Professional Documents

Culture Documents

Oilseed Daily Fundamental Report: Wow/623dex80f12 2ul-14

Oilseed Daily Fundamental Report: Wow/623dex80f12 2ul-14

Uploaded by

AbuCopyright:

Available Formats

You might also like

- Dr. Axe - Healing Food Shopping List PDFDocument2 pagesDr. Axe - Healing Food Shopping List PDFKatrina De Ubago YangaNo ratings yet

- FMI Assignment-8Document3 pagesFMI Assignment-8diveshNo ratings yet

- FennelDocument2 pagesFennelAlesam44bNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- 14th July 2021Document24 pages14th July 2021KUMARI DIVYANo ratings yet

- Rice Report - USDA - Sep 2023Document22 pagesRice Report - USDA - Sep 2023vuongphamducNo ratings yet

- Market Reflection Report AUG'22Document23 pagesMarket Reflection Report AUG'22Komal RaneNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- Economic Outlook - May 2020Document8 pagesEconomic Outlook - May 2020KaraNo ratings yet

- Schedule & S-Curve - Rev.01 - Submitted To JKR (Financial S Curve March 2021)Document1 pageSchedule & S-Curve - Rev.01 - Submitted To JKR (Financial S Curve March 2021)Tony JamesNo ratings yet

- Appsc Group 1 em Prelims Test Series Schedule-Aks IasDocument147 pagesAppsc Group 1 em Prelims Test Series Schedule-Aks IasBNREDDY PSNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0070Document11 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0070dicky muharamNo ratings yet

- Kurva - S Progress Belayan Bridge - 30 Apr 2022 - After FloodedDocument19 pagesKurva - S Progress Belayan Bridge - 30 Apr 2022 - After Floodeddelvi.panjaitan097No ratings yet

- Weekly CME 13 7 2020 1594543835Document7 pagesWeekly CME 13 7 2020 1594543835swapnidNo ratings yet

- EC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22Document7 pagesEC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22SAMYAK PANDEYNo ratings yet

- Time Frame Schedule & S-CurveDocument1 pageTime Frame Schedule & S-CurveaurinkokelloNo ratings yet

- OCP Agriculture Africa Report 2021Document35 pagesOCP Agriculture Africa Report 2021Saloua ElboustatiNo ratings yet

- Equity Weekly PDFDocument6 pagesEquity Weekly PDFMoney Maker ResearchNo ratings yet

- Economic Outlook - July 2020Document8 pagesEconomic Outlook - July 2020KaraNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's HighlightsShivangi RathiNo ratings yet

- Nav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument33 pagesNav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsSports ComNo ratings yet

- Sales - Local Trade Debts - AFCDocument90 pagesSales - Local Trade Debts - AFCShaikh Muhammad Talha 1883095No ratings yet

- Oil - Solving For A Tight MarketDocument14 pagesOil - Solving For A Tight MarketvitortelesNo ratings yet

- Quarterly Review - Quarter 2 - HUL NabhaDocument9 pagesQuarterly Review - Quarter 2 - HUL NabhaJagdeepSinghNo ratings yet

- IA Crop Progress 05-16-22Document2 pagesIA Crop Progress 05-16-22Matt GunnNo ratings yet

- Daftar Isi: Area Business Plan 2014-2018Document4 pagesDaftar Isi: Area Business Plan 2014-2018Azis ahmadNo ratings yet

- Slic UlipDocument12 pagesSlic UlipARKAJIT DEY-DMNo ratings yet

- Amiel Axie DapDocument3 pagesAmiel Axie DapAj PunsalanNo ratings yet

- Stock Price Analysis and Valuations-: Figure 5 (A) 5 (B)Document7 pagesStock Price Analysis and Valuations-: Figure 5 (A) 5 (B)sanjNo ratings yet

- Pes07 InflationDocument12 pagesPes07 InflationMalikNisarAwanNo ratings yet

- BS Mumbai 26-02-2024Document20 pagesBS Mumbai 26-02-2024GP Hari KumarNo ratings yet

- Asag2021 22Document158 pagesAsag2021 22MaheshNo ratings yet

- Controle HH - Construa - 1Document5 pagesControle HH - Construa - 1Danilo RodrigoNo ratings yet

- May 18, 2023 - Investor Day Slide PresentationDocument14 pagesMay 18, 2023 - Investor Day Slide PresentationWHRNo ratings yet

- Flash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20Document2 pagesFlash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20jnn sNo ratings yet

- Indian Pharmaceutical IndustryDocument25 pagesIndian Pharmaceutical IndustryVijaya enterprisesNo ratings yet

- Aggregate Planning: End-of-Chapter ProblemsDocument11 pagesAggregate Planning: End-of-Chapter Problemspastel sparkleNo ratings yet

- Maize June 2020Document3 pagesMaize June 2020Rajveer ChauhanNo ratings yet

- 2022 Sarath Chandra Metal Crusher: 1-Apr-21 To 17-Dec-21Document1 page2022 Sarath Chandra Metal Crusher: 1-Apr-21 To 17-Dec-21yankiNo ratings yet

- IA Crop Progress 06-26-23Document2 pagesIA Crop Progress 06-26-23Matt GunnNo ratings yet

- NAMC Food Price Monitor May 2023Document16 pagesNAMC Food Price Monitor May 2023xolaneNo ratings yet

- Commodity Chemicals - PPT - June2023Document40 pagesCommodity Chemicals - PPT - June2023Sheikh YajidulNo ratings yet

- AFEX Weekly Commodities Report Nov 15 - Nov 19, 2021Document5 pagesAFEX Weekly Commodities Report Nov 15 - Nov 19, 2021Lawrence MbahNo ratings yet

- BOPDocument3 pagesBOPResearch ProjectNo ratings yet

- Global Developments enDocument4 pagesGlobal Developments enAura Creative TeamNo ratings yet

- On The Path To Recovery: Mold-Tek PackagingDocument7 pagesOn The Path To Recovery: Mold-Tek PackagingSumangalNo ratings yet

- IA Crop Progress 07-18-22Document2 pagesIA Crop Progress 07-18-22Matt GunnNo ratings yet

- IA Crop Progress 06-27-22Document2 pagesIA Crop Progress 06-27-22Matt GunnNo ratings yet

- Morning India 20240314 Mosl Mi Pg014Document14 pagesMorning India 20240314 Mosl Mi Pg014Raj VaswaniNo ratings yet

- Getarchreportpath PDFDocument29 pagesGetarchreportpath PDFSyed AbubakarNo ratings yet

- IA Crop Progress 08-22-22Document2 pagesIA Crop Progress 08-22-22Matt GunnNo ratings yet

- Agri FertiliserDocument21 pagesAgri Fertiliserkaushikneha24No ratings yet

- Tasa de Abandono - Actividad en ClaseDocument9 pagesTasa de Abandono - Actividad en Clasemariel CarrascoNo ratings yet

- Schedule of Work TemplateDocument9 pagesSchedule of Work TemplateLorens RiezaNo ratings yet

- New Microsoft Excel WorksheetDocument6 pagesNew Microsoft Excel Worksheetvk parikhNo ratings yet

- PPIS Annual 2020 21 Final CompressedDocument94 pagesPPIS Annual 2020 21 Final CompressedBilalNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0051Document13 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0051dicky muharamNo ratings yet

- IA Crop Progress 09-19-22Document2 pagesIA Crop Progress 09-19-22Matt GunnNo ratings yet

- FinancialDocument5 pagesFinancialHimanshuNo ratings yet

- Chart of The Week - Progress of Monsoon Bodes Well For Rural India!Document1 pageChart of The Week - Progress of Monsoon Bodes Well For Rural India!pawanNo ratings yet

- Just Another Crisis?: The Impact of the COVID-19 Pandemic on Southeast Asia’s Rice SectorFrom EverandJust Another Crisis?: The Impact of the COVID-19 Pandemic on Southeast Asia’s Rice SectorNo ratings yet

- GetarchreportpathDocument65 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument11 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument17 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument17 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Report Sugar & Gur Daily Fundamental ReportDocument5 pagesReport Sugar & Gur Daily Fundamental ReportAbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument13 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- Report Sugar & Gur Daily Fundamental ReportDocument5 pagesReport Sugar & Gur Daily Fundamental ReportAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- Spices-Daily-Fundamental-Report: 20 July, 2021Document14 pagesSpices-Daily-Fundamental-Report: 20 July, 2021AbuNo ratings yet

- Pulses Domestic Fundamentals: Today's UpdateDocument19 pagesPulses Domestic Fundamentals: Today's UpdateAbuNo ratings yet

- Domestic & International Market Highlights:: Rice Daily Fundamental Report 19 Jul 2021Document4 pagesDomestic & International Market Highlights:: Rice Daily Fundamental Report 19 Jul 2021AbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Wheat Daily Fundamental Report 12 Aug - 2021Document4 pagesWheat Daily Fundamental Report 12 Aug - 2021AbuNo ratings yet

- Rice Monthly Research Report 5 October-2020Document13 pagesRice Monthly Research Report 5 October-2020AbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- Rice Monthly Research Report 5 January-2021Document9 pagesRice Monthly Research Report 5 January-2021AbuNo ratings yet

- Six Points of Tabligh EnglishDocument23 pagesSix Points of Tabligh EnglishAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Innovation Is in Our Nature.: Olive PlantsDocument20 pagesInnovation Is in Our Nature.: Olive PlantstpribiloNo ratings yet

- 50 Nombres de Frutas en InglesDocument5 pages50 Nombres de Frutas en InglesWilmer Tun BebNo ratings yet

- Hand Book On Ayurvedic Medicines With Formulae Processes Their Uses H Panda.07111 - 1contents PDFDocument5 pagesHand Book On Ayurvedic Medicines With Formulae Processes Their Uses H Panda.07111 - 1contents PDFg20kpNo ratings yet

- Scope of Minor Fruit Production in IndiaDocument8 pagesScope of Minor Fruit Production in IndiaJitendra singh shivranNo ratings yet

- Plant NameDocument15 pagesPlant NamesubikshababuNo ratings yet

- Edible Landscaping Catalog 2017 BDocument21 pagesEdible Landscaping Catalog 2017 BvitazzoNo ratings yet

- The Organic Medicinal Herb Farmer Table of ContentsDocument2 pagesThe Organic Medicinal Herb Farmer Table of ContentsChelsea Green PublishingNo ratings yet

- Harvest Management of Oil Palm (Elaeis Guineensis Jacq..) in Pelantaran Agro Estate, Kota Waringin Timur, Center BorneoDocument8 pagesHarvest Management of Oil Palm (Elaeis Guineensis Jacq..) in Pelantaran Agro Estate, Kota Waringin Timur, Center BorneoNova OktarinaNo ratings yet

- Freezing Vegetables: Guide E-320Document4 pagesFreezing Vegetables: Guide E-320Dario YoungNo ratings yet

- GPP Forms 2015Document22 pagesGPP Forms 2015Joie UrsalNo ratings yet

- Citrus FruitsDocument11 pagesCitrus FruitsymonnlopezNo ratings yet

- CatalogDocument16 pagesCatalogC C De CastroNo ratings yet

- Juice Detox Masterclass WorkbookDocument15 pagesJuice Detox Masterclass WorkbookMaria Russo100% (1)

- Pinapple City Redevelopmemt of Asia'S Largest Pinapple Market at Vazhakkulam, Ernakulam (Dist.)Document5 pagesPinapple City Redevelopmemt of Asia'S Largest Pinapple Market at Vazhakkulam, Ernakulam (Dist.)Ann NambiaparambilNo ratings yet

- Native Plants of TurkeyDocument12 pagesNative Plants of TurkeyMariana RadulescuNo ratings yet

- Tek. Pengolahan Kelapa Sawit - 1Document17 pagesTek. Pengolahan Kelapa Sawit - 1Bangkit GotamaNo ratings yet

- Alugbati Back PageDocument2 pagesAlugbati Back PageElmer Malbuyo100% (1)

- English Name Urdu Name Sowing Time Rows X Rows (Inch) Plants X Plants (Inch) Yield/Plant First HarvestDocument3 pagesEnglish Name Urdu Name Sowing Time Rows X Rows (Inch) Plants X Plants (Inch) Yield/Plant First HarvestfarrukhNo ratings yet

- Riddles Guess The Fruit or VegetableDocument2 pagesRiddles Guess The Fruit or VegetablegufeoNo ratings yet

- Rice, Cereals & Pulses: HmhubDocument5 pagesRice, Cereals & Pulses: HmhubchefsachinNo ratings yet

- Top 20 Questions of Seating Arrangement For NABARD Office Attendant Mains 2020 QuestionsDocument6 pagesTop 20 Questions of Seating Arrangement For NABARD Office Attendant Mains 2020 QuestionsNisha PariharNo ratings yet

- Chaat Masala RecipeDocument6 pagesChaat Masala RecipeSuchismita SahooNo ratings yet

- l2 Quarter 2 Week 1 - Prepare Mise en PlaceDocument38 pagesl2 Quarter 2 Week 1 - Prepare Mise en PlaceGwyneth VicenteNo ratings yet

- Iso PaisesDocument16 pagesIso PaisesRAMON CESPEDES PAZNo ratings yet

- Different Types of CornDocument3 pagesDifferent Types of Corndinaol yirdawNo ratings yet

- Pip AcceptanceDocument1 pagePip Acceptanceapi-164186474No ratings yet

- Top 10 Beans and Legumes Highest in ProteinDocument12 pagesTop 10 Beans and Legumes Highest in ProteinyogeshNo ratings yet

- PapayaDocument6 pagesPapayafkkfoxNo ratings yet

Oilseed Daily Fundamental Report: Wow/623dex80f12 2ul-14

Oilseed Daily Fundamental Report: Wow/623dex80f12 2ul-14

Uploaded by

AbuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oilseed Daily Fundamental Report: Wow/623dex80f12 2ul-14

Oilseed Daily Fundamental Report: Wow/623dex80f12 2ul-14

Uploaded by

AbuCopyright:

Available Formats

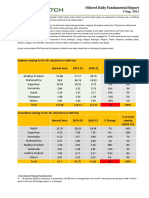

Oilseed Daily Fundamental Report

13 July, 2021

Oilseeds Domesticwow\623dex80F12

Fundamentals: Soybean prices closed up at Indore center despite heavy supply in Madhya Pradesh. However, Rapeseed prices

also went up despite heavy supply supply.

2ul-14

The area under soybean planting

s is likely to increase by 5-7 Percent across the country this kharif season despite speculation in the market over

the shortage of certified seeds. Farmers, however, are hoping for a revival of the monsoon to ensure a good

51http://www.fcei.in/fceicochin/aboutus.php619862072 crop, D N(plant

Soybean Pathak, executive director,

delivery,

SoybeanIndore-new

Processors Association

crop) of India (SOPA) said. Pathak also said that the area under soybean cultivation will definitely increase in

Maharashtra and Rajasthan

harvest but is likely

pressure to go down

along with to some extent in in

decline Madhya

BMDPradesh

CPO (MP).

remained bearish factors for the

domestic oils and fats market.

International

5s––– Oilseeds Fundamentals:

US soybean planting, is almost completed as of 4 July, the US soybean blooming stood at 29% steady from 29% same period last season however

up from 5-year average of 24%. Further Soybean settling pods for week ending July 4 stood at 3% as compared to 2% same period last year,

however 5-year average stood at 3%. Soybean condition for week ending 4 July stood at 14% Excellent, 57% good, 24%fair, 4%poor and 1% Very

poor.

Canola futures soared this week because of heatwave looked to affect harvest scenario for canola in Canada. High temperature forecast in coming

weeks may cause the canola flowers to drop prematurely, lead to drop in yield. Canadian farmers planted an estimated 22.5 million acres of

canola for the 2021-22 crop year, the highest since 2018. This is up from the April forecast of 21.5 million acres and up 8.2% from last year.

Outlook: Soybean (plant delivery, Indore) prices are likely to feature firm tone amid good demand by miller and crusher. The prices are expected

to be in the range of 7,300 – 7,900/qtl. levels in the near-term.

NCDEX Soybean Futures: NCDEX RM Seed Futures:

Contract +/- Open High Low Close Contract +/- Open High Low Close

Jun-21 +2.83 7770 7899 7584 7634 Jun-21 +1.14 7010 7075 6915 6911

Jul-21 +4.10 7312 7524 7215 7224 Jul-21 +1.48 6910 7011 6903 6882

Aug-21 +4.88 6828 7161 6823 6828 +1.34 6979 7000 6917 6888

Aug-21

Contract Volume Change OI Change

Contract Volume Change OI Change

Jun-21 19940 9660 14210 -10820

Jun-21 7430 -855 7945 -5920

Jul-21 Jul-21 43530 4370 48500 2680

30520 8660 35570 4390

Aug-21 3630 1705 4985 2005 Aug-21 4440 960 14450 210

Spread Jul-21 Aug-21 Sept-21 Spread Jul-21 Aug-21 Sept-21

Basis 7600 Basis

7137

Jul-21 -34 Jul-21 226

Aug-21 376 Aug-21 255

Sept-21 772 Sept-21 249

*Far Month Contract - Near Month Contract. Basis: Spot –Future (Indore). *Far Month Contract - Near Month Contract. Basis: Spot – Future (Jaipur).

Demat In-Process Total FED Demat In-Process Total FED

Stocks Stocks

10-July-21 10-July-21 10-July-21 05-July-21 10-July-21 10-July-21 10-July-21 05-July-21

Akola 40 - 40 40 Sri

807 40 847 786

Ganganagar

Indore 20 - 20 20

Bharatpur - - - -

Kota 91 - 91 91 Bikaner - - - -

Sagar - - - - Kota 5707 151 5858 5806

Nagpur - - - - Jaipur 9088 1397 10485 8233

Alwar 370 - 370 210

*SBN Fed Stocks Expiry on ---- Hapur - - - -

*RM Seed Fed Stocks Expiry on ---- *RMS Fed Stocks Expiry on ---

Oilseed Daily Fundamental Report

13 July, 2021

Oilseed Prices at Key Spot Markets:

Commodity / Centre Prices (Rs/Qtl) Change

12-Jul-21 10-Jul-21

Soybean

Low High Low High

Indore –Plant 7500 7700 7350 7550 150

Indore–Mandi 7300 7550 7200 7400 150

Nagpur-Plant 7550 7650 7550 7650 Unch

Nagpur – Mandi 6950 7450 6950 7450 Unch

Latur – Mandi Closed Closed Closed Closed -

Akola – Mandi 6000 7310 Closed Closed -

Kota-Plant 7575 7675 7475 7575 100

Kota – Mandi 7400 7650 7300 7550 100

Bundi-Plant 7400 7600 7300 7500 100

Bundi-Mandi 7300 7550 7100 7400 150

Baran-Plant 7450 7500 7565 7665 -165

Baran-Mandi 7000 7400 7270 7570 -170

Bhawani Mandi Jhalawar–Plant 7425 7525 7585 7685 -160

Jhalwar-Mandi 6975 7275 7135 7435 -160

Rapeseed/Mustard

Jaipur-(Condition) 7125 7150 7000 7025 125

Alwar-(Condition) 6850 6900 6850 6900 Unch

Sri Ganganagar-(Non-Condition) 6550 6650 6500 6600 50

New Delhi–(Condition) 6975 7000 6925 6950 50

Kota-(Condition) 6525 6625 6450 6550 75

Agra-(Condition) 7048 7143 7048 7143 Unch

Neewai-(Condition) 6600 6800 6625 6825 -25

Hapur (UP)-(Condition) 7050 7100 6800 6850 250

Groundnut Seed

Rajkot Closed Closed 1000 1000 -

Sunflower Seed

Gulbarga NA NA NA NA -

Latur 6400 6500 6400 6500 Unch

Sholapur 6400 6500 6400 6500 Unch

Soybean Prices are in INR/qtl. (1 bag=90 kg). Mandi prices – Loose, Mustard Seed Prices

are in INR/qt (1 bag=85 kg) C – Condition (42%), *Groundnut seed in Rs/20 kg, Sunflower

Seed in Rs/qtl.

Oilseed Daily Fundamental Report

13 July, 2021

Oilseed Arrivals in Key Centers:

Commodity / Centre Arrivals in Bags/Qtl Change

Soybean 12-Jul-21 10-Jul-21

Madhya Pradesh 60000 30000 30000

Maharashtra 55000 40000 15000

Rajasthan 7000 6000 1000

Bundi (Raj) 400 100 300

Baran (Raj) 500 700 -200

Jhalawar (Raj) 1200 2000 -800

Rapeseed/Mustard

Rajasthan 100000 90000 10000

Alwar 1500 1600 -100

Sri Ganganagar 1000 700 300

Kota 500 700 -200

Groundnut Seed

Rajkot (Gujarat) Closed 250 -

Sunflower Seed

Sholapur (Maharashtra) 500 500 Unch

Other Oilseed Prices at Mumbai (INR/100 Kg):

Oilseeds 12-Jul-21 10-Jul-21 Change

Groundnut Kernel 7000 7000 Unch

Gr. Bolds 60/70 8250 8250 Unch

Gr. Javas 60/70 9100 9100 Unch

Gr Javas 70/80 8800 8800 Unch

Gr.Javas 80/90 8500 8500 Unch

KardiSeed 2% Exp Qly 5000 5000 Unch

Sesame White 98/2/1 FM 8000 8000 Unch

Whitish 95/5/FFA/1FM 7800 7800 Unch

Brown 48/2 FFA/4 FM 7700 7700 Unch

Brown 48/3 FFA/4 FM 7600 7600 Unch

Brown 48/4 FM/* No FFA Guarantee 7200 7200 Unch

Sunflower Seed 6300 6300 Unch

Niger Seed (4% FM) 7800 7800 Unch

Oilseed Daily Fundamental Report

13 July, 2021

Disclaimer

The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its

accuracy, completeness and correctness. Use of data and information contained in this report is at your own risk. This document is not, and should not

be construed as, an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in

part, by any recipient hereof for any purpose without prior permission from the Company. IASL and its affiliates and/or their officers, directors and

employees may have positions in any commodities mentioned in this document (or in any related investment) and may from time to time add to or

dispose of any such commodities (or investment). Please see the detailed disclaimer at http://www.agriwatch.com/Disclaimer.asp© 2021 Indian

Agribusiness Systems Pvt Ltd.

You might also like

- Dr. Axe - Healing Food Shopping List PDFDocument2 pagesDr. Axe - Healing Food Shopping List PDFKatrina De Ubago YangaNo ratings yet

- FMI Assignment-8Document3 pagesFMI Assignment-8diveshNo ratings yet

- FennelDocument2 pagesFennelAlesam44bNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- 14th July 2021Document24 pages14th July 2021KUMARI DIVYANo ratings yet

- Rice Report - USDA - Sep 2023Document22 pagesRice Report - USDA - Sep 2023vuongphamducNo ratings yet

- Market Reflection Report AUG'22Document23 pagesMarket Reflection Report AUG'22Komal RaneNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- Economic Outlook - May 2020Document8 pagesEconomic Outlook - May 2020KaraNo ratings yet

- Schedule & S-Curve - Rev.01 - Submitted To JKR (Financial S Curve March 2021)Document1 pageSchedule & S-Curve - Rev.01 - Submitted To JKR (Financial S Curve March 2021)Tony JamesNo ratings yet

- Appsc Group 1 em Prelims Test Series Schedule-Aks IasDocument147 pagesAppsc Group 1 em Prelims Test Series Schedule-Aks IasBNREDDY PSNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0070Document11 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0070dicky muharamNo ratings yet

- Kurva - S Progress Belayan Bridge - 30 Apr 2022 - After FloodedDocument19 pagesKurva - S Progress Belayan Bridge - 30 Apr 2022 - After Floodeddelvi.panjaitan097No ratings yet

- Weekly CME 13 7 2020 1594543835Document7 pagesWeekly CME 13 7 2020 1594543835swapnidNo ratings yet

- EC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22Document7 pagesEC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22SAMYAK PANDEYNo ratings yet

- Time Frame Schedule & S-CurveDocument1 pageTime Frame Schedule & S-CurveaurinkokelloNo ratings yet

- OCP Agriculture Africa Report 2021Document35 pagesOCP Agriculture Africa Report 2021Saloua ElboustatiNo ratings yet

- Equity Weekly PDFDocument6 pagesEquity Weekly PDFMoney Maker ResearchNo ratings yet

- Economic Outlook - July 2020Document8 pagesEconomic Outlook - July 2020KaraNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's HighlightsShivangi RathiNo ratings yet

- Nav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument33 pagesNav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsSports ComNo ratings yet

- Sales - Local Trade Debts - AFCDocument90 pagesSales - Local Trade Debts - AFCShaikh Muhammad Talha 1883095No ratings yet

- Oil - Solving For A Tight MarketDocument14 pagesOil - Solving For A Tight MarketvitortelesNo ratings yet

- Quarterly Review - Quarter 2 - HUL NabhaDocument9 pagesQuarterly Review - Quarter 2 - HUL NabhaJagdeepSinghNo ratings yet

- IA Crop Progress 05-16-22Document2 pagesIA Crop Progress 05-16-22Matt GunnNo ratings yet

- Daftar Isi: Area Business Plan 2014-2018Document4 pagesDaftar Isi: Area Business Plan 2014-2018Azis ahmadNo ratings yet

- Slic UlipDocument12 pagesSlic UlipARKAJIT DEY-DMNo ratings yet

- Amiel Axie DapDocument3 pagesAmiel Axie DapAj PunsalanNo ratings yet

- Stock Price Analysis and Valuations-: Figure 5 (A) 5 (B)Document7 pagesStock Price Analysis and Valuations-: Figure 5 (A) 5 (B)sanjNo ratings yet

- Pes07 InflationDocument12 pagesPes07 InflationMalikNisarAwanNo ratings yet

- BS Mumbai 26-02-2024Document20 pagesBS Mumbai 26-02-2024GP Hari KumarNo ratings yet

- Asag2021 22Document158 pagesAsag2021 22MaheshNo ratings yet

- Controle HH - Construa - 1Document5 pagesControle HH - Construa - 1Danilo RodrigoNo ratings yet

- May 18, 2023 - Investor Day Slide PresentationDocument14 pagesMay 18, 2023 - Investor Day Slide PresentationWHRNo ratings yet

- Flash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20Document2 pagesFlash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20jnn sNo ratings yet

- Indian Pharmaceutical IndustryDocument25 pagesIndian Pharmaceutical IndustryVijaya enterprisesNo ratings yet

- Aggregate Planning: End-of-Chapter ProblemsDocument11 pagesAggregate Planning: End-of-Chapter Problemspastel sparkleNo ratings yet

- Maize June 2020Document3 pagesMaize June 2020Rajveer ChauhanNo ratings yet

- 2022 Sarath Chandra Metal Crusher: 1-Apr-21 To 17-Dec-21Document1 page2022 Sarath Chandra Metal Crusher: 1-Apr-21 To 17-Dec-21yankiNo ratings yet

- IA Crop Progress 06-26-23Document2 pagesIA Crop Progress 06-26-23Matt GunnNo ratings yet

- NAMC Food Price Monitor May 2023Document16 pagesNAMC Food Price Monitor May 2023xolaneNo ratings yet

- Commodity Chemicals - PPT - June2023Document40 pagesCommodity Chemicals - PPT - June2023Sheikh YajidulNo ratings yet

- AFEX Weekly Commodities Report Nov 15 - Nov 19, 2021Document5 pagesAFEX Weekly Commodities Report Nov 15 - Nov 19, 2021Lawrence MbahNo ratings yet

- BOPDocument3 pagesBOPResearch ProjectNo ratings yet

- Global Developments enDocument4 pagesGlobal Developments enAura Creative TeamNo ratings yet

- On The Path To Recovery: Mold-Tek PackagingDocument7 pagesOn The Path To Recovery: Mold-Tek PackagingSumangalNo ratings yet

- IA Crop Progress 07-18-22Document2 pagesIA Crop Progress 07-18-22Matt GunnNo ratings yet

- IA Crop Progress 06-27-22Document2 pagesIA Crop Progress 06-27-22Matt GunnNo ratings yet

- Morning India 20240314 Mosl Mi Pg014Document14 pagesMorning India 20240314 Mosl Mi Pg014Raj VaswaniNo ratings yet

- Getarchreportpath PDFDocument29 pagesGetarchreportpath PDFSyed AbubakarNo ratings yet

- IA Crop Progress 08-22-22Document2 pagesIA Crop Progress 08-22-22Matt GunnNo ratings yet

- Agri FertiliserDocument21 pagesAgri Fertiliserkaushikneha24No ratings yet

- Tasa de Abandono - Actividad en ClaseDocument9 pagesTasa de Abandono - Actividad en Clasemariel CarrascoNo ratings yet

- Schedule of Work TemplateDocument9 pagesSchedule of Work TemplateLorens RiezaNo ratings yet

- New Microsoft Excel WorksheetDocument6 pagesNew Microsoft Excel Worksheetvk parikhNo ratings yet

- PPIS Annual 2020 21 Final CompressedDocument94 pagesPPIS Annual 2020 21 Final CompressedBilalNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0051Document13 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0051dicky muharamNo ratings yet

- IA Crop Progress 09-19-22Document2 pagesIA Crop Progress 09-19-22Matt GunnNo ratings yet

- FinancialDocument5 pagesFinancialHimanshuNo ratings yet

- Chart of The Week - Progress of Monsoon Bodes Well For Rural India!Document1 pageChart of The Week - Progress of Monsoon Bodes Well For Rural India!pawanNo ratings yet

- Just Another Crisis?: The Impact of the COVID-19 Pandemic on Southeast Asia’s Rice SectorFrom EverandJust Another Crisis?: The Impact of the COVID-19 Pandemic on Southeast Asia’s Rice SectorNo ratings yet

- GetarchreportpathDocument65 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument11 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument17 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument17 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Report Sugar & Gur Daily Fundamental ReportDocument5 pagesReport Sugar & Gur Daily Fundamental ReportAbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument13 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- Report Sugar & Gur Daily Fundamental ReportDocument5 pagesReport Sugar & Gur Daily Fundamental ReportAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- Spices-Daily-Fundamental-Report: 20 July, 2021Document14 pagesSpices-Daily-Fundamental-Report: 20 July, 2021AbuNo ratings yet

- Pulses Domestic Fundamentals: Today's UpdateDocument19 pagesPulses Domestic Fundamentals: Today's UpdateAbuNo ratings yet

- Domestic & International Market Highlights:: Rice Daily Fundamental Report 19 Jul 2021Document4 pagesDomestic & International Market Highlights:: Rice Daily Fundamental Report 19 Jul 2021AbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Wheat Daily Fundamental Report 12 Aug - 2021Document4 pagesWheat Daily Fundamental Report 12 Aug - 2021AbuNo ratings yet

- Rice Monthly Research Report 5 October-2020Document13 pagesRice Monthly Research Report 5 October-2020AbuNo ratings yet

- GetarchreportpathDocument4 pagesGetarchreportpathAbuNo ratings yet

- Rice Monthly Research Report 5 January-2021Document9 pagesRice Monthly Research Report 5 January-2021AbuNo ratings yet

- Six Points of Tabligh EnglishDocument23 pagesSix Points of Tabligh EnglishAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Innovation Is in Our Nature.: Olive PlantsDocument20 pagesInnovation Is in Our Nature.: Olive PlantstpribiloNo ratings yet

- 50 Nombres de Frutas en InglesDocument5 pages50 Nombres de Frutas en InglesWilmer Tun BebNo ratings yet

- Hand Book On Ayurvedic Medicines With Formulae Processes Their Uses H Panda.07111 - 1contents PDFDocument5 pagesHand Book On Ayurvedic Medicines With Formulae Processes Their Uses H Panda.07111 - 1contents PDFg20kpNo ratings yet

- Scope of Minor Fruit Production in IndiaDocument8 pagesScope of Minor Fruit Production in IndiaJitendra singh shivranNo ratings yet

- Plant NameDocument15 pagesPlant NamesubikshababuNo ratings yet

- Edible Landscaping Catalog 2017 BDocument21 pagesEdible Landscaping Catalog 2017 BvitazzoNo ratings yet

- The Organic Medicinal Herb Farmer Table of ContentsDocument2 pagesThe Organic Medicinal Herb Farmer Table of ContentsChelsea Green PublishingNo ratings yet

- Harvest Management of Oil Palm (Elaeis Guineensis Jacq..) in Pelantaran Agro Estate, Kota Waringin Timur, Center BorneoDocument8 pagesHarvest Management of Oil Palm (Elaeis Guineensis Jacq..) in Pelantaran Agro Estate, Kota Waringin Timur, Center BorneoNova OktarinaNo ratings yet

- Freezing Vegetables: Guide E-320Document4 pagesFreezing Vegetables: Guide E-320Dario YoungNo ratings yet

- GPP Forms 2015Document22 pagesGPP Forms 2015Joie UrsalNo ratings yet

- Citrus FruitsDocument11 pagesCitrus FruitsymonnlopezNo ratings yet

- CatalogDocument16 pagesCatalogC C De CastroNo ratings yet

- Juice Detox Masterclass WorkbookDocument15 pagesJuice Detox Masterclass WorkbookMaria Russo100% (1)

- Pinapple City Redevelopmemt of Asia'S Largest Pinapple Market at Vazhakkulam, Ernakulam (Dist.)Document5 pagesPinapple City Redevelopmemt of Asia'S Largest Pinapple Market at Vazhakkulam, Ernakulam (Dist.)Ann NambiaparambilNo ratings yet

- Native Plants of TurkeyDocument12 pagesNative Plants of TurkeyMariana RadulescuNo ratings yet

- Tek. Pengolahan Kelapa Sawit - 1Document17 pagesTek. Pengolahan Kelapa Sawit - 1Bangkit GotamaNo ratings yet

- Alugbati Back PageDocument2 pagesAlugbati Back PageElmer Malbuyo100% (1)

- English Name Urdu Name Sowing Time Rows X Rows (Inch) Plants X Plants (Inch) Yield/Plant First HarvestDocument3 pagesEnglish Name Urdu Name Sowing Time Rows X Rows (Inch) Plants X Plants (Inch) Yield/Plant First HarvestfarrukhNo ratings yet

- Riddles Guess The Fruit or VegetableDocument2 pagesRiddles Guess The Fruit or VegetablegufeoNo ratings yet

- Rice, Cereals & Pulses: HmhubDocument5 pagesRice, Cereals & Pulses: HmhubchefsachinNo ratings yet

- Top 20 Questions of Seating Arrangement For NABARD Office Attendant Mains 2020 QuestionsDocument6 pagesTop 20 Questions of Seating Arrangement For NABARD Office Attendant Mains 2020 QuestionsNisha PariharNo ratings yet

- Chaat Masala RecipeDocument6 pagesChaat Masala RecipeSuchismita SahooNo ratings yet

- l2 Quarter 2 Week 1 - Prepare Mise en PlaceDocument38 pagesl2 Quarter 2 Week 1 - Prepare Mise en PlaceGwyneth VicenteNo ratings yet

- Iso PaisesDocument16 pagesIso PaisesRAMON CESPEDES PAZNo ratings yet

- Different Types of CornDocument3 pagesDifferent Types of Corndinaol yirdawNo ratings yet

- Pip AcceptanceDocument1 pagePip Acceptanceapi-164186474No ratings yet

- Top 10 Beans and Legumes Highest in ProteinDocument12 pagesTop 10 Beans and Legumes Highest in ProteinyogeshNo ratings yet

- PapayaDocument6 pagesPapayafkkfoxNo ratings yet