Professional Documents

Culture Documents

Guaranty, REM

Guaranty, REM

Uploaded by

Andrea Ivy Dy0 ratings0% found this document useful (0 votes)

27 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views3 pagesGuaranty, REM

Guaranty, REM

Uploaded by

Andrea Ivy DyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

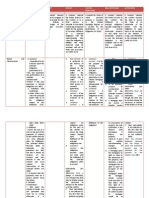

Real Estate Mortgage The mortgage credit may be alienated or assigned to a

1. Accessory third person, in whole or in part, with the formalities

2. Indivisible required by law. (Art. 2128, NCC)

3. Inseparable

4. Real Right Right to Alienate Collateral

5. Real Property A stipulation forbidding the owner from

alienating the immovable mortgaged shall be

Essential Characteristics void. (Art. 2130, NCC)

1. It must be constituted to secure the A stipulation prohibiting the mortgagor from

performance of the principal obligation entering into second or subsequent mortgages

2. The mortgagor must be the absolute owner of was held valid.

the property mortgaged In the case of Philippine Industrial Co. V. El

3. The mortgagor should have free disposal of the Hogal Filipino and Vallejo (G.R. No. 20482, 45

property mortgaged, and in the absence Phil. 336 (1923)), a stipulation prohibiting the

thereof, he should be legally authorized for the mortgagor from entering from entering into

purpose second or subsequent mortgages was held

4. When the principal obligation becomes due, the valid.

property mortgaged may be alienated for the

payment of such obligation Foreclosure

5. The subject matter of the contract must be Judicial – Rule 68, Rules of Court

immovable property or alienable real rights Extrajudicial – Art. 3135, as amended – available

upon immovable only when stipulated by the parties

Registration of Real Estate Mortgage – binding even if Judicial Extrajudicial

not recorded, but only between the parties Equity of Not less than 90 Before sale

Redemption days before the

Obligation Secured by REM property is sold

Dragnet or Blanket Mortgage Clause – a Right of Before 1 year after the

stipulation in a mortgage contract which Redemption confirmation by date of

provides that the property will serve as the court of the registration of

collateral not just for the present loan but also sale the sale

for future loans that may be granted by the Equity – right to redeem the mortgaged property after

bank to the borrower default but before the sale of property

Provision that subsumes all the obligations of a Right – right to repurchase within a certain period after

borrower to the bank whether past, present or it was sold

future obligations.

Exceptions: Guaranty – a contract by virtue of which a person,

o Debts not made by the debtor of the called the guarantor, binds himself to the creditor to

first mortgage; fulfill the obligation of the principal debtor in case the

o Debts secured by another collateral latter should fail to do so. (Art. 2047, NCC)

under Reliance of Security Test (exclude

excess amounts) Obligations Secured

Voidable and unenforceable contracts and

Objects of REM natural obligation (Art. 1205, NCC)

Immovables (Art. 415, NCC) or Alienable Real Future debts with unknown amount and

Rights conditional obligation (Art. 1206, NCC)

Extends to natural accessions, improvements, Continuing Suretyship Agreement

growing fruits, rents and income not yet

received, indemnity and just compensation Parties

Future properties cannot be included Guarantor must integrity, capacity to bind

himself, and sufficient property to answer for

Right to Alienate Mortgage Credit the obligation which he guarantees (Art. 2056,

NCC)

If the guarantor should be convicted in first The guarantor who pays for a debtor must be

instance of a crime involving dishonesty or indemnified by the latter. (Art. 2066, NCC)

should become insolvent, the creditor may The guarantor may set up against the creditor

demand another. (Art. 2057, NCC) all the defenses which pertain to the principal

debtor and are inherent in the debt; but not

Excussion those that are personal to the debtor. (Art.

The guarantor cannot be compelled to pay the 2081, NCC)

creditor unless the latter has exhausted all the

property of the debtor and has resorted to all Article 2071. The guarantor, even before having paid,

the legal remedies against the debtor. (Art. may proceed against the principal debtor:

2058, NCC)

In order that the guarantor may make use of (1) When he is sued for the payment;

the benefit of excussion, he must set it up (2) In case of insolvency of the principal debtor;

against the creditor upon the latter’s demand (3) When the debtor has bound himself to relieve him

for payment from him, and point out to the from the guaranty within a specified period, and this

creditor available property of the debtor within period has expired;

the Philippine territory, sufficient to cover the (4) When the debt has become demandable, by reason

amount of the debt. of the expiration of the period for payment;

Article 2059. The excussion shall not take place: (5) After the lapse of ten years, when the principal

(1) If the guarantor has expressly renounced it; obligation has no fixed period for its maturity, unless it

(2) If he has bound himself solidarily with the debtor; be of such nature that it cannot be extinguished except

(3) In case of insolvency of the debtor; within a period longer than ten years;

(4) When he has absconded, or cannot be sued within (6) If there are reasonable grounds to fear that the

the Philippines unless he has left a manager or principal debtor intends to abscond;

representative; (7) If the principal debtor is in imminent danger of

(5) If it may be presumed that an execution on the becoming insolvent.

property of the principal debtor would not result in the

satisfaction of the obligation. In all these cases, the action of the guarantor is

to obtain release from the guaranty, or to demand a

Right to Protection security that shall protect him from any proceedings by

A compromise between the creditor and the the creditor and from the danger of insolvency of the

principal debtor benefits the guarantor but does debtor.

not prejudice him. (Art. 2063, NCC)

You might also like

- Art 2085-2141 Reviewer Self MadeDocument15 pagesArt 2085-2141 Reviewer Self MadeJyasmine Aura V. AgustinNo ratings yet

- Stambovsky V AckleyDocument6 pagesStambovsky V AckleyalexomidNo ratings yet

- LEA111 LAW ENFORCEMENT ORGANIZATION AND ADMINISTRATION Final NotesDocument77 pagesLEA111 LAW ENFORCEMENT ORGANIZATION AND ADMINISTRATION Final NotesMiguel Lastimosa MorcoNo ratings yet

- Convergences - Law Literature and FeminismDocument45 pagesConvergences - Law Literature and FeminismPaulaNo ratings yet

- Real Estate Mortgage ReviewerDocument26 pagesReal Estate Mortgage ReviewerBenedict Jonathan Bermudez100% (3)

- PledgeDocument26 pagesPledgeAli BastiNo ratings yet

- MortgageDocument19 pagesMortgagesolomontemplestoneNo ratings yet

- Credit Transactions Final ReviewerDocument5 pagesCredit Transactions Final ReviewerJumen Gamaru Tamayo100% (1)

- GUARANTY Surety Mortgages Pledge AntichresisDocument35 pagesGUARANTY Surety Mortgages Pledge AntichresisJennilyn TugelidaNo ratings yet

- Mortagge NotesDocument7 pagesMortagge NotesJhannes Gwendholyne Gorre OdalNo ratings yet

- Personal Property Security ActDocument4 pagesPersonal Property Security ActREENA ALEKSSANDRA ACOPNo ratings yet

- Notes AntichresisDocument3 pagesNotes AntichresisLo100% (1)

- MOD 3 - COMM - FinalsDocument13 pagesMOD 3 - COMM - Finalslunameru93No ratings yet

- CREDIT TRANSACTION Guaranty Chapter 1Document4 pagesCREDIT TRANSACTION Guaranty Chapter 1Soremn PotatoheadNo ratings yet

- Credit Transactions Finals ReviewerDocument12 pagesCredit Transactions Finals ReviewerChristiane Marie BajadaNo ratings yet

- Credit TransDocument11 pagesCredit Transrcmj_supremo3193No ratings yet

- RFBTDocument3 pagesRFBTgelinepardilloNo ratings yet

- Credit Transaction2Document13 pagesCredit Transaction2shai shaiNo ratings yet

- Pledge ReportingDocument8 pagesPledge ReportingRosette G. ReynoNo ratings yet

- RFBT - Chapter 9 - Credit Transaction (Part I)Document5 pagesRFBT - Chapter 9 - Credit Transaction (Part I)laythejoylunas21No ratings yet

- Civil Law NotesDocument10 pagesCivil Law NotesmerebearooNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 2Document4 pagesCREDIT TRANSACTION Guaranty Chapter 2Soremn PotatoheadNo ratings yet

- Mortgage (Otherwise Known As "Real Estate Mortgage" or "RealDocument5 pagesMortgage (Otherwise Known As "Real Estate Mortgage" or "Realimsana minatozakiNo ratings yet

- Real Mortgage Note: de LeonDocument6 pagesReal Mortgage Note: de LeonGela Bea BarriosNo ratings yet

- Summary and Extrajudicial Killings in The Philippines (AHRC) - UPR 3rd CycleDocument52 pagesSummary and Extrajudicial Killings in The Philippines (AHRC) - UPR 3rd CyclearielramadaNo ratings yet

- Real Mortgage Report FinalDocument17 pagesReal Mortgage Report FinalMaritesCatayongNo ratings yet

- Real MortgageDocument6 pagesReal Mortgagechisel_159No ratings yet

- V. Guaranty A. Arts. 2047 To 2081, Civil CodeDocument12 pagesV. Guaranty A. Arts. 2047 To 2081, Civil CodeMunchie MichieNo ratings yet

- Notes On PledgeDocument4 pagesNotes On Pledgefe rose sindinganNo ratings yet

- 4 Pledge Mortage and AntichresisDocument39 pages4 Pledge Mortage and AntichresisJohn Rey LabasanNo ratings yet

- Mortgage Possession of Property MortgagedDocument5 pagesMortgage Possession of Property MortgagedNikki D. ChavezNo ratings yet

- Common Provisions of Pledge and MortgageDocument3 pagesCommon Provisions of Pledge and Mortgagejr castilloNo ratings yet

- Credit Reviewer HandoutsDocument7 pagesCredit Reviewer HandoutsChrizllerNo ratings yet

- 04 Pledge Mortgage and AntichresisDocument24 pages04 Pledge Mortgage and AntichresisJan33% (3)

- 04 Pledge Mortgage and AntichresisDocument36 pages04 Pledge Mortgage and Antichresiskim che100% (2)

- Real Mortgage, Antichresis, Chattel MortgageDocument4 pagesReal Mortgage, Antichresis, Chattel MortgageJapon, Jenn RossNo ratings yet

- Real Estate Mortgage LectureDocument7 pagesReal Estate Mortgage LectureJoycee MarasiganNo ratings yet

- Guaranty and PledgeDocument7 pagesGuaranty and PledgeJhannes Gwendholyne Gorre OdalNo ratings yet

- Contract of Pledge and MortgageDocument10 pagesContract of Pledge and MortgageheyheyNo ratings yet

- Title Xv. - Guaranty Nature and Extent of GuarantyDocument3 pagesTitle Xv. - Guaranty Nature and Extent of GuarantyMaisie ZabalaNo ratings yet

- CredTrans Pledge ReviewerDocument8 pagesCredTrans Pledge ReviewerLayaNo ratings yet

- Law On Mortgage NotesDocument4 pagesLaw On Mortgage NotesRolly Pagtolon-an0% (1)

- Nego Finals PDFDocument8 pagesNego Finals PDFtrixieNo ratings yet

- This Study Resource Was: Credit TransactionsDocument9 pagesThis Study Resource Was: Credit TransactionsChristian FloraldeNo ratings yet

- Article 2085 - PledgeDocument14 pagesArticle 2085 - Pledgepamriri8No ratings yet

- MORTGAGEDocument47 pagesMORTGAGEEdward BatallerNo ratings yet

- PledgeDocument4 pagesPledgefe rose sindinganNo ratings yet

- Guaranty Atty Uribe Chavez MarianDocument5 pagesGuaranty Atty Uribe Chavez MarianKenneth AbuanNo ratings yet

- SDGSDGSDGDocument23 pagesSDGSDGSDGLoren MandaNo ratings yet

- Articles 2047-2084Document5 pagesArticles 2047-2084MarkNo ratings yet

- Credit TransDocument11 pagesCredit Transrcmj_supremoNo ratings yet

- MortgageDocument19 pagesMortgageLisa PorjeoNo ratings yet

- Mortgage and AntichrsisDocument17 pagesMortgage and AntichrsisHeberdon LitaNo ratings yet

- Vi. Pledge: A. DefinitionDocument13 pagesVi. Pledge: A. Definitiontit2pNo ratings yet

- Mortgage NotesDocument6 pagesMortgage NotesJohn AguirreNo ratings yet

- Credit Transaction NotesDocument13 pagesCredit Transaction NotesLyra Osorio VillaruelNo ratings yet

- Finals - Credit TransactionDocument28 pagesFinals - Credit TransactionGillian CapiliNo ratings yet

- Title Xv. - Guaranty Notes and PresentationDocument2 pagesTitle Xv. - Guaranty Notes and Presentationfe rose sindinganNo ratings yet

- LawDocument4 pagesLawMaricar Salvador PenaNo ratings yet

- Credit Reviewer (Initial)Document263 pagesCredit Reviewer (Initial)Tricia MontoyaNo ratings yet

- PledgeDocument26 pagesPledgebluemaja50% (2)

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Petition For Certiorari Under Rule 65 (With Prayer For Issuance of Preliminary Injunction And/or Temporary Restraining Order)Document15 pagesPetition For Certiorari Under Rule 65 (With Prayer For Issuance of Preliminary Injunction And/or Temporary Restraining Order)Andrea Ivy DyNo ratings yet

- 2015-2019 Bar Qs To Answer in Mercantile LawDocument30 pages2015-2019 Bar Qs To Answer in Mercantile LawAndrea Ivy DyNo ratings yet

- FRIA CasesDocument68 pagesFRIA CasesAndrea Ivy Dy100% (1)

- Letters of CreditDocument3 pagesLetters of CreditAndrea Ivy DyNo ratings yet

- Commercial Law Review AMLA NotesDocument2 pagesCommercial Law Review AMLA NotesAndrea Ivy DyNo ratings yet

- 05 Mercantile Law Syllabus 2018Document61 pages05 Mercantile Law Syllabus 2018Andrea Ivy DyNo ratings yet

- Fernando V ST ScholasticaDocument2 pagesFernando V ST ScholasticaChristine Joy PamaNo ratings yet

- Florida LLC Formation FormDocument5 pagesFlorida LLC Formation FormJuanFer Alvarez100% (1)

- Chapter - 4 Audit Programme By: Ghalib Hussain: 2. ObjectivesDocument3 pagesChapter - 4 Audit Programme By: Ghalib Hussain: 2. ObjectivesGhalib Hussain100% (1)

- Asean Pacific Planners v. City of Urdaneta, 566 SCRA 219 (2008)Document31 pagesAsean Pacific Planners v. City of Urdaneta, 566 SCRA 219 (2008)inno KalNo ratings yet

- Madrigal Transport Vs Lapanday Holdings Case DigestDocument2 pagesMadrigal Transport Vs Lapanday Holdings Case Digestjovifactor100% (1)

- Company Law: MCQ LLB Ii and BSL IvDocument25 pagesCompany Law: MCQ LLB Ii and BSL IvajayNo ratings yet

- Partnership-CIR Vs Suter Case DigestDocument2 pagesPartnership-CIR Vs Suter Case DigestDesiree Jane Espa Tubaon100% (1)

- A.M. No. 17-03-09-SCC Rules On Community Legal Aid Service - Includes Those Who Will Pass The 2017 Bar Exams & Are Admitted To The Bar in 2018Document3 pagesA.M. No. 17-03-09-SCC Rules On Community Legal Aid Service - Includes Those Who Will Pass The 2017 Bar Exams & Are Admitted To The Bar in 2018Pretzel TsangNo ratings yet

- In The Matter of The South China Sea ArbitrationDocument4 pagesIn The Matter of The South China Sea ArbitrationElen CiaNo ratings yet

- Current and Emerging Issue in Patent - KajalsharmaaDocument2 pagesCurrent and Emerging Issue in Patent - KajalsharmaaVaibhav SharmaNo ratings yet

- Kerala State Electricity Board LimitedDocument5 pagesKerala State Electricity Board LimitedAVINASH BABU K.MNo ratings yet

- Adelfa Properties, Inc. Vs CADocument3 pagesAdelfa Properties, Inc. Vs CAParis ValenciaNo ratings yet

- Contract of AgencyDocument1 pageContract of AgencyMike SLNo ratings yet

- Philippine Airlines, Inc. v. Civil Aeronautics BoardDocument5 pagesPhilippine Airlines, Inc. v. Civil Aeronautics BoardsophiaNo ratings yet

- Penaranda Vs Bangaga Plywood CorpDocument4 pagesPenaranda Vs Bangaga Plywood CorpDeniseEstebanNo ratings yet

- Homework Due Process and Equal ProtectionDocument2 pagesHomework Due Process and Equal ProtectionDyords TiglaoNo ratings yet

- Book 7Document777 pagesBook 7Riya TayalNo ratings yet

- Urbanes vs. CADocument7 pagesUrbanes vs. CAanajuanitoNo ratings yet

- Confesor vs. PelayoDocument2 pagesConfesor vs. PelayoLance Christian ZoletaNo ratings yet

- Drugstores Association vs. National Council - Full TextDocument14 pagesDrugstores Association vs. National Council - Full TextaudreyNo ratings yet

- Order Granting Motion To DismissDocument5 pagesOrder Granting Motion To DismissDavid Oscar MarkusNo ratings yet

- Civil Service Commission: Constitutional BodiesDocument26 pagesCivil Service Commission: Constitutional BodiesDaisyree CastilloNo ratings yet

- Contract To Sell Agreement With Assume BalanceDocument13 pagesContract To Sell Agreement With Assume BalanceNhel Cudiamat0% (1)

- Amity Law School Weekly Progress Report (WPR) - 3: For THIRD WeekDocument2 pagesAmity Law School Weekly Progress Report (WPR) - 3: For THIRD WeekLakshay TewatiaNo ratings yet

- Education Legislation Final Examination - Villarin2022Document2 pagesEducation Legislation Final Examination - Villarin2022lovelymaritimeenglishNo ratings yet

- Affidavit of DamageDocument1 pageAffidavit of DamageblossomNo ratings yet

- MARL LOUIE G. SEMINIANO-HyLife Application Form (Swine Tech)Document6 pagesMARL LOUIE G. SEMINIANO-HyLife Application Form (Swine Tech)Marl Louie SeminianoNo ratings yet