Professional Documents

Culture Documents

Buss Answer

Buss Answer

Uploaded by

dakshinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buss Answer

Buss Answer

Uploaded by

dakshinCopyright:

Available Formats

Cambridge International Examinations

Cambridge International Advanced Level

BUSINESS 9609/32

Paper 3 Case Study March 2017

MARK SCHEME

Maximum Mark: 100

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge will not enter into discussions about these mark schemes.

Cambridge is publishing the mark schemes for the March 2017 series for most Cambridge IGCSE®,

Cambridge International A and AS Level components and some Cambridge O Level components.

® IGCSE is a registered trademark.

This document consists of 17 printed pages.

© UCLES 2017 [Turn over

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

General Marking Guidance for 9609 Paper 3

• When examiners are in doubt regarding the application of the mark scheme to a candidate’s

response, the team leader must be consulted.

• Crossed out work should be marked UNLESS the candidate has replaced it with an

alternative response.

• Errors that are carried forward (e.g. when an incorrect numerical answer to one part of a

question is used as the starting point for a calculation in the next part of the question) should

not be compounded – use the ‘own figure rule’.

• Poor spelling, handwriting or grammar should not be penalised as long as the answer makes

sense.

• The main Scoris annotations to be used are K (Knowledge), APP (Application), AN

(Analysis), EVAL (Evaluation). For each of these four annotations, the number of marks

awarded for that assessment objective must match the number of times that annotation is on

the answer.

• Only award EVAL if the candidate has also demonstrated APP.

• Other Scoris annotations that can be used are: Tick, Cross, BOD (Benefit Of Doubt), TV (Too

Vague), REP (Repetition), NAQ (Not Answered Question), OFR (Own Figure Rule), SEEN,

On Page Comment.

• Blank pages on a script must be annotated as SEEN.

• A blank space, dash, question mark and a response that bears no relation to the question

constitutes a ‘no response’.

• In Section B, candidates answer either Question 6 or Question 7. The Section B question

that the candidate does not answer must be entered as ‘no response’.

• Blank pages, or pages that contain crossed out material, must be annotated using ‘SEEN’.

This mark scheme includes a summary of appropriate content for answering each question. It

should be emphasised, however, that this material is for illustrative purposes and is not

intended to provide a definitive guide to acceptable answers. It is quite possible that among

the scripts there will be some candidate answers that are not covered directly by the content

of this mark scheme. In such cases, professional judgement should be exercised in assessing

the merits of the answer and the senior examiners should be consulted if further guidance is

required.

Application marks are not awarded for repeating material from the case study. Application is

by answering in the context of the case or by using the information in the case to help answer

the question.

© UCLES 2017 Page 2 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

1 Analyse the likely opportunities and threats to SA of the forecast economic 10

changes given in Appendix 1.

Level Knowledge Application Analysis

3 marks 3 marks 4 marks

2 3 marks 3 marks 3–4 marks

Good knowledge Points well applied Good use of reasoned

shown of opportunities argument or theory to

and threats/impact of explain the likely

them impact of opportunities

and threats

1 1–2 marks 1–2 marks 1–2 marks

Knowledge shown of Some attempt to Some use of reasoned

opportunities and apply points or one argument or theory to

threats/impact of them point well applied explain likely impact of

opportunities and

threats

0 No creditable content

Note:

Application requires understanding of impact on SA of identified change

For application limit to L1 where candidate identifies changes in economic forecasts e.g.

lower economic growth

L2 application requires more specific reference to SA e.g. cost of fuel

Answers could include:

Knowledge:

• Opportunities and threats – external factors that impact businesses positively

and negatively.

• Definition of terms from Appendix 1.

Application:

• In this case predictions suggest that economic growth is slowing and inflation is

rising.

• The currency of SA’s home country is getting stronger against the dollar.

• Inflation is set to rise above the rate of economic growth – credit comments

about falling ‘real growth’.

• With low unemployment could flexible contracts mean more difficulty in

recruiting staff?

• Impact of changes on willingness of SA to make investments such as purchase

of new aircraft.

• Linking changes to relatively low profitability of SA.

• SA not in position of being able to raise fares, as ‘budget airline’ business

model.

• Grants and subsidies from government to encourage overseas businesses and

visitors may offset impact of economic changes.

© UCLES 2017 Page 3 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

Analysis:

• Slowing economic growth may lead to incomes for consumers and businesses

increasing at a slower rate and this could slow the rate of increase in demand

for flights.

• Low unemployment could cause rising wage costs and impact SA’s

competitiveness.

• Businesses such as SA may be less willing to make substantial investments

with falling growth of real GDP.

• Currency appreciation will lead to fares being higher if bought in Euros and

probably other currencies.

• Incomes still increasing at a reasonable rate, continued increase in demand for

air travel.

• SA’s profitability is relatively low and could fall, meaning reliance on loan

finance for future investments, interest rates set to rise.

© UCLES 2017 Page 4 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

2(a)(i) Refer to Appendix 2. Calculate the net present value (NPV) for the purchase of the 4

two new aircraft.

Year Net cash Discount Discounted Marks

flows factor cash flow $m

$m

0 (80) 1 mark for some attempt to use

discount factors

1 8 .89 7.12

2 12 .80 9.6 2 marks for arithmetic error and

failure to subtract capital cost

3 15 .71 10.65

4 20 .64 12.80 3 marks for 1 error

5 30 .57 17.1

4 marks for correct answer

6 54 .49 26.46

NPV 83.73 – 80 =

3.73

Answer Mark Rationale

$3.73m 4 Correct answer

$83.73m 3 Capital cost not subtracted

–$8.03m 3 Ignores residual value

$71.97m 2 Ignores residual value and capital cost not subtracted

2(a)(ii) Refer to Appendix 3. Calculate the new gearing ratio for SA if $80m is borrowed to 4

purchase two new aircraft.

Formula: non-current liabilities / capital employed × 100 = gearing % (1 mark)

$348m + 80m (1 mark)

= 428m/1208m (2 marks)

$1128 + 80m (1 mark)

35.43% (4 marks)

$428/$1128 (fails to add $80 in capital employed) = 37.94% (3 marks)

Alternative formula: non-current liabilities / shareholders’ equity × 100 (1 mark)

$348m + 80m (1 mark)

= 428m/780m (2 marks)

$780m (1 mark)

54.87% (4 marks)

$348m

= 30.85% (2 marks)

$1128m

© UCLES 2017 Page 5 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

2(b) Refer to your results from part (a) and other information in the case. Recommend 14

whether SA should purchase or lease the two aircraft.

Level Knowledge Application Analysis Evaluation

2 marks 2 marks 5 marks 5 marks

2 2 marks 2 marks 3–5 marks 3–5 marks

Good knowledge Good Good use of reasoned Good

shown of relevant application to argument or theory to judgement

issues case explain investment shown in

appraisal result and answer and

other relevant issues conclusion

1 1 mark 1 mark 1–2 marks 1–2 marks

Some knowledge Some Some use of reasoned Some

of relevant issues application to argument or theory to judgement

case either investment shown in

appraisal result or answer and/or

other relevant issues conclusion

0 No creditable content

Examiner note: Limit to L1 A and E if only refers to results from (a) or other information

in the case

Knowledge:

• Investment appraisal is a way of assessing future returns from a capital

purchase.

• NPV takes into account the future value of money.

• Leasing the aircraft involves a yearly cost/expense and aircraft will not be

business assets.

• Balance sheet – Assets would increase with purchase option.

Application:

• NPV 3.73m, so positive after six years, leasing over six years would cost

$4.6m × 2 × 6 = 55.2m.

• Cost of purchase less residual value is £56m.

• Discounted payback 5yrs 10 months.

• Payback is 4yrs 10 months.

• Increase in gearing ratio could be significant, but still low geared.

• How much will painting SA’s colours cost for the leasing option?

• Reference to other financial data, such as profit margin (6.6%).

Analysis:

• If the competition in the airline industry increases – this would affect expected

revenues.

• Purchase of aircraft will require financing and potentially increase pressure on

cashflow.

• Purchase will increase value of assets of SA and increase capital employed

thus increasing size of the business.

• Leasing will have less impact on the short-term cash-flow position of SA

compared to outright purchase.

© UCLES 2017 Page 6 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

Evaluation:

• Accept either option or advise not obtaining new equipment – but must be well

supported by reasoned argument.

• Decision may depend on value after six years/speed of depreciation. How

accurate is the figure given?

• Decision may depend on state of economy – are interest rates likely to

increase as a result of rising inflation? This could be a disadvantage for the

purchase option especially as the payback is nearly 5 years.

© UCLES 2017 Page 7 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

3 To what extent could a detailed marketing plan lead to a successful launch of 16

SA’s proposed new international routes?

Level Knowledge Application Analysis Evaluation

2 marks 2 marks 6 marks 6 marks

2 2 marks 2 marks 4–6 marks 4–6 marks

Good knowledge Good Good use of Good judgement

shown of application reasoned argument shown in answer

strategic to case or theory to explain and conclusion

marketing how effective

planning marketing planning

may lead to

successful launch or

its limitations

1 1 mark 1 mark 1–3 marks 1–3 marks

Some knowledge Some Some use of Some judgement

of strategic application reasoned argument shown in answer

marketing to case or theory to explain and/or conclusion

planning/marketin how effective

g mix marketing planning

may lead to

successful launch or

its limitations

0 No creditable content

Answers could include:

Knowledge:

• Marketing plan – integrated strategy, in this case for launch into a new market,

including marketing research, mix, budget, objectives, strategy, tactics.

• Launch marketing planning – activities to ensure that the maximum number of

potential customers are aware of and buy a new product or service.

Application:

• Ansoff’s matrix – market development.

• Marketing strategy needs to target customers in home country and destination

countries.

• Low gearing in relation to need to finance launch.

Analysis:

• Different tactics may be needed in countries where SA is not a familiar brand

• SA need to research overseas markets carefully – will the budget allow for

this? Is there any opportunity for a joint venture?

• Is pricing method used appropriate? Especially given the currency

appreciation.

• Is communication with existing customers good? How effective is the website?

What other web-based methods can be used? Credit suggestions such as use

of social media.

• Costs of initial launch strategy will be high. Will further borrowing be needed?

© UCLES 2017 Page 8 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

Evaluation:

• How competitive is the market for air travel in destination countries? Will SA be

competing with national state-owned airlines that do not need to make profits?

• Apart from the marketing plan, what other factors will be important? For

example state of economy and incomes in destination countries.

• As a domestic airline, do SA have the skills and knowledge to enter the new

market?

© UCLES 2017 Page 9 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

4(a) Refer to the information on lines 32–34 and 42–46. Assume the average capacity 6

utilisation will be the same on the proposed international routes as on domestic

flights. Calculate SA’s forecast average total revenue for one international flight.

Answer Explanation

Capacity utilisation on current flights given in text:

Economy – 99%

Business – 67%

Apply these to international flights

Economy 126 × 99% = 124.74 seats [1]

Number of seats Business 16 × 67% = 10 .72 seats [1]

sold in business /

economy class Acceptable to round up or down

per flight 125 economy + 11 business [1 + 1]

124 economy + 10 business [1 + 1]

Now use business and economy prices

124.74 × $150 = $18 711 [2]

$22 999

10.72 × $400 = $4 288 [2]

Total $22 999 [6]

125 × $150 = $18 750 [2]

$23 150 (usual

rounding rules) 11 × $400 = $4400 [2]

Total $23 150 [6]

124 × $150 = $18 600 [2]

$22 600

10 × $400 = $4000 [2]

(rounded seats

sold down)

Total $22 600 [6]

$25 300 Full capacity revenue [1]

If no other valid working

Capacity utilisation formula

Current capacity (or seats sold)/maximum capacity (or seats

available) × 100 [1]

1 error – 5 marks

2 errors – 4 marks

3 errors – 3 marks

Some attempt – 1–2 marks

© UCLES 2017 Page 10 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

4(b) Refer to your answer from part (a) and other information from the case. Discuss 12

whether SA should offer more seats for business travellers on the proposed new

routes.

Level Knowledge Application Analysis Evaluation

2 marks 2 marks 4 marks 4 marks

2 2 marks 2 marks 3–4 marks 3–4 marks

At least two Application of Good use of Good judgement

relevant two or more reasoned argument shown in answer and

points made points to the or theory to answer conclusion

case to case question

1 1 mark 1 mark 1–2 marks 1–2 marks

One Some Some use of Some judgement

relevant application to reasoned argument shown in answer

point made case or theory to answer and/or conclusion

question

0 No creditable content

Examiner note: L1 A and E if only refer to answer from (a) or other information

Knowledge:

• Selling a mix of products or in this case service levels is a way of appealing to

different groups of customers with different needs. (not strictly speaking price

discrimination as different service but give credit).

• This is a key decision for SA as it changes aspects of marketing mix

• Understanding of price elasticity of demand.

Application:

• Possibility of ‘disappointing’ leisure travellers, due to less seats available.

• Case suggests that business travellers demand is more price inelastic than

leisure travellers, they are more concerned about comfort and flexibility.

• Comparison of calculation in (a) with same fares but using original mix of seats,

i.e. 138 economy and 12 business (allow full capacity calculation).

• Full capacity: Old configuration $25 500; New configuration $25 300.

• Existing capacity: Old configuration $23 709; New configuration 22 999.

Analysis:

• Consider how SA’s product may differ from others, or not, what is USP?

• Impact of price elasticity on demand and revenues and profits.

• In order to attract increased number of business travellers SA may need to

spend more on advertising than if predominantly just trying to attract leisure

users.

• Impact on cost of staffing as business travellers will have higher expectations

of service than leisure travellers.

© UCLES 2017 Page 11 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

Evaluation:

• Market research suggests levels of demand and elasticity, but how accurate is

this?

• Can the mix of seats be changed according to the route?

• To what extent may business traveller demand be affected by economic

changes?

• Overall judgement in advising SA, supported by the most important factors in

the case.

© UCLES 2017 Page 12 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

5 Evaluate the use of flexible employment contracts for SA’s future success. 14

Level Knowledge Application Analysis Evaluation

2 marks 2 marks 5 marks 5 marks

2 2 marks 2 marks 4–5 marks 4–5 marks

Good knowledge Good Good use of reasoned Good

shown of flexible application argument or theory to judgement

workforce to case explain the advantages shown in

or disadvantages of a answer and

flexible workforce conclusion

1 1 marks 1 marks 1–3 marks 1–3 marks

Some knowledge Some Some use of reasoned Some

shown of flexible application argument or theory to judgement

workforce to case explain the advantages shown in

or disadvantages of a answer and/or

flexible workforce conclusion

0 No creditable content

Answers could include:

Knowledge:

• A flexible workforce includes a mix of employees working under different

contract. Typically a few key people on full time permanent basis and then

others part-time, zero hours, temporary, short term. This leads to workforce

planning that meets the needs of the business.

• Importantly some flexible working arrangements offer flexibility to accept or

refuse work to the employees as well, such as zero hours contracts.

Application:

• In this case, the airline will need staff to cover more or less 24 hours a day

flights to some destinations are seasonal, so changing needs for workers.

• There have been some complaints, but others will be happy to work unsocial

hours, part time, and so on, to fit around other commitments.

• But some insecurity for both the staff and also the airline, as they can’t run

flights without full crew.

• The HR Director has suggested putting more staff on full time contracts and

paying bonuses, so there could be an issue here.

• Are there any other benefits of working for SA? Free travel?

Analysis:

• The wage bill should be lower as SA are only paying workers when they need

them.

• Flexible arrangements suit some workers and not others – motivation issues?

• The demand for air travel is growing and unemployment is low – will skilled

staff still want to work for SA or might they leave and join a competitor for more

secure positions? SA is trying to grow, so will need to retain and recruit.

© UCLES 2017 Page 13 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

Evaluation:

• Judgement may depend on rate of growth of SA, but also nature of staff in all

the different jobs with the company.

• The economic situation in countries where staff are recruited is important in

terms of wage and employment levels.

• Generally jobs working for airlines, budget or otherwise, are popular, so

probably unlikely to face a staff shortage.

• Arguments must be two sided and final judgement well supported.

© UCLES 2017 Page 14 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

Questions 6 and 7 use this marking grid:

Level Knowledge Application Analysis Evaluation

3 marks 3 marks 4 marks 10 marks

3 7–10 marks

Good judgement shown throughout

with well supported conclusion/

recommendation, focused on the

business in the case

2 3 marks 3 marks 3–4 marks 4–6 marks

Good Good Good use of Some judgement shown in the main

understanding application to reasoned body of the answer and an attempt to

shown the case argument or support conclusion/ recommendation,

use of theory focused on the business in the case

to explain OR

points made effective and well supported

conclusion/ recommendation, focused

on the business in the case

1 1–2 marks 1–2 marks 1–2 marks 1–3 marks

Some Some Limited use of Limited attempt to show judgement

understanding application to reasoned either within the answer

shown the case argument or OR

use of theory a weakly supported conclusion/

to support recommendation with some focus on

points made the business in the case

0 No creditable content

© UCLES 2017 Page 15 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

6 Discuss the importance of contingency planning if SA is to continue to be 20

successful.

Answers could include:

Knowledge:

• Contingency planning – preparations made by business for future unexpected

events that may adversely affect the running and reputation of the business.

Contingency plans include procedures to follow when such an event occurs,

such as dealing with the media and ‘disaster recovery’ plans.

• Corporate planning is the overview of company aims, objectives and strategies,

in all areas for the next few years. Contingency planning is part of corporate

planning.

Application:

• In this case, contingency planning (CP) may be used by SA to cope with

disruptions such as a complete failure of the website, fuel shortage, service

disruptions, such as delays, caused by factors such as weather or major

incidents, such as plane technical problems, crashes or terrorism.

• Reference to contingency planning issues if Option B is chosen, e.g. building

delays.

• The airline industry is vulnerable to many external factors (use of local

examples allowable here).

Analysis:

• CP is important because of reassurance to staff (and customers?) that plans

are in place and if, for instance, customers feel that problems such as major

delays are dealt with efficiently and sympathetically, this will enhance

reputation.

• CP can be costly, and requires high levels of skills and knowledge, both in the

process and in terms of preparations, such as having back-up systems and

even equipment.

Evaluation:

• But by the nature of CP, it is used to prepare for the unexpected, cannot

prepare for all eventualities (again local examples)

• Importance of CP may depend on how likely these events are to occur, quite

likely in this industry. A major incident would be disastrous and may cause loss

of life.

• However, other parts of the corporate plan are also very important for the

future of the airline.

• Maybe possible to prepare more detailed CP for more likely problems, such as

passengers stranded by aircraft breakdown.

• Cost of CP needs to be balanced against potential damaging consequences of

not doing it.

• Arguments must be two sided and final judgement well supported.

© UCLES 2017 Page 16 of 17

9609/32 Cambridge International A Level – Mark Scheme March 2017

PUBLISHED

Question Answer Marks

7 Evaluate the techniques that SA could use to make the strategic choice between 20

the two options for growth.

Answers could include:

Knowledge:

• Strategic choice – using appropriate techniques to help make decisions

between alternative long term plans of action.

• Decision trees; force field analysis; Ansoff’s matrix to assess risk involved. Also

investment appraisal; break-even.

Application:

• Option A is market development. Lack of experience in market.

• Option B is diversification.

• SA successful airline with core competence.

• Cost comparison and comments, e.g. the joint venture sum of $35m is initial

cost only.

Analysis:

• Option A – quite risky due to new market/country and lack of experience in

international flying. However, SA is successful airline/core competency issues.

• Option B – but starting within the existing country, and linked with existing

service. Potentially risky, though, as SA has no experience of managing hotels.

How reliable is joint venture partner?

• Both options rely on continued growth of travel industry, so some links between

them meaning factors in strategic choice may be similar.

• Decision trees could be very useful to assess risk involved and to compare this

with expected payoffs – but how reliable would these estimates be? Could

other hotel businesses be investigated to assess returns from Option B? Could

joint venture partner help.

• Force field analysis – important as option A involves operating to and from

different countries and Option B entering a new market. Will SA and its staff be

able to adapt to these changes? What are likely to be the main driving and

restraining forces?

Evaluation:

• Important to use scientific methods of strategic choice as these are both likely

to be costly and expensive strategies and only potentially profitable in the long

run. No one technique better than the others. Lack of experience in either

market could make estimating cash flows very difficult. May need to use advice

from external consultants?

• Comparison of costs has been given and SA’s profit margin is low, finance and

the ability to borrow or raise more funds from shareholders must also be an

important factor here.

© UCLES 2017 Page 17 of 17

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

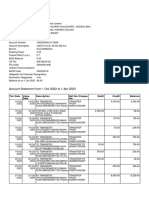

- Account Statement From 1 Oct 2022 To 1 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Oct 2022 To 1 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAman JaiswalNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Strategic Management Final ExamDocument6 pagesStrategic Management Final Examsynwithg100% (1)

- PressedDocument8 pagesPresseddakshinNo ratings yet

- Chapter 3Document17 pagesChapter 3dakshinNo ratings yet

- ACCA AFM S22 NotesDocument66 pagesACCA AFM S22 NotesdakshinNo ratings yet

- Digital Media & Design 9481: Support For Cambridge International AS & A LevelDocument2 pagesDigital Media & Design 9481: Support For Cambridge International AS & A LeveldakshinNo ratings yet

- Syllabus: Cambridge International AS & A Level Digital Media & Design 9481Document38 pagesSyllabus: Cambridge International AS & A Level Digital Media & Design 9481dakshinNo ratings yet

- Syllabus: Cambridge International AS & A Level Law 9084Document35 pagesSyllabus: Cambridge International AS & A Level Law 9084dakshinNo ratings yet

- Accounting As Level NoteDocument38 pagesAccounting As Level NotedakshinNo ratings yet

- Ballada Chap 1 ReviewerDocument3 pagesBallada Chap 1 ReviewerJullianneBalaseNo ratings yet

- WP CVA RISK 2021 FinalDocument11 pagesWP CVA RISK 2021 FinalRenu MundhraNo ratings yet

- 2023-25 NHS Payment Scheme - 23-25-NHS-Payment-Scheme - v1.1Document40 pages2023-25 NHS Payment Scheme - 23-25-NHS-Payment-Scheme - v1.1andry budiarjoNo ratings yet

- Chapter 2 (pr1)Document3 pagesChapter 2 (pr1)Loida Manluctao GacusanNo ratings yet

- E1057 PDFDocument8 pagesE1057 PDFAhmad Zubair RasulyNo ratings yet

- C - TS4CO - 2021: There Are 2 Correct Answers To This QuestionDocument51 pagesC - TS4CO - 2021: There Are 2 Correct Answers To This QuestionHclementeNo ratings yet

- SSR250 - 450HP O&mDocument98 pagesSSR250 - 450HP O&mKamran IbadovNo ratings yet

- Tourism Study Guide Via Africa Term 3 4Document28 pagesTourism Study Guide Via Africa Term 3 4ablykingprsa02No ratings yet

- VILAS HDSCM TOT GPM 3 (GP Operations)Document48 pagesVILAS HDSCM TOT GPM 3 (GP Operations)Nguyễn ChâuNo ratings yet

- Pourmohammad-Zia2021 Article DynamicPricingAndInventoryContDocument40 pagesPourmohammad-Zia2021 Article DynamicPricingAndInventoryContRenzo ErikssonNo ratings yet

- Analisis Pengendalian Kualitas Proses Pengelasan (Welding) Dengan Pendekatan Six Sigma Pada Proyek Pt. XyzDocument13 pagesAnalisis Pengendalian Kualitas Proses Pengelasan (Welding) Dengan Pendekatan Six Sigma Pada Proyek Pt. Xyzaprillia rizkyNo ratings yet

- CorpTax - Sem 8 PDFDocument16 pagesCorpTax - Sem 8 PDFPrakhar KesharNo ratings yet

- Swift Stand by Letter of CreditDocument2 pagesSwift Stand by Letter of CreditJr Qomarruzzaman100% (1)

- TPF OrderDocument2 pagesTPF OrderbeobhavanischoolsNo ratings yet

- Asian Paints AnalysisDocument5 pagesAsian Paints AnalysisAnimesh SalhotraNo ratings yet

- Fundamentals of Money and BankingDocument104 pagesFundamentals of Money and BankingSiraajNo ratings yet

- Module 3 Market Sizing IntermediateDocument14 pagesModule 3 Market Sizing IntermediateBas KelderNo ratings yet

- CL AsaerDocument32 pagesCL AsaerKing Daniel AzurinNo ratings yet

- The Capital Budgeting Decision: Block, Hirt, and DanielsenDocument25 pagesThe Capital Budgeting Decision: Block, Hirt, and DanielsenOona NiallNo ratings yet

- Export Import Procedures and DocumentationDocument11 pagesExport Import Procedures and DocumentationTeena RawatNo ratings yet

- Modular L Product Profile ECPEN18-416 EnglishDocument8 pagesModular L Product Profile ECPEN18-416 EnglishIorgu CristacheNo ratings yet

- ListDocument4 pagesListJc RNo ratings yet

- Covid-19 Impact - Consumers Move More Towards Digital - The Hindu BusinessLineDocument13 pagesCovid-19 Impact - Consumers Move More Towards Digital - The Hindu BusinessLineSamiha MjahedNo ratings yet

- Specimen of A Trial Balance: S.No. Particulars L.F. Debit CreditDocument1 pageSpecimen of A Trial Balance: S.No. Particulars L.F. Debit CreditArun SankarNo ratings yet

- MTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerDocument12 pagesMTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerMelsew BelachewNo ratings yet

- Chapter 2 - Entrepreneurial AttitudeDocument11 pagesChapter 2 - Entrepreneurial AttitudeMaruthi TechnologiesNo ratings yet

- Seminarr PDFDocument30 pagesSeminarr PDFHill NunagNo ratings yet

- Bain Report India Venture Capital 2021Document46 pagesBain Report India Venture Capital 2021Ansuka SahuNo ratings yet