Professional Documents

Culture Documents

Download

Download

Uploaded by

The Nonsens GuyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Download

Download

Uploaded by

The Nonsens GuyCopyright:

Available Formats

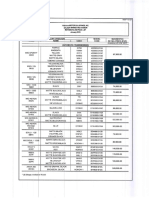

B.Com./Part-II/Gen.

/(1+1+1) System/2G8/2021

UNIVERSITY OF NORTH BENGAL

B.Com. General Part-II Examination, 2021

B.COM.

PAPER-2G8

CORPORATE ACCOUNTING-II

Time Allotted: 2 Hours Full Marks: 50

ASSIGNMENT

The figures in the margin indicate full marks.

Candidates are required to give their answers in their own words as far as practicable.

All symbols are of usual significance.

Answer any two questions 25×2 = 50

য- কান dিট pে র উtর দাও

1. The Balance Sheet of S Ltd. contains the following items as on 31.03.2016: 13+12

(i) 5,000 Equity Shares of Rs. 100 each, issued at par; (ii) 2,000, 10% Preference

Shares of Rs. 100 each, issued at par; (iii) Profit & Loss Account (Dr. balance):

Rs. 2,95,000; (iv) 15% Debentures; Rs. 2,00,000; (v) Short term loan;

Rs. 1,00,000; (vi) Creditors; Rs. 1,50,000; (vii) Accrued Interest on Debentures:

Rs. 30,000; (viii) Freehold Premises: Rs. 2,50,000 (xi) Machinery: Rs. 1,35,000;

(x) Patents: Rs. 70,000; (xi) Stock: Rs. 2,00,000; (xii) Debtors Rs. 1,80,000;

(xiii) Bank Balance Rs. 50,000

The following scheme of reconstruction was passed and approved by the court:

(a) A new company SR Ltd. will be formed by taking over the entire business of

S Ltd.

(b) SR Ltd. should issue (i) one equity share of Rs. 100 each, Rs. 60 paid up, in

exchange of every two equity shares in S Ltd.; (ii) 15, 10% Preference

Shares of Rs. 10 each, fully paid, in exchange of every two Preference

Shares in S Ltd. (iii) sufficient equity shares of Rs. 100 each, fully paid, to

discharge the liability of S Ltd. towards its debenture holders (including

interest accrued).

(c) The creditors of S Ltd. will get 50% of their dues in cash and 25% in equity

shares of Rs. 100 each, fully paid, and the balance to be forgone by them.

2110 1 Turn Over

B.Com./Part-II/Gen./(1+1+1) System/2G8/2021

(d) The freehold premises to be valued at 20% more. The value of machinery

and debtors are to be reduced by 30% and 10% respectively. The stocks and

patents were revalued at Rs. 1,60,000 and 30,000 respectively.

You are required to prepare Ledger Account in the books of S Ltd. and pass

opening journal entries in the books of SR Ltd. assuming that the preliminary

expenses amounted to Rs. 7,000.

2. The Balance Sheet of a company contains the following items as on 31.03.2018: 25

(i) 50,000 Equity Shares of Rs. 100 each; (ii) General Reserve: Rs. 15,00,000;

(iii) Profit & Loss Account: Rs. 8,75,000; (iv) Short-term borrowings:

Rs. 7,50,000; (v) Creditors: Rs. 10,00,000; (vi) Provision for Tax Rs. 12,50,000;

(vii) Premises Rs. 30,00,000; (viii) Plant and Machinery: Rs. 25,00,000;

(ix) Stocks: Rs. 32,50,000; (x) Debtors: Rs. 16,25,000.

Additional Information:

(i) Net Profits before tax of the Company during last five years were:

Rs. 10,00,000, Rs. 12,12,000, Rs. 19,31,200, Rs. 21,42,650, Rs. 22,15,656.

(ii) Managerial Remuneration of Rs. 1,50,000 has been charged for each year.

(iii) Rate of tax is 40%

(iv) Market value of Premises Rs. 28,00,000 and Plant and Machinery

Rs. 26,20,000

(v) Goodwill is to be valued at 5 years purchase of Super Profit

(vi) Normal Rate of Return is 10%

Find the Fair value of each share.

3. (a) State the Provisions in AS 14 regarding the Accounting for Amalgamation. 13

কাmািনর একিtকরেণর িহসাবরkেণর জন AS-14-এর ধারাgিল বণনা কর।

(b) What do you mean by Double Account system? State the main features of this 3+7+2

system. Name some organizations where this system is used in Accounting.

Double Account পdিত সmেn tিম িক বাঝ ? এই পdিতর pধান বিশ gিল লখ। এই

পdিতেত িহসাবরkণ কের এমন িকছু pিত ােনর নাম লখ।

——×——

2110 2

You might also like

- Business Plan For A FMCG Company!!!!!Document31 pagesBusiness Plan For A FMCG Company!!!!!Ranjith AR76% (25)

- Candlestick DescriptionsDocument14 pagesCandlestick Descriptionsflakeman100% (3)

- 5302 Facgdse02t L 4Document4 pages5302 Facgdse02t L 4piyousshil13No ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityRenieNo ratings yet

- Federal Public Service CommissionDocument14 pagesFederal Public Service CommissionSaad GulzarNo ratings yet

- ECO-14 - ENG - CompressedDocument4 pagesECO-14 - ENG - CompressedYzNo ratings yet

- Accountancy & Auditing-II 2021Document2 pagesAccountancy & Auditing-II 2021Zeeshan Ashraf MalikNo ratings yet

- Corp. AccountingDocument6 pagesCorp. AccountingUtkalika R SahooNo ratings yet

- Tls Cl-Xii Accountancy P.T 3 Q.P 2021-22Document13 pagesTls Cl-Xii Accountancy P.T 3 Q.P 2021-22Priyank DhadhiNo ratings yet

- 14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)Document8 pages14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)premium info2222No ratings yet

- Sem5 Acyg CC9Document3 pagesSem5 Acyg CC9Amrita RoyNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- 18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 2021Document5 pages18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 202119BCS531 Nisma FathimaNo ratings yet

- 12 Accc 23Document8 pages12 Accc 23Shail CareerNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- Accountancy-SQP 23-24Document12 pagesAccountancy-SQP 23-24Ashutosh SinghNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Accountancy QPDocument11 pagesAccountancy QPTûshar Thakúr0% (1)

- Accountancy SQPDocument13 pagesAccountancy SQPDeepak Kr. VishwakarmaNo ratings yet

- De CV62 S NX QSB Tetgkk WaDocument24 pagesDe CV62 S NX QSB Tetgkk WaShabanaNo ratings yet

- 12 23 24sp Accountancy ExportDocument12 pages12 23 24sp Accountancy Exportdheeru2197No ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Paper 2 Accountancy 2 2pb QP Set 2Document9 pagesPaper 2 Accountancy 2 2pb QP Set 2Harini NarayananNo ratings yet

- Accountancy em Iii RevisionDocument7 pagesAccountancy em Iii RevisionMalathi RajaNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- FM 15-16Document3 pagesFM 15-16BrijmohanNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- MOCK PAPER Final 23 24Document16 pagesMOCK PAPER Final 23 24k74pqnqdtcNo ratings yet

- CAF 1 FAR1 Spring 2023Document6 pagesCAF 1 FAR1 Spring 2023haris khanNo ratings yet

- Class 12 AMU Model PapersDocument77 pagesClass 12 AMU Model PapersMohammad FarazNo ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- 4th Sem PRT 3Document25 pages4th Sem PRT 3Sunanda MathuriaNo ratings yet

- ACC 12 Set - 1 Pre-Board 1 (2023-24)Document9 pagesACC 12 Set - 1 Pre-Board 1 (2023-24)krishchandnani450000No ratings yet

- PB SQP 12th ACC (SS) 2023-24Document14 pagesPB SQP 12th ACC (SS) 2023-24aanchal prasad100% (4)

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Screenshot 2023-11-27 at 1.48.32 PMDocument9 pagesScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85No ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- 2024-25 ISC Class 12 Accounts SQPDocument33 pages2024-25 ISC Class 12 Accounts SQPMoon LightNo ratings yet

- December 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Document5 pagesDecember 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Eashan YadavNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Caf 01Document151 pagesCaf 01Exam DepartmentNo ratings yet

- Wa0017Document13 pagesWa0017Tûshar ThakúrNo ratings yet

- CAF 1 IA Autumn 2020Document5 pagesCAF 1 IA Autumn 2020Qasim Hafeez KhokharNo ratings yet

- CA Intermediate Advanced Accounting Mock Test 19 - 01 - 2024Document13 pagesCA Intermediate Advanced Accounting Mock Test 19 - 01 - 2024rohit 6375No ratings yet

- Marks: Compulsory. Questions From CompulsoryDocument20 pagesMarks: Compulsory. Questions From Compulsorysupercell.mail.helpshift.sharingNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- DT MT 2Document9 pagesDT MT 2RaghavanNo ratings yet

- Class XII - AccountancyDocument11 pagesClass XII - Accountancyumangchh2306No ratings yet

- Dec 15Document8 pagesDec 15cacow83838No ratings yet

- Adv - Ac - FT1 - Ans @CAInterLegendsDocument18 pagesAdv - Ac - FT1 - Ans @CAInterLegendshitendrapatil6778No ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- 3243 Advanced Corporate Accounting Sep Oct 2022Document15 pages3243 Advanced Corporate Accounting Sep Oct 2022nvenu7434No ratings yet

- CBSE Sample Paper 2024 Class 12 Accountancy SQPDocument13 pagesCBSE Sample Paper 2024 Class 12 Accountancy SQPaninditaNo ratings yet

- 2021 2-11-146 CL2-Financial Accounting Reporting-Feb2021 EnglishDocument13 pages2021 2-11-146 CL2-Financial Accounting Reporting-Feb2021 Englishnoway snirfyNo ratings yet

- Practice Test: Career AvenuesDocument10 pagesPractice Test: Career AvenuesEthan GomesNo ratings yet

- FM-July Aug 2022 QPDocument3 pagesFM-July Aug 2022 QPJasmine Placy DaisNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universitysiddharth devnaniNo ratings yet

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Document11 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNo ratings yet

- QP Accountancy PB2 XIIDocument8 pagesQP Accountancy PB2 XIItarangjagtap2008No ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- STEP-NC-Compliant Systems For The Manufacturing Environment: AbstractDocument6 pagesSTEP-NC-Compliant Systems For The Manufacturing Environment: AbstractNatarajan KrishnanNo ratings yet

- Abdul Qadeer Arshad-ACCADocument3 pagesAbdul Qadeer Arshad-ACCANasir AhmedNo ratings yet

- Accounting For Tania MamDocument24 pagesAccounting For Tania MamTanjinNo ratings yet

- SITXFIN005 Managing Physical AssetsDocument32 pagesSITXFIN005 Managing Physical AssetsNutnaree UdomcharatdateNo ratings yet

- Gmail - Your Grab E-ReceiptDocument1 pageGmail - Your Grab E-ReceiptSyaiful HadiNo ratings yet

- Marketing Management:: An IntroductionDocument66 pagesMarketing Management:: An IntroductionWilsonNo ratings yet

- MGT603 Short NotesDocument20 pagesMGT603 Short NotesAdnan JavedNo ratings yet

- Idbi Financial In4mationDocument9 pagesIdbi Financial In4mationKishor PatelNo ratings yet

- Click To Edit Master Subtitle Style: - By-Arkaprava GhoshDocument49 pagesClick To Edit Master Subtitle Style: - By-Arkaprava Ghosh1234pinkuNo ratings yet

- Estatement - 01 Feb 2024 - 1708262406490Document8 pagesEstatement - 01 Feb 2024 - 1708262406490Hammad KhanNo ratings yet

- Final Exam MGR ECON - MMUT - BATCH2Document5 pagesFinal Exam MGR ECON - MMUT - BATCH2Dani KurniawanNo ratings yet

- Role of Participants in Capital MarketDocument7 pagesRole of Participants in Capital MarketAbbyRefuerzoBalingitNo ratings yet

- MPR Project Report Sample FormatDocument24 pagesMPR Project Report Sample FormatArya khattarNo ratings yet

- Tax On Corporations Oct 2019 PDFDocument70 pagesTax On Corporations Oct 2019 PDFKharen ValdezNo ratings yet

- Research ArticleDocument7 pagesResearch Articleayushir654No ratings yet

- Interest Calculation in Investment ProjectsDocument26 pagesInterest Calculation in Investment Projectsnageswara kuchipudiNo ratings yet

- Executive SummaryDocument18 pagesExecutive SummaryariaNo ratings yet

- Same As Consignee: Unit Price Total Price USD USDDocument1 pageSame As Consignee: Unit Price Total Price USD USDFishy09No ratings yet

- Powdered Activated Carbon: AWWA StandardDocument5 pagesPowdered Activated Carbon: AWWA StandardSistema de Gestão Rio DesertoNo ratings yet

- Moneyweek PDFDocument48 pagesMoneyweek PDFSuresh Kumar DevanathanNo ratings yet

- Final ExamDocument13 pagesFinal ExamddddddaaaaeeeeNo ratings yet

- Real Life CaseDocument2 pagesReal Life CaseFahim Shahriar MozumderNo ratings yet

- Day 3 Chap 1 Rev. FI5 Ex PRDocument8 pagesDay 3 Chap 1 Rev. FI5 Ex PRMaya BarcoNo ratings yet

- YMPH PriceList MC Jan'19Document2 pagesYMPH PriceList MC Jan'19Christofer De Los ReyesNo ratings yet

- West Covina HeightsDocument1 pageWest Covina HeightsBryan Rudolph PascualNo ratings yet

- Aptitude Assessment Preparation Program Trainee HandbookDocument148 pagesAptitude Assessment Preparation Program Trainee HandbookMustafa ShabanNo ratings yet

- Quiz Bowl - Acctg 3Document2 pagesQuiz Bowl - Acctg 3sharen jill montero100% (1)

- Operational Research at General MotorsDocument7 pagesOperational Research at General MotorsMantesh KumarNo ratings yet