Must Equal The Total Amount of The CreditDocument3 pagesSuper Sample Accounting Transactions: Must Equal The Total Amount of The CreditjpgamasNo ratings yet

- Financial Words You Should Know: Over 1,000 Essential Investment, Accounting, Real Estate, and Tax WordsFrom EverandFinancial Words You Should Know: Over 1,000 Essential Investment, Accounting, Real Estate, and Tax WordsRating: 4 out of 5 stars4/5 (12)

- 5 Major AccountsDocument4 pages5 Major AccountsKayelle BelinoNo ratings yet

- Radical AccountingDocument13 pagesRadical AccountingHost_PaulNo ratings yet

- Introduction To Debits and CreditsDocument16 pagesIntroduction To Debits and CreditsMeiRose100% (1)

- 2 Debits and CreditsDocument16 pages2 Debits and Creditswannisa maheswari100% (1)

- Common Mistakes in AccountingDocument9 pagesCommon Mistakes in AccountingPrabir Kumer RoyNo ratings yet

- Accounting Basics: Accountedge Accountedge Plus Accountedge Plus Network EditionDocument21 pagesAccounting Basics: Accountedge Accountedge Plus Accountedge Plus Network EditionIsramanNo ratings yet

- Accounting - Group 2Document30 pagesAccounting - Group 2Angeline EsguerraNo ratings yet

- Reconcilling AccountsDocument8 pagesReconcilling AccountsMaimai DuranoNo ratings yet

- Accounting 101 8 Steps To Set Your Business Up For Sucess by BenchDocument16 pagesAccounting 101 8 Steps To Set Your Business Up For Sucess by BenchDr-Mohammed FaridNo ratings yet

- Food and NutritionDocument8 pagesFood and NutritionFersaudy AlibbunNo ratings yet

- Powerpoint in Problem Solving in Mathematics (MMW)Document25 pagesPowerpoint in Problem Solving in Mathematics (MMW)Fersaudy Alibbun100% (1)

- Charts of Accounts (Accounting)Document1 pageCharts of Accounts (Accounting)Fersaudy AlibbunNo ratings yet

- Numerical Reasoning Formula Sheet: ContentsDocument9 pagesNumerical Reasoning Formula Sheet: ContentsFersaudy AlibbunNo ratings yet

- Services of Askari BankDocument3 pagesServices of Askari BankAdeel KhanNo ratings yet

- 10 Ways To Deal With Car Salesmen Successfully... !!!Document4 pages10 Ways To Deal With Car Salesmen Successfully... !!!a rahNo ratings yet

- Review of Operational Shipyards in Serbia: M.C.I. Shipyard, Novi BecejDocument3 pagesReview of Operational Shipyards in Serbia: M.C.I. Shipyard, Novi BecejDarko GrobarNo ratings yet

- Resume Albert H Manwaring VDocument1 pageResume Albert H Manwaring VKaarthik MandhulaNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Financial Appraisal Chapter 3Document36 pagesFinancial Appraisal Chapter 3mahlet tesfayeNo ratings yet

- Lecture 05 - Capital BudgetingDocument141 pagesLecture 05 - Capital BudgetingSagorNo ratings yet

- Process FlowsDocument76 pagesProcess FlowsRaj KumarNo ratings yet

- Exercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Document2 pagesExercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Gede Tristan Desirata RamaNo ratings yet

- Derivatives - Futures and ForwardsDocument56 pagesDerivatives - Futures and ForwardsSriram VasudevanNo ratings yet

- Upper Tamakoshi Hydropower ProjectDocument5 pagesUpper Tamakoshi Hydropower ProjectShreya ChitrakarNo ratings yet

- International Equity MarketDocument14 pagesInternational Equity MarketGirlie BalingbingNo ratings yet

- Basic Economic Study MethodsDocument53 pagesBasic Economic Study MethodsDrix ReyesNo ratings yet

- Chap 23Document12 pagesChap 23Sakshi GuptaNo ratings yet

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallNarendra VermaNo ratings yet

- FDFGDocument3 pagesFDFGHemanth DevaiahNo ratings yet

- ST Harry PDFDocument10 pagesST Harry PDFharjinder singhNo ratings yet

- Multi FactorDocument22 pagesMulti FactorAnanda Rea KasanaNo ratings yet

- Module. Partnership AccountingDocument45 pagesModule. Partnership AccountingRonalie Alindugan100% (4)

- Fresh Schedule 2021Document268 pagesFresh Schedule 2021bagas waraNo ratings yet

- Chapter 3 Current LiabilitiesDocument21 pagesChapter 3 Current LiabilitiesEzy playboy100% (2)

- Table 1 - Recommended Etfs: Financial Products ResearchDocument3 pagesTable 1 - Recommended Etfs: Financial Products ResearchBobNo ratings yet

- 06 Cafmst14 - CH - 04Document35 pages06 Cafmst14 - CH - 04Mahabub AlamNo ratings yet

- CDS Presentation With ReferencesDocument42 pagesCDS Presentation With ReferencesJohn ReedNo ratings yet

- #13 Convertible NotesDocument1 page#13 Convertible NotesSeth RogersNo ratings yet

- CFA Level 1 - 2020 Curriculum Changes (300hours)Document1 pageCFA Level 1 - 2020 Curriculum Changes (300hours)priyanka kumariNo ratings yet

- Account StatementDocument12 pagesAccount StatementManick SantraNo ratings yet

- Local Media4930298822971004354Document17 pagesLocal Media4930298822971004354Haks MashtiNo ratings yet